Professional Documents

Culture Documents

Imd Cir 3009 Sebi Circular

Imd Cir 3009 Sebi Circular

Uploaded by

pradeepOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Imd Cir 3009 Sebi Circular

Imd Cir 3009 Sebi Circular

Uploaded by

pradeepCopyright:

Available Formats

DEPUTY GENERAL MANAGER

INVESTMENT MANAGEMENT DEPARTMENT

SEBI/IMD/CIR No. 4/ 168230/09

June 30, 2009

All Mutual Funds, Asset Management Companies

and Association of Mutual Funds in India (AMFI)

Madam/ Sir,

Sub: Mutual Funds- Empowering investors through transparency in payment of

commission and load structure

1. SEBI has been taking various steps to empower the investors in mutual funds by

way of more transparency in the loads borne by the investor so that the investor

can take informed investment decisions. Towards this end, SEBI had earlier

abolished initial issue expenses and mutual fund schemes were allowed to

recover expenses connected with sales and distribution through entry load only.

Further, investors making direct applications to the mutual funds were exempted

from entry load.

2. In terms of existing arrangement, though the investor pays for the services

rendered by the mutual fund distributors, distributors are remunerated by Asset

Management Companies (AMCs) from loads deducted from the invested

amounts or the redemption proceeds. SEBI (Mutual Funds) Regulations, 1996

also permit AMCs to charge the scheme (under the annual recurring expense) for

marketing and selling expenses including distributors commission.

3. Further, all loads including Contingent Deferred Sales Charge (CDSC) for the

scheme are maintained in a separate account and this amount is used by the

AMCs to pay commissions to the distributors and to take care of other marketing

and selling expenses. It has been left to the AMCs to credit any surplus in this

account to the scheme, whenever felt appropriate. In order to incentivise long

term investors it is considered necessary that exit loads/CDSCs which are

beyond reasonable levels are credited to the scheme immediately.

4. In order to empower the investors in deciding the commission paid to distributors

in accordance with the level of service received, to bring about more

transparency in payment of commissions and to incentivise long term investment,

it has been decided that:

a) There shall be no entry load for all mutual fund schemes.

b) The scheme application forms shall carry a suitable disclosure to the effect that

the upfront commission to distributors will be paid by the investor directly to the

distributor, based on his assessment of various factors including the service

rendered by the distributor.

c) Of the exit load or CDSC charged to the investor, a maximum of 1% of the

redemption proceeds shall be maintained in a separate account which can be

used by the AMC to pay commissions to the distributor and to take care of other

marketing and selling expenses. Any balance shall be credited to the scheme

immediately.

d) The distributors should disclose all the commissions (in the form of trail

commission or any other mode) payable to them for the different competing

schemes of various mutual funds from amongst which the scheme is being

recommended to the investor.

Applicability

5. This circular shall be applicable for

a. Investments in mutual fund schemes (including additional purchases and

switch-in to a scheme from other schemes) with effect from August 1,

2009 ;

b. Redemptions from mutual fund schemes (including switch-out from other

schemes) with effect from August 1, 2009 ;

c. New mutual fund schemes launched on and after August 1, 2009; and

d. Systematic Investment Plans (SIP) registered on or after August 1, 2009.

6. AMCs shall follow the provisions pertaining in clause 5(2)(b) of SEBI Circular

SEBI/IMD/CIR No. 5/126096/08 dated May 23, 2008 regarding updation of

Scheme Information Document (SID) and Key Information Memorandum (KIM) in

this respect.

7. The AMCs shall bring the contents of this circular to the notice of their distributors

immediately and monitor compliance.

8. This circular is issued in exercise of powers conferred under Section 11 (1) of the

Securities and Exchange Board of India Act, 1992, read with the provisions of

Regulation 77 of SEBI (Mutual Funds) Regulations, 1996, to protect the interests

of investors in securities and to promote the development of, and to regulate the

securities market.

Yours faithfully,

Ruchi Chojer

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Strategic Management (Nestle Company)Document25 pagesStrategic Management (Nestle Company)Anonymous xOqiXnW971% (17)

- TestDocument4 pagesTestsalmanqurashiNo ratings yet

- Ryan AirDocument15 pagesRyan Airsushil.saini8667% (6)

- Economic Manufacturing QuantityDocument2 pagesEconomic Manufacturing QuantityDharshan KofiNo ratings yet

- Nmims Project Sep 21Document33 pagesNmims Project Sep 21Dev ChitkaraNo ratings yet

- English AssignmentDocument45 pagesEnglish AssignmentClésia KassambaNo ratings yet

- Multiple Organizations Overview - R12: Multi-Org Is Operating UnitsDocument6 pagesMultiple Organizations Overview - R12: Multi-Org Is Operating Unitssudharsan49No ratings yet

- Chapter 2 Interest and DepreciationDocument32 pagesChapter 2 Interest and DepreciationJojobaby51714No ratings yet

- Catalogue - DingZing DZ Seals Catalogue-E-SDocument94 pagesCatalogue - DingZing DZ Seals Catalogue-E-SKeron TrotzNo ratings yet

- Guide To Mobile Media Buying PDFDocument15 pagesGuide To Mobile Media Buying PDFFaizal NizbahNo ratings yet

- National Institute For Enterpreneurship & Small Business Development 1Document18 pagesNational Institute For Enterpreneurship & Small Business Development 1Ankit BawaNo ratings yet

- Structure Magazine November 2018 PDFDocument52 pagesStructure Magazine November 2018 PDFJoeyMendozNo ratings yet

- Maintenance Management & Engineering TrainingDocument19 pagesMaintenance Management & Engineering TrainingsaradeepsNo ratings yet

- Introduction To DatabaseDocument16 pagesIntroduction To DatabaseIke Aresta ヅNo ratings yet

- UneakoDocument2 pagesUneakoISHITANo ratings yet

- Euronext Stock OptionsDocument2 pagesEuronext Stock OptionsLamyglNo ratings yet

- Project On Real EstateDocument15 pagesProject On Real EstateMahesh Satapathy100% (1)

- CRM IC ABO Transaction Launcher For BeginnersDocument29 pagesCRM IC ABO Transaction Launcher For BeginnerstksudheeshNo ratings yet

- History of Fiat MoneyDocument5 pagesHistory of Fiat MoneyMau TauNo ratings yet

- 1 - Software Quality Assurance ConceptsDocument50 pages1 - Software Quality Assurance ConceptsMuhammad IbrarNo ratings yet

- Ugc Net Commerce MCQ - 2020 (Hilal Ahmed)Document16 pagesUgc Net Commerce MCQ - 2020 (Hilal Ahmed)Hilal Ahmad40% (5)

- 01 - Overview Bisnis Internasional PDFDocument26 pages01 - Overview Bisnis Internasional PDFannisaNo ratings yet

- Chapter 1Document56 pagesChapter 1Jithun NaiduNo ratings yet

- Proposal - Enterprise Resources PlanningDocument20 pagesProposal - Enterprise Resources PlanningDikman Natanael100% (1)

- Polaris Brochure - CATALOGUEDocument11 pagesPolaris Brochure - CATALOGUEKarthikeyan VisvakNo ratings yet

- Sample Cap TableDocument1 pageSample Cap TablenewyuppieNo ratings yet

- Asian Banker - Core Banking ReplacementDocument173 pagesAsian Banker - Core Banking ReplacementHaris ANo ratings yet

- HEI Report Awareness Session Apeejay 29 11 2022Document18 pagesHEI Report Awareness Session Apeejay 29 11 2022Priyanka PinkyNo ratings yet

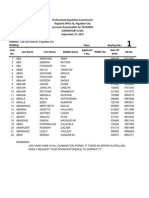

- Pagadian Room Assignment Elementary LETDocument278 pagesPagadian Room Assignment Elementary LETTheSummitExpress75% (4)

- Lkas 38Document28 pagesLkas 38SaneejNo ratings yet