Professional Documents

Culture Documents

Manila Standard Today - Business Daily Stocks Review (March 20, 2015)

Manila Standard Today - Business Daily Stocks Review (March 20, 2015)

Uploaded by

Manila Standard TodayOriginal Description:

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Manila Standard Today - Business Daily Stocks Review (March 20, 2015)

Manila Standard Today - Business Daily Stocks Review (March 20, 2015)

Uploaded by

Manila Standard TodayCopyright:

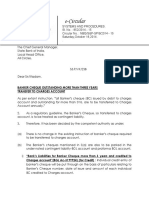

MST Business Daily Stocks Review

Friday, March 20, 2015

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

2.7

75.3

99.4

105.2

63

2.3

4.2

19.6

31.6

22.5

2.95

1.01

92.9

1.65

30.5

75

99

392

59

146.8

1700

130

2.8

1.55

63.5

67.5

82.5

50

1.9

1.1

14.5

23.2

6.84

1.75

0.175

69.35

1.2

20.45

58

76

276

41.5

105.1

1281

116

2.25

AG Finance

6.35

Asia United Bank

70.1

Banco de Oro Unibank Inc. 117.50

Bank of PI

101.00

China Bank

46.8

BDO Leasing & Fin. INc. 2.26

Bright Kindle Resources 2.40

COL Financial

16.72

Eastwest Bank

24.9

Filipino Fund Inc.

8.34

I-Remit Inc.

1.68

MEDCO Holdings

0.510

Metrobank

93.6

Natl. Reinsurance Corp. 0.94

PB Bank

18.40

Phil Bank of Comm

31.05

Phil. National Bank

81.35

PSE Inc.

347

RCBC `A

45.9

Security Bank

169

Sun Life Financial

1387.00

Union Bank

69.40

Vantage Equities

3.03

FINANCIAL

6.35

5.86

70.1

70.1

117.80 116.40

101.00 100.00

46.95

46.7

2.27

2.27

2.44

2.44

16.7

16.54

25.4

24.9

8.30

8.26

1.68

1.68

0.510

0.455

95.15

92.5

0.94

0.94

18.38

18.38

31.05

31.00

81.35

79.10

343

340

46.2

45.75

174.8

169.6

1385.00 1385.00

69.40

69.00

3.03

3.03

INDUSTRIAL

45.2

44.25

1.66

1.66

1.1

1.08

2.14

2.07

8.24

8.1

60

45.45

19

18.7

22

21.65

65.8

63.25

1.96

1.88

12.8

12

21.600 20.5

11.56

11.38

8.31

8.08

9.90

9.71

24.5

22.8

29.9

29

103

101.5

0.4700 0.4600

14.70

14.70

6.7

6.62

0.620

0.620

214.40 211.20

9.9

9.58

35.10

35.00

2.41

2.41

53.00

52.00

26.6

25.95

29

28.5

7.970

7.850

272.00 268.00

4.20

4.06

4.2

4.15

10.10

9.85

5.25

5

11.60

11.10

3.99

3.80

2.90

2.86

1.98

1.46

5.96

5.90

206

205

1.73

1.69

0.175

0.172

1.52

1.48

2.26

2.21

222

214.4

4.5

4.5

0.72

0.71

1.55

1.51

HOLDING FIRMS

0.465

0.465

56.35

55.50

27.30

26.65

1.40

1.40

7.06

7.01

2.72

2.60

2.7

2.56

776

768.5

9.2

9.05

15.50

15.00

4.74

4.50

0.330

0.315

1320

1308

6.28

5.50

70.60

67.75

8.8

8.3

0.74

0.7

16

15.78

0.69

0.65

4.9

4.84

5.1

5

0.0400 0.0400

0.730

0.700

70.30

66.70

2.80

2.80

910.00 902.00

1.25

1.23

0.98

0.95

104.90 98.00

0.5100 0.4650

0.2460 0.2410

PROPERTY

9.000

8.880

0.98

0.94

0.270

0.245

37.90

37.25

4.39

4.29

5.19

5.1

6.2

5.6

6.2

6.2

0.97

0.95

Net Foreign

Change Volume

Trade/Buying

6

70.1

117.20

100.50

46.95

2.27

2.44

16.7

25.05

8.30

1.68

0.475

95.15

0.94

18.38

31.05

79.95

340.8

46

173

1385.00

69.15

3.03

-5.51

0.00

-0.26

-0.50

0.32

0.44

1.67

-0.12

0.60

-0.48

0.00

-6.86

1.66

0.00

-0.11

0.00

-1.72

-1.79

0.22

2.37

-0.14

-0.36

0.00

138,104

18,230

2,656,630

1,905,950

16,400

16,000

16,000

12,000

2,397,100

6,100

1,000

4,137,000

2,812,670

6,000

900

22,500

690,380

3,610

280,900

2,119,180

70

16,460

2,000

45.2

1.66

1.08

2.11

8.15

56

19

22

65.8

1.89

12.2

20.900

11.38

8.19

9.90

23.4

29.1

102.5

0.4700

14.70

6.64

0.620

214.40

9.72

35.00

2.41

52.00

26.1

28.9

7.850

271.00

4.06

4.16

9.95

5.25

11.44

3.99

2.88

1.9

5.90

206

1.69

0.172

1.48

2.23

220

4.5

0.71

1.51

0.78

0.00

-1.82

-0.94

0.00

24.17

1.28

0.00

4.44

1.61

-2.87

2.20

-0.18

-1.44

1.02

-1.89

-0.68

0.69

2.17

0.00

0.30

1.64

1.13

-0.21

-0.14

0.00

-0.95

-1.88

0.35

-1.51

0.74

-3.33

-0.95

-0.70

-0.94

-0.52

4.72

0.70

35.71

-0.17

0.00

-2.31

-1.71

45.10

0.45

2.23

0.00

-1.39

-1.95

3,177,600

20,000

229,000

5,936,000

3,400

7,500

204,200

401,000

31,510

631,000

150,000

20,882,800

3,043,400

78,409,200

602,600

408,100

2,853,300

820,520

40,000

1,600

260,400

280,000

1,550,050

6,309,900

3,800

4,000

60

2,950,100

1,106,000

319,600

382,100

21,000

16,325,000

4,631,200

1,000

59,400

444,000

653,000

6,632,000

963,000

820

675,000

3,290,000

86,000

985,000

3,569,770

94,000

731,000

154,000

0.465

55.75

26.90

1.40

7.01

2.61

2.56

770

9.14

15.20

4.50

0.315

1308

6.28

70.25

8.8

0.73

16

0.68

4.86

5.1

0.0400

0.730

67.95

2.80

902.00

1.24

0.95

104.90

0.4650

0.2430

-1.06

-0.45

-1.28

-4.11

-1.27

-2.61

0.00

0.00

0.33

-0.78

-0.66

-7.35

-1.28

-2.48

1.01

6.02

2.82

1.14

1.49

-0.61

2.00

0.00

4.29

-3.34

0.00

-0.17

0.81

-4.04

5.53

-7.00

-1.22

20,000

2,099,210

10,235,900

8,000

15,300

103,000

17,000

456,810

1,224,900

8,226,600

11,000

4,140,000

230,340

47,900

5,022,940

9,001,800

671,000

3,174,100

2,733,000

28,535,000

25,000

3,600,000

2,823,000

16,518,400

50,000

581,890

129,000

110,000

33,000

38,306,000

2,710,000

8.880

0.94

0.245

37.85

4.3

5.18

5.6

6.2

0.96

0.00

-4.08

-7.55

-0.66

0.00

1.57

-8.20

-4.32

0.00

1,425,200

1,781,000

830,000

17,985,100

2,014,000

402,600

40,000

3,000

2,709,000

1,206,969.00

102,349,158.00

6,840,028.00

-56,280.00

172,056.00

2,307,585.00

22,000.00

200,737,830.50

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

2.51

0.201

0.98

1.09

0.370

2.25

1.77

1.6

4.88

0.180

0.470

0.74

4.45

24.8

2.06

3.6

19.62

1.02

6.66

1.96

6.5

1.21

0.068

0.47

0.87

0.175

1.22

1.18

1.19

2.75

0.070

0.325

0.4

2.5

18.72

1.45

2.9

14.1

0.58

3.05

0.87

4.37

City & Land Dev.

Crown Equities Inc.

Cyber Bay Corp.

Empire East Land

Ever Gotesco

Global-Estate

Filinvest Land,Inc.

Interport `A

Megaworld Corp.

MRC Allied Ind.

Phil. Estates Corp.

Phil. Realty `A

Primex Corp.

Robinsons Land `B

Rockwell

Shang Properties Inc.

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

1.25

0.147

0.460

0.900

0.214

1.50

1.83

1.55

5.46

0.125

0.3400

0.4500

7.65

29.00

1.79

3.20

19.76

0.88

7.23

1.040

7.420

Net Foreign

Change Volume

Trade/Buying

1.25

1.25

1.25

0.146

0.144

0.145

0.460

0.455

0.455

0.900

0.900

0.900

0.202

0.200

0.200

1.53

1.49

1.50

1.82

1.79

1.80

1.54

1.52

1.52

5.61

5.46

5.46

0.128

0.125

0.127

0.3500 0.3400

0.3400

0.4900 0.3900

0.4850

7.67

7.24

7.44

29.45

28.75

28.95

1.79

1.76

1.77

3.20

3.16

3.16

20.20

19.52

20.20

0.88

0.84

0.84

7.41

7.18

7.41

1.070

1.030

1.040

7.500

7.380

7.500

SERVICES

3.25

1.55 2GO Group

6.99

7.32

6.53

6.75

43.7

27

ABS-CBN

61

62

61.2

61.4

1.43

0.92 Acesite Hotel

1.09

1.1

1.07

1.07

1.09

0.59 APC Group, Inc.

0.700

0.720

0.700

0.700

12.46

10

Asian Terminals Inc.

14

14.48

14

14.48

14

8.28 Bloomberry

10.46

10.80

10.50

10.80

0.1640 0.0960 Boulevard Holdings

0.1100

0.1110 0.1090

0.1100

4.05

2.97 Calata Corp.

3.97

3.96

3.83

3.94

71

44.8 Cebu Air Inc. (5J)

85.15

86.35

85.15

86.05

12.3

10.14 Centro Esc. Univ.

10.94

10.6

10.6

10.6

9

4

DFNN Inc.

6.80

7.09

6.86

7.08

1700

1080 FEUI

1000

995

995

995

2008

1580 Globe Telecom

1960

1970

1930

1940

9.04

7.12 GMA Network Inc.

6.70

6.81

6.64

6.66

2.02

1.2

Harbor Star

1.58

1.62

1.57

1.57

118.9

94.4 I.C.T.S.I.

112

112.6

111

112.6

18.4

5

Imperial Res. `A

6.12

7.00

6.50

7.00

12.5

8.72 IPeople Inc. `A

11.86

11.84

11.32

11.84

0.017

0.012 IP E-Game Ventures Inc. 0.015

0.015

0.015

0.015

0.0653 0.026 Island Info

0.290

0.295

0.285

0.295

2.2800 1.560 ISM Communications

1.3300

1.3300 1.2700

1.2800

6.99

1.95 Jackstones

2.64

2.68

2.55

2.68

9.67

5.82 Leisure & Resorts

8.88

8.98

8.70

8.70

2.85

1.15 Liberty Telecom

2.00

2.10

2.00

2.00

2.2

1.1

Lorenzo Shipping

1.47

1.47

1.3

1.47

4.32

1.9

Macroasia Corp.

2.28

2.29

2.29

2.29

1.97

0.485 Manila Bulletin

0.690

0.700

0.680

0.680

2.45

1.42 Manila Jockey

1.95

1.99

1.95

1.99

14.46

10.14 Melco Crown

9.28

9.38

9.2

9.3

0.62

0.35 MG Holdings

0.37

0.36

0.35

0.36

1.040

0.36 NOW Corp.

0.500

0.500

0.500

0.500

6.6

5.2

PAL Holdings Inc.

4.70

4.70

4.70

4.70

2.85

1.85 Paxys Inc.

3.18

3.2

3.12

3.12

18

8.8

Phil. Racing Club

9.5

9.01

9.01

9.01

11.3

4.39 Philweb.Com Inc.

13.86

13.86

13.30

13.76

3486

2572 PLDT Common

2850.00

2840.00 2810.00

2810.00

0.710

0.250 PremiereHorizon

0.600

0.610

0.600

0.600

2.01

0.26 Premium Leisure

1.500

1.560

1.500

1.560

48.5

32.2 Puregold

40.10

40.85

40.05

40.20

74

48

Robinsons RTL

87.00

90.10

87.00

89.00

SSI Group

10.14

10.48

10.14

10.40

0.87

0.59 STI Holdings

0.72

0.74

0.73

0.74

2.95

1.68 Transpacific Broadcast 1.9

1.9

1.85

1.85

11.46

7.78 Travellers

7.04

7.3

7.06

7.08

0.435

0.305 Waterfront Phils.

0.350

0.360

0.345

0.360

1.6

1.04 Yehey

1.450

1.480

1.400

1.480

MINING & OIL

0.0086 0.0028 Abra Mining

0.0056

0.0057 0.0055

0.0056

5.45

1.72 Apex `A

3.00

3.00

2.84

2.98

17.24

11.48 Atlas Cons. `A

9.10

9.11

9.06

9.06

25

9.43 Atok-Big Wedge `A

10.80

10.80

10.80

10.80

1.2

0.5

Century Peak Metals Hldgs 1.1

1.16

1.09

1.14

1.73

0.76 Coal Asia

0.9

0.89

0.88

0.88

10.98

4.93 Dizon

8.53

8.82

8.55

8.76

Ferronickel

2.3

2.43

2.3

2.41

0.46

0.385 Geograce Res. Phil. Inc. 0.345

0.365

0.345

0.360

0.455

0.3000 Lepanto `A

0.238

0.240

0.236

0.236

0.730

0.2950 Lepanto `B

0.246

0.250

0.244

0.244

0.024

0.012 Manila Mining `A

0.0140

0.0150 0.0140

0.0150

0.026

0.014 Manila Mining `B

0.0150

0.0160 0.0160

0.0160

8.2

1.960 Marcventures Hldgs., Inc. 5.4

5.4

5

5.14

48.85

14.22 Nickelasia

28

27.95

27.25

27.5

3.35

1.47 Nihao Mineral Resources 3.83

4.18

3.85

4.17

1.030

0.220 Omico

0.7400

0.7300 0.7300

0.7300

3.06

1.24 Oriental Peninsula Res. 2.160

2.200

2.070

2.150

0.021

0.016 Oriental Pet. `A

0.0130

0.0130 0.0120

0.0120

7.67

4.02 Petroenergy Res. Corp. 5.85

5.85

5.85

5.85

12.88

7.8

Philex `A

7.7

7.82

7.56

7.62

10.42

6.5

PhilexPetroleum

2.55

2.68

2.48

2.49

0.042

0.031 Philodrill Corp. `A

0.016

0.016

0.015

0.016

420

123 Semirara Corp.

157.20

167.00 158.00

159.50

9

4.3

TA Petroleum

4.16

4.15

4.08

4.08

0.016

0.0087 United Paragon

0.0110

0.0100 0.0100

0.0100

PREFERRED

44.1

26.3 ABS-CBN Holdings Corp. 62.4

66

63.45

65

Ayala Corp. Pref `B1

512.5

510

510

510

60

30

Ayala Corp. Pref B2

520

523

520

520

116

102 First Gen G

115

115

114.2

114.2

511

480 GLOBE PREF P

506

506

506

506

9.04

6.76 GMA Holdings Inc.

6.5

6.45

6.35

6.35

9.67

5.82 Leisure and Resort

1.07

1.08

1.08

1.08

MWIDE PREF

108.2

109

108.3

108.9

PCOR-Preferred A

1080

1070

1070

1070

PF Pref 2

1038

1040

1037

1040

77.3

74.2 SMC Preferred A

76.1

76.1

76.05

76.05

81.85

75

SMC Preferred C

84

84

83.5

84

WARRANTS & BONDS

2.42

0.0010 LR Warrant

3.950

3.980

3.900

3.940

SME

10.96

2.4

Double Dragon

7.85

7.95

7.8

7.82

35

7.74 IRipple E-Business Intl 77.5

78.95

77

78.25

Xurpas

10.2

10.46

9.6

10

EXCHANGE TRADED FUNDS

119.6

94

First Metro ETF

127

127

126.8

127

0.00

-1.36

-1.09

0.00

-6.54

0.00

-1.64

-1.94

0.00

1.60

0.00

7.78

-2.75

-0.17

-1.12

-1.25

2.23

-4.55

2.49

0.00

1.08

20,000

2,960,000

550,000

62,000

2,140,000

1,535,000 -1,427,850.00

17,465,000 -2,478,570.00

378,000

202,116,100 166,624,651.00

570,000

1,340,000

530,000

859,800

1,820,500 2,271,665.00

102,000

82,180.00

11,000

-28,440.00

15,911,000 53,632,434.00

10,993,000

17,149,600

107,000

11,465,400 18,672,569.00

-3.43

0.66

-1.83

0.00

3.43

3.25

0.00

-0.76

1.06

-3.11

4.12

-0.50

-1.02

-0.60

-0.63

0.54

14.38

-0.17

0.00

1.72

-3.76

1.52

-2.03

0.00

0.00

0.44

-1.45

2.05

0.22

-2.74

0.00

0.00

-1.89

-5.16

-0.72

-1.40

0.00

4.00

0.25

2.30

2.56

2.78

-2.63

0.57

2.86

2.07

1,512,700

34,180

302,000

706,000

4,100

27,257,100

10,850,000

429,000

543,550

1,500

205,500

40

49,880

327,500

47,000

2,127,420

11,900

27,300

5,000,000

18,030,000

1,342,000

53,000

217,200

42,000

66,000

1,000

213,000

42,000

19,569,700

630,000

23,000

3,000

36,000

600

5,545,100

308,630

1,558,000

30,549,000

1,843,400

2,878,580

5,343,500

4,735,000

20,000

4,654,700

1,760,000

53,000

0.00

-0.67

-0.44

0.00

3.64

-2.22

2.70

4.78

4.35

-0.84

-0.81

7.14

6.67

-4.81

-1.79

8.88

-1.35

-0.46

-7.69

0.00

-1.04

-2.35

0.00

1.46

-1.92

-9.09

602,000,000

210,000

-150,000.00

1,094,000 140,215.00

1,000

2,122,000 180,940.00

554,400

438,595.00

554,400

438,595.00

18,503,000 -546,270.00

2,460,000

6,540,000

2,170,000

1,100,000

1,700,000

2,067,500 -727,561.00

2,336,800 -49,505,030.00

21,510,000 138,430.00

1,000

1,588,000 -38,400.00

2,500,000

1,800

1,199,100 -6,680,006.00

1,521,000

6,300,000

4,678,170 118,993,046.00

34,000

12,900,000

4.17

-0.49

0.00

-0.70

0.00

-2.31

0.93

0.65

-0.93

0.19

-0.07

0.00

154,190

8,500

8,750

5,910

980

32,700

1,095,000

28,800

8,500

11,975

276,070

111,270

-0.25

310,000

-0.38

0.97

-1.96

315,300

62,570

10,939,500 -3,990,664.00

0.00

12,670

MST

42.6

31.75 Aboitiz Power Corp.

44.85

6.1

2.51 Agrinurture Inc.

1.66

1.66

0.88 Alliance Tuna Intl Inc.

1.1

2.3

1.25 Alsons Cons.

2.13

17.98

9.58 Asiabest Group

8.15

113

40.2 Bogo Medelin

45.1

17.2

14.6 Century Food

18.76

15.8

9.82 Cirtek Holdings (Chips) 22

56.8

21.5 Concepcion

63

4.57

0.82 Da Vinci Capital

1.86

39.5

17.3 Del Monte

12.56

14

5.98 DNL Industries Inc.

20.450

12.98

9.05 Emperador

11.40

8.15

4.25 Energy Devt. Corp. (EDC) 8.31

12.34

8.68 EEI

9.80

17

8.61 Federal Res. Inv. Group 23.85

27.1

12.2 First Gen Corp.

29.3

90.5

48.9 First Holdings A

101.8

0.014

0.0097 Greenergy

0.4600

15.74

12.8 Holcim Philippines Inc. 14.70

9.4

2.05 Integ. Micro-Electronics 6.62

0.98

0.32 Ionics Inc

0.610

199.8

150.8 Jollibee Foods Corp.

212.00

10.98

8.55 Lafarge Rep

9.74

79

48.5 Liberty Flour

35.05

4

1.63 Mabuhay Vinyl

2.41

45.45

16

Macay Holdings

52.50

30

20.35 Manila Water Co. Inc.

26.6

90

12

Maxs Group

28.8

14.7

10.1 Megawide

7.970

317

246 Mla. Elect. Co `A

269.00

6.49

3.37 Panasonic Mfg Phil. Corp. 4.20

5.37

4

Pepsi-Cola Products Phil. 4.2

14.48

11.56 Petron Corporation

10.02

7.5

5

Phil H2O

5.3

14.5

9.94 Phinma Corporation

11.50

7.03

4.33 Phoenix Petroleum Phils. 3.81

Phoenix Semiconductor 2.86

Pryce Corp. `A

1.4

6.68

4.88 RFM Corporation

5.91

275

210 San MiguelPure Foods `B 206

2.25

1.7

Splash Corporation

1.73

0.191

0.102 Swift Foods, Inc.

0.175

2.5

1.6

TKC Steel Corp.

1.02

2.68

1.37 Trans-Asia Oil

2.22

188.6

111.3 Universal Robina

215.2

5.5

1.58 Victorias Milling

4.5

1.3

0.550 Vitarich Corp.

0.72

2.17

1.33 Vulcan Indl.

1.54

0.7

61.6

31.85

2.16

7.39

3.29

2.05

747

11.34

84

5.34

0.23

1060

7.1

59.8

6.55

0.9

19.9

0.75

5.4

5.35

0.0550

0.84

88

3.5

866

2.2

1.39

156

0.285

0.245

0.46

45.75

21.95

1.6

6.3

1.8

1.04

508

7.470

47.25

4

0.144

706

5.3

36.7

3.95

0.58

12.96

0.580

4.06

4.5

0.027

0.355

54.5

1.5

680

1.04

0.85

58.05

0.158

0.150

Abacus Cons. `A

0.470

Aboitiz Equity

56.00

Alliance Global Inc.

27.25

Anglo Holdings A

1.46

Anscor `A

7.10

ATN Holdings A

2.68

ATN Holdings B

2.56

Ayala Corp `A

770

Cosco Capital

9.11

DMCI Holdings

15.32

Filinvest Dev. Corp.

4.53

Forum Pacific

0.340

GT Capital

1325

House of Inv.

6.44

JG Summit Holdings

69.55

Lopez Holdings Corp.

8.3

Lodestar Invt. Holdg.Corp. 0.71

LT Group

15.82

Mabuhay Holdings `A

0.67

Metro Pacific Inv. Corp. 4.89

Minerales Industrias Corp. 5

Pacifica `A

0.0400

Prime Orion

0.700

San Miguel Corp `A

70.30

Seafront `A

2.80

SM Investments Inc.

903.50

Solid Group Inc.

1.23

South China Res. Inc.

0.99

Top Frontier

99.40

Unioil Res. & Hldgs

0.5000

Wellex Industries

0.2460

9.03

1.99

0.375

35.3

6.15

6.1

5.6

7.1

2

5.51

0.99

0.185

23.7

4.41

5

2.8

4.6

1.22

8990 HLDG

A. Brown Co., Inc.

Arthaland Corp.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Cebu Prop. `A

Cebu Prop. `B

Century Property

Trading Summary

FINANCIAL

INDUSTRIAL

HOLDING FIRMS

PROPERTY

SERVICES

MINING & OIL

GRAND TOTAL

SHARES

17496727

170393757

141446557

325291839

159386144

876519384

1701864448

8.880

0.98

0.265

38.10

4.3

5.1

6.1

6.48

0.96

16,542.00

-24,527,985.50

-217,610.00

-2,219,265.00

60,253,789.00

96,950.00

-24,157.50

33,000,745.00

1,392,176.00

-147,400.00

-224,774.00

303,437,545.00

4,714,298.00

-172,447,155.00

-599,409.00

-115,950.00

-9,382,860.00

-29,198,807.00

13,800.00

-66,982.00

-60,807,802.00

7,537,972.00

-6,892,750.00

-22,348,975.00

-139,283.00

81,858,412.00

-2,892,460.00

2,470,216.00

363,310.00

263,500.00

-222,913.00

0.00

1,690.00

17,200.00

111,000.00

156,152,298.00

423,000.00

-280,730.00

-8,921,480.00

-28,834,195.00

2,561,840.00

-2,085,570.00

-9,596,638.00

-71,375,475.00

89,723,999.00

21,103,506.00

7,000.00

8,911,480.00

43,492,710.00

-3,550.00

-128,672,205.50

-7,205,160.00

-2,682,883.50

-472,500.00

103,630.00

-82,254,785.00

-150,476,045.00

5,034,930.00

-127,500.00

2,436,980.00

T op G ainers

VALUE

1310814068.33

3034409109.538

3656390400.63

2507697741.29

2882406355.25

1321710843.058

14831427843.60

STOCKS

FINANCIAL

1,834.73 (up) 6.24

INDUSTRIAL

12,673.06 (up) 86.93

HOLDING FIRMS

6,976.73 (down) 11.00

PROPERTY

3,147.77 (up) 6.83

SERVICES

2,107.13 (down) 3.86

MINING & OIL

15,862.82 (up) 25.68

PSEI

7,818.38 (up) 3.83

All Shares Index

4,529.31 (up) 8.53

Gainers: 76; Losers: 105; Unchanged: 41; Total: 222

383,919.00

4,392.00

144,846,772.00

1,765,006.50

137,200.00

-32,619,675.00

88,440,110.00

-1,089,560.00

-72,150.00

-19,983,334.00

21,000.00

6,500.00

-5,406.00

-1,501,400.00

-285,100,120.00

14,456,850.00

-21,147,015.00

71,105,171.50

-2,607,468.00

-1,101,050.00

-20,135,791.00

-1,890,205.50

678,922.00

-71,290.00

2,019,527.00

-1,671,000.00

T op L osers

Close

(P)

Change

(%)

STOCKS

Close

(P)

Change

(%)

TKC Steel Corp.

1.48

45.10

United Paragon

0.0100

-9.09

Pryce Corp. `A'

1.9

35.71

Cebu Prop. `A'

5.6

-8.20

Bogo Medelin

56

24.17

Oriental Pet. `A'

0.0120

-7.69

Imperial Res. `A'

7.00

14.38

Arthaland Corp.

0.245

-7.55

Nihao Mineral Resources

4.17

8.88

Forum Pacific

0.315

-7.35

Phil. Realty `A'

0.4850

7.78

Unioil Res. & Hldgs

0.4650

-7.00

Manila Mining `A'

0.0150

7.14

MEDCO Holdings

0.475

-6.86

Manila Mining `B'

0.0160

6.67

Ever Gotesco

0.200

-6.54

Lopez Holdings Corp.

8.8

6.02

AG Finance

-5.51

Top Frontier

104.90

5.53

Phil. Racing Club

9.01

-5.16

You might also like

- Loan ApplicationDocument5 pagesLoan ApplicationVislavath Venkat40% (5)

- Jamals Black Book PDFDocument82 pagesJamals Black Book PDFShaikh awais100% (6)

- Manila Standard Today - Business Daily Stocks Review (February 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 10, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 10, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 13, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 2, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 2, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 25, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 25, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 30, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 20, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 26, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 26, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 23, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 23, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 24, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 24, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 18, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 18, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 12, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 12, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 17, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 28, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 25, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 02, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 02, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 1, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 1, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 30, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 30, 2013)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 15, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 11, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (January 11, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 11, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 29, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 29, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 19, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (March 19, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 10, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (April 10, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 19, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 19, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 30, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 30, 2012)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 10, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 10, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 8, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 8, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 12, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (August 12, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 13, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 20, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 12, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 12, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 27, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (April 27, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 20, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 26, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 26, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 18, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 18, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 31, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 31, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 2, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 2, 2014)Manila Standard TodayNo ratings yet

- TODAY Tourism & Business Magazine, Volume 22, December, 2015From EverandTODAY Tourism & Business Magazine, Volume 22, December, 2015No ratings yet

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceFrom EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 30, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 28, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 24, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 24, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 23, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 23, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 17, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Weekly Stocks Review (April 19, 2015)Document1 pageThe Standard - Business Weekly Stocks Review (April 19, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 16, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 16, 2015)Manila Standard TodayNo ratings yet

- Business Solutions For Start-Ups: Citibusiness LeapDocument10 pagesBusiness Solutions For Start-Ups: Citibusiness LeapAnand BiNo ratings yet

- PaymentNotification ZHN7CF9B13 FNBRSA02 PDFDocument1 pagePaymentNotification ZHN7CF9B13 FNBRSA02 PDFManzini Mlebogeng100% (1)

- DepreciationDocument4 pagesDepreciationMadhura KhapekarNo ratings yet

- Jiban Bima Sadharan Bima Question.Document33 pagesJiban Bima Sadharan Bima Question.Tarannum Shireen GhaziNo ratings yet

- ER DiagramDocument1 pageER DiagramShobith ChadagaNo ratings yet

- Docshare - Tips Innova-Ranbirpdf PDFDocument2 pagesDocshare - Tips Innova-Ranbirpdf PDFManuprasadNo ratings yet

- Consumer Perception Uti Mutual FundDocument80 pagesConsumer Perception Uti Mutual FundMazhar Zaman100% (1)

- Top Banks in The PhilippinesDocument5 pagesTop Banks in The Philippinessummer mendozaNo ratings yet

- TOR - Land Banking AnalysisDocument3 pagesTOR - Land Banking AnalysisStephen CabalteraNo ratings yet

- Banker CHQ ChargesDocument2 pagesBanker CHQ ChargesAbhinav PandeyNo ratings yet

- Bangalore Metro Rail Corporation Limited: WWW - Bmrc.co - InDocument8 pagesBangalore Metro Rail Corporation Limited: WWW - Bmrc.co - InTej KumarNo ratings yet

- 2005 ACE Limited (NYSE: ACE) 10-KDocument250 pages2005 ACE Limited (NYSE: ACE) 10-KACELitigationWatchNo ratings yet

- Duterte Health Agenda V 7-14-16Document17 pagesDuterte Health Agenda V 7-14-16WazzupNo ratings yet

- Outline class20222023CreditTransactionsDocument7 pagesOutline class20222023CreditTransactionsRoy Angelo NepomucenoNo ratings yet

- Allied Banking Corp V Lim Sio WanDocument2 pagesAllied Banking Corp V Lim Sio WanDebroah Faith PajarilloNo ratings yet

- 해외주식 종목별 투자 현황 (2019년 말)Document160 pages해외주식 종목별 투자 현황 (2019년 말)이정재No ratings yet

- Thomas Cook ReportDocument21 pagesThomas Cook ReportVignesh Karthick Ramamoorthy100% (1)

- Gulf Resorts Inc. v. Philippine Charter Insurance Corp. G.R. No. 156167 May 16 2005Document3 pagesGulf Resorts Inc. v. Philippine Charter Insurance Corp. G.R. No. 156167 May 16 2005Abilene Joy Dela Cruz100% (1)

- Marketing of Bank Products - Emerging Challenges &Document8 pagesMarketing of Bank Products - Emerging Challenges &Vivek Kumar SinghNo ratings yet

- Practise DetailsDocument4 pagesPractise Detailskhaleel ofcNo ratings yet

- Body of NBL-FexDocument76 pagesBody of NBL-FexIshrat JahanNo ratings yet

- Acquisition Proposal - 4249 S Norton Ave Los Angeles CA 90008Document20 pagesAcquisition Proposal - 4249 S Norton Ave Los Angeles CA 90008erespinozaNo ratings yet

- Annual Report 2012 of MJL Bangladesh Limited PDFDocument124 pagesAnnual Report 2012 of MJL Bangladesh Limited PDFTafsir HossainNo ratings yet

- Invoice BI034Document4 pagesInvoice BI034Bonnie Rianii YahyaNo ratings yet

- Minutes Oh 2015-04-23Document4 pagesMinutes Oh 2015-04-23api-205664725No ratings yet

- Marine InsuranceDocument1 pageMarine InsurancePeanutButter 'n JellyNo ratings yet

- Experience at HBL InternshipDocument7 pagesExperience at HBL InternshipStorm BreakerNo ratings yet

- CHKKKDocument15 pagesCHKKKPace LeadgenNo ratings yet