Professional Documents

Culture Documents

01 IMF - Taxing Immovable Property - 2013 7

01 IMF - Taxing Immovable Property - 2013 7

Uploaded by

Dimitris Argyriou0 ratings0% found this document useful (0 votes)

5 views1 pageThis document discusses property taxation concepts and yields. It notes that property taxes encompass a variety of levies on property ownership, use, and transfer, with different objectives and revenue yields. While recurrent taxes on immovable property are the main focus, the document also covers broader property tax definitions. Property tax data coverage and quality makes summarizing global trends difficult, though OECD country data is more comprehensive. The document examines property tax composition, levels, and trends across countries, and the importance of property taxes for local governments and their potential revenue yields.

Original Description:

p7

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses property taxation concepts and yields. It notes that property taxes encompass a variety of levies on property ownership, use, and transfer, with different objectives and revenue yields. While recurrent taxes on immovable property are the main focus, the document also covers broader property tax definitions. Property tax data coverage and quality makes summarizing global trends difficult, though OECD country data is more comprehensive. The document examines property tax composition, levels, and trends across countries, and the importance of property taxes for local governments and their potential revenue yields.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views1 page01 IMF - Taxing Immovable Property - 2013 7

01 IMF - Taxing Immovable Property - 2013 7

Uploaded by

Dimitris ArgyriouThis document discusses property taxation concepts and yields. It notes that property taxes encompass a variety of levies on property ownership, use, and transfer, with different objectives and revenue yields. While recurrent taxes on immovable property are the main focus, the document also covers broader property tax definitions. Property tax data coverage and quality makes summarizing global trends difficult, though OECD country data is more comprehensive. The document examines property tax composition, levels, and trends across countries, and the importance of property taxes for local governments and their potential revenue yields.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

6

II. PROPERTY TAXATIONCONCEPTS AND YIELD

While generally associated with the notion of recurrent (annual) taxes on immovable

property, property taxes in practice encompass a variety of levies on the use, ownership,

and transfer of property. These are taxes with very different objectives and varying yields.

According to standard international tax classifications,6 property taxes encompass recurrent

taxes on immovable property, measured gross of debt and levied on proprietors or tenants;

recurrent taxes on net (of debt) wealth; taxes on estates, inheritances and gifts; financial and

capital transaction taxes on the issue or transfer of securities and checks, or sales of

immovable property; and other recurrent or non-recurrent taxes on property. While recurrent

taxes on immovable property are the key focus of this note, the remainder of this section

presents information also on the broader concept of property taxes.

How much do immovable property taxes generally yield? Due to deficient data coverage and

quality, it is not a straightforward exercise to summarize the importance of and trends in

property taxes on a global scale, and information on levels and trends is sensitive to the

choice of data sources, periods and regions analyzed. Data are particularly scarce for

developing and transition countriesnot least with regard to consistent time-serieswhereas

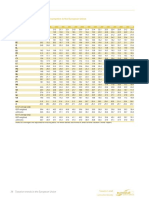

data for OECD countries are comprehensive. The dataset compiled for the purpose of the

paper covers generally the period 19902010. The data for 2010 are re-produced in Appendix

Tables 14 of the paper. This section presents information available concerning key features

of property taxes across countries with the focus first on their composition and then on levels

and trends. It also discusses the importance of property taxes for local governments, and the

issue of how much an immovable property tax potentially could yield. The section first

addresses the broader concept of property taxes, and then the quantitative aspects of

immovable property taxesthe main focus of the paper.

The broader concept of property taxes

Largely dependent on their adopted policy objectives, countries differ substantially with

regard to their use of the different property tax sources. Some countries place emphasis on

providing a stable and substantial source of revenue for sub-national governments through

immovable property taxes, while others prioritize general revenue raising (by using mainly

capital transfer taxes),7 or enhancing the progressivity and fairness of the overall tax system

The main ones being GFS and OECDs Revenue Statistics.

Capital transfer taxation is a buoyant tax handle in some countries (including in some non-OECD countries

such as South Africa), but is also generally acknowledged to generate potentially large efficiency costs, and

may, furthermore, have negative spill-over effects on the working of immovable property tax systems as

discussed in Section IV below.

You might also like

- Salarios Luma Octubre 2021Document24 pagesSalarios Luma Octubre 2021Victor Torres Montalvo100% (1)

- Wells Fargo Everyday CheckingDocument3 pagesWells Fargo Everyday CheckingTest000001No ratings yet

- Solution Review QuestionsDocument41 pagesSolution Review Questionsying huiNo ratings yet

- Manual Oil Cooler BloksmaDocument6 pagesManual Oil Cooler Bloksmaapi-377451960% (5)

- Complying With New Cost Basis Legislation:: What Brokers, Banks, Transfer Agents, Mutual Funds and Issuers Need To KnowDocument19 pagesComplying With New Cost Basis Legislation:: What Brokers, Banks, Transfer Agents, Mutual Funds and Issuers Need To KnowArpan MukherjeeNo ratings yet

- Assignment On Tax and WealthDocument7 pagesAssignment On Tax and WealthAaron WatenaonaNo ratings yet

- Offshore Tax Evasion and Tax Avoidance: A Business Perspective From IndonesiaDocument6 pagesOffshore Tax Evasion and Tax Avoidance: A Business Perspective From IndonesiaSukantoTanoto100% (1)

- Adv PF & TXN Chapter IVDocument55 pagesAdv PF & TXN Chapter IVSamrawit AndualemNo ratings yet

- 1 Property Rating and Property TaxationDocument10 pages1 Property Rating and Property TaxationAyodele Kehinde RotimiNo ratings yet

- Fundamentals of Beps: After Studying This Chapter, You Would Be Able ToDocument29 pagesFundamentals of Beps: After Studying This Chapter, You Would Be Able ToZ H SolutionsNo ratings yet

- 001 Article A001 enDocument47 pages001 Article A001 enGustavoMamaniMamaniNo ratings yet

- Chapter 5. Tax Policy: Policy Framework For Investment User'S ToolkitDocument40 pagesChapter 5. Tax Policy: Policy Framework For Investment User'S ToolkitRediet UtteNo ratings yet

- Offshore Tax Evasion and Tax Avoidance: A Business Perspective From IndonesiaDocument6 pagesOffshore Tax Evasion and Tax Avoidance: A Business Perspective From IndonesiaSukantoTanotoNo ratings yet

- Project MpaDocument33 pagesProject Mparandhawa435No ratings yet

- Determinants of Property Tax Revenue Lessons From Empirical AnalysisDocument23 pagesDeterminants of Property Tax Revenue Lessons From Empirical AnalysisTamratAfeworkNo ratings yet

- The Political Economy of Property Tax Reform: OECD Working Papers On Fiscal Federalism No. 18Document37 pagesThe Political Economy of Property Tax Reform: OECD Working Papers On Fiscal Federalism No. 18Hugo AlmanzaNo ratings yet

- ICRICT Alternatives Eng Sept 2017Document30 pagesICRICT Alternatives Eng Sept 2017Fritz BruggerNo ratings yet

- Property TaxDocument14 pagesProperty Taxanuj dhuppadNo ratings yet

- M15a1 RPHFTDocument2 pagesM15a1 RPHFTkristineclaire mapaloNo ratings yet

- Tax Law and PracticeDocument8 pagesTax Law and PracticeAnorld MunapoNo ratings yet

- 55 1605231035 jsKDFvK1 PDFDocument12 pages55 1605231035 jsKDFvK1 PDFanita syaputriNo ratings yet

- PFA Final Exam October 2022Document4 pagesPFA Final Exam October 2022Jay PugonNo ratings yet

- Tax Competition Between Sub-Central Governments: OECD Economics Department Working Papers No. 872Document45 pagesTax Competition Between Sub-Central Governments: OECD Economics Department Working Papers No. 872Yudha Alief AprilianNo ratings yet

- Problems and Prospects of Land Fees Administration in Rivers State, NigeriaDocument15 pagesProblems and Prospects of Land Fees Administration in Rivers State, NigeriaOpata OpataNo ratings yet

- TAD Ch.4-7Document109 pagesTAD Ch.4-7Yitera SisayNo ratings yet

- Cap 1.2.5Document45 pagesCap 1.2.5DavidNo ratings yet

- Tax HavenDocument16 pagesTax HavenAbdellahBouzelmadNo ratings yet

- MNC D, T H B R T: R E: Ividends AX Olidays and The Urden of The Epatriation AX Ecent VidenceDocument22 pagesMNC D, T H B R T: R E: Ividends AX Olidays and The Urden of The Epatriation AX Ecent VidenceromanticthiefNo ratings yet

- New OECD Country-By-Country Reporting Statistics Offer Insight Into Multinational Group Tax Avoidance BehaviorDocument3 pagesNew OECD Country-By-Country Reporting Statistics Offer Insight Into Multinational Group Tax Avoidance BehaviorRia KuvadiaNo ratings yet

- Emerging International Taxation IssuesDocument8 pagesEmerging International Taxation IssuesSaksham AroraNo ratings yet

- Economic Modelling: Patrice Pieretti, Giuseppe PulinaDocument11 pagesEconomic Modelling: Patrice Pieretti, Giuseppe PulinaFaradillaNo ratings yet

- Chapter 5Document49 pagesChapter 5shambelmekuye804No ratings yet

- The Impact of Tax On Foreign Direct Investment: Empirical Evidence and The Implications For Tax Integration SchemesDocument22 pagesThe Impact of Tax On Foreign Direct Investment: Empirical Evidence and The Implications For Tax Integration SchemesIgor BanovićNo ratings yet

- Multinational Firm Tax Avoidance and Tax Policy - 41790644Document24 pagesMultinational Firm Tax Avoidance and Tax Policy - 41790644mutia.wNo ratings yet

- JufridaDocument6 pagesJufridaMCINo ratings yet

- Country by Country FaqDocument6 pagesCountry by Country FaqJayant JoshiNo ratings yet

- Solution Manual For Government and Not For Profit Accounting Concepts and Practices 5th Edition by GranofDocument13 pagesSolution Manual For Government and Not For Profit Accounting Concepts and Practices 5th Edition by Granofa658506100No ratings yet

- Lecture 2 - Income TaxDocument13 pagesLecture 2 - Income TaxMasitala PhiriNo ratings yet

- International TaxationDocument45 pagesInternational TaxationDavid Ioana100% (1)

- 文化是一种长期形成的共同认识,对人类生活有深入的影响,帮括经济方面。Document6 pages文化是一种长期形成的共同认识,对人类生活有深入的影响,帮括经济方面。Amber FisherNo ratings yet

- Does Private Country-by-Country PDFDocument49 pagesDoes Private Country-by-Country PDFsuelaNo ratings yet

- Accrual Based Accountiung A PriorityDocument4 pagesAccrual Based Accountiung A PriorityVirender WangnooNo ratings yet

- Effect of Tax HavensDocument11 pagesEffect of Tax HavensmonimoniNo ratings yet

- AM WB ValuationDocument9 pagesAM WB ValuationDinesh TimalsinaNo ratings yet

- Mind The (Tax) Gap-Its Bigger Than You Probably Think! Tax Gap Research: Concepts, Methodologies and FindingsDocument37 pagesMind The (Tax) Gap-Its Bigger Than You Probably Think! Tax Gap Research: Concepts, Methodologies and Findingsxilo10No ratings yet

- International Differences in AccountingDocument4 pagesInternational Differences in AccountingHadeel Abdul SalamNo ratings yet

- Wealth Tax: Jump To Navigation Jump To SearchDocument19 pagesWealth Tax: Jump To Navigation Jump To SearchMalte SersNo ratings yet

- International Equity MarketsDocument32 pagesInternational Equity MarketsSachin PadolNo ratings yet

- Lecture On International TaxationDocument20 pagesLecture On International TaxationAtia IbnatNo ratings yet

- Capital Gain IrelandDocument7 pagesCapital Gain IrelandAYAN AHMEDNo ratings yet

- Tax Havens and Money Laundering in IndiaDocument12 pagesTax Havens and Money Laundering in IndiaVaishali RathiNo ratings yet

- Firms' Financial Choices and Thin Capitalization Rules Under Corporate Tax CompetitionDocument3 pagesFirms' Financial Choices and Thin Capitalization Rules Under Corporate Tax CompetitionPande Nyoman Frans WirawanNo ratings yet

- TAD CH.2 PritDocument76 pagesTAD CH.2 PritYitera SisayNo ratings yet

- Zebediah Muneta Chapter 1 & 2Document36 pagesZebediah Muneta Chapter 1 & 2Life UromboNo ratings yet

- 1international Organizations Active in The Field of International Tax LawDocument3 pages1international Organizations Active in The Field of International Tax Lawساكاو /sakaoNo ratings yet

- The 15 Action Points BEPSDocument8 pagesThe 15 Action Points BEPSErique Miguel MachariaNo ratings yet

- Thesis International TaxationDocument7 pagesThesis International Taxationdeniseenriquezglendale100% (2)

- Mentahan Materi Kebijakan PajakDocument8 pagesMentahan Materi Kebijakan Pajakyahdi ilyasNo ratings yet

- A Comprehensive Economic Reform Proposal For Laos - Philip AllanDocument11 pagesA Comprehensive Economic Reform Proposal For Laos - Philip AllanChanhsy Samavong100% (1)

- Group Asgmt 3 - GlobalizationDocument19 pagesGroup Asgmt 3 - GlobalizationJambu BatuNo ratings yet

- Chapter One SolutionsDocument9 pagesChapter One Solutionsapi-3705855100% (1)

- Tax Policy and the Economy, Volume 36From EverandTax Policy and the Economy, Volume 36Robert A. MoffittNo ratings yet

- Taxation Trends in The European Union - 2012 44Document1 pageTaxation Trends in The European Union - 2012 44Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 40Document1 pageTaxation Trends in The European Union - 2012 40Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 42Document1 pageTaxation Trends in The European Union - 2012 42Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 41Document1 pageTaxation Trends in The European Union - 2012 41Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 37Document1 pageTaxation Trends in The European Union - 2012 37Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 38Document1 pageTaxation Trends in The European Union - 2012 38Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 31Document1 pageTaxation Trends in The European Union - 2012 31Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 39Document1 pageTaxation Trends in The European Union - 2012 39Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 33Document1 pageTaxation Trends in The European Union - 2012 33Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 35Document1 pageTaxation Trends in The European Union - 2012 35Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 34Document1 pageTaxation Trends in The European Union - 2012 34Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 37Document1 pageTaxation Trends in The European Union - 2011 - Booklet 37Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 10Document1 pageTaxation Trends in The European Union - 2012 10Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 28Document1 pageTaxation Trends in The European Union - 2012 28Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 26Document1 pageTaxation Trends in The European Union - 2012 26Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 30Document1 pageTaxation Trends in The European Union - 2012 30Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 27Document1 pageTaxation Trends in The European Union - 2012 27Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 24Document1 pageTaxation Trends in The European Union - 2012 24Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 29Document1 pageTaxation Trends in The European Union - 2012 29Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 25Document1 pageTaxation Trends in The European Union - 2012 25Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 35Document1 pageTaxation Trends in The European Union - 2011 - Booklet 35Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 3Document1 pageTaxation Trends in The European Union - 2012 3Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 36Document1 pageTaxation Trends in The European Union - 2011 - Booklet 36Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 8Document1 pageTaxation Trends in The European Union - 2012 8Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 33Document1 pageTaxation Trends in The European Union - 2011 - Booklet 33Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 31Document1 pageTaxation Trends in The European Union - 2011 - Booklet 31Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 34Document1 pageTaxation Trends in The European Union - 2011 - Booklet 34Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 29Document1 pageTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouNo ratings yet

- Dokumen - Tips - JCB 422zx Wheeled Loader Service Repair Manual SN From 2320169 To 2320669 1594970576Document25 pagesDokumen - Tips - JCB 422zx Wheeled Loader Service Repair Manual SN From 2320169 To 2320669 1594970576charnight 2100% (1)

- Quora Use Case NarrativeDocument5 pagesQuora Use Case NarrativeJoannshahin SepasiNo ratings yet

- Cubic Spline Questions: SolutionDocument11 pagesCubic Spline Questions: SolutionJUNIOR CCAIHUARI HOYOSNo ratings yet

- MN006055A01-AC Enus MOTOTRBO Customer Programming Software 2.0 Online HelpDocument647 pagesMN006055A01-AC Enus MOTOTRBO Customer Programming Software 2.0 Online HelpDyego FelixNo ratings yet

- This Is Where Scarcity Factors In. Our Unlimited Wants Are Confronted by A Limited Supply of Goods and ServicesDocument3 pagesThis Is Where Scarcity Factors In. Our Unlimited Wants Are Confronted by A Limited Supply of Goods and ServicesAMECI ElementaryNo ratings yet

- Building Your Technical ToolboxDocument10 pagesBuilding Your Technical Toolboxarryone00No ratings yet

- Reviewer in Transportation Law - Finals PDFDocument9 pagesReviewer in Transportation Law - Finals PDFDiane Althea Valera Pena100% (1)

- Microsoft Certified: Azure Solutions Architect Expert - Skills MeasuredDocument8 pagesMicrosoft Certified: Azure Solutions Architect Expert - Skills Measuredcooldsr2110No ratings yet

- Nicollet AWAIR PlansDocument11 pagesNicollet AWAIR PlansidahssNo ratings yet

- CS1 Suggested Solutions - April 2021Document7 pagesCS1 Suggested Solutions - April 2021Shafak AhamedNo ratings yet

- EMLDocument3 pagesEMLSesinam AhedorNo ratings yet

- Assignment CHPT 12Document3 pagesAssignment CHPT 12Sultan LimitNo ratings yet

- A First Impression of Programming With RobomindDocument14 pagesA First Impression of Programming With Robomindafsheen faiqNo ratings yet

- 2 Stage Air Compressor Report PDFDocument31 pages2 Stage Air Compressor Report PDFChandan JobanputraNo ratings yet

- Pertemuan 1 Auditing 1: Introduction To Auditing and Assurance ServicesDocument36 pagesPertemuan 1 Auditing 1: Introduction To Auditing and Assurance Servicesdina cholidinNo ratings yet

- Retaliatory Hacking: The Hack Back: The Legality ofDocument4 pagesRetaliatory Hacking: The Hack Back: The Legality ofjay.reaper4No ratings yet

- Marie Skłodowska-Curie Actions (MSCA) : - Horizon 2020Document53 pagesMarie Skłodowska-Curie Actions (MSCA) : - Horizon 2020vitis12No ratings yet

- Volvo Penta GensetDocument4 pagesVolvo Penta Gensetafandybaharuddin100% (1)

- Executive Summary Ent300Document1 pageExecutive Summary Ent300Bukhari Suhaidin100% (1)

- Novice PDFDocument23 pagesNovice PDFabeatty34No ratings yet

- Mmbg-Iil-Kkp-Es - 2122-04222Document11 pagesMmbg-Iil-Kkp-Es - 2122-04222Blue VisionNo ratings yet

- SBI Scholar Loan SchemeDocument2 pagesSBI Scholar Loan Schemekanv gulatiNo ratings yet

- ISSO or COMSEC or IT ManagementDocument4 pagesISSO or COMSEC or IT Managementapi-121404646No ratings yet

- AP Daily Live VideosDocument2 pagesAP Daily Live VideosAPTeacherNo ratings yet

- PDS - FX SwapDocument16 pagesPDS - FX SwapvaibhavpatsNo ratings yet

- MathML With HTML5Document10 pagesMathML With HTML5devendraNo ratings yet

- Table Manners in A Formal Restaurant. 1.: Make Good Use of Your Napkin. Place Your Napkin in Your Lap Immediately UponDocument2 pagesTable Manners in A Formal Restaurant. 1.: Make Good Use of Your Napkin. Place Your Napkin in Your Lap Immediately UponAllen KateNo ratings yet