Professional Documents

Culture Documents

Manila Standard Today - Business Daily Stocks Review (March 13, 2015)

Manila Standard Today - Business Daily Stocks Review (March 13, 2015)

Uploaded by

Manila Standard TodayOriginal Description:

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Manila Standard Today - Business Daily Stocks Review (March 13, 2015)

Manila Standard Today - Business Daily Stocks Review (March 13, 2015)

Uploaded by

Manila Standard TodayCopyright:

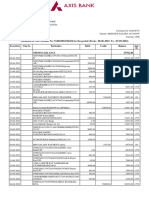

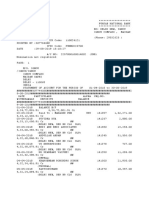

MST Business Daily Stocks Review

Friday, March 13, 2015

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

2.7

75.3

99.4

105.2

63

2.3

4.2

19.6

31.6

22.5

2.95

890

1.01

92.9

30.5

75

99

140

392

59

146.8

1700

130

2.8

1.55

63.5

67.5

82.5

50

1.9

1.1

14.5

23.2

6.84

1.75

625

0.175

69.35

20.45

58

76

119

276

41.5

105.1

1281

116

2.25

AG Finance

6.05

Asia United Bank

70

Banco de Oro Unibank Inc. 114.00

Bank of PI

100.50

China Bank

47

BDO Leasing & Fin. INc. 2.29

Bright Kindle Resources 2.40

COL Financial

16.6

Eastwest Bank

24.8

Filipino Fund Inc.

8.22

I-Remit Inc.

1.79

Manulife Fin. Corp.

730.00

MEDCO Holdings

0.520

Metrobank

94.15

PB Bank

18.46

Phil Bank of Comm

31.00

Phil. National Bank

81.64

Phil. Savings Bank

95.30

PSE Inc.

352

RCBC `A

46.15

Security Bank

166

Sun Life Financial

1335.00

Union Bank

70.00

Vantage Equities

3.08

FINANCIAL

6.94

6.06

70.2

69.2

115.00 113.80

100.30 99.90

47.2

47

2.36

2.29

2.40

2.38

16.6

16.5

25.5

25.1

8.98

8.22

1.70

1.70

730.00 720.00

0.530

0.520

92.9

92.1

18.60

18.46

31.50

30.70

83.50

81.00

95.40

95.20

354

352.2

46.5

46

168.3

163

1350.00 1336.00

70.00

69.50

3.1

3.08

INDUSTRIAL

46

45.55

1.69

1.66

1.11

1.08

2.1

2.05

8.39

8.16

91.00

80.00

19.2

18.8

22

21.6

59

58.7

1.81

1.75

12.26

11.38

20.800 20.3

11.74

11.48

8.55

8.40

9.83

9.70

21.5

19.4

30.2

29.5

105

103.8

0.4850 0.4850

14.76

14.76

6.76

6.64

0.610

0.610

214.80 210.80

10.14

10.1

38.00

38.00

2.7

2.62

27.6

27.15

29.2

28.15

8.200

8.000

280.00 275.20

4.57

4.54

10.58

10.42

5.32

5.2

11.90

11.42

3.98

3.88

2.93

2.91

5.94

5.88

208

205

1.78

1.7

0.204

0.189

1.53

1.52

2.28

2.26

219

213.6

0.74

0.72

1.54

1.52

HOLDING FIRMS

0.475

0.465

58.20

56.10

26.15

25.70

7.17

7.15

1.75

1.55

758

752

9.33

9.25

15.54

15.38

3.04

2.98

4.81

4.68

0.430

0.405

1340

1310

6.30

6.30

65.95

65.00

5.2

5.15

9.2

8.93

0.73

0.69

16.42

16

0.65

0.62

4.93

4.85

5.28

5.12

0.0410 0.0400

0.720

0.700

2.41

2.41

75.00

73.00

924.50 910.50

1.28

1.26

0.99

0.95

105.00 103.00

0.6000 0.5800

0.2700 0.2550

PROPERTY

9.940

9.630

1.04

1.03

1.400

1.320

0.275

0.275

38.60

37.45

4.43

4.39

5.11

5.1

0.98

0.96

0.155

0.149

Net Foreign

Change Volume

Trade/Buying

6.72

70

114.50

100.00

47.05

2.36

2.40

16.6

25.25

8.84

1.70

720.00

0.520

92.5

18.50

31.50

82.00

95.20

352.4

46

163

1350.00

69.50

3.08

11.07

0.00

0.44

-0.50

0.11

3.06

0.00

0.00

1.81

7.54

-5.03

-1.37

0.00

-1.75

0.22

1.61

0.44

-0.10

0.11

-0.33

-1.81

1.12

-0.71

0.00

691,700

14,600

2,350,300

1,204,700

63,000

61,000

340,000

8,900

237,300

80,500

22,000

630

95,000

4,837,460

59,700

10,700

140,010

1,160

2,140

322,700

1,364,140

105

19,210

80,000

187,538.00

557,388.00

-25,245,057.00

30,070,561.00

686,680.00

-7,080.00

45.9

1.69

1.1

2.09

8.27

87.00

19

22

59

1.81

11.92

20.300

11.68

8.45

9.80

19.62

29.6

103.9

0.4850

14.76

6.67

0.610

210.80

10.1

38.00

2.68

27.5

29

8.050

280.00

4.54

10.58

5.2

11.68

3.95

2.91

5.90

205

1.78

0.191

1.52

2.27

217.6

0.73

1.54

0.88

-1.74

0.92

-0.48

0.85

-9.23

1.06

0.00

0.51

0.56

5.67

0.74

1.57

0.12

0.31

6.63

0.34

0.39

1.04

0.00

-0.45

-1.61

-1.86

-0.20

-0.13

6.35

1.29

3.02

0.00

1.74

-0.22

0.76

-3.70

-2.99

-0.25

0.34

0.00

0.00

3.49

-1.55

-0.65

0.00

0.28

-1.35

0.00

2,499,200

42,000

691,000

2,415,000

13,500

940

336,200

346,000

43,900

227,000

1,173,000

5,739,800

20,111,300

38,073,000

3,849,700

348,000

3,240,100

355,870

40,000

900

187,700

22,000

689,650

438,700

300

56,000

1,922,200

396,500

265,500

283,130

77,000

3,785,400

5,100

125,400

694,000

1,108,000

699,200

52,590

92,000

41,900,000

107,000

1,096,000

1,554,980

374,000

264,000

47,071,110.00

33,800.00

0.475

57.00

26.10

7.17

1.73

758

9.3

15.40

2.98

4.81

0.405

1330

6.30

65.00

5.2

9

0.72

16

0.64

4.89

5.28

0.0410

0.720

2.41

73.00

920.00

1.28

0.99

103.00

0.5900

0.2650

-1.04

-2.23

0.77

-0.14

8.13

0.53

0.87

0.26

-1.65

0.42

-1.22

1.92

-1.56

-1.44

1.76

-1.96

5.88

-0.62

0.00

1.03

0.00

2.50

1.41

-5.49

-2.01

0.55

0.00

4.21

-2.37

0.00

0.00

750,000

1,286,050

10,779,200

31,000

603,000

561,510

3,442,900

7,347,800

50,000

185,000

8,660,000

146,905

5,500

1,200,680

25,900

3,374,700

2,204,000

2,519,700

3,948,000

40,960,000

17,000

1,500,000

1,367,000

12,000

253,660

280,820

312,000

61,000

37,290

10,327,000

6,250,000

9.760

1.03

1.340

0.275

37.45

4.4

5.1

0.97

0.151

-1.91

0.00

0.00

3.77

-2.98

0.23

0.00

0.00

-1.95

1,740,700

187,000

48,000

40,000

15,923,200

2,193,000

11,100

7,961,000

39,320,000

36,520.00

1,115,750.00

10,279

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

0.98

1.09

0.370

2.25

1.77

1.6

4.88

0.180

0.470

4.45

24.8

2.06

3.6

19.62

1.02

6.66

1.96

6.5

0.47

0.87

0.175

1.22

1.18

1.19

2.75

0.070

0.325

2.5

18.72

1.45

2.9

14.1

0.58

3.05

0.87

4.37

Cyber Bay Corp.

Empire East Land

Ever Gotesco

Global-Estate

Filinvest Land,Inc.

Interport `A

Megaworld Corp.

MRC Allied Ind.

Phil. Estates Corp.

Primex Corp.

Robinsons Land `B

Rockwell

Shang Properties Inc.

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

0.480

0.900

0.228

1.59

1.83

1.51

5.63

0.125

0.3700

7.3

28.50

1.76

3.20

19.60

0.97

7.15

1.050

7.500

Net Foreign

Change Volume

Trade/Buying

0.480

0.470

0.475

0.900

0.900

0.900

0.228

0.214

0.214

1.63

1.59

1.62

1.84

1.80

1.80

1.51

1.49

1.50

5.73

5.54

5.63

0.129

0.125

0.125

0.3600 0.3500

0.3600

7.43

7.22

7.4

29.60

28.50

28.50

1.76

1.75

1.76

3.21

3.20

3.21

19.80

19.54

19.80

0.99

0.93

0.94

7.3

7.09

7.29

1.060

1.030

1.060

7.570

7.460

7.500

SERVICES

3.25

1.55 2GO Group

9.15

10.3

9.15

9.9

43.7

27

ABS-CBN

64

64.8

63.75

63.8

1.09

0.59 APC Group, Inc.

0.680

0.690

0.680

0.690

12.46

10

Asian Terminals Inc.

13.12

14.1

13.14

14

14

8.28 Bloomberry

10.50

10.68

10.52

10.58

0.1640 0.0960 Boulevard Holdings

0.1090

0.1100 0.1090

0.1090

4.05

2.97 Calata Corp.

4.1

4.12

3.93

4.08

71

44.8 Cebu Air Inc. (5J)

87.8

89

87.5

87.5

12.3

10.14 Centro Esc. Univ.

10.94

10.94

10.94

10.94

3.28

1.99 Discovery World

1.68

1.66

1.66

1.66

9

4

DFNN Inc.

6.48

6.50

6.42

6.42

1700

1080 FEUI

1015

1000

1000

1000

2008

1580 Globe Telecom

1939

1950

1939

1943

9.04

7.12 GMA Network Inc.

7.00

7.05

6.80

6.83

2.02

1.2

Harbor Star

1.61

1.61

1.57

1.59

118.9

94.4 I.C.T.S.I.

113.5

114

111.5

111.5

12.5

8.72 IPeople Inc. `A

11.9

11.9

11.04

11.9

0.017

0.012 IP E-Game Ventures Inc. 0.014

0.014

0.014

0.014

0.0653 0.026 Island Info

0.305

0.330

0.305

0.330

2.2800 1.560 ISM Communications

1.3300

1.3400 1.3200

1.3300

6.99

1.95 Jackstones

2.72

2.76

2.69

2.69

9.67

5.82 Leisure & Resorts

9.14

9.14

9.08

9.08

2.85

1.15 Liberty Telecom

1.95

2.00

1.95

2.00

2.2

1.1

Lorenzo Shipping

1.5

1.58

1.46

1.5

4.32

1.9

Macroasia Corp.

2.29

2.28

2.20

2.28

1.97

0.485 Manila Bulletin

0.710

0.700

0.690

0.690

2.45

1.42 Manila Jockey

1.95

2

1.95

1.97

14.46

10.14 Melco Crown

10.26

10.44

10.06

10.18

0.62

0.35 MG Holdings

0.375

0.375

0.365

0.365

22.8

14.54 Pacific Online Sys. Corp. 18

18.02

18.02

18.02

6.6

5.2

PAL Holdings Inc.

4.60

4.60

4.45

4.55

2.85

1.85 Paxys Inc.

3.31

3.34

3.33

3.33

107

81

Phil. Seven Corp.

103.00

106.00 104.00

105.00

11.3

4.39 Philweb.Com Inc.

13.80

13.80

13.30

13.80

3486

2572 PLDT Common

3002.00

3002.00 2950.00

2950.00

0.710

0.250 PremiereHorizon

0.590

0.600

0.590

0.600

2.01

0.26 Premium Leisure

1.590

1.630

1.570

1.590

48.5

32.2 Puregold

41.00

42.00

41.50

41.75

74

48

Robinsons RTL

88.00

90.05

87.00

87.00

SSI Group

10.68

10.94

10.70

10.80

0.87

0.59 STI Holdings

0.73

0.73

0.71

0.72

2.95

1.68 Transpacific Broadcast 1.9

1.91

1.9

1.9

11.46

7.78 Travellers

7.32

7.49

7.31

7.35

0.435

0.305 Waterfront Phils.

0.380

0.375

0.365

0.365

1.6

1.04 Yehey

1.400

1.420

1.310

1.420

MINING & OIL

0.0086 0.0028 Abra Mining

0.0061

0.0061 0.0058

0.0061

5.45

1.72 Apex `A

2.85

2.99

2.98

2.98

17.24

11.48 Atlas Cons. `A

9.51

9.55

9.46

9.46

0.325

0.225 Basic Energy Corp.

0.275

0.265

0.260

0.260

12.7

6

Benguet Corp `B

7.0100

7.0100 7.01

7.0100

1.2

0.5

Century Peak Metals Hldgs 1.12

1.13

1.08

1.11

1.73

0.76 Coal Asia

0.94

0.96

0.94

0.95

10.98

4.93 Dizon

7.80

8.25

7.75

8.00

Ferronickel

2.55

2.59

2.51

2.52

0.46

0.385 Geograce Res. Phil. Inc. 0.350

0.355

0.340

0.350

0.455

0.3000 Lepanto `A

0.245

0.248

0.244

0.245

0.730

0.2950 Lepanto `B

0.255

0.255

0.250

0.255

0.024

0.012 Manila Mining `A

0.0140

0.0140 0.0140

0.0140

0.026

0.014 Manila Mining `B

0.0160

0.0150 0.0150

0.0150

8.2

1.960 Marcventures Hldgs., Inc. 5.68

5.73

5.67

5.7

48.85

14.22 Nickelasia

27.75

28.15

27.7

28

3.35

1.47 Nihao Mineral Resources 3.4

3.95

3.39

3.8

1.030

0.220 Omico

0.7300

0.7700 0.7400

0.7600

3.06

1.24 Oriental Peninsula Res. 2.260

2.350

2.230

2.300

0.021

0.016 Oriental Pet. `A

0.0140

0.0140 0.0130

0.0140

0.023

0.017 Oriental Pet. `B

0.0150

0.0140 0.0140

0.0140

7.67

4.02 Petroenergy Res. Corp. 5.84

5.85

5.52

5.85

12.88

7.8

Philex `A

7.88

7.95

7.86

7.86

10.42

6.5

PhilexPetroleum

3.06

3.3

3

3

0.042

0.031 Philodrill Corp. `A

0.016

0.016

0.015

0.016

420

123 Semirara Corp.

160.00

160.00 155.30

156.00

9

4.3

TA Petroleum

4.39

4.4

4.28

4.39

PREFERRED

44.1

26.3 ABS-CBN Holdings Corp. 63.95

65.8

65.7

65.7

Ayala Corp. Pref `B1

510

512

512

512

60

30

Ayala Corp. Pref B2

519.5

521

520

520

511

480 GLOBE PREF P

509

509

508.5

508.5

9.04

6.76 GMA Holdings Inc.

6.79

6.82

6.76

6.79

9.67

5.82 Leisure and Resort

1.09

1.06

1.06

1.06

MWIDE PREF

108.5

108.5

108.4

108.5

PCOR-Preferred B

1075

1075

1065

1065

PF Pref 2

1020

1040

1020

1039

77.3

74.2 SMC Preferred A

76.05

76.7

76.5

76.7

78.95

74.5 SMC Preferred B

81.6

82

81.6

82

81.85

75

SMC Preferred C

83.5

83.5

83.3

83.5

WARRANTS & BONDS

2.42

0.0010 LR Warrant

4.010

4.100

4.000

4.020

SME

10.96

2.4

Double Dragon

7.7

7.8

7.71

7.8

35

7.74 IRipple E-Business Intl 60.3

72

70

71.05

Xurpas

11.32

11.7

11.08

11.1

EXCHANGE TRADED FUNDS

119.6

94

First Metro ETF

127

127.2

126.9

126.9

-1.04

0.00

-6.14

1.89

-1.64

-0.66

0.00

0.00

-2.70

1.37

0.00

0.00

0.31

1.02

-3.09

1.96

0.95

0.00

530,000

1,559,000

2,240,000

1,228,000

17,554,000

332,000

41,670,400

7,100,000

110,000

414,200

3,083,000

341,000

46,000

10,672,300

17,825,000

12,023,200

141,000

10,484,800

8.20

-0.31

1.47

6.71

0.76

0.00

-0.49

-0.34

0.00

-1.19

-0.93

-1.48

0.21

-2.43

-1.24

-1.76

0.00

0.00

8.20

0.00

-1.10

-0.66

2.56

0.00

-0.44

-2.82

1.03

-0.78

-2.67

0.11

-1.09

0.60

1.94

0.00

-1.73

1.69

0.00

1.83

-1.14

1.12

-1.37

0.00

0.41

-3.95

1.43

4,419,200

9,210

299,000

497,000

7,572,000

16,590,000

409,000

317,240

3,200

1,000

4,900

10

44,905

244,200

189,000

5,240,110

16,000

9,000,000

85,000,000

691,000

75,000

1,900,000

18,000

290,000

106,000

65,000

77,000

23,202,300

150,000

500

14,000

28,000

806,050

672,600

127,620

814,000

8,145,000

1,981,500

2,150,000

14,431,700

362,000

4,000

384,300

490,000

39,000

0.00

4.56

-0.53

-5.45

0.00

-0.89

1.06

2.56

-1.18

0.00

0.00

0.00

0.00

-6.25

0.35

0.90

11.76

4.11

1.77

0.00

-6.67

0.17

-0.25

-1.96

0.00

-2.50

0.00

1,351,000,000

73,000

311,300

-881,479.00

13,440,000

900

728,000

54,500.00

933,000

247,100

-16,030.00

12,157,000 -9,420,520.00

2,190,000

10,500,000

14,000,000

314,700,000

238,200,000 1,302,000.00

2,342,100

2,341,100 19,483,815.00

17,649,000 -5,150,300.00

1,417,000 76,000.00

461,000

20,430.00

2,200,000

1,900,000

6,900

1,993,300 8,690.00

1,225,000 195,900.00

159,500,000 -3,400.00

668,370

-43,764,690.00

27,000

2.74

0.39

0.10

-0.10

0.00

-2.75

0.00

-0.93

1.86

0.85

0.49

0.00

20

1,000

5,380

6,200

219,700

59,000

27,570

3,830

3,885

50,220

18,170

133,740

0.25

245,000

1.30

17.83

-1.94

218,200

6,350

3,313,600 -747,716.00

-0.08

1,790

-18,000.00

2,061,530.00

-28,680,932.00

-147,500.00

53,330,985.00

-175,440.00

73,801,994.00

-29,840.00

MST

42.6

31.75 Aboitiz Power Corp.

45.5

6.1

2.51 Agrinurture Inc.

1.72

1.66

0.88 Alliance Tuna Intl Inc.

1.09

2.3

1.25 Alsons Cons.

2.1

17.98

9.58 Asiabest Group

8.2

148

15

C. Azuc De Tarlac

95.85

17.2

14.6 Century Food

18.8

15.8

9.82 Cirtek Holdings (Chips) 22

56.8

21.5 Concepcion

58.7

4.57

0.82 Da Vinci Capital

1.8

39.5

17.3 Del Monte

11.28

14

5.98 DNL Industries Inc.

20.150

12.98

9.05 Emperador

11.50

8.15

4.25 Energy Devt. Corp. (EDC) 8.44

12.34

8.68 EEI

9.77

17

8.61 Federal Res. Inv. Group 18.4

27.1

12.2 First Gen Corp.

29.5

90.5

48.9 First Holdings A

103.5

0.014

0.0097 Greenergy

0.4800

15.74

12.8 Holcim Philippines Inc. 14.76

9.4

2.05 Integ. Micro-Electronics 6.7

0.98

0.32 Ionics Inc

0.620

199.8

150.8 Jollibee Foods Corp.

214.80

10.98

8.55 Lafarge Rep

10.12

79

48.5 Liberty Flour

38.05

5.2

2.8

LMG Chemicals

2.52

30

20.35 Manila Water Co. Inc.

27.15

90

12

Maxs Group

28.15

14.7

10.1 Megawide

8.050

317

246 Mla. Elect. Co `A

275.20

5.37

4

Pepsi-Cola Products Phil. 4.55

14.48

11.56 Petron Corporation

10.50

7.5

5

Phil H2O

5.4

14.5

9.94 Phinma Corporation

12.04

7.03

4.33 Phoenix Petroleum Phils. 3.96

Phoenix Semiconductor 2.90

6.68

4.88 RFM Corporation

5.90

275

210 San MiguelPure Foods `B 205

2.25

1.7

Splash Corporation

1.72

0.191

0.102 Swift Foods, Inc.

0.194

2.5

1.6

TKC Steel Corp.

1.53

2.68

1.37 Trans-Asia Oil

2.27

188.6

111.3 Universal Robina

217

1.3

0.550 Vitarich Corp.

0.74

2.17

1.33 Vulcan Indl.

1.54

0.7

61.6

31.85

7.39

2.7

747

11.34

84

3.68

5.34

0.23

1060

7.1

59.8

5.29

6.55

0.9

19.9

0.75

5.4

5.35

0.0550

0.84

2.9

88

866

2.2

1.39

156

0.285

0.245

0.46

45.75

21.95

6.3

1.550

508

7.470

47.25

1.15

4

0.144

706

5.3

36.7

3

3.95

0.58

12.96

0.580

4.06

4.5

0.027

0.355

2.36

54.5

680

1.04

0.85

58.05

0.158

0.150

Abacus Cons. `A

0.480

Aboitiz Equity

58.30

Alliance Global Inc.

25.90

Anscor `A

7.18

Asia Amalgamated A

1.60

Ayala Corp `A

754

Cosco Capital

9.22

DMCI Holdings

15.36

F&J Prince B

3.03

Filinvest Dev. Corp.

4.79

Forum Pacific

0.410

GT Capital

1305

House of Inv.

6.40

JG Summit Holdings

65.95

Keppel Holdings `A

5.11

Lopez Holdings Corp.

9.18

Lodestar Invt. Holdg.Corp. 0.68

LT Group

16.1

Mabuhay Holdings `A

0.64

Metro Pacific Inv. Corp. 4.84

Minerales Industrias Corp. 5.28

Pacifica `A

0.0400

Prime Orion

0.710

Republic Glass A

2.55

San Miguel Corp `A

74.50

SM Investments Inc.

915.00

Solid Group Inc.

1.28

South China Res. Inc.

0.95

Top Frontier

105.50

Unioil Res. & Hldgs

0.5900

Wellex Industries

0.2650

9.03

1.99

2.07

0.375

35.3

6.15

6.1

2

0.201

5.51

0.99

1

0.185

23.7

4.41

5

1.22

0.068

8990 HLDG

A. Brown Co., Inc.

Araneta Prop `A

Arthaland Corp.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Century Property

Crown Equities Inc.

Trading Summary

FINANCIAL

INDUSTRIAL

HOLDING FIRMS

PROPERTY

SERVICES

MINING & OIL

GRAND TOTAL

SHARES

12,009,597

135,791,279

108,803,694

196,161,562

188,728,384

2,150,458,481

2,795,492,937

9.950

1.03

1.340

0.265

38.60

4.39

5.1

0.97

0.154

241,363,145.00

92,300.00

-6,694,799.00

-861,805.00

-26,515,592.00

816.00

2,100,818.00

1,142,178.00

-7,593,684.00

48,105,610.00

-23,062,546.00

-94,127,670.00

-11,648,321.00

190,100.00

8,444,400.00

-10,347,834.00

22,696.00

-74,853,332.00

631,604.00

38,387,165.00

1,656,650.00

-1,729,218.00

30,203,354.00

-1,509,030.00

784,910.00

145,230.00

10,208,800.00

-21,870.00

-318,760.00

10,363,840.00

15,300.00

-17,468,949.50

51,134,120.00

-37,745,990.00

4,031,836.00

11,209,932.00

45,550.00

20,950.00

46,319,845.00

-46,332,921.00

-11,237,956.00

-54,430.00

5,072,172.00

989,220.00

-5,792,040.00

922,769.50

-39,705,125.00

-59,890.00

-3,569,302.00

-549,600.00

-766,950.00

-5,842,783.00

-430,685,885.00

-980,470.00

2,919,240.00

7,600.00

T op G ainers

VALUE

1,110,671,202.75

1,723,985,199.82

1,818,095,753.482

1,448,576,608.21

2,236,306,319.421

337,200,369.943

8,714,710,386.623

STOCKS

FINANCIAL

1,802.31 (up) 1.48

INDUSTRIAL

12,766.75 (up) 31.17

HOLDING FIRMS

6,950.29 (up) 2.21

PROPERTY

3,132.02 (down) 34.70

SERVICES

2,158.92 (down) 23.23

MINING & OIL

15,973.93 (down) 116.54

PSEI

7,809.54 (down) 30.28

All Shares Index

4,545.05 (down) 5.49

Gainers: 90; Losers: 77; Unchanged: 49; Total: 216

10,500.00

-3,514,072.00

120,183.00

33,332.00

30,374,192.00

-16,633,548.50

-6,500.00

54,925,910.00

9,353,023.00

-310,500.00

-45,960.00

-3,900.00

-150,510.00

6,036,858.00

388,935.00

-28,980.00

-157,244,510.00

-5,534,260.00

28,305,385.00

1,857,659.50

-77,947,942.00

-519,034.00

-1,310.00

-678,660.00

468,000.00

7,670.00

-2,100,854.00

T op L osers

Close

(P)

Change

(%)

STOCKS

Close

(P)

Change

(%)

IRipple E-Business Intl

71.05

17.83

C. Azuc De Tarlac

87.00

-9.23

Nihao Mineral Resources

3.8

11.76

Oriental Pet. `B'

0.0140

-6.67

AG Finance

6.72

11.07

Manila Mining `B'

0.0150

-6.25

Island Info

0.330

8.20

Ever Gotesco

0.214

-6.14

2GO Group'

9.9

8.20

Republic Glass 'A'

2.41

-5.49

Asia Amalgamated A

1.73

8.13

Basic Energy Corp.

0.260

-5.45

Filipino Fund Inc.

8.84

7.54

I-Remit Inc.

1.70

-5.03

Asian Terminals Inc.

14

6.71

Waterfront Phils.

0.365

-3.95

Federal Res. Inv. Group

19.62

6.63

Phil H2O

5.2

-3.70

LMG Chemicals

2.68

6.35

Sta. Lucia Land Inc.

0.94

-3.09

You might also like

- Bank Stetment PDFDocument21 pagesBank Stetment PDFraj100% (1)

- Manila Standard Today - Business Daily Stocks Review (March 10, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 10, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 25, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 12, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 12, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 2, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 2, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 18, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 18, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 20, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 30, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 23, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 23, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 20, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 20, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 24, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 24, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 26, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 26, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 25, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 25, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 28, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 8, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 8, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 02, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 02, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 11, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 17, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 11, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (January 11, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 31, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 31, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 30, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 30, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 29, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 29, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 24, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (June 24, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 18, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 18, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 27, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (April 27, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 14, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 14, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 9, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 9, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 20, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 10, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 10, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 20, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 19, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 19, 2013)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 15, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 1, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 1, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 22, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 22, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 23, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 23, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 12, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (August 12, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 8, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 8, 2014)Manila Standard TodayNo ratings yet

- TODAY Tourism & Business Magazine, Volume 22, December, 2015From EverandTODAY Tourism & Business Magazine, Volume 22, December, 2015No ratings yet

- TODAY Tourism & Business Magazine, Volume 22, October , 2015From EverandTODAY Tourism & Business Magazine, Volume 22, October , 2015No ratings yet

- TODAY Tourism & Business Magazine, Volume 22, September, 2015From EverandTODAY Tourism & Business Magazine, Volume 22, September, 2015Rating: 5 out of 5 stars5/5 (1)

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 30, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 28, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 24, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 24, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 23, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 23, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 17, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Weekly Stocks Review (April 19, 2015)Document1 pageThe Standard - Business Weekly Stocks Review (April 19, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 16, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 16, 2015)Manila Standard TodayNo ratings yet

- Bank's Transaction Charges On IRCTC Website: Wallet and Cash CardDocument5 pagesBank's Transaction Charges On IRCTC Website: Wallet and Cash CardAravind MauryaNo ratings yet

- Ultra Hni Data 2Document189 pagesUltra Hni Data 2PDRK BABIUNo ratings yet

- Charge Slip BillingDocument129 pagesCharge Slip BillingMitch Panghilino CandoNo ratings yet

- Datos Bancarios FincasDocument42 pagesDatos Bancarios FincasEve MoralesNo ratings yet

- Introduction To SbiDocument4 pagesIntroduction To Sbisamy7541100% (2)

- The Federal Reserve SystemDocument17 pagesThe Federal Reserve SystemBrithney ButalidNo ratings yet

- Cases ObligationsDocument5 pagesCases ObligationsKaeNo ratings yet

- FSFB Acct STMT Xxxx9968 From 01aug23 To 19feb24Document23 pagesFSFB Acct STMT Xxxx9968 From 01aug23 To 19feb24samiran dasNo ratings yet

- Corporate Information: Scan To VerifyDocument23 pagesCorporate Information: Scan To VerifyNana RosliNo ratings yet

- Bank AccountDocument4 pagesBank AccountKASSAHUN SHUMYENo ratings yet

- Presented By:: Madhuri Koul Narayan Ambulgekar Vrushali Hadawale Anupam Sinha Prajakta KambleDocument14 pagesPresented By:: Madhuri Koul Narayan Ambulgekar Vrushali Hadawale Anupam Sinha Prajakta Kamblepratheesh_tulsiNo ratings yet

- Al Kabir Town ReceiptDocument1 pageAl Kabir Town ReceiptSudais AhmadNo ratings yet

- 1568635487844Document4 pages1568635487844Nivedita PuttiNo ratings yet

- Account Statement For Account:0114002101107545: Branch DetailsDocument4 pagesAccount Statement For Account:0114002101107545: Branch DetailsHappy JainNo ratings yet

- Dailystat 20190326Document15 pagesDailystat 20190326Stefan EbersNo ratings yet

- PDFDocument4 pagesPDFShreya AgrawalNo ratings yet

- Bank ReconciliationDocument10 pagesBank ReconciliationYogun BayonaNo ratings yet

- Private Sector Banks in India - A SWOT Analysis 2004Document23 pagesPrivate Sector Banks in India - A SWOT Analysis 2004Prof Dr Chowdari Prasad67% (3)

- PF I League Tables 2014Document34 pagesPF I League Tables 2014stavros7No ratings yet

- Acct Statement - XX8434 - 07092022Document7 pagesAcct Statement - XX8434 - 07092022Suhail KhanNo ratings yet

- Received Copy LogDocument4 pagesReceived Copy LogRegine LetchejanNo ratings yet

- Ac StatmentDocument11 pagesAc StatmentSai chandu SaiNo ratings yet

- DeliveryDocument25 pagesDeliverymarcusjwheeler013No ratings yet

- Central Bank Statement From 22-Apr-2023 To 22-Jul-2023.Document20 pagesCentral Bank Statement From 22-Apr-2023 To 22-Jul-2023.Shafi MuhimtuleNo ratings yet

- Acct Statement - XX6717 - 18072023Document11 pagesAcct Statement - XX6717 - 18072023Mevaram GurjarNo ratings yet

- Bank Statement Ac No. 14002 PDFDocument102 pagesBank Statement Ac No. 14002 PDFPankaj GroverNo ratings yet

- Acct Statement - XX2024 - 03022024Document17 pagesAcct Statement - XX2024 - 03022024Manjunath M SNo ratings yet

- ObliCon Syllabus Atty. Yangyang EspejoDocument16 pagesObliCon Syllabus Atty. Yangyang EspejoAlexLesle RobleNo ratings yet

- Economic FileDocument135 pagesEconomic Filemonikarohilla33No ratings yet