Professional Documents

Culture Documents

Ch2 HW Hard

Ch2 HW Hard

Uploaded by

MuhammadShabbirHassaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ch2 HW Hard

Ch2 HW Hard

Uploaded by

MuhammadShabbirHassaCopyright:

Available Formats

Question Bank: Chapter 02

Description: P2-29

Question:

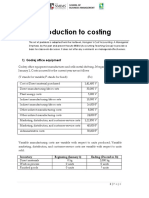

Computing cost of goods purchased and cost of goods sold. The following data are for Marvin

Department Store. The account balances (in thousands) are for 2007.

Marketing, distribution, and customer-service costs

$ 37,000

Merchandise inventory, January 1, 2007

27,000

Utilities

17,000

General and administrative costs

43,000

Merchandise inventory, December 31, 2007

34,000

Purchases

155,000

Miscellaneous costs

4,000

Transportation-in

7,000

Purchase returns and allowances

4,000

Purchase discounts

6,000

Requirement 1:

Compute the cost of goods purchased. (Do not include a "$" sign in your response.)

Cost of goods purchased

Requirement 2:

Compute the cost of goods sold. (Do not include a "$" sign in your response.)

Cost of goods sold

Question Bank: Chapter 02

Description: P2-37

QUESTION:

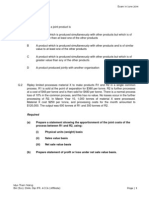

Comprehensive problem on unit costs, product costs. Tampa Office Equipment manufactures and sells

metal shelving. It began operations on January 1, 2007. Costs incurred for 2007 are as follows (V stands for

variable; F stands for fixed):

Direct materials used

Direct manufacturing-labor costs

Plant energy costs

Indirect manufacturing-labor costs

Indirect manufacturing-labor costs

Other indirect manufacturing costs

Other indirect manufacturing costs

Marketing, distribution, and customer-service costs

Marketing, distribution, and customer-service costs

Administrative costs

$ 140,000

30,000

5,000

10,000

16,000

8,000

24,000

122,850

40,000

50,000

V

V

V

V

F

V

F

V

F

F

Variable manufacturing costs are variable with respect to units produced. Variable marketing, distribution, and

customer-service costs are variable with respect to units sold. Inventory data are:

Beginning:

January 1, 2007

0 lb.

0 units

0 units

Direct materials

Work in process

Finished goods

Ending:

December 31, 2007

2,000 lbs

0 units

? units

Production in 2007 was 100,000 units. Two pounds of direct materials are used to make one unit of finished

product.

Revenues in 2007 were $436,800. The selling price per unit and the purchase price per pound of direct

materials were stable throughout the year. The company's ending inventory of finished goods is carried at the

average unit manufacturing costs for 2007. Finished-goods inventory at December 31, 2007, was $20,970.

Requirement 1:

Calculate direct materials inventory, total cost, December 31, 2007. (Do not include a "$" sign in your

response.)

Total cost of direct materials inventory

Requirement 2:

Calculate finished-goods inventory, total units, December 31, 2007. (Round your answer to the nearest full

unit.)

Total units of finished-goods inventory

units

Requirement 3:

Calculate selling price in 2007. (Round your answer to 2 decimal places. Do not include a "$" sign in your

response.)

Selling price

per unit

Requirement 4:

Calculate operating income for 2007. (Do not include a "$" sign in your response.)

Operating income

You might also like

- Demand Forecasting For Perishable Short Shelf-Life Homemade FoodDocument11 pagesDemand Forecasting For Perishable Short Shelf-Life Homemade Foodsoham agarwalNo ratings yet

- LATIHAN Soal Uas AMDocument5 pagesLATIHAN Soal Uas AMqinthara alfarisiNo ratings yet

- MKT1 DHM2Document9 pagesMKT1 DHM2bala sanchitNo ratings yet

- The University of Zambia ZCAS UniversityDocument4 pagesThe University of Zambia ZCAS Universitycaleb chipetaNo ratings yet

- Problems: 2-58. Cost ConceptsDocument16 pagesProblems: 2-58. Cost ConceptsChristy HabelNo ratings yet

- 32041568Document3 pages32041568suruth242No ratings yet

- Assignment No 1 - Cost ClassificationDocument7 pagesAssignment No 1 - Cost ClassificationJitesh Maheshwari100% (1)

- Akb Tugas Ke 3Document6 pagesAkb Tugas Ke 3mekarNo ratings yet

- Cost o Goods ManufacturingDocument28 pagesCost o Goods ManufacturingMaryAnnLasquiteNo ratings yet

- 3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Document2 pages3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Jonathan Altamirano Burgos0% (1)

- Week 1 AssignmentDocument1 pageWeek 1 Assignmenttucker jacobsNo ratings yet

- Final Project LUSH Group 2Document32 pagesFinal Project LUSH Group 2Pat Neenan60% (5)

- Economics, 19th Edition by Samuelson, ReviewerDocument13 pagesEconomics, 19th Edition by Samuelson, ReviewerDo Kyungsooooo100% (1)

- Neuromarketing, From Novelty To MainstreamDocument4 pagesNeuromarketing, From Novelty To MainstreamKarla Tristan0% (1)

- CHAP 3 - Industry AnalysisDocument3 pagesCHAP 3 - Industry AnalysisSébastien Robert100% (1)

- An Introduction To Cost Terms and Purposes Problems 1 11Document3 pagesAn Introduction To Cost Terms and Purposes Problems 1 11b894qr949tNo ratings yet

- VanDerbeck 16e Ch.01 SolutionsDocument20 pagesVanDerbeck 16e Ch.01 Solutionsthenikkitr100% (1)

- 02 Aga Bagoes Ardiansyah 7fkhususDocument4 pages02 Aga Bagoes Ardiansyah 7fkhususAga Bagoes ArdiansyahNo ratings yet

- Cost AccountingDocument11 pagesCost Accountingkedirmahammed8No ratings yet

- CH 23 Exercises ProblemsDocument4 pagesCH 23 Exercises ProblemsAhmed El KhateebNo ratings yet

- Activity 05: 202180927 - VISTA, MARK LESTER A. Ol33E21 - Bs Accountancy Olcae09 - Financial Accounting and ReportingDocument6 pagesActivity 05: 202180927 - VISTA, MARK LESTER A. Ol33E21 - Bs Accountancy Olcae09 - Financial Accounting and ReportingVexana NecromancerNo ratings yet

- Problem Sets PDFDocument3 pagesProblem Sets PDFJcel JcelNo ratings yet

- Akb 2Document9 pagesAkb 2Dani m DarmawanNo ratings yet

- COST Concepts Classification and Cost BehaviorDocument93 pagesCOST Concepts Classification and Cost BehaviorTacy100% (1)

- Variable Costing Discussion ProblemsDocument7 pagesVariable Costing Discussion ProblemsVatchdemonNo ratings yet

- Chapter 6 Cost AccountingDocument12 pagesChapter 6 Cost AccountingYusuf HusseinNo ratings yet

- Assignment 2Document3 pagesAssignment 2SaidurRahamanNo ratings yet

- Managerial AccountingDocument38 pagesManagerial AccountingLEA100% (1)

- Teaching Introduction To Managerial Accounting Using An Excel Spreadsheet ExampleDocument16 pagesTeaching Introduction To Managerial Accounting Using An Excel Spreadsheet Examplesamuel kebedeNo ratings yet

- Accounting For Manufacturing BusinessDocument81 pagesAccounting For Manufacturing BusinessAdrian Faminiano100% (1)

- Ejercicios de Estado de Costo de Producción y VentasDocument4 pagesEjercicios de Estado de Costo de Producción y VentasRodrigo RojasNo ratings yet

- Practical QuestionsDocument5 pagesPractical QuestionsBui Thi Lan Anh (FGW HCM)No ratings yet

- Product Costing Systems: Concepts and Design Issues: Mcgraw-Hill/IrwinDocument73 pagesProduct Costing Systems: Concepts and Design Issues: Mcgraw-Hill/IrwinFarid MahdaviNo ratings yet

- Q3. Master Budget For Manufacturing Problem 3Document2 pagesQ3. Master Budget For Manufacturing Problem 3Robbob JahloveNo ratings yet

- Azerbaijan State Oil and Industry University: Question #1 (6 Points)Document3 pagesAzerbaijan State Oil and Industry University: Question #1 (6 Points)TaToSh GamerNo ratings yet

- 10-11 - Introduction To Cost ConceptsDocument2 pages10-11 - Introduction To Cost ConceptsArchiNo ratings yet

- Topic 2 ExercisesDocument14 pagesTopic 2 ExercisesCLAUDIA RUIZ CUEVAS SAINZNo ratings yet

- Costs Terms, Concepts and Classifications: Chapter TwoDocument23 pagesCosts Terms, Concepts and Classifications: Chapter TwokorpseeNo ratings yet

- Assignment No.2 206Document5 pagesAssignment No.2 206Halimah SheikhNo ratings yet

- Direct Costing and Absorption Costing QuestionsDocument2 pagesDirect Costing and Absorption Costing QuestionsAbigailGraceCascoNo ratings yet

- F2 Joint CostDocument3 pagesF2 Joint CostMyo NaingNo ratings yet

- Lecture 11 Budgeting PDFDocument55 pagesLecture 11 Budgeting PDFShweta SridharNo ratings yet

- Managerial Set 2Document5 pagesManagerial Set 2Dan OrbisoNo ratings yet

- 4 MCQDocument4 pages4 MCQFaisal BaharNo ratings yet

- Libro 7.3 InglesDocument10 pagesLibro 7.3 InglesNathan CalhounNo ratings yet

- Exercise 1 - Cost Accumulation Procedure DeterminationDocument8 pagesExercise 1 - Cost Accumulation Procedure DeterminationstillwinmsNo ratings yet

- Group1 Variable CostingDocument13 pagesGroup1 Variable CostingAika May GarbeNo ratings yet

- Absorption and Variable CostingDocument6 pagesAbsorption and Variable CostingEvangelista, Trisha Gael V.100% (1)

- Seminar Practice 7 Solutions (Latest)Document54 pagesSeminar Practice 7 Solutions (Latest)Feeling_so_fly100% (1)

- Accy211: Management Accounting Ii: Elearning Assignment Question: (A-2)Document1 pageAccy211: Management Accounting Ii: Elearning Assignment Question: (A-2)Bella SeahNo ratings yet

- Managerial Accounting and CostDocument19 pagesManagerial Accounting and CostIqra MughalNo ratings yet

- KisikisiDocument7 pagesKisikisijalunasaNo ratings yet

- BA 117 Diagnostic TestDocument2 pagesBA 117 Diagnostic Testalheruela0% (1)

- Chapter 2Document25 pagesChapter 2Dennis JeonNo ratings yet

- 2 Calculating CostDocument62 pages2 Calculating CostAji Najib Nashr'No ratings yet

- Cost II - Assignment & WorksheetDocument7 pagesCost II - Assignment & WorksheetBeamlak WegayehuNo ratings yet

- ACC 327 Test IIDocument5 pagesACC 327 Test IIthangdongquay1520% (1)

- MGMT 027 Connect 04 HWDocument7 pagesMGMT 027 Connect 04 HWSidra Khan100% (1)

- Cost Terms, Concepts, and ClassificationsDocument33 pagesCost Terms, Concepts, and ClassificationsKlub Matematika SMANo ratings yet

- 121 Mt2 Process Cost KeyDocument2 pages121 Mt2 Process Cost KeyMichelle LeeNo ratings yet

- Managerial Accounting - Final ProjectDocument6 pagesManagerial Accounting - Final ProjectDiego RS.No ratings yet

- Cost Tutorial Student - 1Document6 pagesCost Tutorial Student - 1tirigotu57No ratings yet

- VarDocument36 pagesVarRoselie BarbinNo ratings yet

- Household & Institutional Furniture World Summary: Market Values & Financials by CountryFrom EverandHousehold & Institutional Furniture World Summary: Market Values & Financials by CountryNo ratings yet

- Home Furnishings Stores Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandHome Furnishings Stores Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Cutting Tools & Consumables World Summary: Market Values & Financials by CountryFrom EverandCutting Tools & Consumables World Summary: Market Values & Financials by CountryNo ratings yet

- Sales Force Integration at FedEx (A)Document9 pagesSales Force Integration at FedEx (A)Rishabh ShekharNo ratings yet

- Differences Between Trade and CommerceDocument3 pagesDifferences Between Trade and CommerceTõ RâNo ratings yet

- Organizational Structure and Design of KFC and Fri ChiksDocument15 pagesOrganizational Structure and Design of KFC and Fri ChiksAyesha100% (2)

- Preboard Question Paper BST 2020-21Document8 pagesPreboard Question Paper BST 2020-21Joanna Garcia25% (4)

- Document Thesis MPDocument21 pagesDocument Thesis MPPANICBUCKYNo ratings yet

- Order RatioDocument22 pagesOrder RatioKH IFFTI HASANNo ratings yet

- Tourism Paper3Document21 pagesTourism Paper3Nilanjana ChakrabartyNo ratings yet

- Impact of Covid 19 On Online Shopping Behavior of People in Kathmandu ValleyDocument3 pagesImpact of Covid 19 On Online Shopping Behavior of People in Kathmandu Valleyshree100% (1)

- MRKT 1199 ch.4 E-BookDocument4 pagesMRKT 1199 ch.4 E-BookMiriam LinNo ratings yet

- Quarter 2 Week 8: Animal Raising and Fish FarmingDocument14 pagesQuarter 2 Week 8: Animal Raising and Fish FarmingJean Paula SequiñoNo ratings yet

- Research Papers On Misleading AdvertisingDocument7 pagesResearch Papers On Misleading Advertisinghqeoguplg100% (1)

- Apple Case AnalysisDocument17 pagesApple Case Analysishuma majidNo ratings yet

- Management Accounting For Non Specialists Chapter 6Document5 pagesManagement Accounting For Non Specialists Chapter 6Faysal HossainNo ratings yet

- 115.759 Current Issues in Business Assessment 2: Personal Positioning Plan Lecturer's Name: Jens Mueller Semester One, 2021Document10 pages115.759 Current Issues in Business Assessment 2: Personal Positioning Plan Lecturer's Name: Jens Mueller Semester One, 2021梁浩伟No ratings yet

- Digital Marketing PlanDocument19 pagesDigital Marketing PlanMichael LeeNo ratings yet

- ResearchGate JelliesandJaffasSOSTACDocument8 pagesResearchGate JelliesandJaffasSOSTACChamod PrabashwaraNo ratings yet

- Vikas ResumeDocument2 pagesVikas ResumeAnand GuptaNo ratings yet

- Case StudyDocument11 pagesCase StudyHanzTzy GamingNo ratings yet

- Core Principles: Auction Market TheoryDocument15 pagesCore Principles: Auction Market Theoryshreyas sarang100% (3)

- Executive 2ccredit Control Job Post Avery DennisonDocument1 pageExecutive 2ccredit Control Job Post Avery DennisonShibli ShaidNo ratings yet

- SM9636 w21068666 06052023 DraftDocument23 pagesSM9636 w21068666 06052023 DraftJorris NgNo ratings yet

- Men CosmeticsDocument7 pagesMen CosmeticsÁi Mỹ DuyênNo ratings yet

- Airline Industry: IntroductionDocument5 pagesAirline Industry: IntroductionSanjay SainiNo ratings yet