Professional Documents

Culture Documents

Value Averaging A Smarter Way To Invest

Value Averaging A Smarter Way To Invest

Uploaded by

kwongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Value Averaging A Smarter Way To Invest

Value Averaging A Smarter Way To Invest

Uploaded by

kwongCopyright:

Available Formats

Your wealth creation and retirement partner

Why Value Averaging is a smarter way to invest

$100,000 invested in Australian shares in 1980 with dividends re-invested would be worth $3.42 million 30 years later. Thats a

respectable 11% annual compound return.

Yet despite this 11% annual return, many investors are reluctant to invest in the share market. Scared off by events like the recent

Global Financial Crisis, many investors opt for a lesser (though safer and less volatile) long-term return by investing in cash or

bonds. But what if there was a safer and less volatile way to invest in the share market?

Beyond Dollar Cost averaging

Many investors are already familiar with Dollar Cost Averaging. Put simply, Dollar Cost Averaging is when you invest a fixed

amount each month into shares regardless of whether the market is down, up or indifferent. By doing this on a regular basis, you

buy some shares when the market is cheap, some shares when the market is expensive and some shares when the market is fair

value. But in the long-term you will average your way into the share market and reduce some of the timing risk that is associated

with investing in shares.

As a strategy, Dollar Cost Averaging is a good way to invest into shares. It has two main benefits:

1.

It encourages investors to allocate money each month to a savings plan

2.

It takes some of the emotion out of the investment timing process (you invest every month, regardless of whether you

think the share market is over or undervalued).

Value Averaging is similar to Dollar Cost Averaging, except it takes the process one step further. With Value Averaging, you still

make regular monthly investments, but this time a decision is made to invest each contribution into either Cash or Shares.

So how do you decide? Well its all about Fair Value. As I mentioned earlier the Australian share market has made an average

return of 11% a year in the 30 years leading up to 2010. So lets be a bit conservative and assume that a fair rate of return (in

exchange for the amount of risk we are going to take) is 9% a year. If we have an investment time horizon of 30 years (maybe this

is when we plan to retire), then this allows us to create a Fair Value line. Lets assume you have the following investments and

savings in place and take a look at what the Fair Value line might look like:

Investments

$140,000 (Client, super)

$100,000 (other investments/savings)

Contributions

$1,000pm (Clients super contributions )

$625pm (Partners super contributions)

$2,000pm (household savings to investment portfolio)

Fair Value Target Return

9% a year

Time horizon

30 years

$80,000 (Partner, super)

$16,000,000

$14,000,000

"Fair Value" Investment Goal line, assumes 9% pa return

on your combined investments + your regular contributions

$12,000,000

$10,000,000

$8,000,000

$6,000,000

$14,107,640 is

your "Fair Value"

Investment Goal

after 30 years

$4,000,000

$2,000,000

$0

Nov-80

Nov-85

Nov-90

Nov-95

Nov-00

Nov-05

Nov-10

Palmer Portfolios Pty Ltd (ABN 41 533 933 417) is a Corporate Authorised Representative (no. 301761) of Palmer Portfolios Group Pty Ltd AFSL: 376719 ABN: 78 145 431 107

07 3333 2733 www.palmerportfolios.com.au FAX 07 3367 2889

STREET: Suite 16, 1 Park Rd, Milton Qld 4064

POSTAL: PO Box 718, Paddington Qld 4064

PH

Your wealth creation and retirement partner

Using Fair Value as a benchmark

From the above example you will see that our fair value Investment Goal line says you should have a little over $14 million after 30

years. Of course, the share market doesnt move in a nice straight line. To enjoy the above-average long-term returns of equities

you must be able to stomach a little bit of volatility.

But volatility is not always a bad thing. For many investors, when the newspaper headlines are screaming doom and gloom and

GFC, they rush for the exits and sell their shares. However, history has shown that this is exactly the wrong way to be behaving in

this way.

Smart investors have a portion of the portfolio set aside in cash for when markets behave irrationally. They buy low, when others

are selling in panic. With Value Averaging investors now have an automatic way of taking advantage of these irrational moments in

the share market cycle.

So how does Value Averaging work?

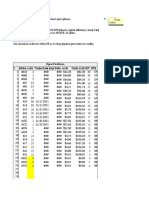

Lets take the same Fair Value line we just created and assume (just by way of example) that the exact same returns of the past

30 years are repeated for the next 30 years. This 30-year period also includes two so-called crashes in 1987 and 2008. Lets also

make the following assumptions:

Instead of investing ALL of your initial starting amount into shares, you start with 15% in Cash

When the value of your investments trades above this Fair Value line (due to normal market fluctuations) you sell down

your shares (i.e. increase Cash) to put aside for a rainy day when shares are selling cheap.

$20,000,000

$18,000,000

$16,000,000

$14,000,000

Note the market crashes of 1987 and 2008.

With Value Averaging, cash is automatically

accumulated "set aside" in good times

(usually preceding a crash) to buy investments

when the market falls.

$12,000,000

$10,000,000

Cash

$8,000,000

$6,000,000

$4,000,000

Portf olio value

$2,000,000

"Fair Value"

Investment Line

$0

You will notice two very important things...

1.

When the share market is doing well (like in the years leading up to the 1987 and 2008 crashes), your portfolio is slowly

accumulating cash. This is because the annual return on your investments is above your target return of 9% a year. So

under the Value Averaging strategy this cash is tucked away to use when the market falls below your 9% Fair Value

line, and shares are arguably cheap.

2.

The Value Averaging strategy has produced a higher internal rate of return over the 30-year time period, and by allocating

part of the portfolio to Cash it has experienced less volatility.

Palmer Portfolios Pty Ltd (ABN 41 533 933 417) is a Corporate Authorised Representative (no. 301761) of Palmer Portfolios Group Pty Ltd AFSL: 376719 ABN: 78 145 431 107

07 3333 2733 www.palmerportfolios.com.au FAX 07 3367 2889

STREET: Suite 16, 1 Park Rd, Milton Qld 4064

POSTAL: PO Box 718, Paddington Qld 4064

PH

Your wealth creation and retirement partner

The mathematics behind Value Averaging strategy

The Value Averaging strategy is based on extensive research and modelling. The original concept was developed by former Harvard

University professor Michael E. Edleson.

By creating random simulations of normal market behaviour, Edleson found that the process of Value Averaging is likely to produce

higher internal rates of return (IRRs) than simple Dollar Cost Averaging. Having a weighting to cash should also reduce the overall

volatility of your portfolio.

Advantages of Value Averaging

Value Averaging automates the buy low & sell high process and takes the emotion out of market timing decisions.

Helps clients visualise and stick to a long-term investment strategy, and to understand that market falls (and rises) are a

normal part of the investment cycle. Indeed, market falls now become an opportunity.

Having an automated strategy will stop most investors from making poor market timing decisions (i.e. panic selling when the

market falls, or buying more investments after an extended period of above-average returns).

By increasing your allowable cash weighting later in life, Value Averaging can help you to reduce your overall risk profile as

you approach retirement.

How often is cash adjusted?

In the example above we have assumed monthly contributions to the planned portfolio. However, the regular cash adjustment (the

decision whether to buy shares, or increase a clients Cash Weighting) does not need to be done monthly. In fact, when you take into

account transaction costs, it has been shown that adjusting the strategy quarterly produces the same long-term benefit, but with less

ongoing cost.

What about the underlying investments?

Value Averaging does not replace good investment selection. In the long-run, a portfolio will benefit from having exposure to a good mix

of growth and income producing investments. With the Value Averaging strategy, your portfolio will usually be split into two components:

1. Growth component. This will typically hold a diversified blend of both Australian and International shares, or share funds, and

will nearly always account for the majority of assets in the portfolio, according to your agreed Risk Profile.

2. Cash component. This can be invested in term deposits, fixed interest funds or at-call cash within the portfolio. The cash

component is also invested to maximise the return while sitting idle.

The majority of long-term returns will be from the Growth component. However, for those times when you are holding extra cash (waiting

for the market to correct) its important to ensure the cash is generating the best return possible.

But what if I am retired or approaching retirement?

Value Averaging is not reliant on the client contributing funds to the portfolio. Even if you are regularly withdrawing (i.e. to fund your

retirement lifestyle) you can use Value Averaging to construct a Fair Value investment line.

If you are retired or approaching retirement, it may be that you adopt a more conservative approach to Value Averaging. This can be

done by increasing your initial Cash Weighting (from say 15% to 40%), or by lowering your Target Return from say 9% to 6%. By

lowering your target return it is likely you will store more of your portfolio as cash in the years ahead, thereby reducing your Risk

Exposure later in life.

Palmer Portfolios Pty Ltd (ABN 41 533 933 417) is a Corporate Authorised Representative (no. 301761) of Palmer Portfolios Group Pty Ltd AFSL: 376719 ABN: 78 145 431 107

07 3333 2733 www.palmerportfolios.com.au FAX 07 3367 2889

STREET: Suite 16, 1 Park Rd, Milton Qld 4064

POSTAL: PO Box 718, Paddington Qld 4064

PH

Your wealth creation and retirement partner

How does Palmer Portfolios implement your Value Averaging strategy

Palmer Portfolios is a fully licenced financial advising firm, and one of the few in Queensland to operate a Limited Managed

Discretionary Account service. Called our Optimum Portfolio Service, it is an agreement between us and our clients to

manage both the underlying investments in our clients portfolios and the regular Cash Adjustments necessary for the Value

Averaging strategy (within agreed parameters).

To our knowledge, we are the only financial advising firm in Queensland offering Value Averaging as a long-term investment

strategy. It is a complete service encompassing a full Financial Plan and initial setup of a clients Fair Value Investment line,

the ongoing management of investments and cash adjustments in the portfolio, and quarterly reporting of your progress

towards your goal.

What else you need to know

More information on Value Averaging can be found online and also in the book Value Averaging: The Safe and Easy Strategy

for Higher Investment Returns. A free copy of which is available to any client who wishes to research this strategy further.

There is also a good summary of Value Averaging on the Wikipedia website, with links to further

reading http://en.wikipedia.org/wiki/Value_averaging

While Value Averaging has been shown to increase the internal rate of return (IRR) in a wide range of different market

conditions, there are no guarantees that this will be the case in the future. Having an allocation to cash will reduce the overall

volatility of your portfolio, but can lead to a lower overall return in times of exceptionally good market returns.

There can be capital gains tax (CGT) implications of selling investments in a rising market. While we always look to minimise

CGT, it is possible that CGT could be higher under this strategy. However, we believe this is offset by the reduced volatility and

likely higher returns of the Value Averaging strategy.

If you would like more information on the Value Averaging Strategy, I invite you to contact me personally.

Joel Palmer B.Bus, Dip FS (FP), C.Dec

Principal Adviser

Palmer Portfolios Pty Ltd

joel@palmerportfolios.com.au

ph 07 3333 2733

Palmer Portfolios Pty Ltd (ABN 41 533 933 417) is a Corporate Authorised Representative (no. 301761) of Palmer Portfolios Group Pty Ltd AFSL: 376719 ABN: 78 145 431 107

07 3333 2733 www.palmerportfolios.com.au FAX 07 3367 2889

STREET: Suite 16, 1 Park Rd, Milton Qld 4064

POSTAL: PO Box 718, Paddington Qld 4064

PH

You might also like

- Kenison, Bruce - Precision Market Timing by The NumbersDocument57 pagesKenison, Bruce - Precision Market Timing by The Numbersabdi1No ratings yet

- Mastering Options: Effective and Profitable Strategies For InvestorsDocument18 pagesMastering Options: Effective and Profitable Strategies For InvestorsCharlene KronstedtNo ratings yet

- Fibonacci Queen Fib NotesDocument6 pagesFibonacci Queen Fib NotesLes Sanga0% (1)

- John Maynard Keynes As An Investor Timeless Lessons and PrinciplesDocument5 pagesJohn Maynard Keynes As An Investor Timeless Lessons and PrincipleskwongNo ratings yet

- Multiplicity and IFSTDocument10 pagesMultiplicity and IFSTkwongNo ratings yet

- Investing The Templeton WayDocument3 pagesInvesting The Templeton Waykma17No ratings yet

- Market Timing Sin A LittleDocument16 pagesMarket Timing Sin A LittlehaginileNo ratings yet

- The Value Averaging Investment StrategyDocument3 pagesThe Value Averaging Investment StrategyfbxurumelaNo ratings yet

- Value Averaging Fund - PresentationDocument27 pagesValue Averaging Fund - Presentationfbxurumela100% (1)

- Value Investing SpreadsheetDocument6 pagesValue Investing SpreadsheetfbxurumelaNo ratings yet

- Model Description: Ticker NameDocument14 pagesModel Description: Ticker NameOleg KondratenkoNo ratings yet

- My Notes (Eurodollar Master Notes From The Eurodollar Futures Book, by BurghardtDocument59 pagesMy Notes (Eurodollar Master Notes From The Eurodollar Futures Book, by Burghardtlaozi222No ratings yet

- A Quantitative Analysis of Managed Futures Strategies: Lintner RevisitedDocument40 pagesA Quantitative Analysis of Managed Futures Strategies: Lintner RevisitedIshan SaneNo ratings yet

- 07 - The Behavioral Investor by Daniel CrosbyDocument7 pages07 - The Behavioral Investor by Daniel CrosbyZulfan ArifNo ratings yet

- Trade Size Allocation PDFDocument8 pagesTrade Size Allocation PDFAdam PerezNo ratings yet

- Kelly Final DraftDocument29 pagesKelly Final DraftAnonymous jne5bpi7No ratings yet

- Videos Trading 2Document2 pagesVideos Trading 2Jesu CryptoNo ratings yet

- Equity Investment Styles - Cyclicalty of Investment StylesDocument118 pagesEquity Investment Styles - Cyclicalty of Investment Stylesatrader123No ratings yet

- VWSC Water Safety Knowledge Q's and A'sDocument3 pagesVWSC Water Safety Knowledge Q's and A'sDEXTERNo ratings yet

- Relative Value Investment StrategiesDocument2 pagesRelative Value Investment StrategiesUday ChaudhariNo ratings yet

- Q3AM Momentum White PaperDocument13 pagesQ3AM Momentum White Paperq3assetmanagementNo ratings yet

- 外汇超短线交易 技术结构和价格行为原理Document297 pages外汇超短线交易 技术结构和价格行为原理wangmh76No ratings yet

- Kampot Survival Guide Issue 20Document24 pagesKampot Survival Guide Issue 20Steve J100% (1)

- Goal Based Asset AllocationDocument32 pagesGoal Based Asset Allocationnilanjan1969No ratings yet

- Investing in Uncertain TimesDocument2 pagesInvesting in Uncertain TimesDinesh0% (1)

- Tactical Asset Allocation, Mebane FaberDocument13 pagesTactical Asset Allocation, Mebane FabersashavladNo ratings yet

- WSJ Barrons Options Insert-NYOT18-LowDocument8 pagesWSJ Barrons Options Insert-NYOT18-LowR@gmailNo ratings yet

- Lichello's Golden Little Secret: by David GressettDocument81 pagesLichello's Golden Little Secret: by David GressettvNo ratings yet

- Behavior Gap Carl RichardsDocument81 pagesBehavior Gap Carl RichardsZaur AbdullayevNo ratings yet

- Equity Collar StrategyDocument3 pagesEquity Collar StrategypkkothariNo ratings yet

- Value InvestingDocument18 pagesValue InvestingharshmarooNo ratings yet

- Strategy Portfolio: Dravyaniti Consulting LLPDocument13 pagesStrategy Portfolio: Dravyaniti Consulting LLPChidambara StNo ratings yet

- Trinity System - Theta Engine (Formerly 45+ DTE)Document404 pagesTrinity System - Theta Engine (Formerly 45+ DTE)trungNo ratings yet

- JoeRossTradingManual C12!97!102Document6 pagesJoeRossTradingManual C12!97!102swarup30No ratings yet

- Stock Repair StrategyDocument6 pagesStock Repair Strategyquality99No ratings yet

- Accounting For Cryptocurrencies-Dec2016Document12 pagesAccounting For Cryptocurrencies-Dec2016Markie GrabilloNo ratings yet

- Alpha InvestingDocument4 pagesAlpha Investingapi-3700769No ratings yet

- Trend Following Risk Parity and The CorrelationsDocument25 pagesTrend Following Risk Parity and The Correlationsbhishma_karki100% (1)

- Are Hedge Funds Becoming Regular Asset Managers or Are Regular Managers Pretending To Be Hedge Funds?Document45 pagesAre Hedge Funds Becoming Regular Asset Managers or Are Regular Managers Pretending To Be Hedge Funds?mayur8898357200No ratings yet

- All of Livermore Trading RulesDocument3 pagesAll of Livermore Trading RulesDavid HoNo ratings yet

- Statistical Arbitrage Pairs Trading With High-Frequency Data (#353612) - 364651Document13 pagesStatistical Arbitrage Pairs Trading With High-Frequency Data (#353612) - 364651lportoNo ratings yet

- IGBloomberg Volatility EbookDocument16 pagesIGBloomberg Volatility EbookHandisaputra LinNo ratings yet

- NewDocument5 pagesNewChen CenNo ratings yet

- The Winners and Losers of The Zero-Sum Game: The Origins of Trading Profits, Price Efficiency and Market LiquidityDocument34 pagesThe Winners and Losers of The Zero-Sum Game: The Origins of Trading Profits, Price Efficiency and Market LiquidityChiou Ying Chen100% (1)

- Technical ResearchDocument30 pagesTechnical Researchamit_idea1No ratings yet

- Trader's Mag May11Document77 pagesTrader's Mag May11Kelly MissBehavesNo ratings yet

- 2001.01.06 - Elliott Wave Theorist - Bear Market StrategiesDocument3 pages2001.01.06 - Elliott Wave Theorist - Bear Market StrategiesBudi MulyonoNo ratings yet

- How To Game Your Sharpe RatioDocument21 pagesHow To Game Your Sharpe RatioCervino InstituteNo ratings yet

- IFTA Journal 2014 PDFDocument104 pagesIFTA Journal 2014 PDFRaptordinos100% (2)

- Income On Demand Guide No 2Document9 pagesIncome On Demand Guide No 2ShamusORookeNo ratings yet

- Financial Glossary - BarclaysDocument4 pagesFinancial Glossary - BarclaysDiwakar AnandNo ratings yet

- Benjamin Graham and The Birth of Value InvestingDocument85 pagesBenjamin Graham and The Birth of Value Investingrsepassi100% (1)

- Catalogue V 22Document20 pagesCatalogue V 22percysearchNo ratings yet

- Machine Learning in Statistical ArbitrageDocument5 pagesMachine Learning in Statistical ArbitragesnsengineNo ratings yet

- Warren Buffet Investing HabbitsDocument6 pagesWarren Buffet Investing Habbitsajayshandilya4309No ratings yet

- Lessons in Investment WarfareDocument4 pagesLessons in Investment WarfareTim PriceNo ratings yet

- Spreadsheet Option Functions Available With Derivatives MarketsDocument13 pagesSpreadsheet Option Functions Available With Derivatives MarketsFanny Sylvia C.100% (4)

- Bisnews Technical AnalysisDocument33 pagesBisnews Technical AnalysisWings SVNo ratings yet

- IB-Matlab User GuideDocument100 pagesIB-Matlab User GuidePratik PatelNo ratings yet

- Ira Strategies 010615 Iwm Big LizardDocument7 pagesIra Strategies 010615 Iwm Big Lizardrbgainous2199No ratings yet

- Smart(er) Investing: How Academic Insights Propel the Savvy InvestorFrom EverandSmart(er) Investing: How Academic Insights Propel the Savvy InvestorNo ratings yet

- Strategic and Tactical Asset Allocation: An Integrated ApproachFrom EverandStrategic and Tactical Asset Allocation: An Integrated ApproachNo ratings yet

- Compound Yield: The Investors Edge in a Traders WorldFrom EverandCompound Yield: The Investors Edge in a Traders WorldNo ratings yet

- 100 Functional Equations Problems-OlympiadDocument15 pages100 Functional Equations Problems-Olympiadsanits591No ratings yet

- Applied CombinatoricsDocument49 pagesApplied CombinatoricskwongNo ratings yet

- Malaysia ASAMO 2014 Form 5 English EditedDocument7 pagesMalaysia ASAMO 2014 Form 5 English EditedkwongNo ratings yet

- Defeat Your Self-Defeating BehaviorDocument39 pagesDefeat Your Self-Defeating Behaviorkwong100% (3)

- Internal Family Systems (IFS) in Indian CountryDocument11 pagesInternal Family Systems (IFS) in Indian Countrykwong100% (1)

- Imso 2014 Essay 28problemsDocument8 pagesImso 2014 Essay 28problemskwong100% (1)

- 199567890123Document37 pages199567890123SeusongNo ratings yet

- Imso 2013 Math - Short AnswerDocument5 pagesImso 2013 Math - Short Answerkwong0% (1)

- Emotion and InvestingDocument10 pagesEmotion and InvestingkwongNo ratings yet

- Growth Vs ValueDocument9 pagesGrowth Vs ValuekwongNo ratings yet

- Buffett's Alpha - Frazzini, Kabiller and PedersenDocument45 pagesBuffett's Alpha - Frazzini, Kabiller and PedersenkwongNo ratings yet

- Linda Bradford Raschke On Short Term Trading StrategiesDocument8 pagesLinda Bradford Raschke On Short Term Trading StrategiesSudarshan DujariNo ratings yet

- Sam SeidenDocument3 pagesSam SeidenPro tube0% (1)

- Dohmen Capital Research Proving Wall Street Wrong Special Report 2021Document22 pagesDohmen Capital Research Proving Wall Street Wrong Special Report 2021aKNo ratings yet

- Hansen, Toni - Quick Reference Guide To Successful Market TimingDocument76 pagesHansen, Toni - Quick Reference Guide To Successful Market TimingAlejandro Mufardini100% (2)

- Ch18 Globalization and International InvestingDocument43 pagesCh18 Globalization and International InvestingA_StudentsNo ratings yet

- 2013 Review & 2014 OutlookDocument21 pages2013 Review & 2014 OutlookJohn CuthbertNo ratings yet

- MMAPreferred Catalog 2010Document12 pagesMMAPreferred Catalog 2010Deep MandaliaNo ratings yet

- Dynamic FX PortfoliosDocument55 pagesDynamic FX PortfolioslorenzoNo ratings yet

- Astrology, Financial Applications of Astronomic CyclesDocument5 pagesAstrology, Financial Applications of Astronomic CyclesPrasanta DebnathNo ratings yet

- Swing Trading and Underlying Principles of Technical Analysis by Linda RaschkeDocument41 pagesSwing Trading and Underlying Principles of Technical Analysis by Linda RaschkeDuck Foo100% (1)

- Session 20 Portfolio Management Framework: The Grand DesignDocument37 pagesSession 20 Portfolio Management Framework: The Grand DesignEkta Saraswat VigNo ratings yet

- Quantpedia Com Strategies Asset Class Trend FollowingDocument7 pagesQuantpedia Com Strategies Asset Class Trend FollowingToby RufeoNo ratings yet

- An Introduction To Portfolio ManagementDocument17 pagesAn Introduction To Portfolio ManagementgiorgiauuuNo ratings yet

- Sector Rotation StrategyDocument53 pagesSector Rotation StrategySylvia KunthieNo ratings yet

- The Use and Abuse of Implementation Shortfall - MarkitDocument18 pagesThe Use and Abuse of Implementation Shortfall - MarkittabbforumNo ratings yet

- Market TimingDocument15 pagesMarket TimingClaysius DewanataNo ratings yet

- The MarketEdge Way 2nd EdDocument66 pagesThe MarketEdge Way 2nd EdMarkNo ratings yet

- Yardeni Stock Market CycleDocument36 pagesYardeni Stock Market CycleOmSilence2651100% (1)

- A - All Trading BooksDocument15 pagesA - All Trading BooksSwanand DhakeNo ratings yet

- Table Interpretation Thesis SampleDocument5 pagesTable Interpretation Thesis Samplenicolesavoielafayette100% (2)

- Thesis Eet UnswDocument4 pagesThesis Eet Unswdwtnpjyv100% (2)

- Wealth Management PlanDocument18 pagesWealth Management PlanVinod PandeyNo ratings yet

- Misery Loves Company: The Spread of Negative Impacts Resulting From An Organizational CrisisDocument21 pagesMisery Loves Company: The Spread of Negative Impacts Resulting From An Organizational Crisislobna_qassem7176No ratings yet

- Amazing Stock Market SeasonalityDocument5 pagesAmazing Stock Market SeasonalityBrook Rene JohnsonNo ratings yet

- Market Timing With Moving Averages PDFDocument39 pagesMarket Timing With Moving Averages PDFcommon citizenNo ratings yet

- DaveLandrys10Best Swing Trading Patterns and StratigiesDocument191 pagesDaveLandrys10Best Swing Trading Patterns and Stratigiesvenkatakrishna1nukal100% (7)

- Tds ThesisDocument4 pagesTds Thesismelissamooreportland100% (1)