Professional Documents

Culture Documents

Tax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate Chart

Tax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate Chart

Uploaded by

Chandan KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate Chart

Tax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate Chart

Uploaded by

Chandan KumarCopyright:

Available Formats

UNION BUDGET 2015-16

----------------------------------------------------------------------------------------------TAX DEDUCTED/COLLECTED AT SOURCE

F.Y. 2015-16 (A.Y. 2016-17)

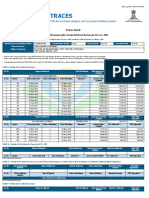

A. TDS RATE CHART

Sl. Section

No. Of Act

1

192

192A

193

194A

194A

194C(1)

7 194C(2)

8 194EE

9

194F

10 194H

16

194I

11

194J

12 194J(1)

(ba)

13

194LA

Nature of Payment in brief

Cut Off Amount

Rate %

HUF/IND.

Others

Till the estimated On the average rates

yearly

taxable on the basis of per

salary exceeds tax individual rates

free limit

Salaries

Payment of Accumulated Balance of EPF

Scheme 1952 to Employees w.e.f. 01.06.15

Interest on debentures

Interest other than Interest on securities (by

Bank)

Interest other than Interest on securities (By

others)

Contracts Yearly Limit u/s 194C:

(Where

the

aggregate

of

the

amounts

paid/credited or likely to be paid/credited

to Contractor or

Sub-contractor

exceeds

Rs.75,000 during the financial year, TDS has to

be deducted u/s 194C.)

Sub-contracts/ Advertisements

Payments out of deposits under NSS

Repurchase of units by MF/UTI

Commission or Brokerage

Rent (Land, building or furniture)

Rent (P & M or Equipment)

Professional/Technical charges/Royalty & Noncompete fees

Any remuneration or commission paid to

director of the company(Effective from 1 July

2012)

Payment on transfer of certain immovable

property

other

than

agricultural

land(applicable only if amount exceeds : (a)

Value exceeds INR 50) (Effective from 1 June

2013)

30000

10

5000

10

10

10000

10

10

5000

10

10

30000

30000

2500

1000

5000

180000

180000

30000

1

20

20

10

10

2

10

2

20

10

10

2

10

NIL

10

10

B. TCS RATE CHART

Sl.No.

1.

2.

3.

Page 1

Nature of Goods

Rates in %

Scrap

Minerals, being coal or lignite or iron ore

Bullion or jewellery (if the sale consideration is paid in cash

exceeding INR 2 lakhs)

1

1

1

TAX DEDUCTED AT SOURCE

UNION BUDGET 2015-16

----------------------------------------------------------------------------------------------C. EDUCATION CESS & SURCHARGE

No Education Cess on payment made to resident-Education Cess is not deductible/collectible at

source in case of resident Individual/HUF /Firm/ AOP/ BOI/ Domestic Company in respect of

payment of income other than salary.

Education Cess @ 2% plus secondary & Higher Education Cess @ 1% is deductible at source in

case of non-residents and foreign company.

Surcharge on Income-tax - Surcharge on Income-tax is not deductible/collectible at source in

case of individual/ HUF /Firm/ AOP / BOI/Domestic Company in respect of payment of income

other than salary.

D. CHANGES IN UNION BUDGET 2015-16

TDS Under Section 194C:- Clarification Regarding Deduction Of Tax From Payments

Made To Transporters/ No Deduction In Payment Made To Transporters Who Is Not

Owing More Than 10 Goods Carriage

It is proposed to amend the provisions of section 194C of the Act to expressly provide that the

relaxation under sub-section (6) of section 194C of the Act from non deduction of tax shall only

be applicable to the payment in the nature of transport charges (whether paid by a person

engaged in the business of transport or otherwise) made to an contractor or sub contractor who

is engaged in the business of transport i.e. plying, hiring or leasing goods carriage and who is

eligible to compute income as per the provisions of section 44AE of the Act (i.e. a person who is

not owning more than 10 goods carriage at any time during the previous year) and who has also

furnished a declaration to this effect along with his PAN.

Hence, invariably a DECLARATION HAS TO BE OBTAINED FROM EVERY Contractor, sub

contractor engaged in TRANSPORTER, that they own 10 or less transport vehicles along

with a copy of PAN Self attested, otherwise TDS has to be deducted for payment/credit to

Transporter, of single transaction exceeding Rs. 30, 000 or when payment/credit in a

financial year reaches Rs. 75, 000. TDS is to be deducted @ 1% for individual/H.U.F.

Transporters or 2% for others. Please note, as before, if PAN details are not provided by

transporter, TDS is to be deducted @20%. (Please refer to Declaration section for Draft

copy of declaration from transporter)

Note:- These amendments will take effect from 1st June, 2015

TDS Deduction On EPF

EPF Trustees while paying the accumulated PF balance should deduct 10% TDS (for payments of

Rs 30000 or more) - Sec 192 A

TDS On Salary

The person responsible for making the payment of salary has to obtain from the assesse the

evidence or proof or particulars of prescribed claims (including claim for set-off of loss) - Sec 192

TDS On Royalty & Technical Fees

Income of the non-resident by way of Royalty or Fees for technical services - the tax rate is

reduced from 25% to 10% - Sec 115A

NON SUBMISSION OF PAN BY PAYEE

Page 2

TAX DEDUCTED AT SOURCE

UNION BUDGET 2015-16

----------------------------------------------------------------------------------------------As earlier higher TDS of 20% for not furnishing correct PAN in case the Payee is not able to

furnish Pan to the deductor, tax shall be deducted at the higher of the rates specified in the

relevant provision of the I.T. Act or at the rates in force or 20%.

TDS IN CASE OF INDIVIDUAL/HUF.

As earlier, an individual or HUF is not liable to deduct tax. However, an individual or HUF, who

is liable to tax audit under section 44AB during the immediate preceding financial year, shall be

liable to deduct ax under sections 194A, 194C, 194H, 194I and 194J, as the case may be.

TAN/RETURN NOT REQUIRED TO BE FILED BY TRANSFEREE OF LAND

As earlier, every transferee, at the time of making payment or crediting any sum by way of

consideration for transfer of immovable property (other than agricultural land), shall be required

to deduct tax. The transferee would not be required to obtain TAN and also not required to

submit TDS Return.

E. PAYMENT, RETURN & CERTIFICATE ISSUANCE DUE DATES

Payment Due Dates:

S.NO.

MONTH ENDING

DUE DATE

April To February

March

By 7th Of Month immediately

following the month of deduction

TDS - By 30th April

TCS By 7th. April

Mode of Payment - E-Payment of tax has to be made in Challan No. ITNS 281, by companies &

other deductors liable for Tax Audit. E-Payment is optional for others.

Return Due Dates

Sl. No.

1.

2.

3.

4.

Date of ending of the quarter of the

financial year

30th June

30th September

31st December

31st March

Return Due date

15th July of the financial year

15th October of the financial year

15th January of the financial year

15th May of the financial year immediately following

the financial year in which deduction is made

Mode Of Filing Returns Forms 26Q & 24Q are required to be E-filed, while Form 27A is to be

filed physically.

TDS Certificate Due Dates

Sl. No.

Category

1.

Salary (Form No.16)

2.

Non-Salary(Form

No.16A)

Page 3

Periodicity of

furnishing TDS

certificate

Annual

Quarterly

Due date

By 31st day of May of the financial year

immediately following the financial year in which

the income was paid and tax deducted

Within fifteen days from the due date for furnishing

the statement of TDS

TAX DEDUCTED AT SOURCE

You might also like

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16Document26 pagesTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86No ratings yet

- TDS Rate Financial Year 13-14Document10 pagesTDS Rate Financial Year 13-14Heena AgreNo ratings yet

- Form Sr. Instruction Instructions For Filling in Return Form & Wealth StatementDocument8 pagesForm Sr. Instruction Instructions For Filling in Return Form & Wealth StatementajgondalNo ratings yet

- Introduction To TDS:-: Tax Deducted at SourceDocument3 pagesIntroduction To TDS:-: Tax Deducted at Sourcepadmanabha14No ratings yet

- Note On Tds ReportingDocument3 pagesNote On Tds ReportingRajunish KumarNo ratings yet

- Tdsincometax (210621)Document3 pagesTdsincometax (210621)Pallavi SharmaNo ratings yet

- Latest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Document0 pagesLatest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Ketan ThakkarNo ratings yet

- FBR IncomeTax Return 2016Document40 pagesFBR IncomeTax Return 2016Muhammad Awais100% (1)

- BIR - Invoicing RequirementsDocument17 pagesBIR - Invoicing RequirementsCkey ArNo ratings yet

- Taxation of Salaried EmployeesDocument41 pagesTaxation of Salaried EmployeesAbhiroop BoseNo ratings yet

- Individual Paper Income Tax Return 2015Document23 pagesIndividual Paper Income Tax Return 2015marrukhjNo ratings yet

- TDS 3Document16 pagesTDS 3payal AgrawalNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #SimpletaxindiaDocument11 pagesTds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #Simpletaxindiashivashankari86No ratings yet

- Tax Deducted at Source: - Presented By: CA Prabhat Kumar Tandon Fca, Disa (Icai)Document20 pagesTax Deducted at Source: - Presented By: CA Prabhat Kumar Tandon Fca, Disa (Icai)shefalijais6491No ratings yet

- After The Previous Year ExpiryDocument4 pagesAfter The Previous Year ExpiryRaj JamadarNo ratings yet

- Notes On Withholding Tax and Income Tax FilingDocument20 pagesNotes On Withholding Tax and Income Tax FilingnengNo ratings yet

- CA-Ashok-Mehta - PPT - Income TaxDocument88 pagesCA-Ashok-Mehta - PPT - Income TaxAbinash DasNo ratings yet

- Service Tax Changes Process Amounting To Manufacture or Production of Goods Excluding Alcoholic Beverages For Human ConsumptionDocument5 pagesService Tax Changes Process Amounting To Manufacture or Production of Goods Excluding Alcoholic Beverages For Human ConsumptionYesBroker InNo ratings yet

- Taxation of Salaried EmployeesDocument39 pagesTaxation of Salaried Employeessailolla30100% (1)

- BIR FormsDocument30 pagesBIR FormsRoma Sabrina GenoguinNo ratings yet

- Individual Paper Income Tax Return 2016Document39 pagesIndividual Paper Income Tax Return 2016aarizahmadNo ratings yet

- 31188sm DTL Finalnew-May-Nov14 Cp28Document66 pages31188sm DTL Finalnew-May-Nov14 Cp28gvcNo ratings yet

- Tds Amendements Via Finance Bill 2020Document12 pagesTds Amendements Via Finance Bill 2020ABHISHEKNo ratings yet

- Asifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-08 PDFDocument18 pagesAsifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-08 PDFaemanNo ratings yet

- 29133rmo 10-2006Document15 pages29133rmo 10-2006Denzel Edward CariagaNo ratings yet

- CA Final Revision MaterialDocument477 pagesCA Final Revision Materialsathish_61288@yahooNo ratings yet

- RR No. 02-2006Document10 pagesRR No. 02-2006odessaNo ratings yet

- 30851ipcc May Nov14 It Vol1 CP 9.unlockedDocument43 pages30851ipcc May Nov14 It Vol1 CP 9.unlockedavesatanas13No ratings yet

- CIR v. PAL (Ortega)Document5 pagesCIR v. PAL (Ortega)Peter Joshua OrtegaNo ratings yet

- List of Bir FormsDocument49 pagesList of Bir Formsblessaraynes50% (4)

- Instructions For Filling in Return Form & Wealth Statement Form Sr. InstructionDocument15 pagesInstructions For Filling in Return Form & Wealth Statement Form Sr. InstructionTausif ArshadNo ratings yet

- Section 139 of Income TaxDocument4 pagesSection 139 of Income TaxMOUSOM ROYNo ratings yet

- For Assessment Year - 2011 - 12 TDS Rates Chart Rates of TDS For Major Nature of Payments For The Financial Year 2010-11Document6 pagesFor Assessment Year - 2011 - 12 TDS Rates Chart Rates of TDS For Major Nature of Payments For The Financial Year 2010-11Savoir PenNo ratings yet

- Intro of TdsDocument6 pagesIntro of Tdsshivani singhNo ratings yet

- Taxation of Salaried Employees, Pensioners and Senior by IndiagovermentDocument88 pagesTaxation of Salaried Employees, Pensioners and Senior by IndiagovermentHarshala NileshNo ratings yet

- Bir 0605Document11 pagesBir 0605Sheelah Sawi0% (1)

- List of Bir FormsDocument37 pagesList of Bir FormsgachiNo ratings yet

- TDS Rate Chart PDFDocument2 pagesTDS Rate Chart PDFjdhamdeep07No ratings yet

- For Tds On Non SalaryDocument39 pagesFor Tds On Non SalaryicahimanshumehtaNo ratings yet

- Circulars 2009 Onreturnforms Final 10062009Document6 pagesCirculars 2009 Onreturnforms Final 10062009api-20002381No ratings yet

- TDS Update Practical Issues Speech MR DR Venkatesh CADocument47 pagesTDS Update Practical Issues Speech MR DR Venkatesh CAAman PooniaNo ratings yet

- 0605Document6 pages0605Ivy TampusNo ratings yet

- Project InfoDocument3 pagesProject Infodevki10No ratings yet

- Submitted To Submitted by MR Mayank Shrivastava RachitaDocument6 pagesSubmitted To Submitted by MR Mayank Shrivastava RachitaRachita WaghadeNo ratings yet

- Dfletter AllDocument11 pagesDfletter AllelangoNo ratings yet

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- Critical Analysis of Income Tax Ordinance 2010Document16 pagesCritical Analysis of Income Tax Ordinance 2010Dilnawaz KhanNo ratings yet

- Chindo ConvocationDocument4 pagesChindo Convocationjoelanyangu2000No ratings yet

- Deduction, Collection & Recovery of TaxesDocument143 pagesDeduction, Collection & Recovery of TaxesjyotiNo ratings yet

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Document6 pagesTax Credit Statement (: Instructions For Filling FORM ITR-2ajey_p1270No ratings yet

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Document7 pagesTax Credit Statement (: Instructions For Filling FORM ITR-2Manyam JainiNo ratings yet

- Return of Income & AssessmentDocument3 pagesReturn of Income & AssessmentABC 123No ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- RMC No 15-2015 Deferment of Implementation On Identified Withholding Tax FormsDocument2 pagesRMC No 15-2015 Deferment of Implementation On Identified Withholding Tax FormsphilippinecpaNo ratings yet

- RMC 72-04Document9 pagesRMC 72-04ai0412No ratings yet

- Tax Deduct at SourceDocument4 pagesTax Deduct at Sourceankit1070No ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- NSDL Conso File FVU Error Code ListDocument22 pagesNSDL Conso File FVU Error Code Listlekireddy33% (9)

- Acppk4010m 2018Document4 pagesAcppk4010m 2018Rohit GuptaNo ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- DD ProjectDocument2 pagesDD Projectjatin kuashikNo ratings yet

- Upkar Dhawan Fy 2016-17Document3 pagesUpkar Dhawan Fy 2016-17amit22505No ratings yet

- Aekpy3088c 2019Document4 pagesAekpy3088c 2019Ajay YadavNo ratings yet

- Tax Information Network (TIN) Ver 1.0Document111 pagesTax Information Network (TIN) Ver 1.0Ravi DesaiNo ratings yet

- TDS CertificateDocument2 pagesTDS Certificatetauqeer25No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rajniNo ratings yet

- Tds in Tally - Erp 9Document81 pagesTds in Tally - Erp 9DAKSHPREET17100% (1)

- DFCPS4106B Ay201920 16 Unsigned PDFDocument6 pagesDFCPS4106B Ay201920 16 Unsigned PDFAnuj SrivastavaNo ratings yet

- 110773Document6 pages110773asheesh kumarNo ratings yet

- GGGG GGGG GGGGGDocument4 pagesGGGG GGGG GGGGGKothapalliGuruManiKantaNo ratings yet

- Form No 16Document2 pagesForm No 16Chasa raviNo ratings yet

- Nature of Payments Made To ResidentDocument28 pagesNature of Payments Made To Residentbonnie.barma2831No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturngrafikeysNo ratings yet

- Urmila JiDocument11 pagesUrmila JiMahendra KumarNo ratings yet

- Introduction To TDS:-: Tax Deducted at SourceDocument3 pagesIntroduction To TDS:-: Tax Deducted at Sourcepadmanabha14No ratings yet

- Project ReportDocument5 pagesProject Reportsonali deotaleNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Palani KumarNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Maurya KabraNo ratings yet

- Form 16 Part A Name and Address of The Employer Name and Designation of The EmployeeDocument3 pagesForm 16 Part A Name and Address of The Employer Name and Designation of The EmployeeishaqmdNo ratings yet

- Salary Jan 2001Document2 pagesSalary Jan 2001Kharde HrishikeshNo ratings yet

- ITR 4 Sugam Form For Assessment Year 2018 19Document9 pagesITR 4 Sugam Form For Assessment Year 2018 19sureshstipl sureshNo ratings yet

- India: What Is The TDS and Income Tax System in India?Document5 pagesIndia: What Is The TDS and Income Tax System in India?Ketan JajuNo ratings yet

- Deductors Manual Qtrly Tds Tcs V 1Document35 pagesDeductors Manual Qtrly Tds Tcs V 1api-3706890No ratings yet

- Azepm3818m 2018-19 PDFDocument2 pagesAzepm3818m 2018-19 PDFlogu prabhuNo ratings yet

- TDS TCSDocument231 pagesTDS TCSNarinderpal SinghNo ratings yet