Professional Documents

Culture Documents

Tax Compliance Charts

Tax Compliance Charts

Uploaded by

Aditya RatnamCopyright:

Available Formats

You might also like

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriNo ratings yet

- Income Slabs Income Tax RateDocument4 pagesIncome Slabs Income Tax RateSavoir PenNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #SimpletaxindiaDocument11 pagesTds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #Simpletaxindiashivashankari86No ratings yet

- Tax CalenderDocument13 pagesTax CalenderAtul KawaleNo ratings yet

- Introduction To TdsDocument28 pagesIntroduction To TdsGavendra BhartiNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16Document26 pagesTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86No ratings yet

- By Shoba Kanakraj: Mstu, ChennaiDocument20 pagesBy Shoba Kanakraj: Mstu, ChennaiVasanthNo ratings yet

- TDS at A Glance 2013-14 BookDocument34 pagesTDS at A Glance 2013-14 Bookajad babuNo ratings yet

- Welcome To Tds Awareness / E-Filing of TDS Returns PROGRAMMEDocument60 pagesWelcome To Tds Awareness / E-Filing of TDS Returns PROGRAMMEmahadevavrNo ratings yet

- Introduction To Tax Deduction at SourceDocument9 pagesIntroduction To Tax Deduction at SourceGhanashyam RoyNo ratings yet

- The Following Information Is Required For Tax Auditaddress Where Books of AccountsDocument3 pagesThe Following Information Is Required For Tax Auditaddress Where Books of AccountsJasmeet DhamijaNo ratings yet

- Prerequisites in E-Filing Income Tax Returns: Dr. Kailash KalyaniDocument62 pagesPrerequisites in E-Filing Income Tax Returns: Dr. Kailash KalyaniRicha KalyaniNo ratings yet

- DSCN - Shree AutomotiveDocument24 pagesDSCN - Shree AutomotiveNikhilesh BhattacharyyaNo ratings yet

- FAQ On Form 16 & ITR Submission: Q. What Is Form 16?Document4 pagesFAQ On Form 16 & ITR Submission: Q. What Is Form 16?n333aroraNo ratings yet

- Tax Alert - Due Date Wise Month Mar-10: S.No. Due Date Act Event Frequency Period Form ApplicableDocument1 pageTax Alert - Due Date Wise Month Mar-10: S.No. Due Date Act Event Frequency Period Form ApplicableCA Arpit YadavNo ratings yet

- Rti DevDocument3 pagesRti DevPraveen RajNo ratings yet

- Service Tax: Levy of STDocument16 pagesService Tax: Levy of STVeeramani ArumugamNo ratings yet

- Session - 1Document14 pagesSession - 1AARCHI JAINNo ratings yet

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaNo ratings yet

- TDS Chart FY 2010-11 & FY 2011-12Document1 pageTDS Chart FY 2010-11 & FY 2011-12R.Gowri Sankar RajaNo ratings yet

- TDS Intrest IncomeDocument3 pagesTDS Intrest Incomekashyap_ajNo ratings yet

- E-Filing Income Tax Returns: Dr. Kailash KalyaniDocument41 pagesE-Filing Income Tax Returns: Dr. Kailash KalyaniRicha KalyaniNo ratings yet

- Tax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate ChartDocument3 pagesTax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate ChartChandan KumarNo ratings yet

- Relevant Dates: 15-Apr QuarterlyDocument6 pagesRelevant Dates: 15-Apr Quarterlysanyu1208No ratings yet

- Income Tax Slabs & Rates For Assessment Year 2013-14Document37 pagesIncome Tax Slabs & Rates For Assessment Year 2013-14Jigar RavalNo ratings yet

- Tax Payment Quick GuideDocument7 pagesTax Payment Quick Guidemohomedsaheel1234No ratings yet

- Form 16Document6 pagesForm 16anon_825378560No ratings yet

- EWT Politicians FINALDocument43 pagesEWT Politicians FINALClark LimNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro LimitedRishabh PareekNo ratings yet

- Online Epf Withdrawal ProcessDocument4 pagesOnline Epf Withdrawal ProcessvinayNo ratings yet

- TaxDocument46 pagesTaxAkashTokeNo ratings yet

- Taxation of Salaried EmployeesDocument41 pagesTaxation of Salaried EmployeesAbhiroop BoseNo ratings yet

- Service TaxDocument4 pagesService TaxMadan DahiyaNo ratings yet

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDocument3 pagesAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinNo ratings yet

- Tds TcsDocument20 pagesTds TcsnaysarNo ratings yet

- 21 Useful Charts of Tax ComplianceDocument24 pages21 Useful Charts of Tax Complianceanon_82143261733% (3)

- TDS Rate Financial Year 13-14Document10 pagesTDS Rate Financial Year 13-14Heena AgreNo ratings yet

- CP 16523370Document1 pageCP 16523370MaYank AdilNo ratings yet

- Taxes and Jobs Updates - 1Document13 pagesTaxes and Jobs Updates - 1Sahar AmeenNo ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- Assessment Year Indian Income Tax Return: I - IndividualDocument6 pagesAssessment Year Indian Income Tax Return: I - IndividualManjunath YvNo ratings yet

- Budget Booklet Ready Reckoner 2012 13Document62 pagesBudget Booklet Ready Reckoner 2012 13www.TdsTaxIndia.comNo ratings yet

- Form-16 Part-A From TDSCPC Website PDFDocument3 pagesForm-16 Part-A From TDSCPC Website PDFgaurav singhNo ratings yet

- GST Registration and GST Return Filing - A GuideDocument3 pagesGST Registration and GST Return Filing - A GuideUkkash KhanNo ratings yet

- Taxation of Salaried EmployeesDocument39 pagesTaxation of Salaried Employeessailolla30100% (1)

- Filing Form GSTR 4 Annual Return by Composition Taxpayers On GST PortalDocument2 pagesFiling Form GSTR 4 Annual Return by Composition Taxpayers On GST PortalFaizan AhmedNo ratings yet

- 53.income Tax Compliance Check ListDocument5 pages53.income Tax Compliance Check ListmercatuzNo ratings yet

- Form - 16A - What Every Taxpayer Should Be Aware ofDocument10 pagesForm - 16A - What Every Taxpayer Should Be Aware oftaxbuddyNo ratings yet

- Income TaxDocument59 pagesIncome TaxRicha Bansal100% (4)

- Income Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21Document11 pagesIncome Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21LAKSHMANARAO PNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrank LamNo ratings yet

- All About Tax Deducted at SourceDocument3 pagesAll About Tax Deducted at SourceBala VinayagamNo ratings yet

- Presentation On Taxation of The Microfinance IndustryDocument23 pagesPresentation On Taxation of The Microfinance IndustryFranco DurantNo ratings yet

- WK 2 Part 2 Corporate OSD and MCITDocument14 pagesWK 2 Part 2 Corporate OSD and MCITLaurence ImmanuelleNo ratings yet

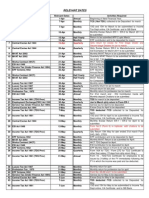

- Bir Tax Deadlines 2015Document2 pagesBir Tax Deadlines 2015Mary Grace BanezNo ratings yet

- Basic Guide To Payroll A4 Booklet 2017Document7 pagesBasic Guide To Payroll A4 Booklet 2017waqasNo ratings yet

- Lesson 2: Income Tax Schemes, Accounting Periods, Methods and ReportingDocument28 pagesLesson 2: Income Tax Schemes, Accounting Periods, Methods and ReportingCJ GranadaNo ratings yet

- Delinquent Tax Report - BellwoodDocument4 pagesDelinquent Tax Report - BellwoodMichaelRomainNo ratings yet

- Bar Exam Questions Income TaxationDocument11 pagesBar Exam Questions Income TaxationG.B. SevillaNo ratings yet

- JioMart Invoice 1700300012886Document1 pageJioMart Invoice 1700300012886shrishti guptaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAditya Adi SinghNo ratings yet

- Business Math - X000D - Using Excel: Chapter 14 - Practice 02Document1 pageBusiness Math - X000D - Using Excel: Chapter 14 - Practice 02malvikatanejaNo ratings yet

- PSPCL: (Pgbillpay - Aspx) (Pgbillpay - Aspx)Document2 pagesPSPCL: (Pgbillpay - Aspx) (Pgbillpay - Aspx)RitishNo ratings yet

- Individual TAXDocument6 pagesIndividual TAXPushpa ValliNo ratings yet

- DLA Piper Guide To Going Global Global Equity Full HandbookDocument298 pagesDLA Piper Guide To Going Global Global Equity Full HandbookOlegNo ratings yet

- Railwire Subscriber InvoiceDocument1 pageRailwire Subscriber InvoiceChinnu SalimathNo ratings yet

- ABC Co. Started Its OperationsDocument1 pageABC Co. Started Its OperationsQueen ValleNo ratings yet

- 25 Fulltext Vda de San Agustin Vs CirDocument5 pages25 Fulltext Vda de San Agustin Vs CirYvon BaguioNo ratings yet

- Strategic Tax Management Chapter 5Document1 pageStrategic Tax Management Chapter 5Angelly EsguerraNo ratings yet

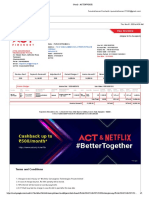

- Act Invoice: ACT Fibernet AdminDocument2 pagesAct Invoice: ACT Fibernet AdminaffanNo ratings yet

- Faculty - Architecture, Planning, and Surveying - 2022 - Session 1 - Degree - Res619Document4 pagesFaculty - Architecture, Planning, and Surveying - 2022 - Session 1 - Degree - Res619Nur AthirahNo ratings yet

- Mcq-Estate TaxDocument2 pagesMcq-Estate TaxRandy ManzanoNo ratings yet

- Pre Colonial Ancient Filipinos Practice Paying Taxes For The Protection From Their "Datu". The Spanish EraDocument4 pagesPre Colonial Ancient Filipinos Practice Paying Taxes For The Protection From Their "Datu". The Spanish EraAbegael Joyce RiveraNo ratings yet

- Share PerformanceTask BDocument5 pagesShare PerformanceTask BMariela PelaezNo ratings yet

- Prestige Marvel Plus Glass Manual Gas Stove: Grand Total 4625.00Document1 pagePrestige Marvel Plus Glass Manual Gas Stove: Grand Total 4625.00SAMIKSHA SAWANTNo ratings yet

- Tax Invoice: MR - Sultan Ali Abdulla HOUSE 279 Road 24 Block 233, Aldair Kingdom of Bahrain, Kingdom of BahrainDocument1 pageTax Invoice: MR - Sultan Ali Abdulla HOUSE 279 Road 24 Block 233, Aldair Kingdom of Bahrain, Kingdom of Bahraingxzfn4qgncNo ratings yet

- Fiscal PolicyDocument6 pagesFiscal Policyshahmonali694No ratings yet

- Capital Gains TaxDocument3 pagesCapital Gains TaxFery AnnNo ratings yet

- 3 DR KBL MathurDocument31 pages3 DR KBL MathurAkhilesh MishraNo ratings yet

- 2019 EU VAT Engleza PDFDocument164 pages2019 EU VAT Engleza PDFcris_ileana_39763320No ratings yet

- Real Time Information User GuideDocument44 pagesReal Time Information User GuideDinkan TalesNo ratings yet

- It 48Document40 pagesIt 48Robert Daysor BancifraNo ratings yet

- Contoh Soal Laporan Arus KasDocument2 pagesContoh Soal Laporan Arus KasRidwanNo ratings yet

- Gasbill 3851735781 202005 20200609192830Document1 pageGasbill 3851735781 202005 20200609192830Shahzaib GujjarNo ratings yet

- MCD 2090 Tutorial Questions T10-Wk10Document5 pagesMCD 2090 Tutorial Questions T10-Wk10kazuyaliemNo ratings yet

- Declaration For Us Person - PPKDocument2 pagesDeclaration For Us Person - PPKIDL_ReporterosNo ratings yet

Tax Compliance Charts

Tax Compliance Charts

Uploaded by

Aditya RatnamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Compliance Charts

Tax Compliance Charts

Uploaded by

Aditya RatnamCopyright:

Available Formats

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

JULY 2014

CA. Dinesh Kumar Tejwani

Topics Covered:

Income Tax

Companies Act

Service Tax

PF

ESIC

Excise

VAT

Stamp Duty

Email: contact@taxprintindia.com / Website: www.taxprintindia.com

tax print

Ph: 022 - 43 47 09 09 ( 4 lines )

Since 1959

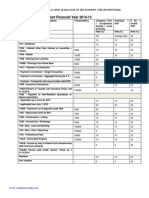

Income Tax Rates

For Individuals, HUF, AOP, BOI

Assessment

Year

Rate

General

Senior Citizen

2015-16

Nil

10%

20%

30%

Upto 2,50,000

2,50,001 to 5,00,000

5,00,001 to 10,00,000

Above 10,00,000

60 to 79 years

80 years & above

Upto 3,00,000

Upto 5,00,000

3,00,001 to 5,00,000

5,00,001 to 10,00,000 5,00,001 to 10,00,000

Above 10,00,000

Above 10,00,000

Surcharge @ 10% if total income exceeds 1 Crore | Cess @3%

Assessment

Year

Rate

General

Senior Citizen

2014-15

Nil

10%

20%

30%

Upto 2,00,000

2,00,001 to 5,00,000

5,00,001 to 10,00,000

Above 10,00,000

60 to 79 years

80 years & above

Upto 2,50,000

Upto 5,00,000

2,50,001 to 5,00,000

5,00,001 to 10,00,000 5,00,001 to 10,00,000

Above 10,00,000

Above 10,00,000

Surcharge @ 10% if total income exceeds 1 Crore | Cess @3%

Assessment

Year

Rate

General

Senior Citizen

2013-14

Nil

10%

20%

30%

Upto 2,00,000

2,00,001 to 5,00,000

5,00,001 to 10,00,000

Above 10,00,000

60 to 79 years

80 years & above

Upto 2,50,000

Upto 5,00,000

2,50,001 to 5,00,000

5,00,001 to 10,00,000 5,00,001 to 10,00,000

Above 10,00,000

Above 10,00,000

Cess @3%

Assessment

Year

2012-13

Rate

General

Women

Nil

Upto 1,80,000

Upto 1,90,000

10% 1,80,001 to 5,00,000 1,90,001 to 5,00,000

20% 5,00,001 to 8,00,000 5,00,001 to 8,00,000

30%

Above 8,00,000

Above 8,00,000

Cess @3%

Senior Citizen

60 to 79 years

80 years & above

Upto 2,50,000

Upto 5,00,000

2,50,001 to 5,00,000

5,00,001 to 8,00,000 5,00,001 to 8,00,000

Above 8,00,000

Above 8,00,000

tax print

Since 1959

INCOME TAX RATES

Ph: 022 - 43 47 09 09 ( 4 lines )

Assessment Year 2015-16

Other than Individuals

Co-operative Societies

Tax on distribution of dividend, buyback of shares

tax print

Since 1959

TDS Rate Chart: Resident

For Individuals, HUF, AOP, BOI

Ph: 022 - 43 47 09 09 ( 4 lines )

Assessment Year 2015-16

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

TDS Rate Chart: Non-Resident

Assessment Year 2015-16

FINANCIAL YEAR 2014-2015 : ASSESSMENT YEAR

tax print

Since 1959

Interest Accrual: NSC

For Individuals, HUF, AOP, BOI

Ph: 022 - 43 47 09 09 ( 4 lines )

Assessment Year 2015-16

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

Assessment Year 2015-16

TCS Rate Chart

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

TDS Rates under DTAA Treaties

Assessment Year 2015-16

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

Assessment Year 2015-16

Capital Gains Tax Rates

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

Assessment Year 2015-16

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

Penalties under Income Tax Act

Assessment Year 2015-16

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

Assessment Year 2015-16

Depreciation Chart: Income Tax

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

Assessment Year 2015-16

Interest payable - Income Tax Act

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

Assessment Year 2015-16

Gold - Silver Rates of Last 12 Years

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

Assessment Year 2015-16

Depreciation Chart: Companies Act, 2013

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

PF, ESIC & Payroll Compliance

PF and ESIC

Profession Tax Maharashtra

Assessment Year 2015-16

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

Service Tax Compliance

Basic Exemption Limit Chart

Rate Of Service Tax

Payment of Service Tax Using Challan GAR-7

Interest for Delayed Payment

Half-yearly Return In Form ST-3

Revision of Form ST-3

Frequency Norms of Service Tax Audit

Assessment Year 2015-16

tax print

Since 1959

Stamp Duty Mumbai

Ph: 022 - 43 47 09 09 ( 4 lines )

Assessment Year 2015-16

Stamp Duty Rates for Sale Agreements (Commercial and residential)

Stamp Duty Rates for Leave & License Agreement (w.e.f 01-05-2013)

Registration Charges

tax print

Since 1959

VAT - Maharashtra

Due Date For Payment Of VAT

VAT / CST Returns

MVAT Audit

Interest For Delayed Payment

Registration under MVAT

Ph: 022 - 43 47 09 09 ( 4 lines )

Assessment Year 2015-16

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

Assessment Year 2015-16

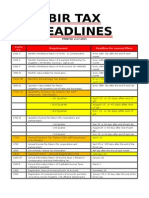

Due Dates Chart

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

Assessment Year 2015-16

Excise Duty: Periodical Returns

tax print

Since 1959

List of Holidays - 2014

Bank holidays in Maharashtra State

Ph: 022 - 43 47 09 09 ( 4 lines )

tax print

Since 1959

Ph: 022 - 43 47 09 09 ( 4 lines )

List of Holidays - 2014

Holidays in Income Tax Department - Mumbai

tax print

Software Solutions Available on

e-TDS

Electronics TDS Returns in four clicks

Web based TDS

XBRL

WEB

PAY R O L L

PAY R O L L

WEB HRMS

INCOME

TAX

FIXED ASSET

WEB FIXED ASSET

SERVICE TAX

For Free Demo,

Please call us at

DIGITAL SIGNATURE

tax print

Call : 08080 655 355

Email: contact@taxprintindia.com

www.taxprintindia.com

PDF SIGNER

You might also like

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriNo ratings yet

- Income Slabs Income Tax RateDocument4 pagesIncome Slabs Income Tax RateSavoir PenNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #SimpletaxindiaDocument11 pagesTds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #Simpletaxindiashivashankari86No ratings yet

- Tax CalenderDocument13 pagesTax CalenderAtul KawaleNo ratings yet

- Introduction To TdsDocument28 pagesIntroduction To TdsGavendra BhartiNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16Document26 pagesTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86No ratings yet

- By Shoba Kanakraj: Mstu, ChennaiDocument20 pagesBy Shoba Kanakraj: Mstu, ChennaiVasanthNo ratings yet

- TDS at A Glance 2013-14 BookDocument34 pagesTDS at A Glance 2013-14 Bookajad babuNo ratings yet

- Welcome To Tds Awareness / E-Filing of TDS Returns PROGRAMMEDocument60 pagesWelcome To Tds Awareness / E-Filing of TDS Returns PROGRAMMEmahadevavrNo ratings yet

- Introduction To Tax Deduction at SourceDocument9 pagesIntroduction To Tax Deduction at SourceGhanashyam RoyNo ratings yet

- The Following Information Is Required For Tax Auditaddress Where Books of AccountsDocument3 pagesThe Following Information Is Required For Tax Auditaddress Where Books of AccountsJasmeet DhamijaNo ratings yet

- Prerequisites in E-Filing Income Tax Returns: Dr. Kailash KalyaniDocument62 pagesPrerequisites in E-Filing Income Tax Returns: Dr. Kailash KalyaniRicha KalyaniNo ratings yet

- DSCN - Shree AutomotiveDocument24 pagesDSCN - Shree AutomotiveNikhilesh BhattacharyyaNo ratings yet

- FAQ On Form 16 & ITR Submission: Q. What Is Form 16?Document4 pagesFAQ On Form 16 & ITR Submission: Q. What Is Form 16?n333aroraNo ratings yet

- Tax Alert - Due Date Wise Month Mar-10: S.No. Due Date Act Event Frequency Period Form ApplicableDocument1 pageTax Alert - Due Date Wise Month Mar-10: S.No. Due Date Act Event Frequency Period Form ApplicableCA Arpit YadavNo ratings yet

- Rti DevDocument3 pagesRti DevPraveen RajNo ratings yet

- Service Tax: Levy of STDocument16 pagesService Tax: Levy of STVeeramani ArumugamNo ratings yet

- Session - 1Document14 pagesSession - 1AARCHI JAINNo ratings yet

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaNo ratings yet

- TDS Chart FY 2010-11 & FY 2011-12Document1 pageTDS Chart FY 2010-11 & FY 2011-12R.Gowri Sankar RajaNo ratings yet

- TDS Intrest IncomeDocument3 pagesTDS Intrest Incomekashyap_ajNo ratings yet

- E-Filing Income Tax Returns: Dr. Kailash KalyaniDocument41 pagesE-Filing Income Tax Returns: Dr. Kailash KalyaniRicha KalyaniNo ratings yet

- Tax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate ChartDocument3 pagesTax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate ChartChandan KumarNo ratings yet

- Relevant Dates: 15-Apr QuarterlyDocument6 pagesRelevant Dates: 15-Apr Quarterlysanyu1208No ratings yet

- Income Tax Slabs & Rates For Assessment Year 2013-14Document37 pagesIncome Tax Slabs & Rates For Assessment Year 2013-14Jigar RavalNo ratings yet

- Tax Payment Quick GuideDocument7 pagesTax Payment Quick Guidemohomedsaheel1234No ratings yet

- Form 16Document6 pagesForm 16anon_825378560No ratings yet

- EWT Politicians FINALDocument43 pagesEWT Politicians FINALClark LimNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro LimitedRishabh PareekNo ratings yet

- Online Epf Withdrawal ProcessDocument4 pagesOnline Epf Withdrawal ProcessvinayNo ratings yet

- TaxDocument46 pagesTaxAkashTokeNo ratings yet

- Taxation of Salaried EmployeesDocument41 pagesTaxation of Salaried EmployeesAbhiroop BoseNo ratings yet

- Service TaxDocument4 pagesService TaxMadan DahiyaNo ratings yet

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDocument3 pagesAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinNo ratings yet

- Tds TcsDocument20 pagesTds TcsnaysarNo ratings yet

- 21 Useful Charts of Tax ComplianceDocument24 pages21 Useful Charts of Tax Complianceanon_82143261733% (3)

- TDS Rate Financial Year 13-14Document10 pagesTDS Rate Financial Year 13-14Heena AgreNo ratings yet

- CP 16523370Document1 pageCP 16523370MaYank AdilNo ratings yet

- Taxes and Jobs Updates - 1Document13 pagesTaxes and Jobs Updates - 1Sahar AmeenNo ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- Assessment Year Indian Income Tax Return: I - IndividualDocument6 pagesAssessment Year Indian Income Tax Return: I - IndividualManjunath YvNo ratings yet

- Budget Booklet Ready Reckoner 2012 13Document62 pagesBudget Booklet Ready Reckoner 2012 13www.TdsTaxIndia.comNo ratings yet

- Form-16 Part-A From TDSCPC Website PDFDocument3 pagesForm-16 Part-A From TDSCPC Website PDFgaurav singhNo ratings yet

- GST Registration and GST Return Filing - A GuideDocument3 pagesGST Registration and GST Return Filing - A GuideUkkash KhanNo ratings yet

- Taxation of Salaried EmployeesDocument39 pagesTaxation of Salaried Employeessailolla30100% (1)

- Filing Form GSTR 4 Annual Return by Composition Taxpayers On GST PortalDocument2 pagesFiling Form GSTR 4 Annual Return by Composition Taxpayers On GST PortalFaizan AhmedNo ratings yet

- 53.income Tax Compliance Check ListDocument5 pages53.income Tax Compliance Check ListmercatuzNo ratings yet

- Form - 16A - What Every Taxpayer Should Be Aware ofDocument10 pagesForm - 16A - What Every Taxpayer Should Be Aware oftaxbuddyNo ratings yet

- Income TaxDocument59 pagesIncome TaxRicha Bansal100% (4)

- Income Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21Document11 pagesIncome Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21LAKSHMANARAO PNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrank LamNo ratings yet

- All About Tax Deducted at SourceDocument3 pagesAll About Tax Deducted at SourceBala VinayagamNo ratings yet

- Presentation On Taxation of The Microfinance IndustryDocument23 pagesPresentation On Taxation of The Microfinance IndustryFranco DurantNo ratings yet

- WK 2 Part 2 Corporate OSD and MCITDocument14 pagesWK 2 Part 2 Corporate OSD and MCITLaurence ImmanuelleNo ratings yet

- Bir Tax Deadlines 2015Document2 pagesBir Tax Deadlines 2015Mary Grace BanezNo ratings yet

- Basic Guide To Payroll A4 Booklet 2017Document7 pagesBasic Guide To Payroll A4 Booklet 2017waqasNo ratings yet

- Lesson 2: Income Tax Schemes, Accounting Periods, Methods and ReportingDocument28 pagesLesson 2: Income Tax Schemes, Accounting Periods, Methods and ReportingCJ GranadaNo ratings yet

- Delinquent Tax Report - BellwoodDocument4 pagesDelinquent Tax Report - BellwoodMichaelRomainNo ratings yet

- Bar Exam Questions Income TaxationDocument11 pagesBar Exam Questions Income TaxationG.B. SevillaNo ratings yet

- JioMart Invoice 1700300012886Document1 pageJioMart Invoice 1700300012886shrishti guptaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAditya Adi SinghNo ratings yet

- Business Math - X000D - Using Excel: Chapter 14 - Practice 02Document1 pageBusiness Math - X000D - Using Excel: Chapter 14 - Practice 02malvikatanejaNo ratings yet

- PSPCL: (Pgbillpay - Aspx) (Pgbillpay - Aspx)Document2 pagesPSPCL: (Pgbillpay - Aspx) (Pgbillpay - Aspx)RitishNo ratings yet

- Individual TAXDocument6 pagesIndividual TAXPushpa ValliNo ratings yet

- DLA Piper Guide To Going Global Global Equity Full HandbookDocument298 pagesDLA Piper Guide To Going Global Global Equity Full HandbookOlegNo ratings yet

- Railwire Subscriber InvoiceDocument1 pageRailwire Subscriber InvoiceChinnu SalimathNo ratings yet

- ABC Co. Started Its OperationsDocument1 pageABC Co. Started Its OperationsQueen ValleNo ratings yet

- 25 Fulltext Vda de San Agustin Vs CirDocument5 pages25 Fulltext Vda de San Agustin Vs CirYvon BaguioNo ratings yet

- Strategic Tax Management Chapter 5Document1 pageStrategic Tax Management Chapter 5Angelly EsguerraNo ratings yet

- Act Invoice: ACT Fibernet AdminDocument2 pagesAct Invoice: ACT Fibernet AdminaffanNo ratings yet

- Faculty - Architecture, Planning, and Surveying - 2022 - Session 1 - Degree - Res619Document4 pagesFaculty - Architecture, Planning, and Surveying - 2022 - Session 1 - Degree - Res619Nur AthirahNo ratings yet

- Mcq-Estate TaxDocument2 pagesMcq-Estate TaxRandy ManzanoNo ratings yet

- Pre Colonial Ancient Filipinos Practice Paying Taxes For The Protection From Their "Datu". The Spanish EraDocument4 pagesPre Colonial Ancient Filipinos Practice Paying Taxes For The Protection From Their "Datu". The Spanish EraAbegael Joyce RiveraNo ratings yet

- Share PerformanceTask BDocument5 pagesShare PerformanceTask BMariela PelaezNo ratings yet

- Prestige Marvel Plus Glass Manual Gas Stove: Grand Total 4625.00Document1 pagePrestige Marvel Plus Glass Manual Gas Stove: Grand Total 4625.00SAMIKSHA SAWANTNo ratings yet

- Tax Invoice: MR - Sultan Ali Abdulla HOUSE 279 Road 24 Block 233, Aldair Kingdom of Bahrain, Kingdom of BahrainDocument1 pageTax Invoice: MR - Sultan Ali Abdulla HOUSE 279 Road 24 Block 233, Aldair Kingdom of Bahrain, Kingdom of Bahraingxzfn4qgncNo ratings yet

- Fiscal PolicyDocument6 pagesFiscal Policyshahmonali694No ratings yet

- Capital Gains TaxDocument3 pagesCapital Gains TaxFery AnnNo ratings yet

- 3 DR KBL MathurDocument31 pages3 DR KBL MathurAkhilesh MishraNo ratings yet

- 2019 EU VAT Engleza PDFDocument164 pages2019 EU VAT Engleza PDFcris_ileana_39763320No ratings yet

- Real Time Information User GuideDocument44 pagesReal Time Information User GuideDinkan TalesNo ratings yet

- It 48Document40 pagesIt 48Robert Daysor BancifraNo ratings yet

- Contoh Soal Laporan Arus KasDocument2 pagesContoh Soal Laporan Arus KasRidwanNo ratings yet

- Gasbill 3851735781 202005 20200609192830Document1 pageGasbill 3851735781 202005 20200609192830Shahzaib GujjarNo ratings yet

- MCD 2090 Tutorial Questions T10-Wk10Document5 pagesMCD 2090 Tutorial Questions T10-Wk10kazuyaliemNo ratings yet

- Declaration For Us Person - PPKDocument2 pagesDeclaration For Us Person - PPKIDL_ReporterosNo ratings yet