Professional Documents

Culture Documents

Ranges (Up Till 11.50am HKT) : Currency Currency

Ranges (Up Till 11.50am HKT) : Currency Currency

Uploaded by

api-290371470Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ranges (Up Till 11.50am HKT) : Currency Currency

Ranges (Up Till 11.50am HKT) : Currency Currency

Uploaded by

api-290371470Copyright:

Available Formats

Ranges (Up till 11.

50am HKT)

Currency

AudUsd stops have developed beneath 0.7260 but bids

are also gathering near 0.7240.

Currency

EURUSD

1.0932-57

EURJPY

135.55-84

USDJPY

123.91-11

EURGBP

0.7017-28

GBPUSD

1.5570-99

USDSGD

1.3777-1.3809

USDCHF

AUDUSD

0.9692-0.9704

0.7264-0.7302

USDTHB

USDKRW

35.09-14

1168.9-1172.0

NZDUSD

0.6550-72

USDTWD

31.639-760

USDCAD

1.3147-76

USDCNH

6.2164-6.2200

AUDNZD

1.1067-1.1124

XAU

1081.4-1086.0

Key Headlines

Australian July retail sales were better than expected

and Aud traded higher. There are offers mentioned

above 0.7325 but lets see what RBA does.

An interesting remark by BOJ Deputy Governor when

he spoke to parliament this morning. He said there is a

need to be careful about communications with market. Is

he trying to prevent repeat of June 10 when Governor

Kuroda to signal the Jpy weakness should end?

The focus was definitely on Asia despite RBA rates

decision today. To be honest, so far the stock market is

behaving well, Kospi positive while Nikkei is flat

Usd/Asia creeping higher.

No one is looking at Greece, not till we get close to Aug

20.

FX Flows

Since Europeans left for the day, UsdJpy slipped into

123.85-124.10 range and we have not gotten an offside.

BOJ Deputy Governor Iwata appeared in parliament and

said he sees little risks of possible Fed and BOE rate

hikes. He felt that market has priced in rate hikes and

BOJ monetary policy concentrating on price stability and

not to target FX. It was however interesting that he said

there is a need to be careful about communications with

market. Usual sell orders are still intact above 124.25 to

124.60. I hear buy orders are raised from 123.45 to

123.70-80.

As we worked our way into NY close, AudNzd demand

was felt following report in AFR that Australia's Origin

Energy to sell all of its shares in New Zealand's Contact

Energy for about Nzd1.8bn. The cross peaked above

1.1115 then backed off to 1.1080. Apparently this news

wasnt new. AudNzd had another test on top side when

Australia reported a better than expected retail sales.

Trade balance was weak but it was in line with

expectations. Revisions improved for all.

AudUsd rose to 0.7302 ahead of RBA. Some talk of sells

near 0.7320 but no confirmation of credibility. Weak

Euro came under pressure immediately after the Tokyo

opened; the only reason I can think of is the trigger of

stop loss orders at 1.0940, belonging to intraday

accounts. No one is looking at Greece, not till we get

close to Aug 20. However, one macro name I talked to

said there is a build-up of short EurGbp positions ahead

of super Thursday. Bids in EurUsd have lightened up , or

the AAA names buying have decided not to show hand.

Offers remain above 1.0990.

UsdCad printed one point higher than North American

session at 1.3176. Overall, it has been lacklustre. Even

with AudUsd touching 0.73-handle; UsdCad just backed

off to 1.3164. Offers on top are light while buyers await

low 1.31s.

Asians

The focus was definitely on Asia despite RBA rates

decision today. To be honest, so far the stock market is

behaving well, Kospi positive while Nikkei is flat

Usd/Asia creeping higher.

UsdSgd printed 1.3800 and took out a barrier option

there. It didnt take long to take out the stops at 1.3805

printed 1.3809. Seeing profit taking from proprietary

traders both on-and-offshore. We are likely to see

demand from model funds below 1.3770. Market talked

above another barrier at 1.3850 and even more stops

above 1.3905.

Korean equities started the session in black according

to WSJ, it was due to the July inflation which remains

below 1%. UsdKrw, like rest of Usd/Asia is firm. Have a

look at the JpyKrw chart, as long as this UsdJpy stays

above 124.00; UsdKrw should also stay bid.

Believe it or not! CNY fixed again in the 6.11-handle at

6.1177 (44 days in a row!)

Who said what

Economic Info Daily: China will likely continue

relatively loose monetary policy and may cut some

banks RRR in 2H

US Senator Lindsey Graham: China cheating and no

ones calling them on it

US Senator Lindsey Graham: Foreign policy

clenched fist, open hand, you choose

Jeb Bush: US economic growth should target 4%

BOJ Iwata: Do not see any risk posed by possible rate

hikes by Fed or BOE

BOJ Iwata: It is possible that FX market have fully

priced in rate hikes by other central banks

These information have been obtained or derived from sources believed to be reliable, but I make no representation or warranty as to their accuracy or completeness.

Copyright 2013 The Poon Report by Vincent Poon. All rights reserved.

BOJ Iwata: FX level not problematic reflecting

fundamentals

BOJ Iwata: Jpy wont fall if rate differentials priced in

BOJ Iwata: Market sets FX rate

BOJ Iwata: Too early to talk about exit

BOJ Iwata: Need to be careful about communications

with market

Citic Sec: Suspends short selling business

payment on its Public Finance Corporation (PFC) bonds.

Broader defaults could hit investors widely, as nearly one

out of every three of all U.S. muni mutual funds have

holdings in Puerto Rico, a U.S. territory. Bond prices for

Puerto Ricos debt already have plunged this year,

hurting performance.

http://www.marketwatch.com/story/what-puerto-ricosmissed-debt-payment-means-2015-07-16

News & Data

The Globe and Mail: Two-thirds of Canadians

votes up for grabs, poll suggests

Its unsettled, unpredictable and wide open. This

election campaign is not only a three-way race most

voters are still up for grabs. Only 40 per cent of

Canadians have picked a party and say thats the only

one theyll consider. Most voters, three-fifths of the

electorate, are still considering voting for two or more

parties, or arent sure who they might pick, according to

Nanos Research data from rolling surveys that provide

an insight into potential swing votes. In fact, 20 per cent

of those surveyed would still consider voting for any one

of three or more parties.

http://www.theglobeandmail.com/news/politics/twothirds-of-canadians-votes-up-for-grabs-pollsuggests/article25819640/

South Korea July CPI M/M up 0.2% from flat

South Korea July CPI Y/Y unchanged at 0.7%

South Korea July Core CPI Y/Y unchanged at 2.0%

Australia ANZ Roy Morgan Weekly Consumer

Confidence up 112.9 from 112.5

New Zealand July QV House Prices Y/Y rose 10.1% vs

9.3%

New Zealand ANZ Commodity Price fell 11.2% from

-3.1%

Australia June Trade Deficit Aud2.933bn from

Aud2.751bn

Australia June Retail Sales rose 0.7% from 0.3%

Australia Q2 Retail Sales Ex Inflation Q/Q rose 0.8%

from 0.7%

WSJ: Oil-and-Gas Debt Deals Sting Investors

It is shaping up as a cruel summer for debt investors

wagering on a rebound in the oil-and-gas business.

Funds managed by Franklin Resources Inc., Blackstone

Group LP and Oaktree Capital Group LLC, among

others, are facing paper losses on substantial

investments this year in exploration-and-production

companies. The sector is coming under further pressure

as oil prices have turned downward again, dropping

below $46 a barrel in New York to a four-month low.

http://www.wsj.com/articles/oil-and-gas-debt-dealssting-investors-1438634208?mod=wsj_nview_latest

AFR: Origin Energy to sell Contact Energy stake

at $NZ4.65 a share

Macquarie Capital has been mandated to sell Origin

Energy's $NZ1.82 billion stake in Contact Energy stake

at $NZ4.65 a share via a block trade. The offer price is

pegged at a 7.5 per cent discount to the last close and an

8.25 per cent discount to the volume-weighted average

price.

http://www.afr.com/street-talk/origin-energy-to-sellcontact-energy-stake-at-nz465-a-share-20150803giq2q2

MarketWatch - Puerto Rico sees first-ever

default: Whats next for bond investors

Puerto Rico saw its first-ever bond default on Monday, a

move that potentially could ripple through other Puerto

Rican debt, threatening U.S. investors with more losses.

The small U.S. territory failed to make a $58 million

WSJ: Foreign Investors Turn Frosty on

Australian Debt

Touching down recently in Tokyo, Australian bondmarket strategist Martin Whetton looked forward to

amicable talks with groups of Japanese investors.

Halfway through his meetings, Mr. Whetton, who works

for Australia & New Zealand Banking Group, realized

that his Japanese clientsamong the most prolific

buyers of Australian government debtwere turning

frosty on the trade. Several spoke of the darkening

outlook for resource-rich Australias economy, citing a

plunge in commodity prices, escalating unemployment,

and the risk of a property bust. Many were alarmed, too,

by recent big falls in the Australian dollar, already

generating significant losses on their largely unhedged

bond investments.

http://www.wsj.com/articles/foreign-investors-turnfrosty-on-australian-debt-1438635474?

mod=wsj_nview_latest

Ambrose Evans-Pritchard in Telegraph: Puerto

Rico triggers historic default as austerity spiral

deepens

Puerto Rico has triggered the biggest municipal default

in US history, risking years of bitter legal warfare with

creditors and an austerity "death spiral" with echoes of

Greece. The island Commonwealth finally ran out of

money on Monday after a desperate effort to stay afloat,

and missed a final deadline for a $58m payment handing over just $628,000. It implies a sweeping

These information have been obtained or derived from sources believed to be reliable, but I make no representation or warranty as to their accuracy or completeness.

Copyright 2013 The Poon Report by Vincent Poon. All rights reserved.

default on much of its $72bn debt burden, equal to

100pc of Puerto Ricos gross national product (GNP) and

more than five times the debt ratio of California or

Texas.

http://www.telegraph.co.uk/finance/economics/117812

49/Puerto-Rico-triggers-historic-default-as-austerityspiral-deepens.html

The Telegraph: EU pays jobless migrants to come

to Britain

Unemployed migrants are being given thousands of

pounds to find work in Britain under an EU scheme, The

Telegraph can disclose. It has emerged that the UK has

taken a third of the young migrants involved in the Your

First EURES Job programme. Some 1,178 unemployed

young people from the Continent have been found jobs,

training or apprenticeships in Britain under the jobs

mobility programme since it was set up in 2012. That

accounted for 34.7 per cent of the 3,387 jobs handed out

so far, much higher than second place Germany, which

has provided 659 placements. At the same time, just 25

Britons under 30 have found work under the scheme,

less than 1 per cent of the total.

http://www.telegraph.co.uk/news/uknews/immigration

/11781637/EU-pays-jobless-migrants-to-come-toBritain.html

WSJ: IMF Says Sanctions Take Toll On Russia

Russias economy faces the loss of as much as 9% of its

inflation-adjusted value of goods and services it

produces if Western sanctions and Moscows retaliatory

measures remain in place in the medium term, the

International Monetary Fund said on Monday. The IMF

said Moscows financial and economic authorities acted

well to handle sanctions and a drop in oil prices, which

helped to absorb external shocks. But the IMF warned

that further escalation of geopolitical tensions would

send the ruble falling, would boost inflation and capital

outflows, and further batter domestic demand.

http://www.wsj.com/articles/imf-says-sanctions-taketoll-on-russia-1438657218?mod=wsj_nview_latest

SCMP: Strong stimulus not necessary to spur

Chinas growth: state media commentary

China has no need for "massive stimulus measures" to

keep its economy steady, the state-run People's Daily

said yesterday, in an apparent effort to assuage growing

concern over the country's slowing growth. The frontpage commentary came amid a sustained fall in factory

activity figures and speculation that the ruling

Communist Party's top leaders are holding their summer

policy talks in Beidaihe , Hebei province, at which

economic development is expected to be on top of their

agenda.

http://www.scmp.com/news/china/economy/article/18

46281/strong-stimulus-not-necessary-spur-chinasgrowth-state-media

WSJ: China Curbs Short Selling; Commodities

Weakness Spreads

China shares made tentative gains after officials

announced fresh steps to rein in short selling, while

commodities weakness spread to some Asian currencies,

including the Malaysian ringgit. Late Monday, the

Shanghai and Shenzhen stock exchanges announced

revised rules on short selling to curb high-frequency

trading, according to statements published on their

official websites. Under new rules, short sellers must

wait at least one day to cover their positions and pay

back loans used to buy shares. Previously, investors

could cover their positions within the same day.

http://www.wsj.com/articles/china-curbs-short-sellingcommodities-weakness-spreads-1438653066?

mod=wsj_nview_latest

Kathimerini: Greek Pension reforms to apply

from July, official says

Greece and its lenders discussing a third multi-billioneuro bailout deal have agreed that pension reforms will

affect only those who retired after the end of June, Labor

Ministry officials said on Monday. When creditors

agreed in July to negotiate a deal aimed at keeping it

afloat and in the eurozone, Greece committed to

implementing major reforms, such as scrapping early

retirement, by the end of October.

http://www.ekathimerini.com/200214/article/ekathime

rini/news/pension-reforms-to-apply-from-july-officialsays

These information have been obtained or derived from sources believed to be reliable, but I make no representation or warranty as to their accuracy or completeness.

Copyright 2013 The Poon Report by Vincent Poon. All rights reserved.

You might also like

- The Killing of James BulgerDocument2 pagesThe Killing of James BulgerNurul Mardiah0% (1)

- K, Froehlich, Bibical Interpretation PDFDocument146 pagesK, Froehlich, Bibical Interpretation PDFבנ מיכאל בנ מיכאל100% (1)

- 52R 06Document14 pages52R 06Showki Wani100% (1)

- Motorola Technical OriginalDocument1,038 pagesMotorola Technical OriginalMarianoPVenicio100% (1)

- Ranges (Up Till 12.20pm HKT) : Currency CurrencyDocument4 pagesRanges (Up Till 12.20pm HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.59am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.59am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.35am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.35am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 12.10pm HKT) Asians: Currency CurrencyDocument3 pagesRanges (Up Till 12.10pm HKT) Asians: Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.15am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.15am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.32am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.32am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.40am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.28am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.28am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.40am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 12.10pm HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 12.10pm HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 12.12pm HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 12.12pm HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.47am HKT) : Currency CurrencyDocument4 pagesRanges (Up Till 11.47am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 12.00pm HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 12.00pm HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.38am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.38am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument4 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument4 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.25am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.25am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 12.08pm HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 12.08pm HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.35am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.35am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.30am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.30am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.40am HKT) : Currency CurrencyDocument4 pagesRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.40am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 12.00pm HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 12.00pm HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.40am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.18am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.18am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.53am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.53am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470No ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- INTL Tech 19 12 12 PDFDocument3 pagesINTL Tech 19 12 12 PDFMarcin LipiecNo ratings yet

- Ranges (Up Till 12.33pm HKT) FX Flows: Currency CurrencyDocument3 pagesRanges (Up Till 12.33pm HKT) FX Flows: Currency Currencyapi-290371470No ratings yet

- Market Outlook Report 22 April 2013Document4 pagesMarket Outlook Report 22 April 2013zenergynzNo ratings yet

- Daily FX STR Europe 27 July 2011Document8 pagesDaily FX STR Europe 27 July 2011timurrsNo ratings yet

- 8-15-11 Steady As She GoesDocument3 pages8-15-11 Steady As She GoesThe Gold SpeculatorNo ratings yet

- Ranges (Up Till 11.05am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.05am HKT) : Currency Currencyapi-290371470No ratings yet

- Market Outlook Report 10 December 2012Document4 pagesMarket Outlook Report 10 December 2012zenergynzNo ratings yet

- Market Outlook Report 15 October 2012Document4 pagesMarket Outlook Report 15 October 2012zenergynzNo ratings yet

- David Morrison - 28.07.09Document5 pagesDavid Morrison - 28.07.09gftforexNo ratings yet

- The Day Ahead - April 10th 2013Document8 pagesThe Day Ahead - April 10th 2013wallstreetfoolNo ratings yet

- Market Outlook Report 18 March 2013Document4 pagesMarket Outlook Report 18 March 2013zenergynzNo ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Ranges (Up Till 11.59am HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 11.59am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.40am HKT) : Currency CurrencyDocument4 pagesRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470No ratings yet

- Week in Review: Gold Fundamentals Are Intact. Current Prices Are A Buying Opportunity!Document26 pagesWeek in Review: Gold Fundamentals Are Intact. Current Prices Are A Buying Opportunity!Paolo GerosaNo ratings yet

- Precious Metals Trading: How To Profit from Major Market MovesFrom EverandPrecious Metals Trading: How To Profit from Major Market MovesRating: 4.5 out of 5 stars4.5/5 (2)

- News SummaryDocument19 pagesNews Summaryapi-290371470No ratings yet

- News SummaryDocument15 pagesNews Summaryapi-290371470No ratings yet

- News SummaryDocument21 pagesNews Summaryapi-290371470No ratings yet

- News Summary: Ar04 - 16 PDFDocument10 pagesNews Summary: Ar04 - 16 PDFapi-290371470No ratings yet

- News SummaryDocument17 pagesNews Summaryapi-290371470No ratings yet

- Ranges (Up Till 12.30pm HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 12.30pm HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470No ratings yet

- News SummaryDocument14 pagesNews Summaryapi-290371470No ratings yet

- News SummaryDocument12 pagesNews Summaryapi-290371470No ratings yet

- News SummaryDocument14 pagesNews Summaryapi-290371470No ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.59am HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 11.59am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.30am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.30am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.28am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.28am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 12.20pm HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 12.20pm HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.05am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.05am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 12.20pm HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 12.20pm HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 12.00pm HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 12.00pm HKT) : Currency Currencyapi-290371470No ratings yet

- Ranges (Up Till 11.40am HKT) : Currency CurrencyDocument4 pagesRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470No ratings yet

- Planning AnswersDocument51 pagesPlanning AnswersBilly Dentiala IrvanNo ratings yet

- Nokia Deploying 5G Networks White Paper ENDocument16 pagesNokia Deploying 5G Networks White Paper ENIyesusgetanew100% (1)

- Hassan Shahata Resume 250Document2 pagesHassan Shahata Resume 250Mg International VisaNo ratings yet

- 12 - Epstein Barr Virus (EBV)Document20 pages12 - Epstein Barr Virus (EBV)Lusiana T. Sipil UnsulbarNo ratings yet

- CD NCLEX NOTES-Infection ControlDocument1 pageCD NCLEX NOTES-Infection ControlrenchiecaingletNo ratings yet

- Standars and Guidelines SomalilandDocument54 pagesStandars and Guidelines Somalilanddawit negassaNo ratings yet

- Session 14. Legal MemorandumDocument27 pagesSession 14. Legal Memorandumsamantha100% (1)

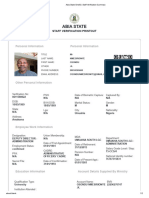

- Abia State OneID - Staff Verification SummaryDocument2 pagesAbia State OneID - Staff Verification Summaryuche100% (2)

- The Differences Between A Parliamentary and Presidentialist Democracy and The Advantages and Disadvantages of EachDocument1 pageThe Differences Between A Parliamentary and Presidentialist Democracy and The Advantages and Disadvantages of EachElli GeissNo ratings yet

- Go JoseonDocument7 pagesGo JoseonSanket PatilNo ratings yet

- Times-Trib 02 MG 2018 DummyDocument16 pagesTimes-Trib 02 MG 2018 DummynewspubincNo ratings yet

- Cre Form 1 2020 Schemes of WorkDocument12 pagesCre Form 1 2020 Schemes of Worklydia mutuaNo ratings yet

- MTTM 11Document17 pagesMTTM 11Rakesh dahiyaNo ratings yet

- BrochureDocument7 pagesBrochureapi-596896646No ratings yet

- DARPA-BAA-16-22 Open ProjectDocument21 pagesDARPA-BAA-16-22 Open ProjectAnonymous VTLglDVNo ratings yet

- My First Two Thousand Years - The Autobio - George Sylvester ViereckDocument392 pagesMy First Two Thousand Years - The Autobio - George Sylvester Viereckglencbr100% (1)

- DRRR Lesson 2.editedDocument4 pagesDRRR Lesson 2.editedLuvie Jhun GahiNo ratings yet

- Brigada Pagbasa OrientationDocument43 pagesBrigada Pagbasa OrientationGreg Beloro100% (1)

- Case Study of Capital BudgetingDocument38 pagesCase Study of Capital BudgetingZara Urooj100% (1)

- Edgar Rice Burroughs - (John Carter Barsoom #3) The Warlord of MarsDocument152 pagesEdgar Rice Burroughs - (John Carter Barsoom #3) The Warlord of MarsConstantin Clement VNo ratings yet

- Android Update For SAMSUNG Galaxy Tab 7.0 Plus (GT-P6200) - Android Updates DownloadsDocument5 pagesAndroid Update For SAMSUNG Galaxy Tab 7.0 Plus (GT-P6200) - Android Updates DownloadsJoeJojoNo ratings yet

- New Microsoft Office Word DocumentDocument4 pagesNew Microsoft Office Word DocumentRizkaNo ratings yet

- Topic 1 - Introduction To Economics (Week1)Document30 pagesTopic 1 - Introduction To Economics (Week1)Wei SongNo ratings yet

- Profile Summary: Charul BhanDocument1 pageProfile Summary: Charul Bhanricha khushuNo ratings yet

- XH-H-edit 3e PPT Chap06Document36 pagesXH-H-edit 3e PPT Chap06An NhiênNo ratings yet

- Interesting Facts About AlgeriaDocument6 pagesInteresting Facts About AlgeriaMegh KonnaNo ratings yet