Professional Documents

Culture Documents

"What About Group Insurance?": Clients Want To Know

"What About Group Insurance?": Clients Want To Know

Uploaded by

pkgarg_iitkgpOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

"What About Group Insurance?": Clients Want To Know

"What About Group Insurance?": Clients Want To Know

Uploaded by

pkgarg_iitkgpCopyright:

Available Formats

Clients want to know:

What about group insurance?

After reading this, you should understand:

The different forms of group insurance coverage

Those with group insurance policies have a form and amount of coverage that is

controlled by the group policy owner. Understanding the benefits of group

policies may illustrate the need for additional personal coverage.

Group insurance is provided to employers, professionals, associations, unions, and

alumni groups. The theory underlying group insurance is that similar people band

together in these organizations. When such sameness exists, it is easier for the

insurer to more accurately assess risk and, correspondingly, to estimate premiums.

Group insurance has lower premiums for the same amount of coverage provided

on an individual policyholder basis, because risk is shared among the group

members and administrative costs are lower. The lapse rate due to premium nonpayment is reduced, because the employer pays all or part of the premium,

medical exams do not have to be reviewed by the insurer, and the probationary

period that most employees go through when they first join the company

eliminates employees who change jobs frequently.

Because risk is spread among the members of the group, the larger the group size,

the better. For this reason, standard group insurance begins with a group not

smaller than 25 people. When there are fewer than 25 members in the group, the

group is insurable as a small group, but evidence of insurability is often required,

because risk is not shared adequately. The smallest groups will be required to

show insurability.

Risk is further diminished by the requirement that a group include at least 75% of

eligible employees (eligibility being determined by the number of employees who

have met the requirements of the probationary period).

Group insurance is often provided as an employee benefit.

Copyright 2011 Oliver Publishing Inc. All rights reserved.

103

LLQP

N.B. All of these factors the pooled group of similar individuals, the size

requirements for the group, the need for a certain percentage of employees,

and the requirement for an employee to be a permanent employee to qualify

are all evidence of the insurance company preventing adverse selection.

In other words, whereas individual insurance attracts buyers who want

and/or need insurance (and pay premiums accordingly), group insurance

enrols everyone in the group, regardless of want or need, and may even

include those who would not qualify for an individual policy.

Many different

occupations

enjoy the

benefits of

group coverage

offered by their

employer or

professional

associations.

Who pays the premium on a group policy?

A

B

C

D

The group

The members of the group

The employer of the group

The eligible employees of the group

Group Life Insurance

+ FILE

See file 24

for group life policy

provisions.

Group life insurance is available as:

Term insurance;

Dependent life insurance;

Survivor income benefit insurance;

Optional group life insurance;

Accidental death and dismemberment insurance (AD&D);

Creditor group insurance.

Over 99% of group life insurance is yearly (one-year) renewable term

insurance. The contract for group term life must be renewed annually by the

policy owner, not by the individual group members. The policy owner is

responsible for paying the premium, and renewing the policy.

104 Copyright 2011 Oliver Publishing Inc. All rights reserved.

Group Insurance

The amount of coverage for the individuals covered by the group plan is

determined by the policy owner. This is why coverage provided in a group plan

sometimes needs topping-up in a personal policy if the coverage is lower than

need would indicate. The individuals, however, do name the beneficiary of their

group policy.

If a group plan provides for dependent coverage, a member of a group life plan

can cover his or her spouse (legal or common-law) and dependent children

through dependent life coverage. Dependent life provides a specified amount to

the group member in a lump-sum payment in the event that his or her spouse or

dependent dies.

A survivor income plan provides for the spouse and dependent children of a

group life plan member who dies. Instead of providing a lump-sum payment, this

plan provides an income in the form of ongoing annuity payments. Usually

payments are made monthly. The amount received by the survivors will be either

a flat amount or a percentage of the amount earned by the deceased to a predetermined maximum.

The spouse of a group insurance plan member would receive a lump-sum death

benefit if the group plan provided:

A

B

C

D

Dependent life coverage

A survivor income plan

Both of these options

Neither of these options

Optional group life, in addition to the basic life plan. Again, the type of

insurance provided is term, but the employee both chooses the amount of

coverage and pays for the additional coverage. He or she will also be required to

show evidence of insurability.

Accidental death and dismemberment (AD&D) insurance coverage provides the

same benefit to employees as those who elect such a policy on an individual basis.

The death benefit is paid to a beneficiary; the benefit from an injury is paid to the

employee. Similar exclusions to individual plans apply to group plans.

Group life insurance premiums, if paid by the employee, are paid with after-tax

dollars and therefore the life insurance benefit received by the beneficiary will be

tax-free. If the employer pays the premium, the employer must declare the

premiums paid in respect of the employee as a taxable benefit to the employee,

and therefore the life insurance death benefit is tax-free to the beneficiary.

Copyright 2011 Oliver Publishing Inc. All rights reserved. 105

LLQP

Group life insurance coverage offered by employers is convertible by the

employee to individual life insurance, in the event the employee quits the plan

membership (usually by quitting the employment), within 31 days of termination

of the membership. The employee who opts for conversion is guaranteed to get

the coverage because there is no medical proof required but the employee will

have to pay the higher premiums of the individual policy based on his attained

age at conversion.

Group creditor life insurance is provided to creditors to insure the lives of their

debtors. A creditor is a person or institution that lends money. For instance, a bank

is a creditor. Those who borrow from a creditor are debtors; that is, a debtor owes

a debt to the creditor.

I ran into income-tax trouble

last year when I owed $19,000

and couldnt pay the bill. I went

to my bank and they gave me a

loan, which uses my house as

collateral. They suggested I

take out life insurance on the

loan so that, if I died, the loan

would be repaid and my wife

would continue to have the

security of our home. I did that,

and the premiums on the

insurance are included with my

monthly loan payment.

The policy names the creditor as beneficiary. Coverage is equal to the amount of

debt owed to the creditor. The debtor is usually responsible for premiums;

however, the creditor can pay the premium or a portion of the premium. Premiums

are included with the loan repayment, making it easy for the debtor to repay with

no chance of premiums lapsing, providing the debtor makes the loan payments on

time. If the debtor is responsible for premiums, then he or she can refuse to take

on the policy offered by the creditor and seek coverage elsewhere.

Group Disability Income Insurance

Group disability income insurance, also known as a wage loss replacement plan,

provides an income to a member of a group that is insured during a period of time

the insured is not able to work because of illness or an accident.

106 Copyright 2011 Oliver Publishing Inc. All rights reserved.

Group Insurance

Membership in a group plan can be complemented by a personal policy. For

instance, a personal policy might be used to extend the benefit period provided by

the short-term disability plan of the group. The client cannot supplement the

group benefit with a personal benefit or with government coverage so that the

amount being received in disability benefits is greater than what the client would

receive as income.

Group disability is structured into short-term disability (STD) and long-term

disability (LTD) benefits. STD benefits can range from 15 weeks to 24 months;

12 or 24 months is most common. LTD benefits begin when STD has expired.

Definition of Disability

Group disability income insurance defines disability quite differently from the

definitions in a personal plan.

Group insurance has a more restrictive definition of total disability in order to

reduce the number of qualifying claims and maintain the integrity of the group. A

group insured will receive a disability benefit if he or she meets the own

occupation definition for total disability. However, the own occupation definition

in group insurance is not the same as own occupation in an individual policy; it is

similar to the regular occupation definition found in individual long-term

disability income policies.

While receiving a disability benefit, the insurer will assess the disabled on an

ongoing basis with a view to retraining based on his or her education, experience,

and medical condition. If appropriate, the insurer will pay for retraining to restore

the disabled to a position that provides a level of income close to, or greater than,

what the disabled earned pre-disability.

If a disabled person cannot be restored to his or her level of pre-disability earnings

by the new position for which he or she has been retrained, LTD will provide a

full, or proportionate, benefit for the duration of the benefit period (e.g., two years,

five years, or to age 65).

+ FILE

Short-term Disability (STD)

This form of disability insurance is also called the weekly income benefit. It

covers an absence from work caused by an accident or sickness.

See file 25

about how

employment

insurance can be

used to reduce

employer costs for

short-term

disability.

Copyright 2011 Oliver Publishing Inc. All rights reserved. 107

LLQP

When an accident is the reason for the disability, benefits sometimes begin on the

first day. When sickness is the reason for the disability, benefits generally begin

on the eighth day. Benefits are paid for a period of up to two years duration,

depending on the contract between the policy owner and the insurer, and are a set

percentage of pre-disability salary, typically either 60% or 66-2/3% of his or her

weekly income. This income is received tax-free if the employer declares the

premium paid by the employer as taxable benefit to the employee. If the premium

was not declared as taxable benefit, the employee disability insurance benefit,

minus the dollar amount the employee may have contributed towards premiums,

will be taxed.

+ FILE

See file 26

for a comparison of

individual and

group disability

insurance.

When the period of short-term disability insurance ends, if the employee is still

unable to work, the employee will begin long-term disability.

Long-term Disability (LTD)

Benefits for LTD are provided when an accident or illness seriously disables the

group member. Benefits begin when STD ends and they will continue for two

years, five years, or to age 65. The benefit amount is also a set percentage of predisability salary; 60% is typical if the employee has paid the premium, and 75% is

typical if the employer has paid the premium.

To qualify under most definitions, the group member must not be able to work in

his or her own occupation for an initial period of disability usually two years.

Benefits are paid after this period only if the group member is unable to work in

any occupation for which he or she is qualified.

+ FILE

See file 27 for

group disability

exclusions and

limitations.

I pay the disability

premium for my group

plan. Because I pay the

premiums and not the

company, if I go on

disability leave, the

money I receive will be

tax-free.

Group Health Insurance

Group health insurance can provide all the same benefits as individual plans.

They are an appealing employee benefit and again are provided to all members

covered by the group plan.

108 Copyright 2011 Oliver Publishing Inc. All rights reserved.

Group Insurance

Accident and sickness plans are provided for:

Extended health care benefits;

Dental insurance;

Vision care;

Accidental death and dismemberment.

Group Extended Health Care

Group extended health care, also called major medical, covers:

Ambulance services;

Prescribed drugs;

Private-duty nursing;

Appliances, such as back braces and artificial limbs;

Diagnostic services.

Group Dental Plans

Group dental plans reimburse the group plan member to the maximum benefit

payable under the plan. Procedures covered typically include:

Preventative (basic), diagnostic, and emergency endodontic and

periodontic procedures;

Restorative and surgical procedures;

Prosthodontic procedures;

Orthodontic procedures.

Vision Care

When eyesight correction is prescribed by an optometrist or ophthalmologist, a

vision care plan will pay a set amount towards purchase or replacement of an

appliance, whether glasses or contact lenses, within a set period of time.

Accidental Death and Dismemberment (AD&D)

Group Accidental Death and Dismemberment (AD&D) plans can be issued as a

stand-alone policy, and they can be added to a group life or health policy.

Group AD&D is a low-cost plan and provides an employee benefit at a relatively

low cost to the employer. The benefit of a group AD&D plan is usually equal to

the amount of the group term life plan. Coverage can be extended by a travel

accident benefit as a rider or a separate policy that will cover an accident that

occurs while an employee is travelling for the employer.

Copyright 2011 Oliver Publishing Inc. All rights reserved. 109

LLQP

The benefit is paid as a lump sum if death results from an accident or the insured

suffers qualifying multiple dismemberments; a partial benefit is paid for a partial

dismemberment.

AD&D is available as a basic plan and, additionally, as a voluntary plan. The

basic AD&D plan can insure different classes of employees at rates that can be a

multiple of salary, such as executives at five times salary, mid-managers at three

times salary, and all other employees at one times salary. The employer pays

premiums.

Voluntary AD&D is an option for employees already covered by a basic plan,

although it is sometimes offered to employees who do not have a basic plan. It

increases coverage, usually in $25,000 increments, to a maximum of $250,000.

There is no medical exam required and premiums, paid by employees through

payroll deduction, are very inexpensive.

Accidental death or dismemberment resulting from the following activities are

not covered by AD&D insurance (that is, they are exclusions):

An act of war;

Suicide or self-inflicted injury;

Service in the armed forces;

Flying in a non-commercial aircraft;

Committing a criminal offence;

Driving while impaired;

An accident caused by drugs or intoxicants;

Inhaling of poisonous gas, accidentally or intentionally.

110 Copyright 2011 Oliver Publishing Inc. All rights reserved.

You might also like

- Life Insurance Exam Questions and Answers PDFDocument13 pagesLife Insurance Exam Questions and Answers PDFDairo GaniyatNo ratings yet

- Insurance Commission Exam ReviewerDocument5 pagesInsurance Commission Exam ReviewerApolinar Alvarez Jr.98% (40)

- IC-78 Miscellaneous InsuranceDocument304 pagesIC-78 Miscellaneous InsuranceJass Brar86% (7)

- INSURANCEDocument28 pagesINSURANCEcharuNo ratings yet

- PF PassbookDocument2 pagesPF Passbookvinayak tiwari100% (1)

- Employee Life Insurance - Global Trends You Need To KnowDocument14 pagesEmployee Life Insurance - Global Trends You Need To KnowNicole ChimwamafukuNo ratings yet

- Vivek College of Commerce Introduction To InsuranceDocument45 pagesVivek College of Commerce Introduction To InsuranceNayak SandeshNo ratings yet

- Chapter 16 - Disability Income CoverageDocument7 pagesChapter 16 - Disability Income CoverageKashyap KashNo ratings yet

- Group Life InsuranceDocument18 pagesGroup Life InsuranceMikaila BurnettNo ratings yet

- Nature of Group InsuranceDocument12 pagesNature of Group InsuranceKhushwant SinghNo ratings yet

- Group Insurance Is An Insurance That Covers A Defined Group of People, ForDocument11 pagesGroup Insurance Is An Insurance That Covers A Defined Group of People, ForherambNo ratings yet

- RISK Chapter 5Document19 pagesRISK Chapter 5Taresa AdugnaNo ratings yet

- Knowledge Center GlossaryDocument3 pagesKnowledge Center Glossarychezzter25No ratings yet

- What Is Life Insurance?Document11 pagesWhat Is Life Insurance?Ratul BanerjeeNo ratings yet

- FAQ Group Life InsuranceDocument5 pagesFAQ Group Life InsuranceMuhammad Yousuf FazalNo ratings yet

- Risk Managemennt Chapter 6 - AAU 2020Document12 pagesRisk Managemennt Chapter 6 - AAU 2020Gregg AaronNo ratings yet

- Employer Provided Health Insurance - EditedDocument4 pagesEmployer Provided Health Insurance - EditedSHARMA VISHAL RAKESH 1923236No ratings yet

- InsuranceDocument7 pagesInsuranceVairag JainNo ratings yet

- The Role of Insurance in Risk Management: Medical and Health Insurance and TakafulDocument7 pagesThe Role of Insurance in Risk Management: Medical and Health Insurance and TakafulhazmiNo ratings yet

- Group Life Insurance: Help Protect Loved Ones From Financial HardshipDocument13 pagesGroup Life Insurance: Help Protect Loved Ones From Financial HardshipAnonymous i6rY3kG50oNo ratings yet

- Introduction & Classification of Group InsuranceDocument17 pagesIntroduction & Classification of Group InsuranceMajharul Islam BillalNo ratings yet

- Lecture 7 Employee BenefitsDocument25 pagesLecture 7 Employee BenefitsAysha NavinaNo ratings yet

- Whole Life InsuranceDocument16 pagesWhole Life Insuranceemilda_samuel211No ratings yet

- Importance of Life and General InsuranceDocument22 pagesImportance of Life and General InsuranceBhavik JainNo ratings yet

- Insurance Glossary: AccidentDocument7 pagesInsurance Glossary: AccidentVipul DesaiNo ratings yet

- Origin of The Company: Meaning and Definition Nature and Scope Importance of Insurance Objectives of The StudyDocument32 pagesOrigin of The Company: Meaning and Definition Nature and Scope Importance of Insurance Objectives of The Studypav_deshpande8055No ratings yet

- Life Insurance Kotak Mahindra Group Old MutualDocument16 pagesLife Insurance Kotak Mahindra Group Old MutualKanchan khedaskerNo ratings yet

- Life Insurance HandbookDocument12 pagesLife Insurance HandbookChi MnuNo ratings yet

- Characteristics of Traditional Group InsuranceDocument8 pagesCharacteristics of Traditional Group Insurancechsureshkumar1985No ratings yet

- Irda - Hand Book On Life InsuranceDocument12 pagesIrda - Hand Book On Life InsuranceRajesh SinghNo ratings yet

- GROUP Life 1017247626064944420815Document28 pagesGROUP Life 1017247626064944420815Ernest John TamanaNo ratings yet

- On Group InsuranceDocument14 pagesOn Group Insuranceyuviuv8867% (3)

- Life Assurance 225 KDocument18 pagesLife Assurance 225 KRiajul islamNo ratings yet

- Life Insurance:: Principles & Practices of Insurance Unit 3Document6 pagesLife Insurance:: Principles & Practices of Insurance Unit 3ashishsinghashishNo ratings yet

- Life Insurance FAQsDocument3 pagesLife Insurance FAQsEdappon100% (2)

- Insurance Introduction - EFS Vipul Texbook Page No. 131 - 139Document7 pagesInsurance Introduction - EFS Vipul Texbook Page No. 131 - 139Payal DalalNo ratings yet

- Insurance: Institute of Productivity & ManagementDocument39 pagesInsurance: Institute of Productivity & ManagementishanchughNo ratings yet

- California Life and Health Insurance Final ExamDocument94 pagesCalifornia Life and Health Insurance Final ExamkibabumeghanNo ratings yet

- Annuities & Pensions Group InsuranceDocument34 pagesAnnuities & Pensions Group Insurancem_dattaiasNo ratings yet

- Introduction To Insurance IndustriesDocument37 pagesIntroduction To Insurance IndustriesNishaTambeNo ratings yet

- 1 Types of Life Insurance Plans & ULIPSDocument40 pages1 Types of Life Insurance Plans & ULIPSJaswanth Singh RajpurohitNo ratings yet

- Chap 5Document18 pagesChap 5yhikmet613No ratings yet

- Private vs. Group Disability InsuranceDocument5 pagesPrivate vs. Group Disability InsuranceT. Reilly O'NealNo ratings yet

- Insurance Capsule For LIC ADO ExDocument10 pagesInsurance Capsule For LIC ADO ExSIVA KRISHNA PRASAD ARJANo ratings yet

- Insurance & Risk ManagementDocument8 pagesInsurance & Risk ManagementJASONM22No ratings yet

- Insurance ....Document8 pagesInsurance ....SanyaNo ratings yet

- 0403 Glossary of Life Insurance TermsDocument6 pages0403 Glossary of Life Insurance TermsttongNo ratings yet

- Pricing of GroupDocument57 pagesPricing of GroupBurosuvoNo ratings yet

- Life Insuranc (Sem - LLL)Document20 pagesLife Insuranc (Sem - LLL)Milton Rosario MoraesNo ratings yet

- Life Insurance ProductsDocument6 pagesLife Insurance ProductsBharani GogulaNo ratings yet

- Common Insurance TermsDocument16 pagesCommon Insurance TermsCarolNo ratings yet

- FIN 5009 Critical Illness (Winter 2024)Document17 pagesFIN 5009 Critical Illness (Winter 2024)312Dhruvin ShihoraNo ratings yet

- Insurance Health Care Health SystemDocument7 pagesInsurance Health Care Health SystemSrinivas LaishettyNo ratings yet

- Tugas Inggris Health InsurenceDocument5 pagesTugas Inggris Health InsurenceputriNo ratings yet

- Life InsuranceDocument13 pagesLife Insurancesmiley12345678910No ratings yet

- Risk CH 5 PDFDocument14 pagesRisk CH 5 PDFWonde BiruNo ratings yet

- History: Entrepreneurs, and Other Self-Employed, Lenore Janecek Claims That Entrepreneurs ShouldDocument18 pagesHistory: Entrepreneurs, and Other Self-Employed, Lenore Janecek Claims That Entrepreneurs ShouldTarequl IslamNo ratings yet

- Glossary of Life Insurance 10Document18 pagesGlossary of Life Insurance 10Ankur TiwariNo ratings yet

- Insurance Fm2accDocument4 pagesInsurance Fm2accyabaneifflemaurNo ratings yet

- INSURANCE LAW - ImpromptuDocument7 pagesINSURANCE LAW - ImpromptuDiya MirajNo ratings yet

- Tax ConsiderationsDocument8 pagesTax Considerationspkgarg_iitkgpNo ratings yet

- View Listings 1 ApartmentDocument1 pageView Listings 1 Apartmentpkgarg_iitkgpNo ratings yet

- 4 SharedDocument11 pages4 Sharedpkgarg_iitkgpNo ratings yet

- Practice Mcat 3: Ken Evans, MSC, MD Charlene Bramwell, MedDocument47 pagesPractice Mcat 3: Ken Evans, MSC, MD Charlene Bramwell, MedNaomi RyuNo ratings yet

- Vectors NotesDocument7 pagesVectors Notespkgarg_iitkgpNo ratings yet

- Guita Practice 1Document1 pageGuita Practice 1pkgarg_iitkgpNo ratings yet

- Parabola BasicsDocument1 pageParabola Basicspkgarg_iitkgpNo ratings yet

- RRSP MortgagesDocument6 pagesRRSP Mortgagespkgarg_iitkgpNo ratings yet

- IXL - British Columbia Grade 9 Math CurriculumDocument5 pagesIXL - British Columbia Grade 9 Math Curriculumpkgarg_iitkgpNo ratings yet

- IXL - British Columbia Grade 7 Math CurriculumDocument6 pagesIXL - British Columbia Grade 7 Math Curriculumpkgarg_iitkgpNo ratings yet

- IXL - British Columbia Grade 6 Math CurriculumDocument6 pagesIXL - British Columbia Grade 6 Math Curriculumpkgarg_iitkgpNo ratings yet

- Tax Notes A.Y. 2022-1Document96 pagesTax Notes A.Y. 2022-1Aaditya BavaskarNo ratings yet

- Final Krishna Rpr-2Document77 pagesFinal Krishna Rpr-2Phoenix DreamerNo ratings yet

- Interview Questions Based On Thermal Power PlantDocument3 pagesInterview Questions Based On Thermal Power Plantrohit_me083No ratings yet

- E1049217251 12520 1322185717213Document5 pagesE1049217251 12520 1322185717213Sumit PattanaikNo ratings yet

- Income TaxDocument57 pagesIncome TaxDenis FernandesNo ratings yet

- Current LiabilitiesDocument40 pagesCurrent Liabilitieswarsima100% (1)

- Amendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORDocument42 pagesAmendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORKen ChiaNo ratings yet

- Riverside Local Teachers Contract - Painesville, OhioDocument105 pagesRiverside Local Teachers Contract - Painesville, Ohiocarecommitteepac100% (7)

- A1846812814 24953 21 2019 Rent Free Accommodation Computation & Taxability-StudyDocument3 pagesA1846812814 24953 21 2019 Rent Free Accommodation Computation & Taxability-StudyAvi MaheshwariNo ratings yet

- Bonus LiabilityDocument2 pagesBonus LiabilityRosemarie CruzNo ratings yet

- 2020 Resident - Fellow Salary and BenefitsDocument2 pages2020 Resident - Fellow Salary and Benefitsmld ozilNo ratings yet

- Goodricke Annual Report 16 17Document118 pagesGoodricke Annual Report 16 17Toma BaraiNo ratings yet

- WctariffDocument127 pagesWctariffNio Kumar100% (1)

- RR 03-98Document5 pagesRR 03-98Ayvee BlanchNo ratings yet

- TRAIN Law 2018Document27 pagesTRAIN Law 2018Solar PowerNo ratings yet

- DocsDocument90 pagesDocsSanjay RoutNo ratings yet

- Vdocument - in - Labor Law in CambodiaDocument76 pagesVdocument - in - Labor Law in Cambodiaチューン メアスNo ratings yet

- Abolishing Pro Rich Dr. Ikram Final Study 1Document308 pagesAbolishing Pro Rich Dr. Ikram Final Study 1Tanweere AhmedNo ratings yet

- Department of Labor: WAGE and HOUR DIVISI V WD ENTERPRISES INC 2004SCA00005 (OCT 18 2005) 121046 CADEC SDDocument28 pagesDepartment of Labor: WAGE and HOUR DIVISI V WD ENTERPRISES INC 2004SCA00005 (OCT 18 2005) 121046 CADEC SDUSA_DepartmentOfLaborNo ratings yet

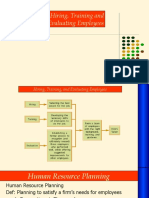

- Chapter 11 Hiring Training and Evaluating EmployeesDocument30 pagesChapter 11 Hiring Training and Evaluating EmployeesM Abubakar GhummanNo ratings yet

- Cases JloDocument10 pagesCases JloOwen DefuntaronNo ratings yet

- Wage, Salary and Reward AdministrationDocument34 pagesWage, Salary and Reward AdministrationSuparna2No ratings yet

- MWSS vs. CADocument8 pagesMWSS vs. CALaura MangantulaoNo ratings yet

- Appointment Letter FORMAT by HR NudgeDocument3 pagesAppointment Letter FORMAT by HR NudgeSid Roy50% (2)

- I. Concept Notes IAS19: Employee BenefitsDocument5 pagesI. Concept Notes IAS19: Employee Benefitsem cortezNo ratings yet

- Benefits-WPS OfficeDocument8 pagesBenefits-WPS OfficeMae Arra Lecobu-anNo ratings yet

- But If There Is A Portion of It That's Unliquidated, TaxableDocument10 pagesBut If There Is A Portion of It That's Unliquidated, TaxableJoesil Dianne SempronNo ratings yet

- Bhel Employee WelfareDocument74 pagesBhel Employee WelfareSandeep Gawande60% (5)

- Foglalkoztatás I.Document35 pagesFoglalkoztatás I.Maja OsváthNo ratings yet