Professional Documents

Culture Documents

Long-Term Vulnerabilities Warrant "High Risk" Designation

Long-Term Vulnerabilities Warrant "High Risk" Designation

Uploaded by

politix0 ratings0% found this document useful (0 votes)

27 views1 pageThe Pension Benefit Guaranty Corporation's single-employer pension insurance program has been designated as "high risk" due to its growing accumulated deficit and long-term vulnerabilities. The program's deficit grew from a $9.7 billion surplus in 2000 to a $3.6 billion deficit in 2002, and an estimated $5.4 billion deficit in 2003. This was largely due to the termination of large, underfunded pension plans in industries like steel and airlines. Additionally, the degree of underfunding in private pension plans has increased significantly, and PBGC estimates that financially weak firms have over $35 billion in unfunded pension benefits that could become further losses. The "high risk" designation will bring greater oversight to

Original Description:

Original Title

d031050sp

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Pension Benefit Guaranty Corporation's single-employer pension insurance program has been designated as "high risk" due to its growing accumulated deficit and long-term vulnerabilities. The program's deficit grew from a $9.7 billion surplus in 2000 to a $3.6 billion deficit in 2002, and an estimated $5.4 billion deficit in 2003. This was largely due to the termination of large, underfunded pension plans in industries like steel and airlines. Additionally, the degree of underfunding in private pension plans has increased significantly, and PBGC estimates that financially weak firms have over $35 billion in unfunded pension benefits that could become further losses. The "high risk" designation will bring greater oversight to

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

27 views1 pageLong-Term Vulnerabilities Warrant "High Risk" Designation

Long-Term Vulnerabilities Warrant "High Risk" Designation

Uploaded by

politixThe Pension Benefit Guaranty Corporation's single-employer pension insurance program has been designated as "high risk" due to its growing accumulated deficit and long-term vulnerabilities. The program's deficit grew from a $9.7 billion surplus in 2000 to a $3.6 billion deficit in 2002, and an estimated $5.4 billion deficit in 2003. This was largely due to the termination of large, underfunded pension plans in industries like steel and airlines. Additionally, the degree of underfunding in private pension plans has increased significantly, and PBGC estimates that financially weak firms have over $35 billion in unfunded pension benefits that could become further losses. The "high risk" designation will bring greater oversight to

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

July 23, 2003

PENSION BENEFIT GUARANTY

CORPORATION SINGLE-EMPLOYER

INSURANCE PROGRAM

Note: This highlights page is a

standalone document, GAO-03-1050SP.

Long-Term Vulnerabilities Warrant “High

Background Risk” Designation

The potential losses that PBGC,

through its single-employer

insurance program, might face Why Area is “High Risk”

from the termination of

underfunded plans have been a

GAO has designated PBGC’s single-employer pension insurance program as

longstanding concern of the

Congress and GAO. In 1990, as “high risk,” adding it to the list of agencies or major programs that need

part of our effort to call attention urgent attention and transformation to ensure that our national government

to high-risk areas in the federal functions in the most economical, efficient and effective manner possible.

government, we noted that The single-employer insurance program insures the pension benefits of over

weaknesses in the single-employer 34 million participants in more than 30,000 private defined benefit plans.

insurance program’s financial Agencies or programs receiving a “high risk” designation receive greater

condition threatened PBGC’s long- attention from GAO and are assessed in regular biennial reports.

term viability. We stated that

minimum funding rules still did not After fluctuating over the last decade, the single employer insurance

ensure that plan sponsors would

program now has a large and growing accumulated deficit. The program has

contribute enough for terminating

plans to have sufficient assets to moved from a $9.7 billion accumulated surplus in 2000 to a $3.6 billion

cover all promised benefits. In accumulated deficit in fiscal year 2002. As of April 2003, the program’s

1992, we also reported that PBGC unaudited deficit was an estimated $5.4 billion, the largest in PBGC history.

had weaknesses in its internal Furthermore, the degree of underfunding in the private pension system has

controls and financial systems that increased dramatically and additional severe losses may be on the horizon.

placed the entire agency, and not PBGC estimates that financially weak firms sponsor plans with over $35

just the single employer program, billion in unfunded benefits, which ultimately might become program losses.

at risk. Three years later, we The termination of large underfunded pension plans of bankrupt firms in

reported that legislation enacted in troubled industries like steel or airlines was the major cause of the deficit.

1994 had strengthened PBGC’s Declines in the stock market and interest rates and certain weaknesses in

program weaknesses and that we

the current funding rules contributed to the severity of the plans'

believed improvements had been

significant enough for us to remove underfunded condition. However, these factors mask broader trends that

the agency’s high-risk designation. pose serious program risks. For example, the program’s insured participant

However, given the potential for base continues to shift away from active workers, falling from 78 percent of

significant changes in the all participants in 1980 to 53 percent in 2000. In addition, the program’s risk

program’s position, we continued pool has become concentrated in industries affected by global competition

to monitor the situation. and the movement from an industrial to a knowledge based economy. In

2001, almost half of all program insured participants were in plans

Early this year, PBGC’s single- sponsored by firms in manufacturing industries.

employer pension insurance

program reported a $3.6 billion

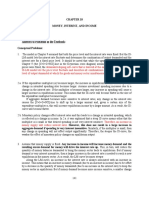

Program Assets, Liabilities, and Net Position, Fiscal Years 1976-2002

accumulated deficit for fiscal year

2002, brought on by the termination $30

(2002 dollars in billions)

of a number of large underfunded $25

pension plans. Given significant $20

risk of termination of other large $15

underfunded plans, GAO is $10

assigning PBGC’s single-employer $5

insurance program to its “high risk” $0

list, highlighting the need for -$5

congressional and agency action. -$10

1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002

For additional information, contact Barbara

Bovbjerg at (202) 512-5491,Charles Jeszeck, Assets Liabilities Net financial position

(202) 512-7036, or George Scott, (202) 512-

5932.

Source: PBGC annual reports

You might also like

- Corporate Tax Planning V2Document6 pagesCorporate Tax Planning V2solvedcareNo ratings yet

- Perry V Schwarzenegger - Vol-13-6-16-10Document164 pagesPerry V Schwarzenegger - Vol-13-6-16-10towleroadNo ratings yet

- Is A Strong Singapore Dollar Always Good and A Weak Singapore Dollar Always BadDocument4 pagesIs A Strong Singapore Dollar Always Good and A Weak Singapore Dollar Always BadSiti Radilah Ahmad Sidek100% (2)

- Crop Insurance: Update On Opportunities To Reduce Program CostsDocument73 pagesCrop Insurance: Update On Opportunities To Reduce Program CostsSally Jo SorensenNo ratings yet

- 2021 Insurance Outlook Accelerating Recovery From The Pandemic While Pivoting To Thrive3186Document36 pages2021 Insurance Outlook Accelerating Recovery From The Pandemic While Pivoting To Thrive3186Nikhil GokhaleNo ratings yet

- Financial Difficulty of Banking Management During COVID 19 in BangladeshDocument10 pagesFinancial Difficulty of Banking Management During COVID 19 in BangladeshSabbir AhmmedNo ratings yet

- Art Sol Si Lic 1Document31 pagesArt Sol Si Lic 1chisliliana7No ratings yet

- FM Case Study FinalDocument13 pagesFM Case Study Finalgellie villarinNo ratings yet

- PWC - Covid-19 Impact On The Indian Insurance IndustryDocument38 pagesPWC - Covid-19 Impact On The Indian Insurance IndustryRural Marketing Association of IndiaNo ratings yet

- Covid 19 ImpactDocument38 pagesCovid 19 ImpactNavneet NandaNo ratings yet

- 2022 PC Market OutlookDocument50 pages2022 PC Market Outlookcharul sharmaNo ratings yet

- Autor Et Al, The $800 Billion Paycheck Protection ProgramDocument26 pagesAutor Et Al, The $800 Billion Paycheck Protection Programtomislav javisNo ratings yet

- Insurance Markets Impacts of and Regulatory Response To The 2007-2009 Financial CrisisDocument91 pagesInsurance Markets Impacts of and Regulatory Response To The 2007-2009 Financial CrisisStanislav LazarovNo ratings yet

- En Special Series On Covid 19 Impact of Covid 19 On InsurersDocument11 pagesEn Special Series On Covid 19 Impact of Covid 19 On InsurersDika LasenjaNo ratings yet

- Impact of COVID-19 On The Insurance SectorDocument19 pagesImpact of COVID-19 On The Insurance SectorJulius mera smithNo ratings yet

- Netra January 24Document22 pagesNetra January 24happypallavNo ratings yet

- Insurance Industry Analysis March 2013Document34 pagesInsurance Industry Analysis March 2013Pieter NoppeNo ratings yet

- The Impact of The Financial Crisis On Defined Benefit Plans and The Need For Counter-Cyclical Funding RegulationsDocument32 pagesThe Impact of The Financial Crisis On Defined Benefit Plans and The Need For Counter-Cyclical Funding Regulationsdata4csasNo ratings yet

- Fsibriefs 5Document9 pagesFsibriefs 5Shrey NirmalNo ratings yet

- BFE 420 Lecture 3Document17 pagesBFE 420 Lecture 3jeraNo ratings yet

- COVID-19 and Public–Private Partnerships in Asia and the Pacific: Guidance NoteFrom EverandCOVID-19 and Public–Private Partnerships in Asia and the Pacific: Guidance NoteNo ratings yet

- Public Finance-10.1-Fiscal Policy and AgingDocument36 pagesPublic Finance-10.1-Fiscal Policy and Agingmc9bwrd8fkNo ratings yet

- Grosen JorgensenDocument36 pagesGrosen JorgensensssskkkkllllNo ratings yet

- Federal Budget 2020Document15 pagesFederal Budget 2020Muhammad FarazNo ratings yet

- Rating Action - Moodys-downgrades-Camposols-rating-to-B3-outlook-remains-negative - 21dec22Document5 pagesRating Action - Moodys-downgrades-Camposols-rating-to-B3-outlook-remains-negative - 21dec22leopoldo cajahuancaNo ratings yet

- Global Insurance Market Trends 2020Document36 pagesGlobal Insurance Market Trends 2020Daltonist OggyNo ratings yet

- Global Debt Monitor - April2020 IIF PDFDocument5 pagesGlobal Debt Monitor - April2020 IIF PDFAndyNo ratings yet

- SSS Net Loss Doubles in 2021Document2 pagesSSS Net Loss Doubles in 2021Biel De Ala MoreNo ratings yet

- Response To Moodys Jan 18 2013 vF2Document6 pagesResponse To Moodys Jan 18 2013 vF2Hut MasterNo ratings yet

- Business Interruption Insurance EfficacyDocument20 pagesBusiness Interruption Insurance EfficacyTruyên BùiNo ratings yet

- Organisation For Economic Co-Operation and Development: Hosted by The Government of BrazilDocument11 pagesOrganisation For Economic Co-Operation and Development: Hosted by The Government of Brazildata4csasNo ratings yet

- Comment Letter ISO SEC Climate Disclosure Prop RulesDocument35 pagesComment Letter ISO SEC Climate Disclosure Prop RulesBrandon Michael ChewNo ratings yet

- Averting A Fiscal CrisisDocument23 pagesAverting A Fiscal CrisisCommittee For a Responsible Federal BudgetNo ratings yet

- AigDocument2 pagesAigNadzripolice OtaiNo ratings yet

- The Role of Alternative Finance Mechanisms For SL - FinalDocument17 pagesThe Role of Alternative Finance Mechanisms For SL - FinalSanjaya AriyawansaNo ratings yet

- FRA ASSIGNMENT - AnkitAgarwal - 22620Document1 pageFRA ASSIGNMENT - AnkitAgarwal - 22620Ankit AgarwalNo ratings yet

- Feasibillity Report 13072021Document67 pagesFeasibillity Report 13072021Muhammad AkhtrNo ratings yet

- Q4 2022 Earnings PresentationDocument21 pagesQ4 2022 Earnings PresentationCesar AugustoNo ratings yet

- Reporting Alert: COVID-19: MD&A Disclosures in Volatile and Uncertain TimesDocument6 pagesReporting Alert: COVID-19: MD&A Disclosures in Volatile and Uncertain TimesAchmad AndruNo ratings yet

- Insolvency Prospects Among Small and Medium Enterprises in Advanced Economies: Assessment and Policy OptionsDocument29 pagesInsolvency Prospects Among Small and Medium Enterprises in Advanced Economies: Assessment and Policy OptionsHungNo ratings yet

- The Climate-Related Financial Disclosure Regulations 2022: A Step in The Right Direction For ESG in The Private SectorDocument20 pagesThe Climate-Related Financial Disclosure Regulations 2022: A Step in The Right Direction For ESG in The Private SectorAdriana CarpiNo ratings yet

- DBS 200818 - Insights - SG - Financial - Wellness PDFDocument40 pagesDBS 200818 - Insights - SG - Financial - Wellness PDFhhNo ratings yet

- Foundations of Financial Markets and Institutions 4th Edition Fabozzi Solutions ManualDocument8 pagesFoundations of Financial Markets and Institutions 4th Edition Fabozzi Solutions Manualfinificcodille6d3h100% (26)

- 1679-Article Text-2291-1-10-20220407Document17 pages1679-Article Text-2291-1-10-20220407Khaled BarakatNo ratings yet

- MERCADO, Erica Kaye M. April 15, 2020 A2B Markfin: Loan CommitmentsDocument3 pagesMERCADO, Erica Kaye M. April 15, 2020 A2B Markfin: Loan CommitmentsMila MercadoNo ratings yet

- If 12007Document3 pagesIf 12007data4csasNo ratings yet

- Group Annual Report 2020Document260 pagesGroup Annual Report 2020Prysmian GroupNo ratings yet

- Business Management Assignment 121eDocument16 pagesBusiness Management Assignment 121eZowvuyour Zow Zow MazuluNo ratings yet

- A New Defined Benefit Pension Risk Measurement Methodology2015Insurance Mathematics and EconomicsDocument12 pagesA New Defined Benefit Pension Risk Measurement Methodology2015Insurance Mathematics and EconomicsMartínCamarenaNo ratings yet

- Privatization Lessons From JordanDocument4 pagesPrivatization Lessons From JordanHussam AnanzehNo ratings yet

- Blueprint For Restoring Safety and Soundness To The GSEsDocument15 pagesBlueprint For Restoring Safety and Soundness To The GSEsGSE Safety and SoundnessNo ratings yet

- FIN533 - Group AssignmentDocument17 pagesFIN533 - Group AssignmentAizuddin awesomeNo ratings yet

- COVID-19: Incentive Compensation Design in A Shifting LandscapeDocument8 pagesCOVID-19: Incentive Compensation Design in A Shifting Landscapecoolsar25No ratings yet

- 2022 Business Plan UpdateDocument19 pages2022 Business Plan UpdateHilaire_ShaggyNo ratings yet

- RetrieveDocument27 pagesRetrieveSpencer MaldonadoNo ratings yet

- Icpau Tax Proposals For Fy 2023-24 BudgetDocument12 pagesIcpau Tax Proposals For Fy 2023-24 BudgetByamukama RobertNo ratings yet

- Department of Health & Human ServicesDocument31 pagesDepartment of Health & Human ServicesBrian AhierNo ratings yet

- Fiscal Risk Statement FY2023 24Document23 pagesFiscal Risk Statement FY2023 24hamzaahmad0955No ratings yet

- (IMF Working Papers) COVID-19 and SME FailuresDocument49 pages(IMF Working Papers) COVID-19 and SME FailuresDR. OMID R TabrizianNo ratings yet

- Insurance Companies Asset Allocation Drivers Part3Document19 pagesInsurance Companies Asset Allocation Drivers Part3400258tiiNo ratings yet

- BCB 109Document9 pagesBCB 109DONALDNo ratings yet

- Buku Tentang Financial Buku Tentang FinancialBuku Tentang FinancialBuku Tentang FinancialBuku Tentang FinancialDocument6 pagesBuku Tentang Financial Buku Tentang FinancialBuku Tentang FinancialBuku Tentang FinancialBuku Tentang FinancialHadi Pranggono100% (1)

- Strategic Management Final ReportDocument22 pagesStrategic Management Final ReportSheila HodgeNo ratings yet

- Preliminary Inquiry Into The Matter of Senator John EnsignDocument75 pagesPreliminary Inquiry Into The Matter of Senator John EnsignpolitixNo ratings yet

- OMB Guidance Agency Use 3rd Party Websites AppsDocument9 pagesOMB Guidance Agency Use 3rd Party Websites AppsAlex HowardNo ratings yet

- America's Healthy Future Act of 2009Document223 pagesAmerica's Healthy Future Act of 2009KFFHealthNewsNo ratings yet

- Symbolic ObamaCare "Repeal" Bill by Rep. Steve King (R-IA)Document1 pageSymbolic ObamaCare "Repeal" Bill by Rep. Steve King (R-IA)politixNo ratings yet

- ElenaKagan PublicQuestionnaireDocument202 pagesElenaKagan PublicQuestionnairefrajam79No ratings yet

- DOJ Memorandum: Status of Certain OLC Opinions Issued in The Aftermath of The Terrorist Attacks of September 11, 2001Document11 pagesDOJ Memorandum: Status of Certain OLC Opinions Issued in The Aftermath of The Terrorist Attacks of September 11, 2001politix100% (10)

- Volume 10 Pages 2331 - 2583 UNITEDDocument254 pagesVolume 10 Pages 2331 - 2583 UNITEDG-A-YNo ratings yet

- Blagojevich ComplaintDocument78 pagesBlagojevich ComplaintWashington Post Investigations100% (56)

- Republican PrezDocument72 pagesRepublican PrezZerohedgeNo ratings yet

- 1 in The United States District Court For The District of MarylandDocument57 pages1 in The United States District Court For The District of Marylandpolitix100% (3)

- The Electoral College: How It WorksDocument15 pagesThe Electoral College: How It Workspolitix100% (7)

- Webcast Feedback Form 071907Document1 pageWebcast Feedback Form 071907politixNo ratings yet

- Plaintiff,: in The United States District Court For The Southern District of Alabama Northern Division Bethany KarrDocument16 pagesPlaintiff,: in The United States District Court For The Southern District of Alabama Northern Division Bethany Karrpolitix100% (1)

- Ali Ahmed S/O Muhammad Hussain 37-Sunny Park LHR.: Web Generated BillDocument1 pageAli Ahmed S/O Muhammad Hussain 37-Sunny Park LHR.: Web Generated BillMuhammad Rashid MurtazaNo ratings yet

- Assignment No 02Document2 pagesAssignment No 02FaiXan Ahmad KhiljiNo ratings yet

- Money and The Federal Reserve System: Learning ObjectivesDocument16 pagesMoney and The Federal Reserve System: Learning ObjectivesNeven Ahmed HassanNo ratings yet

- Vii PPPDocument26 pagesVii PPPjnkpatel561No ratings yet

- Chapter 11Document16 pagesChapter 11RamrajNo ratings yet

- Super ImperialismDocument8 pagesSuper Imperialismhassscribed100% (4)

- Liquidity Pref TheoryDocument2 pagesLiquidity Pref Theoryrohan_jangid8No ratings yet

- Pros Vs Cons MP Vs FPDocument2 pagesPros Vs Cons MP Vs FPShoaib PatelNo ratings yet

- The East Asian MiracleDocument8 pagesThe East Asian MiracleimamNo ratings yet

- CBSE Class 10 Social Science Revision Notes History CHAPTER 5 The Age of IndustrialisationDocument2 pagesCBSE Class 10 Social Science Revision Notes History CHAPTER 5 The Age of IndustrialisationRaj AKNo ratings yet

- Chapter 12 (Income Tax On Corporations)Document10 pagesChapter 12 (Income Tax On Corporations)libraolrackNo ratings yet

- CH 3 Problem SolutionsDocument9 pagesCH 3 Problem SolutionsFrancisco PradoNo ratings yet

- Eurozone Debt CrisisDocument11 pagesEurozone Debt Crisisricha tomarNo ratings yet

- Eureka ForbesDocument24 pagesEureka ForbesHarmeet Singh BatraNo ratings yet

- Overview of de Minimis Value Regimes Open To Express Shipments World WideDocument3 pagesOverview of de Minimis Value Regimes Open To Express Shipments World WideMiguel Angel JaramilloNo ratings yet

- The Employer of Last ResortDocument34 pagesThe Employer of Last ResortDanilo Santiago Criollo ChávezNo ratings yet

- Simple and Compound Interest - Print Quizizz Part 2 PDFDocument4 pagesSimple and Compound Interest - Print Quizizz Part 2 PDFJohn Albert AguirreNo ratings yet

- Log TaxDocument5 pagesLog Taxstevenhokeemail100% (1)

- WTO and Developing CountriesDocument34 pagesWTO and Developing Countriesnhim78100% (1)

- Chapter 34 - The Influence of Monetary and Fiscal Policy On Aggregate Demand (Compatibility Mode) PDFDocument19 pagesChapter 34 - The Influence of Monetary and Fiscal Policy On Aggregate Demand (Compatibility Mode) PDFthanhvu78No ratings yet

- Bitcoin Is Evil - NYTimesDocument25 pagesBitcoin Is Evil - NYTimesquinteroudinaNo ratings yet

- Cir vs. Cebu Toyo Corp. 451 SCRA 447 FactsDocument1 pageCir vs. Cebu Toyo Corp. 451 SCRA 447 FactsMichelle SulitNo ratings yet

- Lecture Proper - CTT EmailDocument129 pagesLecture Proper - CTT EmailCattleyaNo ratings yet

- Macro Exam 2018Document4 pagesMacro Exam 2018Vignesh BalachandarNo ratings yet

- Economics Lesson PlanDocument8 pagesEconomics Lesson Planperiasamy156100% (1)

- MAY-2006 International Business Paper - Mumbai UniversityDocument2 pagesMAY-2006 International Business Paper - Mumbai UniversityMAHENDRA SHIVAJI DHENAKNo ratings yet

- LIBERTAS, Zagreb 16-17.10.2019 Call For Papers Schedule 2019Document6 pagesLIBERTAS, Zagreb 16-17.10.2019 Call For Papers Schedule 2019Boban StojanovicNo ratings yet