Professional Documents

Culture Documents

Balance Sheet of Households and Nonprofit Organizations With Equity Detail

Balance Sheet of Households and Nonprofit Organizations With Equity Detail

Uploaded by

Paulo CastilloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet of Households and Nonprofit Organizations With Equity Detail

Balance Sheet of Households and Nonprofit Organizations With Equity Detail

Uploaded by

Paulo CastilloCopyright:

Available Formats

139

Z.1, June 11, 2015

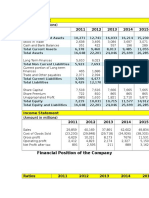

B.101.e Balance Sheet of Households and Nonprofit Organizations with Equity Detail

Billions of dollars; amounts outstanding end of period, not seasonally adjusted

2009

Assets

2010

2011

2012

2013

2014

Q1

Q2

2014

Q3

Q4

2015

Q1

72333.2

76239.9

77449.5

83501.9

93054.2

97464.9

94108.0

95673.4

95725.5

97464.9

99076.3

Nonfinancial assets

23715.2

23351.7

23378.2

25084.0

27702.2

29150.2

28100.3

28384.8

28718.6

29150.2

29693.7

Financial assets

48618.0

52888.2

54071.3

58417.9

65352.0

68314.7

66007.7

67288.6

67006.9

68314.7

69382.6

8097.7

4835.3

8071.0

4915.1

8716.1

4395.5

9239.0

4208.9

9600.2

3856.9

10144.1

3314.5

9760.6

3666.5

9771.4

3502.7

9897.4

3419.0

10144.1

3314.5

10287.2

3271.4

4

5

13132.1

15444.4

14915.4

17041.3

22034.1

23615.9

22337.3

23448.9

22772.4

23615.9

24103.1

4

5

Deposits

Credit market instruments

Equity shares at market value

Directly held

7255.8

8696.2

8498.4

9676.3

12501.8

13360.7

12580.0

13307.1

12777.4

13360.7

13640.8

Indirectly held

5876.3

6748.2

6417.1

7365.0

9532.3

10255.2

9757.2

10141.8

9995.1

10255.2

10462.3

1220.3

1875.3

105.3

224.8

2450.6

1408.6

2175.0

128.5

250.3

2785.8

1382.4

2087.1

124.0

223.5

2600.0

1537.3

2362.8

138.3

242.0

3084.7

1804.6

3069.7

195.0

294.7

4168.3

1858.6

3351.4

223.8

307.9

4513.3

1824.2

3125.7

200.8

298.0

4308.6

1869.0

3246.3

210.5

305.2

4510.8

1827.2

3226.6

213.8

301.6

4425.9

1858.6

3351.4

223.8

307.9

4513.3

1889.4

3405.2

231.6

313.2

4622.9

9

10

11

12

13

9

10

11

12

13

Life insurance companies

Private pension funds (1)

Federal govt. retirement funds (1)

State and local govt. retirement funds (1)

Mutual funds

14

Other

22552.9

24457.7

26044.4

27928.7

29860.8

31240.3

30243.3

30565.6

30918.1

31240.3

31720.8

14

15

Liabilities

14062.8

13782.3

13570.9

13637.8

13792.5

14168.9

13780.6

13949.1

14075.3

14168.9

14151.6

15

16

Net worth

58270.4

62457.6

63878.6

69864.2

79261.7

83296.0

80327.4

81724.3

81650.2

83296.0

84924.6

16

18.2

27.0

20.3

29.2

19.3

27.6

20.4

29.2

23.7

33.7

24.2

34.6

23.7

33.8

24.5

34.8

23.8

34.0

24.2

34.6

24.3

34.7

17

18

Memo:

17

18

Equity shares (line 6) as a percent of

Total assets (line 1)

Financial assets (line 3)

Supplements

(1) Defined contribution plans. Assets held by defined benefit pension funds are not considered assets of the household sector. Defined benefit pension entitlements are included in line 14.

140

Z.1, June 11, 2015

F.101.a Nonprofit Organizations (1)

Billions of dollars; quarterly figures are seasonally adjusted annual rates

1988

1989

1990

1991

1992

1993

1995

1996

1997

1998

1999

2000

Net lending (+) or net borrowing (-)

53.5

42.1

21.7

8.8

23.3

11.1

52.5

48.5

83.6

9.2

1.5

-6.0

39.6

Net acquisition of financial assets

70.9

75.8

53.8

46.4

53.0

45.2

76.5

84.9

120.0

47.4

55.0

28.8

108.1

0.5

-0.2

-13.1

0.4

-1.0

5.4

4.9

3.1

1.3

-6.2

-1.2

-2.2

4.0

10.4

32.9

-1.3

1.2

-2.4

4.0

6.0

1.7

-1.5

-13.8

0.5

-2.5

0.2

1.1

0.2

2.3

0.2

1.2

0.2

8.3

1.1

9.4

1.4

2.9

0.3

-1.8

0.0

3.1

1.1

7.1

1.3

2.3

0.6

3.8

0.7

5.1

0.8

4.5

0.8

3

4

5

6

54.9

21.9

22.2

-17.6

10.9

25.5

16.6

38.8

36.7

23.1

36.4

46.7

32.6

38.2

6.4

4.5

0.0

6.6

-0.8

-5.7

13.8

2.6

0.5

9.7

0.9

5.8

4.8

4.6

-0.5

8.2

-0.7

-35.2

6.1

3.6

0.0

7.9

-0.1

-5.8

6.8

3.1

0.2

5.6

0.9

12.4

5.1

2.3

0.3

4.5

0.9

4.7

6.4

2.9

0.4

2.4

-0.1

2.0

16.4

7.6

0.1

11.9

0.9

4.1

13.9

6.4

0.0

11.7

0.6

1.3

8.9

4.1

-0.1

8.3

0.6

3.0

11.6

5.4

0.1

15.4

0.9

4.7

17.5

8.1

0.1

15.4

0.8

12.4

5.4

2.5

0.0

10.5

1.7

8

9

10

11

12

13

5.2

-1.0

16.1

2.6

15.0

1.2

-18.6

-3.3

18.6

0.7

8.9

-0.7

45.1

1.5

-10.4

1.3

21.0

2.4

-30.6

-1.0

-40.7

0.4

-67.4

-3.3

15.4

-1.0

14

15

2.8

2.8

2.8

2.8

2.6

2.6

2.0

2.0

1.1

1.1

0.8

1.8

2.0

2.1

1.5

1.6

3.4

3.5

3.7

2.6

4.6

4.6

1.1

1.1

4.3

4.3

16

17

-0.1

18.6

-3.9

21.0

-6.0

24.5

15.2

20.5

10.6

1.2

7.0

15.0

0.2

10.1

10.2

38.0

8.4

24.4

9.7

38.3

12.5

24.7

12.0

31.2

16.3

25.0

18

19

17.3

33.6

32.1

37.6

29.7

34.1

24.0

36.4

36.3

38.2

53.5

34.7

68.5

20

7.5

11.7

11.8

14.3

10.0

13.8

2.4

-0.6

11.0

10.6

23.4

13.5

19.3

21

1.5

1.6

-0.0

4.4

3.2

1.4

-0.0

7.2

3.0

1.4

0.3

7.2

3.8

1.6

0.4

8.6

2.4

1.2

-0.2

6.6

1.1

2.0

0.1

10.7

3.2

-0.2

0.1

-0.8

0.2

-0.1

-0.1

-0.6

6.1

0.8

0.0

4.1

7.1

0.6

-0.2

3.1

11.8

1.9

-0.1

9.9

10.4

0.5

0.1

2.5

5.8

2.2

-0.3

11.6

22

23

24

25

2.4

7.4

16.2

5.8

9.3

10.9

9.4

13.8

5.9

13.8

6.0

14.3

5.2

16.5

7.9

29.1

8.0

17.3

8.9

18.7

8.7

21.4

4.1

17.0

3.8

45.4

26

27

3

4

5

6

Checkable deposits and currency

Time and savings deposits

Money market fund shares

Security repurchase agreements (2)

Credit market instruments

8

9

10

11

12

13

Open market paper

Treasury securities

Agency- and GSE-backed securities

Municipal securities

Corporate and foreign bonds

Mortgages

14

15

Corporate equities

Mutual fund shares

16

17

Security credit

Trade receivables (2)

18

19

Equity in noncorporate business

Miscellaneous assets (2)

20

21

22

23

24

25

26

27

Net increase in liabilities

Credit market instruments

Municipal securities

Depository institution loans n.e.c.

Other loans and advances

Commercial mortgages

Trade payables

Miscellaneous liabilities (2)

(1) Does not include religious organizations or organizations with less than $25,000 in gross annual receipts.

(2) Not included in table F.101.

Supplements

1994

141

Z.1, June 11, 2015

L.101.a Nonprofit Organizations (1)

Billions of dollars; amounts outstanding end of period, not seasonally adjusted

Total financial assets

2

3

4

5

Checkable deposits and currency

Time and savings deposits

Money market fund shares

Security repurchase agreements (2)

Credit market instruments

7

8

9

10

11

12

Open market paper

Treasury securities

Agency- and GSE-backed securities

Municipal securities

Corporate and foreign bonds

Mortgages

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

590.7

710.5

742.1

828.1

890.2

957.1

1025.5

1214.0

1414.1

1607.3

1793.9

1974.7

2003.8

17.0

1.5

15.9

1.7

15.9

6.8

20.8

4.8

17.3

0.6

19.6

2.5

21.3

11.1

52.5

1.3

22.5

8.7

56.5

7.3

24.1

7.1

42.7

7.8

21.6

7.3

43.8

8.0

23.9

7.5

45.1

8.2

32.1

8.6

54.5

9.6

35.0

8.9

52.7

9.6

38.1

10.0

59.8

10.9

40.4

10.6

63.6

11.6

45.5

11.4

68.1

12.5

2

3

4

5

229.3

251.2

273.4

255.9

266.8

292.3

308.9

347.7

384.4

407.6

443.9

490.6

523.2

93.6

55.7

26.3

0.1

51.1

2.6

87.9

69.5

28.9

0.6

60.8

3.5

93.7

74.3

33.5

0.1

69.0

2.8

58.5

80.3

37.1

0.2

77.0

2.8

52.7

87.1

40.3

0.4

82.6

3.7

65.0

92.2

42.6

0.8

87.1

4.6

69.7

98.5

45.5

1.1

89.5

4.5

71.7

114.9

53.1

1.2

101.4

5.3

75.8

128.8

59.5

1.3

113.1

6.0

77.1

137.6

63.6

1.2

121.4

6.6

80.2

149.2

69.0

1.3

136.8

7.4

84.9

166.8

77.1

1.5

152.2

8.3

97.3

172.2

79.6

1.5

162.6

10.0

7

8

9

10

11

12

145.8

10.2

203.0

15.8

197.5

15.3

214.6

15.9

241.1

17.7

270.2

18.5

308.2

19.0

397.1

24.6

494.7

30.4

604.9

34.5

692.0

38.7

769.3

42.7

708.6

38.8

13

14

13

14

Corporate equities

Mutual fund shares

15

16

Security credit

Trade receivables (2)

25.7

25.7

28.5

28.5

31.1

31.1

33.1

33.1

34.3

34.3

35.0

36.1

37.1

38.1

38.6

39.7

42.0

43.2

45.8

45.8

50.3

50.3

51.5

51.5

55.8

55.8

15

16

17

18

Equity in noncorporate business

Miscellaneous assets (2)

26.1

92.0

22.2

112.9

16.2

137.4

31.4

158.0

42.0

159.2

49.0

174.2

49.2

184.3

59.4

222.2

67.8

246.7

77.5

285.0

90.0

309.7

102.0

340.9

118.3

365.9

17

18

253.8

287.5

319.5

357.1

386.8

421.0

444.9

481.4

517.7

555.8

609.3

644.1

712.5

19

154.4

166.1

177.9

192.3

202.3

216.1

218.5

217.9

228.9

239.5

262.9

276.4

295.7

20

79.6

11.8

0.3

62.7

82.7

13.1

0.3

70.0

85.7

14.5

0.5

77.2

89.5

16.1

0.9

85.8

91.9

17.3

0.7

92.3

93.0

19.3

0.8

103.0

96.1

19.2

0.9

102.2

96.4

19.1

0.8

101.6

102.4

19.8

0.9

105.7

109.6

20.4

0.7

108.8

121.3

22.3

0.6

118.7

131.7

22.7

0.7

121.2

137.5

24.9

0.4

132.8

21

22

23

24

41.3

58.2

57.4

63.9

66.8

74.8

76.2

88.6

82.1

102.5

88.1

116.8

93.2

133.3

101.1

162.4

109.1

179.7

118.0

198.4

126.8

219.7

130.9

236.8

134.7

282.1

25

26

19

20

21

22

23

24

25

26

Liabilities

Credit market instruments

Municipal securities

Depository institution loans n.e.c.

Other loans and advances

Commercial mortgages

Trade payables

Miscellaneous liabilities (2)

Supplements

(1) Does not include religious organizations or organizations with less than $25,000 in gross annual receipts.

(2) Not included in table L.101.

You might also like

- Client and Partner Group OverviewDocument31 pagesClient and Partner Group OverviewRavi Chaurasia100% (4)

- Polar Sports, Inc SpreadsheetDocument19 pagesPolar Sports, Inc Spreadsheetjordanstack100% (3)

- World Wide EquipmentDocument5 pagesWorld Wide EquipmentRahul RanjanNo ratings yet

- Toy World - ExhibitsDocument9 pagesToy World - Exhibitsakhilkrishnan007No ratings yet

- Financial Model of NLMKDocument38 pagesFinancial Model of NLMKIaroslav AfoninNo ratings yet

- Case 1 - Pret A MangerDocument4 pagesCase 1 - Pret A MangerAjay Chandar100% (1)

- Case - Polar SportsDocument12 pagesCase - Polar SportsSagar SrivastavaNo ratings yet

- How To Think Like A Marketing Genius - Jay AbrahamDocument12 pagesHow To Think Like A Marketing Genius - Jay Abrahamkento50% (2)

- Current Macroeconomic Situation (English) - 2071-08 Tables 46 (Based On Three Months Data of 2071-72) - NewDocument46 pagesCurrent Macroeconomic Situation (English) - 2071-08 Tables 46 (Based On Three Months Data of 2071-72) - NewChandeshwor ShahNo ratings yet

- Balance Sheet of Households and Nonprofit Organizations. FEDDocument6 pagesBalance Sheet of Households and Nonprofit Organizations. FEDvaleriobrlNo ratings yet

- Ever Gotesco: Quarterly ReportDocument35 pagesEver Gotesco: Quarterly ReportBusinessWorld100% (1)

- Binder - HCT - Collusion - MartinDocument9 pagesBinder - HCT - Collusion - MartinMy-Acts Of-SeditionNo ratings yet

- Microsoft Corporation: United States Securities and Exchange CommissionDocument75 pagesMicrosoft Corporation: United States Securities and Exchange Commissionavinashtiwari201745No ratings yet

- Ravi 786Document23 pagesRavi 786Tatiana HarrisNo ratings yet

- Quik Silver Inc 10 Q 31715Document52 pagesQuik Silver Inc 10 Q 31715pakistanNo ratings yet

- Identify The IndustriesDocument11 pagesIdentify The Industrieslouiegoods2450% (2)

- CHAP - 02 - Financial Statements of BankDocument72 pagesCHAP - 02 - Financial Statements of BankTran Thanh NganNo ratings yet

- Source: Annual Accounts of BanksDocument6 pagesSource: Annual Accounts of BanksARVIND YADAVNo ratings yet

- Exhibit 99.1 Message To ShareholdersDocument8 pagesExhibit 99.1 Message To ShareholdersWilliam HarrisNo ratings yet

- CHAP - 02 - Financial Statements of BankDocument49 pagesCHAP - 02 - Financial Statements of BankTú NguyễnNo ratings yet

- BBVA Bancomer, S.A.: Company Tear SheetDocument7 pagesBBVA Bancomer, S.A.: Company Tear SheetDavid AbonzaNo ratings yet

- Financial Statement SampleDocument172 pagesFinancial Statement SampleJennybabe PetaNo ratings yet

- Form L-27-Unit Linked Business-3A: Part - BDocument6 pagesForm L-27-Unit Linked Business-3A: Part - BSantoshkumar YandamuriNo ratings yet

- Chapter - I: An Overview of The Finances of The State GovernmentDocument27 pagesChapter - I: An Overview of The Finances of The State GovernmentrdamarapatiNo ratings yet

- CHAP - 04 - Financial Statements of Bank - For StudentDocument87 pagesCHAP - 04 - Financial Statements of Bank - For Studentkhanhlmao25252No ratings yet

- Central Bank of Eutopia Statement of Financial Position: As at 31 December 2012Document0 pagesCentral Bank of Eutopia Statement of Financial Position: As at 31 December 2012Sanath FernandoNo ratings yet

- Central Bank of Eutopia Statement of Financial Position (Continued.)Document0 pagesCentral Bank of Eutopia Statement of Financial Position (Continued.)Sanath FernandoNo ratings yet

- V F Corporation NYSE VFC FinancialsDocument10 pagesV F Corporation NYSE VFC FinancialsvipinNo ratings yet

- NBP Unconsolidated Financial Statements 2015Document105 pagesNBP Unconsolidated Financial Statements 2015Asif RafiNo ratings yet

- June Financial Soundness Indicators - 2007-12Document53 pagesJune Financial Soundness Indicators - 2007-12shakira270No ratings yet

- Consolidated First Page To 11.2 Property and EquipmentDocument18 pagesConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564No ratings yet

- Fixed Income Investor Review: John Gerspach Eric AboafDocument43 pagesFixed Income Investor Review: John Gerspach Eric AboafAhsan AliNo ratings yet

- Balance of PaymentsDocument8 pagesBalance of PaymentsAliNo ratings yet

- Precision Capital S.A. 2015Document31 pagesPrecision Capital S.A. 2015LuxembourgAtaGlanceNo ratings yet

- Bid 03312013x10q PDFDocument59 pagesBid 03312013x10q PDFpeterlee100No ratings yet

- Local Water UtilitiesDocument75 pagesLocal Water UtilitiesadsleeNo ratings yet

- Consolidated Financial StatementsDocument78 pagesConsolidated Financial StatementsAbid HussainNo ratings yet

- CHAP - 02 - Financial Statements and Bank Performance AnalysisDocument74 pagesCHAP - 02 - Financial Statements and Bank Performance AnalysisPhuc Hoang DuongNo ratings yet

- Standalone Accounts 2008Document87 pagesStandalone Accounts 2008Noore NayabNo ratings yet

- First Four Months Macroecon - NRB FY 2009-10Document43 pagesFirst Four Months Macroecon - NRB FY 2009-10Chandan SapkotaNo ratings yet

- Financial Statements: December 31, 2011Document55 pagesFinancial Statements: December 31, 2011b21t3chNo ratings yet

- Karishma WorkDocument14 pagesKarishma WorkApoorva MathurNo ratings yet

- John M CaseDocument6 pagesJohn M CaseSwapnil JainNo ratings yet

- 690 Tables #1Document6 pages690 Tables #1cary_puyatNo ratings yet

- Balance Sheet: of Which Bridging Credit 0 0Document2 pagesBalance Sheet: of Which Bridging Credit 0 0Yonela JordanNo ratings yet

- Book 1Document3 pagesBook 1mirmaniNo ratings yet

- United States Securities and Exchange Commission FORM 10-QDocument71 pagesUnited States Securities and Exchange Commission FORM 10-QWai LonnNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- 10000006490Document17 pages10000006490Chapter 11 DocketsNo ratings yet

- Luckycement Annual Report 2Document4 pagesLuckycement Annual Report 2jointariqaslamNo ratings yet

- Annual Financial Statements 2007Document0 pagesAnnual Financial Statements 2007hyjulioNo ratings yet

- Mills' 1Q12 Result: Ebitda Financial Indicators Per DivisionDocument13 pagesMills' 1Q12 Result: Ebitda Financial Indicators Per DivisionMillsRINo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument11 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- MCB Annual Report 2008Document93 pagesMCB Annual Report 2008Umair NasirNo ratings yet

- Financial Position of The Engro FoodsDocument2 pagesFinancial Position of The Engro FoodsJaveriarehanNo ratings yet

- Fianancial StatementsDocument84 pagesFianancial StatementsMuhammad SaeedNo ratings yet

- Samsung Electronics Co., LTD.: Index December 31, 2009 and 2008Document74 pagesSamsung Electronics Co., LTD.: Index December 31, 2009 and 2008Akshay JainNo ratings yet

- KB FG.1H11 PresentationDocument19 pagesKB FG.1H11 PresentationSam_Ha_No ratings yet

- Current Macroeconomic Situation: (Based On Seven Months' Data of 2013/14)Document44 pagesCurrent Macroeconomic Situation: (Based On Seven Months' Data of 2013/14)hello worldNo ratings yet

- Randy Quick FIN3150 Homework Project 1 Fall 20xx BWLD and CMGDocument10 pagesRandy Quick FIN3150 Homework Project 1 Fall 20xx BWLD and CMGkywellsNo ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- China's Trump Card: Cryptocurrency and its Game-Changing Role in Sino-US TradeFrom EverandChina's Trump Card: Cryptocurrency and its Game-Changing Role in Sino-US TradeNo ratings yet

- 6 Theories of Value, Output and Employment: John EatwellDocument25 pages6 Theories of Value, Output and Employment: John EatwellMiguel TorresNo ratings yet

- Final Project Report On Mutual FundDocument61 pagesFinal Project Report On Mutual FundSophia Ali0% (1)

- Application of Sales and Distribution ManagementDocument16 pagesApplication of Sales and Distribution Managementvyapak0% (1)

- Comunicado Terreno RBSENGDocument1 pageComunicado Terreno RBSENGMultiplan RINo ratings yet

- Convexity and VolatilityDocument20 pagesConvexity and Volatilitydegas981100% (2)

- Lums Cases Bibliography FinalDocument137 pagesLums Cases Bibliography Final540377No ratings yet

- Ashu SeminarDocument7 pagesAshu SeminarmadihajuttNo ratings yet

- Super FINAL ORGANIZATION AND MANAGEMENT Q2 Week16Document24 pagesSuper FINAL ORGANIZATION AND MANAGEMENT Q2 Week16Caranay BillyNo ratings yet

- StarboyDocument6 pagesStarboyMarvin AgullanaNo ratings yet

- BMW Success FactorDocument9 pagesBMW Success FactorMukhtar Ahmed HunjraNo ratings yet

- Agricultural Crop Production - MODULE 1Document49 pagesAgricultural Crop Production - MODULE 1Vinz Villahermosa BorbonNo ratings yet

- Rudrakshi SIPDocument36 pagesRudrakshi SIPAalok GhoshNo ratings yet

- GeM 3.0 Overview PPT RevisedDocument33 pagesGeM 3.0 Overview PPT Revisednarpati100% (2)

- Markscheme: M13/3/ECONO/HP1/ENG/TZ1/XX/MDocument17 pagesMarkscheme: M13/3/ECONO/HP1/ENG/TZ1/XX/MJustNo ratings yet

- Tire City ExampleDocument7 pagesTire City Exampleapi-299614008No ratings yet

- 2010 - 05 ProspectusDocument293 pages2010 - 05 ProspectusPak DefanceNo ratings yet

- British Private Equity Is Losing Out To American Firms Such As KKR's Henry Kravis and Blackstone's Stephen SchwarzmanDocument9 pagesBritish Private Equity Is Losing Out To American Firms Such As KKR's Henry Kravis and Blackstone's Stephen SchwarzmanAlex HoltNo ratings yet

- Chapter 6 - Functional Level StrategyDocument26 pagesChapter 6 - Functional Level StrategyKalkidanNo ratings yet

- Marketing Strategy Analysis: Fossil WatchesDocument7 pagesMarketing Strategy Analysis: Fossil WatchesSourav RahaNo ratings yet

- Integrated Marketing Communications: Kirti DuttaDocument15 pagesIntegrated Marketing Communications: Kirti DuttaAamir KhanNo ratings yet

- Book of Proceedings EsdPorto2020 Online20200423 43786 Ynn404 With Cover Page v2Document673 pagesBook of Proceedings EsdPorto2020 Online20200423 43786 Ynn404 With Cover Page v2Erin Dwike PutriNo ratings yet

- Service TriangleDocument8 pagesService TriangleAnithaNo ratings yet

- What Is A Wedge?: Key TakeawaysDocument2 pagesWhat Is A Wedge?: Key TakeawaysAli Abdelfatah MahmoudNo ratings yet

- BiziMobile Inc.-2021 PDFDocument5 pagesBiziMobile Inc.-2021 PDFtahjinNo ratings yet

- How Influencer Marketing Shapes Consumer Perception and Behavior in The U.K. Fashion Industry Name of StudentDocument19 pagesHow Influencer Marketing Shapes Consumer Perception and Behavior in The U.K. Fashion Industry Name of StudentGreat MindNo ratings yet

- Puregold Annual Report CY 2018Document152 pagesPuregold Annual Report CY 2018Jessa Joy Alano Lopez100% (1)