Professional Documents

Culture Documents

Chemical Activity Barometer

Chemical Activity Barometer

Uploaded by

CEO DailyCopyright:

Available Formats

You might also like

- Samsung Class Action SuitDocument80 pagesSamsung Class Action SuitTMJ4 News100% (2)

- Dhanya - Final ReadytoprintDocument86 pagesDhanya - Final Readytoprintಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- General Electric "GE's Imagination BreakthroughsDocument40 pagesGeneral Electric "GE's Imagination BreakthroughsTayyaba Mahr100% (1)

- Options Trading StrategiesDocument6 pagesOptions Trading Strategiessumeetsj87% (23)

- Barclays Oil ReportDocument55 pagesBarclays Oil ReportGargar100% (1)

- Trackign Business Cycles in Brazil With Composite Indexes of Coincident and Leading Economic IndicatorsDocument29 pagesTrackign Business Cycles in Brazil With Composite Indexes of Coincident and Leading Economic IndicatorssbrownvNo ratings yet

- Stock Market Fluctuations and The Business Cycle: SSRN Electronic Journal September 2001Document32 pagesStock Market Fluctuations and The Business Cycle: SSRN Electronic Journal September 2001nguyenvanlanh_ql04No ratings yet

- Durable Goods GSDocument1 pageDurable Goods GSZerohedgeNo ratings yet

- Relationship Between Macroeconomic Indicators and Economic Cycles in U.SDocument12 pagesRelationship Between Macroeconomic Indicators and Economic Cycles in U.SMuhammet Ali CETINNo ratings yet

- The Prediction of RoeDocument44 pagesThe Prediction of RoeWill YingNo ratings yet

- Excecutive SummaryDocument18 pagesExcecutive SummaryAnjali Bansal GuptaNo ratings yet

- ECO6433 Term Paper Jason KrausDocument14 pagesECO6433 Term Paper Jason KrausCristian CernegaNo ratings yet

- Macroeconomic Factors and Yield Curve For The Emerging Indian EconomyDocument28 pagesMacroeconomic Factors and Yield Curve For The Emerging Indian EconomyMandar NadgoudaNo ratings yet

- Fundamental Analysis: 1. OverviewDocument20 pagesFundamental Analysis: 1. OverviewRahul PujariNo ratings yet

- An Econometric Analysis of Inventory Turnover Performance in Retail ServicesDocument35 pagesAn Econometric Analysis of Inventory Turnover Performance in Retail Servicespruthvi9999No ratings yet

- Learn Retail - Inventory - Productivity - Analysis - and - BenchmaDocument36 pagesLearn Retail - Inventory - Productivity - Analysis - and - BenchmaPatterns of IvyNo ratings yet

- Creating A Cost-of-Doing-Business Index: Alexandru Voicu Michael L. LahrDocument51 pagesCreating A Cost-of-Doing-Business Index: Alexandru Voicu Michael L. LahrRalf Marcos EhmkeNo ratings yet

- Econ Ind Assignment 2015Document5 pagesEcon Ind Assignment 2015api-304774443No ratings yet

- 2.3 Analysis of Financial RatiosDocument2 pages2.3 Analysis of Financial RatiosariaNo ratings yet

- Bodie Investments 12e IM CH17Document3 pagesBodie Investments 12e IM CH17lexon_kbNo ratings yet

- Lecture Eight Analysis and Interpretation of Financial StatementDocument19 pagesLecture Eight Analysis and Interpretation of Financial StatementSoledad PerezNo ratings yet

- IIP - Vs - PMI, DifferencesDocument5 pagesIIP - Vs - PMI, DifferencesChetan GuptaNo ratings yet

- July August 2022 Stock Market Report CtaDocument42 pagesJuly August 2022 Stock Market Report CtaaNo ratings yet

- 9676-Article Text-36134-2-10-20160502.pdf Brazil PDFDocument8 pages9676-Article Text-36134-2-10-20160502.pdf Brazil PDFwahyu erlanggaNo ratings yet

- A Descriptive Analysis of Economic IndicatorsDocument11 pagesA Descriptive Analysis of Economic IndicatorsTeboho QholoshaNo ratings yet

- Financial Ratio AnalysisDocument80 pagesFinancial Ratio AnalysisRajesh BathulaNo ratings yet

- Economic Modelling and Regional Impact Analysis: Key FindingsDocument26 pagesEconomic Modelling and Regional Impact Analysis: Key Findingssultan alshammariNo ratings yet

- EOP Mid ProjectDocument9 pagesEOP Mid ProjectHamza ShafiqNo ratings yet

- U.S. Key Economic Indicators: 1 Auto and Truck SalesDocument24 pagesU.S. Key Economic Indicators: 1 Auto and Truck SalesMohammad Joynal AbedinNo ratings yet

- Barometric Method of Forecastin1Document2 pagesBarometric Method of Forecastin1AaruniNo ratings yet

- Profit US BanksDocument49 pagesProfit US BanksFlaviub23No ratings yet

- 2 Debreceny XBRL Ratios 20101213Document31 pages2 Debreceny XBRL Ratios 20101213Ardi PrawiroNo ratings yet

- Modeling GDP Fluctuations With Agent-Based ModelDocument10 pagesModeling GDP Fluctuations With Agent-Based ModelDev DrudiNo ratings yet

- Annual Policy Statement For The Year 2006-07: Reserve Bank of India MumbaiDocument74 pagesAnnual Policy Statement For The Year 2006-07: Reserve Bank of India Mumbaisanju2k9bitNo ratings yet

- Barometric MethodsDocument5 pagesBarometric MethodsMaria ShamsNo ratings yet

- Gov Matters 5 No AnnexDocument45 pagesGov Matters 5 No AnnexLaura McMilliganNo ratings yet

- Research Paper 1Document4 pagesResearch Paper 1kejsi bylykuNo ratings yet

- Economics and Business Strategy - Economic Crisis and Its Impact On Strategic Decisions in Emerging Countries - PHD Ricardo BrittoDocument13 pagesEconomics and Business Strategy - Economic Crisis and Its Impact On Strategic Decisions in Emerging Countries - PHD Ricardo BrittoMeghanaKVLNo ratings yet

- Wiley Journal of Accounting Research: This Content Downloaded From 132.174.250.76 On Tue, 01 Sep 2020 21:56:03 UTCDocument20 pagesWiley Journal of Accounting Research: This Content Downloaded From 132.174.250.76 On Tue, 01 Sep 2020 21:56:03 UTCBenjamin NaulaNo ratings yet

- How Much Does Industry Matter ReallyDocument16 pagesHow Much Does Industry Matter ReallyOno JoksimNo ratings yet

- Part II Milestone Overview and Macroeconomics VariablesDocument4 pagesPart II Milestone Overview and Macroeconomics VariablesUsman FarooqNo ratings yet

- An Examination of Audit Report Lag For BanksDocument3 pagesAn Examination of Audit Report Lag For Banksnurul2106No ratings yet

- Sapm (MT)Document12 pagesSapm (MT)Joy NathNo ratings yet

- Macroeconomic Factors and The Stock Market: Journal Buriness Financc &accountingDocument18 pagesMacroeconomic Factors and The Stock Market: Journal Buriness Financc &accountingalfianaNo ratings yet

- Business Structure, Economic Cycles, and National PolicyDocument20 pagesBusiness Structure, Economic Cycles, and National PolicyJohanManuelNo ratings yet

- Financial Statements Analysis - Dhaka Stock ExchangeDocument49 pagesFinancial Statements Analysis - Dhaka Stock ExchangeShubhagata ChakrabortyNo ratings yet

- This Content Downloaded From 213.55.83.51 On Wed, 14 Dec 2022 06:05:04 UTCDocument14 pagesThis Content Downloaded From 213.55.83.51 On Wed, 14 Dec 2022 06:05:04 UTCabdiyooNo ratings yet

- The Income-And Expenditure-Side Estimates of U.S. Output GrowthDocument58 pagesThe Income-And Expenditure-Side Estimates of U.S. Output GrowthgrcchsbbfNo ratings yet

- SSRN Id2365633Document45 pagesSSRN Id2365633fauziahNo ratings yet

- Working With Economic Indicators: Interpretation and SourcesDocument9 pagesWorking With Economic Indicators: Interpretation and SourcesBusiness Expert Press0% (1)

- Leading Indicators in A Globalised World: Ferdinand - Fichtner@ecb - IntDocument17 pagesLeading Indicators in A Globalised World: Ferdinand - Fichtner@ecb - IntStonerNo ratings yet

- PEST Analysis: P E S TDocument25 pagesPEST Analysis: P E S TEdmond Santiago100% (1)

- Tan BankfDocument28 pagesTan BankfTouseefNo ratings yet

- Mduszynski-18112022135942-Topic3-2 - Environment - AnalysisDocument22 pagesMduszynski-18112022135942-Topic3-2 - Environment - AnalysisSviatoslav DzhumanNo ratings yet

- 1.6 Review of LiteratureDocument8 pages1.6 Review of LiteratureMaha LakshmiNo ratings yet

- Timeliness of Audited Financial Reports of Jordanian Listed CompaniesDocument9 pagesTimeliness of Audited Financial Reports of Jordanian Listed CompaniesInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Jordan RosenDocument28 pagesJordan RosenJeffry ORNo ratings yet

- Market PowerDocument44 pagesMarket PowerAlexandre AutranNo ratings yet

- Financial Statement As Instrument For PredictingDocument18 pagesFinancial Statement As Instrument For PredictingnanakethanNo ratings yet

- SSRN Id1105398Document91 pagesSSRN Id1105398Iie SriwijayaNo ratings yet

- Corporate Default Projection Using Machine Learning PDFDocument40 pagesCorporate Default Projection Using Machine Learning PDFaa aaNo ratings yet

- Parkin 01 PDFDocument28 pagesParkin 01 PDFEugenio MartinezNo ratings yet

- Channel Design 1Document7 pagesChannel Design 1Saurabh GuptaNo ratings yet

- Designing and Managing Service ProcessesDocument17 pagesDesigning and Managing Service ProcessesNeza RuzannaNo ratings yet

- SD Questions About Pricing ConditionDocument9 pagesSD Questions About Pricing ConditionAniruddha Chakraborty100% (1)

- Discrepancies and DivergencesDocument5 pagesDiscrepancies and DivergencesZinck Hansen100% (1)

- Push and Pull Strategy 1Document6 pagesPush and Pull Strategy 1kiranaishaNo ratings yet

- Nike Ships Products Directly To CustomersDocument8 pagesNike Ships Products Directly To CustomersradhikaNo ratings yet

- Postal Ballot Form FormatDocument4 pagesPostal Ballot Form FormatGaurav Kumar SharmaNo ratings yet

- Senior Vice President Human Resources in Washington DC Baltimore MD Resume Tom MirgonDocument3 pagesSenior Vice President Human Resources in Washington DC Baltimore MD Resume Tom MirgonTomMirgonNo ratings yet

- Navigating An Agile TransformationDocument16 pagesNavigating An Agile Transformationmhamrawy100% (1)

- Lydia Sumipat v. Brigido BangaDocument2 pagesLydia Sumipat v. Brigido BangaRosanne SoliteNo ratings yet

- Ass Mar 2Document21 pagesAss Mar 2hana_kimi_91No ratings yet

- Marikina Valley vs. FlojoDocument9 pagesMarikina Valley vs. FlojoRose Ann CalanglangNo ratings yet

- International BusinessDocument24 pagesInternational BusinessRaj KumarNo ratings yet

- Indian Oil CorporationDocument48 pagesIndian Oil CorporationShubha Shree100% (6)

- Group D7: Giridaran - Moksh - Mithila - Revant - Rhythym - SwapnilDocument6 pagesGroup D7: Giridaran - Moksh - Mithila - Revant - Rhythym - Swapnilrev1202No ratings yet

- EntrepreneurshipDocument10 pagesEntrepreneurshipMaham AnwarNo ratings yet

- PLANNING AND WORKING CAPITAL MANAGEMENT (Chapter 3)Document3 pagesPLANNING AND WORKING CAPITAL MANAGEMENT (Chapter 3)Marie Nica J. GarciaNo ratings yet

- MonopolyDocument49 pagesMonopolybarkeNo ratings yet

- Final Course Outline-Marketing of Financial Products & ServicesDocument3 pagesFinal Course Outline-Marketing of Financial Products & ServicesDivya AhujaNo ratings yet

- Sap Fico Fresher ResumeDocument3 pagesSap Fico Fresher Resumemoody84100% (1)

- Future Generali Brochure PDFDocument19 pagesFuture Generali Brochure PDFSangeeta LakhoteNo ratings yet

- Control Chart GraphDocument18 pagesControl Chart Graphapi-3852736100% (1)

- Factoring & Forfeiting: Learning ObjectivesDocument7 pagesFactoring & Forfeiting: Learning ObjectivesLohith SanjeevNo ratings yet

- Bourse Stock ExchangeDocument20 pagesBourse Stock ExchangeSiva IddipilliNo ratings yet

- Penawaran Harga PT. Sinar Laut InternusaDocument26 pagesPenawaran Harga PT. Sinar Laut InternusaSalwa AnggreaniNo ratings yet

- New Microsoft Office Excel WorksheetDocument164 pagesNew Microsoft Office Excel WorksheetMohiddinBhattNo ratings yet

Chemical Activity Barometer

Chemical Activity Barometer

Uploaded by

CEO DailyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chemical Activity Barometer

Chemical Activity Barometer

Uploaded by

CEO DailyCopyright:

Available Formats

Chemical Activity Barometer

March 2013

American chemistry is essential to the U.S. economy. Chemistrys early position in the supply chain gives the American Chemistry

Council (ACC) the ability to identify emerging trends in the U.S. economy and specific sectors outside of, but closely linked to, the

business of chemistry.

The Chemical Activity Barometer (CAB), the ACCs first-of-its kind, leading macroeconomic indicator will highlight the peaks and

troughs in the overall U.S. economy and illuminate potential trends in market sectors outside of chemistry. The barometer is a critical

tool for evaluating the direction of the U.S. economy.

The index provides a longer lead (performs better) than the National Bureau of Economic Research (NBER). The CAB leads by two to

fourteen months, with an average lead of eight months.

How is it created?

The CAB is a composite index which comprises indicators drawn from a range of chemicals and sectors, including chlorine and other

alkalies, pigments, plastic resins and other selected basic industrial chemicals. It first originated through a study of the relationship

between the business cycles in the production of selected chemicals and cycles in the larger economy during the period from 1947 to

2011. Other specific indicators used include:

Hours worked in chemicals;

Chemical company stock data; publicly sourced, chemical price information;

End-use (or customer) industry sales-to-inventories; and

Several broader leading economic measures (building permits and ISM PMI new orders).

The CAB is constructed using a five-step procedure similar to that used by the Conference Board to calculate composite indexes:

1. Calculate month-to-month changes in the component indices;

2. Adjust month-to-month changes by multiplying them by the components weighting;

3. Sum the adjusted month-to-month changes (across the components for each month);

4. Compute preliminary levels of the composite index; and

5. Rebase the composite index to reflect the average lead (in months) of an average 100 in the base year (the year 2007 was

used) of a reference time series (the Federal Reserves Industrial Production index was used).

To update the CAB from month to month, steps 1 through 4 are followed to incorporate the most recent six months of data. The

revisions to the base year (step 5) are made when the Federal Reserve changes its base year for the industrial production (IP) index.

The CAB is designed and prepared in compliance with ACCs Antitrust Guidelines and FTC Safe Harbor Guidelines; does not use company-specific price

information as input data; and data is aggregated such that company-specific and product-specific data cannot be determined.

The CAB and its relationship to the broader economy

What is a leading indicator?

The CAB is a composite index of chemical industry activity that produces a leading indicator of broader economy-wide activity. To

better understand shifts in the business cycle its important to distinguish between leading, coincident and lagging indicators of the

cycle, which essentially reflect the timing of their movements:

Leading indicators (average weekly hours, new orders, consumer expectations, building permits, stock prices, etc.) are those

that consistently turn before the economy does.

Coincident indicators (employment, industrial production, personal income, business sales, etc.) turn in step with the

economy and track the progress of the business cycle.

Lagging indicators (inventory-to-sales ratios, change in unit labor costs, C&I loans outstanding, etc.) turn after the economy

turns, thus playing a confirming role.

The three types of indicators are important in their own right although most attention is played to the role of leading indicators because they tend to shift direction in advance of the business cycle.

Why is it critical?

The CAB:

Provides earlier forecasting

Determines turning points and likely future trends of the wider U.S. economy

Identifies shifts in other industries within the U.S. economy

Highlights the industrys role in driving economic growth

The CAB is not a leading index of chemical industry activity. Rather, it is a leading index (barometer) based on chemical industry data

that leads overall industrial production and the overall business cycle. The relationship between the CAB and IP index are presented

in Figures 1 and 2. Figure 1 presents the CAB versus the IP index and Figure 2 presents the year-over-year growth rate of the CAB and

the IP index. The shaded columns in both charts represent periods of recessions. The data presented in both figures are based on

three-month-moving averages to smooth volatility and thus ease comparisons. Analysis of the data indicates a positive correlation of

over 0.90 between the industrial production index and the CAB eight months prior.

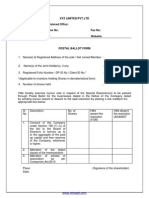

The CAB vs. Industrial Production Index (A Long and Short-Term View)

Index where 2007=100 (3MMA) (Figure 1)

% Change Year-over-Year (3MMA) (Figure 2)

Index where 2007=100 (3MMA) (Figure 3)

% Change Year-over-Year (3MMA) (Figure 4)

You might also like

- Samsung Class Action SuitDocument80 pagesSamsung Class Action SuitTMJ4 News100% (2)

- Dhanya - Final ReadytoprintDocument86 pagesDhanya - Final Readytoprintಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- General Electric "GE's Imagination BreakthroughsDocument40 pagesGeneral Electric "GE's Imagination BreakthroughsTayyaba Mahr100% (1)

- Options Trading StrategiesDocument6 pagesOptions Trading Strategiessumeetsj87% (23)

- Barclays Oil ReportDocument55 pagesBarclays Oil ReportGargar100% (1)

- Trackign Business Cycles in Brazil With Composite Indexes of Coincident and Leading Economic IndicatorsDocument29 pagesTrackign Business Cycles in Brazil With Composite Indexes of Coincident and Leading Economic IndicatorssbrownvNo ratings yet

- Stock Market Fluctuations and The Business Cycle: SSRN Electronic Journal September 2001Document32 pagesStock Market Fluctuations and The Business Cycle: SSRN Electronic Journal September 2001nguyenvanlanh_ql04No ratings yet

- Durable Goods GSDocument1 pageDurable Goods GSZerohedgeNo ratings yet

- Relationship Between Macroeconomic Indicators and Economic Cycles in U.SDocument12 pagesRelationship Between Macroeconomic Indicators and Economic Cycles in U.SMuhammet Ali CETINNo ratings yet

- The Prediction of RoeDocument44 pagesThe Prediction of RoeWill YingNo ratings yet

- Excecutive SummaryDocument18 pagesExcecutive SummaryAnjali Bansal GuptaNo ratings yet

- ECO6433 Term Paper Jason KrausDocument14 pagesECO6433 Term Paper Jason KrausCristian CernegaNo ratings yet

- Macroeconomic Factors and Yield Curve For The Emerging Indian EconomyDocument28 pagesMacroeconomic Factors and Yield Curve For The Emerging Indian EconomyMandar NadgoudaNo ratings yet

- Fundamental Analysis: 1. OverviewDocument20 pagesFundamental Analysis: 1. OverviewRahul PujariNo ratings yet

- An Econometric Analysis of Inventory Turnover Performance in Retail ServicesDocument35 pagesAn Econometric Analysis of Inventory Turnover Performance in Retail Servicespruthvi9999No ratings yet

- Learn Retail - Inventory - Productivity - Analysis - and - BenchmaDocument36 pagesLearn Retail - Inventory - Productivity - Analysis - and - BenchmaPatterns of IvyNo ratings yet

- Creating A Cost-of-Doing-Business Index: Alexandru Voicu Michael L. LahrDocument51 pagesCreating A Cost-of-Doing-Business Index: Alexandru Voicu Michael L. LahrRalf Marcos EhmkeNo ratings yet

- Econ Ind Assignment 2015Document5 pagesEcon Ind Assignment 2015api-304774443No ratings yet

- 2.3 Analysis of Financial RatiosDocument2 pages2.3 Analysis of Financial RatiosariaNo ratings yet

- Bodie Investments 12e IM CH17Document3 pagesBodie Investments 12e IM CH17lexon_kbNo ratings yet

- Lecture Eight Analysis and Interpretation of Financial StatementDocument19 pagesLecture Eight Analysis and Interpretation of Financial StatementSoledad PerezNo ratings yet

- IIP - Vs - PMI, DifferencesDocument5 pagesIIP - Vs - PMI, DifferencesChetan GuptaNo ratings yet

- July August 2022 Stock Market Report CtaDocument42 pagesJuly August 2022 Stock Market Report CtaaNo ratings yet

- 9676-Article Text-36134-2-10-20160502.pdf Brazil PDFDocument8 pages9676-Article Text-36134-2-10-20160502.pdf Brazil PDFwahyu erlanggaNo ratings yet

- A Descriptive Analysis of Economic IndicatorsDocument11 pagesA Descriptive Analysis of Economic IndicatorsTeboho QholoshaNo ratings yet

- Financial Ratio AnalysisDocument80 pagesFinancial Ratio AnalysisRajesh BathulaNo ratings yet

- Economic Modelling and Regional Impact Analysis: Key FindingsDocument26 pagesEconomic Modelling and Regional Impact Analysis: Key Findingssultan alshammariNo ratings yet

- EOP Mid ProjectDocument9 pagesEOP Mid ProjectHamza ShafiqNo ratings yet

- U.S. Key Economic Indicators: 1 Auto and Truck SalesDocument24 pagesU.S. Key Economic Indicators: 1 Auto and Truck SalesMohammad Joynal AbedinNo ratings yet

- Barometric Method of Forecastin1Document2 pagesBarometric Method of Forecastin1AaruniNo ratings yet

- Profit US BanksDocument49 pagesProfit US BanksFlaviub23No ratings yet

- 2 Debreceny XBRL Ratios 20101213Document31 pages2 Debreceny XBRL Ratios 20101213Ardi PrawiroNo ratings yet

- Modeling GDP Fluctuations With Agent-Based ModelDocument10 pagesModeling GDP Fluctuations With Agent-Based ModelDev DrudiNo ratings yet

- Annual Policy Statement For The Year 2006-07: Reserve Bank of India MumbaiDocument74 pagesAnnual Policy Statement For The Year 2006-07: Reserve Bank of India Mumbaisanju2k9bitNo ratings yet

- Barometric MethodsDocument5 pagesBarometric MethodsMaria ShamsNo ratings yet

- Gov Matters 5 No AnnexDocument45 pagesGov Matters 5 No AnnexLaura McMilliganNo ratings yet

- Research Paper 1Document4 pagesResearch Paper 1kejsi bylykuNo ratings yet

- Economics and Business Strategy - Economic Crisis and Its Impact On Strategic Decisions in Emerging Countries - PHD Ricardo BrittoDocument13 pagesEconomics and Business Strategy - Economic Crisis and Its Impact On Strategic Decisions in Emerging Countries - PHD Ricardo BrittoMeghanaKVLNo ratings yet

- Wiley Journal of Accounting Research: This Content Downloaded From 132.174.250.76 On Tue, 01 Sep 2020 21:56:03 UTCDocument20 pagesWiley Journal of Accounting Research: This Content Downloaded From 132.174.250.76 On Tue, 01 Sep 2020 21:56:03 UTCBenjamin NaulaNo ratings yet

- How Much Does Industry Matter ReallyDocument16 pagesHow Much Does Industry Matter ReallyOno JoksimNo ratings yet

- Part II Milestone Overview and Macroeconomics VariablesDocument4 pagesPart II Milestone Overview and Macroeconomics VariablesUsman FarooqNo ratings yet

- An Examination of Audit Report Lag For BanksDocument3 pagesAn Examination of Audit Report Lag For Banksnurul2106No ratings yet

- Sapm (MT)Document12 pagesSapm (MT)Joy NathNo ratings yet

- Macroeconomic Factors and The Stock Market: Journal Buriness Financc &accountingDocument18 pagesMacroeconomic Factors and The Stock Market: Journal Buriness Financc &accountingalfianaNo ratings yet

- Business Structure, Economic Cycles, and National PolicyDocument20 pagesBusiness Structure, Economic Cycles, and National PolicyJohanManuelNo ratings yet

- Financial Statements Analysis - Dhaka Stock ExchangeDocument49 pagesFinancial Statements Analysis - Dhaka Stock ExchangeShubhagata ChakrabortyNo ratings yet

- This Content Downloaded From 213.55.83.51 On Wed, 14 Dec 2022 06:05:04 UTCDocument14 pagesThis Content Downloaded From 213.55.83.51 On Wed, 14 Dec 2022 06:05:04 UTCabdiyooNo ratings yet

- The Income-And Expenditure-Side Estimates of U.S. Output GrowthDocument58 pagesThe Income-And Expenditure-Side Estimates of U.S. Output GrowthgrcchsbbfNo ratings yet

- SSRN Id2365633Document45 pagesSSRN Id2365633fauziahNo ratings yet

- Working With Economic Indicators: Interpretation and SourcesDocument9 pagesWorking With Economic Indicators: Interpretation and SourcesBusiness Expert Press0% (1)

- Leading Indicators in A Globalised World: Ferdinand - Fichtner@ecb - IntDocument17 pagesLeading Indicators in A Globalised World: Ferdinand - Fichtner@ecb - IntStonerNo ratings yet

- PEST Analysis: P E S TDocument25 pagesPEST Analysis: P E S TEdmond Santiago100% (1)

- Tan BankfDocument28 pagesTan BankfTouseefNo ratings yet

- Mduszynski-18112022135942-Topic3-2 - Environment - AnalysisDocument22 pagesMduszynski-18112022135942-Topic3-2 - Environment - AnalysisSviatoslav DzhumanNo ratings yet

- 1.6 Review of LiteratureDocument8 pages1.6 Review of LiteratureMaha LakshmiNo ratings yet

- Timeliness of Audited Financial Reports of Jordanian Listed CompaniesDocument9 pagesTimeliness of Audited Financial Reports of Jordanian Listed CompaniesInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Jordan RosenDocument28 pagesJordan RosenJeffry ORNo ratings yet

- Market PowerDocument44 pagesMarket PowerAlexandre AutranNo ratings yet

- Financial Statement As Instrument For PredictingDocument18 pagesFinancial Statement As Instrument For PredictingnanakethanNo ratings yet

- SSRN Id1105398Document91 pagesSSRN Id1105398Iie SriwijayaNo ratings yet

- Corporate Default Projection Using Machine Learning PDFDocument40 pagesCorporate Default Projection Using Machine Learning PDFaa aaNo ratings yet

- Parkin 01 PDFDocument28 pagesParkin 01 PDFEugenio MartinezNo ratings yet

- Channel Design 1Document7 pagesChannel Design 1Saurabh GuptaNo ratings yet

- Designing and Managing Service ProcessesDocument17 pagesDesigning and Managing Service ProcessesNeza RuzannaNo ratings yet

- SD Questions About Pricing ConditionDocument9 pagesSD Questions About Pricing ConditionAniruddha Chakraborty100% (1)

- Discrepancies and DivergencesDocument5 pagesDiscrepancies and DivergencesZinck Hansen100% (1)

- Push and Pull Strategy 1Document6 pagesPush and Pull Strategy 1kiranaishaNo ratings yet

- Nike Ships Products Directly To CustomersDocument8 pagesNike Ships Products Directly To CustomersradhikaNo ratings yet

- Postal Ballot Form FormatDocument4 pagesPostal Ballot Form FormatGaurav Kumar SharmaNo ratings yet

- Senior Vice President Human Resources in Washington DC Baltimore MD Resume Tom MirgonDocument3 pagesSenior Vice President Human Resources in Washington DC Baltimore MD Resume Tom MirgonTomMirgonNo ratings yet

- Navigating An Agile TransformationDocument16 pagesNavigating An Agile Transformationmhamrawy100% (1)

- Lydia Sumipat v. Brigido BangaDocument2 pagesLydia Sumipat v. Brigido BangaRosanne SoliteNo ratings yet

- Ass Mar 2Document21 pagesAss Mar 2hana_kimi_91No ratings yet

- Marikina Valley vs. FlojoDocument9 pagesMarikina Valley vs. FlojoRose Ann CalanglangNo ratings yet

- International BusinessDocument24 pagesInternational BusinessRaj KumarNo ratings yet

- Indian Oil CorporationDocument48 pagesIndian Oil CorporationShubha Shree100% (6)

- Group D7: Giridaran - Moksh - Mithila - Revant - Rhythym - SwapnilDocument6 pagesGroup D7: Giridaran - Moksh - Mithila - Revant - Rhythym - Swapnilrev1202No ratings yet

- EntrepreneurshipDocument10 pagesEntrepreneurshipMaham AnwarNo ratings yet

- PLANNING AND WORKING CAPITAL MANAGEMENT (Chapter 3)Document3 pagesPLANNING AND WORKING CAPITAL MANAGEMENT (Chapter 3)Marie Nica J. GarciaNo ratings yet

- MonopolyDocument49 pagesMonopolybarkeNo ratings yet

- Final Course Outline-Marketing of Financial Products & ServicesDocument3 pagesFinal Course Outline-Marketing of Financial Products & ServicesDivya AhujaNo ratings yet

- Sap Fico Fresher ResumeDocument3 pagesSap Fico Fresher Resumemoody84100% (1)

- Future Generali Brochure PDFDocument19 pagesFuture Generali Brochure PDFSangeeta LakhoteNo ratings yet

- Control Chart GraphDocument18 pagesControl Chart Graphapi-3852736100% (1)

- Factoring & Forfeiting: Learning ObjectivesDocument7 pagesFactoring & Forfeiting: Learning ObjectivesLohith SanjeevNo ratings yet

- Bourse Stock ExchangeDocument20 pagesBourse Stock ExchangeSiva IddipilliNo ratings yet

- Penawaran Harga PT. Sinar Laut InternusaDocument26 pagesPenawaran Harga PT. Sinar Laut InternusaSalwa AnggreaniNo ratings yet

- New Microsoft Office Excel WorksheetDocument164 pagesNew Microsoft Office Excel WorksheetMohiddinBhattNo ratings yet