Professional Documents

Culture Documents

Financial Projections Template V 1.33

Financial Projections Template V 1.33

Uploaded by

Pham Hong HaiCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Break Even Analysis Template For RestaurantDocument6 pagesBreak Even Analysis Template For RestaurantPham Hong Hai100% (3)

- Cash Flows and Financial Statements at Sunset BoardsDocument4 pagesCash Flows and Financial Statements at Sunset Boards131N100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Financial Statements and Notes of ZETA Corporation Are Reproduced Over The Next Several PagesDocument5 pagesThe Financial Statements and Notes of ZETA Corporation Are Reproduced Over The Next Several PagesJesia DjaduNo ratings yet

- Indoor Soccer Facility Business Plan1 2Document29 pagesIndoor Soccer Facility Business Plan1 2Ihsan QolbuNo ratings yet

- Restaurant Duty RosterDocument38 pagesRestaurant Duty RosterPham Hong HaiNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Secret Club Projected Income Statement - Year OneDocument1 pageSecret Club Projected Income Statement - Year OnePham Hong HaiNo ratings yet

- Menu BreakfastDocument2 pagesMenu BreakfastPham Hong HaiNo ratings yet

- Accounts Positions Initial Training Plan Training NeeedsDocument12 pagesAccounts Positions Initial Training Plan Training NeeedstaolaNo ratings yet

- Financial Statements 2Document65 pagesFinancial Statements 2srisrirockstarNo ratings yet

- L2 - Written Work #4Document4 pagesL2 - Written Work #4WenNo ratings yet

- Inacc3 BalucanDocument8 pagesInacc3 BalucanLuigi Enderez BalucanNo ratings yet

- Common Terms in AccountingDocument2 pagesCommon Terms in AccountingRazvanRzvNo ratings yet

- Elements of SFPDocument11 pagesElements of SFPMylene Salvador71% (7)

- Plas Mech BS 07-08Document32 pagesPlas Mech BS 07-08plasmechNo ratings yet

- Candor Cashflow ExerciseDocument2 pagesCandor Cashflow ExerciseHue PhamNo ratings yet

- Tutorial Questions - Trimester - 2210.Document26 pagesTutorial Questions - Trimester - 2210.premsuwaatiiNo ratings yet

- Bus CombiDocument4 pagesBus CombiErickk EscanooNo ratings yet

- CPAR MAS (Problems) PDFDocument50 pagesCPAR MAS (Problems) PDFTyra Joyce RevadaviaNo ratings yet

- Chapter 17 - Consol. Fs Part 2Document6 pagesChapter 17 - Consol. Fs Part 2PutmehudgJasdNo ratings yet

- Exercise 8 13 TemplateDocument4 pagesExercise 8 13 TemplateashibhallauNo ratings yet

- Full Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions ManualDocument36 pagesFull Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manualkisslingcicelypro100% (40)

- Assets: Assets To Be Realized: Assets RealizedDocument10 pagesAssets: Assets To Be Realized: Assets RealizedKylabsssNo ratings yet

- CH 10Document94 pagesCH 10Ashish YadavNo ratings yet

- Advanced Accounts AS Notes by CA Sandeep Arora SirDocument75 pagesAdvanced Accounts AS Notes by CA Sandeep Arora Sirraju0% (1)

- Sample Financial ProjectionsDocument21 pagesSample Financial ProjectionssfsdffedsNo ratings yet

- PIPFADocument36 pagesPIPFAfadosani100% (1)

- Acc Module 4 Accounting Cycle Exercises With AnswersDocument15 pagesAcc Module 4 Accounting Cycle Exercises With AnswersEbina WhiteNo ratings yet

- Assets Harta: Account Title ArtinyaDocument3 pagesAssets Harta: Account Title ArtinyaAndri Anto SaputraNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementVora JeetNo ratings yet

- Chapter 9 Signature AssignmentDocument17 pagesChapter 9 Signature Assignmentapi-270738730No ratings yet

- MANG6296 AssignmentDocument28 pagesMANG6296 Assignmentxu zhenchuanNo ratings yet

- Adjusting Entries Asnwer KeyDocument19 pagesAdjusting Entries Asnwer KeyCATUGAL, LANCE ALECNo ratings yet

- Adjusting The Accounts Assignment Classification TableDocument108 pagesAdjusting The Accounts Assignment Classification TableDalbir SinghNo ratings yet

- FDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFDocument5 pagesFDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFJames de LeonNo ratings yet

- Cost - Vi SemDocument18 pagesCost - Vi SemAR Ananth Rohith BhatNo ratings yet

Financial Projections Template V 1.33

Financial Projections Template V 1.33

Uploaded by

Pham Hong HaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Projections Template V 1.33

Financial Projections Template V 1.33

Uploaded by

Pham Hong HaiCopyright:

Available Formats

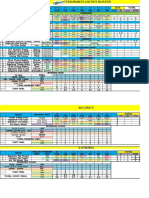

Income Statement

Year 1

Year 2

Year 3

Year 4

Year 5

Revenue

40,000

75,000

100,000

200,000

300,000

Cost of sales

18,000

33,750

45,000

90,000

135,000

Gross margin

Assumptions

22,000

41,250

55,000

110,000

165,000

Research and development

55.0%

5,000

6,000

8,000

17,000

25,000

Sales and marketing

6,000

7,000

8,000

16,000

24,000

General and administrative

6,000

6,000

9,000

17,000

26,000

17,000

19,000

25,000

50,000

75,000

5,000

14,000

11,600

9,680

11,744

8,250

18,400

50,320

78,256

Operating expenses

Depreciation

20.0%

Operating income

Finance costs

4.0%

Income before tax

Income tax expense

990

1,250

690

230

7,260

17,150

49,630

78,026

20.0%

Net income

Balance sheet

500

-500

Assumptions

Opening

1,352

3,430

9,926

15,605

-500

5,908

13,720

39,704

62,421

Year 1

Year 2

Year 3

Year 4

Year 5

Assets

Cash

5,000

966

396

4,580

29,521

61,126

Accounts receivable

45

6,000

4,932

9,247

12,329

24,658

36,986

Inventory

90

5,000

4,438

8,322

11,096

22,192

33,288

Current assets

16,000

10,336

17,964

28,004

76,371

131,400

Long-term assets

20,000

20,000

56,000

46,400

38,720

46,976

36,000

30,336

73,964

74,404

115,091

178,376

22,192

Total assets

Liabilities

Accounts payable

60

3,500

2,959

5,548

7,397

14,795

Other liabilities

60

2,500

2,877

3,508

4,879

9,964

14,932

6,000

5,836

9,056

12,276

24,759

37,124

Current liabilities

Long-term debt

15,000

10,000

39,500

23,000

11,500

21,000

15,836

48,556

35,276

36,259

37,124

10,000

10,000

15,000

15,000

15,000

15,000

5,000

4,500

10,408

24,128

63,832

126,253

Total equity

15,000

14,500

25,408

39,128

78,832

141,253

Total liabilities and equity

36,000

30,336

73,964

74,404

115,091

178,376

Total liabilities

Equity

Capital

Retained earnings

2015 www.planprojections.com

266966876.xlsx

Cash Flow Statement

Assumptions

Year 1

Net income

Year 2

Year 3

Year 4

Year 5

-500

5,908

13,720

39,704

62,421

5,000

14,000

11,600

9,680

11,744

1,068

-4,315

-3,082

-12,329

-12,329

562

-3,884

-2,774

-11,096

-11,096

-541

2,589

1,849

7,397

7,397

377

632

1,371

5,085

4,968

5,966

14,930

22,684

38,442

63,105

Add back depreciation

Changes in working capital

Accounts receivable

Inventory

Accounts payable

Other liabilities

Cash flows from operating activities

Amount paid for long-term assets

Cash flows from investing activities

Proceeds from long-term debt

-5,000

-50,000

-2,000

-2,000

-20,000

-5,000

-50,000

-2,000

-2,000

-20,000

46,000

5,000

-5,000

-16,500

-16,500

-11,500

-11,500

-5,000

34,500

-16,500

-11,500

-11,500

-4,034

-570

4,184

24,942

31,605

5,000

966

396

4,580

29,521

966

396

4,580

29,521

61,126

Proceeds from issue of share capital

Repayment of long-term debt

Cash flow from financing activities

Cash flow

Opening cash balance

Closing cash balance

Graphs

Revenue

Net income

350,000

70,000

300,000

60,000

250,000

50,000

200,000

40,000

150,000

30,000

100,000

20,000

50,000

10,000

0

0

1

-10,000

Free cash flow (cumulative)

Cash balance

80000

70,000

60,000

60000

50,000

40000

40,000

20000

30,000

20,000

0

-20000

10,000

0

-40000

2015 www.planprojections.com

266966876.xlsx

Ratios

Year 1

Year 2

Year 3

Year 4

Year 5

Gross margin percentage

55.0%

55.0%

55.0%

55.0%

55.0%

Operating expenses ratio

Profitability ratios

42.5%

25.3%

25.0%

25.0%

25.0%

Return on sales

0.0%

11.0%

18.4%

25.2%

26.1%

Net profit ratio

-1.3%

7.9%

13.7%

19.9%

20.8%

0.0%

12.7%

29.6%

55.7%

55.4%

Asset turnover ratio

1.32

1.01

1.34

1.74

1.68

Fixed asset turnover ratio

2.00

1.34

2.16

5.17

6.39

Working capital turnover ratio

8.89

8.42

6.36

3.88

3.18

Current ratio

1.77

1.98

2.28

3.08

3.54

Quick ratio

1.01

1.06

1.38

2.19

2.64

Gearing ratio

0.41

0.61

0.37

0.13

0.00

Debt equity ratio

0.69

1.55

0.59

0.15

0.00

Interest coverage ratio

0.00

8.33

14.72

72.93

340.24

Accounts receivable days

45

45

45

45

45

Accounts payable days

60

60

60

60

60

Other liabilities days

60

60

60

60

60

Inventory days

90

90

90

90

90

-3%

23%

35%

50%

44%

40,909

61,800

68,818

109,764

158,135

Monthly cash (burn) rate

80

-2,923

1,724

3,037

3,592

Zero date

12

10

17

135

135

135

135

135

75

75

75

75

75

Return on capital employed

Efficiency ratios

Liquidity ratios

Leverage ratios

Activity ratios

Investor ratios

Return on equity

Breakeven point

Breakeven revenue

Cash flow

Operating cycle

Cash conversion cycle

2015 www.planprojections.com

266966876.xlsx

Notes and major health warnings

Users use this template at their own risk. We make no warranty or representation as to its accuracy

covered by the terms of our legal disclaimer, which you are deemed to have read.

This is an example of an accounting template that you might use. It is purely illustrative. This is n

reflect general standards or targets for any particular company or sector.

If you do spot a mistake in the template, please let us know and we will try to fix it.

Additional templates are available for download at our website

http://www.planprojections.com/

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Break Even Analysis Template For RestaurantDocument6 pagesBreak Even Analysis Template For RestaurantPham Hong Hai100% (3)

- Cash Flows and Financial Statements at Sunset BoardsDocument4 pagesCash Flows and Financial Statements at Sunset Boards131N100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Financial Statements and Notes of ZETA Corporation Are Reproduced Over The Next Several PagesDocument5 pagesThe Financial Statements and Notes of ZETA Corporation Are Reproduced Over The Next Several PagesJesia DjaduNo ratings yet

- Indoor Soccer Facility Business Plan1 2Document29 pagesIndoor Soccer Facility Business Plan1 2Ihsan QolbuNo ratings yet

- Restaurant Duty RosterDocument38 pagesRestaurant Duty RosterPham Hong HaiNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Secret Club Projected Income Statement - Year OneDocument1 pageSecret Club Projected Income Statement - Year OnePham Hong HaiNo ratings yet

- Menu BreakfastDocument2 pagesMenu BreakfastPham Hong HaiNo ratings yet

- Accounts Positions Initial Training Plan Training NeeedsDocument12 pagesAccounts Positions Initial Training Plan Training NeeedstaolaNo ratings yet

- Financial Statements 2Document65 pagesFinancial Statements 2srisrirockstarNo ratings yet

- L2 - Written Work #4Document4 pagesL2 - Written Work #4WenNo ratings yet

- Inacc3 BalucanDocument8 pagesInacc3 BalucanLuigi Enderez BalucanNo ratings yet

- Common Terms in AccountingDocument2 pagesCommon Terms in AccountingRazvanRzvNo ratings yet

- Elements of SFPDocument11 pagesElements of SFPMylene Salvador71% (7)

- Plas Mech BS 07-08Document32 pagesPlas Mech BS 07-08plasmechNo ratings yet

- Candor Cashflow ExerciseDocument2 pagesCandor Cashflow ExerciseHue PhamNo ratings yet

- Tutorial Questions - Trimester - 2210.Document26 pagesTutorial Questions - Trimester - 2210.premsuwaatiiNo ratings yet

- Bus CombiDocument4 pagesBus CombiErickk EscanooNo ratings yet

- CPAR MAS (Problems) PDFDocument50 pagesCPAR MAS (Problems) PDFTyra Joyce RevadaviaNo ratings yet

- Chapter 17 - Consol. Fs Part 2Document6 pagesChapter 17 - Consol. Fs Part 2PutmehudgJasdNo ratings yet

- Exercise 8 13 TemplateDocument4 pagesExercise 8 13 TemplateashibhallauNo ratings yet

- Full Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions ManualDocument36 pagesFull Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manualkisslingcicelypro100% (40)

- Assets: Assets To Be Realized: Assets RealizedDocument10 pagesAssets: Assets To Be Realized: Assets RealizedKylabsssNo ratings yet

- CH 10Document94 pagesCH 10Ashish YadavNo ratings yet

- Advanced Accounts AS Notes by CA Sandeep Arora SirDocument75 pagesAdvanced Accounts AS Notes by CA Sandeep Arora Sirraju0% (1)

- Sample Financial ProjectionsDocument21 pagesSample Financial ProjectionssfsdffedsNo ratings yet

- PIPFADocument36 pagesPIPFAfadosani100% (1)

- Acc Module 4 Accounting Cycle Exercises With AnswersDocument15 pagesAcc Module 4 Accounting Cycle Exercises With AnswersEbina WhiteNo ratings yet

- Assets Harta: Account Title ArtinyaDocument3 pagesAssets Harta: Account Title ArtinyaAndri Anto SaputraNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementVora JeetNo ratings yet

- Chapter 9 Signature AssignmentDocument17 pagesChapter 9 Signature Assignmentapi-270738730No ratings yet

- MANG6296 AssignmentDocument28 pagesMANG6296 Assignmentxu zhenchuanNo ratings yet

- Adjusting Entries Asnwer KeyDocument19 pagesAdjusting Entries Asnwer KeyCATUGAL, LANCE ALECNo ratings yet

- Adjusting The Accounts Assignment Classification TableDocument108 pagesAdjusting The Accounts Assignment Classification TableDalbir SinghNo ratings yet

- FDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFDocument5 pagesFDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFJames de LeonNo ratings yet

- Cost - Vi SemDocument18 pagesCost - Vi SemAR Ananth Rohith BhatNo ratings yet