Professional Documents

Culture Documents

Press Release Q2fy1415

Press Release Q2fy1415

Uploaded by

MLastTryOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Press Release Q2fy1415

Press Release Q2fy1415

Uploaded by

MLastTryCopyright:

Available Formats

13th October, 2014

Q2FY15 Result communication

Sintex Industries Limited, Kalol (N.G.) 382 721.

Q2FY15 Highlights

Topline crosses Rs 30 bn

EBITDA rises 36%

PAT up 47%

Sintex Industries, a dominant leader

in plastics and textiles segment

announced results for the quarter

ended September 2014.

Highlighting the strategic importance

of Q2FY15 developments, Amit Patel,

Group Managing Director, Sintex

Industries, said:

Our results reflect a sense of

renewed vibrancy. Q2FY15 is a

reflection of strong growth and a

drastic improvement in business

sentiment. Utilisations are picking up

across businesses, upturn in margins

and topline growth is clearly visible.

The

initiatives

on

clean

India

campaign has thrown open new set of

opportunities.

I believe the uptick in overall

environment is a strategic opportunity

as we enhance efficiencies across the

value chain. This will also result in

incrementally higher ROCE in the

coming years. "

Consol.

Sales

23 %

EBITDA

36 %

Building products

Custom Molding

Textiles

26 %

18 %

31 %

Profit After Tax

1,074 mn

47 % to Rs

Basic EPS at Rs 3.32 (not annualized)

Highlighting the strategic initiatives of

the new government Chairman,

Dinesh Patel, said :

There

is

a buoyancy

environment for business.

emphasis on cleanliness is a

is a need of the hour and we

taking very seriously.

in

the

But an

mission,

are also

We ourselves have a range of

products catering to Swachh Bharat

mission and as we move ahead, our

endeavour is to create a cleaner India

with a range of products from industry

to environment and addressing the

ecosystem for a healthy future.

Q2FY15 Result communication

13th October, 2014

Building Products

Sintex Prefabs touches the masses through varied product portfolio in education, healthcare and

sanitation. A lot of our innovations do take long time before it actually generates decent toplines.

In short, launch is well ahead of times. Infact, Sintex Prefab toilets today command 90-95% of

the market share. And we are also a Pan-Indian company to offer complete solutions under one

roof, say a toilet with a water tank, a soak pit or a Bio gas chamber. In effect, offering an entire

solutions package for remote villages where sewage treatment is an issue.

Apart from toilets, package treatment plants and biogas are at the cusp of an inflection point.

Looking at the recent initiatives on Swacch Bharat Mission, clean India campaign. The campaign

entails to address open defecation, disposal of solid waste and liquid waste through recycling.

Sintex has presence across the spectrum. As per the circular of Ministry of Urban development

and drinking water and sanitation, it would cover 1.04 crore households, provide 2.5 lac seats of

community toilets, 2.6 lac public toilets and solid waste management for 4041 statutory towns.

The total cost of the programme over 5 years is estimated at Rs 620 bn with Central outlay

earmarked at Rs 146 bln over a period of 5 years. The government apart, private sector is rising

to the social cause in a big way through CSR initiatives to address drinking water, sanitation

issues.

A large outlay from corporate kitty is available to further bolster the campaign, an

estimated Rs 70-80 bn to be spent per annum.

Similarly, the National mission for clean Ganga it is proposed to spend Rs 510 bn to completely

stop discharge of untreated sewer and waste water from 29,000 small and medium industries

and 118 urban habitations into ganga river. Under the mission, all 1649 gram panchayats along

the river to be free from open defacation. This represents a huge opportunity for toilet blocks,

waste management and package treatment plants (launched under Sintex Nishihara tie-up) for

the company looking ahead.

In a nutshell, in terms of opportunity for Prefabs, we are yet scratching the surface.

The

potential is huge considering Sintexs national presence, full service capabilities and products

already demonstrated in the marketplace. The Building materials business continued its strong

growth of 26% during the quarter largely driven by the Prefabricated buildings business.

Consolidation continues in monolithic business as focus is maintained on streamlining working

capital.

13th October, 2014

Q2FY15 Result communication

Custom Molding

The custom molding business is shaping up strongly. The overseas business has grown 14%

during the period. The complete benefits of integration will be fully visible in FY16 as the

acquisitions contribute to full potential in both topline and margins.

The French subsidiary due to its aggressive posturing in acquiring companies added altogether

new capabilities, geographies as well as Customers. Hence, poised for a sizeable growth. The

Poschmann acquisition is already stabilizing and contributing, while Simonin adds completely new

dimension to the groups capabilities in metal and metal over molded with plastic parts. These

parts are small and precise in characteristics and can be easily imported in India.

While US subsidiary this year has added altogether new dimension to India by setting up its new

plant in Pune for LRTM and VARTM facility. This is targeted towards off the road vehicles

segment, besides Mass transit to cater to the Indian Market primarily marquee customers like

John Deer, Caterpillar, Siemens and CNH and others.

Domestically, automotive business catered to by Bright AutoPlast (BAPL) is witnessing strong

volume growth with the recovery in automotive numbers.

Hence, Increased supplies to new

models with better sales realization is resulting in a profitable product mix. The electrical facility

for precision components is on an upswing and reflecting a healthy traction, a further expansion

in facility is under consideration. In effect, integration and synergic benefits from overseas

customers is flowing smoothly and adding to the qualitative volume growth for BAPL.

The Industrial products business largely catered by Sintex is generating significantly higher

volumes with a large base of clients ranging from electrical utilities, industrials and others. With

the overall pick in Industrial activity, the segment is on a sound footing with a set of marquee

customers and product range. Reflecting a healthy uptick in the domestic business environment,

the business grew 24% for the quarter under review.

Textiles

The textiles segment registered a healthy volume growth resulting in a topline growth of 31%.

EBITDA margin improved to 24% with better volumes up by 100 bps. The addition of capacity

which completed last year has given much more head room for growth witnessed by

improvement in topline as well as margins. This business can easily be ramped up to 800 crs in

2-3 years timeframe.

13th October, 2014

Q2FY15 Result communication

Spinning Project

The spinning project is progressing as per schedule.

Orders for plant and machinery already

placed and project execution is in full swing. We are very excited with the way Spinning business

is globally poised, with comparative manufacturing advantages all shifting in favor of India. Our

project will be unique in terms of state of the art technology with minimum human intervention,

contamination free environment, high degree of automation, world-class offline and real time

testing lab.

A global scale infrastructure, superior technology and automation coupled with economies of

scale. The locational advantage with close proximity to Port and Cotton fields makes it one of the

best plant in terms of globally competitive export oriented unit for high quality and variety of

yarn.

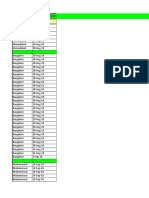

Segmentwise Sales wise break-up

Topline (Rs mn)

%Growth

Q2 FY15

Q2 FY14

Building Materials

8100

6410

26%

Custom Molding

6930

5880

18%

Textiles

1710

1310

31%

*Infra

is part of monolithic business in building materials.

13th October, 2014

Q2FY15 Result communication

FY15 Results :

(Rs mn)

Q2FY15

Net Sales

EBITDA

Interest

Depreciation

PBT

PAT

EPS (Rs)

16731

2878

677

602

1608

1074

3.32

Q2FY14

13414

2074

477

572

993

729

2.34

% chg

25

39

42

5

62

47

H1FY15

30145

4952

1326

1148

2472

1690

5.12

H1FY14

24835

3730

911

1136

1654

1195

3.84

% chg

21

33

46

1

50

41

About Sintex Industries :

Sintex Industries is a dominant player in the plastics and textile business segments. The company manufactures

a range of building materials and composites at its 16 plants across India. Subsequent to several strategic

acquisitions the Company also posseses a global footprint that is spread across the continents of USA and

Europe. In the textile segment the Company is focussed on niche offerings, possessing specialization in mens

structured shirting in the very premium fashion category.

For further information, please contact :

Rajiv Naidu

Sintex Industries Ltd

Tel : +91-22-26124901

E mail : rajiv.naidu@sintex.co.in

Balan Nair

Sintex Industries Ltd

Tel : +91-2764- 253000

Email : balan@sintex.co.in

Some of the statements in this communication that are not historical facts are forward looking statements. These

statements are based on the present business environment and regulatory framework. Developments that could affect

the Companys operations include significant changes in political and economic environment in India, tax laws, import

duties, litigation and labour relations. We assume no responsibility for any action taken based on the said information,

or to update the same as circumstances change.

Q2FY15 Result communication

13th October, 2014

Recent news clippings pertaining to Swachh Bharat Mission and Ganga Action Plan.

You might also like

- C7-C9 Electrical Electronic GuideDocument204 pagesC7-C9 Electrical Electronic GuideElibey Cuadros Berbesi93% (42)

- Halil İnalcık - The Ottoman Economic Mind and Aspects of The Ottoman Economy PDFDocument10 pagesHalil İnalcık - The Ottoman Economic Mind and Aspects of The Ottoman Economy PDFA Seven HasdemirNo ratings yet

- Operations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationFrom EverandOperations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationNo ratings yet

- Catalogus VMLGDocument148 pagesCatalogus VMLGgeorgekc77No ratings yet

- Casting Sigil Magic To Get LaidDocument2 pagesCasting Sigil Magic To Get LaidSlaavoNo ratings yet

- Sintex-Industries-Limited 827 InitiatingCoverageDocument10 pagesSintex-Industries-Limited 827 InitiatingCoverageMLastTryNo ratings yet

- Good Sintext Report by DREDocument4 pagesGood Sintext Report by DREMLastTryNo ratings yet

- Visaka Industries Annual Report FY11Document60 pagesVisaka Industries Annual Report FY11rajan10_kumar_805053No ratings yet

- Economics ProjectDocument14 pagesEconomics ProjectROSHAN KUMAR SAHOONo ratings yet

- Manufacturing MattersDocument24 pagesManufacturing MatterskshintlNo ratings yet

- q4 Ceo Remarks - FinalDocument11 pagesq4 Ceo Remarks - Finalakshay kumarNo ratings yet

- SintexInd Sunidhi 211014Document7 pagesSintexInd Sunidhi 211014MLastTryNo ratings yet

- Group Project AsignmentDocument22 pagesGroup Project AsignmentAzizi MustafaNo ratings yet

- Requirements AnalysisDocument3 pagesRequirements AnalysisUtso DasNo ratings yet

- Pranay (FM) - ProjectDocument61 pagesPranay (FM) - ProjectprashantNo ratings yet

- Annualreport2009 10Document132 pagesAnnualreport2009 10Abhishek KumarNo ratings yet

- Fra ProjectDocument18 pagesFra ProjectRUTUJANo ratings yet

- Lenovo Press - 2324 - q4Document5 pagesLenovo Press - 2324 - q4gustavo.kahilNo ratings yet

- Assignment On Annual ReportsDocument4 pagesAssignment On Annual ReportsPranay JainNo ratings yet

- 4410872Document2 pages4410872Peter OnyangoNo ratings yet

- Triveni Turbine: Company OverviewDocument7 pagesTriveni Turbine: Company OverviewvikasNo ratings yet

- BEML - Annual Report - FY 2020-2021Document278 pagesBEML - Annual Report - FY 2020-2021NILESH SHETENo ratings yet

- 153 - File - Directors' Report & Management Discussion & Analysis For The Year Ended 31st March, 2015Document33 pages153 - File - Directors' Report & Management Discussion & Analysis For The Year Ended 31st March, 2015vishald4No ratings yet

- Directors Report 12 ACC CementsDocument13 pagesDirectors Report 12 ACC Cements9987303726No ratings yet

- ICICI SecuritiesDocument37 pagesICICI SecuritiesDipak ChandwaniNo ratings yet

- Project ReportDocument80 pagesProject ReportVimal KatiyarNo ratings yet

- Vce Final ReportDocument32 pagesVce Final ReportTushar GuptaNo ratings yet

- Emerging Companies Following The Manifesto 02-06-14!00!56Document7 pagesEmerging Companies Following The Manifesto 02-06-14!00!56MLastTryNo ratings yet

- Annual Report - Hyderabad Industries - 2009-2010Document24 pagesAnnual Report - Hyderabad Industries - 2009-2010siruslara6491No ratings yet

- Annual Report 2022 TIMDocument498 pagesAnnual Report 2022 TIMDJRNo ratings yet

- A Project Report ON: Ratio Analysis Super Spinning Mills LTDDocument66 pagesA Project Report ON: Ratio Analysis Super Spinning Mills LTDHari Krishna ReddyNo ratings yet

- Q1 FY 21 (Consolidated) Key Highlights:: For Immediate ReleaseDocument4 pagesQ1 FY 21 (Consolidated) Key Highlights:: For Immediate Releasesrinivas murthyNo ratings yet

- FY2016AnnualRepL&T Annual Report 2015-16Document412 pagesFY2016AnnualRepL&T Annual Report 2015-16OngfaNo ratings yet

- Management Development Institute: CRBV Project ReportDocument25 pagesManagement Development Institute: CRBV Project ReportPuneet GargNo ratings yet

- Samsung Sustainability Report 2011Document94 pagesSamsung Sustainability Report 2011CSRmedia.ro NetworkNo ratings yet

- Jan - MarDocument23 pagesJan - Marsanayaseen yaseenNo ratings yet

- Analysis Report of TIME TECHNOPLAST LTDDocument23 pagesAnalysis Report of TIME TECHNOPLAST LTDAnju SinghNo ratings yet

- Global Business AssigenmentDocument7 pagesGlobal Business AssigenmentAnshul SinghNo ratings yet

- Ultra Tech Docs PDFDocument304 pagesUltra Tech Docs PDFVinita AgrawalNo ratings yet

- KLJ Group - BBA Summer ReportDocument54 pagesKLJ Group - BBA Summer ReportHardik SNo ratings yet

- Hinduja Ventures Annual Report 2015Document157 pagesHinduja Ventures Annual Report 2015ajey_p1270No ratings yet

- BKT b2b Project ReportDocument17 pagesBKT b2b Project ReportAshok Kumar50% (2)

- 7digital Group PLC Consolidated Report and Financial Statements For The Year To 31 December 2016Document49 pages7digital Group PLC Consolidated Report and Financial Statements For The Year To 31 December 2016gaja babaNo ratings yet

- Principles of Accounting: Group AssignmentDocument14 pagesPrinciples of Accounting: Group AssignmentChâu Nguyễn Ngọc MinhNo ratings yet

- InvestIndia - PLI Textiles - VFDocument44 pagesInvestIndia - PLI Textiles - VFTushar JoshiNo ratings yet

- Q1 FY23 Earnings Conference Call TranscriptDocument13 pagesQ1 FY23 Earnings Conference Call TranscriptAbhishek Singh DeoNo ratings yet

- Dixon Technologies Q4FY21: Financial Results & HighlightsDocument4 pagesDixon Technologies Q4FY21: Financial Results & HighlightsabhiNo ratings yet

- Industry OutlookDocument7 pagesIndustry OutlookRahul KumarNo ratings yet

- Annual DataDocument364 pagesAnnual DataGaurav VishalNo ratings yet

- Draft Base PaperDocument10 pagesDraft Base PaperTanmei KamathNo ratings yet

- D - 2 - Final ReportDocument13 pagesD - 2 - Final ReportAnchal BagariaNo ratings yet

- Strama Final Edited 180901 For PrintingDocument102 pagesStrama Final Edited 180901 For PrintingSheilaMarieAnnMagcalasNo ratings yet

- Endurance Technologies LTDDocument15 pagesEndurance Technologies LTDUNKNOWN PersonNo ratings yet

- MANTO Industrial PLCDocument55 pagesMANTO Industrial PLCTeshome AbebeNo ratings yet

- Wipro Technologies LTD.: Sapm Project Submission Submitted byDocument18 pagesWipro Technologies LTD.: Sapm Project Submission Submitted byManoj ThadaniNo ratings yet

- Sustainability Report ReviewDocument5 pagesSustainability Report ReviewArpit YadavNo ratings yet

- Third Quarter Report MAR 31 2012Document20 pagesThird Quarter Report MAR 31 2012Asad Imran MunawwarNo ratings yet

- The Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesFrom EverandThe Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesNo ratings yet

- Capturing the Digital Economy—A Proposed Measurement Framework and Its Applications: A Special Supplement to Key Indicators for Asia and the Pacific 2021From EverandCapturing the Digital Economy—A Proposed Measurement Framework and Its Applications: A Special Supplement to Key Indicators for Asia and the Pacific 2021No ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- IPCE New Guidance November2020Document22 pagesIPCE New Guidance November2020MLastTryNo ratings yet

- 13-Disaster Guide For ConstructionnDocument24 pages13-Disaster Guide For ConstructionnMLastTryNo ratings yet

- Conversion-Circular 2017 PDFDocument1 pageConversion-Circular 2017 PDFMLastTryNo ratings yet

- RKH Qitarat RFP Is Prog Assur 01mar18Document8 pagesRKH Qitarat RFP Is Prog Assur 01mar18MLastTryNo ratings yet

- IR 71.3 Visitor RegisterDocument2 pagesIR 71.3 Visitor RegisterMLastTryNo ratings yet

- XII Test (Death, Ret - Diss)Document4 pagesXII Test (Death, Ret - Diss)MLastTryNo ratings yet

- 47 Women As Equal PartnersDocument60 pages47 Women As Equal PartnersMLastTryNo ratings yet

- Heart Attack Prevention TipsDocument1 pageHeart Attack Prevention TipsMLastTryNo ratings yet

- R P (R P) I S A 2009-10: Equest For Roposal F FOR Nformation Ystems UditDocument32 pagesR P (R P) I S A 2009-10: Equest For Roposal F FOR Nformation Ystems UditMLastTryNo ratings yet

- Kwality 2nd CoC PDFDocument1 pageKwality 2nd CoC PDFMLastTryNo ratings yet

- NPV CalculationDocument11 pagesNPV CalculationMLastTryNo ratings yet

- 521 - Download - Prof Murli Annual 2015Document5 pages521 - Download - Prof Murli Annual 2015MLastTryNo ratings yet

- Clarifications Required UDC RFPDocument1 pageClarifications Required UDC RFPMLastTryNo ratings yet

- NPV CalculationDocument14 pagesNPV CalculationMLastTryNo ratings yet

- FYBBIDocument69 pagesFYBBIMLastTryNo ratings yet

- Time Table of FYJC Science & Commerce Annual Exam 2017 - 18Document6 pagesTime Table of FYJC Science & Commerce Annual Exam 2017 - 18MLastTryNo ratings yet

- Uco Bank AUDITDocument5 pagesUco Bank AUDITMLastTryNo ratings yet

- M. L. Dahanukar College of Commerce B. Com. (Accounting & Finance) Fees Details For The Year 2017-2018Document1 pageM. L. Dahanukar College of Commerce B. Com. (Accounting & Finance) Fees Details For The Year 2017-2018MLastTryNo ratings yet

- List of Participating Organisations For Campus Placement Programme Aug-Sept 2018 Center Interview DateDocument10 pagesList of Participating Organisations For Campus Placement Programme Aug-Sept 2018 Center Interview DateMLastTryNo ratings yet

- S.Y. T.y, & Prof Course Admission Notice 2016 - 2017Document4 pagesS.Y. T.y, & Prof Course Admission Notice 2016 - 2017MLastTryNo ratings yet

- Outsourcing DRP BCPDocument4 pagesOutsourcing DRP BCPMLastTryNo ratings yet

- Info - Iec62443 2 1 (Ed1.0) enDocument9 pagesInfo - Iec62443 2 1 (Ed1.0) enMLastTryNo ratings yet

- Electronic Data Backup SOPDocument8 pagesElectronic Data Backup SOPMLastTryNo ratings yet

- Fuel Price History (QR) : Month Gasoline Premium Gasoline Super DieselDocument1 pageFuel Price History (QR) : Month Gasoline Premium Gasoline Super DieselMLastTryNo ratings yet

- Data Backup PolicyDocument4 pagesData Backup PolicyMLastTryNo ratings yet

- Property, Plant and Equipment (IAS 16.Pptx NEW LATESTDocument47 pagesProperty, Plant and Equipment (IAS 16.Pptx NEW LATESTNick254No ratings yet

- Monthly Test (April) - Igcse Maths: Marks %Document6 pagesMonthly Test (April) - Igcse Maths: Marks %Aqilah AbdullahNo ratings yet

- 9-5 Complex Numbers and de Moivre - S TheoremDocument45 pages9-5 Complex Numbers and de Moivre - S Theorembinode100% (1)

- Part Winding StartDocument2 pagesPart Winding Startmark amthonyNo ratings yet

- Data Analysis For Parallel Car-Crash Simulation ResultsDocument22 pagesData Analysis For Parallel Car-Crash Simulation ResultsGoutham Mareeswaran BNo ratings yet

- Ingilizce 700+yeni SorularDocument98 pagesIngilizce 700+yeni SorularDuran Türkyılmaz100% (2)

- Newmark&Hall Earthquake Spectrum MakingDocument6 pagesNewmark&Hall Earthquake Spectrum MakingLobsang MatosNo ratings yet

- Octopus Crochet Pattern - v1Document6 pagesOctopus Crochet Pattern - v1Baitiar CallejaNo ratings yet

- Proceedings 10th Mountain Cheese DefDocument95 pagesProceedings 10th Mountain Cheese DefLazline BrownNo ratings yet

- HOMESPY The Invisible Sniffer of Infrared Remote Control of Smart TVsDocument18 pagesHOMESPY The Invisible Sniffer of Infrared Remote Control of Smart TVs123No ratings yet

- Arni DivisionDocument42 pagesArni DivisionAO VandavasiNo ratings yet

- Nurses NotesDocument2 pagesNurses NotesDanica Kate GalleonNo ratings yet

- 0 - 30 V / 10 A Power Supply: Scientech 4181Document2 pages0 - 30 V / 10 A Power Supply: Scientech 4181kalidasdoraemonNo ratings yet

- By: Howard Gardner: Multiple IntelligenceDocument1 pageBy: Howard Gardner: Multiple IntelligenceChenie CoronelNo ratings yet

- Fcnyabwihntend4 PDFDocument11 pagesFcnyabwihntend4 PDFFasihNawazNo ratings yet

- Conduction Convection Radiation PowerpointDocument27 pagesConduction Convection Radiation PowerpointApet Satusembilansembilan JieNo ratings yet

- Assignment: Embedded SystemsDocument6 pagesAssignment: Embedded SystemsSudarshanNo ratings yet

- Probelm SetsDocument57 pagesProbelm SetsAllison N. MillarNo ratings yet

- Lecture 1 Surface and Interfacial PhenomenaDocument26 pagesLecture 1 Surface and Interfacial Phenomenabattal eduNo ratings yet

- DIY Custom NeoPixel Rings From ScratchDocument12 pagesDIY Custom NeoPixel Rings From Scratchdaniel deeeNo ratings yet

- Age Frequency Percentage %Document9 pagesAge Frequency Percentage %Jolly Mae CatabayNo ratings yet

- Lecture Dimensionality ReductionDocument34 pagesLecture Dimensionality ReductionAlbert FengNo ratings yet

- 6.VLSI Architecture Design For Analysis of Fast Locking ADPLL Via Feed Forward Compensation Algorithm (33-38)Document6 pages6.VLSI Architecture Design For Analysis of Fast Locking ADPLL Via Feed Forward Compensation Algorithm (33-38)ijcctsNo ratings yet

- Fillet Welded JointsDocument4 pagesFillet Welded Jointsjocelyn beltranNo ratings yet

- Oishi GroupDocument20 pagesOishi GroupCamilleJoyceAdrianoNo ratings yet

- Agenda Kick Off Meeting FINALDocument2 pagesAgenda Kick Off Meeting FINALСлободан Кљајић100% (1)