Professional Documents

Culture Documents

Pernod Ricard (India) : Premiumization Mantra

Pernod Ricard (India) : Premiumization Mantra

Uploaded by

Mayank DixitCopyright:

Available Formats

You might also like

- Tata Steel Complete Financial ModelDocument64 pagesTata Steel Complete Financial Modelsiddharth.nt923450% (2)

- Dec 20 StatmentDocument5 pagesDec 20 Statmentfuddy luziNo ratings yet

- Sodarshan Chakra KriyaDocument10 pagesSodarshan Chakra KriyaMayank Dixit100% (1)

- White Label ATMDocument8 pagesWhite Label ATMch_nasir834481No ratings yet

- Marico 4Q FY 2013Document11 pagesMarico 4Q FY 2013Angel BrokingNo ratings yet

- Aditya Birla Nuvo: Consolidating Growth BusinessesDocument6 pagesAditya Birla Nuvo: Consolidating Growth BusinessesSouravMalikNo ratings yet

- TCS Financial Results: Quarter I FY 2014 - 15Document28 pagesTCS Financial Results: Quarter I FY 2014 - 15Bethany CaseyNo ratings yet

- Sunidhi's Super Seven-I Outperformed The Broader Index by 9%Document19 pagesSunidhi's Super Seven-I Outperformed The Broader Index by 9%api-234474152No ratings yet

- Cravatex: Strategic Partnerships To Be Key DriverDocument14 pagesCravatex: Strategic Partnerships To Be Key DriverAngel BrokingNo ratings yet

- Hinduja Global Solutions: Healthcare Spending To Drive Growth Margins To ExpandDocument4 pagesHinduja Global Solutions: Healthcare Spending To Drive Growth Margins To Expandapi-234474152No ratings yet

- India Equity Analytics Today: Buy Stock of KPIT TechDocument24 pagesIndia Equity Analytics Today: Buy Stock of KPIT TechNarnolia Securities LimitedNo ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- Smart Gains 42 PDFDocument4 pagesSmart Gains 42 PDF476No ratings yet

- AnandRathi Relaxo 05oct2012Document13 pagesAnandRathi Relaxo 05oct2012equityanalystinvestorNo ratings yet

- Dishman 2QFY2013RUDocument10 pagesDishman 2QFY2013RUAngel BrokingNo ratings yet

- La Opala RG - Initiating Coverage - Centrum 30062014Document21 pagesLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaNo ratings yet

- Radico Khaitan: CMP: Inr97 TP: INR 115 BuyDocument6 pagesRadico Khaitan: CMP: Inr97 TP: INR 115 BuyDeepak GuptaNo ratings yet

- Marico Result UpdatedDocument10 pagesMarico Result UpdatedAngel BrokingNo ratings yet

- Piramal Enterprises Limited Investor Presentation Nov 2016 20161108025005Document74 pagesPiramal Enterprises Limited Investor Presentation Nov 2016 20161108025005ratan203No ratings yet

- Hitachi Home & Life Solutions: Performance HighlightsDocument13 pagesHitachi Home & Life Solutions: Performance HighlightsAngel BrokingNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument20 pagesMarket Outlook Market Outlook: Dealer's DiaryangelbrokingNo ratings yet

- Idea Cellular: Wireless Traffic Momentum To SustainDocument10 pagesIdea Cellular: Wireless Traffic Momentum To SustainKothapatnam Suresh BabuNo ratings yet

- KPIT 2QFY16 Outlook ReviewDocument5 pagesKPIT 2QFY16 Outlook ReviewgirishrajsNo ratings yet

- Indoco Remedies, 30th January 2013Document11 pagesIndoco Remedies, 30th January 2013Angel BrokingNo ratings yet

- Efoods Review - JsDocument1 pageEfoods Review - JssaaaruuuNo ratings yet

- J. P Morgan - Pidilite IndustriesDocument36 pagesJ. P Morgan - Pidilite Industriesparry0843No ratings yet

- Marico Result UpdatedDocument10 pagesMarico Result UpdatedAngel BrokingNo ratings yet

- DLF IdbiDocument5 pagesDLF IdbivivarshneyNo ratings yet

- MindTree LTD Q2'13 Earning EstimateDocument2 pagesMindTree LTD Q2'13 Earning EstimateSuranjoy SinghNo ratings yet

- Asian Paints Result UpdatedDocument10 pagesAsian Paints Result UpdatedAngel BrokingNo ratings yet

- Best Performing Stock Advice For Today - Neutral Rating On GAIL Stock With A Target Price of Rs.346Document22 pagesBest Performing Stock Advice For Today - Neutral Rating On GAIL Stock With A Target Price of Rs.346Narnolia Securities LimitedNo ratings yet

- PGOLD: Investor Presentation MaterialsDocument18 pagesPGOLD: Investor Presentation MaterialsBusinessWorldNo ratings yet

- Fortnightly: Ipca LabDocument5 pagesFortnightly: Ipca Labbinoy666No ratings yet

- V-Guard Industries: CMP: INR523 TP: INR650 BuyDocument10 pagesV-Guard Industries: CMP: INR523 TP: INR650 BuySmriti SrivastavaNo ratings yet

- Set For Strong Growth: FMCG Q2FY14 Result Preview 08 Oct 2013Document5 pagesSet For Strong Growth: FMCG Q2FY14 Result Preview 08 Oct 2013Abhishek SinghNo ratings yet

- Investors' Presentation (Company Update)Document28 pagesInvestors' Presentation (Company Update)Shyam SunderNo ratings yet

- Dishman Pharmaceuticals: Performance HighlightsDocument10 pagesDishman Pharmaceuticals: Performance HighlightsAngel BrokingNo ratings yet

- AgilityDocument5 pagesAgilityvijayscaNo ratings yet

- Finolex Industries Limited: Q2FY14 ResultsDocument17 pagesFinolex Industries Limited: Q2FY14 ResultsSwamiNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Food Initiation It's Just Started: Sector UpdateDocument48 pagesFood Initiation It's Just Started: Sector UpdatePrashant TomarNo ratings yet

- Ankit TNG Retail India Pvt. LTD.: Credit Analysis & Research LimitedDocument3 pagesAnkit TNG Retail India Pvt. LTD.: Credit Analysis & Research LimitedjshashaNo ratings yet

- Indian Hotels (INDHOT) : Disappoints AgainDocument6 pagesIndian Hotels (INDHOT) : Disappoints Againrakeshshah78No ratings yet

- Redington IndiaDocument73 pagesRedington Indialokesh38No ratings yet

- Relaxo Footwear 1QFY2013RU 070812Document12 pagesRelaxo Footwear 1QFY2013RU 070812Angel BrokingNo ratings yet

- Poly Medicure Ltd. - Initiating Coverage 25-11-2013Document10 pagesPoly Medicure Ltd. - Initiating Coverage 25-11-2013Rajesh KatareNo ratings yet

- Market Outlook 9th August 2011Document6 pagesMarket Outlook 9th August 2011Angel BrokingNo ratings yet

- Fsa Assignment - Web - MRFDocument31 pagesFsa Assignment - Web - MRFNipu KurupNo ratings yet

- Cipla LTD: Company AnalysisDocument13 pagesCipla LTD: Company AnalysisDante DonNo ratings yet

- Radico Khaitan - ICDocument21 pagesRadico Khaitan - ICMaulik ChhedaNo ratings yet

- TRIVENI140509 Wwwmon3yworldblogspotcomDocument3 pagesTRIVENI140509 Wwwmon3yworldblogspotcomAbhishek Kr. MishraNo ratings yet

- JMV PreferredDocument25 pagesJMV PreferredAnonymous W7lVR9qs25No ratings yet

- Investor Presentation Q4 FY14 1Document35 pagesInvestor Presentation Q4 FY14 1Janarthanan YadavNo ratings yet

- Ranbaxy, 1st March, 2013Document11 pagesRanbaxy, 1st March, 2013Angel BrokingNo ratings yet

- Market Outlook 11th August 2011Document4 pagesMarket Outlook 11th August 2011Angel BrokingNo ratings yet

- Cordlife Group Limited: Results ReviewDocument10 pagesCordlife Group Limited: Results ReviewKelvin FuNo ratings yet

- L&T 4Q Fy 2013Document15 pagesL&T 4Q Fy 2013Angel BrokingNo ratings yet

- Marico: Performance HighlightsDocument12 pagesMarico: Performance HighlightsAngel BrokingNo ratings yet

- Vivimed Labs: Good Times Ahead, Attractive Valuations Initiating, With A BuyDocument20 pagesVivimed Labs: Good Times Ahead, Attractive Valuations Initiating, With A Buyapi-234474152No ratings yet

- Astra Microwave Products LTD: Exponential Growth On The Way!Document5 pagesAstra Microwave Products LTD: Exponential Growth On The Way!api-234474152No ratings yet

- Dubai Islamic Bank Results Update 16 AugustDocument4 pagesDubai Islamic Bank Results Update 16 AugustEmran Lhr PakistanNo ratings yet

- Independent Equity Research: Enhancing Investment DecisionDocument0 pagesIndependent Equity Research: Enhancing Investment DecisionvivekdkrpuNo ratings yet

- Professional & Management Development Training Revenues World Summary: Market Values & Financials by CountryFrom EverandProfessional & Management Development Training Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Opportunities & Procurement News: Subscription FormDocument2 pagesBusiness Opportunities & Procurement News: Subscription FormMayank DixitNo ratings yet

- Revenue 142 Cr. 108 Cr. Profit (Before Tax) 10.23 Cr. 12.39 Cr. Profit (After Tax) 6.75 Cr. 8.12 CRDocument1 pageRevenue 142 Cr. 108 Cr. Profit (Before Tax) 10.23 Cr. 12.39 Cr. Profit (After Tax) 6.75 Cr. 8.12 CRMayank DixitNo ratings yet

- Online Assignment Process FlowDocument6 pagesOnline Assignment Process FlowMayank DixitNo ratings yet

- Tender Document: National Innovation Foundation-IndiaDocument7 pagesTender Document: National Innovation Foundation-IndiaMayank DixitNo ratings yet

- Signature Not Verified: Digitally Signed by KRISHNA KANTA Sharma Date: 2016.03.01 11:22:34 PST Location: RajasthanDocument1 pageSignature Not Verified: Digitally Signed by KRISHNA KANTA Sharma Date: 2016.03.01 11:22:34 PST Location: RajasthanMayank DixitNo ratings yet

- Elecrama ExhDocument44 pagesElecrama ExhMayank Dixit100% (1)

- Importance of Garbhadhana Samskara - 0Document5 pagesImportance of Garbhadhana Samskara - 0Mayank DixitNo ratings yet

- Directorate General of Hydrocarbons (Under Ministry of Petroleum & Natural Gas) Plot No. 2, OIDB Bhawan, Sector 73, Noida - 201 301 U.PDocument62 pagesDirectorate General of Hydrocarbons (Under Ministry of Petroleum & Natural Gas) Plot No. 2, OIDB Bhawan, Sector 73, Noida - 201 301 U.PMayank DixitNo ratings yet

- Brahmana Thread 1Document4 pagesBrahmana Thread 1Mayank DixitNo ratings yet

- Procedure To Do Anushtan/Invocation: Frankinscence (Guggal)Document5 pagesProcedure To Do Anushtan/Invocation: Frankinscence (Guggal)Mayank DixitNo ratings yet

- Guide To Ritual ImpurityDocument13 pagesGuide To Ritual ImpurityMayank DixitNo ratings yet

- Duties of The Brahmacari - 0Document4 pagesDuties of The Brahmacari - 0Mayank DixitNo ratings yet

- Arcana As Yoga - 0Document7 pagesArcana As Yoga - 0Mayank DixitNo ratings yet

- Duties of The Sannyasi - 1Document10 pagesDuties of The Sannyasi - 1Mayank DixitNo ratings yet

- Shiva Shadakshara StotramDocument2 pagesShiva Shadakshara StotramMayank DixitNo ratings yet

- Choosing Rudraksha by TherapyDocument2 pagesChoosing Rudraksha by TherapyMayank DixitNo ratings yet

- Ganesha Pancharatnam: Mudakaratta ModakamDocument13 pagesGanesha Pancharatnam: Mudakaratta ModakamMayank DixitNo ratings yet

- Puja MaterialsDocument1 pagePuja MaterialsMayank DixitNo ratings yet

- Ganesha Chaturthi Puja Vidhi NewDocument21 pagesGanesha Chaturthi Puja Vidhi NewMayank Dixit100% (1)

- Lord Venkatesvara & Tirupati Notes: Appearance of Visnu On VenkatadriDocument1 pageLord Venkatesvara & Tirupati Notes: Appearance of Visnu On VenkatadriMayank DixitNo ratings yet

- Beej Mantra For All PlanetsDocument2 pagesBeej Mantra For All PlanetsMayank Dixit0% (1)

- Chap 8 - Money Supply - Part 2Document30 pagesChap 8 - Money Supply - Part 2Linh TrangNo ratings yet

- Personal Loan PDFDocument3 pagesPersonal Loan PDFbusiness loanNo ratings yet

- Roosevelt Cayman V Vasquez DiazDocument21 pagesRoosevelt Cayman V Vasquez DiazMolly GottNo ratings yet

- 7110 s09 QP 2Document20 pages7110 s09 QP 2mstudy123456100% (1)

- Banking Course OutlineDocument13 pagesBanking Course OutlineShravan ReddyNo ratings yet

- What Type of Proof of Funds Are Available?Document1 pageWhat Type of Proof of Funds Are Available?nurdinyusofNo ratings yet

- YCJQ54 SSGW EPp K818Document3 pagesYCJQ54 SSGW EPp K818chaithu goudNo ratings yet

- Week 2 QuestionsDocument2 pagesWeek 2 Questionskailu sunNo ratings yet

- Panama PapersDocument10 pagesPanama PapersArnoldg Guac100% (1)

- Chapter 9 - Mortgage MarketsDocument12 pagesChapter 9 - Mortgage MarketsLevi Emmanuel Veloso BravoNo ratings yet

- NOC116589620Document1 pageNOC116589620propvisor real estateNo ratings yet

- CC 46 2022Document4 pagesCC 46 2022Pijush BarmanNo ratings yet

- Metrobank/UCPB v. SLGT, Dylanco, ASB Devt (GR 175181)Document1 pageMetrobank/UCPB v. SLGT, Dylanco, ASB Devt (GR 175181)Alyanna BarreNo ratings yet

- List - of - Alumni - Online - Registration - DR - Azam17 - .07 - .2018 - Mixed NumbersDocument38 pagesList - of - Alumni - Online - Registration - DR - Azam17 - .07 - .2018 - Mixed NumbersbibahabondhonitNo ratings yet

- Disstressed AnalysisDocument5 pagesDisstressed Analysisrafael castro ruiz100% (1)

- Indian Financial System PDFDocument29 pagesIndian Financial System PDFPravesh YadavNo ratings yet

- Statement of Account - 10 - 28 - 56 PDFDocument3 pagesStatement of Account - 10 - 28 - 56 PDFSUDHAKARNo ratings yet

- Fin430 - Individual AssignmentDocument5 pagesFin430 - Individual AssignmentIBNATUL KHAIRIAH KAMARUZAMANNo ratings yet

- EnglishmagazinesDocument148 pagesEnglishmagazinesSwati JainNo ratings yet

- SBI Associate Bank Clerk Paper 1Document11 pagesSBI Associate Bank Clerk Paper 1deepNo ratings yet

- Mansi Rawat Major ProjectDocument45 pagesMansi Rawat Major ProjectSunil VermaNo ratings yet

- Morp PDFDocument52 pagesMorp PDFAnonymous zDh9ksnNo ratings yet

- An Analysis of Atm Banking Service Quality and Its DimensionsDocument9 pagesAn Analysis of Atm Banking Service Quality and Its DimensionsPratibha KambleNo ratings yet

- Aparna Western MeadowsDocument9 pagesAparna Western Meadowsa_veerenderNo ratings yet

- List of Universal BanksDocument5 pagesList of Universal BanksNikki D. ChavezNo ratings yet

- RTGS NeftDocument3 pagesRTGS NeftAshish Kumar AgnihotriNo ratings yet

- Internationalization of Service FirmsDocument34 pagesInternationalization of Service FirmsManish Kanwar100% (4)

- Assefa W OredeDocument76 pagesAssefa W Oredesamibelay1234No ratings yet

Pernod Ricard (India) : Premiumization Mantra

Pernod Ricard (India) : Premiumization Mantra

Uploaded by

Mayank DixitOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pernod Ricard (India) : Premiumization Mantra

Pernod Ricard (India) : Premiumization Mantra

Uploaded by

Mayank DixitCopyright:

Available Formats

10 April 2014

Update | Sector: Consumer

Pernod Ricard (India)

BSE Sensex

22,715

S&P CNX

6,796

Not Rated

Premiumization mantra

Well placed to capitalize growing IMFL opportunity

We interacted with the global management of Pernod Ricard to gain perspective and

understand the long term strategic goals for its Indian operations. Following are the

key takeaways:

Premiumization remains the key focus for Pernod Ricard in India.

It is targeting a value market share of 50% in two to three years from existing

47%.

Operating environment is challenging but it is building blocks to capitalize on

emerging IMFL growth opportunity.

Variance in product mix explains the difference in profitability v/s UNSP.

Premiumization is the strategy: Pernod Ricard is singularly focused on

driving premiumization in India notwithstanding the short term cyclical

hiccups along the way. Favorable macro factors like rising middle class,

urbanization, demographics (100m new entrants in the legal drinking age in

five years) provide good long term potential in IMFL.

Targeting 50% value market share in two years: Pernod intends to increase

its value market share from 47% currently to 50% in two to three years. It

does not have a volume market share target. Company will be chasing

profitability by focusing on delivering better value proposition to

consumers. Thus, despite price cuts by UNSP in Royal Challenge, Pernod has

not reciprocated. Price cuts in premium brands impair the brand equity,

which is difficult to recoup, as per Pernod Ricard. However, it has lost a

miniscule 100bp market share in Royal Stag (from 81% to 80%), post price

cuts by Royal Challenge.

Challenging operating environment: India is a challenging market to

operate,

given

the

multitude

of

restrictions

on

pricing/distribution/advertising and thus it is not easy to premiumize the

market. Hence, a competitive landscape is not detrimental to the

underlying premiumization theme as the top two players are focused on

protecting earnings growth. Pernod uses brand extension strategy to get

the desired price hikes.

Robust operating performance: Pernod Ricard India has delivered 17%

revenue growth in 1HFY14, with 6-8% coming from pricing and mix

improvement. In India, 90% of Pernods revenue comes from three brands

Royal Stag, Blenders Pride and Imperial Blue. Pernods India operations

have scaled up significantly in the last decade - volumes have grown 7x

from 4m cases in FY03 to 29m cases in FY13, and bottling units from 8 to 25.

It covers 80% of the targeted market universe through 15 profit centers.

Company is looking to expand products and geographic portfolio to meet its

target of 50% value market share in two years. The dominant contribution

Gautam Duggad (Gautam.Duggad@MotilalOswal.com); +91 22 3982 5404

Manish Poddar (Manish.Poddar@MotilalOswal.com); +91 22 3027 8029

Investors are advised to refer through disclosures made at the end of the Research Report.

Pernod Ricard (India)

of premium portfolio explains the gap between UNSP and Pernods

profitability. Despite 4x volumes, UNSPs operating profit index is 14%

lower compared to Pernod Ricard India.

ENA-based spirits more profitable v/s molasses; sub-contracts RM

production: Pernods strength lies in branding and marketing quality liquor;

it sub-contracts RM production (ENA) through long term arrangements with

vendors. Also, company imports certain required grains and benefits from

synergies of group-level buying.

Lowering of tariffs on imported liquor an eventuality, timing

unpredictable: Pernod believes tariffs on imported liquor will eventually be

reduced. However, predicting the time line for such a move is difficult, as

per management. Existing custom duty rates of 150% were speculated to be

lowered to 40% as per media articles in 2013. However, we note that

negotiations for the Free Trade Agreement between India and EU are on

since 2007 and may encounter protests from local manufacturers.

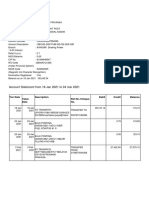

PRI medium term goals in India

Source: Company

Volumes moved up 7x in 10 years

Premium Western Style Spirits (Above USD7-varies by state)

Volume Market Share (%)

Volume M (9L cases)

Bottling Units

# People

2002/03

23

4

8

345

2007/08

41

11

15

535

2012/13

46

29

25

830

Source: Company

Pernod is value leader in Premium Western Style Spirits (%)..

Pernod

40

...along with being the most profitable player

Key Competitor

47

Pernod

36

31

Key Competitor

311

290

192

100

07/08

11/12

Source: Company

10 April 2014

07/08

11/12

Source: Company

2

Pernod Ricard (India)

Over the last two years revenues have increased at 28% CAGR (INR m)

FY11

FY12

FY13

Gross Revenues

43,932.2

59,407.8

72,164.2

Profit before tax

5,078.0

8,818.6

10,068.2

Profit after tax

3,352.0

5,925.7

6,851.7

PBT Margin

11.6%

14.8%

14.0%

PAT Margin

7.6%

10.0%

9.5%

Source: Company

Pernods Balance Sheet (INR m)

March

Equity and liabilities

Shareholders' funds

Share capital

Reserves and surplus

Total Shareholders' Funds

Share application money pending allotment

Non-current liabilities

Long-term borrowings

Other long-term liabilities

Long-term provisions

Total non-current liabilities

Current liabilities

Short-term borrowings

Trade payables

Other current liabilities

Short-term provisions

Total current liabilities

Total Equity and Liabilities

Assets

Non-current assets

Fixed assets

Tangible assets

Intangible assets

Tangible assets capital work-in-progress

Intangible assets under development or work-inTotal Fixed Assets

Non-current investments

Deferred tax assets (net)

Long-term loans and advances

Other non-current assets

Total non-current assets

Current assets

Current investments

Inventories

Trade receivables

Cash and bank balances

Short-term loans and advances

Other current assets

Total current assets

Total Assets

10 April 2014

FY11

FY12

FY13

474

5,453

5,927

0

474

5,843

6,317

0

474

6,013

6,486

0

0

22

162

184

86

30

210

326

86

37

319

443

0

3,974

6,963

1,078

12,015

18,126

0

4,838

8,199

6,913

19,950

26,592

0

5,438

8,566

8,592

22,596

29,525

797

19

18

27

861

0

1,513

484

0

2,859

873

36

17

74

1,000

0

1,108

666

18

2,793

916

96

27

90

1,129

0

1,476

571

33

3,209

0

1,988

5,976

3,423

3,801

78

15,267

18,126

0

0

2,864

3,686

7,677

10,840

5,913

4,242

7,230

7,441

115

107

23,799

26,316

26,592

29,525

Source: Company

Pernod Ricard (India)

Pernods Cash flow statement (INR m)

March

Cash flows from used in operating activities

Profit before extraordinary items and tax

Adjustments for reconcile profit (loss)

Adjustments to profit (loss)

Adjustments for finance costs

Adjustments for depreciation and amortisation expense

Adjustments for unrealised foreign exchange losses gains

Other adjustments for which cash effects are investing or financing cash flow

Other adjustments for non-cash items

Total adjustments to profit (loss)

Adjustments for working capital

Adjustments for decrease (increase) in inventories

Adjustments for decrease (increase) in trade receivables

Adjustments for decrease (increase) in other current and non-current assets

Adjustments for increase (decrease) in trade payables

Adjustments for increase (decrease) in other current and non-current liabilities

Adjustments for provisions

Total adjustments for working capital

Total adjustments for reconcile profit (loss)

Net cash flows from (used in) Operations

Income taxes (paid) refund

Net cash flows from (used in) operating activities before extraordinary items

Net cash flows from (used in) operating activities

Cash flows from used in investing activities

Other cash receipts from sales of equity or debt instruments of other entities

Proceeds from sales of tangible assets

Purchase of tangible assets

Purchase of intangible assets

Interest received

Net cash flows from (used in) investing activities before extraordinary items

Net cash flows from (used in) Investing activities

Cash flows from used in financing activities

Proceeds from borrowings

Dividends paid

Interest paid

Other inflows (outflows) of cash

Net cash flows from (used in) financing activities before extraordinary items

Net cash flows from (used in) Financing activities

Net increase (decrease) in cash and cash equivalents before effect of exchange rate changes

Net increase (decrease) in cash and cash equivalents

Cash and cash equivalents cash flow statement at end of period

FY11

FY12

FY13

5,078

8,819

10,068

352

142

18

(328)

(174)

10

268

157

(7)

(404)

1

14

108

203

(5)

(268)

(324)

(285)

(223)

(1,281)

(3,143)

(2,219)

6,441

1,078

653

663

5,741

2,155

3,586

3,586

(876)

(1,731)

(3,412)

946

1,234

303

(3,536)

(3,521)

5,297

2,710

2,587

2,587

(822)

(3,237)

(327)

957

391

686

(2,352)

(2,637)

7,431

3,464

3,968

3,968

7

229

44

478

212

212

0

5

222

78

374

79

79

6

237

100

303

(28)

(28)

4,973

348

(2,514)

(7,835)

(7,835)

(4,037)

(4,037)

3,408

86

247

(161)

(161)

2,505

2,505

5,913

4,763

75

(773)

(5,611)

(5,611)

(1,671)

(1,671)

4,242

Source: Company

10 April 2014

Pernod Ricard (India)

NOTES

10 April 2014

Disclosures

Pernod Ricard (India)

This report is for personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. This research report does not constitute an offer, invitation or

inducement to invest in securities or other investments and Motilal Oswal Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon it. This report is not for public distribution

and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form.

Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The person accessing this information specifically agrees to exempt MOSt or any of its

affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold MOSt or any of its affiliates or employees responsible for any such misuse and further agrees

to hold MOSt or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays.

The information contained herein is based on publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, MOSt and/or

its affiliates are under no obligation to update the information. Also there may be regulatory, compliance, or other reasons that may prevent MOSt and/or its affiliates from doing so. MOSt or any of its

affiliates or employees shall not be in any way responsible and liable for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MOSt or any

of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of

merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations.

This report is intended for distribution to institutional investors. Recipients who are not institutional investors should seek advice of their independent financial advisor prior to taking any investment decision

based on this report or for any necessary explanation of its contents.

MOSt and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure of

Interest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report.

Disclosure of Interest Statement

1. Analyst ownership of the stock

2. Group/Directors ownership of the stock

3. Broking relationship with company covered

4. Investment Banking relationship with company covered

Pernod Ricard (India)

No

No

No

No

Analyst Certification

The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is,

or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The research analysts, strategists, or research associates principally

responsible for preparation of MOSt research receive compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues.

Regional Disclosures (outside India)

This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would be contrary

to law, regulation or which would subject MOSt & its group companies to registration or licensing requirements within such jurisdictions.

For U.K.

This report is intended for distribution only to persons having professional experience in matters relating to investments as described in Article 19 of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (referred to as "investment professionals"). This document must not be acted on or relied on by persons who are not investment professionals. Any investment or investment activity

to which this document relates is only available to investment professionals and will be engaged in only with such persons.

For U.S.

Motilal Oswal Securities Limited (MOSL) is not a registered broker - dealer under the U.S. Securities Exchange Act of 1934, as amended (the"1934 act") and under applicable state laws in the United

States. In addition MOSL is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under

applicable state laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by MOSL, including the products and services

described herein are not available to or intended for U.S. persons.

This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC (henceforth referred to as "major

institutional investors"). This document must not be acted on or relied on by persons who are not major institutional investors. Any investment or investment activity to which this document relates is only

available to major institutional investors and will be engaged in only with major institutional investors. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange

Act of 1934, as amended (the "Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commission ("SEC") in order to conduct business with Institutional Investors based in the

U.S., MOSL has entered into a chaperoning agreement with a U.S. registered broker-dealer, Motilal Oswal Securities International Private Limited. ("MOSIPL"). Any business interaction pursuant to this

report will have to be executed within the provisions of this chaperoning agreement.

The Research Analysts contributing to the report may not be registered /qualified as research analyst with FINRA. Such research analyst may not be associated persons of the U.S. registered brokerdealer, MOSIPL, and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a subject company, public appearances and trading securities held by a

research analyst account.

For Singapore

Motilal Oswal Capital Markets Singapore Pte Limited is acting as an exempt financial advisor under section 23(1)(f) of the Financial Advisers Act(FAA) read with regulation 17(1)(d) of the Financial

Advisors Regulations and is a subsidiary of Motilal Oswal Securities Limited in India. This research is distributed in Singapore by Motilal Oswal Capital Markets Singapore Pte Limited and it is only directed

in Singapore to accredited investors, as defined in the Financial Advisers Regulations and the Securities and Futures Act (Chapter 289), as amended from time to time.

In respect of any matter arising from or in connection with the research you could contact the following representatives of Motilal Oswal Capital Markets Singapore Pte Limited:

Anosh Koppikar

Kadambari Balachandran

Email:anosh.Koppikar@motilaloswal.com

Email : kadambari.balachandran@motilaloswal.com

Contact(+65)68189232

Contact: (+65) 68189233 / 65249115

Office Address:21 (Suite 31),16 Collyer Quay,Singapore 04931

Motilal Oswal Securities Ltd

Motilal Oswal Tower, Level 9, Sayani Road, Prabhadevi, Mumbai 400 025

Phone: +91 22 3982 5500 E-mail: reports@motilaloswal.com

10Investors

April 2014

are advised to refer through disclosures made at the end of the Research Report.

You might also like

- Tata Steel Complete Financial ModelDocument64 pagesTata Steel Complete Financial Modelsiddharth.nt923450% (2)

- Dec 20 StatmentDocument5 pagesDec 20 Statmentfuddy luziNo ratings yet

- Sodarshan Chakra KriyaDocument10 pagesSodarshan Chakra KriyaMayank Dixit100% (1)

- White Label ATMDocument8 pagesWhite Label ATMch_nasir834481No ratings yet

- Marico 4Q FY 2013Document11 pagesMarico 4Q FY 2013Angel BrokingNo ratings yet

- Aditya Birla Nuvo: Consolidating Growth BusinessesDocument6 pagesAditya Birla Nuvo: Consolidating Growth BusinessesSouravMalikNo ratings yet

- TCS Financial Results: Quarter I FY 2014 - 15Document28 pagesTCS Financial Results: Quarter I FY 2014 - 15Bethany CaseyNo ratings yet

- Sunidhi's Super Seven-I Outperformed The Broader Index by 9%Document19 pagesSunidhi's Super Seven-I Outperformed The Broader Index by 9%api-234474152No ratings yet

- Cravatex: Strategic Partnerships To Be Key DriverDocument14 pagesCravatex: Strategic Partnerships To Be Key DriverAngel BrokingNo ratings yet

- Hinduja Global Solutions: Healthcare Spending To Drive Growth Margins To ExpandDocument4 pagesHinduja Global Solutions: Healthcare Spending To Drive Growth Margins To Expandapi-234474152No ratings yet

- India Equity Analytics Today: Buy Stock of KPIT TechDocument24 pagesIndia Equity Analytics Today: Buy Stock of KPIT TechNarnolia Securities LimitedNo ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- Smart Gains 42 PDFDocument4 pagesSmart Gains 42 PDF476No ratings yet

- AnandRathi Relaxo 05oct2012Document13 pagesAnandRathi Relaxo 05oct2012equityanalystinvestorNo ratings yet

- Dishman 2QFY2013RUDocument10 pagesDishman 2QFY2013RUAngel BrokingNo ratings yet

- La Opala RG - Initiating Coverage - Centrum 30062014Document21 pagesLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaNo ratings yet

- Radico Khaitan: CMP: Inr97 TP: INR 115 BuyDocument6 pagesRadico Khaitan: CMP: Inr97 TP: INR 115 BuyDeepak GuptaNo ratings yet

- Marico Result UpdatedDocument10 pagesMarico Result UpdatedAngel BrokingNo ratings yet

- Piramal Enterprises Limited Investor Presentation Nov 2016 20161108025005Document74 pagesPiramal Enterprises Limited Investor Presentation Nov 2016 20161108025005ratan203No ratings yet

- Hitachi Home & Life Solutions: Performance HighlightsDocument13 pagesHitachi Home & Life Solutions: Performance HighlightsAngel BrokingNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument20 pagesMarket Outlook Market Outlook: Dealer's DiaryangelbrokingNo ratings yet

- Idea Cellular: Wireless Traffic Momentum To SustainDocument10 pagesIdea Cellular: Wireless Traffic Momentum To SustainKothapatnam Suresh BabuNo ratings yet

- KPIT 2QFY16 Outlook ReviewDocument5 pagesKPIT 2QFY16 Outlook ReviewgirishrajsNo ratings yet

- Indoco Remedies, 30th January 2013Document11 pagesIndoco Remedies, 30th January 2013Angel BrokingNo ratings yet

- Efoods Review - JsDocument1 pageEfoods Review - JssaaaruuuNo ratings yet

- J. P Morgan - Pidilite IndustriesDocument36 pagesJ. P Morgan - Pidilite Industriesparry0843No ratings yet

- Marico Result UpdatedDocument10 pagesMarico Result UpdatedAngel BrokingNo ratings yet

- DLF IdbiDocument5 pagesDLF IdbivivarshneyNo ratings yet

- MindTree LTD Q2'13 Earning EstimateDocument2 pagesMindTree LTD Q2'13 Earning EstimateSuranjoy SinghNo ratings yet

- Asian Paints Result UpdatedDocument10 pagesAsian Paints Result UpdatedAngel BrokingNo ratings yet

- Best Performing Stock Advice For Today - Neutral Rating On GAIL Stock With A Target Price of Rs.346Document22 pagesBest Performing Stock Advice For Today - Neutral Rating On GAIL Stock With A Target Price of Rs.346Narnolia Securities LimitedNo ratings yet

- PGOLD: Investor Presentation MaterialsDocument18 pagesPGOLD: Investor Presentation MaterialsBusinessWorldNo ratings yet

- Fortnightly: Ipca LabDocument5 pagesFortnightly: Ipca Labbinoy666No ratings yet

- V-Guard Industries: CMP: INR523 TP: INR650 BuyDocument10 pagesV-Guard Industries: CMP: INR523 TP: INR650 BuySmriti SrivastavaNo ratings yet

- Set For Strong Growth: FMCG Q2FY14 Result Preview 08 Oct 2013Document5 pagesSet For Strong Growth: FMCG Q2FY14 Result Preview 08 Oct 2013Abhishek SinghNo ratings yet

- Investors' Presentation (Company Update)Document28 pagesInvestors' Presentation (Company Update)Shyam SunderNo ratings yet

- Dishman Pharmaceuticals: Performance HighlightsDocument10 pagesDishman Pharmaceuticals: Performance HighlightsAngel BrokingNo ratings yet

- AgilityDocument5 pagesAgilityvijayscaNo ratings yet

- Finolex Industries Limited: Q2FY14 ResultsDocument17 pagesFinolex Industries Limited: Q2FY14 ResultsSwamiNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Food Initiation It's Just Started: Sector UpdateDocument48 pagesFood Initiation It's Just Started: Sector UpdatePrashant TomarNo ratings yet

- Ankit TNG Retail India Pvt. LTD.: Credit Analysis & Research LimitedDocument3 pagesAnkit TNG Retail India Pvt. LTD.: Credit Analysis & Research LimitedjshashaNo ratings yet

- Indian Hotels (INDHOT) : Disappoints AgainDocument6 pagesIndian Hotels (INDHOT) : Disappoints Againrakeshshah78No ratings yet

- Redington IndiaDocument73 pagesRedington Indialokesh38No ratings yet

- Relaxo Footwear 1QFY2013RU 070812Document12 pagesRelaxo Footwear 1QFY2013RU 070812Angel BrokingNo ratings yet

- Poly Medicure Ltd. - Initiating Coverage 25-11-2013Document10 pagesPoly Medicure Ltd. - Initiating Coverage 25-11-2013Rajesh KatareNo ratings yet

- Market Outlook 9th August 2011Document6 pagesMarket Outlook 9th August 2011Angel BrokingNo ratings yet

- Fsa Assignment - Web - MRFDocument31 pagesFsa Assignment - Web - MRFNipu KurupNo ratings yet

- Cipla LTD: Company AnalysisDocument13 pagesCipla LTD: Company AnalysisDante DonNo ratings yet

- Radico Khaitan - ICDocument21 pagesRadico Khaitan - ICMaulik ChhedaNo ratings yet

- TRIVENI140509 Wwwmon3yworldblogspotcomDocument3 pagesTRIVENI140509 Wwwmon3yworldblogspotcomAbhishek Kr. MishraNo ratings yet

- JMV PreferredDocument25 pagesJMV PreferredAnonymous W7lVR9qs25No ratings yet

- Investor Presentation Q4 FY14 1Document35 pagesInvestor Presentation Q4 FY14 1Janarthanan YadavNo ratings yet

- Ranbaxy, 1st March, 2013Document11 pagesRanbaxy, 1st March, 2013Angel BrokingNo ratings yet

- Market Outlook 11th August 2011Document4 pagesMarket Outlook 11th August 2011Angel BrokingNo ratings yet

- Cordlife Group Limited: Results ReviewDocument10 pagesCordlife Group Limited: Results ReviewKelvin FuNo ratings yet

- L&T 4Q Fy 2013Document15 pagesL&T 4Q Fy 2013Angel BrokingNo ratings yet

- Marico: Performance HighlightsDocument12 pagesMarico: Performance HighlightsAngel BrokingNo ratings yet

- Vivimed Labs: Good Times Ahead, Attractive Valuations Initiating, With A BuyDocument20 pagesVivimed Labs: Good Times Ahead, Attractive Valuations Initiating, With A Buyapi-234474152No ratings yet

- Astra Microwave Products LTD: Exponential Growth On The Way!Document5 pagesAstra Microwave Products LTD: Exponential Growth On The Way!api-234474152No ratings yet

- Dubai Islamic Bank Results Update 16 AugustDocument4 pagesDubai Islamic Bank Results Update 16 AugustEmran Lhr PakistanNo ratings yet

- Independent Equity Research: Enhancing Investment DecisionDocument0 pagesIndependent Equity Research: Enhancing Investment DecisionvivekdkrpuNo ratings yet

- Professional & Management Development Training Revenues World Summary: Market Values & Financials by CountryFrom EverandProfessional & Management Development Training Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Opportunities & Procurement News: Subscription FormDocument2 pagesBusiness Opportunities & Procurement News: Subscription FormMayank DixitNo ratings yet

- Revenue 142 Cr. 108 Cr. Profit (Before Tax) 10.23 Cr. 12.39 Cr. Profit (After Tax) 6.75 Cr. 8.12 CRDocument1 pageRevenue 142 Cr. 108 Cr. Profit (Before Tax) 10.23 Cr. 12.39 Cr. Profit (After Tax) 6.75 Cr. 8.12 CRMayank DixitNo ratings yet

- Online Assignment Process FlowDocument6 pagesOnline Assignment Process FlowMayank DixitNo ratings yet

- Tender Document: National Innovation Foundation-IndiaDocument7 pagesTender Document: National Innovation Foundation-IndiaMayank DixitNo ratings yet

- Signature Not Verified: Digitally Signed by KRISHNA KANTA Sharma Date: 2016.03.01 11:22:34 PST Location: RajasthanDocument1 pageSignature Not Verified: Digitally Signed by KRISHNA KANTA Sharma Date: 2016.03.01 11:22:34 PST Location: RajasthanMayank DixitNo ratings yet

- Elecrama ExhDocument44 pagesElecrama ExhMayank Dixit100% (1)

- Importance of Garbhadhana Samskara - 0Document5 pagesImportance of Garbhadhana Samskara - 0Mayank DixitNo ratings yet

- Directorate General of Hydrocarbons (Under Ministry of Petroleum & Natural Gas) Plot No. 2, OIDB Bhawan, Sector 73, Noida - 201 301 U.PDocument62 pagesDirectorate General of Hydrocarbons (Under Ministry of Petroleum & Natural Gas) Plot No. 2, OIDB Bhawan, Sector 73, Noida - 201 301 U.PMayank DixitNo ratings yet

- Brahmana Thread 1Document4 pagesBrahmana Thread 1Mayank DixitNo ratings yet

- Procedure To Do Anushtan/Invocation: Frankinscence (Guggal)Document5 pagesProcedure To Do Anushtan/Invocation: Frankinscence (Guggal)Mayank DixitNo ratings yet

- Guide To Ritual ImpurityDocument13 pagesGuide To Ritual ImpurityMayank DixitNo ratings yet

- Duties of The Brahmacari - 0Document4 pagesDuties of The Brahmacari - 0Mayank DixitNo ratings yet

- Arcana As Yoga - 0Document7 pagesArcana As Yoga - 0Mayank DixitNo ratings yet

- Duties of The Sannyasi - 1Document10 pagesDuties of The Sannyasi - 1Mayank DixitNo ratings yet

- Shiva Shadakshara StotramDocument2 pagesShiva Shadakshara StotramMayank DixitNo ratings yet

- Choosing Rudraksha by TherapyDocument2 pagesChoosing Rudraksha by TherapyMayank DixitNo ratings yet

- Ganesha Pancharatnam: Mudakaratta ModakamDocument13 pagesGanesha Pancharatnam: Mudakaratta ModakamMayank DixitNo ratings yet

- Puja MaterialsDocument1 pagePuja MaterialsMayank DixitNo ratings yet

- Ganesha Chaturthi Puja Vidhi NewDocument21 pagesGanesha Chaturthi Puja Vidhi NewMayank Dixit100% (1)

- Lord Venkatesvara & Tirupati Notes: Appearance of Visnu On VenkatadriDocument1 pageLord Venkatesvara & Tirupati Notes: Appearance of Visnu On VenkatadriMayank DixitNo ratings yet

- Beej Mantra For All PlanetsDocument2 pagesBeej Mantra For All PlanetsMayank Dixit0% (1)

- Chap 8 - Money Supply - Part 2Document30 pagesChap 8 - Money Supply - Part 2Linh TrangNo ratings yet

- Personal Loan PDFDocument3 pagesPersonal Loan PDFbusiness loanNo ratings yet

- Roosevelt Cayman V Vasquez DiazDocument21 pagesRoosevelt Cayman V Vasquez DiazMolly GottNo ratings yet

- 7110 s09 QP 2Document20 pages7110 s09 QP 2mstudy123456100% (1)

- Banking Course OutlineDocument13 pagesBanking Course OutlineShravan ReddyNo ratings yet

- What Type of Proof of Funds Are Available?Document1 pageWhat Type of Proof of Funds Are Available?nurdinyusofNo ratings yet

- YCJQ54 SSGW EPp K818Document3 pagesYCJQ54 SSGW EPp K818chaithu goudNo ratings yet

- Week 2 QuestionsDocument2 pagesWeek 2 Questionskailu sunNo ratings yet

- Panama PapersDocument10 pagesPanama PapersArnoldg Guac100% (1)

- Chapter 9 - Mortgage MarketsDocument12 pagesChapter 9 - Mortgage MarketsLevi Emmanuel Veloso BravoNo ratings yet

- NOC116589620Document1 pageNOC116589620propvisor real estateNo ratings yet

- CC 46 2022Document4 pagesCC 46 2022Pijush BarmanNo ratings yet

- Metrobank/UCPB v. SLGT, Dylanco, ASB Devt (GR 175181)Document1 pageMetrobank/UCPB v. SLGT, Dylanco, ASB Devt (GR 175181)Alyanna BarreNo ratings yet

- List - of - Alumni - Online - Registration - DR - Azam17 - .07 - .2018 - Mixed NumbersDocument38 pagesList - of - Alumni - Online - Registration - DR - Azam17 - .07 - .2018 - Mixed NumbersbibahabondhonitNo ratings yet

- Disstressed AnalysisDocument5 pagesDisstressed Analysisrafael castro ruiz100% (1)

- Indian Financial System PDFDocument29 pagesIndian Financial System PDFPravesh YadavNo ratings yet

- Statement of Account - 10 - 28 - 56 PDFDocument3 pagesStatement of Account - 10 - 28 - 56 PDFSUDHAKARNo ratings yet

- Fin430 - Individual AssignmentDocument5 pagesFin430 - Individual AssignmentIBNATUL KHAIRIAH KAMARUZAMANNo ratings yet

- EnglishmagazinesDocument148 pagesEnglishmagazinesSwati JainNo ratings yet

- SBI Associate Bank Clerk Paper 1Document11 pagesSBI Associate Bank Clerk Paper 1deepNo ratings yet

- Mansi Rawat Major ProjectDocument45 pagesMansi Rawat Major ProjectSunil VermaNo ratings yet

- Morp PDFDocument52 pagesMorp PDFAnonymous zDh9ksnNo ratings yet

- An Analysis of Atm Banking Service Quality and Its DimensionsDocument9 pagesAn Analysis of Atm Banking Service Quality and Its DimensionsPratibha KambleNo ratings yet

- Aparna Western MeadowsDocument9 pagesAparna Western Meadowsa_veerenderNo ratings yet

- List of Universal BanksDocument5 pagesList of Universal BanksNikki D. ChavezNo ratings yet

- RTGS NeftDocument3 pagesRTGS NeftAshish Kumar AgnihotriNo ratings yet

- Internationalization of Service FirmsDocument34 pagesInternationalization of Service FirmsManish Kanwar100% (4)

- Assefa W OredeDocument76 pagesAssefa W Oredesamibelay1234No ratings yet