Professional Documents

Culture Documents

Prime Cost of Daywork Rates 2014-15

Prime Cost of Daywork Rates 2014-15

Uploaded by

Peter Jean-jacquesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prime Cost of Daywork Rates 2014-15

Prime Cost of Daywork Rates 2014-15

Uploaded by

Peter Jean-jacquesCopyright:

Available Formats

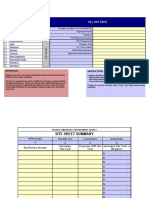

PRIME COST OF DAYWORK RATES BASED ON THE BATJIC AGREEMENT

June 30th 2014 to June 28th 2015

Notes

1 BATJIC STANDARD HOURS AND HOLIDAYS INFORMATION

a) The total number of hours worked per annum (pa)

without holiday pay = 2028hrs.

Calculations

52 Weeks x 39 hrs/week =

2028 hrs pa

17 Days Annual Holiday

at 8 hrs/day

4 Days Annual Holiday

at 7 hrs/day

b) BATJIC pays 29 days holiday to a total of 227 hrs.

7 Days Public Holiday

at 8 hrs/day

1 Day Public Holiday

at 7 hrs/day

c) This means that the standard number of hours worked pa = 1801

d) This means that there are 46.2 weeks worked in a year.

What are the Prime Cost of Day Work Rates?

The Prime Cost of Day Work Rates are a guide for employers

showing them how to work out the real cost of employment

so that it can be factored into quotes for work. They show

the workings out for these calculations based on application

of the current BATJIC working rule agreement and pay rates.

However, they do not cover other costs such as workers travel or

accommodation, and do not cover any of the non employment

costs that employers need to factor into quotes for work such as

administration, supervision, materials etc.

2028hrs total - 227hrs

holiday = 1801 hrs

29 days holiday divided by

5 working days per week =

5.8 weeks holiday per year.

EXAMPLES

Advanced Craft

Intermediate Craft

Adult General Operative

436.80pw /

11.20phr

376.35pw /

9.65phr

327.60pw /

8.40phr

46.2 x 436.80=

20,180.16

46.2 x 376.35=

17,387.37

46.2 x 327.60=

15,135.12

20,180.16

17,387.37

15,135.12

2,036.32

1,602.64

1,252.68

2. GUARANTEED MINIMUM EARNINGS

This is the amount of money paid to

the worker for the hours worked. This

excludes benefits and paid holiday.

Note: Those applying intermittent

and consolidated rates of pay for skill,

should refer to Working Rule 1c of the

BATJIC Working Rule Agreement, and

adjust the pay rate accordingly.

Weeks worked pa x weekly

pay = Net Total pa

NET TOTAL PA

3. BASIC EMPLOYERS COSTS AND CONTRIBUTIONS

a) Employers National Insurance

Contributions (ENICs) are paid at

13.8% above earnings threshold of

148 per week.

((Weekly pay - 148) x 13.8%) x 52

b) Holidays with Pay

Hourly rate x 227 Hours

2,542.40

2,190.55

1,906.80

c) CITB Levy at 0.5% (for direct labour

PAYE employees)

(Net Total pay) x 0.5%

113.61

97.89

85.21

d) Stakeholder Pension

Employees contribution up to

13.50 x 52 Weeks

702.00

702.00

702.00

e) Death Benefit

9.13 x 12 months, plus 7.50 per

annum

117.06

117.06

117.06

ANNUAL COST OF EMPLOYMENT

Net Total + a + b + c + d + e

25,691.55

22,097.51

19,198.87

14.27

12.27

10.66

12.34

10.54

9.10

4. HOURLY BASIC RATE

This is the amount that the employer

will have to charge per hour per worker

on that pay scale, to cover wages and

direct employers obligations. This

sum does not include overhead costs,

administration, materials, supervision etc.

Annual Cost of Employment

1801 standard working hours

5. NON PRODUCTIVE HOURLY BASIC RATE

This is the prime cost of employment

per person, which the employer has

to meet even if there is no work for the

employee to do.

(Weekly pay x 46.2) +

((Weekly pay - 148) x 13.8% x 46.2)

1801 standard working hours

The printers / compilers cannot accept any responsibility for the accuracy of the contents above or legal responsibility for any errors contained therein.

All calculations above have been made based on the rounding of all numbers to two decimal places at every stage of calculation.

You might also like

- HR EMail ID Bahrain CountryDocument47 pagesHR EMail ID Bahrain CountryNaveenJainNo ratings yet

- Nanny Share ContractDocument6 pagesNanny Share ContractJax EsiNo ratings yet

- Rajendra Kumar Dubey PDFDocument1 pageRajendra Kumar Dubey PDFSaurabh Upadhyay100% (1)

- NY Bar Review - Trusts Lecture NotesDocument14 pagesNY Bar Review - Trusts Lecture Noteswavygirly50% (2)

- Job Order Costing ExampleDocument3 pagesJob Order Costing ExampleImperoCo LLCNo ratings yet

- C2 PN 003 Manpower Recruit - 0Document8 pagesC2 PN 003 Manpower Recruit - 0ebsmsartNo ratings yet

- Reimbursement FormDocument1 pageReimbursement FormChrisinius Lawrencor HodakahnNo ratings yet

- Tempo Craft MixDocument2 pagesTempo Craft MixkamlNo ratings yet

- 2-Year 2014 BaseDocument25 pages2-Year 2014 BaseMohamed MolhamNo ratings yet

- Man HoursDocument2 pagesMan Hourserastus_petersNo ratings yet

- Rate Analysis - UniqueDocument3 pagesRate Analysis - UniqueAjay SastryNo ratings yet

- 1.1 Quotation Format#2, Revised-FinalDocument2 pages1.1 Quotation Format#2, Revised-FinalJing JingNo ratings yet

- Name of Bidder: Bidder'S Proposal Ref.#: Date of Submission of Bid: Revision #Document6 pagesName of Bidder: Bidder'S Proposal Ref.#: Date of Submission of Bid: Revision #Dean DumaguingNo ratings yet

- Estimation MasterDocument25 pagesEstimation MasterfajarNo ratings yet

- Pipe Eng Codes PDFDocument1 pagePipe Eng Codes PDFkamlNo ratings yet

- Planning Handbook: F:/Field Controls/HANDDocument24 pagesPlanning Handbook: F:/Field Controls/HANDespinozcristianNo ratings yet

- Standard Data Book (Road & Bridge)Document10 pagesStandard Data Book (Road & Bridge)Anonymous aNyCxZWNo ratings yet

- CV Sample - 2Document20 pagesCV Sample - 2Lateef Ur REhmanNo ratings yet

- 9736-Schedule Analisis 20180813 R3 - PIPDocument36 pages9736-Schedule Analisis 20180813 R3 - PIPaateka02No ratings yet

- Drawing Atap WP 7Document1 pageDrawing Atap WP 7Fresly PatriaNo ratings yet

- Staffing Management PlanDocument8 pagesStaffing Management PlanPrasad KshirsagarNo ratings yet

- CBD Apartments Boq EstimateDocument271 pagesCBD Apartments Boq EstimateRiddell P JereNo ratings yet

- Wild Carrot Proposal For 3901 Shaw Boulevard - St. Louis, MODocument30 pagesWild Carrot Proposal For 3901 Shaw Boulevard - St. Louis, MOnextSTL.comNo ratings yet

- Bid Form (Boq)Document15 pagesBid Form (Boq)John CedricNo ratings yet

- Fill Out First: Instructions AttentionDocument31 pagesFill Out First: Instructions AttentionGabrielAlejandroMontalvoQuinterosNo ratings yet

- CI-PN-006 Construction Organ Plan - 0Document6 pagesCI-PN-006 Construction Organ Plan - 0ebsmsartNo ratings yet

- Family Budget Planner: Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total AvgDocument8 pagesFamily Budget Planner: Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total AvgRuznaya RuzNo ratings yet

- Furnace Area & VolumeDocument22 pagesFurnace Area & VolumeRajnath Rajbhar PanchamNo ratings yet

- Take: Size of CS Pipe Spool: 6", Spools: 2 Nos., Each of 4 MTRDocument1 pageTake: Size of CS Pipe Spool: 6", Spools: 2 Nos., Each of 4 MTRSafarudin RamliNo ratings yet

- Interim Payment For Interior Plastering WorksDocument14 pagesInterim Payment For Interior Plastering Worksarchie_728No ratings yet

- NAWCPF-MSBI-NCPF-000-CV-RFQ-31072 - 001 - CPF-Civil Works-SOWDocument45 pagesNAWCPF-MSBI-NCPF-000-CV-RFQ-31072 - 001 - CPF-Civil Works-SOWMouhebNo ratings yet

- QAQC Presentation - GIS - DAYDocument28 pagesQAQC Presentation - GIS - DAYsrsureshrajanNo ratings yet

- Asphalting Detailed EstimateDocument19 pagesAsphalting Detailed EstimateAsrar Hussain KhanNo ratings yet

- Hilti Core CuttingDocument5 pagesHilti Core CuttingSarinNo ratings yet

- Template For Preparation of A Tender Document For Design and Build For Construction Works - February, 2022Document103 pagesTemplate For Preparation of A Tender Document For Design and Build For Construction Works - February, 2022MWITA STEPHANONo ratings yet

- Pre-Contract Weekly Status Report For Projects To Be ImplementedDocument8 pagesPre-Contract Weekly Status Report For Projects To Be ImplementedDaniel EvansNo ratings yet

- BORL Feedback: Workshop On Project Execution StrategiesDocument24 pagesBORL Feedback: Workshop On Project Execution StrategiesVinothrajaNo ratings yet

- JC-1 Remodel: Project Number: Address: 3030 Travis St. Project DescriptionDocument44 pagesJC-1 Remodel: Project Number: Address: 3030 Travis St. Project DescriptionjcccgiNo ratings yet

- PR SteelDocument3 pagesPR SteelCY LeeNo ratings yet

- Estimating ToolDocument65 pagesEstimating ToolanaNo ratings yet

- 3963 Dgen 0 04 0001 - D PDFDocument172 pages3963 Dgen 0 04 0001 - D PDFDaniyal KhursheedNo ratings yet

- Supply of Pipe and Fittings BlankDocument7 pagesSupply of Pipe and Fittings BlankMiko AbiNo ratings yet

- Government & Prime Contractor Opportunities List Scheduled For November 4, 2013Document16 pagesGovernment & Prime Contractor Opportunities List Scheduled For November 4, 2013georgeptacNo ratings yet

- COST ESTIMATE (Fire ProtectionSystem)Document10 pagesCOST ESTIMATE (Fire ProtectionSystem)Nikki RobertsNo ratings yet

- Estimator for Building _ Building Cost Calculator _ Building Construction Cost Estimators _ Building Paint Job Cost Estimate service _ Estimate Building Costs _ Construction Estimators _ Building cost calculator.pdfDocument2 pagesEstimator for Building _ Building Cost Calculator _ Building Construction Cost Estimators _ Building Paint Job Cost Estimate service _ Estimate Building Costs _ Construction Estimators _ Building cost calculator.pdfSelvaraj VillyNo ratings yet

- Cost S CurveDocument1 pageCost S Curvexchannel28No ratings yet

- Payment Schedule FNLDocument2 pagesPayment Schedule FNLAndrew ArahaNo ratings yet

- PO Tracking Airfield Pavement Remediation Works at HIA (559/QQA4)Document10 pagesPO Tracking Airfield Pavement Remediation Works at HIA (559/QQA4)Pranoy JosephNo ratings yet

- Arctic Insultion Case Study - Rashik GuptaDocument12 pagesArctic Insultion Case Study - Rashik GuptaRashik Gupta50% (2)

- Engineering Administration and Cost - Progress ReportingDocument13 pagesEngineering Administration and Cost - Progress Reportingaugur886No ratings yet

- Bill of MaterialDocument102 pagesBill of MaterialPrasad RajashekarNo ratings yet

- 3-CS-02.0 Measurements and PaymentsDocument10 pages3-CS-02.0 Measurements and PaymentsVinodh PalanichamyNo ratings yet

- Boq Working JharkhandDocument36 pagesBoq Working JharkhandsmithNo ratings yet

- Crane Painting SystemDocument1 pageCrane Painting SystemdbpatNo ratings yet

- Construction of Multi-Purpose Building (MPB) in Datu Mamintal National High School, Bubong, Lanao Del SurDocument31 pagesConstruction of Multi-Purpose Building (MPB) in Datu Mamintal National High School, Bubong, Lanao Del SurSalaman II Bongcarawan MangcaNo ratings yet

- Construction Material Requisition 14: Project Code: Uttara Project Name: DateDocument14 pagesConstruction Material Requisition 14: Project Code: Uttara Project Name: Datechriscivil12No ratings yet

- Free Download Electrician Quotation Template Word FormatDocument2 pagesFree Download Electrician Quotation Template Word FormatHenry ChipindaNo ratings yet

- Estimating Costing VDocument4 pagesEstimating Costing Vशंकर थापाNo ratings yet

- USS - Clairton Battery CDocument10 pagesUSS - Clairton Battery CRay KelleyNo ratings yet

- S No. Item Discription Price Remarks: Total 707426Document3 pagesS No. Item Discription Price Remarks: Total 707426Gaurav MahajanNo ratings yet

- CP 0191 Payment CertificationDocument244 pagesCP 0191 Payment CertificationtabaquiNo ratings yet

- Final Invoice Storage Tank MagdyDocument6 pagesFinal Invoice Storage Tank MagdyAhmed KhalifaNo ratings yet

- School For Postgraduate Studies: Master of Project Planning & Management-MppDocument17 pagesSchool For Postgraduate Studies: Master of Project Planning & Management-MppSaidi BuyeraNo ratings yet

- Final Tentative Agreement 9-8-2022Document10 pagesFinal Tentative Agreement 9-8-2022inforumdocsNo ratings yet

- Soil PenetrometerDocument4 pagesSoil PenetrometerPeter Jean-jacquesNo ratings yet

- Sports Field DrainageDocument3 pagesSports Field DrainagePeter Jean-jacquesNo ratings yet

- Keyboard ShortcutsDocument2 pagesKeyboard ShortcutsUmt KcNo ratings yet

- Design of Custom ElementsDocument5 pagesDesign of Custom ElementsPeter Jean-jacquesNo ratings yet

- Equipment: Method of Assessment:: Block Extraction and ExaminationDocument2 pagesEquipment: Method of Assessment:: Block Extraction and ExaminationPeter Jean-jacquesNo ratings yet

- RICS Standard Form For Consultants AppointmentDocument39 pagesRICS Standard Form For Consultants AppointmentPeter Jean-jacquesNo ratings yet

- Argos Usa - Cements For MasonryDocument39 pagesArgos Usa - Cements For MasonryPeter Jean-jacques0% (1)

- Steel Sheet Piling SpecificationDocument5 pagesSteel Sheet Piling SpecificationPeter Jean-jacquesNo ratings yet

- Metal Spiral Stairs Install ManualDocument36 pagesMetal Spiral Stairs Install ManualPeter Jean-jacquesNo ratings yet

- Approach Slab DetailsDocument2 pagesApproach Slab DetailsPeter Jean-jacquesNo ratings yet

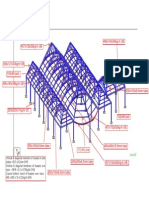

- Cathedral Roof Truss StructureDocument1 pageCathedral Roof Truss StructurePeter Jean-jacquesNo ratings yet

- Weep Hole Part Elevation Section: Drawn: Checked: Approved: Date: CAW 5/9/2011Document1 pageWeep Hole Part Elevation Section: Drawn: Checked: Approved: Date: CAW 5/9/2011Peter Jean-jacquesNo ratings yet

- f' f φ = 29° γ = 120 pcf: AssumptionsDocument3 pagesf' f φ = 29° γ = 120 pcf: AssumptionsPeter Jean-jacquesNo ratings yet

- The Champion Legal Ads 02-04-21Document38 pagesThe Champion Legal Ads 02-04-21Donna S. SeayNo ratings yet

- Exide Life Smart Term Plus - Benefit Illustration A Non-Linked, Non-Participating Individual Life Insurance Savings PlanDocument5 pagesExide Life Smart Term Plus - Benefit Illustration A Non-Linked, Non-Participating Individual Life Insurance Savings PlanEticala RohithNo ratings yet

- Philhealth Agency's Mandate and FunctionsDocument10 pagesPhilhealth Agency's Mandate and FunctionsjonaNo ratings yet

- 2010 L 42 Valuation Basis (Health)Document18 pages2010 L 42 Valuation Basis (Health)VivekNo ratings yet

- Alexander-Howden Co LTD V CIRDocument2 pagesAlexander-Howden Co LTD V CIRCharmaine Ganancial SorianoNo ratings yet

- MortgageServicingBankAccountProgramMSP 2Document2 pagesMortgageServicingBankAccountProgramMSP 2Nye LavalleNo ratings yet

- Acko Car Policy - DCTR00697661837 - 00Document1 pageAcko Car Policy - DCTR00697661837 - 00KaushNo ratings yet

- Resume Update1 Doni Sta BrigidaDocument5 pagesResume Update1 Doni Sta BrigidaMichael Sta BrigidaNo ratings yet

- Belzak Matter - JPMorgan Chase Proof of Claim, January 1, 2011 PDFDocument24 pagesBelzak Matter - JPMorgan Chase Proof of Claim, January 1, 2011 PDFFraudInvestigationBureau50% (2)

- Alternative Dispute Resolution DigestsDocument8 pagesAlternative Dispute Resolution DigestsPrincess Delos ReyesNo ratings yet

- Advanced Accounting RE.Document73 pagesAdvanced Accounting RE.SEMAHAGN ADAMUNo ratings yet

- Reparations Commission v. Universal Deep Sea FishingDocument1 pageReparations Commission v. Universal Deep Sea FishingwuplawschoolNo ratings yet

- Introduction To Risk & Risk Management-1Document28 pagesIntroduction To Risk & Risk Management-1Mehul BharwadNo ratings yet

- Bank Rules On Check Deposits With Multiple Payees MyBankTrackerDocument1 pageBank Rules On Check Deposits With Multiple Payees MyBankTrackerjustin hoyleNo ratings yet

- Residential Valuation Report 6 Birk HallDocument18 pagesResidential Valuation Report 6 Birk Hallcharmi bhanushaliNo ratings yet

- ERM Study ScheduleDocument32 pagesERM Study ScheduleAnonymous guNi9LNo ratings yet

- Form-Loan Express March 2015 PDFDocument3 pagesForm-Loan Express March 2015 PDFJesse Carredo0% (1)

- Contractor All Risk INSURANCEDocument17 pagesContractor All Risk INSURANCEbonny100% (1)

- Time Value of MoneyDocument3 pagesTime Value of MoneyAnshuman TewariNo ratings yet

- Dahl's FilingDocument116 pagesDahl's FilingwhohdNo ratings yet

- HDFC Life ProGrowth Plus IllustrationDocument3 pagesHDFC Life ProGrowth Plus IllustrationSrikanth DornaluNo ratings yet

- BSNLDocument66 pagesBSNLmitulsmodiNo ratings yet

- Series 66 Test SpecsDocument6 pagesSeries 66 Test SpecsSnow BurritoNo ratings yet

- United States Court of Appeals, Third CircuitDocument36 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- L&T DemergerDocument28 pagesL&T DemergerabcdeffabcdefNo ratings yet

- BirlaDocument1 pageBirlaSaurabh SinghNo ratings yet