Professional Documents

Culture Documents

Budget

Budget

Uploaded by

Gimson D ParambilOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget

Budget

Uploaded by

Gimson D ParambilCopyright:

Available Formats

1

BUDGETARY CONTROL

BUDGET: Budget has been defined by CIMA U. K. as, a financial and or quantitative

statement prepared prior to a defined period of time, of the policy to be pursued during that

period for the purpose of achieving a given objective.

Budget is prepared either in quantitative details or monetary details or both. This means that

budget will show the planning in terms of rupees or in quantity or both. A budget is a

statement that is always prepared prior to a defined period of time, the policy to be pursued

in future for the purpose of achieving well-defined objectives is reflected in the budget.

BUDGETARY CONTROL

Budgetary control is actually a means of control in which the actual results are compared

with the budgeted results so that appropriate action may be taken with regard to any

deviations between the two. CIMA London defines budgetary control as, the establishment

of the budgets relating to the responsibilities of executives to the requirements of a policy

and the continuous comparison of actual with budgeted result either to secure by individual

action the objectives of that policy or to provide a firm basis for its revision. Budgetary

control has the following stages.

A. Developing Budgets

B. Recording Actual Performance:

C. Comparison of Budgeted and Actual Performance

D. Corrective Action

Preparation of Budget: A budgetary control is extremely useful for planning and

controlling as described above. However, for getting these benefits, sufficient preparation

should be made. For complete success, a solid foundation should be laid down and in view

of this the following aspects are of crucial importance.

1. Budget Committee: Budget committee consisting of the chief executive, budget officer

and heads of main departments in the organization. The functions of the budget committee

are to get the budgets prepared and then scrutinize the same, to lay down broad policies

regarding the preparation of budgets, to approve the budgets, suggest for revision, to monitor

the implementation and to recommend the action to be taken in a given situation.

2. Budget Centre: A budget centre is a group of activities or a section of the organization for

which budget can be developed. Budget centers should be defined clearly so that preparation

becomes easy.

3. Budget Period: A budget is always prepared prior to a defined period of time. This means

that the period for which a budget is prepared is decided in advance. Thus a budget may be

prepared for three years, one year, six months, one month or even for a week

4. Preparation of an Organization chart: The organization chart will define clearly the

functions to be performed by each executive relating to the budget preparation and his

relationship with other executives. The organization chart may have to be ensure that each

budget center is controlled by an appropriate member of the staff.

5. Budget Manual: A budget manual is defined by ICMA as a document whish sets out the

responsibilities of the person engaged in, the routine of and the forms and records required

for budgetary control. The budget manual thus is a schedule, document or booklet, which

contains different forms to be used, procedures to be followed, budgeting organization

details, and set of instructions to be followed in the budgeting system.

6. Principal Budget Factor: A principal budget factor is that factor the extent of whose

influence must first be assessed in order to prepare the functional budgets. Normally sales is

the key factor or principal budget factor but other factors like production, purchase, skilled

labor may also be the key factors. The key factor puts restrictions on the other functions and

hence it must be considered carefully in advance. So continuous assessment of the business

situation becomes necessary. In all conditions the key factor is the starting point in the

process of preparation of budgets. A typical list of some of the key factor is given below:

Sales: Consumer demand, shortage of sales staff, inadequate advertising.

Material: Availability of supply, restrictions on import Labor: Shortage of labor

Plant: Availability of capacity, bottlenecks in key processes

Management: Lack of capital, pricing policy, lack of skilled employees etc.

7. Accounting Records: It is essential that the accounting system should be able to record

and analyze the transaction involved. A chart of accounts or accounts code should be

maintained which may correspond with the budget centers for establishment of budgets and

finally, control through budgets.

FUNCTIONAL BUDGETS: The Functional Budgets are prepared for each function of the

organization. These budgets are normally prepared for a period of one year and then broken

down to each month. The following budgets are included in this category.

i. Sales Budget: A Sales budget shows forecast of expected sales in the future period and

expressed in quantity of the product to be sold as well as the monetary value of the same. A

Sales Budget may be prepared product wise, territories/ area/ country wise, customer group

wise, salesmen wise as well as time like quarter wise, month wise, weekly etc.

ii. Production Budget: This budget shows the production target to be achieved in the year or

the future period. The production budget is prepared in quantity as well as in monetary

terms. Before preparation of this budget it is necessary to study the principal budget or the

key factor. The principal budget factor can be sales demand or the production capacity or

availability of raw material. The policy of the management regarding the inventory is also

taken into consideration. Production targets are decided by adding the budgeted closing

inventory in the sales forecast and subtracting the opening inventory from the total of the

same. Production Cost Budget is prepared by multiplying the production targets by the

budgeted production cost per unit.

iii. Material Purchase Budget: This budget of materials tot be purchased during the coming

year. For the preparation of this budget, production budget is the starting point if it is the key

factor. If the raw material availability is the key factor, it becomes the starting point. The

desired closing inventory of the raw materials is added to the requirement as per the

production budget and the opening inventory is subtracted from the gross requirements.

iv. Cash Budget: Cash budget is an estimate of cash receipts and cash payments prepared

for each month. In this budget all expected payments, revenue as well as capital and all

receipts, revenue and capital are taken into consideration. The main purpose of cash budget

is to predict the receipts and payments in cash so that the firm will be able to find out the

cash balance at the end of the budget period. This will help the firm to know whether there

will be surplus or deficit at the end of budget period. It will help them to plan for either

investing the surplus or raise necessary amount to finance deficit. Cash budget is prepared in

various ways, but the most popular form of the same is by method of Receipt and Payment

method.

v. Master Budget: All the budgets described above are called as Functional Budgets that

are prepared for the planning of individual function of the organization. For example,

Budgets are prepared for Purchase, Sales, Production, Manpower Planning, and so on. A

master budget which is also called as Compressive Budget is a consolidation of all the

functional budgets. According to ICMA London Master budget is the summery budget

incorporating its component functional budgets and which is finally approved and

employed. For preparation of this budget, all functional budgets are combined together and

the relevant figures are incorporated in preparation of the projected Profit and Loss Account

and Balance Sheet. Thus Master Budget is prepared for the organization and not for

individual functions.

Fixed and Flexible Budgets:

i. Fixed Budget: When a budget is prepared by assuming a fixed percentage of capacity

utilization, it is called as a fixed budget. The Institute of Cost and Management Accountants

of (U.K.) as the budget which is designed to remain unchanged irrespective of the level of

activity actually attained. It is based on a single level of activity. For preparation of this

budget, sales forecast will have to be prepared along with the cost estimate. Cost estimate

can be prepared by segregating the costs according to their behavior i.e. fixed and variable.

Cost predictions should be made element wise and the projected profit or loss can be worked

out by deducing the cost from the sales revenue. The budget may reveal the difference

between the budgeted costs and actual costs but the reason for the deviations may not be

pointed out. A fixed budget may be prepared when the budgeted output and actual output are

quite close and not much deviation exists between the two. In such cases, maximum control

can be exercised between the budgeted performance and actual performance

ii. Flexible Budgets / Sliding Scale Budget: Flexible budget is a budget that is prepared for

different levels of capacity utilization. It can be called as a series of fixed budgets prepared

for different levels of activity. According to ICMA London, a flexible budget as a budget

which, by recognising the difference in behaviour between fixed and variable cost in relation

to fluctuation in output, turnover or other variable factors such as number of employees, is

designed to change appropriately with such fluctuations. Thus a flexible budget covers a

range of activity, it is flexible i.e. easy with variation in production levels and it facilitates

performance measurement and evaluation.

While preparing flexible budget, it is necessary to study the behaviour of cost and

divide them in fixed, variable and semi variable. After doing this, the costs can be estimated

for a given level of activity. It is also necessary to plan the range of activity. It is necessary to

estimate the costs and associate them with chosen level of activity. Finally the profit or loss

at different levels of activity will be computed by comparing the costs with the revenues.

ZERO BASE BUDGETING: is method of budgeting whereby all activities are revaluated

each time budget is formulated and every item of expenditure in the budget is fully justified.

Thus the Zero Base Budgeting involves from scratch or zero.

PERFORMANCE BUDGETING:

It is budgetary system where the input costs are the

performance i.e. the end results. Performance budgets are established in such a manner that

each item of expenditure related to a specific responsibility centre is closely linked with the

performance of that centre. This budgeting is used extensively in the Government and Public

Sector Undertakings.

You might also like

- Unit 3 Strategic ManagementDocument9 pagesUnit 3 Strategic ManagementKarenJoy KJ Navarro OcampoNo ratings yet

- Zero Resistance Book V2.1 Chapters 1 3.compressedDocument107 pagesZero Resistance Book V2.1 Chapters 1 3.compressedalz66No ratings yet

- Group 1 SCM Assignment 2 VF BrandsDocument5 pagesGroup 1 SCM Assignment 2 VF BrandsRahul Mayank88% (8)

- Theory of Cost and ProfitDocument11 pagesTheory of Cost and ProfitCenniel Bautista100% (4)

- Chap9 (Cash & Marketable Securities Management) VanHorne&Brigham, CabreaDocument4 pagesChap9 (Cash & Marketable Securities Management) VanHorne&Brigham, CabreaClaudine DuhapaNo ratings yet

- Book Multiple Choice QuestionsDocument10 pagesBook Multiple Choice Questionszitorocksmyheart0% (1)

- Meaning of Financial PlanningDocument4 pagesMeaning of Financial PlanningSakshi AgarwalNo ratings yet

- Project Report - Management Accounting 2Document5 pagesProject Report - Management Accounting 2Anindyadeep PalNo ratings yet

- Short Essay 1: UnrestrictedDocument8 pagesShort Essay 1: UnrestrictedSatesh KalimuthuNo ratings yet

- SMC Company ProfileDocument2 pagesSMC Company ProfileAldrin CabangbangNo ratings yet

- Note 08Document6 pagesNote 08Tharaka IndunilNo ratings yet

- An Empirical Study of The Effectiveness of Internal Control and Influencing FactorsDocument7 pagesAn Empirical Study of The Effectiveness of Internal Control and Influencing FactorsDedi PramonoNo ratings yet

- CapmDocument7 pagesCapmVaishali ShuklaNo ratings yet

- Financial Market in Pakistan: Financial Markets and Their Roles: Commercial BanksDocument5 pagesFinancial Market in Pakistan: Financial Markets and Their Roles: Commercial BanksAnamMalikNo ratings yet

- Chapter 16 - Securities Firms and Investment BanksDocument2 pagesChapter 16 - Securities Firms and Investment Banksmvlg26No ratings yet

- Corporate Level Strategy: By-Devesh Hari ROLL - NO. - 15 Mpmir 3 SemesterDocument21 pagesCorporate Level Strategy: By-Devesh Hari ROLL - NO. - 15 Mpmir 3 SemesterSuraj RajbharNo ratings yet

- Corporate Governance-As Defined by SECP (Pakistan)Document1 pageCorporate Governance-As Defined by SECP (Pakistan)tehreemNo ratings yet

- Strategic Planning in RetailDocument11 pagesStrategic Planning in RetailDILIP JAINNo ratings yet

- Macroeconomics Definitions ReviewerDocument6 pagesMacroeconomics Definitions ReviewerArizza NocumNo ratings yet

- Chap 19Document14 pagesChap 19N.S.RavikumarNo ratings yet

- Aas 16 Going ConcernDocument5 pagesAas 16 Going ConcernRishabh GuptaNo ratings yet

- 4 Functional Areas of An OrganizationDocument2 pages4 Functional Areas of An OrganizationAkanbi Cerbury DelawNo ratings yet

- Assessment Task 1: Requisites of ObligationDocument5 pagesAssessment Task 1: Requisites of ObligationJoy ConsigeneNo ratings yet

- YakultDocument15 pagesYakultPRIYA KUMARINo ratings yet

- An Analysis of The Inventory Management System (Case Study)Document9 pagesAn Analysis of The Inventory Management System (Case Study)Imelda Maria Tania RosarioNo ratings yet

- Ass. Cov. Pag.Document8 pagesAss. Cov. Pag.Rumi Ferdouswahid MohammedNo ratings yet

- Strategic Management Concepts and Cases 14th Edition David Solutions ManualDocument24 pagesStrategic Management Concepts and Cases 14th Edition David Solutions ManualKeithRomerosNo ratings yet

- Isre 2400Document21 pagesIsre 2400naveedawan321No ratings yet

- Cost of CapitalDocument36 pagesCost of Capitalrambabu100% (1)

- New Venture Financing Lecture Note (Ch-2)Document30 pagesNew Venture Financing Lecture Note (Ch-2)BeamlakNo ratings yet

- Requirement For Accreditation CPAs in Public Practice PDFDocument2 pagesRequirement For Accreditation CPAs in Public Practice PDFRicalyn E. SumpayNo ratings yet

- 100 149 PDFDocument53 pages100 149 PDFSamuelNo ratings yet

- External Factor Evaluation Matrix (Efe)Document14 pagesExternal Factor Evaluation Matrix (Efe)Christian CagasNo ratings yet

- 1 The Basis of Strategy: StructureDocument17 pages1 The Basis of Strategy: StructureAlliah Gianne JacelaNo ratings yet

- Industry AnalysisDocument25 pagesIndustry AnalysisPrashant Tejwani100% (1)

- Citibank's E-Business Strategy For Global Corporate Banking - Cs - 1Document20 pagesCitibank's E-Business Strategy For Global Corporate Banking - Cs - 1piyush aryaNo ratings yet

- BP MidtermDocument4 pagesBP MidtermGelyn CruzNo ratings yet

- Chapter 6 (Installment Sales)Document3 pagesChapter 6 (Installment Sales)Jean100% (1)

- Effects of Errors 2021Document2 pagesEffects of Errors 2021Ali SwizzleNo ratings yet

- Ebook - MARKETING PDFDocument71 pagesEbook - MARKETING PDFJosette BaraquiaNo ratings yet

- Procter & Gamble: Company's ProfileDocument4 pagesProcter & Gamble: Company's ProfileMadiha KhanNo ratings yet

- Economic DevelopmentDocument17 pagesEconomic DevelopmentVher Christopher Ducay100% (1)

- Chapter 3 Managerial-Finance Solutions PDFDocument24 pagesChapter 3 Managerial-Finance Solutions PDFMohammad Mamun UddinNo ratings yet

- Chap 13 Statement of Cash FlowsPractice QuestionsDocument7 pagesChap 13 Statement of Cash FlowsPractice QuestionshatanoloveNo ratings yet

- 3 - IAS 40 - Investment Property - SV PDFDocument16 pages3 - IAS 40 - Investment Property - SV PDFHồ Đan ThụcNo ratings yet

- Report Presentation (SDAM)Document8 pagesReport Presentation (SDAM)Muhamad Faiz SulaimanNo ratings yet

- Chap6: International Trade TheoriesDocument40 pagesChap6: International Trade TheoriesJoydeb Kumar SahaNo ratings yet

- Capital Budgeting and Investment DecisionsDocument3 pagesCapital Budgeting and Investment DecisionsCharmae Agan CaroroNo ratings yet

- What Is A Balance Sheet AuditDocument6 pagesWhat Is A Balance Sheet AuditSOMOSCONo ratings yet

- 13.strategic ControlDocument26 pages13.strategic ControlMarzia Parvin RifatNo ratings yet

- The Balanced Scorecard: A Tool To Implement StrategyDocument39 pagesThe Balanced Scorecard: A Tool To Implement StrategyAilene QuintoNo ratings yet

- Financial Management SummaryDocument3 pagesFinancial Management SummaryChristoph MagistraNo ratings yet

- Topic 6 MFRS 108 Changes in Acc Policies, Estimates, ErrorsDocument30 pagesTopic 6 MFRS 108 Changes in Acc Policies, Estimates, Errorsdini sofiaNo ratings yet

- Pertemuan 10-Managing The Internal Audit FunctionDocument30 pagesPertemuan 10-Managing The Internal Audit FunctionRaihan AkmalNo ratings yet

- Chapter 21 INTANGIBLE ASSSETSDocument38 pagesChapter 21 INTANGIBLE ASSSETSmarj ponceNo ratings yet

- Chapter 4 - Managing in A Global EnvironmentDocument5 pagesChapter 4 - Managing in A Global Environmentbiancag_91No ratings yet

- Pepsi and Coke Financial ManagementDocument11 pagesPepsi and Coke Financial ManagementNazish Sohail100% (1)

- M, LLKLDocument14 pagesM, LLKLSophia PerezNo ratings yet

- W05 - Accounting Standard-Godfrey - Student PDFDocument34 pagesW05 - Accounting Standard-Godfrey - Student PDFRazafinandrasanaNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Budget and BudgetryDocument6 pagesBudget and Budgetryram sagar100% (1)

- 14 Fgfgfgdsdcontrol TheoryDocument40 pages14 Fgfgfgdsdcontrol TheoryDeepak R GoradNo ratings yet

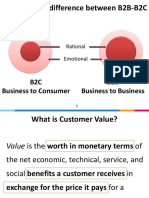

- Fundamental Difference Between B2B-B2C: B2C Business To Consumer B2B Business To BusinessDocument24 pagesFundamental Difference Between B2B-B2C: B2C Business To Consumer B2B Business To BusinessALOK PRADHANNo ratings yet

- Georgemaia Resume Merch ManagerDocument2 pagesGeorgemaia Resume Merch Managerapi-340666755No ratings yet

- GlobalTap v. Petersen Mfg. - ComplaintDocument81 pagesGlobalTap v. Petersen Mfg. - ComplaintSarah BursteinNo ratings yet

- Industry Analysis: The Fundamentals: Outlin EDocument21 pagesIndustry Analysis: The Fundamentals: Outlin ENarayanan SubramanianNo ratings yet

- App Aud - Prelim Exam (Key)Document16 pagesApp Aud - Prelim Exam (Key)Shaina Kaye De GuzmanNo ratings yet

- Subsequent Measurement:: Differ in Inventory ValueDocument4 pagesSubsequent Measurement:: Differ in Inventory ValueCharina Jane PascualNo ratings yet

- Chapter 7 Extinguisment of SaleDocument25 pagesChapter 7 Extinguisment of SaleMarianne Hope Villas100% (2)

- Marketing VS SalesDocument6 pagesMarketing VS Salesprince husainNo ratings yet

- SAP Business One Form Types and Object Types - Geri Grenacher 2Document17 pagesSAP Business One Form Types and Object Types - Geri Grenacher 2shmilyouNo ratings yet

- 107 Killer Traffic Conversion SecretsDocument15 pages107 Killer Traffic Conversion SecretskevinjhooNo ratings yet

- Organisational Behaviour - Future GroupDocument31 pagesOrganisational Behaviour - Future GroupAmulya BahetiNo ratings yet

- Entrep Chapter 5Document12 pagesEntrep Chapter 5Sebastian CabunilasNo ratings yet

- Marketing Ppt.. SPLASH N H N MDocument17 pagesMarketing Ppt.. SPLASH N H N MunsatiablereaderNo ratings yet

- Rocky Mountain Chocolate Factory IncDocument13 pagesRocky Mountain Chocolate Factory IncIza Balagtas0% (1)

- Purchase SummaryDocument5 pagesPurchase SummaryAbid IqbalNo ratings yet

- Place of Supply of Goods or Services or BothDocument38 pagesPlace of Supply of Goods or Services or BothHarshit GuptaNo ratings yet

- q4 Virtonomics ReportDocument9 pagesq4 Virtonomics Reportapi-410426030No ratings yet

- Sale of Goods Act (9.6.2022) DiscussionDocument19 pagesSale of Goods Act (9.6.2022) DiscussionDrEi Shwesin HtunNo ratings yet

- AFP Full SCM 2019Document136 pagesAFP Full SCM 2019MokshitNo ratings yet

- Fractions Decimals and Percents 1 1p59zelDocument45 pagesFractions Decimals and Percents 1 1p59zeliyyugNo ratings yet

- Admas University: MICROECONOMICS-II: Group AssignmentDocument2 pagesAdmas University: MICROECONOMICS-II: Group Assignmentgm29No ratings yet

- 5.1 Financial Accounting-15cp51t PDFDocument22 pages5.1 Financial Accounting-15cp51t PDFSuraj NK100% (1)

- Retailing Management NewsletterDocument14 pagesRetailing Management NewsletterSudhansuSekharNo ratings yet

- Clients and Markets - Week 1Document21 pagesClients and Markets - Week 1dusty_13No ratings yet

- Chapter 5 - Accounting For Merchandise OperationsDocument42 pagesChapter 5 - Accounting For Merchandise OperationsTâm Lê Hồ HồngNo ratings yet

- Teston V DBPDocument3 pagesTeston V DBPKenneth DavidNo ratings yet

- Libby7ce PPT Ch07Document56 pagesLibby7ce PPT Ch07Moussa ElsayedNo ratings yet