Professional Documents

Culture Documents

Recovery in MHCV Whereas LCV Struggles Due To Lag Effect: Sector Update

Recovery in MHCV Whereas LCV Struggles Due To Lag Effect: Sector Update

Uploaded by

forumajmeraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Recovery in MHCV Whereas LCV Struggles Due To Lag Effect: Sector Update

Recovery in MHCV Whereas LCV Struggles Due To Lag Effect: Sector Update

Uploaded by

forumajmeraCopyright:

Available Formats

HDFC Bank Investment Advisory Group

December 18, 2014

Indian Automobile Industry - Recovery in Commercial Vehicle

Sector Update

India is seventh-largest vehicle producer in the world with an average annual production of 17.5

Million vehicles, of which ~13% are exported. The overall vehicle sales in India grew at a CAGR of

9.87% during FY05-FY14 while commercial vehicle (contributing 3.4% of total sales in volumes

terms) grew at CAGR of 10.7% over the same period. However, the demand for Commercial

Vehicle (CV) is closely linked to economic growth rate and with Indian economy struggled to post

GDP growth rate above 5% for seven (excluding 5.2% YoY in Q2FY14) out of eight quarters till

FY14, the CV segment saw a decline of 2% YoY in FY13 and 20% YoY in FY14.

CV registering ~20%YoY decline for two consecutive years started show early signs of improvement

Source: Bloomberg

Recovery in MHCV whereas LCV struggles due to lag effect

The overall CV demand in India remained depressed throughout FY13 and FY14. During FY13,

the overall CV sales dipped by ~2% due to weak performance by Medium and Heavy Commercial

Vehicles (M&HCV) segment which was partially offset by Light Commercial Vehicle (LCV).

However, in FY14 both MHCV and LCV reported subdued growth resulting to 20% YoY decline in

overall CV segment. The ban on iron ore mining, fleet underutilization, fall in resale value and low

economic activities were major contributors to depressed demand during this period.

Recovery in MHCV: The M&HCV segment recorded a dip of 25.3% YoY in FY14 vs. decline of

23.1% YoY in FY13 in its sales volume. However, over the past few months, the government has

been making an effort to revive the sector with announcements like extension of reduction in

excise duty. This has brought some cheers to MHCV segment. In November 2014, MHCV

reported a strong 40.1% YoY growth, the third straight month where it has reported a double digit

growth. This early signs of improvement in commercial vehicle cycle is due to host of factors like

partial lifting of mining bans, improvement in freight rates and due to revival in construction activity

led by improved focus on infrastructure development.

Source: Bloomberg

LCV segment still lagging: While MHCV segment was struggling, the LCV segment had reported

14.0% YoY growth in FY13 due to shift of customers in low capacity vehicles on the back of

subdued demand. However, the subdued economic growth started pinching LCV segment as well

December 18, 2014

and consequently, it reported a decline of 17.6% YoY in FY14. So far in FY15 (till November), it

declined by 12.9% YoY. The fall in LCV segment is mainly due to drop in sales of Small

Commercial Vehicle (SCV) where fund availability is the main concern. The high default rates in

loans prompted the financiers to tighten lending norms and reduce the Loan-to-value (LTV) ratio.

The financiers are still cautious while funding to SCV buyers due to their weak credit profile which

is further delaying growth in LCV segment. However, LCV segment is indicating some signs of

bottoming as the rate of decline in LCV segment have reduced to 2.1% YoY in November as

against decline of 13.1% YoY in October 2014. According to Society of Indian Automobile

Manufacturers (SIAM), the growth in domestic sales of four-wheelers is expected to be around 33.5% for FY15 which will be driven by strong growth in MHCV segment whereas LCV is expected

to report a negative growth due to stringent lending norms.

Key drivers of improvement in CV cycle

The extension of benefit from excise duty cuts (to 8% from 12%) has given some relief to bleeding

CV segment. However it has started to improve in past few months on the expectation of revival in

economy. There are few other factors which are indicating further improvement in overall CV cycle

and are expected to drive strong growth for H2FY15. Some of these factors are mentioned below

Recovery in Mining and quarrying activity

The ban on mining activity in Karnataka in

2011 and followed by ban in Odisha and Goa

has taken a significant toll on the mining

activity in India and which was also reflected

in demand for commercial vehicles. However

partial resumption of mines in Karnataka with

the production cap of 30 million tonne in April

2013 has given some relief to mining sector.

From there on mining and quarrying activity

showed reduction in de-growth and for the

past two quarters it has started posting

positive growth. Further, the government is in

process of finalizing coal block allocation

policy which may provide clear direction for

mining activity and is expected to register a

Source: Bloomberg

Construction GDP growth of close to 5% YoY for second consecutive quarter

Construction sector which contributed ~7.4%

of the total GDP in Q2FY15 has grown close

to 5% YoY for second consecutive quarter.

This reflects strong demand for cement

sector. Further, it is expected to improve in

H2FY15 given the improved focus on

infrastructure from the government. Improved

demand from cement players is likely to

increase the utilization levels for freight

operators and thereby increase in demand

for commercial vehicles.

robust growth due to expected pickup in

demand.

Source: Bloomberg

Improvement in utilization rate and stable freight rates

In November 2014, truck rentals have come down by about 5% which has raised some question

on the strong growth depicted in MHCV sales. However, as per industry experts, rentals have

come down due to sharp fall in diesel prices and not due to overall slowdown. Despite reduction in

truck rentals, the freight rates have remained stable in 11 truck routes. Further, industry wide

many big fleet operators have seen an improvement in truck utilization level to 70% in August

December 18, 2014

2014 from 60% in April 2014. Going forward, the utilization level is expected to improve further

post a hike in rail haulage charges by 25-41% as road freight charges are about 15-20% cheaper

than rail freight charges. This indicates that with increasing utilization level demand for new

commercial vehicle is expected to rise.

Discount levels are still at high but slowly stabilizing

During the time of slowdown and falling demand, industry saw withdrawal of small fleet operators

(having five trucks or less) from the market. This forced CV manufactures to either curtail

production or announce heavy discounts to avoid inventory pile up. As a result discounts had shot

up to all time high levels. However, with early signs of pick up in MHCV segment discounts are

showing some sign of stabilizing (although at higher levels) and are expected to come down

gradually. OEMs are still cautious on reducing discounts levels and are rather working on

mitigating negative effects of discounts.

According to Ravindra Pisharody, executive director at Tata Motors, discounts are still at

unreasonably high but are stable and we are working on ways to bring down the negative effect of

discounts. (Source: Business Standard article dated November 18, 2014)

We think that high level of discounts may help OEMs to maintain high growth rate depicted in

recent months.

Fleet operators looking to replace the ageing trucks

During the economic slowdown in past two fiscal years, many fleet operators have prolonged their

new buying of trucks by one to two years which had severely impacted the CV sales. This ageing

truck have higher maintenance cost than new vehicles. According to media reports, with

improvement in capacity utilization levels majority of fleet operators are looking to replace the

ageing trucks due to high cost of maintenance. According to industry experts, close to 100,000

aged trucks were scrapped during the last four quarters. Further, the customers have also started

demanding for younger fleets which may pressurize fleet operators to place orders for new

vehicles.

View

The CV segment is showing early signs of improvement led by strong growth in MHCV sales

while LCV dragging the overall growth rate for the segment. We believe that H2FY15 may

see an accelerated growth rate for MHCV segment on the back of reform push by

government to promote investments, develop infrastructure, revive mining activities,

declining interest rate and demand for goods carrier vehicles. Apart from these factors, the

growth of LCV segment will largely depend on the easy availability of finance for new

buyers. Overall we remain positive on the sector from the long term perspective on the

expected pickup in infrastructure activity and on the expectation of interest rate cut in near

to medium which may bring new buyers and lead to stronger growth in overall CV segment.

We are looking for opportunities to take part in the CV revival story and would look to add

such stock in the model portfolio as and when valuation of individual stocks starts looking

attractive. However as a quasi play we have Mahindra & Mahindra in our model portfolio

which deals largely in LCV segment.

December 18, 2014

Mahindra & Mahindra Limited

CMP:Rs.1220

Background

Mahindra & Mahindra Limited operates in multiple segments directly or via holding in other

companies. Automotive Segment consists of sales of automobiles, spare parts and related

services. Farm Equipment Segment consists of sales of tractors, spare parts and related services.

Information Technology (IT) Services consists of services rendered for IT and Telecom. Financial

Services consists of services relating to financing, leasing and hire purchase of automobiles and

tractors. Steel Trading and Processing consists of trading and processing of steel. Infrastructure

consists of operating of commercial complexes, project management and development. Hospitality

consists of sale of vacation ownership. Others consist of Logistics, After-market, Two wheelers and

Investments.

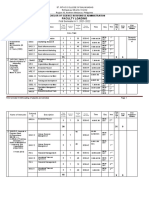

Key Details

52 week H/L(Rs)

Book Value/ Share (Rs) YTD

FV (Rs)

PE (TTM)

Dividend Yield (%)

1421/847

375.3

5.00

17.4

1.14

Shareholding Pattern (%) on 30 September

2014

Promoter

25.78

FII

40.21

DII

16.40

Others

17.61

Total

100.00

Valuations

FY14

20.3

PE

FY15E

FY16E

18.5

16.3

Sources: Bloomberg

View: Due to deficient monsoon tractor industry growth was flat and is not expected to

improve drastically; however M&M continues to be a leader in the segment and has gained

market share marginally on YoY basis with the launch of new tractor. While the Company is

facing slowdown in Auto segment due to absence in Compact UV segment, new Scorpio is

expected to support the volume growth in the segment. Further, UV volumes are expected

to improve from H2FY15 on the back of improvement in the economy and new launches in

Q3FY15. With the new launches are on the expected to bring revenue growth, the margin

would be the key monitorable for the stock. We remain positive on the stock on the

expected new launches on both product and engine side in Q3FY15 and on good return

ratios of over 20%. At CMP the stock is trading at 16.3x FY16E earnings. We maintain our

BUY rating on the stock with revised target price of Rs.1502 (15x FY16E EPS of Rs.75.0 +

Rs.377 as value of subsidiaries at 30% holding company discount).

December 18, 2014

Disclaimer: This communication is being sent by the Investment Advisory Group of HDFC Bank Ltd., registered under SEBI

(Investment Advisors) Regulations, 2013

This note has been prepared exclusively for the benefit and internal use of the recipient and does not carry any right of

reproduction or disclosure. Neither this note nor any of its contents maybe used for any other purpose without the prior

written consent of HDFC Bank Ltd, Investment Advisory Group. In preparing this note, we have relied upon and assumed,

without any independent verification, accuracy and completeness of all information available in public domain or from

sources considered reliable.

This note contains certain assumptions and views, which HDFC Bank Ltd, Investment Advisory Group considers reasonable

at this point in time, and which are subject to change. Computations adopted in this note are indicative and are based on

current market prices and general market sentiment. No representation or warranty is given by HDFC Bank Ltd, Investment

Advisory Group as to the achievement or reasonableness or completeness of any idea and/or assumptions.

This note does not purport to contain all the information that the recipient may require. Recipients should not construe any

of the contents herein as advice relating to business, financial, legal, taxation, or other matters and they are advised to

consult their own business, financial, legal, taxation and other experts / advisors concerning the company regarding the

appropriateness of investing in any securities or investment strategies discussed or recommended in this note and should

understand that statements regarding future prospects may not be realized. It may be noted that investments in equity and

equity-related securities involve a degree of risk and investors should not invest any funds unless they can afford to take the

risk of losing their investment. Investors are advised to undertake necessary due diligence before making an investment

decision. For making an investment decision, investors must rely on their own examination of the Company including the

risks involved. Investors should note that income from investment in such securities, if any, may fluctuate and that each

securitys price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Neither

HDFC Bank nor any of its employees shall be liable for any direct, indirect, special, incidental, consequential, punitive or

exemplary damages, including lost profits arising in any way from the information contained in this material.

This note does not constitute an offer for sale, or an invitation to subscribe for, or purchase equity shares or other assets or

securities of the company and the information contained herein shall not form the basis of any contract. It is also not meant

to be or to constitute any offer for any transaction.

HDFC Bank and its affiliates, officers, directors, key managerial persons and employees, including persons involved in the

preparation or issuance of this material may from time to time, have long or short positions in, and buy or sell the securities

thereof, of company (ies) mentioned herein. HDFC Bank may at any time solicit or provide commercial banking, credit,

advisory or other services to the issuer of any security referred to herein. Accordingly, information may be available to

HDFC Bank, which is not reflected in this material, and HDFC Bank may have acted upon or used the information prior to,

or immediately following its publication.

Disclosures:

Research analyst or his/her relatives or HDFC Bank or its associates may have financial interest in the subject company in

ordinary course of business. Research analyst or his/her relatives does not have actual/ beneficial ownership of 1% or more

securities of the subject company at the end of the month immediately preceding the date of publication of research report:

HDFC Bank or its associates may have actual/beneficial ownership of 1% or more securities of the subject company at the

end of the month immediately preceding the date of publication of research report. Subject company may have been client

of HDFC Bank or its associates during twelve months preceding the date of publication of the research report. HDFC Bank

or its associates may have received compensation from the subject company in the past twelve months. HDFC Bank or its

associates may have managed or co-managed public offering of securities for the subject company in the past twelve

months. HDFC Bank or its associates may have received compensation for investment banking or merchant banking or

brokerage services from the subject company in the past twelve months. HDFC Bank or its associates may have received

compensation for products or services other than investment banking or merchant banking or brokerage services from the

subject company in the past twelve months. HDFC Bank or its associates has not received compensation or other benefits

from the subject company or third party in connection with the research report. Research analyst has not served as an

officer, director or employee of the subject company. Neither research analyst nor HDFC Bank has been engaged in market

making activity for the subject company. Three year price history of the daily closing price of the securities covered in this

note is available at www.nseindia.com and www.bseindia.com.

You might also like

- When The World Goes Quiet - Gian SardarDocument283 pagesWhen The World Goes Quiet - Gian Sardarmengchhoungleang.cbvhNo ratings yet

- Authority To UseDocument2 pagesAuthority To UseRoyceNo ratings yet

- Factors Affecting Demand Supply of Automobile IndustryDocument7 pagesFactors Affecting Demand Supply of Automobile IndustryNalin Gupta83% (23)

- NeedScope CaseStudiesDocument18 pagesNeedScope CaseStudiesforumajmeraNo ratings yet

- Project Report On Commercial Vehicles IndustryDocument26 pagesProject Report On Commercial Vehicles IndustryVivekNo ratings yet

- SAALM01 - 33 Degree ZionDocument29 pagesSAALM01 - 33 Degree Ziona-c-t-i-o-n_acio100% (1)

- Automotive SectorDocument13 pagesAutomotive SectorachalconstNo ratings yet

- SH 2015 Q3 1 ICRA AutocomponentsDocument7 pagesSH 2015 Q3 1 ICRA AutocomponentsjhampiaNo ratings yet

- Report About Market ShareDocument16 pagesReport About Market ShareRenault BDNo ratings yet

- Industry: Key Points Supply DemandDocument4 pagesIndustry: Key Points Supply DemandHarsh AgarwalNo ratings yet

- Auto Industy Demand AnalysisDocument8 pagesAuto Industy Demand Analysisppc1110No ratings yet

- Indian Automotive Industry - Market Size and Growth: Domestic Market Share For 2009-10Document5 pagesIndian Automotive Industry - Market Size and Growth: Domestic Market Share For 2009-1009FN085No ratings yet

- 1.1 Importance of The TopicDocument10 pages1.1 Importance of The TopicKushi RajuNo ratings yet

- FSA Assignment WMP10055Document7 pagesFSA Assignment WMP10055Anshul VermaNo ratings yet

- Credit Rating of Tata MotorsDocument11 pagesCredit Rating of Tata MotorsSharonNo ratings yet

- Indian Automobile IndustryDocument4 pagesIndian Automobile Industryv_anand89No ratings yet

- Project Report On Commercial Vehicles IndustryDocument26 pagesProject Report On Commercial Vehicles IndustryMansi Prashar0% (2)

- Project On Tvs Vs BajajDocument63 pagesProject On Tvs Vs BajajSk Rabiul Islam100% (1)

- About CompanyDocument13 pagesAbout CompanyDivya ChokNo ratings yet

- Indian Four Wheeler Segment - A ReportDocument6 pagesIndian Four Wheeler Segment - A Reportsrini.srk83No ratings yet

- Analysis of Automobile IndustryDocument9 pagesAnalysis of Automobile IndustryNikhil Kakkar100% (1)

- Indian CV Industry An UpdateDocument17 pagesIndian CV Industry An UpdateSantanu KararNo ratings yet

- Security Analysis of Automobile IndustryDocument62 pagesSecurity Analysis of Automobile Industrysehgal110No ratings yet

- Vegi Sree Vijetha (1226113156)Document6 pagesVegi Sree Vijetha (1226113156)Pradeep ChintadaNo ratings yet

- CRISIL Research-Report Cars Sep11Document7 pagesCRISIL Research-Report Cars Sep11sanjit_oberaiNo ratings yet

- India Multi Brand Car Service Market Report:2020-Ken ResearchDocument14 pagesIndia Multi Brand Car Service Market Report:2020-Ken Researchsam662223No ratings yet

- Introduction 177Document12 pagesIntroduction 177r90466859No ratings yet

- Automotive Perspective - 2012 and Beyond: The India OpportunityDocument2 pagesAutomotive Perspective - 2012 and Beyond: The India OpportunitySameer SamNo ratings yet

- Changes in The Marketing Strategies of Automobile Sector Due To RecessionDocument102 pagesChanges in The Marketing Strategies of Automobile Sector Due To RecessionVivek SinghNo ratings yet

- Retail Sector of Automobile IndustryDocument10 pagesRetail Sector of Automobile IndustryAadhavan ParthipanNo ratings yet

- Case Study Report - 22MBAB35Document50 pagesCase Study Report - 22MBAB35varshini vishakanNo ratings yet

- New Microsoft Office Word DocumentDocument6 pagesNew Microsoft Office Word Documentkishan_dbmspce11No ratings yet

- 4 Key Points Financial Year '10 Prospects Sector Do's and Dont'sDocument3 pages4 Key Points Financial Year '10 Prospects Sector Do's and Dont'sBhushan KasarNo ratings yet

- Business Analysis of Auto IndusrtyDocument29 pagesBusiness Analysis of Auto IndusrtySaurabh Ambaselkar100% (1)

- Analysis Report of Indian AutoDocument2 pagesAnalysis Report of Indian AutoShital PatilNo ratings yet

- MotoGaze - ICICI February 2013Document18 pagesMotoGaze - ICICI February 2013Vivek MehtaNo ratings yet

- SH Commercial Vehicles Q3 1 March 2017Document7 pagesSH Commercial Vehicles Q3 1 March 2017saurabharora102No ratings yet

- Industry Report - Non-Commercial VehicleDocument12 pagesIndustry Report - Non-Commercial VehicleSanath SunnyNo ratings yet

- Automobiles Industry ReportDocument5 pagesAutomobiles Industry ReportvaasurastogiNo ratings yet

- Indian Auto IndustryDocument55 pagesIndian Auto IndustrySk Rabiul IslamNo ratings yet

- Final Report Passenger CarsDocument20 pagesFinal Report Passenger CarsAditya Nagpal100% (2)

- Fundamental and Technical Analysis of Automobile SectorDocument82 pagesFundamental and Technical Analysis of Automobile SectorYusuf DungraNo ratings yet

- Economics Assignment: (Decline in Sales in Automobile Sector)Document9 pagesEconomics Assignment: (Decline in Sales in Automobile Sector)AryanNo ratings yet

- AssignmentDocument10 pagesAssignmentAnurag AgrawalNo ratings yet

- Auto Second CarDocument6 pagesAuto Second CarkrantiakNo ratings yet

- Comprehensive Pack - Commercial VehiclesDocument102 pagesComprehensive Pack - Commercial Vehiclessheet revisionNo ratings yet

- Bangladesh Automotive Industry - A Roadmap To The Future - LightCastle PartnersDocument8 pagesBangladesh Automotive Industry - A Roadmap To The Future - LightCastle PartnersbcmandalNo ratings yet

- XSCDDocument83 pagesXSCDZacharia VincentNo ratings yet

- Automobiles Industry in IndiaDocument79 pagesAutomobiles Industry in India2014rajpoint0% (1)

- Fundamental and Technical Analysis of Automobile SectorDocument82 pagesFundamental and Technical Analysis of Automobile Sectormba_financearticles88% (8)

- Prashaste - Indian Automotive Industry - 10 JanuaryDocument14 pagesPrashaste - Indian Automotive Industry - 10 JanuaryDeepakPahwaNo ratings yet

- Indian Automobile Industry ReportDocument6 pagesIndian Automobile Industry Report121923601018100% (1)

- ReportDocument12 pagesReportroushan_kumar_5No ratings yet

- Indian Commercial Vehicle Sector: Trends & Outlook: July 2010Document15 pagesIndian Commercial Vehicle Sector: Trends & Outlook: July 2010aniljainwisdomNo ratings yet

- ICRA - Tyre IndustryDocument6 pagesICRA - Tyre IndustryravisundaramNo ratings yet

- Murugaselvi M Main Project ReportDocument84 pagesMurugaselvi M Main Project Report20PAU016 Karthikeyan RNo ratings yet

- 2W Multi Brand Repair StudioDocument26 pages2W Multi Brand Repair StudioShubham BishtNo ratings yet

- Passenger Cars Profile and Growth AspectsDocument15 pagesPassenger Cars Profile and Growth AspectsRam PoddarNo ratings yet

- Growth of Motorcycle Use in Metro Manila: Impact on Road SafetyFrom EverandGrowth of Motorcycle Use in Metro Manila: Impact on Road SafetyNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Truck, Utility Trailer & RV Rental & Leasing Revenues World Summary: Market Values & Financials by CountryFrom EverandTruck, Utility Trailer & RV Rental & Leasing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Myanmar Transport Sector Policy NotesFrom EverandMyanmar Transport Sector Policy NotesRating: 3 out of 5 stars3/5 (1)

- AV and Baseline of Pharmaceutical CompaniesDocument2 pagesAV and Baseline of Pharmaceutical CompaniesforumajmeraNo ratings yet

- The 8Ps of Luxury Brand MarketingDocument6 pagesThe 8Ps of Luxury Brand MarketingforumajmeraNo ratings yet

- Fire Act 2007Document56 pagesFire Act 2007forumajmeraNo ratings yet

- Changing DynamicsDocument40 pagesChanging DynamicsforumajmeraNo ratings yet

- DETERMINANTS of Insurance Purchase in KerelaDocument265 pagesDETERMINANTS of Insurance Purchase in Kerelaforumajmera50% (2)

- The New SEC System Used in India: AZ Research Partners PVT Ltd. AZ Research Partners PVT LTDDocument4 pagesThe New SEC System Used in India: AZ Research Partners PVT Ltd. AZ Research Partners PVT LTDforumajmeraNo ratings yet

- A Study On Implementation of CRM in Retail Fuel StationsDocument95 pagesA Study On Implementation of CRM in Retail Fuel StationsforumajmeraNo ratings yet

- Bhav PratikramanDocument30 pagesBhav PratikramanforumajmeraNo ratings yet

- How To Install CKAN 2.4.1 On CentOS 7 Ckan - Ckan Wiki GitHubDocument9 pagesHow To Install CKAN 2.4.1 On CentOS 7 Ckan - Ckan Wiki GitHubDoru Ciprian MuresanNo ratings yet

- UNE The Universal NPC Emulator (Rev)Document18 pagesUNE The Universal NPC Emulator (Rev)Tiago MouraNo ratings yet

- Words EnglishDocument3 pagesWords EnglishOthmane BettemNo ratings yet

- Trang An Ecotourism Destination (Which Is) Located in Trang An Scenic LandscapeDocument2 pagesTrang An Ecotourism Destination (Which Is) Located in Trang An Scenic LandscapeHương Phan QuỳnhNo ratings yet

- BSBA FINAL LOADING For BOT 2021-2022 1st SEMESTERDocument5 pagesBSBA FINAL LOADING For BOT 2021-2022 1st SEMESTERMaureen GalendezNo ratings yet

- Unit 4Document27 pagesUnit 4Diệp PhanNo ratings yet

- Environmental Study Report - Fort York Pedestrian & Cycle BridgeDocument143 pagesEnvironmental Study Report - Fort York Pedestrian & Cycle BridgeReivax50No ratings yet

- 中联印尼宣传文件Document23 pages中联印尼宣传文件zhaobaoaixiaoyanNo ratings yet

- ContractorsDocument12 pagesContractorsrx330No ratings yet

- Water and Sanitation Project MoniccaDocument8 pagesWater and Sanitation Project MoniccaMAGOMU DAN DAVIDNo ratings yet

- Basketball Basic RulesDocument10 pagesBasketball Basic RulesMohan ArumugavallalNo ratings yet

- The Art of The PortraitDocument180 pagesThe Art of The PortraitLadyDi100% (3)

- Isoiec11801-Cor3 (Ed2 0) en PDFDocument2 pagesIsoiec11801-Cor3 (Ed2 0) en PDFShubham KaklijNo ratings yet

- The Jewish Kingdoms of Arabia 390-626 CEDocument7 pagesThe Jewish Kingdoms of Arabia 390-626 CEyohannpintoNo ratings yet

- Auditor's Responsibilities Relating The Subsequent Event in An Audit of The Financial StatementsDocument6 pagesAuditor's Responsibilities Relating The Subsequent Event in An Audit of The Financial StatementsHarutraNo ratings yet

- Motives For Participation in Halal Food Standard Implementation: An Empirical Study in Malaysian Halal Food IndustryDocument27 pagesMotives For Participation in Halal Food Standard Implementation: An Empirical Study in Malaysian Halal Food Industryzlatan82No ratings yet

- Civil December 09 (Vol-3)Document172 pagesCivil December 09 (Vol-3)Parikshit AgarwalNo ratings yet

- Penugasan Tak Terstruktur - Recount Text - B.InggrisDocument2 pagesPenugasan Tak Terstruktur - Recount Text - B.InggrisAhmad Nab'al FalahNo ratings yet

- Department Wise ISO 14001-2015 EMS and ISO 9001-2015 and OHSAS 18001-EQHSMS Department Wise Audit QuestionnaireDocument29 pagesDepartment Wise ISO 14001-2015 EMS and ISO 9001-2015 and OHSAS 18001-EQHSMS Department Wise Audit Questionnairemd sarfaraz khanNo ratings yet

- Farko Cerna UTS + TugasDocument357 pagesFarko Cerna UTS + TugasAnnisa N RahmayantiNo ratings yet

- Champion Service Sector 05.08.19Document78 pagesChampion Service Sector 05.08.19pr1041No ratings yet

- Report of The Film Fact Finding CommitteDocument435 pagesReport of The Film Fact Finding CommitteOmar ZakirNo ratings yet

- NPC Vs RamoranDocument2 pagesNPC Vs RamoranKhiel CrisostomoNo ratings yet

- The Right Thing To DoDocument4 pagesThe Right Thing To DoAyeen AbdullahNo ratings yet

- 2022 JOAP Remedial Law Mock Bar ExaminationDocument14 pages2022 JOAP Remedial Law Mock Bar ExaminationVincent Jave GutierrezNo ratings yet

- E-Tender Document Tender For Supply of Blood Bags, Test Kits and Reagents For The Year-2018-19Document102 pagesE-Tender Document Tender For Supply of Blood Bags, Test Kits and Reagents For The Year-2018-19Moath AlshabiNo ratings yet

- Ancient Hermetism and EsotericismDocument27 pagesAncient Hermetism and EsotericismJeremy Parker100% (5)