Professional Documents

Culture Documents

Motor Private Car ENG

Motor Private Car ENG

Uploaded by

ascap77Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Motor Private Car ENG

Motor Private Car ENG

Uploaded by

ascap77Copyright:

Available Formats

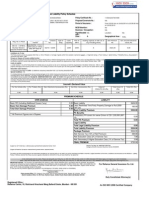

PRODUCT DISCLOSURE SHEET

Read this Product Disclosure Sheet before you decide

to participate in Private Car Takaful Scheme.

Please be sure to also read the general terms and

conditions.

Private Car Takaful

Date: 6 November 2014

1. What is this scheme about?

This Scheme indemnifies you against your liabilities to third parties for injury or death, damage to third

parties property and accidental or fire damage to your vehicle or theft to your vehicle.

2.

What are the Shariah concepts applicable?

This scheme applies a Wakalah Contract.

Wakalah is a contract where the participant appoints the Company to carry out transactions on the

Participant's behalf to invest and manage the contribution in the Company's General Takaful Fund (hereinafter

referred to as "GTF"). As a return, the participant allows the Company to deduct certain amount as Wakalah

fee for the services rendered.

Takaful concepts pursuits to mutual financial assistance/joint guarantee in the event of catastrophe.

Tabarru' is a donation contract where a participant donates a portion of the contribution into the GTF which

will be used to help other participants in times of misfortune.

Any surplus arising from the GTF, if any, will be determined and distributed at the Company's sole and

absolute discretion where the annual amount of surplus distribution between Participant and the Company in

the proportions of 50% to the participant and 50% to the Company, provided that the participant did not

make any claim and/or received any benefit during the current certificate year/period of takaful.

If the GTF is in deficit, and after having exhausted all available avenues, an interest free loan from the

Company on Qardh will be taken. The Qardh will be repaid when the GTF returns to be profitable and before

any surplus is distributed.

3.

What are the covers / benefits provided?

This scheme covers:

A. Loss or damage to your own vehicle due to accidental fire, theft or accident.

B. Your liability or your authorized drivers liability to third party for:

Bodily injury and death; and

Property loss or damage

Optional benefits that are available by paying additional contribution:

Windscreen damage

Vehicle Accessories

Damage arising from Flood and Landslide

Strike, Riot and Civil Commotion

Legal Liability to Passenger

Legal Liability of Passenger

Named Driver (for third name and above)

Motor Personal Accident

Note:

it is an offence under the laws of the Republic of Singapore to enter the country without extending passenger

liability cover for your motor takaful.

Duration of cover is for one year. You need to renew your takaful certificate annually.

4.

How much contribution do I have to pay?

The contribution you have to pay may vary depending on the sum covered and cubic capacity of your vehicle,

no claim discount (NCD) entitlement, optional benefits required and our underwriting requirements.

Example:

Gross contribution for a new private vehicle with sum covered RM50,000.00* and 1500 cubic capacity

Comprehensive cover

RM 1,552.50

NCD entitlement 25%

RM 388.13

Additional cover Windscreen up to RM800.00

RM 120.00

*This amount covered is based on the current market value of the vehicle based on reference to Redbook

vehicle valuation database.

The estimated gross contribution that you have to pay is RM2,060.63, subject to minimum contribution of

RM50.00

5.

What are the fees and charges that I have to pay?

Type

Amount

Wakalah Fees

37.50% of contribution of which:

Commission 10%

Other expenses 27.50%

Stamp Duty

RM10.00

*Service Tax

6%

*Note:

Goods and Services Tax - Upon enforcement of the Goods and Services Tax (GST), the Company shall reserve

the right to impose the GST at the prescribed rate on each certificate and payable by all certificate owners i.e.

individual and/or organisation (where applicable).

6.

7.

What are some of the key terms and conditions that I should be aware of?

Importance of disclosure you must disclose all material facts that you know or ought to know,

otherwise your certificate may be invalidated; such as previous accident(s) and modification to engine of

the vehicle.

Vehicle Market Value You must ensure that your vehicle is covered at the appropriate amount which is

the current market value of the vehicle. Failure to cover based on prevailing Market Value of the vehicle

may affect the claims settlement as the Average Clause (payment subject to average) will apply where

the amount of payment offered will be lesser than the coverage amount.

Excess the first amount of loss you have to bear in the event of claim as stated in the schedule.

Compulsory Excess if your vehicle is driven by a person who is:

a) Under 21 years old, or

b) A L license holder or

c) A full license holder for less than 2 years or

d) Not named in your certificate

The amount of loss you have to bear is RM400

Cash before cover full contribution must be paid to us or our authorized agent representing us before

cover can be granted

What are the major exclusions under this scheme?

This scheme does not cover certain losses, such as:

i) Your own death or bodily injury due to a motor accident

ii) Your liability against claims from passengers in your vehicle

iii) Loss of use of your vehicle

iv) Loss, damage or liability arising from an act of nature i.e. flood, storm or landslide

Note:

This list is non-exhaustive. Please refer to the Takaful Certificate for the full list of exclusions under this

scheme.

8.

Can I cancel my certificate?

You may cancel your certificate by giving written notice to us. Upon cancellation, you are entitled to a partial

refund of the contribution provided you have not made any claim.

9.

What do I need to do if there are changes to my contact details?

It is important that you inform us of any change in your contact details to ensure that all correspondences

reaches you in a timely manner.

10. Where can I get further information?

Should you require additional information on Private Car Takaful, please refer to the insurance infobooklet,

available at all our branches or visit www.islamicfinanceinfo.com.my.

If you have any enquiries, please contact us at:

Customer Service Unit (CSU)

Syarikat Takaful Malaysia Berhad,

Menara Takaful Malaysia,

No. 4, Jalan Sultan Sulaiman,

50000 Kuala Lumpur.

P.O. Box 11483,

50746 Kuala Lumpur.

Tel: 1-300 8 TAKAFUL (825 2385)

Fax: 603 - 2274 0237

E-mail : csu@takaful-malaysia.com.my

Website: takaful-malaysia.com.my

11. Other types of similar cover available.

Please refer to our branches or agents for other similar types of cover available.

IMPORTANT NOTE:

YOU SHOULD ENSURE THAT YOUR VEHICLE IS COVERED AT THE APPROPRIATE AMOUNT AS IT WILL AFFECT THE

AMOUNT YOU CAN CLAIM. IN THE EVENT OF AN ACCIDENT, YOU ARE ADVISED TO DEAL WITH APPROVED

WORKSHOPS. IF YOU HAVE A COMPREHENSIVE COVER AND YOU ARE NOT AT FAULT, YOU ARE ADVISED TO

SUBMIT YOUR CLAIM TO YOUR TAKAFUL OPERATOR. YOU SHOULD READ AND UNDERSTAND THE TAKAFUL

CERTIFICATE AND DISCUSS WITH THE AGENT OR CONTACT THE TAKAFUL OPERATOR DIRECTLY FOR MORE

INFORMATION.

Syarikat Takaful Malaysia Berhad is licensed under the Islamic Financial Services Act 2013 and regulated by Bank

Negara Malaysia.

The information provided in this disclosure sheet is valid as at 6/11/2014

You might also like

- Vehicle Insurance Policy FormatDocument4 pagesVehicle Insurance Policy Formatarunavonline_947835049% (59)

- Reliance Car InsuranceDocument4 pagesReliance Car InsuranceMatthew Smith67% (9)

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument3 pagesIffco-Tokio General Insurance Co - LTD: Servicing Officevijay_sudha50% (2)

- Iffco TokioDocument2 pagesIffco Tokioneel55% (11)

- 9202532312008516Document2 pages9202532312008516Roopesh KumarNo ratings yet

- Project Proposal DraftDocument14 pagesProject Proposal DraftAdasa EdwardsNo ratings yet

- Takaful MyMotor Motor PDS ENGDocument4 pagesTakaful MyMotor Motor PDS ENGNamirahMujahidahSyahidahNo ratings yet

- Takaful MyClick Motor PDS V1Document3 pagesTakaful MyClick Motor PDS V1Muhd FakhrulNo ratings yet

- Takaful MyClick Motor PDS V1Document3 pagesTakaful MyClick Motor PDS V1حمدي رمليNo ratings yet

- Takaful Myclick Motor PDS V1Document3 pagesTakaful Myclick Motor PDS V1Ahmad FikriNo ratings yet

- Example:: 1 Pmg/Egtb/Motor/Pds/Eng/Echannel/Direct/2105V2.5Document3 pagesExample:: 1 Pmg/Egtb/Motor/Pds/Eng/Echannel/Direct/2105V2.5aniesNo ratings yet

- NotesDocument10 pagesNotesgimgiNo ratings yet

- PO Comprehensive MotorcycleDocument3 pagesPO Comprehensive Motorcyclelloyd_yongNo ratings yet

- PDSMotor FormDocument3 pagesPDSMotor FormAkoo MeraNo ratings yet

- Ikhlas Comprehensive Private Car Takaful Pds - Eng Jan2015Document4 pagesIkhlas Comprehensive Private Car Takaful Pds - Eng Jan2015Lah IrsNo ratings yet

- Motor Insurance PDS PDFDocument4 pagesMotor Insurance PDS PDFalister kellenNo ratings yet

- Auto365 Comprehensive Premier - PDS - Kur - ENG - 1022Document4 pagesAuto365 Comprehensive Premier - PDS - Kur - ENG - 1022Kanggatharan MunusamyNo ratings yet

- Car Insurance Policy BookletDocument28 pagesCar Insurance Policy BookletvenunainiNo ratings yet

- Third Party Fire and Theft - Product Dislosure Sheet - EnglishDocument4 pagesThird Party Fire and Theft - Product Dislosure Sheet - EnglishhishamhamdanNo ratings yet

- PCP 96175276 PDFDocument3 pagesPCP 96175276 PDFpvsairam100% (5)

- Takaful First PartyDocument3 pagesTakaful First Partyahrafza91No ratings yet

- Product Disclosure Sheet: Pacific & Orient Insurance Co. BerhadDocument4 pagesProduct Disclosure Sheet: Pacific & Orient Insurance Co. Berhadrasheed265No ratings yet

- Product Disclosure Sheet: Pacific & Orient Insurance Co. BerhadDocument4 pagesProduct Disclosure Sheet: Pacific & Orient Insurance Co. BerhadHamzah AzizanNo ratings yet

- PDS Motor InsuranceDocument3 pagesPDS Motor InsuranceHooter ShooterNo ratings yet

- Allianz General Insurance Company (Malaysia) BerhadDocument6 pagesAllianz General Insurance Company (Malaysia) BerhadSiti Nurazlin FariddunNo ratings yet

- ZGTMB Z-Driver PDS - ENGDocument3 pagesZGTMB Z-Driver PDS - ENGAzizul YahayaNo ratings yet

- Houseowner Xtra I - PdsDocument2 pagesHouseowner Xtra I - PdsHaiqal 9A plusNo ratings yet

- Sompo Motor Insurance (Private Car Comprehensive Policy) : Product Disclosure SheetDocument6 pagesSompo Motor Insurance (Private Car Comprehensive Policy) : Product Disclosure SheetMuhammad Shamaran AbdullahNo ratings yet

- TWP 87187353Document2 pagesTWP 87187353Abilon Smith100% (2)

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument2 pagesIffco-Tokio General Insurance Co - LTD: Servicing OfficeRANGITHNo ratings yet

- Iffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017Document3 pagesIffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017SureshNo ratings yet

- Product Disclosure Sheet: Prepared For: Print DateDocument4 pagesProduct Disclosure Sheet: Prepared For: Print DatePhua Kien HanNo ratings yet

- Motor Policy - The New India Assurance Co. LTDDocument5 pagesMotor Policy - The New India Assurance Co. LTDu4rishiNo ratings yet

- PDS - AGENCY (TAKAFUL) - Takaful Personal Accident 140410Document2 pagesPDS - AGENCY (TAKAFUL) - Takaful Personal Accident 140410lord_saladinNo ratings yet

- Product Disclosure Sheet FLEXI PA TakafulDocument2 pagesProduct Disclosure Sheet FLEXI PA Takafulashyraf81No ratings yet

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument2 pagesIffco-Tokio General Insurance Co - LTD: Servicing Officesumit.raj.iiit5613No ratings yet

- Innova Ranbir PDFDocument2 pagesInnova Ranbir PDFNarinder KaurNo ratings yet

- Vehicle Insurance 2nd YearDocument2 pagesVehicle Insurance 2nd YearVivek KuppusamyNo ratings yet

- Aviation Fuelling Liability PdsDocument3 pagesAviation Fuelling Liability PdsNoraini Mohd Shariff100% (1)

- S M Asloob.Document2 pagesS M Asloob.saikripa1210% (1)

- Thunderbird Twinspark Insurance2014Document4 pagesThunderbird Twinspark Insurance2014vijaybk73No ratings yet

- mh43x8786 Xylo E6Document4 pagesmh43x8786 Xylo E6Asif ShaikhNo ratings yet

- Dated: 07/09/2022Document6 pagesDated: 07/09/2022Fatin AsyuraNo ratings yet

- Rac Policy BookletDocument24 pagesRac Policy Bookletkeener66No ratings yet

- PDS (OTO360) FormDocument2 pagesPDS (OTO360) Formawang naziroolNo ratings yet

- Workmens Compensation TakafulDocument3 pagesWorkmens Compensation TakafulFaizZiyannNo ratings yet

- PDS (OTO360) FormDocument2 pagesPDS (OTO360) FormSara AriffNo ratings yet

- PDS RoadWarrior ENG AZ0623Document3 pagesPDS RoadWarrior ENG AZ0623achmadegNo ratings yet

- Reliance Private Car Vehicle Certificate Cum Policy ScheduleDocument3 pagesReliance Private Car Vehicle Certificate Cum Policy ScheduleMatthew Smith100% (5)

- AD116 - Policybook - 0110Document60 pagesAD116 - Policybook - 0110johndkellyNo ratings yet

- Iffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017Document3 pagesIffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017ams20110% (1)

- Policy PLATINUM EUDocument19 pagesPolicy PLATINUM EUmeNo ratings yet

- Allianz General Insurance Company (Malaysia) BerhadDocument3 pagesAllianz General Insurance Company (Malaysia) Berhadmysara othmanNo ratings yet

- Insurance BasicDocument4 pagesInsurance BasicMark Cristian SaysonNo ratings yet

- Airport Contractors Liability PdsDocument2 pagesAirport Contractors Liability PdsNoraini Mohd ShariffNo ratings yet

- 2 Fire Consequential Loss Insurance Product Disclosure Sheet-English VersionDocument3 pages2 Fire Consequential Loss Insurance Product Disclosure Sheet-English VersionAshish TiwariNo ratings yet

- Motor Policy Wording UaeDocument64 pagesMotor Policy Wording UaeBassam MustafaNo ratings yet

- Air Meet Liability PdsDocument3 pagesAir Meet Liability PdsNoraini Mohd ShariffNo ratings yet

- Car Hire Policy DocumentDocument19 pagesCar Hire Policy DocumentGabor SzucsNo ratings yet

- Motor Add OnDocument6 pagesMotor Add Onsunder_vasudevanNo ratings yet

- CDL Study Guide: Guide on hazardous materials, chamber vehicles and basic vehicle control skillsFrom EverandCDL Study Guide: Guide on hazardous materials, chamber vehicles and basic vehicle control skillsNo ratings yet

- Services To GASCO On Unified Drawing Format & Drawing AutomationDocument14 pagesServices To GASCO On Unified Drawing Format & Drawing Automationmadhu_karekar100% (1)

- TM I RubenDocument165 pagesTM I RubenMark Kevin DaitolNo ratings yet

- Moot Court (Clinical)Document2 pagesMoot Court (Clinical)prince KumarNo ratings yet

- Underwood C. P., "HVAC Control Systems, Modelling Analysis and Design" RoutledgeDocument2 pagesUnderwood C. P., "HVAC Control Systems, Modelling Analysis and Design" Routledgeatif shaikhNo ratings yet

- Drilled Shaft in Rock Analysis and Design - Part3Document109 pagesDrilled Shaft in Rock Analysis and Design - Part3rshaghayan100% (2)

- SK Z3 2022 BudgetDocument2 pagesSK Z3 2022 Budgetgenesis tolibasNo ratings yet

- Roger Bacon Resume Nov2020Document1 pageRoger Bacon Resume Nov2020api-232293986No ratings yet

- Pamagat NG Isang Thesis Sa FilipinoDocument6 pagesPamagat NG Isang Thesis Sa Filipinocdayxnzcf100% (2)

- University Day 2018Document16 pagesUniversity Day 2018jackbull321No ratings yet

- Bijections - Zuming Feng - IdeaMath 2008Document4 pagesBijections - Zuming Feng - IdeaMath 2008bruh pogNo ratings yet

- PAS 28 - Investments in Associates and Joint Ventures-1Document12 pagesPAS 28 - Investments in Associates and Joint Ventures-1Krizzia DizonNo ratings yet

- Dance Poetry PDFDocument10 pagesDance Poetry PDFEric EllulNo ratings yet

- ICEfaces Asynchronous HTTP ServerDocument33 pagesICEfaces Asynchronous HTTP ServerIniyaNo ratings yet

- Resume Li Cui JhuDocument1 pageResume Li Cui Jhuapi-340127718No ratings yet

- Notice No. 320 (B) (Regarding Online Classes)Document2 pagesNotice No. 320 (B) (Regarding Online Classes)Ayush DubeyNo ratings yet

- Sulh On Maintenance of WifeDocument20 pagesSulh On Maintenance of WifeNurulatika Lasiman100% (1)

- Fragments Studies in Iconology 14 Leuven PDFDocument184 pagesFragments Studies in Iconology 14 Leuven PDFojazosdemadera100% (1)

- Navansha Dasha JaiminiDocument6 pagesNavansha Dasha JaiminiSandhya KadamNo ratings yet

- Saavaj: Episode 298 SC 298/1 Ajay's Room Int Day Ajay ToralDocument4 pagesSaavaj: Episode 298 SC 298/1 Ajay's Room Int Day Ajay ToraltunewingsNo ratings yet

- Indian Feminism - Class, Gendera & Identity in Medieval AgesDocument33 pagesIndian Feminism - Class, Gendera & Identity in Medieval AgesSougata PurkayasthaNo ratings yet

- Basic Cell Culture TechniquesDocument22 pagesBasic Cell Culture TechniquestapanagnihotriNo ratings yet

- SpMats ManualDocument112 pagesSpMats ManualjulesjusayanNo ratings yet

- Book Project FinalDocument12 pagesBook Project FinalAuguste RiedlNo ratings yet

- Pathophysiology-Threatened MiscarriageDocument1 pagePathophysiology-Threatened MiscarriageMoses Gabriel ValledorNo ratings yet

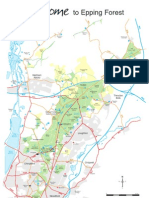

- Epping Forest MapDocument1 pageEpping Forest MapViktor CasualNo ratings yet

- Fore 307 Notes 2022Document18 pagesFore 307 Notes 2022Meekie VahNo ratings yet

- Northern RegionDocument56 pagesNorthern RegionAbiramiNaidu100% (1)

- Horn Persistence Natural HornDocument4 pagesHorn Persistence Natural Hornapi-478106051No ratings yet

- NSTP Barangay ProfileDocument6 pagesNSTP Barangay ProfilealbertNo ratings yet