Professional Documents

Culture Documents

CIBC - Case Study

CIBC - Case Study

Uploaded by

Sunil MishraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIBC - Case Study

CIBC - Case Study

Uploaded by

Sunil MishraCopyright:

Available Formats

Financial Services

SAS Global Forum 2009

Paper 131-2009

Case Study

Rick Miller

SAS Global Forum 2009

Vice-President, Credit Risk Data Solutions

Risk Management, CIBC

CIBC 2009 All Rights Reserved

Risk Management:

Using the SAS Platform at CIBC

For what matters.

Financial Services

SAS Global Forum 2009

Disclaimer

Any views, opinions, advice, statements, or other information or content

expressed or implied in the following presentation are solely those of the

presenter and do not necessarily state or reflect the views, positions, or

SAS Global Forum 2009

opinion of Canadian Imperial Bank of Commerce (CIBC) or any of its

CIBC 2009 All Rights Reserved

subsidiaries or affiliates.

For what matters.

Financial Services

SAS Global Forum 2009

Key Data Challenges

The Journey Ahead

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

Increased Spotlight on Credit Risk Data

A Brief Overview of the Basel II Framework

Todays Discussion

For what matters.

Financial Services

SAS Global Forum 2009

About CIBC

All amounts in C$

Canadian Imperial Bank of Commerce (CIBC) is a leading

North American Financial institution

we offer a full range of products and services to almost

11 million individuals and small businesses, corporate and

institutional clients

SAS Global Forum 2009

At year-end (October 31, 2008):

Market capitalization was $20.8 billion

Tier 1 capital ratio was 10.5%

employed nearly 40,000 employees worldwide

had 1,050 branches in Canada and more than 3,700 ABMs

CIBC 2009 All Rights Reserved

constituent of the Dow Jones Sustainability Index (DJSI)

for seven consecutive years (one of 25 banks worldwide)

For what matters.

Financial Services

SAS Global Forum 2009

The Basel II Framework Goals

a global framework issued by Bank of International

Settlements (BIS) and managed by national supervisors

Credit Risk

Operational Risk

Market Risk

developed over the period 1999 2005 with broad

impact studies

consultation globally

with

Pillar III

Pillar I along

Pillar

II quantitative

Calculation of

SelfDisclosure

Minimum

Assessment

and

Capital

and

The Basel IIRequirements

Committee Goals

were: Market

Supervisory

Discipline

Review

to enhance risk sensitivity

of capital

requirements

greater emphasis on banks own assessment of risk

improve transparency for market discipline

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

Basel II was implemented November 1, 2007 by CIBC and

other major banks in Canada

For what matters.

Financial Services

SAS Global Forum 2009

Pillar I

Pillar II

Disclosure

and

Market

Discipline

Pillar III

SAS Global Forum 2009

Calculation of

Minimum

Capital

Requirements

CIBC 2009 All Rights Reserved

SelfAssessment

and

Supervisory

Review

Credit Risk

Operational Risk

Market Risk

The Basel II Framework

For what matters.

Financial Services

SAS Global Forum 2009

Best

Bank A

Bank B

Default Rating

Worst

Corporate

Loan Portfolio

Distribution of Credit Risk

For what matters.

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

ILLUSTRATIVE

assume credit portfolio size is identical for both banks

but with a different mix of credit risk

Exposure ($)

Financial Services

SAS Global Forum 2009

Exposures

Total

CAR 1

Capital

Corporate

Loan Portfolio

Bank B

Bank A

Previous CAR: No Differentiation

For what matters.

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

ILLUSTRATIVE

Under previous Capital Adequacy rules, both portfolios

would require the same amount of minimum regulatory capital

($)

Financial Services

SAS Global Forum 2009

Total

CAR 1

Capital

Basel II

Capital

Corporate

Loan Portfolio

Exposures

Bank B

Bank A

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

ILLUSTRATIVE

AIRB Approach

Basel II: Risk Sensitive, More Capital

For what matters.

The strategic implication is that banks with riskier portfolios

will have higher minimum regulatory capital requirements

($)

Financial Services

SAS Global Forum 2009

Basel II Glossary: Credit Risk Capital

The Basel II Framework allows the use of bank-specific

estimates of risk components in determining the capital

component for a given exposure:

Probability of default (PD)

Exposure at default (EAD)

Loss given default (LGD)

Effective maturity

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

10

Firm-size adjustment for Small Medium Enterprises (SME)

For what matters.

Financial Services

SAS Global Forum 2009

Basel II Glossary: Credit Risk Capital

Expected Loss (EL) = PD * EAD * LGD

Unexpected

loss

SAS Global Forum 2009

11

Unexpected Loss (UL) calculated using sophisticated Basel II

formulae incorporating PD, EAD, LGD

Loss

99.9th percentile

of loss

Probability of Default

Expected loss

CIBC 2009 All Rights Reserved

minimum regulatory capital is a function of the calculation

of unexpected loss (UL) and expected loss (EL)

For what matters.

Financial Services

SAS Global Forum 2009

some capital relief for credit risk

mitigation (e.g., collateral)

SAS Global Forum 2009

12

banks can use external credit ratings

more gradations of risk

similar to existing BIS88

STANDARDIZED APPROACH

Basel II: Three Options for Credit Risk

Standardized

Approach

CIBC 2009 All Rights Reserved

More Stringent Qualifying Criteria

For what matters.

More Sophistication and Risk Sensitivity

Financial Services

SAS Global Forum 2009

SAS Global Forum 2009

13

expected Minimum requirement for

internationally active banks

supervisors provide estimates for:

Loss Given Default (LGD) and

Exposure At Default (EAD)

banks use their own estimates of:

Probability of Default (PD)

based on internal data and risk ratings

FOUNDATION INTERNAL RATINGS

BASED APPROACH (FIRB)

Basel II: Three Options for Credit Risk

Foundation

Internal Ratings

Based Approach

Standardized

Approach

CIBC 2009 All Rights Reserved

More Stringent Qualifying Criteria

For what matters.

More Sophistication and Risk Sensitivity

Financial Services

SAS Global Forum 2009

banks use their own estimates of:

Probability of Default (PD)

Loss Given Default (LGD)

Exposure at Default (EAD)

complex and internationally active

banks encouraged to move to this

approach

SAS Global Forum 2009

14

based on internal data and risk ratings

ADVANCED INTERNAL RATINGS

BASED APPROACH (AIRB)

Basel II: Three Options for Credit Risk

Advanced

Internal Ratings

Based Approach

(AIRB)

Foundation

Internal Ratings

Based Approach

Standardized

Approach

CIBC 2009 All Rights Reserved

More Stringent Qualifying Criteria

For what matters.

More Sophistication and Risk Sensitivity

Financial Services

SAS Global Forum 2009

SAS Global Forum 2009

15

Supervisor expects all major

Canadian banks to implement

AIRB

Banks must have a robust

system in place to validate the

accuracy and consistency of:

- rating systems,

- processes, and

- estimation of all relevant

risk components

Banks must meet broad

risk-quantification standards

for own estimates of PD,

LGD, EAD

Basel II: Three Options for Credit Risk

Advanced

Internal Ratings

Based Approach

(AIRB)

Foundation

Internal Ratings

Based Approach

Standardised

Approach

CIBC 2009 All Rights Reserved

More Stringent Qualifying Criteria

For what matters.

More Sophistication and Risk Sensitivity

Financial Services

SAS Global Forum 2009

Basel II Glossary: Exposure Classes

CORPORATE

SOVEREIGN

BANK

RETAIL

Residential Secured

Qualifying Revolving Retail

All Other Retail

EQUITIES (non-traded)

under the IRB approach, banks must categorize banking-book

exposures into broad classes of assets, specifically:

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

16

the work here was focused on ensuring that the identifiers to

classify exposures were available, accurate, complete, and

persistent in the source data

For what matters.

Financial Services

SAS Global Forum 2009

Basel II Glossary: Exposure Types

additional granularity of reporting using counterparty type

Other Retail

Qualifying revolving retail

Residential secured

xxx

xxx

xxx

xxx

Drawn

xxx

xxx

xxx

xxx

xxx

Undrawn

xxx

xxx

xxx

xxx

xxx

xxx

Repo style

transactions

xxx

xxx

xxx

xxx

xxx

xxx

OTC

derivatives

xxx

xxx

xxx

xxx

xxx

xxx

xxx

Other

xxx

xxx

xxx

xxx

xxx

xxx

xxx

TOTAL

ILLUSTRATIVE

Corporate

xxx

xxx

xxx

Credit Exposures

by type for the period ending...

Sovereign

xxx

xxx

(Canadian $ millions)

Bank

xxx

SAS Global Forum 2009

xxx

CIBC 2009 All Rights Reserved

Total Gross Credit Risk Exposures

For what matters.

17

Financial Services

SAS Global Forum 2009

Data Maintenance Focus by Regulators

Implementation Note by the Canadian supervisor (OSFI),

Data Maintenance at IRB Institutions

provides general guidance on data maintenance

and principles to apply

supervisor will monitor ongoing data maintenance

compliance

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

Data Maintenance Principles include guidance on:

Senior Management Oversight Accountabilities

Data Life-Cycle Management

For what matters.

18

Financial Services

SAS Global Forum 2009

So, What Is the Prize?

regulatory compliance is critical

SAS Global Forum 2009

19

for CIBCs mix of business, using the Basel II AIRB approach

results in a small overall reduction of capital for credit risk

for line of business operations, ties the allocation and use

of regulatory capital to the risk profile of the business

promotes an enterprise-wide focus on the importance of

accurate and complete risk data

CIBC 2009 All Rights Reserved

introduces formal requirements for back testing and

stress testing of rating systems and parameter estimates

to supplement and enhance existing practices

For what matters.

Financial Services

SAS Global Forum 2009

Getting Started

CIBC Case Study

Developing Parameter Estimates

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

Calculating Basel II Regulatory Capital

For what matters.

20

Financial Services

SAS Global Forum 2009

CIBC Case Study: Where We Started

developed a broad understanding of the Basel II Framework

requirements

assessed what already existed, in terms of:

People

Processes

Data

Systems / tools

developed a gap analysis and secured senior management

support and funding for projects to close the gaps

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

21

strategy was to leverage existing capability, wherever possible

For what matters.

Financial Services

SAS Global Forum 2009

The Data Approach

use the Basel II Framework document to understand and

then define the mandatory risk data

create a logical model to consolidate and organise the data

determine where the data exists and identify any data gaps

enhance systems to collect and store the required data

harmonise different data definitions through the application

of business logic

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

implement a data maintenance framework to include:

risk data stewardship roles & responsibilities

data standards for accuracy, completeness, timeliness

data controls, measurement, and monitoring

data security and access

For what matters.

22

Financial Services

SAS Global Forum 2009

BORROWER

VOLUME

EXPOSURE

DIMENSIONS

ASSIGNMENT OF

RISK PARAMETERS

VIEW OF

CREDIT RISK

Hundreds of thousands

Large authorization /

outstanding balances per

borrower - multiple facilities

Assigned to each borrower

Borrower-centric

(across all org units and all

products)

CORPORATE, SOVEREIGN,

BANK, EXPOSURE CLASSES

Many millions

Small authorization /

outstanding balances

Assigned to each pool

Product-centric

(homogeneous pools)

RETAIL EXPOSURE

CLASSES

Different Credit Risk Data Challenges

RATING SYSTEMS

Requires sophisticated risk

rating systems

Requires less

complex credit

scoring

23

More straightforward

SAS Global Forum 2009

Challenging across exposure

classes and exposure types

CIBC 2009 All Rights Reserved

RECONCILIATION:

EXPOSURES TO G/L

For what matters.

Financial Services

SAS Global Forum 2009

Key Challenges: Credit Risk Data

significant amount of data is required

require numerous feeds from different kinds of source

systems

state of current credit risk data

SAS Global Forum 2009

how to reconcile credit risk balances originating in these

disparate systems to the General Ledger

CIBC 2009 All Rights Reserved

systems constraints / timing

For what matters.

24

Financial Services

SAS Global Forum 2009

What Data Do We Need?

SAS Global Forum 2009

25

ILLUSTRATIVE

decompose Basel II Framework clauses into mandatory

credit risk data for AIRB compliance

CIBC 2009 All Rights Reserved

Borrower / Guarantor

Effective

Borrower

Characteristics

Maturity

Default

Expected

Ratings

Loss

Facility Info

Economic

Loss History

External

Parameter

Collateral

Credit

Estimates

Characteristics

Basel II Capital

Assessments

(PD, LGD, EAD)

Calculations

Credit Risk

Exposures

Basel II

Mitigation

Exposure

Risk

Classes

Weighted Assets Borrower / Guarantor

Identity

(RWA)

Risk Rating /

Scoring Models

For what matters.

Financial Services

SAS Global Forum 2009

SAS Global Forum 2009

(3) booking,

managing

exposures,

and collateral

value

Credit

Adjudication

(2) approve

terms and

conditions

(e.g., limits,

default ratings)

Where To Look For The Data

Credit

Application

CIBC 2009 All Rights Reserved

Fulfillment

and

Operations

Analyze the

Credit Risk Data Lifecycle

(1) initial

data capture,

verification,

validation

For what matters.

Monitoring

and

Reporting

ILLUSTRATIVE

26

Financial Services

SAS Global Forum 2009

CIBC 2009 All Rights Reserved

Risk

Weighted Assets

(RWA)

Risk

Calculations

(PD, LGD, EAD)

SAS Global Forum 2009

27

ILLUSTRATIVE

Basel II

Regulatory

Capital

Mandatory Credit Risk Data

How Do We Organize The Data?

For what matters.

Financial Services

SAS Global Forum 2009

CIBC 2009 All Rights Reserved

Risk

Weighted Assets

(RWA)

Risk

Calculations

(PD, LGD, EAD)

Risk Rating /

Scoring Models

Parameter

Estimates

SAS Global Forum 2009

28

ILLUSTRATIVE

Basel II

Regulatory

Capital

Mandatory Credit Risk Data

How Do We Organize The Data?

For what matters.

Financial Services

SAS Global Forum 2009

Risk

Calculations

(PD, LGD, EAD)

Risk Rating /

Scoring Models

Economic

Loss History

External

Credit

Assessments

29

ILLUSTRATIVE

Basel II

Regulatory

Capital

SAS Global Forum 2009

Parameter

Estimates

Mandatory Credit Risk Data

How Do We Organize The Data?

Borrower /

Guarantor

Identity

Borrower /

Guarantor

Characteristics

Facility

Details

Credit Risk

Mitigation

Risk

Weighted Assets

(RWA)

CIBC 2009 All Rights Reserved

Instrument

Balances

For what matters.

Financial Services

SAS Global Forum 2009

What We Learned About Our Data

the most challenging task was mapping data

there was no common data model

there were some data breaks

we didnt have granular enough historical data

data definitions were inconsistent

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

as the parallel year progressed, we measured success by the

reduction in the use of defaults for RWA calculations

For what matters.

30

Financial Services

SAS Global Forum 2009

Risk Rating /

Scoring Models

Risk

Calculations

(PD, LGD, EAD)

Economic

Loss History

31

External

Credit

Assessments

Basel II

Regulatory

Capital

SAS Global Forum 2009

Parameter

Estimates

using Residential Mortgages

as an example

Case Study #1: Parameter Estimation

Borrower /

Guarantor

Identity

Borrower /

Guarantor

Characteristics

Facility

Details

Credit Risk

Mitigation

Risk

Weighted Assets

(RWA)

CIBC 2009 All Rights Reserved

Instrument

Balances

For what matters.

Financial Services

SAS Global Forum 2009

Overview: Parameter Estimation

risk rating systems rank order the quality of individual credit

risk exposures and groupings of exposures

there are three important dimensions:

the risk of the borrower defaulting (PD)

factors specific to individual transactions to estimate

the economic loss, given default (LGD)

the calculation of exposure amount at default (EAD)

the estimates for PDs need to be long-run averages of the

actual one-year default rates

LGDs must be developed from historical losses and recoveries

SAS Global Forum 2009

32

these parameters must be good predictors of future loss events

CIBC 2009 All Rights Reserved

banks are expected to reflect conservative estimates

For what matters.

Financial Services

SAS Global Forum 2009

Key Challenges: Parameter Estimation

required history (at least one full economic cycle) not readily

available for some required attributes

scarcity of CIBC-specific default data (e.g., Sovereigns, Banks)

granularity of data not always available

persistence of key data over time due to systems changes

requires unique analytical skill sets to build parameter

estimation models

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

33

parameter estimation models must be independently validated

For what matters.

Financial Services

SAS Global Forum 2009

Developing Retail PD Estimates

Basel II requires banks to pool retail exposures with similar risk

characteristics and estimate the Probability of Default (PD)

Transaction Metrics

Pool Pool Pool Pool Pool Pool

1

2

3

4

5

n

Borrower Metrics

Transaction Metrics

Pool Pool Pool Pool Pool Pool

1

2

3

4

5

n

PD

SAS Global Forum 2009

34

Analytic Engine:

determines pools

forecasts PD for each pool

revises pools to ensure

appropriate Capital

stress testing

each individual exposure within the pool then acquires the

parameters of the pool to which it belongs

Historic Portfolio

Performance Data

CIBC 2009 All Rights Reserved

Historic Economic Data

For what matters.

Borrower Metrics

Financial Services

SAS Global Forum 2009

SAS Global Forum 2009

35

Basel II Definitions: Probability of Default (PD)

Probability of Default (PD) is a measure of the likelihood of an

uncertain future event.

the Basel II Residential Mortgages Exposure Class includes

mortgages for:

single-family homes, whether they are owner-occupied or not

multi-family buildings with maximum of 4 units

Basel II definition of default (clauses 452-453), either or both of:

obligor is past due 90 days on credit obligation to the bank

the bank considers the obligor unlikely to pay credit

obligations in full

Basel II time horizon (clause 466) specifies historical observations

of at least five years

CIBC 2009 All Rights Reserved

Basel II data sources (clause 464) specifies banks must regard

internal data as the primary source of information for estimating

loss characteristics

For what matters.

Financial Services

SAS Global Forum 2009

Creating Pools for Residential Mortgages

Internal

source data

Current

ILLUSTRATIVE

Owner-occupied /

mixed

LTV > 0.x

Rental property

Pool F

36

Pool E

SAS Global Forum 2009

Pool D

LTV <= 0.x

through analysis, we derived the key available risk factors

we pooled mortgage loans on the following criteria:

arrears status in bands, e.g., current, 1-29 days delinquent, etc.

Loan-To-Value (LTV) ratio

Occupancy Status, e.g., rental, owner-occupied, etc.

1-29 days

delinquent

Pool C

CIBC 2009 All Rights Reserved

Pool B

30-59 days

delinquent

Pooling for Residential Mortgages

60-89 days

delinquent

Pool A

For what matters.

Financial Services

SAS Global Forum 2009

Meeting the Basel II Requirements

To conform to the Basel II requirements, we ensure that:

SAS Global Forum 2009

37

1. The pools clearly differentiate the PDs (clause 401)

PD in one pool should not significantly intersect with others

2. Each pool contains enough borrowers and defaulted borrowers

to allow for meaningful quantification and validation of loss

characteristics at the pool level (clause 409)

3. PD pools display sufficiently homogenous behaviour over time

subject to policy changes, etc.

CIBC 2009 All Rights Reserved

4. If any pool would have a PD less than 3 basis points, we assign

the Basel II floor of 3 basis points (clause 331)

For what matters.

Financial Services

SAS Global Forum 2009

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

ILLUSTRATIVE

Reviewing the Historical Performance Data

For what matters.

38

Financial Services

SAS Global Forum 2009

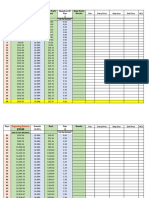

Next Steps Deriving the PDs

for each Residential Mortgages pool, data was analyzed to produce

lower quartile, median, and upper quartile values

0000.00

0000.00

0000.00

0000.00

0000.00

0000.00

0000.00

0000.00

0000.00

0000.00

Max

0000.00

0000.00

0000.00

0000.00

0000.00

Adjusted

PD

0000.00

0000.00

0000.00

0000.00

0000.00

PD

Estimate

00.0

00.0

00.0

00.0

00.0

00.0

Average

Balance

ILLUSTRATIVE

A

0000.00

0000.00

0000.00

0000.00

0000.00

PD (bps)

B

0000.00

0000.00

0000.00

0000.00

Min

C

0000.00

0000.00

0000.00

Std

0000.00

0000.00

Mean PD

0000.00

SAS Global Forum 2009

0000.00

CIBC 2009 All Rights Reserved

Pool ID

For what matters.

39

Financial Services

SAS Global Forum 2009

Next Steps Implementing & Monitoring

statistical analysis was performed to test for:

meaningful distribution of borrowers across pools

homogenous behaviour within pools

trending

adjustment needed for sampling error(s)

we derived our estimate of long-run average PD for each pool

we tested the accuracy of our predictions

we implemented the PD model into production for calculation

of Risk Weighted Assets (RWAs) for Residential Mortgages

we monitor and analyze the observed default rate over time

against the estimate

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

40

reports to senior management highlight performance over time

For what matters.

Financial Services

SAS Global Forum 2009

Risk Rating /

Scoring Models

Risk

Calculations

(PD, LGD, EAD)

Economic

Loss History

41

External

Credit

Assessments

Basel II

Regulatory

Capital

SAS Global Forum 2009

Parameter

Estimates

Case Study #2: Calculating Risk Weighted Assets

Borrower /

Guarantor

Identity

Borrower /

Guarantor

Characteristics

Facility

Details

Credit Risk

Mitigation

Risk

Weighted Assets

(RWA)

CIBC 2009 All Rights Reserved

Instrument

Balances

For what matters.

Financial Services

SAS Global Forum 2009

The Road to Basel II Risk Weighted Assets

minimum regulatory capital under Basel II is based on the

calculation of Risk Weighted Assets (RWAs)

RWAs are calculated according to established mathematical

formulae utilizing PDs, LGDs, EADs, and in some cases,

maturity adjustments

Sourcing, processing, and reconciling data in order to calculate,

store, and report on RWAs for the calculation of minimum

regulatory capital is the core of the Basel II data challenge

The Basel II Capital Adequacy Requirements (BCAR) Return

provides Canadian regulators with quarterly status on the

Banks capitalization in relation to the risks it has assumed

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

42

In Canada, the minimum ratio for Total Capital to Risk Assets

and Total Assets is 8%

For what matters.

Financial Services

SAS Global Forum 2009

staging areas

Economic

Capital

calculation

engines

CIBC 2009 All Rights Reserved

Business

Rules

Risk

Analytics

Models

RETAIL &

WHOLESALE

CREDIT

RISK DATA

WAREHOUSES

RWA

calculation

engines

SAS Global Forum 2009

Business Intelligence Layer

Direct

Feed to

Regulators

Other

Applications

& Models

Reports

Views

ILLUSTRATIVE

Credit Risk Data Architecture Overview

Party

Reference

Data

G/L

Balances &

Hierarchies

Credit

Application &

Adjudication

Account

Management

& Monitoring

Transaction

Systems

External

Ratings

For what matters.

Data Integration Layer (various ETL tools push/pull)

43

Financial Services

SAS Global Forum 2009

final reconciliation of

all risk assets

ILLUSTRATIVE

General Ledger

reconcile balances of

retail assets to

General Ledger

RWA calculator engine

for all retail assets and

pool summaries

SAS Global Forum 2009

analytic engine to assign

retail assets into pools

assign retail assets to

Basel II Exposure Class

reference data

The Process for RWAs Retail Credit Risk

extract monthly source

data for all retail assets

as at month-end

staging area

data validation

Parameter tables

(PD, LGD, EAD)

CIBC 2009 All Rights Reserved

creation of BCAR and

other regulatory reports

For what matters.

44

Financial Services

SAS Global Forum 2009

Org

Org

BOA

Account

BOA

Account

SubAcct

CustGrp

CustGrp

For what matters.

Balance

Balance

CIBC 2009 All Rights Reserved

Credit Risk data warehouses

Other Risk Data Attributes

Finance systems

Other Financial Attributes

SAS Global Forum 2009

reconciliation is required for all Basel II Exposure Classes and

Exposure Types (drawn, undrawn, other off-balance sheet)

SubAcct

Reconciliation To The General Ledger

Product

Accounting

Code block

Product

45

Financial Services

SAS Global Forum 2009

Org

Org

BOA

Account

BOA

Account

SubAcct

CustGrp

CustGrp

For what matters.

Balance

Balance

CIBC 2009 All Rights Reserved

Credit Risk data warehouses

Other Risk Data Attributes

Finance systems

Other Financial Attributes

SAS Global Forum 2009

Challenges:

source systems are not unique by Basel II Exposure Class

ensuring accurate booking of transactions across multiple source

systems

reconciliation is required for all Basel II Exposure Classes and

Exposure Types (drawn, undrawn, other off-balance sheet)

SubAcct

Reconciliation To The General Ledger

Product

Accounting

Code block

Product

46

Financial Services

SAS Global Forum 2009

Analysis and Reporting

multiple business stakeholders have regulatory and

management reporting needs for credit risk data

Regulators require specific credit risk reports quarterly,

due 30 days after fiscal quarter-end:

BCAR (Basel II regulatory capital)

NCR (new credit risks)

Board of Directors and senior management oversight

Line of Business Analysis of:

exposures, risk calculations (e.g., EAD, EL, RWA, etc.)

risk profiles - ODR/LGD distributions, etc.

portfolio metrics geographic, industry, etc.

CIBC 2009 All Rights Reserved

SAS Global Forum 2009

Performance measurement of risk analytics models for

continuous improvement

For what matters.

47

Financial Services

SAS Global Forum 2009

SAS

Enterprise

Miner

Risk

Analytics

Models

RETAIL

CREDIT

RISK DATA

WAREHOUSE

SAS

Enterprise

Guide

SAS

DI Studio

Business

Rules

SAS

Enterprise

Guide

SAS

Risk Dimensions

RWA

calculation

engines

SAS Global Forum 2009

Reports

Other

Applications

& Models

Direct

Feed to

Regulators

SAS

OLAP

Studio

48

Analytic Cubes / Marts

SAS Platform for Retail Credit Risk

ILLUSTRATIVE

staging areas

Economic

Capital

calculation

engines

CIBC 2009 All Rights Reserved

Business Intelligence Layer

Party

Reference

Data

G/L

Balances &

Hierarchies

Credit

Application &

Adjudication

Account

Management

& Monitoring

Transaction

Systems

External

Ratings

For what matters.

Data Integration Layer (various ETL tools push/pull)

Financial Services

SAS Global Forum 2009

Summary

under Basel II AIRB, a bank will be able to self-assess and

report minimum regulatory capital for credit risk

SAS Global Forum 2009

49

approval and ongoing compliance is dependent upon banks

demonstrating the integrity of their risk rating methodologies

and data used to calculate regulatory capital

senior management has accountability for establishing and

monitoring the enterprise-wide observance of the risk data

management framework

CIBC 2009 All Rights Reserved

the payback on the Basel II investment comes from the

use of the new regulatory capital information for businesses

to more effectively manage risk

For what matters.

Financial Services

SAS Global Forum 2009

For what matters.

SAS Global Forum 2009

While we are well on our way

at CIBC, the journey continues

CIBC 2009 All Rights Reserved

50

Financial Services

SAS Global Forum 2009

For what matters.

Thank You

SAS Global Forum 2009

contact: rick.miller@cibc.ca

CIBC 2009 All Rights Reserved

51

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ERP Quiz 3Document18 pagesERP Quiz 3simi263No ratings yet

- 09 How Low Can It GoDocument3 pages09 How Low Can It GoHéctor Eduardo Moreno Sandoval75% (4)

- Takeover DefensesDocument24 pagesTakeover DefensesShadab KhanNo ratings yet

- Wharton Venture CapitalDocument9 pagesWharton Venture CapitalMarthy RavelloNo ratings yet

- Distribution Channel NotesDocument2 pagesDistribution Channel NotesRuth Pecson100% (1)

- Afar 3Document2 pagesAfar 3Eric Kevin LecarosNo ratings yet

- Total Retail Bond Trading 1512Document329 pagesTotal Retail Bond Trading 1512Sorken75No ratings yet

- Fund-BarometerDocument134 pagesFund-BarometerVanessa DavisNo ratings yet

- Solidblock: Product - Customer Value Innovation - Unique Selling PointDocument1 pageSolidblock: Product - Customer Value Innovation - Unique Selling PointYael TamarNo ratings yet

- FT - Evaluation Quiz 2Document3 pagesFT - Evaluation Quiz 2LLYOD FRANCIS LAYLAYNo ratings yet

- Cruzebow Premium BB Strategy 1Document15 pagesCruzebow Premium BB Strategy 1Isuru PathiranaNo ratings yet

- Kaufman Short-Term Patterns - V39 - C01 - 168KAUFDocument13 pagesKaufman Short-Term Patterns - V39 - C01 - 168KAUFJoseph WestNo ratings yet

- Gross Profit MethodDocument25 pagesGross Profit MethoddionirtaNo ratings yet

- I&M Marketing&StrategyDocument16 pagesI&M Marketing&StrategynevilleNo ratings yet

- Hotel Room RekapDocument9 pagesHotel Room RekapSoehermanto DodyNo ratings yet

- Smithson Rediscovering WDGanns Method of Forecasting The Financial MarketsDocument24 pagesSmithson Rediscovering WDGanns Method of Forecasting The Financial Marketsmadeoff100% (2)

- Annual Report - J Kumar Infraprojects LTD - 2015Document93 pagesAnnual Report - J Kumar Infraprojects LTD - 2015deeptiNo ratings yet

- Basics-For-Traders Idbi STK MKT V V V Imp Gooood 220622Document20 pagesBasics-For-Traders Idbi STK MKT V V V Imp Gooood 220622jig3309No ratings yet

- SPX MiniDocument2 pagesSPX Minizmcoup100% (1)

- Student: Assumptions / InputsDocument10 pagesStudent: Assumptions / InputsAnuj BhattNo ratings yet

- TTP 90 Day Freedom PlanDocument4 pagesTTP 90 Day Freedom PlanRuweida OsmanNo ratings yet

- List of Countries by Stock Market Capitalization - WikipediaDocument4 pagesList of Countries by Stock Market Capitalization - WikipediaBonnie DebbarmaNo ratings yet

- Crypto DictionaryDocument11 pagesCrypto DictionaryKaveen KavyaNo ratings yet

- FM ProblemsDocument2 pagesFM ProblemsAjeet YadavNo ratings yet

- Financial Statement Analysis PPT 3427Document25 pagesFinancial Statement Analysis PPT 3427imroz_alamNo ratings yet

- Week 4 An Overview of Corporate FinancingDocument40 pagesWeek 4 An Overview of Corporate FinancingPol 馬魄 MattostarNo ratings yet

- FAP T10 KuralayDocument8 pagesFAP T10 KuralayKuralay TilegenNo ratings yet

- 0 MSCI Corporate Events Methodology 20200512Document116 pages0 MSCI Corporate Events Methodology 20200512SwethaNo ratings yet

- FE Chapter 11 Hedging, Insuring and DiversifyingDocument25 pagesFE Chapter 11 Hedging, Insuring and Diversifyingnguyen tungNo ratings yet

- 05 Euro Aggregate Corporate Index FactsheetDocument2 pages05 Euro Aggregate Corporate Index FactsheetRoberto PerezNo ratings yet