Professional Documents

Culture Documents

Dynamics GP TAX Management Mexico - Data Sheet

Dynamics GP TAX Management Mexico - Data Sheet

Uploaded by

Ariel SpallettiCopyright:

Available Formats

You might also like

- Income Tax Study MaterialDocument303 pagesIncome Tax Study MaterialAbith Mathew77% (217)

- International Financial QuestionnaireDocument4 pagesInternational Financial QuestionnaireHenrypat Uche Ogbudu100% (1)

- A Risk Management Approach: Seventh EditionDocument23 pagesA Risk Management Approach: Seventh EditionOugoust DrakeNo ratings yet

- Cutover Strategy Document For ARASCO V1.0Document12 pagesCutover Strategy Document For ARASCO V1.0Anonymous hCDnyHWjTNo ratings yet

- Argentina Localization - Tax ReportsDocument37 pagesArgentina Localization - Tax Reportssvgonzalez-183% (6)

- SAP ISU IntroDocument15 pagesSAP ISU IntroshilpaNo ratings yet

- Vertex How To GuideDocument9 pagesVertex How To Guidesap_lm6663No ratings yet

- NakedPutsOptionsInvesting PDFDocument177 pagesNakedPutsOptionsInvesting PDFRamy Taraboulsi100% (1)

- Includes $2,000 Depreciation Each MonthDocument3 pagesIncludes $2,000 Depreciation Each MonthLynnard Philip Panes100% (1)

- Spain PDFDocument4 pagesSpain PDFbbazul1No ratings yet

- Taxbase E BrochureDocument4 pagesTaxbase E BrochurePrashant ChaudhariNo ratings yet

- Slovakia Report DocumentationDocument3 pagesSlovakia Report DocumentationfiatmanojNo ratings yet

- Tax in PurchasingDocument8 pagesTax in PurchasingRussellNo ratings yet

- E InvoicingDocument4 pagesE Invoicingvaddepallyanil goudNo ratings yet

- VAT Return 2015 SAP LibraryDocument17 pagesVAT Return 2015 SAP LibraryTatyana KosarevaNo ratings yet

- Tds TcsDocument20 pagesTds TcsnaysarNo ratings yet

- Withholding TaxDocument31 pagesWithholding TaxharishNo ratings yet

- GST - E-InvoicingDocument17 pagesGST - E-Invoicingnehal ajgaonkarNo ratings yet

- SAT - TCS - Einvoice & Ewaybill Solution PDFDocument10 pagesSAT - TCS - Einvoice & Ewaybill Solution PDFvenkatNo ratings yet

- SAT - TCS - Einvoice & Ewaybill Solution PDFDocument10 pagesSAT - TCS - Einvoice & Ewaybill Solution PDFvenkatNo ratings yet

- Tax Calculation Process in SDDocument4 pagesTax Calculation Process in SDVinayNo ratings yet

- Cin Information15Document41 pagesCin Information15SATYANARAYANA MOTAMARRINo ratings yet

- SAP Financials - Tax Collected at Source ManualDocument5 pagesSAP Financials - Tax Collected at Source ManualSurya Pratap Shingh RajputNo ratings yet

- Intercopmany IdocDocument24 pagesIntercopmany Idocnelsondarla12No ratings yet

- GST Invoice Details I Essential InformationDocument7 pagesGST Invoice Details I Essential InformationShaik MastanvaliNo ratings yet

- B8 Accounting With TallyDocument4 pagesB8 Accounting With Tallymichele983No ratings yet

- AX 2012 Indian LocalisationDocument6 pagesAX 2012 Indian LocalisationdossindossNo ratings yet

- Dynamics AX Localization - PakistanDocument9 pagesDynamics AX Localization - PakistanAdeel EdhiNo ratings yet

- RI Training - Sem Logo - V.03 - EnGDocument73 pagesRI Training - Sem Logo - V.03 - EnGPaulo GolpeConsumado Silva100% (1)

- Introducing A New VAT System: Everything You Always Wanted To Know About VAT in SAP But Were Not Aware To AskDocument7 pagesIntroducing A New VAT System: Everything You Always Wanted To Know About VAT in SAP But Were Not Aware To Askchandra_kumarbrNo ratings yet

- TAX On Sales and Purchases2Document27 pagesTAX On Sales and Purchases2harishNo ratings yet

- SAP CRM Tax ConfigurationDocument18 pagesSAP CRM Tax Configurationtushar_kansaraNo ratings yet

- SD - Tax Determination in Sales and DistributionDocument15 pagesSD - Tax Determination in Sales and DistributionNarendra BodhisatvaNo ratings yet

- GST+ E-Invoice+E-Way Enterprise With SAP Non SapDocument14 pagesGST+ E-Invoice+E-Way Enterprise With SAP Non SapkarthikeyanwebtelNo ratings yet

- GU - SAP S4 HANA - 872449 - Tax Determination in Sales and DistributionDocument14 pagesGU - SAP S4 HANA - 872449 - Tax Determination in Sales and DistributionPaper ArtNo ratings yet

- Tep 11 - Setting Up Special Asset ClassesDocument5 pagesTep 11 - Setting Up Special Asset ClassesSmith F. JohnNo ratings yet

- Screenshots Remarks Creating Tax Codes: o o o oDocument11 pagesScreenshots Remarks Creating Tax Codes: o o o oSiber CKNo ratings yet

- 10) TDS With Holding TaxDocument47 pages10) TDS With Holding TaxMarge PranitNo ratings yet

- E-Invoicing ConceptDocument12 pagesE-Invoicing ConceptMohit GuptaNo ratings yet

- GST eInvoiceSystemDetailedOverviewDocument12 pagesGST eInvoiceSystemDetailedOverviewYours YoursNo ratings yet

- Getting Started With Oracle (TRCS) Tax Reporting Cloud Service Part IDocument8 pagesGetting Started With Oracle (TRCS) Tax Reporting Cloud Service Part IDock N DenNo ratings yet

- E-Invoice (Electronic Invoice) : List of AbbreviationsDocument5 pagesE-Invoice (Electronic Invoice) : List of AbbreviationsChirag SolankiNo ratings yet

- System Documentation For Malaysia GSTDocument10 pagesSystem Documentation For Malaysia GSTviru2allNo ratings yet

- Not Configuration in SAPDocument6 pagesNot Configuration in SAPVenkat Ram NarasimhaNo ratings yet

- Checklist For VAT Rate Changes in SAP - Tax Management ConsultancyDocument3 pagesChecklist For VAT Rate Changes in SAP - Tax Management Consultancyfairdeal2k1No ratings yet

- Organizations Data Deletion and Retention Policies Before Complying With A RequestDocument2 pagesOrganizations Data Deletion and Retention Policies Before Complying With A RequestdesperadounoNo ratings yet

- Eagle Localization MexicanRequirementsDocument36 pagesEagle Localization MexicanRequirementsAgnaldo GomesNo ratings yet

- Types of GST Returns - Forms, Due Dates & PenaltiesDocument24 pagesTypes of GST Returns - Forms, Due Dates & PenaltiesShaik MastanvaliNo ratings yet

- IVAS - DLV - BP User Guide For Submit Value Added Tax Return Mushak-9.1 - With TradersDocument44 pagesIVAS - DLV - BP User Guide For Submit Value Added Tax Return Mushak-9.1 - With TradersMehedi Hasan MunnaNo ratings yet

- Tds NotesDocument15 pagesTds NotesnaysarNo ratings yet

- SAP Key PointsDocument74 pagesSAP Key Pointsimmanial yamarthi100% (2)

- GST ConfigurationDocument15 pagesGST ConfigurationSahitee BasaniNo ratings yet

- Styles Themes Shapes Building Blocks Footnotes Cross References Collaboration Password Protection Mail MergeDocument2 pagesStyles Themes Shapes Building Blocks Footnotes Cross References Collaboration Password Protection Mail MergeIASAM ACADEMYNo ratings yet

- RealSoft VAT Module - User ManualDocument26 pagesRealSoft VAT Module - User ManualKhaleel Abdul GaffarNo ratings yet

- 18 - Poseidón - Entendimiento Impuestos 2023Document17 pages18 - Poseidón - Entendimiento Impuestos 20237ttcmwx77yNo ratings yet

- Withholding Tax BestDocument14 pagesWithholding Tax Bestsoumya singhNo ratings yet

- Fi GL Ar ApDocument130 pagesFi GL Ar Apfharooks100% (2)

- FI-Training OverviewDocument78 pagesFI-Training OverviewMajut AlenkNo ratings yet

- SAP FICO Interview Q&ADocument44 pagesSAP FICO Interview Q&Amm1979No ratings yet

- Inter Company Billing Automatic Posting To Vendor Account SAP EDIDocument17 pagesInter Company Billing Automatic Posting To Vendor Account SAP EDIRAGHU BALAKRISHNANNo ratings yet

- Tax CodeDocument1 pageTax CodeEdmondNo ratings yet

- Rfuvpt00 DocuDocument4 pagesRfuvpt00 Docusa saNo ratings yet

- Asset Accounting and CO NotesDocument34 pagesAsset Accounting and CO NotesSaisurya VemulaNo ratings yet

- Profite Center AccountingDocument9 pagesProfite Center AccountingBalraj JNo ratings yet

- Pink Floyd / Steven Soderbergh Chopper / Art in The DarkDocument32 pagesPink Floyd / Steven Soderbergh Chopper / Art in The DarkAriel SpallettiNo ratings yet

- Venturing Into An Artistic MindDocument37 pagesVenturing Into An Artistic MindAriel SpallettiNo ratings yet

- The Venetian Painters of The RenaissanceThird Edition by Berenson Bernard 1865 1959Document119 pagesThe Venetian Painters of The RenaissanceThird Edition by Berenson Bernard 1865 1959Ariel SpallettiNo ratings yet

- How To Solve Chess ProblemsDocument101 pagesHow To Solve Chess ProblemsAriel SpallettiNo ratings yet

- From: Finance - Month End AP/AR Navigation PageDocument2 pagesFrom: Finance - Month End AP/AR Navigation PageAriel SpallettiNo ratings yet

- 2022 Cheat SheetDocument1 page2022 Cheat SheetAriel SpallettiNo ratings yet

- GL006-Period Close v11Document4 pagesGL006-Period Close v11Ariel SpallettiNo ratings yet

- ChatLog Meet Now 2019 - 04 - 15 13 - 52Document1 pageChatLog Meet Now 2019 - 04 - 15 13 - 52Ariel SpallettiNo ratings yet

- ChatLog Review Accounts Payable Process 2019-05-28 17 - 12Document1 pageChatLog Review Accounts Payable Process 2019-05-28 17 - 12Ariel SpallettiNo ratings yet

- ChatLog Curso Entender Ajedrez 2 - 0 - Clases Intensivas de Ajedrez - 2019-04-13 09 - 05Document2 pagesChatLog Curso Entender Ajedrez 2 - 0 - Clases Intensivas de Ajedrez - 2019-04-13 09 - 05Ariel SpallettiNo ratings yet

- ChatLog Reportes Financieros 2018-12-11 16 - 27Document1 pageChatLog Reportes Financieros 2018-12-11 16 - 27Ariel SpallettiNo ratings yet

- ChatLog Ariel - S Meeting 2019-05-29 12 - 04Document1 pageChatLog Ariel - S Meeting 2019-05-29 12 - 04Ariel SpallettiNo ratings yet

- Eric (To Everyone) : Eric (To Everyone) : Ariel Spalletti (To Everyone)Document1 pageEric (To Everyone) : Eric (To Everyone) : Ariel Spalletti (To Everyone)Ariel SpallettiNo ratings yet

- ChatLog Foot Print Consollidated Reporting 2019-03-21 10 - 12Document1 pageChatLog Foot Print Consollidated Reporting 2019-03-21 10 - 12Ariel SpallettiNo ratings yet

- ChatLog Ariel - S Meeting 2019-03-14 16 - 08Document1 pageChatLog Ariel - S Meeting 2019-03-14 16 - 08Ariel SpallettiNo ratings yet

- Eligio e (To Everyone) : Ariel Spalletti (To Everyone)Document1 pageEligio e (To Everyone) : Ariel Spalletti (To Everyone)Ariel SpallettiNo ratings yet

- XXI May 2012Document14 pagesXXI May 2012Ariel SpallettiNo ratings yet

- Prospect: Services Presentation DateDocument16 pagesProspect: Services Presentation DateAriel SpallettiNo ratings yet

- ChatLog Discussion On SI Financial Reports 2018-12-11 17 - 08Document1 pageChatLog Discussion On SI Financial Reports 2018-12-11 17 - 08Ariel SpallettiNo ratings yet

- ChatLog Payables Training 2019-05-30 11 - 25Document1 pageChatLog Payables Training 2019-05-30 11 - 25Ariel SpallettiNo ratings yet

- Sage ERP X3: Standard Edition - Solution OverviewDocument31 pagesSage ERP X3: Standard Edition - Solution OverviewAriel SpallettiNo ratings yet

- XXI Jan 2012Document14 pagesXXI Jan 2012Ariel SpallettiNo ratings yet

- XXI Feb 2012Document14 pagesXXI Feb 2012Ariel SpallettiNo ratings yet

- VDT Apr 2012Document14 pagesVDT Apr 2012Ariel SpallettiNo ratings yet

- SonyDocument21 pagesSonyNeha UpadhyayNo ratings yet

- Holding and SubsidiaryDocument2 pagesHolding and SubsidiaryRizwana BegumNo ratings yet

- Council Reply - Complaint 7 Nov 11Document4 pagesCouncil Reply - Complaint 7 Nov 11MiscellaneousNo ratings yet

- Hospitalization Accident Claim FormDocument8 pagesHospitalization Accident Claim FormWYNo ratings yet

- Tutorial Questions Week 4Document10 pagesTutorial Questions Week 4julia chengNo ratings yet

- Corporate Acts Voting RequirementDocument6 pagesCorporate Acts Voting RequirementVilma PabinesNo ratings yet

- Ratio Analysis AllDocument78 pagesRatio Analysis AllSuraj GawandeNo ratings yet

- Deep Dive Into IEV and Views From The Market: Sanket KawatkarDocument62 pagesDeep Dive Into IEV and Views From The Market: Sanket Kawatkarankur taunkNo ratings yet

- Deductions From Gross Income Lesson 13Document72 pagesDeductions From Gross Income Lesson 13Mikaela SamonteNo ratings yet

- Instructions For Filing Your Sales or Use Tax Return Using An Excel DocumentDocument31 pagesInstructions For Filing Your Sales or Use Tax Return Using An Excel DocumentMichelle ParksNo ratings yet

- Bihar State Milk Co-Operative Federation Limited, Patna Balance Sheet As at 31st March, 2014Document1 pageBihar State Milk Co-Operative Federation Limited, Patna Balance Sheet As at 31st March, 2014SATYAM KUMARNo ratings yet

- Accounting 2 PrelimsDocument3 pagesAccounting 2 PrelimsJohn Alfred Castino100% (1)

- BIR Ruling NoDocument1 pageBIR Ruling NoPau Line EscosioNo ratings yet

- Fresh Start', A Big Challenge Facing The Microfinance IndustryDocument4 pagesFresh Start', A Big Challenge Facing The Microfinance IndustryVinod ChanrasekharanNo ratings yet

- Financial Analysis & Performance of Indian Oil Corporation LTDDocument5 pagesFinancial Analysis & Performance of Indian Oil Corporation LTDsubhaseduNo ratings yet

- 0 MasterfileDocument598 pages0 MasterfileAngel VenableNo ratings yet

- Hoki 2019 PDFDocument95 pagesHoki 2019 PDFPutriNo ratings yet

- Accounting TerminologyDocument215 pagesAccounting TerminologyJyoshna Reddy50% (2)

- Slides Higgins 11e CH 4Document20 pagesSlides Higgins 11e CH 4Huy NguyễnNo ratings yet

- 2 RahnuDocument12 pages2 RahnuAhmadUmairIlyasNo ratings yet

- Study On Mutual Fund - New Fund Offer V/S Equity Initial Public Offer'Document78 pagesStudy On Mutual Fund - New Fund Offer V/S Equity Initial Public Offer'sumesh894No ratings yet

- Affordable Housing MeaningDocument5 pagesAffordable Housing Meaningcadeepak singh0% (1)

- ACCOUNTING FOR CORPORATIONS-Basic ConsiderationsDocument41 pagesACCOUNTING FOR CORPORATIONS-Basic ConsiderationsMarriel Fate Cullano100% (2)

- VODADocument2 pagesVODADhinakaran BabuNo ratings yet

- Balance of Payments EssayDocument2 pagesBalance of Payments EssayKevin Nguyen100% (1)

Dynamics GP TAX Management Mexico - Data Sheet

Dynamics GP TAX Management Mexico - Data Sheet

Uploaded by

Ariel SpallettiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dynamics GP TAX Management Mexico - Data Sheet

Dynamics GP TAX Management Mexico - Data Sheet

Uploaded by

Ariel SpallettiCopyright:

Available Formats

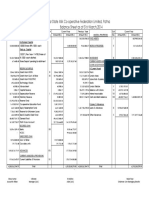

TAX Management for Dynamics GP - MX

TAX Management for Microsoft Dynamics GP - MX is our proven solution for the Mexican

market, for companies that use Microsoft Dynamics GP as their ERP solution, solving their

taxes report issues in order to match legal forms with all the tax information requested by

the Mexican Tax Office - SAT (Servicio de Administracin Tributaria).

Benefits

Provide customers with a development

that will work within the solution

Microsoft Dynamics GP and will allow

users to in an automatically and

transparent way get all the tax

information requested by the Mexican

Tax Office - SAT

All recognized flexibility and scalability

of a worldwide solution is now available

to power an automated practical solution

to cover Mexican tax mandatory

requirements

Issuing tax information on cash basis

within purchase, sales, collections and

payments as requested by local SAT

Tax Office

Provide on line reporting and

calculations for Value Added Tax (IVA

Impuesto al Valor Agregado), Income

Tax (ISR Impuesto Sobre la Renta),

Withholdings (Retenciones IVA / ISR)

and Unique Rate Business Tax ( IETU

Impuesto Empresarial a Tasa Unica)

Complete reports identifying payments

or collections by Tax Id. (RFC

Registro Fiscal del Contribuyente) for

companies (Persona Moral) as well as

individuals (Persona Fsica)

Regular situations management: partial

invoice payment, currency exchange

rates gap and petty cash

Technical Requirements

Operating System: All supported by Microsoft

Dynamics GP 10 or later.

Microsoft Dynamics GP 10 or later

TAX Management for Dynamics GP - MX

Main functional features detail

Treasury Circuits

Payment/Receive Multiple Methods (MMCP Mltiples Medios de

Cobro/Pago)

Payment Circuit

Payment entry for Legal Entities (Personas Morales)

Applies the cash basis concept over Value Added Tax (IVA Impuesto al

Valor Agregado) at payment stage (by paid to by accrued IVA

accounting entry).

Payment entry for Individuals (Personas Fsicas)

Applies the cash basis concept over Value Added Tax (IVA Impuesto al

Valor Agregado) as well as Income Tax (ISR Impuesto Sobre la Renta) at

payment stage. Income Tax may apply to both IVA and ISR.

Collect Circuit

Receipts (collection) entry

Applies the cash basis concept over Value Added Tax (IVA Impuesto al

Valor Agregado) at collection stage (by paid to by accrued IVA

accounting entry).

Task Information

Report Query providing VAT Paid Book (Libro IVA Pagado) in summary mode

data including the following columns:

ID Proveedor (Vendor ID)

Nombre Proveedor (Vendor Name)

R.F.C. (Tax ID)

Importe Total Pagado (Total Paid Amount)

IVA Percibido (Paid VAT)

IVA Retenido Percibido (Paid Withhold VAT)

ISR Retenido Percibido (Paid Withhold Income Tax)

Report Query providing VAT Paid Book (Libro IVA Pagado) in detailed mode

data including the following columns:

ID Proveedor (Vendor ID)

Nombre Proveedor (Vendor Name)

R.F.C. (Tax ID)

Nmero de Pago (Payment Number)

Importe Total Pagado (Total Paid Amount)

IVA Percibido (Paid VAT)

IVA Retenido Percibido (Paid Withhold VAT)

ISR Retenido Percibido (Paid Withhold Income Tax)

Report Query providing VAT Collect Book (Libro IVA Cobrado) summary mode

data including the following columns:

Importe Total Cobrado (Total Collect Amount)

IVA Percibido (Paid VAT)

Report Query providing VAT Collect Book (Libro IVA Cobrado) detailed mode

data including the following columns:

ID Cliente (Customer ID)

Nombre Cliente (Customer Name)

R.F.C. (Tax ID)

Nmero de Cobro (Receipt Number)

Importe Total Cobrado (Total Collect Amount)

IVA Percibido (Paid VAT)

TAX Management for Dynamics GP - MX

Unique Rate Business Tax

IETU Impuesto Empresarial a Tasa Unica

Provide basic revenue and expense information in order to ease calculations and

delivery of the tax report as required by SAT Tax Office.

Excel Reporting connected to Dynamics GP will show all incomes and expenses to

which IETU should be applied from the beginning of the fiscal year providing

information to whom corresponds for the final tax calculations and SAT form

presentation.

Our solution TAX Management for Dynamics GP - MX was designed to join investment

plans and legal requirements for your business. This implementation and launching

process includes all specialized consultancy tasks and training required to fully bring the

solution operative in your company, and in a very short time.

For more information, please contact us:

www.tiiselam.com

Tel.: 54-11-4926-1050

Colombres 1396 Boedo - C1238AAH

C.A.B.A. Argentina

You might also like

- Income Tax Study MaterialDocument303 pagesIncome Tax Study MaterialAbith Mathew77% (217)

- International Financial QuestionnaireDocument4 pagesInternational Financial QuestionnaireHenrypat Uche Ogbudu100% (1)

- A Risk Management Approach: Seventh EditionDocument23 pagesA Risk Management Approach: Seventh EditionOugoust DrakeNo ratings yet

- Cutover Strategy Document For ARASCO V1.0Document12 pagesCutover Strategy Document For ARASCO V1.0Anonymous hCDnyHWjTNo ratings yet

- Argentina Localization - Tax ReportsDocument37 pagesArgentina Localization - Tax Reportssvgonzalez-183% (6)

- SAP ISU IntroDocument15 pagesSAP ISU IntroshilpaNo ratings yet

- Vertex How To GuideDocument9 pagesVertex How To Guidesap_lm6663No ratings yet

- NakedPutsOptionsInvesting PDFDocument177 pagesNakedPutsOptionsInvesting PDFRamy Taraboulsi100% (1)

- Includes $2,000 Depreciation Each MonthDocument3 pagesIncludes $2,000 Depreciation Each MonthLynnard Philip Panes100% (1)

- Spain PDFDocument4 pagesSpain PDFbbazul1No ratings yet

- Taxbase E BrochureDocument4 pagesTaxbase E BrochurePrashant ChaudhariNo ratings yet

- Slovakia Report DocumentationDocument3 pagesSlovakia Report DocumentationfiatmanojNo ratings yet

- Tax in PurchasingDocument8 pagesTax in PurchasingRussellNo ratings yet

- E InvoicingDocument4 pagesE Invoicingvaddepallyanil goudNo ratings yet

- VAT Return 2015 SAP LibraryDocument17 pagesVAT Return 2015 SAP LibraryTatyana KosarevaNo ratings yet

- Tds TcsDocument20 pagesTds TcsnaysarNo ratings yet

- Withholding TaxDocument31 pagesWithholding TaxharishNo ratings yet

- GST - E-InvoicingDocument17 pagesGST - E-Invoicingnehal ajgaonkarNo ratings yet

- SAT - TCS - Einvoice & Ewaybill Solution PDFDocument10 pagesSAT - TCS - Einvoice & Ewaybill Solution PDFvenkatNo ratings yet

- SAT - TCS - Einvoice & Ewaybill Solution PDFDocument10 pagesSAT - TCS - Einvoice & Ewaybill Solution PDFvenkatNo ratings yet

- Tax Calculation Process in SDDocument4 pagesTax Calculation Process in SDVinayNo ratings yet

- Cin Information15Document41 pagesCin Information15SATYANARAYANA MOTAMARRINo ratings yet

- SAP Financials - Tax Collected at Source ManualDocument5 pagesSAP Financials - Tax Collected at Source ManualSurya Pratap Shingh RajputNo ratings yet

- Intercopmany IdocDocument24 pagesIntercopmany Idocnelsondarla12No ratings yet

- GST Invoice Details I Essential InformationDocument7 pagesGST Invoice Details I Essential InformationShaik MastanvaliNo ratings yet

- B8 Accounting With TallyDocument4 pagesB8 Accounting With Tallymichele983No ratings yet

- AX 2012 Indian LocalisationDocument6 pagesAX 2012 Indian LocalisationdossindossNo ratings yet

- Dynamics AX Localization - PakistanDocument9 pagesDynamics AX Localization - PakistanAdeel EdhiNo ratings yet

- RI Training - Sem Logo - V.03 - EnGDocument73 pagesRI Training - Sem Logo - V.03 - EnGPaulo GolpeConsumado Silva100% (1)

- Introducing A New VAT System: Everything You Always Wanted To Know About VAT in SAP But Were Not Aware To AskDocument7 pagesIntroducing A New VAT System: Everything You Always Wanted To Know About VAT in SAP But Were Not Aware To Askchandra_kumarbrNo ratings yet

- TAX On Sales and Purchases2Document27 pagesTAX On Sales and Purchases2harishNo ratings yet

- SAP CRM Tax ConfigurationDocument18 pagesSAP CRM Tax Configurationtushar_kansaraNo ratings yet

- SD - Tax Determination in Sales and DistributionDocument15 pagesSD - Tax Determination in Sales and DistributionNarendra BodhisatvaNo ratings yet

- GST+ E-Invoice+E-Way Enterprise With SAP Non SapDocument14 pagesGST+ E-Invoice+E-Way Enterprise With SAP Non SapkarthikeyanwebtelNo ratings yet

- GU - SAP S4 HANA - 872449 - Tax Determination in Sales and DistributionDocument14 pagesGU - SAP S4 HANA - 872449 - Tax Determination in Sales and DistributionPaper ArtNo ratings yet

- Tep 11 - Setting Up Special Asset ClassesDocument5 pagesTep 11 - Setting Up Special Asset ClassesSmith F. JohnNo ratings yet

- Screenshots Remarks Creating Tax Codes: o o o oDocument11 pagesScreenshots Remarks Creating Tax Codes: o o o oSiber CKNo ratings yet

- 10) TDS With Holding TaxDocument47 pages10) TDS With Holding TaxMarge PranitNo ratings yet

- E-Invoicing ConceptDocument12 pagesE-Invoicing ConceptMohit GuptaNo ratings yet

- GST eInvoiceSystemDetailedOverviewDocument12 pagesGST eInvoiceSystemDetailedOverviewYours YoursNo ratings yet

- Getting Started With Oracle (TRCS) Tax Reporting Cloud Service Part IDocument8 pagesGetting Started With Oracle (TRCS) Tax Reporting Cloud Service Part IDock N DenNo ratings yet

- E-Invoice (Electronic Invoice) : List of AbbreviationsDocument5 pagesE-Invoice (Electronic Invoice) : List of AbbreviationsChirag SolankiNo ratings yet

- System Documentation For Malaysia GSTDocument10 pagesSystem Documentation For Malaysia GSTviru2allNo ratings yet

- Not Configuration in SAPDocument6 pagesNot Configuration in SAPVenkat Ram NarasimhaNo ratings yet

- Checklist For VAT Rate Changes in SAP - Tax Management ConsultancyDocument3 pagesChecklist For VAT Rate Changes in SAP - Tax Management Consultancyfairdeal2k1No ratings yet

- Organizations Data Deletion and Retention Policies Before Complying With A RequestDocument2 pagesOrganizations Data Deletion and Retention Policies Before Complying With A RequestdesperadounoNo ratings yet

- Eagle Localization MexicanRequirementsDocument36 pagesEagle Localization MexicanRequirementsAgnaldo GomesNo ratings yet

- Types of GST Returns - Forms, Due Dates & PenaltiesDocument24 pagesTypes of GST Returns - Forms, Due Dates & PenaltiesShaik MastanvaliNo ratings yet

- IVAS - DLV - BP User Guide For Submit Value Added Tax Return Mushak-9.1 - With TradersDocument44 pagesIVAS - DLV - BP User Guide For Submit Value Added Tax Return Mushak-9.1 - With TradersMehedi Hasan MunnaNo ratings yet

- Tds NotesDocument15 pagesTds NotesnaysarNo ratings yet

- SAP Key PointsDocument74 pagesSAP Key Pointsimmanial yamarthi100% (2)

- GST ConfigurationDocument15 pagesGST ConfigurationSahitee BasaniNo ratings yet

- Styles Themes Shapes Building Blocks Footnotes Cross References Collaboration Password Protection Mail MergeDocument2 pagesStyles Themes Shapes Building Blocks Footnotes Cross References Collaboration Password Protection Mail MergeIASAM ACADEMYNo ratings yet

- RealSoft VAT Module - User ManualDocument26 pagesRealSoft VAT Module - User ManualKhaleel Abdul GaffarNo ratings yet

- 18 - Poseidón - Entendimiento Impuestos 2023Document17 pages18 - Poseidón - Entendimiento Impuestos 20237ttcmwx77yNo ratings yet

- Withholding Tax BestDocument14 pagesWithholding Tax Bestsoumya singhNo ratings yet

- Fi GL Ar ApDocument130 pagesFi GL Ar Apfharooks100% (2)

- FI-Training OverviewDocument78 pagesFI-Training OverviewMajut AlenkNo ratings yet

- SAP FICO Interview Q&ADocument44 pagesSAP FICO Interview Q&Amm1979No ratings yet

- Inter Company Billing Automatic Posting To Vendor Account SAP EDIDocument17 pagesInter Company Billing Automatic Posting To Vendor Account SAP EDIRAGHU BALAKRISHNANNo ratings yet

- Tax CodeDocument1 pageTax CodeEdmondNo ratings yet

- Rfuvpt00 DocuDocument4 pagesRfuvpt00 Docusa saNo ratings yet

- Asset Accounting and CO NotesDocument34 pagesAsset Accounting and CO NotesSaisurya VemulaNo ratings yet

- Profite Center AccountingDocument9 pagesProfite Center AccountingBalraj JNo ratings yet

- Pink Floyd / Steven Soderbergh Chopper / Art in The DarkDocument32 pagesPink Floyd / Steven Soderbergh Chopper / Art in The DarkAriel SpallettiNo ratings yet

- Venturing Into An Artistic MindDocument37 pagesVenturing Into An Artistic MindAriel SpallettiNo ratings yet

- The Venetian Painters of The RenaissanceThird Edition by Berenson Bernard 1865 1959Document119 pagesThe Venetian Painters of The RenaissanceThird Edition by Berenson Bernard 1865 1959Ariel SpallettiNo ratings yet

- How To Solve Chess ProblemsDocument101 pagesHow To Solve Chess ProblemsAriel SpallettiNo ratings yet

- From: Finance - Month End AP/AR Navigation PageDocument2 pagesFrom: Finance - Month End AP/AR Navigation PageAriel SpallettiNo ratings yet

- 2022 Cheat SheetDocument1 page2022 Cheat SheetAriel SpallettiNo ratings yet

- GL006-Period Close v11Document4 pagesGL006-Period Close v11Ariel SpallettiNo ratings yet

- ChatLog Meet Now 2019 - 04 - 15 13 - 52Document1 pageChatLog Meet Now 2019 - 04 - 15 13 - 52Ariel SpallettiNo ratings yet

- ChatLog Review Accounts Payable Process 2019-05-28 17 - 12Document1 pageChatLog Review Accounts Payable Process 2019-05-28 17 - 12Ariel SpallettiNo ratings yet

- ChatLog Curso Entender Ajedrez 2 - 0 - Clases Intensivas de Ajedrez - 2019-04-13 09 - 05Document2 pagesChatLog Curso Entender Ajedrez 2 - 0 - Clases Intensivas de Ajedrez - 2019-04-13 09 - 05Ariel SpallettiNo ratings yet

- ChatLog Reportes Financieros 2018-12-11 16 - 27Document1 pageChatLog Reportes Financieros 2018-12-11 16 - 27Ariel SpallettiNo ratings yet

- ChatLog Ariel - S Meeting 2019-05-29 12 - 04Document1 pageChatLog Ariel - S Meeting 2019-05-29 12 - 04Ariel SpallettiNo ratings yet

- Eric (To Everyone) : Eric (To Everyone) : Ariel Spalletti (To Everyone)Document1 pageEric (To Everyone) : Eric (To Everyone) : Ariel Spalletti (To Everyone)Ariel SpallettiNo ratings yet

- ChatLog Foot Print Consollidated Reporting 2019-03-21 10 - 12Document1 pageChatLog Foot Print Consollidated Reporting 2019-03-21 10 - 12Ariel SpallettiNo ratings yet

- ChatLog Ariel - S Meeting 2019-03-14 16 - 08Document1 pageChatLog Ariel - S Meeting 2019-03-14 16 - 08Ariel SpallettiNo ratings yet

- Eligio e (To Everyone) : Ariel Spalletti (To Everyone)Document1 pageEligio e (To Everyone) : Ariel Spalletti (To Everyone)Ariel SpallettiNo ratings yet

- XXI May 2012Document14 pagesXXI May 2012Ariel SpallettiNo ratings yet

- Prospect: Services Presentation DateDocument16 pagesProspect: Services Presentation DateAriel SpallettiNo ratings yet

- ChatLog Discussion On SI Financial Reports 2018-12-11 17 - 08Document1 pageChatLog Discussion On SI Financial Reports 2018-12-11 17 - 08Ariel SpallettiNo ratings yet

- ChatLog Payables Training 2019-05-30 11 - 25Document1 pageChatLog Payables Training 2019-05-30 11 - 25Ariel SpallettiNo ratings yet

- Sage ERP X3: Standard Edition - Solution OverviewDocument31 pagesSage ERP X3: Standard Edition - Solution OverviewAriel SpallettiNo ratings yet

- XXI Jan 2012Document14 pagesXXI Jan 2012Ariel SpallettiNo ratings yet

- XXI Feb 2012Document14 pagesXXI Feb 2012Ariel SpallettiNo ratings yet

- VDT Apr 2012Document14 pagesVDT Apr 2012Ariel SpallettiNo ratings yet

- SonyDocument21 pagesSonyNeha UpadhyayNo ratings yet

- Holding and SubsidiaryDocument2 pagesHolding and SubsidiaryRizwana BegumNo ratings yet

- Council Reply - Complaint 7 Nov 11Document4 pagesCouncil Reply - Complaint 7 Nov 11MiscellaneousNo ratings yet

- Hospitalization Accident Claim FormDocument8 pagesHospitalization Accident Claim FormWYNo ratings yet

- Tutorial Questions Week 4Document10 pagesTutorial Questions Week 4julia chengNo ratings yet

- Corporate Acts Voting RequirementDocument6 pagesCorporate Acts Voting RequirementVilma PabinesNo ratings yet

- Ratio Analysis AllDocument78 pagesRatio Analysis AllSuraj GawandeNo ratings yet

- Deep Dive Into IEV and Views From The Market: Sanket KawatkarDocument62 pagesDeep Dive Into IEV and Views From The Market: Sanket Kawatkarankur taunkNo ratings yet

- Deductions From Gross Income Lesson 13Document72 pagesDeductions From Gross Income Lesson 13Mikaela SamonteNo ratings yet

- Instructions For Filing Your Sales or Use Tax Return Using An Excel DocumentDocument31 pagesInstructions For Filing Your Sales or Use Tax Return Using An Excel DocumentMichelle ParksNo ratings yet

- Bihar State Milk Co-Operative Federation Limited, Patna Balance Sheet As at 31st March, 2014Document1 pageBihar State Milk Co-Operative Federation Limited, Patna Balance Sheet As at 31st March, 2014SATYAM KUMARNo ratings yet

- Accounting 2 PrelimsDocument3 pagesAccounting 2 PrelimsJohn Alfred Castino100% (1)

- BIR Ruling NoDocument1 pageBIR Ruling NoPau Line EscosioNo ratings yet

- Fresh Start', A Big Challenge Facing The Microfinance IndustryDocument4 pagesFresh Start', A Big Challenge Facing The Microfinance IndustryVinod ChanrasekharanNo ratings yet

- Financial Analysis & Performance of Indian Oil Corporation LTDDocument5 pagesFinancial Analysis & Performance of Indian Oil Corporation LTDsubhaseduNo ratings yet

- 0 MasterfileDocument598 pages0 MasterfileAngel VenableNo ratings yet

- Hoki 2019 PDFDocument95 pagesHoki 2019 PDFPutriNo ratings yet

- Accounting TerminologyDocument215 pagesAccounting TerminologyJyoshna Reddy50% (2)

- Slides Higgins 11e CH 4Document20 pagesSlides Higgins 11e CH 4Huy NguyễnNo ratings yet

- 2 RahnuDocument12 pages2 RahnuAhmadUmairIlyasNo ratings yet

- Study On Mutual Fund - New Fund Offer V/S Equity Initial Public Offer'Document78 pagesStudy On Mutual Fund - New Fund Offer V/S Equity Initial Public Offer'sumesh894No ratings yet

- Affordable Housing MeaningDocument5 pagesAffordable Housing Meaningcadeepak singh0% (1)

- ACCOUNTING FOR CORPORATIONS-Basic ConsiderationsDocument41 pagesACCOUNTING FOR CORPORATIONS-Basic ConsiderationsMarriel Fate Cullano100% (2)

- VODADocument2 pagesVODADhinakaran BabuNo ratings yet

- Balance of Payments EssayDocument2 pagesBalance of Payments EssayKevin Nguyen100% (1)