Professional Documents

Culture Documents

Look Out - Someone Just Took Your Businesss - Oct 12

Look Out - Someone Just Took Your Businesss - Oct 12

Uploaded by

kiransookOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Look Out - Someone Just Took Your Businesss - Oct 12

Look Out - Someone Just Took Your Businesss - Oct 12

Uploaded by

kiransookCopyright:

Available Formats

Tax & Business Tips

Oct 2012

Business Issues Leases & Goodwill, International tax

traps

Contents

Look out someone just took your business! ......................................................................................... 1

The international tax trap ....................................................................................................................... 2

Checklists and Templates ................................................................................................................ 4

Two heads are better than 1? Discuss your plans? Call to chat ... .......................................................... 4

Look out someone just took your business!

Imagine that you own a small supermarket. Youve been operating in the same location for just

under a decade. Since you opened, the business has established a regular customer base and

business seems fairly consistent. You might look to sell in a few years to capitalise on all the time

and effort you put into building the business, and find something new. But this is something to think

more seriously about in a few years time. Then, your landlord contacts you and says that the lease is

due for renewal in a few weeks and gives you an ultimatum: pay double the current rent along with

a hefty annual increase, or get out.

You have a valuation of the current market rent completed and find that what youre paying now is

about right. Doubling the rent will put your rent well outside of market rates.

If you sign the lease, the business will be difficult to sell as the rent will be an impediment for any

purchaser. If you leave, you walk away from the goodwill you have generated. And, particularly for

small retailers operating under franchise arrangements, the franchise arrangement often ends when

the lease ends. If you leave the landlord could set up a new business, identical to the one you

created, and then run it under management until they can sell the business effectively

appropriating the goodwill you have worked hard to create.

While there is specific retail tenancy legislation in each State and territory to address bargaining

imbalances the reality is that it is a common tactic to limit a tenants bargaining power by seeking to

negotiate at the very last minute.

The number one rule is that you cannot rely on your relationships. If the terms and conditions are

not in writing, or if the process for managing lease agreements is not adhered to, disputes can

quickly escalate. Generally, if you have already signed the contract, its too late to do anything

about the terms unless you have grounds to claim that the agreement was signed under duress. Like

with any legal agreement, you need be fully aware of what you are agreeing to. And, if you have

experience in the industry and access to advice, then the likelihood of redressing any issues is

Tax & Business Tips

Oct 2012

diminished.

In most cases, retailers leasing a space of under 1,000 sqm are protected by specific legislation. For

example, in NSW the legislation sets out what is believed to be unconscionable conduct taking into

account bargaining power, the use of undue influence or unfair tactics, and the amount for which an

identical lease could have been obtained.

In general however, the landlord has the right not to renew your lease. As a result, you need to

operate with the understanding that your current location just might not be available when your

lease ends. While you cant be forced to vacate immediately, the move (assuming you have the

capacity to move), will still be disruptive.

The loss of goodwill is not uncommon in these sorts of scenarios either directly by pushing the

client out or surreptitiously by gouging the profit out of the business.

Goodwill is an important part of the value of your business and often a misunderstood one because

most owners expect a payoff for all their hard work and effort. Its important to understand what

goodwill is and what you can do to ensure that the goodwill value rests with you, not someone else.

There are different types of goodwill, including corporate, personal and location goodwill.

Corporate goodwill is the value items such as brand, business presence, an excellent client database,

and repeat customers add to the value of the business. When we talk about a brand, we are talking

about something that is recognised, not just a logo.

When we ask business owners what differentiates their business from others, one of the commonest

responses is personal service. Your customers or clients come to you because they like dealing

with you. Thats personal goodwill. Your customers stay with you because of the strength of the

relationship that you have developed with them. Thats excellent if you are the owner but when it

comes to selling your business, personal goodwill is generally worth less to the new owners.

Location goodwill is where the location of your business delivers a result for the business. For

example, a service station on a major road that is convenient for motorists to enter and exit. If you

have location goodwill, the value of the goodwill is determined by factors such as whether you own

or lease the location, how long your lease is for and anticipated changes and development in the

area. Security of tenure is critical to location goodwill.

The international tax trap

Increased globalisation means that more and more SMEs deal with customers or suppliers outside of

Australia. While this can open up some lucrative opportunities, it also introduces a range of new tax

issues that need to be addressed particularly if your business has dealings with a related entity

overseas.

Transfer pricing is a tax trap for unwary companies. The transfer pricing rules often affect Australian

Tax & Business Tips

Oct 2012

companies that have dealings with an international parent. For example, an Australian subsidiary of

a foreign parent company may rely on that parent company to supply products or management

services. The Australian Tax Office (ATO) is looking closely at these relationships to ensure that the

prices charged for goods and services between related parties are consistent with the prices that

would be charged by a completely independent provider (i.e., the arms length principle) to avoid

profits being shifted outside of Australia (e.g., a foreign parent company may charge management

fees that exceed the value of the services provided). If the ATO believes that a profit shifting

arrangement is in place or the profits being reported in Australia are not appropriate, the

Commissioner can make adjustments for tax purposes.

All this means that not only do you need to have your pricing right, but your paperwork must be in

place as well.

Generally, this means the creation of some documentation that would not otherwise be created in

the ordinary course of business. The ATO expects SMEs with related party dealings to carry out the

following four-step process:

1.

2.

3.

4.

Identify and record the nature of transactions with foreign related parties and how these transactions

fit into the everyday business.

Select the most appropriate transfer pricing methodology and document the choice that is made.

Apply the transfer pricing method and determine the arms length outcome. This would typically

involve a benchmarking study to demonstrate that the outcome is consistent with arms length

transactions.

Review the transaction pricing and benchmarking study on a regular basis to ensure that any material

changes are reflected and documented.

One of the key things the ATO will look for in a transfer pricing review is whether the business has

maintained contemporaneous documentation. This refers to documentation that existed or was

created at or before the time of preparing the tax return for the relevant income year.

This issue is particularly relevant for businesses that need to disclose details of international related

party dealings on an International Dealings Schedule. This schedule must be lodged with the tax

return when a business has dealings with foreign related parties of $2m or more (including loan

balances) and is used by the ATO to identify situations where there might be a risk of profit shifting.

Putting a comprehensive transfer pricing file in place is a great way to satisfy the ATOs expectations

and provide the first line of defence in the event of an ATO review or audit.

Quote of the month

From a commercial point of view, if Christmas did not exist it would be necessary to invent it.

Katharine Whitehorn

Tax & Business Tips

Oct 2012

Checklists and Templates

To make the compilation & reporting task for 2012 tax returns easier, clients of Property Tax Specialists

receive checklists and templates to facilitate the process ... saving them time and money ... the write way is

having clear documentation. ATO way means time/money wastage with audit investigation.

Two heads are better than 1? Discuss your plans? Call to chat ...

Contact us if you would like to

- review & discuss your current property & tax situation ... maybe the next deal or

- whether or not to sell a property, which one in the portfolio should be sold

- your asset protection strategy. What is your risk profile? High ..medium ..low

- structuring your next investment property. In whose name should it be?

- Should you rent out your home and live closer to work in a rented space

- Should you invest your capital in 1 Main Residence or 2 smaller rental properties

planning to legally minimise your tax position or just to explore the possibilities

- Subdividing a block or your Main Residence Capital Gain or Business Profit?

- Is your Self Managed Super Fund ready to acquire a property

1. with limited recourse loans

2. from lending institutions or yourself

- prepare your next tax return or application to reduce your PAYG Withholding tax

We look forward to being of service. We also look forward to your referrals.

To improve our service we welcome all constructive comments on this newsletter and other

materials.

Call/email Shukri Barbara at Property Tax Specialists at Shukri@propertytaxspecialists.com.au

Checklists and Templates

To make the compilation & reporting task for 2011 tax returns easier, clients of Property Tax Specialists

received checklists and templates to facilitate the process ... saving them time and money ... the write way is

having clear documentation. ATO way means time/money wastage with audit investigation.

Disclaimer

The material and contents provided in this publication are informative in nature only. It is not intended to be advice and

you should not act specifically on the basis of this information alone. If expert assistance is required, professional advice

should be obtained. Contact your accountant or Property Tax Specialists at info@propertytaxspecialists.com.au or call 02

9411 8133

Tax & Business Tips

Kind Regards

Winner - Readers Choice Awards Your Investment Property Magazine

2012 - Property Tax Adviser of the Year

2011- Property Tax Specialist of the Year

Tax Columnist Smart Property Investment magazine

Property Tax Specialists Prosperity & Peace of Mind

Barbara & Co cpa

phone 02 9411 8133

fax 02 9412 2833

mobile 0410 588 305

post: P.O.Box 665 Chatswood NSW 2057

office : Level 5 suite 509, 71-73 Archer Street Chatswood NSW 2067

website www.propertytaxspecialists.com.au <http://www.propertytaxspecialists.com.au>

"Liability is limited by a Scheme approved under Professional Standards Legislation

Oct 2012

You might also like

- How to Use Limited Liability Companies & Limited Partnerships: Getting the Most Out of Your Legal StructureFrom EverandHow to Use Limited Liability Companies & Limited Partnerships: Getting the Most Out of Your Legal StructureRating: 5 out of 5 stars5/5 (3)

- Trading Mentor PDFDocument1 pageTrading Mentor PDFShrikant DNo ratings yet

- Advanced Accounting Vol 2 2014 Edition Baysa-LupisanDocument110 pagesAdvanced Accounting Vol 2 2014 Edition Baysa-LupisanIzzy B100% (4)

- Summer Project Black BookDocument50 pagesSummer Project Black BookBhagesh Gharat100% (1)

- 794 Business-Value TDDocument6 pages794 Business-Value TDAnonymous 5z7ZOp100% (1)

- Steps Followed in Establishing A Home Furnishing Unit/ Design StudioDocument5 pagesSteps Followed in Establishing A Home Furnishing Unit/ Design StudioshashikantshankerNo ratings yet

- Buying A Business Legal DocumentsDocument15 pagesBuying A Business Legal DocumentsAe AndokiNo ratings yet

- Cash Flow Management WorksheetDocument5 pagesCash Flow Management WorksheetAshenafi Belete AlemayehuNo ratings yet

- Tart-P Asics: An Overview To Starting Your Own BusinessDocument28 pagesTart-P Asics: An Overview To Starting Your Own Business1ncognit0No ratings yet

- Starting A Business Checklist 2023 GovDocument10 pagesStarting A Business Checklist 2023 Govjcgoku9No ratings yet

- Corporate Sales: Frequently Asked QuestionsDocument7 pagesCorporate Sales: Frequently Asked QuestionsLeonardo SepúlvedaNo ratings yet

- Everthing I Need To Start A BusinessDocument14 pagesEverthing I Need To Start A BusinessLamar ColeNo ratings yet

- 7 MA Docs DemystifiedDocument30 pages7 MA Docs Demystifiedwhaza789No ratings yet

- On The Money - December 2016.htmlDocument8 pagesOn The Money - December 2016.htmlKen NgeowNo ratings yet

- Lecture 2Document28 pagesLecture 2Modest DarteyNo ratings yet

- Business Case Studies For UK OutsourcingDocument14 pagesBusiness Case Studies For UK OutsourcingPavel DhakaNo ratings yet

- The Insider Secret of Business: Growing Successful Financially and ProductivelyFrom EverandThe Insider Secret of Business: Growing Successful Financially and ProductivelyNo ratings yet

- Navigating Commercial Property Taxes - A Comprehensive Guide To Tax Rates and Calculations - 1718647410003 - 4xb6sDocument3 pagesNavigating Commercial Property Taxes - A Comprehensive Guide To Tax Rates and Calculations - 1718647410003 - 4xb6sMichael JonesNo ratings yet

- Finding Your Customers: Starting A Business? Start HereDocument7 pagesFinding Your Customers: Starting A Business? Start HereSahil DasNo ratings yet

- Literature Review On Debtors ManagementDocument8 pagesLiterature Review On Debtors Managementafmzkbuvlmmhqq100% (1)

- SZH Long VersionDocument8 pagesSZH Long VersionsaelesehaynesNo ratings yet

- Buying An Existing Business: The Right ChoiceDocument14 pagesBuying An Existing Business: The Right ChoicebhattpreNo ratings yet

- Setting Up Business in UK Made Feasible For Greece Residents! NewDocument4 pagesSetting Up Business in UK Made Feasible For Greece Residents! Newmike petersonNo ratings yet

- Sell Your Business in 90 Days or Less by RetireFromMyBizComDocument33 pagesSell Your Business in 90 Days or Less by RetireFromMyBizComMike SongerNo ratings yet

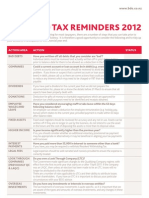

- Year-End Tax Reminders 2012: Action Area Action StatusDocument2 pagesYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783No ratings yet

- Business Plan Company Ownership SampleDocument5 pagesBusiness Plan Company Ownership SamplejxqcfyozgNo ratings yet

- Chapter 6 Business Classifications and Form and Article AnalysisDocument11 pagesChapter 6 Business Classifications and Form and Article Analysisandrei cajayonNo ratings yet

- Santiago CRSDocument2 pagesSantiago CRSshaft181No ratings yet

- Legal Formalities Business PlanDocument5 pagesLegal Formalities Business Planhf6hf6hwNo ratings yet

- Account Payable ThesisDocument4 pagesAccount Payable Thesiskerrylewiswashington100% (2)

- Legal Consideration For Going GlobalDocument22 pagesLegal Consideration For Going GlobalAryan GuptaNo ratings yet

- Nutro blast drinksDocument24 pagesNutro blast drinksscottkeith1218No ratings yet

- ACCT1101 Wk2 Tutorial 1 SolutionsDocument12 pagesACCT1101 Wk2 Tutorial 1 SolutionskyleNo ratings yet

- Business Expenses: Publication 535Document50 pagesBusiness Expenses: Publication 535Birgitte SangermanoNo ratings yet

- Legal Requirments of Business ManagementDocument42 pagesLegal Requirments of Business ManagementAasi RaoNo ratings yet

- Step by Step Guide To A Business StartupDocument13 pagesStep by Step Guide To A Business StartupNirolama 11 2ndNo ratings yet

- Protect Your Business SpeechDocument19 pagesProtect Your Business SpeechIon GondobescuNo ratings yet

- Project CDocument5 pagesProject CKort JenselNo ratings yet

- Class Report CheckedDocument12 pagesClass Report CheckedRolando AlmengorNo ratings yet

- Your Busines Your Bank - Final VersionDocument17 pagesYour Busines Your Bank - Final VersionBrian ClearyNo ratings yet

- Due Diligence ThesisDocument8 pagesDue Diligence Thesiscrystalwilliamscleveland100% (2)

- Business Plan For A Stock Brokerage FirmDocument9 pagesBusiness Plan For A Stock Brokerage FirmafkndyfxwNo ratings yet

- Business Valuation and Forensic Accounting: For Resolving Disputes in HawaiiFrom EverandBusiness Valuation and Forensic Accounting: For Resolving Disputes in HawaiiNo ratings yet

- Invoice FactoringDocument7 pagesInvoice FactoringtocangahNo ratings yet

- XA2201144 Costachi UWL RBTDocument20 pagesXA2201144 Costachi UWL RBTTanjim HossainNo ratings yet

- Business Plan For Accounting ServicesDocument7 pagesBusiness Plan For Accounting Servicesprkn26yeNo ratings yet

- How To Set Up and Run Your Own BusinessDocument8 pagesHow To Set Up and Run Your Own BusinessDhiraj DixitNo ratings yet

- From Idea Generation to Preparation of Detailed Business PlansDocument7 pagesFrom Idea Generation to Preparation of Detailed Business Plansmr3m3cchNo ratings yet

- Research Paper Tax PlanningDocument7 pagesResearch Paper Tax Planningvshyrpznd100% (1)

- Subject 1: Human Resource ManagementDocument6 pagesSubject 1: Human Resource Managementsaurav jhaNo ratings yet

- Estate Planning Business OwnersDocument7 pagesEstate Planning Business Ownershxgcf7hbNo ratings yet

- Due DiligenceDocument6 pagesDue Diligencemiboca8966No ratings yet

- JKWCPA Accounting 101 For Small Businesses EGuideDocument13 pagesJKWCPA Accounting 101 For Small Businesses EGuideAlthaf CassimNo ratings yet

- Dissertation Due DiligenceDocument8 pagesDissertation Due DiligenceCustomPaperServiceSingapore100% (1)

- Legal Documents For Small BusinessesDocument28 pagesLegal Documents For Small BusinessesvidrascuNo ratings yet

- Financial ModelDocument30 pagesFinancial ModelrecasmarkNo ratings yet

- FA2201097 Ion Valention UWL RBTDocument20 pagesFA2201097 Ion Valention UWL RBTTanjim HossainNo ratings yet

- AgEc Acctg HandoutDocument96 pagesAgEc Acctg HandoutAsnake YohanisNo ratings yet

- Collection Group WorkDocument4 pagesCollection Group WorkYvonne Grashelle Cabang BusalNo ratings yet

- 17 Key Lessons For Entrepreneurs Starting A BusinessDocument3 pages17 Key Lessons For Entrepreneurs Starting A BusinessP SssNo ratings yet

- Special Topics in Financial Management ReviewerDocument4 pagesSpecial Topics in Financial Management ReviewerJoelan AbdulaNo ratings yet

- Theories of FDIDocument18 pagesTheories of FDIZuhaib Bazaz0% (1)

- Cost AccountingDocument21 pagesCost Accountinganand371No ratings yet

- Deleveraging Investing Optimizing Capital StructurDocument42 pagesDeleveraging Investing Optimizing Capital StructurDanaero SethNo ratings yet

- Indicative Bond RatesDocument10 pagesIndicative Bond RatesSimon ReidNo ratings yet

- Industrial Revolution Key VocabularyDocument4 pagesIndustrial Revolution Key VocabularyJustPassingByNo ratings yet

- Variance Swaps PrimerDocument104 pagesVariance Swaps PrimerVitaly ShatkovskyNo ratings yet

- Due Diligence Documents ChecklistDocument19 pagesDue Diligence Documents ChecklistKingsely.shuNo ratings yet

- Economic Functions of BankPPTDocument23 pagesEconomic Functions of BankPPTKeith Brandon AlanaNo ratings yet

- 2.certificate, AcknowledgementDocument5 pages2.certificate, AcknowledgementTarun BamolaNo ratings yet

- Deneb Pre Listing 201411Document144 pagesDeneb Pre Listing 201411Makoya_malumeNo ratings yet

- Global Marketing Management 8th Edition Keegan Test BankDocument9 pagesGlobal Marketing Management 8th Edition Keegan Test BankAdrina AdamNo ratings yet

- FACTA PDF JPMDocument20 pagesFACTA PDF JPMnatashajain4No ratings yet

- Question Revision 2Document20 pagesQuestion Revision 2lananhgau1603No ratings yet

- Banking - Unit - Assets and Liability ManagmentDocument54 pagesBanking - Unit - Assets and Liability ManagmentDarshini Thummar-ppmNo ratings yet

- Income Taxes of Estates & Trusts: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument13 pagesIncome Taxes of Estates & Trusts: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersJane Mae CruzNo ratings yet

- Iift GKDocument113 pagesIift GKDishant MongaNo ratings yet

- Foreign Exchange MarketDocument8 pagesForeign Exchange Marketsravani maddlaNo ratings yet

- BOI - Promoting Investments Through ServicingDocument15 pagesBOI - Promoting Investments Through ServicingAnonymous yKUdPvwjNo ratings yet

- Tangible Non-Current Assets: Learning ObjectivesDocument26 pagesTangible Non-Current Assets: Learning Objectivesduong duongNo ratings yet

- John Tudor StrategyDocument18 pagesJohn Tudor StrategyArjun BhatnagarNo ratings yet

- Online STMTDocument7 pagesOnline STMTdjk765No ratings yet

- IPONote - Shyam MetalicsDocument1 pageIPONote - Shyam MetalicsAnamika GputaNo ratings yet

- 02 LasherIM Ch02Document25 pages02 LasherIM Ch02Rohit SinghaniaNo ratings yet

- A Study On Effective Cash Management System Performance in Abc Techno Labs India Private LimitedDocument8 pagesA Study On Effective Cash Management System Performance in Abc Techno Labs India Private LimitedBabasaheb JawalgeNo ratings yet

- Betting Against Beta - Frazzini and PedersenDocument25 pagesBetting Against Beta - Frazzini and PedersenGustavo Barbeito LacerdaNo ratings yet

- Financial ManagementDocument48 pagesFinancial Managementalokthakur100% (1)