Professional Documents

Culture Documents

PrintTax14 PDF

PrintTax14 PDF

Uploaded by

arnieanuCopyright:

Available Formats

You might also like

- Pay Slip March 2017Document4 pagesPay Slip March 2017Anonymous AsVoWD04c0% (1)

- Attendance PolicyDocument4 pagesAttendance Policyiamonlyone100% (1)

- Form 16 2020-2021Document2 pagesForm 16 2020-2021Parth BeriNo ratings yet

- Form 16Document2 pagesForm 16SIVA100% (1)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelNo ratings yet

- Dbkps7123e - Ay 2017 18Document5 pagesDbkps7123e - Ay 2017 18Damodar SurisettyNo ratings yet

- Acknowledgement Itr PDFDocument1 pageAcknowledgement Itr PDFShobhit PathakNo ratings yet

- Lease ContractDocument5 pagesLease Contractczabina fatima delicaNo ratings yet

- Completion Bonus: Iqor Employees Who Are Offered The Iqor Completion Incentive PlanDocument6 pagesCompletion Bonus: Iqor Employees Who Are Offered The Iqor Completion Incentive PlanNestor Del PilarNo ratings yet

- Earnest Money Deposit Receipt AgreementDocument2 pagesEarnest Money Deposit Receipt AgreementGene Abot100% (2)

- 001 008 SG 873749 PDFDocument8 pages001 008 SG 873749 PDFtebo8teboNo ratings yet

- Separation and Release AgreementDocument2 pagesSeparation and Release AgreementSophia SajulNo ratings yet

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556No ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiNo ratings yet

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhNo ratings yet

- ADEPJ433Document2 pagesADEPJ433ravibhartia1978No ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Form 16Document2 pagesForm 16Mithun KumarNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- Form16 PDFDocument9 pagesForm16 PDFHarish KumarNo ratings yet

- b5047 Form16 Fy1819 PDFDocument9 pagesb5047 Form16 Fy1819 PDFBhumika JoshiNo ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part AHarish KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSagar Kumar GuptaNo ratings yet

- Deve 60398Document7 pagesDeve 60398Devesh Pratap ChandNo ratings yet

- FS51853 KPMG PDFDocument9 pagesFS51853 KPMG PDFAman AgrawalNo ratings yet

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNo ratings yet

- Form 16Document2 pagesForm 16sowjanya0% (1)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPradeep NegiNo ratings yet

- DD ProjectDocument2 pagesDD Projectjatin kuashikNo ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- Form 16ADocument4 pagesForm 16AniranjansankaNo ratings yet

- Employee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeDocument2 pagesEmployee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeGjjnnmNo ratings yet

- Ahhpt7531m 2020-21 PDFDocument2 pagesAhhpt7531m 2020-21 PDFAshish BhartiNo ratings yet

- Form 16 ADocument5 pagesForm 16 Anisha_khanNo ratings yet

- Biapg2824f - Partb - 2019-20 Sameer PDFDocument3 pagesBiapg2824f - Partb - 2019-20 Sameer PDFGanesh LohakareNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Manav ChaudharyNo ratings yet

- Form 16 2020 21Document6 pagesForm 16 2020 21Manoj MahimkarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurupaappaapNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rajen sahaNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedsaisindhuNo ratings yet

- Computation of Total Income Income From Other Sources (Chapter IV F) 289381Document2 pagesComputation of Total Income Income From Other Sources (Chapter IV F) 289381Ashish AgarwalNo ratings yet

- 2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFDocument1 page2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFmaxNo ratings yet

- Clhps7458a 2019-20Document2 pagesClhps7458a 2019-20Gurudeep singhNo ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- Form 16 20-21 PartaDocument2 pagesForm 16 20-21 PartaTEMPORARY TEMPNo ratings yet

- 322 PartaDocument2 pages322 Partaritik tiwariNo ratings yet

- Form 16 Part - BDocument3 pagesForm 16 Part - BdivanshuNo ratings yet

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADocument2 pagesAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNo ratings yet

- Anil 21-22Document2 pagesAnil 21-22chrisj 99No ratings yet

- Form 16 Part B 2016-17Document4 pagesForm 16 Part B 2016-17atulsharmaNo ratings yet

- BGCC M01495Document2 pagesBGCC M01495RAJKUMAR CHATTERJEE. (RAJA.)No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- Form 16 PDFDocument3 pagesForm 16 PDFkk_mishaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurusunilchampNo ratings yet

- Aekpy3088c 2019Document4 pagesAekpy3088c 2019Ajay YadavNo ratings yet

- Form 16Document2 pagesForm 16Kushal MalhotraNo ratings yet

- Form 26ASDocument3 pagesForm 26ASHarshil MehtaNo ratings yet

- ADRPD2454Document2 pagesADRPD2454ravibhartia1978No ratings yet

- Ahspy8053e 2014-15Document2 pagesAhspy8053e 2014-15kzx08110No ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaNo ratings yet

- Vocabulary For TOEIC - 14 - Job RecruitmentDocument2 pagesVocabulary For TOEIC - 14 - Job RecruitmentTeacher100% (1)

- BIR Accreditation of ImporterDocument1 pageBIR Accreditation of ImporterAnonymous Xa8cEVVNo ratings yet

- FIX Group 5 Summary Accounting Theory 10th Meeting Chapter 11 Positive Theory of Accounting Policy and DisclosureDocument9 pagesFIX Group 5 Summary Accounting Theory 10th Meeting Chapter 11 Positive Theory of Accounting Policy and DisclosureEggie Auliya HusnaNo ratings yet

- 03 - Chapter 1Document14 pages03 - Chapter 1fidamehdiNo ratings yet

- Siga-An v. VillanuevaDocument10 pagesSiga-An v. VillanuevaEnzoNo ratings yet

- Functions of The NLRCDocument2 pagesFunctions of The NLRCaugielusungNo ratings yet

- Richard Lobo EVP and Head Human Resources - Infosys LimitedDocument8 pagesRichard Lobo EVP and Head Human Resources - Infosys LimitedAditya TiwariNo ratings yet

- McPherson v. Tennessee Football, Inc. - Document No. 8Document16 pagesMcPherson v. Tennessee Football, Inc. - Document No. 8Justia.comNo ratings yet

- Gabriel v. SOLEDocument2 pagesGabriel v. SOLEEva TrinidadNo ratings yet

- Collective BargainingDocument11 pagesCollective BargainingAtaur Rahaman KhanNo ratings yet

- Pabugais v. SahijwaniDocument3 pagesPabugais v. SahijwaniEmir MendozaNo ratings yet

- Arbonne Opportunity PresentationDocument26 pagesArbonne Opportunity PresentationJaretNo ratings yet

- Law QuestionDocument18 pagesLaw QuestionAbhishek RawatNo ratings yet

- MARSHALL-Citizenship and Social ClassDocument7 pagesMARSHALL-Citizenship and Social ClassSebastian Gabriel Guzman RiveraNo ratings yet

- Muller Vs PNBDocument2 pagesMuller Vs PNBMarklawrence Fortes100% (1)

- Rl'qd. Office: 115/535, Old Mahabalipuram Road, Okkiam Thoraipakkam, Chennai - 600 097Document9 pagesRl'qd. Office: 115/535, Old Mahabalipuram Road, Okkiam Thoraipakkam, Chennai - 600 097eidpics 2022No ratings yet

- 78 Cavite Development Bank v. LimDocument3 pages78 Cavite Development Bank v. LimIldefonso Hernaez100% (1)

- Case DigestDocument62 pagesCase DigestMylesNo ratings yet

- Usita Lecture TranscriptDocument34 pagesUsita Lecture TranscriptAmberChanNo ratings yet

- SchemaDocument140 pagesSchemaDanny Hahn100% (8)

- Ukur BahanDocument7 pagesUkur BahanChikwason Sarcozy Mwanza0% (1)

- Cagampan Vs NLRC DigestDocument2 pagesCagampan Vs NLRC DigestDazzle Duterte100% (2)

- The Pricing of Group Life Insurance Schemes PDFDocument53 pagesThe Pricing of Group Life Insurance Schemes PDFMula PrasadNo ratings yet

- NBADocument12 pagesNBANishanth Varier100% (2)

PrintTax14 PDF

PrintTax14 PDF

Uploaded by

arnieanuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PrintTax14 PDF

PrintTax14 PDF

Uploaded by

arnieanuCopyright:

Available Formats

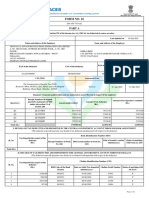

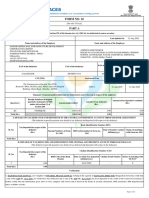

FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Certificate No. VYZVLYH

Last updated on

Name and address of the Employer

10-Jun-2014

Name and address of the Employee

ALL INDIA INSTITUTE OF MEDICAL SCIENCE

DIRECTORS WING, AIIMS, ANSARI NAGAR,

ANSARI NAGAR, NEW DELHI - 110029

Delhi

+(91)11-26593293

aiims_tds@aiims.ac.in

ANURAG SINGH

126 ISHWAR COLONY EXT 3, DELHI ROAD BAWANA,

BAWANA, DELHI, DELHI - 110039 Delhi

PAN of the Deductor

TAN of the Deductor

AAATA4049H

DELA00110F

PAN of the Employee

Employee Reference No.

provided by the Employer

(If available)

BZXPS2804M

CIT (TDS)

Assessment Year

The Commissioner of Income Tax (TDS)

Aayakar Bhawan, District Centre, 6th Floor Room no 610, Hall no.

4 , Luxmi Nagar, Delhi - 110092

2014-15

Period with the Employer

From

To

01-Apr-2013

31-Mar-2014

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter(s)

Receipt Numbers of original

quarterly statements of TDS

under sub-section (3) of

Section 200

Q4

QQQMZFTE

Total (Rs.)

Amount of tax deposited / remitted

(Rs.)

Amount of tax deducted

(Rs.)

Amount paid/credited

34882.00

5194.00

5194.00

34882.00

5194.00

5194.00

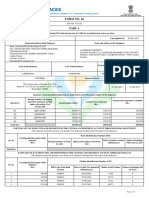

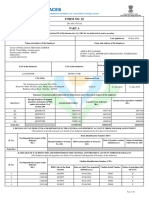

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Receipt Numbers of Form

No. 24G

DDO serial number in Form no.

24G

Date of transfer voucher Status of matching

(dd/mm/yyyy)

with Form no. 24G

Total (Rs.)

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

5194.00

Total (Rs.)

5194.00

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited Challan Serial Number

(dd/mm/yyyy)

0001536

09-01-2014

00006

Status of matching with

OLTAS*

F

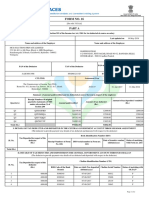

Verification

I, VIJAY PAL SINGH, son / daughter of MADAN LAL working in the capacity of ACCOUNTS OFFICER (designation) do hereby certify that a sum of Rs. 5194.00 [Rs.

Five Thousand One Hundred and Ninety Four Only (in words)] has been deducted and a sum of Rs. 5194.00 [Rs. Five Thousand One Hundred and Ninety Four Only]

has been deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the

books of account, documents, TDS statements, TDS deposited and other available records.

Page 1 of 2

Certificate Number: VYZVLYH

TAN of Employer: DELA00110F

Place

NEW DELHI

Date

11-Jun-2014

Designation: ACCOUNTS OFFICER

PAN of Employee: BZXPS2804M

Assessment Year: 2014-15

(Signature of person responsible for deduction of Tax)

Full Name:VIJAY PAL SINGH

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

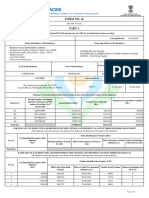

Legend used in Form 16

* Status of matching with OLTAS

Legend

Description

Definition

Unmatched

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

details in bank match with details of deposit in TDS / TCS statement

Provisional

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

verification of payment details submitted by Pay and Accounts Officer (PAO)

Final

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Overbooked

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

Page 2 of 2

You might also like

- Pay Slip March 2017Document4 pagesPay Slip March 2017Anonymous AsVoWD04c0% (1)

- Attendance PolicyDocument4 pagesAttendance Policyiamonlyone100% (1)

- Form 16 2020-2021Document2 pagesForm 16 2020-2021Parth BeriNo ratings yet

- Form 16Document2 pagesForm 16SIVA100% (1)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelNo ratings yet

- Dbkps7123e - Ay 2017 18Document5 pagesDbkps7123e - Ay 2017 18Damodar SurisettyNo ratings yet

- Acknowledgement Itr PDFDocument1 pageAcknowledgement Itr PDFShobhit PathakNo ratings yet

- Lease ContractDocument5 pagesLease Contractczabina fatima delicaNo ratings yet

- Completion Bonus: Iqor Employees Who Are Offered The Iqor Completion Incentive PlanDocument6 pagesCompletion Bonus: Iqor Employees Who Are Offered The Iqor Completion Incentive PlanNestor Del PilarNo ratings yet

- Earnest Money Deposit Receipt AgreementDocument2 pagesEarnest Money Deposit Receipt AgreementGene Abot100% (2)

- 001 008 SG 873749 PDFDocument8 pages001 008 SG 873749 PDFtebo8teboNo ratings yet

- Separation and Release AgreementDocument2 pagesSeparation and Release AgreementSophia SajulNo ratings yet

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556No ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiNo ratings yet

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhNo ratings yet

- ADEPJ433Document2 pagesADEPJ433ravibhartia1978No ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Form 16Document2 pagesForm 16Mithun KumarNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- Form16 PDFDocument9 pagesForm16 PDFHarish KumarNo ratings yet

- b5047 Form16 Fy1819 PDFDocument9 pagesb5047 Form16 Fy1819 PDFBhumika JoshiNo ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part AHarish KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSagar Kumar GuptaNo ratings yet

- Deve 60398Document7 pagesDeve 60398Devesh Pratap ChandNo ratings yet

- FS51853 KPMG PDFDocument9 pagesFS51853 KPMG PDFAman AgrawalNo ratings yet

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNo ratings yet

- Form 16Document2 pagesForm 16sowjanya0% (1)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPradeep NegiNo ratings yet

- DD ProjectDocument2 pagesDD Projectjatin kuashikNo ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- Form 16ADocument4 pagesForm 16AniranjansankaNo ratings yet

- Employee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeDocument2 pagesEmployee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeGjjnnmNo ratings yet

- Ahhpt7531m 2020-21 PDFDocument2 pagesAhhpt7531m 2020-21 PDFAshish BhartiNo ratings yet

- Form 16 ADocument5 pagesForm 16 Anisha_khanNo ratings yet

- Biapg2824f - Partb - 2019-20 Sameer PDFDocument3 pagesBiapg2824f - Partb - 2019-20 Sameer PDFGanesh LohakareNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Manav ChaudharyNo ratings yet

- Form 16 2020 21Document6 pagesForm 16 2020 21Manoj MahimkarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurupaappaapNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rajen sahaNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedsaisindhuNo ratings yet

- Computation of Total Income Income From Other Sources (Chapter IV F) 289381Document2 pagesComputation of Total Income Income From Other Sources (Chapter IV F) 289381Ashish AgarwalNo ratings yet

- 2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFDocument1 page2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFmaxNo ratings yet

- Clhps7458a 2019-20Document2 pagesClhps7458a 2019-20Gurudeep singhNo ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- Form 16 20-21 PartaDocument2 pagesForm 16 20-21 PartaTEMPORARY TEMPNo ratings yet

- 322 PartaDocument2 pages322 Partaritik tiwariNo ratings yet

- Form 16 Part - BDocument3 pagesForm 16 Part - BdivanshuNo ratings yet

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADocument2 pagesAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNo ratings yet

- Anil 21-22Document2 pagesAnil 21-22chrisj 99No ratings yet

- Form 16 Part B 2016-17Document4 pagesForm 16 Part B 2016-17atulsharmaNo ratings yet

- BGCC M01495Document2 pagesBGCC M01495RAJKUMAR CHATTERJEE. (RAJA.)No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- Form 16 PDFDocument3 pagesForm 16 PDFkk_mishaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurusunilchampNo ratings yet

- Aekpy3088c 2019Document4 pagesAekpy3088c 2019Ajay YadavNo ratings yet

- Form 16Document2 pagesForm 16Kushal MalhotraNo ratings yet

- Form 26ASDocument3 pagesForm 26ASHarshil MehtaNo ratings yet

- ADRPD2454Document2 pagesADRPD2454ravibhartia1978No ratings yet

- Ahspy8053e 2014-15Document2 pagesAhspy8053e 2014-15kzx08110No ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaNo ratings yet

- Vocabulary For TOEIC - 14 - Job RecruitmentDocument2 pagesVocabulary For TOEIC - 14 - Job RecruitmentTeacher100% (1)

- BIR Accreditation of ImporterDocument1 pageBIR Accreditation of ImporterAnonymous Xa8cEVVNo ratings yet

- FIX Group 5 Summary Accounting Theory 10th Meeting Chapter 11 Positive Theory of Accounting Policy and DisclosureDocument9 pagesFIX Group 5 Summary Accounting Theory 10th Meeting Chapter 11 Positive Theory of Accounting Policy and DisclosureEggie Auliya HusnaNo ratings yet

- 03 - Chapter 1Document14 pages03 - Chapter 1fidamehdiNo ratings yet

- Siga-An v. VillanuevaDocument10 pagesSiga-An v. VillanuevaEnzoNo ratings yet

- Functions of The NLRCDocument2 pagesFunctions of The NLRCaugielusungNo ratings yet

- Richard Lobo EVP and Head Human Resources - Infosys LimitedDocument8 pagesRichard Lobo EVP and Head Human Resources - Infosys LimitedAditya TiwariNo ratings yet

- McPherson v. Tennessee Football, Inc. - Document No. 8Document16 pagesMcPherson v. Tennessee Football, Inc. - Document No. 8Justia.comNo ratings yet

- Gabriel v. SOLEDocument2 pagesGabriel v. SOLEEva TrinidadNo ratings yet

- Collective BargainingDocument11 pagesCollective BargainingAtaur Rahaman KhanNo ratings yet

- Pabugais v. SahijwaniDocument3 pagesPabugais v. SahijwaniEmir MendozaNo ratings yet

- Arbonne Opportunity PresentationDocument26 pagesArbonne Opportunity PresentationJaretNo ratings yet

- Law QuestionDocument18 pagesLaw QuestionAbhishek RawatNo ratings yet

- MARSHALL-Citizenship and Social ClassDocument7 pagesMARSHALL-Citizenship and Social ClassSebastian Gabriel Guzman RiveraNo ratings yet

- Muller Vs PNBDocument2 pagesMuller Vs PNBMarklawrence Fortes100% (1)

- Rl'qd. Office: 115/535, Old Mahabalipuram Road, Okkiam Thoraipakkam, Chennai - 600 097Document9 pagesRl'qd. Office: 115/535, Old Mahabalipuram Road, Okkiam Thoraipakkam, Chennai - 600 097eidpics 2022No ratings yet

- 78 Cavite Development Bank v. LimDocument3 pages78 Cavite Development Bank v. LimIldefonso Hernaez100% (1)

- Case DigestDocument62 pagesCase DigestMylesNo ratings yet

- Usita Lecture TranscriptDocument34 pagesUsita Lecture TranscriptAmberChanNo ratings yet

- SchemaDocument140 pagesSchemaDanny Hahn100% (8)

- Ukur BahanDocument7 pagesUkur BahanChikwason Sarcozy Mwanza0% (1)

- Cagampan Vs NLRC DigestDocument2 pagesCagampan Vs NLRC DigestDazzle Duterte100% (2)

- The Pricing of Group Life Insurance Schemes PDFDocument53 pagesThe Pricing of Group Life Insurance Schemes PDFMula PrasadNo ratings yet

- NBADocument12 pagesNBANishanth Varier100% (2)