Professional Documents

Culture Documents

Cash Counts Procedures

Cash Counts Procedures

Uploaded by

Popeye Alex67%(3)67% found this document useful (3 votes)

901 views2 pagesThis document outlines cash count procedures for Texas A&M University. It details 8 steps for performing a cash count, including reviewing policies and prior reports, obtaining necessary forms, counting the cash and reconciling amounts, observing security practices, and inquiring about cash handling procedures. The cash counter is to document the count, have the custodian sign, and note any recommendations to improve accountability, security, or the cash count process.

Original Description:

g

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines cash count procedures for Texas A&M University. It details 8 steps for performing a cash count, including reviewing policies and prior reports, obtaining necessary forms, counting the cash and reconciling amounts, observing security practices, and inquiring about cash handling procedures. The cash counter is to document the count, have the custodian sign, and note any recommendations to improve accountability, security, or the cash count process.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

67%(3)67% found this document useful (3 votes)

901 views2 pagesCash Counts Procedures

Cash Counts Procedures

Uploaded by

Popeye AlexThis document outlines cash count procedures for Texas A&M University. It details 8 steps for performing a cash count, including reviewing policies and prior reports, obtaining necessary forms, counting the cash and reconciling amounts, observing security practices, and inquiring about cash handling procedures. The cash counter is to document the count, have the custodian sign, and note any recommendations to improve accountability, security, or the cash count process.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

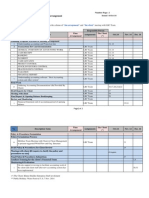

Texas A&M University

Cash Count Procedures

Status/

Reference

1. Review cash handling related policies, regulations, rules, and guidelines:

a. System Regulation 21.01.02 Receipt, Custody, and Deposit of Revenues

b. Guidelines for Cash Handling Procedures

2. Obtain a copy of the Custodian Receipt Form for the fund to be counted.

3. Review prior cash count reports for the fund.

4. Begin the cash count:

c. request access to the fund,

d. ensure proper ID is presented to the fund custodian, and

e. request that the fund custodian remain present during the count.

5. Perform the cash count of the fund.

a. For a working fund:

If a cash register is in use, obtain a copy of the X reading for the days sales and

verify Z totals to the prior days activity.

Document the count on a cash count form.

Reconcile the funds on hand with the working fund amount according to the

Custodial Receipt Form.

Have the fund custodian sign the cash count form verifying that all funds were

returned to him/her intact.

For permanent working funds, document the amount of times the fund was

replenished in the last 12 months. Assess the appropriateness of the fund amount

based on the times replenished and through discussion with the fund custodian.

b. For a petty cash fund:

List the receipts (or run a tape) for all expenditures made from the fund that have not

been reimbursed by FMO.

Verify that the fund is being used for the purpose listed on the Custodial Receipt

Form and that all expenditures are allowable.

Ascertain that the fund is being reimbursed in a timely manner.

Verify that the amount of the fund is appropriate based on the frequency of

reimbursement.

6. Observation made during the cash count:

a. observe if the area is orderly and has adequate security

b. observe if there are any lists or notes which could be used to track funds borrowed from

the fund, etc.

c. for all checks, observe that they have been restrictively endorsed

1

University Risk and Compliance

http://universityrisk.tamu.edu/

7. Inquire of the fund custodian(s) and/or observe to determine if:

a. there are written policies and procedures for cash operations

b. the funds are kept in a safe or locked drawer during temporary placement as well as

long-term and overnight storage

c. the key to the cash register and/or safe is kept on the person if the fund is >$100 or in a

secured drawer if the fund is <$100

d. the combination of the safe is changed periodically and record when it was last changed.

e. duplicate keys and combinations to the safe are submitted to department head or

designee for use if fund custodian(s) are out. Document with whom and how are they

secured.

f. cash register tapes and counts of cash are reconciled daily

g. cash receipts are deposited daily (observe dates on checks)

h. person who makes deposits does not post to customer accounts and/or prepares

monthly reconciliation (bank account/ FAMIS)

i. personal checks are not cashed from the fund

j. checks are restrictively endorsed upon initial receipt or handling by TAMU employee (i.e.,

when mail is opened)

k. returned checks are collected by the fund custodian

l. cash register receipts are given to customers

m. handwritten receipts are pre-numbered

n. not more than one person operates the cash register during a shift (using the same cash

drawer)

o. shortages are recorded and not made up from personal funds

p. overages are immediately deposited not held

q. cash handling areas are secured from entry by unauthorized persons

r. cash handlers are trained in the event of an emergency (i.e., natural disaster, power

outage, robbery, etc.)

s. the fund custodian information and job descriptions are current

t. voids or adjustments are approved by someone who does not have access to the funds.

If not, ensure that voids are independently reviewed for appropriateness and analyzed for

possible trends.

8. Prepare report of cash count

a. complete cash count form (include signature of the counter and fund custodian).

b. include recommendations for enhancing the accountability, security, segregation of

duties, and/or documentation/reconciliation process

c. include any suggestions to improve effectiveness of subsequent cash counts

2

University Risk and Compliance

http://universityrisk.tamu.edu/

You might also like

- 06 Materiality TemplateDocument9 pages06 Materiality TemplateRussel SarachoNo ratings yet

- Verification of Cash Payment To SubscriptionDocument2 pagesVerification of Cash Payment To SubscriptionAlexNo ratings yet

- SCRIBD - Memo On Observation of Inventories and Fixed Assets Count For Batch PlantDocument4 pagesSCRIBD - Memo On Observation of Inventories and Fixed Assets Count For Batch Plantalejandroctay100% (1)

- CARMELO D. FAZON - Internal Quality Review ProceduresDocument3 pagesCARMELO D. FAZON - Internal Quality Review ProceduresCarmelo FazonNo ratings yet

- Oath of Undertaking: CPG-FTEB-BLAD-Form No.42/rev.00/11.07.18Document1 pageOath of Undertaking: CPG-FTEB-BLAD-Form No.42/rev.00/11.07.18Joenn EugenioNo ratings yet

- Revised Rules of Procedure CoaDocument7 pagesRevised Rules of Procedure CoaJaime M. Palattao Jr.No ratings yet

- Cash Disbursement PolicyDocument5 pagesCash Disbursement PolicyRia Dumapias100% (1)

- Sec Memo Circular No.6 Series of 2008 Section 3Document2 pagesSec Memo Circular No.6 Series of 2008 Section 3orlyNo ratings yet

- Revenue Memorandum Order 26-2010Document2 pagesRevenue Memorandum Order 26-2010Jayvee OlayresNo ratings yet

- COA Process Flow Diagram PDFDocument3 pagesCOA Process Flow Diagram PDFMonica AtizadoNo ratings yet

- Affidavit of Loss: Republic of The Philippines) City of Pasay) S.SDocument1 pageAffidavit of Loss: Republic of The Philippines) City of Pasay) S.SJillene FlororitaNo ratings yet

- Picpa (Functions)Document18 pagesPicpa (Functions)Rheneir MoraNo ratings yet

- Revenue District Offices - Bureau of Internal RevenueDocument79 pagesRevenue District Offices - Bureau of Internal RevenueKharylle ConolNo ratings yet

- Trademark Application FormDocument2 pagesTrademark Application FormlemmorepisacNo ratings yet

- Cash AdvanceDocument5 pagesCash AdvanceAnie Guiling-Hadji GaffarNo ratings yet

- Lesson 1 - History of DanceDocument1 pageLesson 1 - History of DanceFA LopezNo ratings yet

- Yellow Book: Presented by-H.V.Sithuruwan Fernando (Engineering Cadet)Document24 pagesYellow Book: Presented by-H.V.Sithuruwan Fernando (Engineering Cadet)piliyandalaleosNo ratings yet

- Motorola Technical OriginalDocument1,038 pagesMotorola Technical OriginalMarianoPVenicio100% (1)

- PCF PolicyDocument4 pagesPCF Policyking100% (1)

- Audit Program - Revolving FundDocument11 pagesAudit Program - Revolving FundAlvin Lozares CasajeNo ratings yet

- Financial StatementDocument7 pagesFinancial StatementEunice SorianoNo ratings yet

- COA Circular 2005-074, Solana CovenantDocument3 pagesCOA Circular 2005-074, Solana CovenantStBernard15No ratings yet

- Reimbursement of Expenses PresentationDocument26 pagesReimbursement of Expenses PresentationAlex Ochinang Jr.No ratings yet

- Accounting Policy - Cash Receipts and Bounced ChecksDocument13 pagesAccounting Policy - Cash Receipts and Bounced ChecksneilNo ratings yet

- Format For Bank'S Certificate Towards Availability of Credit FacilitiesDocument2 pagesFormat For Bank'S Certificate Towards Availability of Credit FacilitiesAshwin RaparthiNo ratings yet

- Random Drug Testing Acknowledgment FormDocument2 pagesRandom Drug Testing Acknowledgment FormBudong BernalNo ratings yet

- Audit Program For Accounts Receivable and Sales Client Name: Date of Financial Statements: Iii. Accounts Receivable and SalesDocument6 pagesAudit Program For Accounts Receivable and Sales Client Name: Date of Financial Statements: Iii. Accounts Receivable and SalesFatima MacNo ratings yet

- Appendix 28 - ORDER OF PAYMENTDocument1 pageAppendix 28 - ORDER OF PAYMENTPau PerezNo ratings yet

- Appendix 44 - Instructions - LRDocument1 pageAppendix 44 - Instructions - LRpdmu regionix100% (1)

- Cash Advance For Petty Operating ExpensesDocument25 pagesCash Advance For Petty Operating ExpensesGuiller C. Magsumbol100% (2)

- Life To Date FinalDocument89 pagesLife To Date FinalView100% (1)

- GCG MC No. 2012-09 - The Chief Executive Officer (CEO)Document13 pagesGCG MC No. 2012-09 - The Chief Executive Officer (CEO)eg_abadNo ratings yet

- Annex B - Post-Evaluation Guide FormDocument8 pagesAnnex B - Post-Evaluation Guide Formrheign plantasNo ratings yet

- 2018 - COA-Audited-Financial Statements PDFDocument66 pages2018 - COA-Audited-Financial Statements PDFAnna Marie AlferezNo ratings yet

- The Audit of InventoriesDocument7 pagesThe Audit of InventoriesRae Alariao-CabicoNo ratings yet

- Jocelyn Amor M. Gonda: Brief Descriptions of Our Internal Quality Review ProcessDocument2 pagesJocelyn Amor M. Gonda: Brief Descriptions of Our Internal Quality Review ProcessBillcounterNo ratings yet

- PFF053 MembersContributionRemittanceForm V02-FillableDocument2 pagesPFF053 MembersContributionRemittanceForm V02-FillableCYvelle TorefielNo ratings yet

- Ieird Form (Front)Document1 pageIeird Form (Front)lorennethNo ratings yet

- Application For Changing of Address During SemesterDocument1 pageApplication For Changing of Address During SemesterYousafMeesamNo ratings yet

- Bank Deposits Daily: 2. Safe Count:: Form CH1-F4Document1 pageBank Deposits Daily: 2. Safe Count:: Form CH1-F4joanna7988No ratings yet

- Cash Handling PolicyDocument9 pagesCash Handling PolicyPasti TerengganuNo ratings yet

- Statement of Managements Responsibility For Financial StatementsDocument1 pageStatement of Managements Responsibility For Financial StatementsresurgumNo ratings yet

- Obligation Request and Status Budget Utilization Request and StatusDocument2 pagesObligation Request and Status Budget Utilization Request and StatusKatrina SedilloNo ratings yet

- Sample MemorandumDocument3 pagesSample MemorandumchrisNo ratings yet

- Management Representation LetterDocument10 pagesManagement Representation LetterJOHN MARK ARGUELLESNo ratings yet

- Report of Factual Findings XYZ Company (Address of The Company)Document2 pagesReport of Factual Findings XYZ Company (Address of The Company)RM LabanNo ratings yet

- COA M2014 013 CellcardDocument2 pagesCOA M2014 013 CellcardRobehgene Atud-JavinarNo ratings yet

- Waiver and QuitclaimDocument1 pageWaiver and QuitclaimBlu KurakaoNo ratings yet

- Tourist Visa Turkey Requirements For Pakistani ResidentDocument1 pageTourist Visa Turkey Requirements For Pakistani ResidentMuhammad AslamNo ratings yet

- SEC SMR Format 2yrs - 2018 - 10 CopiesDocument1 pageSEC SMR Format 2yrs - 2018 - 10 CopiesMarvin CeledioNo ratings yet

- Purchase Order Purchase Order: Lubes: LubesDocument2 pagesPurchase Order Purchase Order: Lubes: LubesMisty HughesNo ratings yet

- Lex Libris Search ToolsDocument3 pagesLex Libris Search ToolsJobar BuenaguaNo ratings yet

- FULL PFRS - Unqualified Auditors Report (Capital Deficiency) 2016 TemplateDocument3 pagesFULL PFRS - Unqualified Auditors Report (Capital Deficiency) 2016 TemplateMyda RafaelNo ratings yet

- COAble Common COA FindingsDocument4 pagesCOAble Common COA FindingsDerick AlmoNo ratings yet

- Application For Securing Certificate of Compliance (Coc) : (As Indicated in DTI / SEC / CDA Registration)Document1 pageApplication For Securing Certificate of Compliance (Coc) : (As Indicated in DTI / SEC / CDA Registration)Muhammad Hasher Anjalin100% (1)

- Sec Cover SheetDocument32 pagesSec Cover SheetMeow MeowNo ratings yet

- Letter of ConformityDocument1 pageLetter of ConformityAlfred FranciscoNo ratings yet

- Purchasing Audit ProgrammeDocument12 pagesPurchasing Audit ProgrammemercymabNo ratings yet

- BIR Form No. 1709 Final PDFDocument3 pagesBIR Form No. 1709 Final PDFErica Caliuag0% (1)

- Property and Supply ManagementDocument50 pagesProperty and Supply ManagementLexa SpecterNo ratings yet

- Affidavit of SupportDocument1 pageAffidavit of SupportJustin Jomel ConsultaNo ratings yet

- Ppsas 17 - Ppe Oct-18 2013Document4 pagesPpsas 17 - Ppe Oct-18 2013Ar Line100% (2)

- Sample Policies and Procedures: Cash Management: PurposeDocument9 pagesSample Policies and Procedures: Cash Management: PurposeRYENA111No ratings yet

- 10% Welcome Bonus: EligibilityDocument1 page10% Welcome Bonus: EligibilityPopeye AlexNo ratings yet

- Citi InsightDocument16 pagesCiti InsightPopeye AlexNo ratings yet

- What Will I Learn During The 4x4 Process Video Series?Document4 pagesWhat Will I Learn During The 4x4 Process Video Series?Popeye AlexNo ratings yet

- Chart of AccountsDocument15 pagesChart of AccountsPopeye AlexNo ratings yet

- Weekly FX Insight: Citibank Wealth ManagementDocument16 pagesWeekly FX Insight: Citibank Wealth ManagementPopeye AlexNo ratings yet

- Citiinsight PDFDocument16 pagesCitiinsight PDFPopeye AlexNo ratings yet

- FX Insight e PDFDocument16 pagesFX Insight e PDFPopeye AlexNo ratings yet

- FX Insight eDocument16 pagesFX Insight ePopeye AlexNo ratings yet

- FX Insifddggfght e PDFDocument16 pagesFX Insifddggfght e PDFPopeye AlexNo ratings yet

- + Liabilities Owners' Equity AssetsDocument1 page+ Liabilities Owners' Equity AssetsPopeye AlexNo ratings yet

- Hotel Safety Shoes Quotation From Shanghai LangfengDocument3 pagesHotel Safety Shoes Quotation From Shanghai LangfengPopeye AlexNo ratings yet

- Financial Management: Friday 6 June 2014Document8 pagesFinancial Management: Friday 6 June 2014cm senNo ratings yet

- 2fidge Louis Primary Foundation Skills Reading PDFDocument48 pages2fidge Louis Primary Foundation Skills Reading PDFPopeye AlexNo ratings yet

- Prakas: Governor Seal and Signature: Chea ChantoDocument1 pagePrakas: Governor Seal and Signature: Chea ChantoPopeye AlexNo ratings yet

- CHOOSE Function: Index Num - This Is The Relative Number of Item To Choose From The Values Supplied. If We PutDocument1 pageCHOOSE Function: Index Num - This Is The Relative Number of Item To Choose From The Values Supplied. If We PutPopeye AlexNo ratings yet

- AND FunctionDocument1 pageAND FunctionPopeye AlexNo ratings yet

- f9 2014 Dec QDocument13 pagesf9 2014 Dec QreadtometooNo ratings yet

- W-AP - Administration and Selling ExpensesDocument15 pagesW-AP - Administration and Selling ExpensesPopeye AlexNo ratings yet

- Accounting Systems and Procedures Basic Course: Download Full PDF HereDocument6 pagesAccounting Systems and Procedures Basic Course: Download Full PDF HerePopeye AlexNo ratings yet

- 2011 Audit of CashDocument2 pages2011 Audit of CashPopeye AlexNo ratings yet

- AVERAGE Function: Number1 - This Is The Range of Cells You Want Averaged. Number2Document1 pageAVERAGE Function: Number1 - This Is The Range of Cells You Want Averaged. Number2Popeye AlexNo ratings yet

- ABS Function: This Function Will Give You The Absolute Value of A NumberDocument1 pageABS Function: This Function Will Give You The Absolute Value of A NumberPopeye AlexNo ratings yet

- Syl Auditing Spring 2012Document3 pagesSyl Auditing Spring 2012Popeye AlexNo ratings yet

- The Russia Microfinance Project: Accounting For Microfinance OrganizationsDocument15 pagesThe Russia Microfinance Project: Accounting For Microfinance OrganizationsPopeye AlexNo ratings yet

- 1 Quickbooks Online 2013 OverviewDocument25 pages1 Quickbooks Online 2013 OverviewPopeye AlexNo ratings yet

- 1106 Teacher GuideDocument38 pages1106 Teacher GuidePopeye AlexNo ratings yet

- SUM Function: Number1 - This Is The Range of Cells You Want Added. Number2Document1 pageSUM Function: Number1 - This Is The Range of Cells You Want Added. Number2Popeye AlexNo ratings yet

- LOWER Function: Row 2 - The Formula We Use in Cell B2 Is LOWER (A2) - So We Are Taking What Is in A2, Which IsDocument1 pageLOWER Function: Row 2 - The Formula We Use in Cell B2 Is LOWER (A2) - So We Are Taking What Is in A2, Which IsPopeye AlexNo ratings yet

- Client: Khmer Builder Enterprise Subject: Program Activities & Meeting ArrangementDocument2 pagesClient: Khmer Builder Enterprise Subject: Program Activities & Meeting ArrangementPopeye AlexNo ratings yet

- New PPT mc1899Document21 pagesNew PPT mc1899RYAN JEREZNo ratings yet

- Kate's Essay Edited by Christina GallegosDocument5 pagesKate's Essay Edited by Christina Gallegosapi-579831401No ratings yet

- Chapter 3 Ins200Document11 pagesChapter 3 Ins2002024985375No ratings yet

- Paragon Collective AgreementDocument38 pagesParagon Collective AgreementDebbyNo ratings yet

- Topic One The Context of Strategic Human Resource Management (Autosaved)Document61 pagesTopic One The Context of Strategic Human Resource Management (Autosaved)Maha DajaniNo ratings yet

- Session 14. Legal MemorandumDocument27 pagesSession 14. Legal Memorandumsamantha100% (1)

- Tutorial 4Document3 pagesTutorial 4Puvithera A/P GunasegaranNo ratings yet

- Fig 4-4 RMS Sample QC Daily Report PDFDocument2 pagesFig 4-4 RMS Sample QC Daily Report PDFDavidPerezNo ratings yet

- Okeke, Ogechi Lilian: BiodataDocument3 pagesOkeke, Ogechi Lilian: BiodatafelixNo ratings yet

- CIPS Global Standard Segment 3.1 Understanding Systems For Procurement and SupplyDocument3 pagesCIPS Global Standard Segment 3.1 Understanding Systems For Procurement and SupplytmtsukataNo ratings yet

- Greeting Lesson PlanDocument4 pagesGreeting Lesson Planhawanur266No ratings yet

- Olano V Lim Eng CoDocument22 pagesOlano V Lim Eng CoRimvan Le SufeorNo ratings yet

- Impact of COVID On Spice SectorDocument10 pagesImpact of COVID On Spice SectorRatulNo ratings yet

- Magellan International Corp. v. Salzgitter Handel GMBHDocument10 pagesMagellan International Corp. v. Salzgitter Handel GMBHNga DinhNo ratings yet

- Does V Boies Schiller Reply BriefDocument20 pagesDoes V Boies Schiller Reply BriefPaulWolfNo ratings yet

- Engleski Jezik Seminarski RadDocument11 pagesEngleski Jezik Seminarski RadUna SavićNo ratings yet

- HR Consultant Company: S.E.O-Tanveer SinghDocument18 pagesHR Consultant Company: S.E.O-Tanveer SinghSukhjeet SinghNo ratings yet

- Apes Final ReviewDocument41 pagesApes Final ReviewirregularflowersNo ratings yet

- Disaster Waste Management in Malaysia: Significant Issues, Policies & StrategiesDocument7 pagesDisaster Waste Management in Malaysia: Significant Issues, Policies & Strategiesmuhamadrafie1975No ratings yet

- Social, Economic and Political Thought: Summer 2012Document12 pagesSocial, Economic and Political Thought: Summer 2012Jan Robert Ramos GoNo ratings yet

- Bti (Bar) FinalDocument128 pagesBti (Bar) FinalFariha BarshaNo ratings yet

- Interesting Facts About AlgeriaDocument6 pagesInteresting Facts About AlgeriaMegh KonnaNo ratings yet

- Bipa Newletter 2011Document10 pagesBipa Newletter 2011JP RajendranNo ratings yet

- The Following Text Is For Questions 91 To 95Document4 pagesThe Following Text Is For Questions 91 To 95NapNo ratings yet

- Sanlakas v. Executive SecretaryDocument2 pagesSanlakas v. Executive SecretaryMigs RaymundoNo ratings yet

- List of Network HospitalsDocument270 pagesList of Network HospitalsAbhishekNo ratings yet

- 6.2 Making My First DecisionsDocument7 pages6.2 Making My First Decisionschuhieungan0729No ratings yet