Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1K viewsTaxation CH 6

Taxation CH 6

Uploaded by

Kristel Nuyda LobasThis document summarizes capital gains taxation in the Philippines. It defines ordinary assets as those used in business and capital assets as all other assets. Gains from selling ordinary assets are subject to regular income tax, while gains from capital assets may be subject to either regular income tax or capital gains tax. Specifically, capital gains tax applies to gains from selling domestic stocks directly to a buyer and gains from selling real property in the Philippines. The capital gains tax rate is 5% for gains up to 100,000 pesos and 10% for gains above 100,000 pesos. The document provides additional details on what constitutes domestic stocks, different modes of disposing of stocks, and capital gains tax compliance requirements.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You might also like

- Chapter 5 Final Income Taxation Summary BanggawanDocument8 pagesChapter 5 Final Income Taxation Summary Banggawanyours truly,100% (3)

- Chapter 03 Gross EstateDocument16 pagesChapter 03 Gross EstateNikki Bucatcat0% (1)

- Chapter 1 Succession and Transfer Taxes Part 1Document2 pagesChapter 1 Succession and Transfer Taxes Part 1AngieNo ratings yet

- Gross Estate ProblemsDocument17 pagesGross Estate ProblemsLloyd Sonica100% (1)

- Chapter 14-Regular Income Taxation: IndividualsDocument28 pagesChapter 14-Regular Income Taxation: Individualsarjay matanguihan100% (2)

- Answer Key To Quiz 2 MidtermsDocument2 pagesAnswer Key To Quiz 2 MidtermsRyan Christian Balanquit100% (1)

- CH 5 Final Income TaxationDocument19 pagesCH 5 Final Income TaxationGabriel Trinidad SonielNo ratings yet

- TaxDocument3 pagesTaxArven FrancoNo ratings yet

- Capital Gains Taxation: Lesson 6Document30 pagesCapital Gains Taxation: Lesson 6lc100% (4)

- State of Georgia G-4 PDFDocument2 pagesState of Georgia G-4 PDFJames BoyerNo ratings yet

- Chapter 6 Capital Gains TaxationDocument34 pagesChapter 6 Capital Gains TaxationJason Mables100% (1)

- Capital Gains TaxationDocument44 pagesCapital Gains TaxationPrince Anton DomondonNo ratings yet

- Dealings in Property: Lesson 12Document18 pagesDealings in Property: Lesson 12lcNo ratings yet

- Corporation Quiz PDFDocument8 pagesCorporation Quiz PDFangelo vasquezNo ratings yet

- M5 - Deductions From Gross Estate - Students'Document33 pagesM5 - Deductions From Gross Estate - Students'micaella pasionNo ratings yet

- Taxation CH 5Document6 pagesTaxation CH 5Kristel Nuyda LobasNo ratings yet

- Chapter 6 To Chapter 8Document4 pagesChapter 6 To Chapter 8Jarren BasilanNo ratings yet

- (Tax1) - Income Tax On Individuals - Discussion and ActivitiesDocument12 pages(Tax1) - Income Tax On Individuals - Discussion and ActivitiesKim EllaNo ratings yet

- Chapter 5 Final Income TaxationDocument2 pagesChapter 5 Final Income TaxationBisag AsaNo ratings yet

- Chapter 6 Income Tax by Banggawan Chapter 6 Income Tax by BanggawanDocument11 pagesChapter 6 Income Tax by Banggawan Chapter 6 Income Tax by BanggawanEarth PirapatNo ratings yet

- Transfer and Business TaxationDocument131 pagesTransfer and Business TaxationMr.AccntngNo ratings yet

- Chapter 12 - Dealings in Properties - AnswerDocument7 pagesChapter 12 - Dealings in Properties - AnswerAnonymous eyw8h69EZuNo ratings yet

- 02 IndividualsDocument95 pages02 IndividualsRoronoa Zoro67% (3)

- Chap. 6 8Document44 pagesChap. 6 82vpsrsmg7jNo ratings yet

- Quiz 6 - Fringe BenefitsDocument7 pagesQuiz 6 - Fringe BenefitsCarlo manejaNo ratings yet

- Income Taxation Chapter 2Document5 pagesIncome Taxation Chapter 2Jasmine OlayNo ratings yet

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Chapter 15 Regular Income Taxation CorporationsDocument9 pagesChapter 15 Regular Income Taxation CorporationsMary Jane PabroaNo ratings yet

- Chapter 10Document5 pagesChapter 10여자라라No ratings yet

- Estate TaxDocument48 pagesEstate TaxBhosx Kim100% (1)

- Deductions From Gross Income 2 1Document42 pagesDeductions From Gross Income 2 1Katherine EderosasNo ratings yet

- A) B) C) D) : 1 PointDocument11 pagesA) B) C) D) : 1 Pointprey kunNo ratings yet

- Answers - Business Taxation - Gross Estate (Chapter 13)Document2 pagesAnswers - Business Taxation - Gross Estate (Chapter 13)Gino Cajolo100% (1)

- Compute The Tax Due Assuming That - A The Foreign Taxes Are Claimed As Tax Credit: 2 500 2.5 10 250,000 45,000 Answer M+ K M× % +Document6 pagesCompute The Tax Due Assuming That - A The Foreign Taxes Are Claimed As Tax Credit: 2 500 2.5 10 250,000 45,000 Answer M+ K M× % +Lenny Ramos Villafuerte100% (1)

- Donor's Tax QuizDocument2 pagesDonor's Tax Quizsujulove foreverNo ratings yet

- Estate QuizDocument6 pagesEstate QuizJedi DuenasNo ratings yet

- Chapter 5 Final Income TaxationDocument26 pagesChapter 5 Final Income TaxationJason MablesNo ratings yet

- Introduction To Business Taxation: Chapter 3 (Part 1)Document38 pagesIntroduction To Business Taxation: Chapter 3 (Part 1)Niño Mendoza MabatoNo ratings yet

- Tax ReviewerDocument4 pagesTax ReviewerMel Loise DelmoroNo ratings yet

- Tax 2 Part 3 Estate TaxDocument25 pagesTax 2 Part 3 Estate TaxShane TorrieNo ratings yet

- TAX Code - Section 109Document3 pagesTAX Code - Section 109Ranin, Manilac Melissa SNo ratings yet

- Strategic Tax Management - Week 5Document37 pagesStrategic Tax Management - Week 5Arman DalisayNo ratings yet

- Q3 Capital Gains TaxDocument7 pagesQ3 Capital Gains TaxNhajNo ratings yet

- Responsibility Accounting and Transfer PricingDocument68 pagesResponsibility Accounting and Transfer PricingMari Louis Noriell MejiaNo ratings yet

- HQ05 - Capital Gains TaxationDocument10 pagesHQ05 - Capital Gains TaxationClarisaJoy Sy100% (3)

- Module 2 - Estate TaxDocument14 pagesModule 2 - Estate TaxHaidee Flavier SabidoNo ratings yet

- INCOTAX - Multiple Choices - Problems Part 1Document3 pagesINCOTAX - Multiple Choices - Problems Part 1Harvey100% (1)

- VATDocument5 pagesVATCyril John RamosNo ratings yet

- Income Taxation For IndividualsDocument60 pagesIncome Taxation For IndividualsFrancis Elaine FortunNo ratings yet

- Vat Quizzer ReviewerDocument3 pagesVat Quizzer ReviewerLouiseNo ratings yet

- 50cb2fca 1597910723873pdf PDF FreeDocument10 pages50cb2fca 1597910723873pdf PDF FreefarandiNo ratings yet

- Final Income Taxation: Lesson 5Document28 pagesFinal Income Taxation: Lesson 5lc50% (4)

- Value Added TaxDocument8 pagesValue Added TaxErica VillaruelNo ratings yet

- MAS Product Costing Part IDocument2 pagesMAS Product Costing Part IMary Dale Joie BocalaNo ratings yet

- TaxationnnnDocument12 pagesTaxationnnnRenji kleinNo ratings yet

- Types of Gains On Dealing in PropertiesDocument10 pagesTypes of Gains On Dealing in PropertiesJMNo ratings yet

- Dealings in Property: Capital Gains, Capital Loss, and Capital Gains TaxDocument24 pagesDealings in Property: Capital Gains, Capital Loss, and Capital Gains TaxJezza Mae Gomba RegidorNo ratings yet

- Chapter 5 v5 RevisedDocument18 pagesChapter 5 v5 RevisedThe makas AbababaNo ratings yet

- Dealings in PropertyDocument5 pagesDealings in PropertyNoroNo ratings yet

- Dealings in Property NotesDocument6 pagesDealings in Property NotesLinrhay RicohermosoNo ratings yet

- Chapter 12 Dealings in PropertyDocument7 pagesChapter 12 Dealings in PropertyCharmie JaviertoNo ratings yet

- The Demand For Audit and Other Assurance Services: Review Questions 1-1Document13 pagesThe Demand For Audit and Other Assurance Services: Review Questions 1-1Kristel Nuyda LobasNo ratings yet

- Elements of Gross Income: Why Is Income Subject To Tax?Document6 pagesElements of Gross Income: Why Is Income Subject To Tax?Kristel Nuyda LobasNo ratings yet

- Elements of Gross Income: Why Is Income Subject To Tax?Document6 pagesElements of Gross Income: Why Is Income Subject To Tax?Kristel Nuyda LobasNo ratings yet

- Marketing Channels ReportDocument22 pagesMarketing Channels ReportKristel Nuyda LobasNo ratings yet

- Taxation CH 5Document6 pagesTaxation CH 5Kristel Nuyda LobasNo ratings yet

- Taxation CH 5Document6 pagesTaxation CH 5Kristel Nuyda LobasNo ratings yet

- Taxation CH 3Document6 pagesTaxation CH 3Kristel Nuyda LobasNo ratings yet

- Taxation CH 4Document3 pagesTaxation CH 4Kristel Nuyda LobasNo ratings yet

- Payslip PDFDocument1 pagePayslip PDFChetna PatwalNo ratings yet

- Tax Practice Math Solution PDFDocument1 pageTax Practice Math Solution PDFnurulaminNo ratings yet

- Receipt: No: PRCHE/114905 Date: 06-Jun-2021 Payment Mode: PGDocument2 pagesReceipt: No: PRCHE/114905 Date: 06-Jun-2021 Payment Mode: PGPampanagouda YadavNo ratings yet

- 11.7 - Completing A 1040 PROJECTDocument3 pages11.7 - Completing A 1040 PROJECTrbchamberlin2006No ratings yet

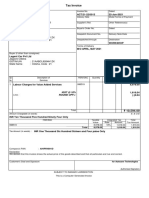

- Tax Invoice: Andreas STIHL (Pty) LTD., P O Box 100148, Scottsville, 3209Document1 pageTax Invoice: Andreas STIHL (Pty) LTD., P O Box 100148, Scottsville, 3209Hermen ManhicaNo ratings yet

- GST Session 43Document20 pagesGST Session 43manjulaNo ratings yet

- Does Not Exceed The VAT Thershold (P3,000,000) : Sales/receipt and Other Non-Operating IncomeDocument5 pagesDoes Not Exceed The VAT Thershold (P3,000,000) : Sales/receipt and Other Non-Operating IncomeJPNo ratings yet

- Ipr2020 - Rosales, Josha IzzavelleDocument2 pagesIpr2020 - Rosales, Josha IzzavelleBaggyaro LaparanNo ratings yet

- Your National Insurance Number: About This FormDocument4 pagesYour National Insurance Number: About This FormTatyana TerziyskaNo ratings yet

- CIR v. LednickyDocument19 pagesCIR v. LednickyAran Khristian MendozaNo ratings yet

- Create Law SummaryDocument2 pagesCreate Law SummaryJiza GarciaNo ratings yet

- A Guide To Taxation in The PhilippinesDocument3 pagesA Guide To Taxation in The PhilippinesPhia CustodioNo ratings yet

- E-Way Bill System-22110616-ERODE-DETAILEDDocument1 pageE-Way Bill System-22110616-ERODE-DETAILEDvragavhNo ratings yet

- 21 Philippine Bank of Communications v. Commissioner of Internal Revenue, G.R. No. 112024, 28 January 1999.Document1 page21 Philippine Bank of Communications v. Commissioner of Internal Revenue, G.R. No. 112024, 28 January 1999.loschudentNo ratings yet

- China Banking Corporation v. CADocument2 pagesChina Banking Corporation v. CANiko Mangaoil AguilarNo ratings yet

- RMC 2020 No. 3 Availability of The Revised BIR Form 1702Q PDFDocument2 pagesRMC 2020 No. 3 Availability of The Revised BIR Form 1702Q PDFBien Bowie A. CortezNo ratings yet

- How To Achieve Tax Savings As A TraderDocument42 pagesHow To Achieve Tax Savings As A TraderHisExcellencyNo ratings yet

- Biswana TH Guha: I. R. Technology Services Pvt. LTDDocument1 pageBiswana TH Guha: I. R. Technology Services Pvt. LTDRoma BeheraNo ratings yet

- Chamber of Real Estate and Builders' Assoc. Vs Hon. Exec. Sec. Alberto RomuloDocument2 pagesChamber of Real Estate and Builders' Assoc. Vs Hon. Exec. Sec. Alberto RomuloRhea Mae Lasay-Sumpiao100% (1)

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This Packagetarles666No ratings yet

- Jaypore Odisha Gstin/Uin: 21AABCL9264H1ZK State Name: Odisha, Code: 21Document1 pageJaypore Odisha Gstin/Uin: 21AABCL9264H1ZK State Name: Odisha, Code: 21M D Prasad RaoNo ratings yet

- GU215RG Post To Home Address: SurreyDocument1 pageGU215RG Post To Home Address: SurreyhelikacarvalhoNo ratings yet

- Collector of Internal Revenue v. de LaraDocument6 pagesCollector of Internal Revenue v. de LaraFaustina del RosarioNo ratings yet

- Dheeraj 1Document1 pageDheeraj 1MOHD ASRAF ANSARINo ratings yet

- MIRA 906 - MRTGS Remittance RequestDocument2 pagesMIRA 906 - MRTGS Remittance RequestSODDEYNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnKylie sheena MendezNo ratings yet

- GST Tax Invoice Format For Services TeachooDocument2 pagesGST Tax Invoice Format For Services TeachoodheerajdorlikarNo ratings yet

- Irs Form 9465 ExampleDocument2 pagesIrs Form 9465 ExampleScottNo ratings yet

- No Name T1 2022Document42 pagesNo Name T1 2022Indo -CanadianNo ratings yet

Taxation CH 6

Taxation CH 6

Uploaded by

Kristel Nuyda Lobas0 ratings0% found this document useful (0 votes)

1K views2 pagesThis document summarizes capital gains taxation in the Philippines. It defines ordinary assets as those used in business and capital assets as all other assets. Gains from selling ordinary assets are subject to regular income tax, while gains from capital assets may be subject to either regular income tax or capital gains tax. Specifically, capital gains tax applies to gains from selling domestic stocks directly to a buyer and gains from selling real property in the Philippines. The capital gains tax rate is 5% for gains up to 100,000 pesos and 10% for gains above 100,000 pesos. The document provides additional details on what constitutes domestic stocks, different modes of disposing of stocks, and capital gains tax compliance requirements.

Original Description:

Reviewer for taxation

Original Title

Taxation Ch 6

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes capital gains taxation in the Philippines. It defines ordinary assets as those used in business and capital assets as all other assets. Gains from selling ordinary assets are subject to regular income tax, while gains from capital assets may be subject to either regular income tax or capital gains tax. Specifically, capital gains tax applies to gains from selling domestic stocks directly to a buyer and gains from selling real property in the Philippines. The capital gains tax rate is 5% for gains up to 100,000 pesos and 10% for gains above 100,000 pesos. The document provides additional details on what constitutes domestic stocks, different modes of disposing of stocks, and capital gains tax compliance requirements.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

1K views2 pagesTaxation CH 6

Taxation CH 6

Uploaded by

Kristel Nuyda LobasThis document summarizes capital gains taxation in the Philippines. It defines ordinary assets as those used in business and capital assets as all other assets. Gains from selling ordinary assets are subject to regular income tax, while gains from capital assets may be subject to either regular income tax or capital gains tax. Specifically, capital gains tax applies to gains from selling domestic stocks directly to a buyer and gains from selling real property in the Philippines. The capital gains tax rate is 5% for gains up to 100,000 pesos and 10% for gains above 100,000 pesos. The document provides additional details on what constitutes domestic stocks, different modes of disposing of stocks, and capital gains tax compliance requirements.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

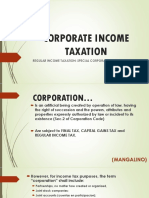

Chapter

Capital Gains Taxation

Reviewer

CLASSIFICATION OF

TAXPAYERS PROPERTIES

1. Ordinary assets - assets

used in business

2. Capital assets - any assets

other than oridnary assets

Asset classification is relative

-the classification of asset or

properties depends upon the

nature of taxpayers business.

*All the personal assets of

taxpayer not engaged in business

are capital ssets while the

business assets of taxpayers

engaged in business may either

be ordinary or capital asset

GAINS ON DEALINGS IN

PROPERTIES

1. Ordinary gain - arises from the

sale, exchange and other

disposition, including pacto de

retro sales and other conditional

sales, of ordinary assets

2. Capital gain - arises from the

sale, exchange and other

disposition, including pacto de

retro sales and other conditional

sales, of capital asstes

Taxation of Gains on Dealings

in Properties

Applicable taxation

Type of

scheme

gain

Ordinary

Regular income tax

gains

Capital

General Rule:

gains

Regular income tax

Exception rule:

Capital gains tax

CAPITAL GAINS SUBJECT TO

CAPITAL GAINS TAX

1. Capital gains on the sale of

domestic stocks sold directly to

buyer

2. Capital gains on the sale of

real properties not used in

business

SCOPE OF CAPITAL GAINS

TAXATION

Gains on dealings in capital

assets

Gain on domestic stocks

directly to the buyer (1)

Sale, exchange and other

disposition of real property

in the Philippines (2)

Gains from other capital

assets

Tax Rates

5% and

10%

capital

gains tax

6% capital

gains tax

Regular

income

tax

SALE, EXCHANGE AND OTHER

DISPOSITION OF DOMESTIC

STOCKS DIRECTLY TO BUYER

Meaning of Domestic

Stocks

-are evidence of ownership or

rights to ownership in a domestic

corporation, regardless of its

feature such as:

1. Preferred stocks

2. Common stocks

3. Stock rights

4. Stock options

5. Stock warrants

6. Unit of participation in any

association, recreation or

amusement club

Exchange of domestic stocks in

kind and other disposition such

as:

1. Foreclosure of property in

settlement of debt

2. Pacto de retro sales - sale with

buy back agreement

3. Conditional sales - sales which

will be perfected upon completion

of certain specified conditions

4. Voluntary buy back of shares

by the issuing corporation

MODES OF DISPOSING

DOMESTIC STOCKS

Shares of stocks may be sold,

exchanged or disposed:

1. Through Philippine Stock

Exchange (PSE) or

2. Directly to the buyer

TAX ON SALE OF DOMESTIC

STOCKS THROUGH THE PSE

The sale of domestic stocks

classified as capital assets

through the PSE is subject to a

stock transaction tax of 1/2 of 1%

of the selling price.

TAX ON SALE, EXCHANGE AND

OTHER DISPOSITIONS OF

DOMESTIC STOCK DIRECTLY

TO THE BUYER

Tax

Rate

Net gain up to P100,000

5%

Excess net gain above

10%

P100,000

CAPITAL GAINS TAX

COMPLIANCE

1. Transactional capital gains tax

2. Annual capital gains tax

Deadline of the transactional

capital gains tax return

-within 30 days after each sale,

exchange and other disposition of

stocks

You might also like

- Chapter 5 Final Income Taxation Summary BanggawanDocument8 pagesChapter 5 Final Income Taxation Summary Banggawanyours truly,100% (3)

- Chapter 03 Gross EstateDocument16 pagesChapter 03 Gross EstateNikki Bucatcat0% (1)

- Chapter 1 Succession and Transfer Taxes Part 1Document2 pagesChapter 1 Succession and Transfer Taxes Part 1AngieNo ratings yet

- Gross Estate ProblemsDocument17 pagesGross Estate ProblemsLloyd Sonica100% (1)

- Chapter 14-Regular Income Taxation: IndividualsDocument28 pagesChapter 14-Regular Income Taxation: Individualsarjay matanguihan100% (2)

- Answer Key To Quiz 2 MidtermsDocument2 pagesAnswer Key To Quiz 2 MidtermsRyan Christian Balanquit100% (1)

- CH 5 Final Income TaxationDocument19 pagesCH 5 Final Income TaxationGabriel Trinidad SonielNo ratings yet

- TaxDocument3 pagesTaxArven FrancoNo ratings yet

- Capital Gains Taxation: Lesson 6Document30 pagesCapital Gains Taxation: Lesson 6lc100% (4)

- State of Georgia G-4 PDFDocument2 pagesState of Georgia G-4 PDFJames BoyerNo ratings yet

- Chapter 6 Capital Gains TaxationDocument34 pagesChapter 6 Capital Gains TaxationJason Mables100% (1)

- Capital Gains TaxationDocument44 pagesCapital Gains TaxationPrince Anton DomondonNo ratings yet

- Dealings in Property: Lesson 12Document18 pagesDealings in Property: Lesson 12lcNo ratings yet

- Corporation Quiz PDFDocument8 pagesCorporation Quiz PDFangelo vasquezNo ratings yet

- M5 - Deductions From Gross Estate - Students'Document33 pagesM5 - Deductions From Gross Estate - Students'micaella pasionNo ratings yet

- Taxation CH 5Document6 pagesTaxation CH 5Kristel Nuyda LobasNo ratings yet

- Chapter 6 To Chapter 8Document4 pagesChapter 6 To Chapter 8Jarren BasilanNo ratings yet

- (Tax1) - Income Tax On Individuals - Discussion and ActivitiesDocument12 pages(Tax1) - Income Tax On Individuals - Discussion and ActivitiesKim EllaNo ratings yet

- Chapter 5 Final Income TaxationDocument2 pagesChapter 5 Final Income TaxationBisag AsaNo ratings yet

- Chapter 6 Income Tax by Banggawan Chapter 6 Income Tax by BanggawanDocument11 pagesChapter 6 Income Tax by Banggawan Chapter 6 Income Tax by BanggawanEarth PirapatNo ratings yet

- Transfer and Business TaxationDocument131 pagesTransfer and Business TaxationMr.AccntngNo ratings yet

- Chapter 12 - Dealings in Properties - AnswerDocument7 pagesChapter 12 - Dealings in Properties - AnswerAnonymous eyw8h69EZuNo ratings yet

- 02 IndividualsDocument95 pages02 IndividualsRoronoa Zoro67% (3)

- Chap. 6 8Document44 pagesChap. 6 82vpsrsmg7jNo ratings yet

- Quiz 6 - Fringe BenefitsDocument7 pagesQuiz 6 - Fringe BenefitsCarlo manejaNo ratings yet

- Income Taxation Chapter 2Document5 pagesIncome Taxation Chapter 2Jasmine OlayNo ratings yet

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Chapter 15 Regular Income Taxation CorporationsDocument9 pagesChapter 15 Regular Income Taxation CorporationsMary Jane PabroaNo ratings yet

- Chapter 10Document5 pagesChapter 10여자라라No ratings yet

- Estate TaxDocument48 pagesEstate TaxBhosx Kim100% (1)

- Deductions From Gross Income 2 1Document42 pagesDeductions From Gross Income 2 1Katherine EderosasNo ratings yet

- A) B) C) D) : 1 PointDocument11 pagesA) B) C) D) : 1 Pointprey kunNo ratings yet

- Answers - Business Taxation - Gross Estate (Chapter 13)Document2 pagesAnswers - Business Taxation - Gross Estate (Chapter 13)Gino Cajolo100% (1)

- Compute The Tax Due Assuming That - A The Foreign Taxes Are Claimed As Tax Credit: 2 500 2.5 10 250,000 45,000 Answer M+ K M× % +Document6 pagesCompute The Tax Due Assuming That - A The Foreign Taxes Are Claimed As Tax Credit: 2 500 2.5 10 250,000 45,000 Answer M+ K M× % +Lenny Ramos Villafuerte100% (1)

- Donor's Tax QuizDocument2 pagesDonor's Tax Quizsujulove foreverNo ratings yet

- Estate QuizDocument6 pagesEstate QuizJedi DuenasNo ratings yet

- Chapter 5 Final Income TaxationDocument26 pagesChapter 5 Final Income TaxationJason MablesNo ratings yet

- Introduction To Business Taxation: Chapter 3 (Part 1)Document38 pagesIntroduction To Business Taxation: Chapter 3 (Part 1)Niño Mendoza MabatoNo ratings yet

- Tax ReviewerDocument4 pagesTax ReviewerMel Loise DelmoroNo ratings yet

- Tax 2 Part 3 Estate TaxDocument25 pagesTax 2 Part 3 Estate TaxShane TorrieNo ratings yet

- TAX Code - Section 109Document3 pagesTAX Code - Section 109Ranin, Manilac Melissa SNo ratings yet

- Strategic Tax Management - Week 5Document37 pagesStrategic Tax Management - Week 5Arman DalisayNo ratings yet

- Q3 Capital Gains TaxDocument7 pagesQ3 Capital Gains TaxNhajNo ratings yet

- Responsibility Accounting and Transfer PricingDocument68 pagesResponsibility Accounting and Transfer PricingMari Louis Noriell MejiaNo ratings yet

- HQ05 - Capital Gains TaxationDocument10 pagesHQ05 - Capital Gains TaxationClarisaJoy Sy100% (3)

- Module 2 - Estate TaxDocument14 pagesModule 2 - Estate TaxHaidee Flavier SabidoNo ratings yet

- INCOTAX - Multiple Choices - Problems Part 1Document3 pagesINCOTAX - Multiple Choices - Problems Part 1Harvey100% (1)

- VATDocument5 pagesVATCyril John RamosNo ratings yet

- Income Taxation For IndividualsDocument60 pagesIncome Taxation For IndividualsFrancis Elaine FortunNo ratings yet

- Vat Quizzer ReviewerDocument3 pagesVat Quizzer ReviewerLouiseNo ratings yet

- 50cb2fca 1597910723873pdf PDF FreeDocument10 pages50cb2fca 1597910723873pdf PDF FreefarandiNo ratings yet

- Final Income Taxation: Lesson 5Document28 pagesFinal Income Taxation: Lesson 5lc50% (4)

- Value Added TaxDocument8 pagesValue Added TaxErica VillaruelNo ratings yet

- MAS Product Costing Part IDocument2 pagesMAS Product Costing Part IMary Dale Joie BocalaNo ratings yet

- TaxationnnnDocument12 pagesTaxationnnnRenji kleinNo ratings yet

- Types of Gains On Dealing in PropertiesDocument10 pagesTypes of Gains On Dealing in PropertiesJMNo ratings yet

- Dealings in Property: Capital Gains, Capital Loss, and Capital Gains TaxDocument24 pagesDealings in Property: Capital Gains, Capital Loss, and Capital Gains TaxJezza Mae Gomba RegidorNo ratings yet

- Chapter 5 v5 RevisedDocument18 pagesChapter 5 v5 RevisedThe makas AbababaNo ratings yet

- Dealings in PropertyDocument5 pagesDealings in PropertyNoroNo ratings yet

- Dealings in Property NotesDocument6 pagesDealings in Property NotesLinrhay RicohermosoNo ratings yet

- Chapter 12 Dealings in PropertyDocument7 pagesChapter 12 Dealings in PropertyCharmie JaviertoNo ratings yet

- The Demand For Audit and Other Assurance Services: Review Questions 1-1Document13 pagesThe Demand For Audit and Other Assurance Services: Review Questions 1-1Kristel Nuyda LobasNo ratings yet

- Elements of Gross Income: Why Is Income Subject To Tax?Document6 pagesElements of Gross Income: Why Is Income Subject To Tax?Kristel Nuyda LobasNo ratings yet

- Elements of Gross Income: Why Is Income Subject To Tax?Document6 pagesElements of Gross Income: Why Is Income Subject To Tax?Kristel Nuyda LobasNo ratings yet

- Marketing Channels ReportDocument22 pagesMarketing Channels ReportKristel Nuyda LobasNo ratings yet

- Taxation CH 5Document6 pagesTaxation CH 5Kristel Nuyda LobasNo ratings yet

- Taxation CH 5Document6 pagesTaxation CH 5Kristel Nuyda LobasNo ratings yet

- Taxation CH 3Document6 pagesTaxation CH 3Kristel Nuyda LobasNo ratings yet

- Taxation CH 4Document3 pagesTaxation CH 4Kristel Nuyda LobasNo ratings yet

- Payslip PDFDocument1 pagePayslip PDFChetna PatwalNo ratings yet

- Tax Practice Math Solution PDFDocument1 pageTax Practice Math Solution PDFnurulaminNo ratings yet

- Receipt: No: PRCHE/114905 Date: 06-Jun-2021 Payment Mode: PGDocument2 pagesReceipt: No: PRCHE/114905 Date: 06-Jun-2021 Payment Mode: PGPampanagouda YadavNo ratings yet

- 11.7 - Completing A 1040 PROJECTDocument3 pages11.7 - Completing A 1040 PROJECTrbchamberlin2006No ratings yet

- Tax Invoice: Andreas STIHL (Pty) LTD., P O Box 100148, Scottsville, 3209Document1 pageTax Invoice: Andreas STIHL (Pty) LTD., P O Box 100148, Scottsville, 3209Hermen ManhicaNo ratings yet

- GST Session 43Document20 pagesGST Session 43manjulaNo ratings yet

- Does Not Exceed The VAT Thershold (P3,000,000) : Sales/receipt and Other Non-Operating IncomeDocument5 pagesDoes Not Exceed The VAT Thershold (P3,000,000) : Sales/receipt and Other Non-Operating IncomeJPNo ratings yet

- Ipr2020 - Rosales, Josha IzzavelleDocument2 pagesIpr2020 - Rosales, Josha IzzavelleBaggyaro LaparanNo ratings yet

- Your National Insurance Number: About This FormDocument4 pagesYour National Insurance Number: About This FormTatyana TerziyskaNo ratings yet

- CIR v. LednickyDocument19 pagesCIR v. LednickyAran Khristian MendozaNo ratings yet

- Create Law SummaryDocument2 pagesCreate Law SummaryJiza GarciaNo ratings yet

- A Guide To Taxation in The PhilippinesDocument3 pagesA Guide To Taxation in The PhilippinesPhia CustodioNo ratings yet

- E-Way Bill System-22110616-ERODE-DETAILEDDocument1 pageE-Way Bill System-22110616-ERODE-DETAILEDvragavhNo ratings yet

- 21 Philippine Bank of Communications v. Commissioner of Internal Revenue, G.R. No. 112024, 28 January 1999.Document1 page21 Philippine Bank of Communications v. Commissioner of Internal Revenue, G.R. No. 112024, 28 January 1999.loschudentNo ratings yet

- China Banking Corporation v. CADocument2 pagesChina Banking Corporation v. CANiko Mangaoil AguilarNo ratings yet

- RMC 2020 No. 3 Availability of The Revised BIR Form 1702Q PDFDocument2 pagesRMC 2020 No. 3 Availability of The Revised BIR Form 1702Q PDFBien Bowie A. CortezNo ratings yet

- How To Achieve Tax Savings As A TraderDocument42 pagesHow To Achieve Tax Savings As A TraderHisExcellencyNo ratings yet

- Biswana TH Guha: I. R. Technology Services Pvt. LTDDocument1 pageBiswana TH Guha: I. R. Technology Services Pvt. LTDRoma BeheraNo ratings yet

- Chamber of Real Estate and Builders' Assoc. Vs Hon. Exec. Sec. Alberto RomuloDocument2 pagesChamber of Real Estate and Builders' Assoc. Vs Hon. Exec. Sec. Alberto RomuloRhea Mae Lasay-Sumpiao100% (1)

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This Packagetarles666No ratings yet

- Jaypore Odisha Gstin/Uin: 21AABCL9264H1ZK State Name: Odisha, Code: 21Document1 pageJaypore Odisha Gstin/Uin: 21AABCL9264H1ZK State Name: Odisha, Code: 21M D Prasad RaoNo ratings yet

- GU215RG Post To Home Address: SurreyDocument1 pageGU215RG Post To Home Address: SurreyhelikacarvalhoNo ratings yet

- Collector of Internal Revenue v. de LaraDocument6 pagesCollector of Internal Revenue v. de LaraFaustina del RosarioNo ratings yet

- Dheeraj 1Document1 pageDheeraj 1MOHD ASRAF ANSARINo ratings yet

- MIRA 906 - MRTGS Remittance RequestDocument2 pagesMIRA 906 - MRTGS Remittance RequestSODDEYNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnKylie sheena MendezNo ratings yet

- GST Tax Invoice Format For Services TeachooDocument2 pagesGST Tax Invoice Format For Services TeachoodheerajdorlikarNo ratings yet

- Irs Form 9465 ExampleDocument2 pagesIrs Form 9465 ExampleScottNo ratings yet

- No Name T1 2022Document42 pagesNo Name T1 2022Indo -CanadianNo ratings yet