Professional Documents

Culture Documents

Recent Supreme Court Decision Does NOT Lift Campaign Restrictions On 501 (C) (3) Charitable Nonprofits

Recent Supreme Court Decision Does NOT Lift Campaign Restrictions On 501 (C) (3) Charitable Nonprofits

Uploaded by

National Council of NonprofitsCopyright:

Available Formats

You might also like

- Quiet Title ApproachDocument5 pagesQuiet Title ApproachBob Ramers100% (6)

- Double Sales ReportDocument9 pagesDouble Sales ReportDiazmean Sotelo100% (1)

- Outline of Wyden-Murkowski Disclosure ProposalDocument6 pagesOutline of Wyden-Murkowski Disclosure ProposalSenLisaMurkowskiNo ratings yet

- Ohio Attorney General's Nonprofit HandbookDocument30 pagesOhio Attorney General's Nonprofit HandbookMike DeWine100% (2)

- Building A Frontline Defense To Stop Secret Political SpendingDocument51 pagesBuilding A Frontline Defense To Stop Secret Political SpendingmmcauliffNo ratings yet

- SCOTUS Page3Document1 pageSCOTUS Page3The Brennan Center for JusticeNo ratings yet

- Fighting The Influence of Big Money in PoliticsDocument4 pagesFighting The Influence of Big Money in PoliticsSally HayatiNo ratings yet

- Rethinking Campaign Finance: Toward A Pro-Democracy JurisprudenceDocument18 pagesRethinking Campaign Finance: Toward A Pro-Democracy JurisprudenceThe Brennan Center for JusticeNo ratings yet

- Citizens United and The 2010 Midterm Elections: December 2010Document16 pagesCitizens United and The 2010 Midterm Elections: December 2010dfreedlanderNo ratings yet

- IRS InfoDocument2 pagesIRS Infokatenunley100% (1)

- Free Speech and The 527 Prohibition, Cato Briefing Paper No. 96Document13 pagesFree Speech and The 527 Prohibition, Cato Briefing Paper No. 96Cato InstituteNo ratings yet

- Script - Mip .PPDocument8 pagesScript - Mip .PPDestiana DewNo ratings yet

- Ajph 89 9 1425Document5 pagesAjph 89 9 1425Hanny GraciaNo ratings yet

- 01-06-12 Letter To SEC Regarding Political SpendingDocument16 pages01-06-12 Letter To SEC Regarding Political SpendingCREWNo ratings yet

- Letter To Campaign Finance and Disclosure Board in Support of Staff RecommendationsDocument4 pagesLetter To Campaign Finance and Disclosure Board in Support of Staff RecommendationsMike DeanNo ratings yet

- 2018 08 14 IFS Analysis ND Campaign Finance Lobbying Initiated Constitutional AmendmentDocument8 pages2018 08 14 IFS Analysis ND Campaign Finance Lobbying Initiated Constitutional AmendmentRob PortNo ratings yet

- Chap 09Document26 pagesChap 09Ghazala AdnanNo ratings yet

- Letter To House in Support of Disclose Act 2012 - 2 15 2012Document3 pagesLetter To House in Support of Disclose Act 2012 - 2 15 2012CREWNo ratings yet

- Brennan Center Testimony Supporting Washington DISCLOSE ACTDocument7 pagesBrennan Center Testimony Supporting Washington DISCLOSE ACTThe Brennan Center for JusticeNo ratings yet

- PPM176 Irs Tax Exempt 9-28-10Document3 pagesPPM176 Irs Tax Exempt 9-28-10Megan WilsonNo ratings yet

- Hansen-Horn, LobbyingDocument2 pagesHansen-Horn, LobbyingMadutza MadyNo ratings yet

- PA SPN ReportDocument32 pagesPA SPN ReportprogressnowNo ratings yet

- Irs Petition July 27 2011Document20 pagesIrs Petition July 27 2011Doug AlexanderNo ratings yet

- Lobbying Compliance, Registration and FilingDocument10 pagesLobbying Compliance, Registration and FilingMichele Di FrancoNo ratings yet

- Analyzing The Impact of The Supreme CourtDocument4 pagesAnalyzing The Impact of The Supreme CourtArpita RanjanNo ratings yet

- Cases and Principles in Political LawDocument11 pagesCases and Principles in Political LawMeng GoblasNo ratings yet

- Advocacy-vs-LobbyingDocument2 pagesAdvocacy-vs-LobbyingNarutoNo ratings yet

- TIGTA Oral Testimony at Senate Finance Hearing On IRS Targeting, May 21, 2013Document11 pagesTIGTA Oral Testimony at Senate Finance Hearing On IRS Targeting, May 21, 2013Ed O'KeefeNo ratings yet

- Corporate Ca Mpaign Spending: Giving Shareholders A Voice: Ciara Torres-SpelliscyDocument44 pagesCorporate Ca Mpaign Spending: Giving Shareholders A Voice: Ciara Torres-Spelliscyapi-26512242No ratings yet

- FAQS On 501c4'sDocument7 pagesFAQS On 501c4'sblankamncoNo ratings yet

- 01-AER-2020-Tax-Exempt Lobbying Corporate Philanthropy As A Tool For Political InfluenceDocument39 pages01-AER-2020-Tax-Exempt Lobbying Corporate Philanthropy As A Tool For Political InfluenceNiamatNo ratings yet

- Interest Group ProjectDocument11 pagesInterest Group Projectapi-251934738No ratings yet

- Election and Political LawDocument2 pagesElection and Political LawjamesNo ratings yet

- Campaign Finance Reform ThesisDocument5 pagesCampaign Finance Reform Thesistjgyhvjef100% (2)

- Kalla Broockman Donor Access Field ExperimentDocument24 pagesKalla Broockman Donor Access Field ExperimentArthur M. ColléNo ratings yet

- Thinking of Forming A Non ProfitDocument36 pagesThinking of Forming A Non ProfitManuel Fernando Nunez100% (4)

- Election Funding Reforms FinalDocument3 pagesElection Funding Reforms FinalAakash ChauhanNo ratings yet

- II. History of Campaign Finance Reform-NIKOLEDocument14 pagesII. History of Campaign Finance Reform-NIKOLEapi-283159057No ratings yet

- Austin v. Michigan Chamber of Commerce, 494 U.S. 652 (1990)Document49 pagesAustin v. Michigan Chamber of Commerce, 494 U.S. 652 (1990)Scribd Government DocsNo ratings yet

- Testimony On Weaponizing Federal Resources: Exposing The SBAs Voter Registration Efforts Before The House Small Business CommitteeDocument10 pagesTestimony On Weaponizing Federal Resources: Exposing The SBAs Voter Registration Efforts Before The House Small Business CommitteeThe Brennan Center for JusticeNo ratings yet

- All Charitable Leaders Need To Help Protect The SectorDocument5 pagesAll Charitable Leaders Need To Help Protect The SectorMike DeWineNo ratings yet

- 2022-11-10 FCC 10DLC Comment FinalDocument13 pages2022-11-10 FCC 10DLC Comment FinalAndyNo ratings yet

- SSRN Id2915025Document4 pagesSSRN Id2915025HkNo ratings yet

- Entities ComplaintDocument34 pagesEntities ComplaintThe Federalist100% (1)

- Questions For Maryland Gubernatorial Candidates 2014: Progressive NeighborsDocument19 pagesQuestions For Maryland Gubernatorial Candidates 2014: Progressive NeighborsDavid MoonNo ratings yet

- JCOPE Complaint 11-18-13 FINAl PDFDocument5 pagesJCOPE Complaint 11-18-13 FINAl PDFRick KarlinNo ratings yet

- JPS Speech (DC) - 09-12-2014Document18 pagesJPS Speech (DC) - 09-12-2014Tom SingNo ratings yet

- Political Parties Viz-A-Viz Right To Information Act, 2005: A Critical AnalysisDocument10 pagesPolitical Parties Viz-A-Viz Right To Information Act, 2005: A Critical AnalysisMukul ChoudharyNo ratings yet

- Advocacy Lobbying V 2Document13 pagesAdvocacy Lobbying V 2ZeeshanNo ratings yet

- Commentary DraftDocument8 pagesCommentary Draftapi-580115711No ratings yet

- 501 (C) (4) - BallotpediaDocument4 pages501 (C) (4) - Ballotpedianoworrieso5No ratings yet

- An Honest Day's Work: Regulating Outside Income of Legislative Officers - CAPI Issue Brief - September 2016Document4 pagesAn Honest Day's Work: Regulating Outside Income of Legislative Officers - CAPI Issue Brief - September 2016Center for the Advancement of Public IntegrityNo ratings yet

- Olivia Loren - BOR Citizens United V FECDocument3 pagesOlivia Loren - BOR Citizens United V FECOlivia LorenNo ratings yet

- Checklist For CSO Laws: 1. Protecting Fundamental FreedomsDocument8 pagesChecklist For CSO Laws: 1. Protecting Fundamental FreedomsEena ClaveroNo ratings yet

- Citizens United Fact SheetDocument6 pagesCitizens United Fact SheetveneabraNo ratings yet

- CIC's Nudge: Transparency and Accountability of Political Parties Will Only Strengthen DemocracyDocument2 pagesCIC's Nudge: Transparency and Accountability of Political Parties Will Only Strengthen Democracyupendra nath singhNo ratings yet

- Free Speech LetterDocument10 pagesFree Speech LetterRob PortNo ratings yet

- Understanding The Lobbying Disclosure ActDocument2 pagesUnderstanding The Lobbying Disclosure ActbdlimmNo ratings yet

- Balancing Rights To Privacy and Information Electoral Bonds CaseDocument3 pagesBalancing Rights To Privacy and Information Electoral Bonds CaseKRISHNA VIDHUSHANo ratings yet

- International Program - Philippines May 9 2012Document3 pagesInternational Program - Philippines May 9 2012Judicial Watch, Inc.No ratings yet

- Vote For Honesty and Get Democracy Done: Four Simple Steps to Change PoliticsFrom EverandVote For Honesty and Get Democracy Done: Four Simple Steps to Change PoliticsNo ratings yet

- Complete Your Enrolment Process Siddesh PPDocument6 pagesComplete Your Enrolment Process Siddesh PPSiddesh PingaleNo ratings yet

- Co v. PNBDocument14 pagesCo v. PNBNorie SapantaNo ratings yet

- Nikah NammaDocument4 pagesNikah NammaM.ASIM IQBAL KIANI100% (2)

- Credit Card Billing Fraud Appellant's Opening BriefDocument35 pagesCredit Card Billing Fraud Appellant's Opening BriefEmanuel McCrayNo ratings yet

- Community Planning and Development RecommendationDocument114 pagesCommunity Planning and Development RecommendationNickNo ratings yet

- Balanay v. MartinezDocument8 pagesBalanay v. MartinezJenNo ratings yet

- Land Aqusition Management System UgandaDocument66 pagesLand Aqusition Management System Ugandaalwil144548100% (1)

- Lucio Dimayuga V Antonio DimayugaDocument1 pageLucio Dimayuga V Antonio DimayugaLaura R. Prado-LopezNo ratings yet

- Clubbing of Income.Document24 pagesClubbing of Income.Deeptangshu KarNo ratings yet

- Rule 132 Authentication and Proof of Docments CasesDocument90 pagesRule 132 Authentication and Proof of Docments CasesHyuga NejiNo ratings yet

- 12 DKC Holdings Corp V CA DigestDocument2 pages12 DKC Holdings Corp V CA DigestGarette LasacNo ratings yet

- Leak Allowance FormDocument2 pagesLeak Allowance FormGeoffery WilliamNo ratings yet

- Criminology 1Document13 pagesCriminology 1Jf AnisetoNo ratings yet

- Beumer V Amores, G.R. No. 195670Document7 pagesBeumer V Amores, G.R. No. 195670Cyrus Pural Eboña100% (1)

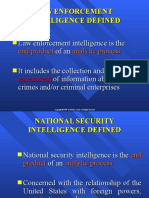

- Law Enforcement Intelligence DefinedDocument26 pagesLaw Enforcement Intelligence DefinedALee BudNo ratings yet

- 08XXXDocument2 pages08XXXdashNo ratings yet

- Adobe Scan 28 Aug 2021Document23 pagesAdobe Scan 28 Aug 2021Merlin KNo ratings yet

- Thomas J. Lavin v. New York News, Inc., D.J. Saunders, Paul Meskill, Robert Hunt, James G. Wieghart, Larry Layout and Harry Headliner, Charles Voss and Robert Sapio, 757 F.2d 1416, 3rd Cir. (1985)Document16 pagesThomas J. Lavin v. New York News, Inc., D.J. Saunders, Paul Meskill, Robert Hunt, James G. Wieghart, Larry Layout and Harry Headliner, Charles Voss and Robert Sapio, 757 F.2d 1416, 3rd Cir. (1985)Scribd Government DocsNo ratings yet

- Opening Statement 2014-15Document2 pagesOpening Statement 2014-15api-272584043No ratings yet

- Finishing ExercisesDocument26 pagesFinishing ExercisesChoco Redondela83% (6)

- Hilado vs. CIRDocument1 pageHilado vs. CIRAlan GultiaNo ratings yet

- Week 9: Network Security & Ethics: Elizabeth Lane Lawley, InstructorDocument18 pagesWeek 9: Network Security & Ethics: Elizabeth Lane Lawley, InstructoramirsalahibrahimNo ratings yet

- Ang Mga Kaanib Sa Iglesia NG Dios Kay Kristo Hesus v. Iglesia NG Dios Kay Cristo JesusDocument8 pagesAng Mga Kaanib Sa Iglesia NG Dios Kay Kristo Hesus v. Iglesia NG Dios Kay Cristo JesusCassie GacottNo ratings yet

- Succession Notes Final Draft v.1Document117 pagesSuccession Notes Final Draft v.1Anonymous 2UPF2xNo ratings yet

- Unit-Vi: International Law & Use of Force by StatesDocument79 pagesUnit-Vi: International Law & Use of Force by StatesAnonymous aheaSNNo ratings yet

- MLS (Civil Law Act 1956)Document35 pagesMLS (Civil Law Act 1956)Mia GeorgeNo ratings yet

- SyllabusDocument34 pagesSyllabusPrateek DwivediNo ratings yet

- Chapter-Iii Enforcement Agenices and InvestigationsDocument25 pagesChapter-Iii Enforcement Agenices and Investigationsakash tiwariNo ratings yet

Recent Supreme Court Decision Does NOT Lift Campaign Restrictions On 501 (C) (3) Charitable Nonprofits

Recent Supreme Court Decision Does NOT Lift Campaign Restrictions On 501 (C) (3) Charitable Nonprofits

Uploaded by

National Council of NonprofitsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Recent Supreme Court Decision Does NOT Lift Campaign Restrictions On 501 (C) (3) Charitable Nonprofits

Recent Supreme Court Decision Does NOT Lift Campaign Restrictions On 501 (C) (3) Charitable Nonprofits

Uploaded by

National Council of NonprofitsCopyright:

Available Formats

Recent Supreme Court Decision Does NOT Lift

Campaign Restrictions on 501(c)(3) Charitable Nonprofits

The U.S. Supreme Court’s recent landmark decision in Citizens United v. Federal Election Commission

(No. 08-205; decided January 21, 2010), concerning the application of certain election laws to

corporations, does NOT change how other laws limit the election-related activities of charitable nonprofit

organizations with tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. The National

Council of Nonprofits prepared this brief analysis to clear up any confusion surrounding the decision and

to help charitable nonprofits avoid actions that could jeopardize their tax-exempt status.

Key Laws Still Limit Election Activities by Charitable Nonprofits

Federal law declares that charitable nonprofits and foundations may not “participate in, or intervene in

(including publishing or distributing statements), any political campaign on behalf of (or in opposition to)

any candidate for political office” at the federal, state, and local levels. 26 U.S.C. § 501(c)(3). The IRS

has warned: “all section 501(c)(3) organizations are absolutely prohibited from directly or indirectly

participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate

for elective office. Contributions to political campaign funds or public statements of position (verbal or

written) made on behalf of the organization in favor or in opposition to any candidate for public office

clearly violate the prohibition against political campaign activity. Violating this prohibition may result in

denial or revocation of tax-exempt status and the imposition of certain excise taxes.”

But What About the Recent Supreme Court Case?

Readers of the Supreme Court’s majority opinion must look at the entire context, the underlying facts, and

the actual holding of the case rather than just this sweeping language on page 50: “Government may not

suppress political speech on the basis of the speaker’s corporate identity. No sufficient governmental

interest justifies limits on the political speech of nonprofit or for-profit corporations.” That language does

not allow 501(c)(3) charitable nonprofits to ignore other federal laws. Here’s why:

1. The issue the Court ruled on was the constitutionality of Section 441b of federal election laws

as amended by Section 203 of the Bipartisan Campaign Reform Act of 2002 (the “McCain-

Feingold” Act), not anything else. That provision concerned the ability of corporations and

unions to use their funds to expressly advocate for the election or defeat of candidates or to

broadcast “electioneering communications” within 30 or 60 days of an election.

2. On page 3 of the majority opinion, the Court essentially affirmed that federal law still prohibits

corporations and unions from making direct contributions to candidates and from making

independent expenditures that expressly advocate for the election or defeat of a candidate –

which are similar to the prohibitions in Section 501(c)(3) that apply to charitable nonprofits.

3. But according to the Court’s opinion, Citizens United is a nonprofit, so doesn’t that open the

door for all nonprofits? No, because Citizens United is a 501(c)(4) nonprofit, and federal law

has always given other nonprofits – (c)(4) civic groups, (c)(5) labor unions, and (c)(6)

chambers of commerce and trade associations – much greater latitude in election matters

than (c)(3) charities. The reason: Donations to 501(c)(3) nonprofits are tax deductible.

4. But what about the language on pages 20-21 of the majority opinion that cites the Sierra

Club, the National Rifle Association, and the American Civil Liberties Union in examples to

demonstrate how application of the law would censor nonprofits? First, note how the

majority opinion on those pages limits its analysis strictly to the application of Section 441b.

Second, the NRA is a 501(c)(4) and the ACLU and Sierra Club both have 501(c)(3) and

501(c)(4) counterparts with those names. So once again, the opinion’s seemingly broad

language does not change the laws that apply to 501(c)(3) charitable nonprofits.

National Council of Nonprofits ♦ 202.962-0322 ♦ www.councilofnonprofits.org

What Can 501(c)(3) Charitable Nonprofits Do in Connection with Political Campaigns?

1. Know the law. Federal law, as interpreted by the IRS, still allows charitable nonprofits to

engage in a lot of different activities relating to elections, such as “certain voter education

activities … [and] other activities intended to encourage people to participate in the electoral

process, such as voter registration and get-out-the-vote drives … if conducted in a non-

partisan manner.” Indeed, to fully advance their own missions, charitable nonprofits need to

appreciate the many reasons why they should get more involved in election-related work,

and how easy it is to do. The Nonprofit Voter Engagement Network’s website explains why

nonprofits should engage in election work. Nonprofits can learn more about what they legally

can do in connection with elections from these trusted resources:

· Alliance for Justice: www.afj.org

o “Electoral Activities Checklist”

· Center for Lobbying in the Public Interest: www.clpi.org

o “Nonprofits & Election-Related Activities”

o “Initiatives & Referenda”

· Internal Revenue Service: www.irs.gov

o “Election Year Activities and the Prohibition on Political Campaign Intervention

for Section 501(c)(3) Organizations”

o “Charities, Churches, and Educational Organizations – Political Campaign

Intervention”

· Nonprofit Voter Engagement Network: www.nonprofitvote.org

o How can nonprofits legally engage in election work?

2. Participate on a nonpartisan basis in elections involving candidates. Although charitable

nonprofits may not endorse or work for or against individual candidates, the IRS recognizes

that charitable nonprofits may engage in voter registration, education, and participation

efforts if done neutrally on a nonpartisan basis. Revenue Ruling 2007-41 I.R.B. (June 18,

2007) at 3. For example, charitable nonprofits “may encourage people to participate in the

electoral process through voter registration and get-out-the-vote drives, conducted in a non-

partisan manner. On the other hand, voter education or registration activities conducted in a

biased manner that favors (or opposes) one or more candidates is prohibited.” Id.

3. Campaigns for/against specific issues (e.g., legislation, initiatives and ballot measures).

Charitable nonprofits are free to engage in campaigns regarding issues. Any expenditures of

money (including for staff time) will be reported on your 990 as a lobbying expenditure.

What Else Can Charitable Nonprofits Do?

Many commentators are predicting that the Court’s decision will allow big corporations to have a far

greater impact on elections and legislation across the country, so is there anything that charitable

nonprofits can do? Yes. It is essential that charitable 501(c)(3) nonprofits:

1. Exercise their constitutional right to engage in lobbying and other advocacy activities to

positively influence public policy. Virtually every nonprofit can advance and better protect its

mission if it engages in public policy work on a regular basis.

2. Recognize that “there is safety and power in numbers” and join their state association of

nonprofits. By doing so, individual nonprofits will gain access to critical information about

federal and state public policy matters, among many other benefits. The charitable nonprofit

sector enjoys great diversity, yet we also share many common interests that can be

protected best by uniting together. In doing so, nonprofits can amplify our collective voices

on policy matters more clearly and forcefully.

3. Stay tuned; while these are the immediate implications, it is inevitable that there will be

many court challenges, FEC rulings, and legislative activities at the federal and state levels

that will provide additional guidance.

This memo is intended for educational and informational purposes only.

Nothing contained herein is to be considered as legal advice for specific matters;

National

readersCouncil of Nonprofits

are responsible ♦ 202.962-0322

for obtaining www.councilofnonprofits.org

such advice♦from their own legal counsel.

You might also like

- Quiet Title ApproachDocument5 pagesQuiet Title ApproachBob Ramers100% (6)

- Double Sales ReportDocument9 pagesDouble Sales ReportDiazmean Sotelo100% (1)

- Outline of Wyden-Murkowski Disclosure ProposalDocument6 pagesOutline of Wyden-Murkowski Disclosure ProposalSenLisaMurkowskiNo ratings yet

- Ohio Attorney General's Nonprofit HandbookDocument30 pagesOhio Attorney General's Nonprofit HandbookMike DeWine100% (2)

- Building A Frontline Defense To Stop Secret Political SpendingDocument51 pagesBuilding A Frontline Defense To Stop Secret Political SpendingmmcauliffNo ratings yet

- SCOTUS Page3Document1 pageSCOTUS Page3The Brennan Center for JusticeNo ratings yet

- Fighting The Influence of Big Money in PoliticsDocument4 pagesFighting The Influence of Big Money in PoliticsSally HayatiNo ratings yet

- Rethinking Campaign Finance: Toward A Pro-Democracy JurisprudenceDocument18 pagesRethinking Campaign Finance: Toward A Pro-Democracy JurisprudenceThe Brennan Center for JusticeNo ratings yet

- Citizens United and The 2010 Midterm Elections: December 2010Document16 pagesCitizens United and The 2010 Midterm Elections: December 2010dfreedlanderNo ratings yet

- IRS InfoDocument2 pagesIRS Infokatenunley100% (1)

- Free Speech and The 527 Prohibition, Cato Briefing Paper No. 96Document13 pagesFree Speech and The 527 Prohibition, Cato Briefing Paper No. 96Cato InstituteNo ratings yet

- Script - Mip .PPDocument8 pagesScript - Mip .PPDestiana DewNo ratings yet

- Ajph 89 9 1425Document5 pagesAjph 89 9 1425Hanny GraciaNo ratings yet

- 01-06-12 Letter To SEC Regarding Political SpendingDocument16 pages01-06-12 Letter To SEC Regarding Political SpendingCREWNo ratings yet

- Letter To Campaign Finance and Disclosure Board in Support of Staff RecommendationsDocument4 pagesLetter To Campaign Finance and Disclosure Board in Support of Staff RecommendationsMike DeanNo ratings yet

- 2018 08 14 IFS Analysis ND Campaign Finance Lobbying Initiated Constitutional AmendmentDocument8 pages2018 08 14 IFS Analysis ND Campaign Finance Lobbying Initiated Constitutional AmendmentRob PortNo ratings yet

- Chap 09Document26 pagesChap 09Ghazala AdnanNo ratings yet

- Letter To House in Support of Disclose Act 2012 - 2 15 2012Document3 pagesLetter To House in Support of Disclose Act 2012 - 2 15 2012CREWNo ratings yet

- Brennan Center Testimony Supporting Washington DISCLOSE ACTDocument7 pagesBrennan Center Testimony Supporting Washington DISCLOSE ACTThe Brennan Center for JusticeNo ratings yet

- PPM176 Irs Tax Exempt 9-28-10Document3 pagesPPM176 Irs Tax Exempt 9-28-10Megan WilsonNo ratings yet

- Hansen-Horn, LobbyingDocument2 pagesHansen-Horn, LobbyingMadutza MadyNo ratings yet

- PA SPN ReportDocument32 pagesPA SPN ReportprogressnowNo ratings yet

- Irs Petition July 27 2011Document20 pagesIrs Petition July 27 2011Doug AlexanderNo ratings yet

- Lobbying Compliance, Registration and FilingDocument10 pagesLobbying Compliance, Registration and FilingMichele Di FrancoNo ratings yet

- Analyzing The Impact of The Supreme CourtDocument4 pagesAnalyzing The Impact of The Supreme CourtArpita RanjanNo ratings yet

- Cases and Principles in Political LawDocument11 pagesCases and Principles in Political LawMeng GoblasNo ratings yet

- Advocacy-vs-LobbyingDocument2 pagesAdvocacy-vs-LobbyingNarutoNo ratings yet

- TIGTA Oral Testimony at Senate Finance Hearing On IRS Targeting, May 21, 2013Document11 pagesTIGTA Oral Testimony at Senate Finance Hearing On IRS Targeting, May 21, 2013Ed O'KeefeNo ratings yet

- Corporate Ca Mpaign Spending: Giving Shareholders A Voice: Ciara Torres-SpelliscyDocument44 pagesCorporate Ca Mpaign Spending: Giving Shareholders A Voice: Ciara Torres-Spelliscyapi-26512242No ratings yet

- FAQS On 501c4'sDocument7 pagesFAQS On 501c4'sblankamncoNo ratings yet

- 01-AER-2020-Tax-Exempt Lobbying Corporate Philanthropy As A Tool For Political InfluenceDocument39 pages01-AER-2020-Tax-Exempt Lobbying Corporate Philanthropy As A Tool For Political InfluenceNiamatNo ratings yet

- Interest Group ProjectDocument11 pagesInterest Group Projectapi-251934738No ratings yet

- Election and Political LawDocument2 pagesElection and Political LawjamesNo ratings yet

- Campaign Finance Reform ThesisDocument5 pagesCampaign Finance Reform Thesistjgyhvjef100% (2)

- Kalla Broockman Donor Access Field ExperimentDocument24 pagesKalla Broockman Donor Access Field ExperimentArthur M. ColléNo ratings yet

- Thinking of Forming A Non ProfitDocument36 pagesThinking of Forming A Non ProfitManuel Fernando Nunez100% (4)

- Election Funding Reforms FinalDocument3 pagesElection Funding Reforms FinalAakash ChauhanNo ratings yet

- II. History of Campaign Finance Reform-NIKOLEDocument14 pagesII. History of Campaign Finance Reform-NIKOLEapi-283159057No ratings yet

- Austin v. Michigan Chamber of Commerce, 494 U.S. 652 (1990)Document49 pagesAustin v. Michigan Chamber of Commerce, 494 U.S. 652 (1990)Scribd Government DocsNo ratings yet

- Testimony On Weaponizing Federal Resources: Exposing The SBAs Voter Registration Efforts Before The House Small Business CommitteeDocument10 pagesTestimony On Weaponizing Federal Resources: Exposing The SBAs Voter Registration Efforts Before The House Small Business CommitteeThe Brennan Center for JusticeNo ratings yet

- All Charitable Leaders Need To Help Protect The SectorDocument5 pagesAll Charitable Leaders Need To Help Protect The SectorMike DeWineNo ratings yet

- 2022-11-10 FCC 10DLC Comment FinalDocument13 pages2022-11-10 FCC 10DLC Comment FinalAndyNo ratings yet

- SSRN Id2915025Document4 pagesSSRN Id2915025HkNo ratings yet

- Entities ComplaintDocument34 pagesEntities ComplaintThe Federalist100% (1)

- Questions For Maryland Gubernatorial Candidates 2014: Progressive NeighborsDocument19 pagesQuestions For Maryland Gubernatorial Candidates 2014: Progressive NeighborsDavid MoonNo ratings yet

- JCOPE Complaint 11-18-13 FINAl PDFDocument5 pagesJCOPE Complaint 11-18-13 FINAl PDFRick KarlinNo ratings yet

- JPS Speech (DC) - 09-12-2014Document18 pagesJPS Speech (DC) - 09-12-2014Tom SingNo ratings yet

- Political Parties Viz-A-Viz Right To Information Act, 2005: A Critical AnalysisDocument10 pagesPolitical Parties Viz-A-Viz Right To Information Act, 2005: A Critical AnalysisMukul ChoudharyNo ratings yet

- Advocacy Lobbying V 2Document13 pagesAdvocacy Lobbying V 2ZeeshanNo ratings yet

- Commentary DraftDocument8 pagesCommentary Draftapi-580115711No ratings yet

- 501 (C) (4) - BallotpediaDocument4 pages501 (C) (4) - Ballotpedianoworrieso5No ratings yet

- An Honest Day's Work: Regulating Outside Income of Legislative Officers - CAPI Issue Brief - September 2016Document4 pagesAn Honest Day's Work: Regulating Outside Income of Legislative Officers - CAPI Issue Brief - September 2016Center for the Advancement of Public IntegrityNo ratings yet

- Olivia Loren - BOR Citizens United V FECDocument3 pagesOlivia Loren - BOR Citizens United V FECOlivia LorenNo ratings yet

- Checklist For CSO Laws: 1. Protecting Fundamental FreedomsDocument8 pagesChecklist For CSO Laws: 1. Protecting Fundamental FreedomsEena ClaveroNo ratings yet

- Citizens United Fact SheetDocument6 pagesCitizens United Fact SheetveneabraNo ratings yet

- CIC's Nudge: Transparency and Accountability of Political Parties Will Only Strengthen DemocracyDocument2 pagesCIC's Nudge: Transparency and Accountability of Political Parties Will Only Strengthen Democracyupendra nath singhNo ratings yet

- Free Speech LetterDocument10 pagesFree Speech LetterRob PortNo ratings yet

- Understanding The Lobbying Disclosure ActDocument2 pagesUnderstanding The Lobbying Disclosure ActbdlimmNo ratings yet

- Balancing Rights To Privacy and Information Electoral Bonds CaseDocument3 pagesBalancing Rights To Privacy and Information Electoral Bonds CaseKRISHNA VIDHUSHANo ratings yet

- International Program - Philippines May 9 2012Document3 pagesInternational Program - Philippines May 9 2012Judicial Watch, Inc.No ratings yet

- Vote For Honesty and Get Democracy Done: Four Simple Steps to Change PoliticsFrom EverandVote For Honesty and Get Democracy Done: Four Simple Steps to Change PoliticsNo ratings yet

- Complete Your Enrolment Process Siddesh PPDocument6 pagesComplete Your Enrolment Process Siddesh PPSiddesh PingaleNo ratings yet

- Co v. PNBDocument14 pagesCo v. PNBNorie SapantaNo ratings yet

- Nikah NammaDocument4 pagesNikah NammaM.ASIM IQBAL KIANI100% (2)

- Credit Card Billing Fraud Appellant's Opening BriefDocument35 pagesCredit Card Billing Fraud Appellant's Opening BriefEmanuel McCrayNo ratings yet

- Community Planning and Development RecommendationDocument114 pagesCommunity Planning and Development RecommendationNickNo ratings yet

- Balanay v. MartinezDocument8 pagesBalanay v. MartinezJenNo ratings yet

- Land Aqusition Management System UgandaDocument66 pagesLand Aqusition Management System Ugandaalwil144548100% (1)

- Lucio Dimayuga V Antonio DimayugaDocument1 pageLucio Dimayuga V Antonio DimayugaLaura R. Prado-LopezNo ratings yet

- Clubbing of Income.Document24 pagesClubbing of Income.Deeptangshu KarNo ratings yet

- Rule 132 Authentication and Proof of Docments CasesDocument90 pagesRule 132 Authentication and Proof of Docments CasesHyuga NejiNo ratings yet

- 12 DKC Holdings Corp V CA DigestDocument2 pages12 DKC Holdings Corp V CA DigestGarette LasacNo ratings yet

- Leak Allowance FormDocument2 pagesLeak Allowance FormGeoffery WilliamNo ratings yet

- Criminology 1Document13 pagesCriminology 1Jf AnisetoNo ratings yet

- Beumer V Amores, G.R. No. 195670Document7 pagesBeumer V Amores, G.R. No. 195670Cyrus Pural Eboña100% (1)

- Law Enforcement Intelligence DefinedDocument26 pagesLaw Enforcement Intelligence DefinedALee BudNo ratings yet

- 08XXXDocument2 pages08XXXdashNo ratings yet

- Adobe Scan 28 Aug 2021Document23 pagesAdobe Scan 28 Aug 2021Merlin KNo ratings yet

- Thomas J. Lavin v. New York News, Inc., D.J. Saunders, Paul Meskill, Robert Hunt, James G. Wieghart, Larry Layout and Harry Headliner, Charles Voss and Robert Sapio, 757 F.2d 1416, 3rd Cir. (1985)Document16 pagesThomas J. Lavin v. New York News, Inc., D.J. Saunders, Paul Meskill, Robert Hunt, James G. Wieghart, Larry Layout and Harry Headliner, Charles Voss and Robert Sapio, 757 F.2d 1416, 3rd Cir. (1985)Scribd Government DocsNo ratings yet

- Opening Statement 2014-15Document2 pagesOpening Statement 2014-15api-272584043No ratings yet

- Finishing ExercisesDocument26 pagesFinishing ExercisesChoco Redondela83% (6)

- Hilado vs. CIRDocument1 pageHilado vs. CIRAlan GultiaNo ratings yet

- Week 9: Network Security & Ethics: Elizabeth Lane Lawley, InstructorDocument18 pagesWeek 9: Network Security & Ethics: Elizabeth Lane Lawley, InstructoramirsalahibrahimNo ratings yet

- Ang Mga Kaanib Sa Iglesia NG Dios Kay Kristo Hesus v. Iglesia NG Dios Kay Cristo JesusDocument8 pagesAng Mga Kaanib Sa Iglesia NG Dios Kay Kristo Hesus v. Iglesia NG Dios Kay Cristo JesusCassie GacottNo ratings yet

- Succession Notes Final Draft v.1Document117 pagesSuccession Notes Final Draft v.1Anonymous 2UPF2xNo ratings yet

- Unit-Vi: International Law & Use of Force by StatesDocument79 pagesUnit-Vi: International Law & Use of Force by StatesAnonymous aheaSNNo ratings yet

- MLS (Civil Law Act 1956)Document35 pagesMLS (Civil Law Act 1956)Mia GeorgeNo ratings yet

- SyllabusDocument34 pagesSyllabusPrateek DwivediNo ratings yet

- Chapter-Iii Enforcement Agenices and InvestigationsDocument25 pagesChapter-Iii Enforcement Agenices and Investigationsakash tiwariNo ratings yet