Professional Documents

Culture Documents

Gujarat Technological University

Gujarat Technological University

Uploaded by

Shyamsunder SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gujarat Technological University

Gujarat Technological University

Uploaded by

Shyamsunder SinghCopyright:

Available Formats

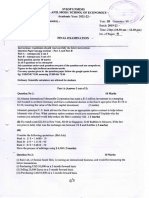

Seat No.

: ________

Enrolment No.___________

GUJARAT TECHNOLOGICAL UNIVERSITY

MBA - SEMESTERIV EXAMINATIONSUMMER 2015

Subject Code: 2840202

Subject Name: Risk Management (RM)

Time: 10.30 am - 13.30 pm

Date: 13-05-2015

Total Marks: 70

Instructions:

1. Attempt all questions.

2. Make suitable assumptions wherever necessary.

3. Figures to the right indicate full marks.

Q.1

(a) What do you understand by risks and what are different ways of classifying 07

and managing them?

(b) Who are the principal users of the derivatives market? What are their motives 07

and how do they reduce their risk?

Q.2

(a) Explain the principles of put-call parity with suitable example.

07

(b) Explain features/specifications of stock/index futures. Explain applications of

index futures.

OR

(b) Company X wishes to borrow U.S. Dollars at a fixed rate of interest.

Company Y wishes to borrow Japanese yen at a fixed rate of interest. The

amounts required by the two companies are roughly the same at the current

exchange rate. The companies have been quoted the following interest rates,

which have been adjusted for the impact of taxes:

Yen

Dollars

Company X

5.0 %

9.6 %

Company Y

6.5 %

10.0 %

Prepare a Currency Swap on the basis of above data.

(a) What is derivative? Explain features of derivatives. Bring out the differences

between the forward, future and options contracts in detail.

(b) Consider a 6 month forward contract on 100 shares with a price of Rs 1000

each. The risk free rate of interest semiannually compounded is 9 % per

annum. The share is expected to yield a dividend of Rs.6 in 3 months from

now. Determine the value of the forward contract.

OR

What

is

a

commodity

future?

How

farmers can hedge with the help of

(a)

commodity futures? Illustrate with example.

(b) Explain Black Scholes model (BSM) for option pricing. Explain assumptions

of BSM.

07

Q.3

Q.3

Q.4

Q.4

07

07

07

07

07

(a) Explain two ways in which a Bull spread can be created. Include the payoff

07

table for the strategy.

(b) Discuss the meaning of Cost to carry and convenience Yield, and establish 07

relation between Future Price, Spot Price, Cost of Carry and Convenience

Yield.

OR

(a) Explain the Straddle and Strangles Combination Strategy. Also discuss the 07

difference between them.

1

Q.4

(b) Differentiate between call and put options. What are the rights and 07

obligations of the holders of long and short positions in them?

Q.5

(a) A stock price is currently Rs.100.Over each of the next two three-month

periods it is expected to go up by 10 % or down 10 %.The risk free interest

rate is 8 % per annum with continuous compounding. What is the value of a

six-month European call option with a strike price of Rs.100? Use risk

neutral Valuation.

(b) The gamma of a portfolio of options on an underlying asset is the rate of

change of the portfolios delta with respect to the price of underlying asset.

Explain.

OR

(a) Consider a position consisting of a Rs. 3, 00 ,000 investment in asset A and a

Rs. 5,00,000 investment in asset B. Assume that the daily volatilities of the

assets are1.8 % and 1.2 %,respectively, and that the coefficient of correlation

between their returns is 0.3. What is the 5-day 95 % value at risk for the

portfolio?

(b) Discuss Initial margin, Maintenance margin and Margin call with the help of

an example.

Q.5

07

07

07

07

*************

You might also like

- Strategic Marketing 1st Edition Mooradian Test BankDocument9 pagesStrategic Marketing 1st Edition Mooradian Test Bankmeganfloresyfwemzsrdp100% (15)

- CT8 Financial Economics PDFDocument6 pagesCT8 Financial Economics PDFVignesh SrinivasanNo ratings yet

- End Sem Derivatives 2021Document2 pagesEnd Sem Derivatives 2021vinayNo ratings yet

- RM Question Paper-May 2014Document2 pagesRM Question Paper-May 2014shruthi_9327No ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversitysuchipatelNo ratings yet

- Gujarat Technological University: InstructionsDocument1 pageGujarat Technological University: InstructionsSagar KotakNo ratings yet

- 810002Document2 pages810002jigneshparmarNo ratings yet

- 1 RiskManagement QpaperDocument2 pages1 RiskManagement QpaperBhavish VohraNo ratings yet

- 2840202Document4 pages2840202lathigara jayNo ratings yet

- Sem-8 Gtu QpapersDocument9 pagesSem-8 Gtu QpapersKrishnapalsinh Indrajitsinh VirparaNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversitymansiNo ratings yet

- Gujarat Technological University: InstructionsDocument1 pageGujarat Technological University: InstructionsmansiNo ratings yet

- TEST 1: ASC570 Financial Economics II: All The BestDocument1 pageTEST 1: ASC570 Financial Economics II: All The BestSumaiyyahRoshidiNo ratings yet

- ACCG329 Sample Exam PaperDocument25 pagesACCG329 Sample Exam PaperLinh Dieu NghiemNo ratings yet

- IMT 09 Security Analysis & Portfolio Management M2Document4 pagesIMT 09 Security Analysis & Portfolio Management M2solvedcareNo ratings yet

- International Finance 2021-22Document3 pagesInternational Finance 2021-22NAITIK SHAHNo ratings yet

- Important Questions: Unit 1Document4 pagesImportant Questions: Unit 1Nageswara Rao ThotaNo ratings yet

- FM402 2019Document4 pagesFM402 2019skinnNo ratings yet

- 2830203-Security Analysis and Portfolio ManagementDocument2 pages2830203-Security Analysis and Portfolio ManagementbhumikajasaniNo ratings yet

- Gujarat Technological University: InstructionsDocument1 pageGujarat Technological University: InstructionsAkash ModiNo ratings yet

- 427 Question PaperDocument2 pages427 Question PaperPacific TigerNo ratings yet

- IFDocument2 pagesIFAshok ShahNo ratings yet

- Derivatives Jan 11Document5 pagesDerivatives Jan 11Matthew FlemingNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityCA Kiran KhatriNo ratings yet

- Be Winter 2021Document1 pageBe Winter 2021YashNo ratings yet

- SMM200 Derivatives and Risk Management 2021 QuestionsDocument5 pagesSMM200 Derivatives and Risk Management 2021 Questionsminh daoNo ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningmahendernayal007No ratings yet

- Gujarat Technological University: InstructionsDocument1 pageGujarat Technological University: InstructionsVivek DeshaiNo ratings yet

- Sem 2 Papers 2021 PDFDocument17 pagesSem 2 Papers 2021 PDFsahil sharmaNo ratings yet

- Efm Question BankDocument4 pagesEfm Question BankriddhisanghviNo ratings yet

- Gujarat Technological UniversityDocument1 pageGujarat Technological UniversitysuchjazzNo ratings yet

- Master of Commerce Term-End Examination December, 2OO8Document4 pagesMaster of Commerce Term-End Examination December, 2OO8Smriti SoniNo ratings yet

- Derivatives Mock ExamDocument5 pagesDerivatives Mock ExamMatthew FlemingNo ratings yet

- Investment & Financial Markets Exam-November 2019: Normal Distribution Calculator Prometric Web SiteDocument12 pagesInvestment & Financial Markets Exam-November 2019: Normal Distribution Calculator Prometric Web SiteSujith GopinathanNo ratings yet

- Investment & Financial Markets Exam-July 2019: Normal Distribution Calculator Prometric Web SiteDocument12 pagesInvestment & Financial Markets Exam-July 2019: Normal Distribution Calculator Prometric Web SiteDudenNo ratings yet

- Edu 2017 Spring Qfi Core SyllabiDocument11 pagesEdu 2017 Spring Qfi Core SyllabiJeffNo ratings yet

- Old Paper 2597121Document2 pagesOld Paper 2597121IlyasNo ratings yet

- Gujarat Technological University: InstructionsDocument1 pageGujarat Technological University: InstructionssceneoritaNo ratings yet

- Winter 2021 23-02-2022Document2 pagesWinter 2021 23-02-2022Grishma BhindoraNo ratings yet

- Gujarat Technological UniversityDocument1 pageGujarat Technological UniversitymansiNo ratings yet

- Arm - MF - Final - Sample (From 2016)Document27 pagesArm - MF - Final - Sample (From 2016)甜瓜No ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityMehul VarmaNo ratings yet

- Simulation Tutorial QuestionsDocument2 pagesSimulation Tutorial QuestionsClaudia ChoiNo ratings yet

- 2810002Document4 pages2810002Jay WilliamsNo ratings yet

- FM212 2017 PaperDocument5 pagesFM212 2017 PaperSam HanNo ratings yet

- Theory of Finance Questions Jan 2019Document5 pagesTheory of Finance Questions Jan 2019minh daoNo ratings yet

- MMPC-010 2Document2 pagesMMPC-010 2faizNo ratings yet

- Mba 4 Sem Risk Management 840203 Summer 2014Document2 pagesMba 4 Sem Risk Management 840203 Summer 2014Hansa PrajapatiNo ratings yet

- Edu 2008 11 Fete ExamDocument22 pagesEdu 2008 11 Fete ExamcalvinkaiNo ratings yet

- Sapm QBDocument8 pagesSapm QBSiva KumarNo ratings yet

- FEDocument12 pagesFEThaddee Nibamureke0% (1)

- W1 QuestionsDocument2 pagesW1 QuestionsJingchi LiNo ratings yet

- Capital Markets InstrumentsDocument3 pagesCapital Markets InstrumentsRNo ratings yet

- International Finance 2018-19 ReDocument2 pagesInternational Finance 2018-19 ReNAITIK SHAHNo ratings yet

- Tyfm Derivative Markets Question BankDocument4 pagesTyfm Derivative Markets Question BankSmith ShettyNo ratings yet

- FD Question BankDocument5 pagesFD Question Bankruchi agrawalNo ratings yet

- Winter 2020 04-01-2021Document2 pagesWinter 2020 04-01-2021Grishma BhindoraNo ratings yet

- Gujarat Technological University: InstructionsDocument2 pagesGujarat Technological University: InstructionsVasim ShaikhNo ratings yet

- Interest Rate Derivatives Explained: Volume 1: Products and MarketsFrom EverandInterest Rate Derivatives Explained: Volume 1: Products and MarketsNo ratings yet

- CFA 2012 - Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyFrom EverandCFA 2012 - Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyRating: 3 out of 5 stars3/5 (2)

- Banking and Beyond: The Evolution of Financing along Traditional and Alternative AvenuesFrom EverandBanking and Beyond: The Evolution of Financing along Traditional and Alternative AvenuesCaterina CrucianiNo ratings yet

- 090617000053Document5 pages090617000053Shyamsunder SinghNo ratings yet

- Gujarat Technological University: InstructionsDocument2 pagesGujarat Technological University: InstructionsShyamsunder SinghNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityShyamsunder SinghNo ratings yet

- Don't Lecture Us After What You Did To India: PM Attacks CongDocument1 pageDon't Lecture Us After What You Did To India: PM Attacks CongShyamsunder SinghNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityShyamsunder SinghNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityShyamsunder SinghNo ratings yet

- Gujarat Technological UniversityDocument1 pageGujarat Technological UniversityShyamsunder SinghNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityShyamsunder SinghNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityShyamsunder SinghNo ratings yet

- Gujarat Technological University: InstructionsDocument1 pageGujarat Technological University: InstructionsShyamsunder SinghNo ratings yet

- Gujarat Technological UniversityDocument1 pageGujarat Technological UniversityShyamsunder SinghNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityShyamsunder SinghNo ratings yet

- Gujarat Technological UniversityDocument1 pageGujarat Technological UniversityShyamsunder SinghNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityShyamsunder SinghNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityShyamsunder SinghNo ratings yet

- Gujarat Technological UniversityDocument1 pageGujarat Technological UniversityShyamsunder SinghNo ratings yet

- 830102.pdf 5Document2 pages830102.pdf 5Shyamsunder SinghNo ratings yet

- 830102.pdf 5Document2 pages830102.pdf 5Shyamsunder SinghNo ratings yet

- Wirex Investment Opportunity 05042019Document7 pagesWirex Investment Opportunity 05042019vsNo ratings yet

- Decentralized Perpetual Contract Trading PlatformDocument33 pagesDecentralized Perpetual Contract Trading PlatformNitheesh RajNo ratings yet

- Multibagger StudiesDocument47 pagesMultibagger StudiesRam0% (1)

- Awp Examination Guide For Exams From 1 May 2016 Up To 30 April 2017Document22 pagesAwp Examination Guide For Exams From 1 May 2016 Up To 30 April 2017Piere Christofer Salas HerreraNo ratings yet

- Augmont Daily ReportDocument2 pagesAugmont Daily ReportSarthak KhandelwalNo ratings yet

- Call Money MarketDocument24 pagesCall Money MarketiyervsrNo ratings yet

- Chapter15 LengkapDocument7 pagesChapter15 LengkapSulistyonoNo ratings yet

- Baker Wurgler 2015 Do Strict Capital Requirements Raise The Cost of Capital Bank Regulation Capital Structure and TheDocument15 pagesBaker Wurgler 2015 Do Strict Capital Requirements Raise The Cost of Capital Bank Regulation Capital Structure and TheIssabella SonneNo ratings yet

- Mozambique Stock ExchangeDocument21 pagesMozambique Stock ExchangeFabio BrigatiNo ratings yet

- Complete Guide To Container Freight DerivativesDocument81 pagesComplete Guide To Container Freight Derivativesmaersk01No ratings yet

- BFN 2044 Chap 6ADocument26 pagesBFN 2044 Chap 6Acharlie simoNo ratings yet

- The Idea Generation ProcessDocument26 pagesThe Idea Generation ProcessDaud ShafeeqNo ratings yet

- Design Your Business Model - Jonathan Prathama - Solelands - 03 Aug 2023Document16 pagesDesign Your Business Model - Jonathan Prathama - Solelands - 03 Aug 2023Syamsul AlamNo ratings yet

- Mid-Sem Exam NotesDocument21 pagesMid-Sem Exam Notesdaksh.aggarwal26No ratings yet

- BetterSystemTrader-Episode124-TradeManagementWithLindaRaschke (BLZ 5, Volume NYSE First 30 Minutes)Document12 pagesBetterSystemTrader-Episode124-TradeManagementWithLindaRaschke (BLZ 5, Volume NYSE First 30 Minutes)aadbosmaNo ratings yet

- Midterm Exam - PMDocument2 pagesMidterm Exam - PMSergion vergaraNo ratings yet

- POM Case 2Document3 pagesPOM Case 2DeepanshuNo ratings yet

- Inv 3 Investment Committee MemorandumDocument4 pagesInv 3 Investment Committee MemorandumvelquerNo ratings yet

- Ing Vysya Bank IPO ViolationDocument4 pagesIng Vysya Bank IPO ViolationtenetchatNo ratings yet

- Quarterly CKD and CERPI Update - 1Q23Document16 pagesQuarterly CKD and CERPI Update - 1Q23Abraham VillalobosNo ratings yet

- Call With Dividends: Input DataDocument2 pagesCall With Dividends: Input DataCH NAIRNo ratings yet

- Fin45a01 Group 2Document16 pagesFin45a01 Group 2Hoàng Việt VũNo ratings yet

- 4 Bir Ruling 370 2011Document13 pages4 Bir Ruling 370 2011Isabella GamuloNo ratings yet

- Valuation Mergers ProjectDocument3 pagesValuation Mergers Projectsuraj nairNo ratings yet

- Notes - On - The - Thoughtful - Investor Basant - MaheshwariDocument17 pagesNotes - On - The - Thoughtful - Investor Basant - Maheshwarishylesh86100% (2)

- Research and Marketing of Financial ServicesDocument26 pagesResearch and Marketing of Financial ServicesHIGGSBOSON304No ratings yet

- Omnicom - 1-Page AppraisalDocument1 pageOmnicom - 1-Page AppraisalAndy ParkNo ratings yet

- Level III 2020 IFT Mock Exam SampleDocument13 pagesLevel III 2020 IFT Mock Exam SampleDenis DikarevNo ratings yet

- (PDF) FinMan Cabrera SM (Vol1)Document22 pages(PDF) FinMan Cabrera SM (Vol1)Florie May SaynoNo ratings yet