Professional Documents

Culture Documents

Your Local Executive Summary

Your Local Executive Summary

Uploaded by

api-25884946Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Your Local Executive Summary

Your Local Executive Summary

Uploaded by

api-25884946Copyright:

Available Formats

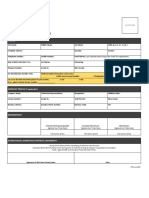

Monday February 1, 2010

Your Local Executive LOS ANGELES, CA 90049

Summary Single Family Homes

This Week

Real-Time Market Profile Trend

Median List Price $ 2,295,000 ±+

Asking Price Per Square Foot $ 721 ±+

The median list price in LOS ANGELES, CA 90049 this week is Average Days on Market (DOM) 270 ==

$2,295,000.

Percent of Properties with Price Decrease 28 %

Percent Relisted (reset DOM) 85 %

Inventory and days-on-market are both trending higher recently.

However, the improving Market Action Index implies some Percent Flip (price increased) 3%

increased demand will temper the negative trends. Median House Size (sq ft) 3222

Median Lot Size 0.25 - 0.50 acre

Median Number of Bedrooms 4.0

Median Number of Bathrooms 3.5

Supply and Demand Market Action Index Strong Buyer's 17.7 ==

Home sales have been exceeding new inventory for several weeks. ±+ No change == Strong upward trend ≠≠ Strong downward trend

Since this is a Buyer's market prices are not yet moving higher as

excess inventory is consumed. However, the as supply and demand = Slight upward trend ≠ Slight downward trend

trends continue, the market moves into the Seller's zone, and we are

likely to see upward pressure on pricing.

Price

Market Action Index Recently prices in this zip have settled at a plateau even though

they dipped this week. Look for a persistent up-shift in the

Market Action Index before we see prices significantly move

from these levels.

Price Trends

7-Day Rolling Average 90-Day Rolling Average Buyer/Seller Cutoff

The Market Action Index answers the question "How's the

Market?" By measuring the current rate of sale versus the

amount of the inventory. Index above 30 implies Seller's

Market conditions. Below 30, conditions favor the buyer.

Quartiles

7-Day Rolling Average 90-Day Rolling Average

Characteristics per Quartile Investigate the market in quartiles -

where each quartile is 25% of homes

ordered by price.

Quartile Median Price Sq. Ft. Lot Size Beds Baths Age Inventory New Absorbed DOM

0.50 - 1.0

Top/First $ 6,000,000 5702 acre 5.0 5.5 31 35 0 2 313 Most expensive 25% of properties

0.25 - 0.50

Upper/Second $ 2,795,000 3876 acre 5.0 5.0 48 35 4 4 274 Upper-middle 25% of properties

0.25 - 0.50

Lower/Third $ 1,875,000 2938 acre 4.0 3.0 49 35 4 0 224 Lower-middle 25% of properties

8,001 -

Bottom/Fourth $ 1,299,000 2207 10,000 sqft 3.0 2.0 56 36 2 2 268 Least expensive 25% of properties

Pickford Escrow

Powered by Altos Research LLC | www.altosresearch.com | Copyright ©2009 Altos Research LLC

You might also like

- Team 6 - Pricing Assignment 2 - Cambridge Software Corporation V 1.0Document7 pagesTeam 6 - Pricing Assignment 2 - Cambridge Software Corporation V 1.0SJ100% (1)

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26371094No ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26327314No ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26327314No ratings yet

- Thursday September 17, 2009Document1 pageThursday September 17, 2009api-27591084No ratings yet

- Monthly Market ReportDocument1 pageMonthly Market ReportmiguelnunezNo ratings yet

- Market OverviewDocument1 pageMarket OverviewmiguelnunezNo ratings yet

- Monthly Market ReportDocument1 pageMonthly Market ReportmiguelnunezNo ratings yet

- Thursday September 17, 2009Document1 pageThursday September 17, 2009api-27591084No ratings yet

- Thursday September 17, 2009Document1 pageThursday September 17, 2009api-27591084No ratings yet

- Thursday September 17, 2009Document1 pageThursday September 17, 2009api-27591084No ratings yet

- November Market ReportDocument1 pageNovember Market ReportmiguelnunezNo ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26216409No ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-22871972No ratings yet

- This Week: San Diego, CaDocument1 pageThis Week: San Diego, Caapi-26437180No ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-22871972No ratings yet

- This Week: San Diego, Ca 92130Document1 pageThis Week: San Diego, Ca 92130api-26526570No ratings yet

- Mission Viejo - CondoDocument17 pagesMission Viejo - CondoDeborah Lynn ThomasNo ratings yet

- This Week: San Diego, CaDocument1 pageThis Week: San Diego, Caapi-26437180No ratings yet

- This Week: PASADENA, CA 91106Document1 pageThis Week: PASADENA, CA 91106api-26327314No ratings yet

- The Local Market Executive SummaryDocument1 pageThe Local Market Executive Summaryapi-26128632No ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26216409No ratings yet

- Thursday September 17, 2009Document1 pageThursday September 17, 2009api-27591084No ratings yet

- Thursday September 17, 2009Document1 pageThursday September 17, 2009api-27591084No ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-19054998No ratings yet

- Geneva Jul05 ExecSum SFDocument1 pageGeneva Jul05 ExecSum SFlebersoleNo ratings yet

- This Week: San Diego, CaDocument1 pageThis Week: San Diego, Caapi-26437180No ratings yet

- Lake Forest - CondoDocument7 pagesLake Forest - CondoDeborah Lynn ThomasNo ratings yet

- Monthly Market ReportDocument1 pageMonthly Market ReportmiguelnunezNo ratings yet

- Thursday September 17, 2009Document1 pageThursday September 17, 2009api-27591084No ratings yet

- November Market ReportDocument1 pageNovember Market ReportmiguelnunezNo ratings yet

- This Week: San Diego, CaDocument1 pageThis Week: San Diego, Caapi-26437180No ratings yet

- This Week: San Diego, CaDocument1 pageThis Week: San Diego, Caapi-26437180No ratings yet

- Lake Forest - CondoDocument7 pagesLake Forest - CondoDeborah Lynn ThomasNo ratings yet

- This Week: POWAY, CA 92064Document1 pageThis Week: POWAY, CA 92064api-27645880No ratings yet

- Weekly Market Summary - Jessica LeDoux 503 310-5816Document1 pageWeekly Market Summary - Jessica LeDoux 503 310-5816Jessica LeDouxNo ratings yet

- Market Report NovemberDocument1 pageMarket Report NovembermiguelnunezNo ratings yet

- Market OverviewDocument1 pageMarket OverviewmiguelnunezNo ratings yet

- Lake Forest - SFDocument7 pagesLake Forest - SFDeborah Lynn ThomasNo ratings yet

- Lake Forest Condo & Single Family Weekly UpdateDocument14 pagesLake Forest Condo & Single Family Weekly UpdateDeborah Lynn ThomasNo ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26327314No ratings yet

- This Week: CARLSBAD, CA 92009Document1 pageThis Week: CARLSBAD, CA 92009api-25884946No ratings yet

- This Week: San Diego, Ca 92129Document1 pageThis Week: San Diego, Ca 92129api-27645880No ratings yet

- Lake Forest - SFDocument7 pagesLake Forest - SFDeborah Lynn ThomasNo ratings yet

- This Week: La Jolla, CaDocument1 pageThis Week: La Jolla, Caapi-26526570No ratings yet

- Lake Forest - CondoDocument7 pagesLake Forest - CondoDeborah Lynn ThomasNo ratings yet

- Mission Viejo - CondoDocument17 pagesMission Viejo - CondoDeborah Lynn ThomasNo ratings yet

- Lake Forest - SFDocument7 pagesLake Forest - SFDeborah Lynn ThomasNo ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26216409No ratings yet

- This Week: Vista, CaDocument1 pageThis Week: Vista, Caapi-26216409No ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26216409No ratings yet

- Rancho Santa Margarita - CondoDocument7 pagesRancho Santa Margarita - CondoDeborah Lynn ThomasNo ratings yet

- This Week: San Diego, CaDocument1 pageThis Week: San Diego, Caapi-26437180No ratings yet

- Monthly Market ReportDocument1 pageMonthly Market ReportmiguelnunezNo ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26327314No ratings yet

- Lake Forest - CondoDocument7 pagesLake Forest - CondoDeborah Lynn ThomasNo ratings yet

- Mission Viejo - CondoDocument17 pagesMission Viejo - CondoDeborah Lynn ThomasNo ratings yet

- Monthly Market ReportDocument1 pageMonthly Market ReportmiguelnunezNo ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26216409No ratings yet

- Rancho Santa Fe Market ReportDocument1 pageRancho Santa Fe Market ReportmiguelnunezNo ratings yet

- Buy Now: The Ultimate Guide to Owning and Investing in PropertyFrom EverandBuy Now: The Ultimate Guide to Owning and Investing in PropertyRating: 5 out of 5 stars5/5 (1)

- This Week: PASADENA, CA 91105Document1 pageThis Week: PASADENA, CA 91105api-26327314No ratings yet

- This Week: PASADENA, CA 91106Document1 pageThis Week: PASADENA, CA 91106api-26327314No ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26327314No ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26327314No ratings yet

- Distressed Commercial RE GrowingDocument1 pageDistressed Commercial RE Growingapi-26327314No ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26327314No ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26327314No ratings yet

- Your Local Executive SummaryDocument1 pageYour Local Executive Summaryapi-26327314No ratings yet

- A 78?8 BL /e4 6 /8681? 5 PPT) 777&1e4 6?8681? 5& K) T L?2054 "$$ (/e4 6 /8681? 5 PPTDocument1 pageA 78?8 BL /e4 6 /8681? 5 PPT) 777&1e4 6?8681? 5& K) T L?2054 "$$ (/e4 6 /8681? 5 PPTapi-26327314No ratings yet

- PDF26 2Document182 pagesPDF26 2Issac EbbuNo ratings yet

- Yexmarine AnsDocument14 pagesYexmarine AnsKunalNo ratings yet

- Financial PlanDocument16 pagesFinancial PlanEtchin Agcol AnunciadoNo ratings yet

- Moelis Valuation AnalysisDocument27 pagesMoelis Valuation AnalysispriyanshuNo ratings yet

- Sellers GuideDocument32 pagesSellers GuideR HartmannNo ratings yet

- Chatziantoniou Et Al, 2021 - A Closer Look Into The Global Determinants of Oil Price VolatilityDocument11 pagesChatziantoniou Et Al, 2021 - A Closer Look Into The Global Determinants of Oil Price VolatilitySlice LeNo ratings yet

- Decisions of Microeconomics Central Themes of Microeconomics Uses of Microeconomics ReferencesDocument12 pagesDecisions of Microeconomics Central Themes of Microeconomics Uses of Microeconomics ReferencesRavi KashyapNo ratings yet

- Solutions-03 - PRODUCT DESIGN AND DEVELOPMENTDocument5 pagesSolutions-03 - PRODUCT DESIGN AND DEVELOPMENTHamid Masood 109-FET/MSME/F22No ratings yet

- TLE HE - Video Demo On Corndog by Heather Reeje L. AldayDocument2 pagesTLE HE - Video Demo On Corndog by Heather Reeje L. AldaygladysNo ratings yet

- Tutorials Chapter 1: Financial Markets Multiple Choice QuestionsDocument4 pagesTutorials Chapter 1: Financial Markets Multiple Choice QuestionsNe PaNo ratings yet

- Tender Document For The Uprating of Power Substation Transformers Under Kafue Bulk Water Supply ProjectDocument209 pagesTender Document For The Uprating of Power Substation Transformers Under Kafue Bulk Water Supply ProjectsparkCENo ratings yet

- 5 Tips To MAKE MONEY From Print On Demand & ShopifyDocument6 pages5 Tips To MAKE MONEY From Print On Demand & ShopifyJoshua Miguel BelarminoNo ratings yet

- Imp Fillable Form As of June 2022 v1Document13 pagesImp Fillable Form As of June 2022 v1Anna Lyn AnceroNo ratings yet

- Stakeholder QuestionsDocument22 pagesStakeholder Questionsandreea kjojkNo ratings yet

- 80649AE AX2012R3 ENUS DAT InstructorNotesDocument58 pages80649AE AX2012R3 ENUS DAT InstructorNotesSky Boon Kok LeongNo ratings yet

- Pooja Shrimali SYBMS-88: Apna BazaarDocument8 pagesPooja Shrimali SYBMS-88: Apna BazaarPooja Shrimali Thakur100% (2)

- Arnott 1987Document30 pagesArnott 1987Leandro BarrosNo ratings yet

- Services Marketing Project On CafeDocument32 pagesServices Marketing Project On CafePrakriti DuttaNo ratings yet

- Dept. of ECE, SVIT (2019-20)Document4 pagesDept. of ECE, SVIT (2019-20)Sunitha MNo ratings yet

- (James M. Henderson and Richard E. Quandt) Microec PDFDocument304 pages(James M. Henderson and Richard E. Quandt) Microec PDFMohammad Baqir100% (1)

- Linking Small Farmers To Emerging Agricultural Marketing Systems in India-The Case Study of A Fresh Food Retail Chain in PunjabDocument5 pagesLinking Small Farmers To Emerging Agricultural Marketing Systems in India-The Case Study of A Fresh Food Retail Chain in PunjabihsanulhaqiiuNo ratings yet

- Marketing in The 21st CenturyDocument13 pagesMarketing in The 21st CenturyAshish AggarwalNo ratings yet

- Pricing Policy NotesDocument67 pagesPricing Policy NotesMellisa AndileNo ratings yet

- Anderson and Marcouiller - 2002 Insecurity and The Pattern of TradeDocument11 pagesAnderson and Marcouiller - 2002 Insecurity and The Pattern of Tradepaulhau2002No ratings yet

- Chapter 6. PricingDocument26 pagesChapter 6. PricingTadele BekeleNo ratings yet

- Spring 2013 IB 3 Study SheetDocument8 pagesSpring 2013 IB 3 Study Sheet13xxx13100% (1)

- Chapter 9 - Background To Supply - Production and CostDocument20 pagesChapter 9 - Background To Supply - Production and CostDIMAKATSONo ratings yet

- (Report PPT) Chap 5Document41 pages(Report PPT) Chap 5Nicole Anne GatilaoNo ratings yet

- Umderstanding Markets & Industry Changes (With Activity)Document26 pagesUmderstanding Markets & Industry Changes (With Activity)Migz labianoNo ratings yet