Professional Documents

Culture Documents

Financial Results For June 30, 2015 (Standalone) (Result)

Financial Results For June 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

You might also like

- Heating and Ventilating Contractors' AssociationDocument4 pagesHeating and Ventilating Contractors' Associationsshoeburrahman0% (2)

- CHALK 2017-09-29 Complaint PDFDocument39 pagesCHALK 2017-09-29 Complaint PDFal_crespoNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document8 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Document3 pagesAnnounces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document6 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam Sunder0% (1)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2014 (Audited) (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2014 (Audited) (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document6 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- SIDBI Financial Result DEC 2010 EnglishDocument2 pagesSIDBI Financial Result DEC 2010 EnglishSunil GuptaNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Impacts of The Downtown Environment On The Tourism Industry and Vistor PerceptionsDocument13 pagesImpacts of The Downtown Environment On The Tourism Industry and Vistor PerceptionsMichael_Lee_RobertsNo ratings yet

- Marquise 902A Price SheetDocument1 pageMarquise 902A Price SheetBungalowwalaNo ratings yet

- Delhi Inter-State Migrant Workmen (Regulation of Employee and Conditions of Service) Rules, 1982Document26 pagesDelhi Inter-State Migrant Workmen (Regulation of Employee and Conditions of Service) Rules, 1982Ayesha AlwareNo ratings yet

- A Critique On Accounting For Murabaha Contract A Comparative Analysis of IFRS and AAOIFI Accounting Standards PDFDocument13 pagesA Critique On Accounting For Murabaha Contract A Comparative Analysis of IFRS and AAOIFI Accounting Standards PDFAhmad BaehaqiNo ratings yet

- TSCM52 - 66 SAP Certified Application Associate - MMDocument3 pagesTSCM52 - 66 SAP Certified Application Associate - MMAmar Singh0% (1)

- Hse TasksDocument9 pagesHse TasksAnonymous xEZHQfNo ratings yet

- Model Management StrategicDocument15 pagesModel Management StrategicMarian Butacu100% (1)

- Country-Of-Origin Marketing: A List of Typical Strategies With ExamplesDocument13 pagesCountry-Of-Origin Marketing: A List of Typical Strategies With Examplesnoneedforausername2No ratings yet

- Concepts/approaches of Strategic ManagementDocument1 pageConcepts/approaches of Strategic ManagementVidushi KhajuriaNo ratings yet

- Tendeing IntroductionDocument7 pagesTendeing IntroductionAmulieNo ratings yet

- Industry Analysis Is A Tool That Facilitates A CompanyDocument3 pagesIndustry Analysis Is A Tool That Facilitates A CompanyAri NugrahaNo ratings yet

- ACCT2121 Ch8Document52 pagesACCT2121 Ch8Derek DerekNo ratings yet

- Multiple Choice - AuditDocument22 pagesMultiple Choice - AuditArem CapuliNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsDhruv NarangNo ratings yet

- Government of Andhra Pradesh Municipal Administration DepartmentDocument6 pagesGovernment of Andhra Pradesh Municipal Administration Departmentuttamreddy8244266No ratings yet

- Method For Grid ConnectivityDocument5 pagesMethod For Grid ConnectivitydevashreechandeNo ratings yet

- 1.1 Pros and Cons of Entrepreneurship VsDocument14 pages1.1 Pros and Cons of Entrepreneurship VsJef GalinganNo ratings yet

- Audit of ReceivablesDocument9 pagesAudit of Receivablesmissy100% (2)

- F&F ATS - SellerDocument1 pageF&F ATS - SellerAdarsh PandeyNo ratings yet

- Huawei ODN Products Series BrochureDocument38 pagesHuawei ODN Products Series BrochureDitu Daniel0% (1)

- SDSD SDDDocument10 pagesSDSD SDDshambhu ChoudharyNo ratings yet

- Currency DerivativesDocument28 pagesCurrency DerivativesChetan Patel100% (1)

- Batch Derivation With BADI Derivation - SAP BlogsDocument9 pagesBatch Derivation With BADI Derivation - SAP BlogsSudeep JainNo ratings yet

- Strikes and LockoutDocument11 pagesStrikes and LockoutbaboabNo ratings yet

- SAS AddIn MS OfficeDocument92 pagesSAS AddIn MS Officeaminiotis100% (1)

- Sew What Inc - Case StudyDocument12 pagesSew What Inc - Case Studytaniya17No ratings yet

- Economictimes IndiatimeDocument5 pagesEconomictimes IndiatimeSrinivas BhupathiNo ratings yet

- MoaDocument25 pagesMoahermae valenzonaNo ratings yet

Financial Results For June 30, 2015 (Standalone) (Result)

Financial Results For June 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results For June 30, 2015 (Standalone) (Result)

Financial Results For June 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

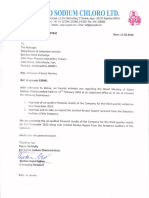

Kohinoor Techno Engineers Limited

(Previously Known asAsian independent Network Limited)

Reg.

All lS0 9001-2008 hrlilied

Ofice:'KOHINOOR HOUSE", Plot No.1, Gajera lndustrial Estate,

Opp. l.C.GandhiMill, A. K. Road, SURAT-GUJAMT-INDIA.

Tel. :

2il2786, Fax : 0261-2563650

Web : www.kohinoormachineries.com

Email : sale@kohinoormachinedes.@m

ainl_surat@yahoo.in

(+91.92611

Date:

Ref No..

Annexure-1

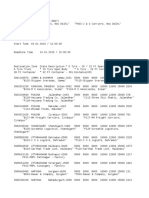

Statement of Standalone Audited Results for the Quarter Ended

Particulars

3A106/2015

]al6lza75

3Al06l70L4

3Ll03lz0ls

30/a6120L5

3UA6t2014

3 Months Ended

3 Months Ended

3 Months Ended

Yearlv

Yearlv

Yearlv

Previous

Previous

Year endeC

Year ended

(Audited)

{Audite.ll

193.49

1300.45

(nudited)

(Audited)

(Audited)

Current

Period ended

(Audited)

121.06

193.49

841.95

121.46

31t43t2018

'Refer Notes Below}

1

lncome from operations

a) Net sales/income from ooerations

Net of excise duty)

(b) Other operaiing incl.rrt

Total income from oir.l raiions (net)

Exoenses

a) Cost of materials consumed

'b) Purchase of stock-intrade

O Chanqes in inventories of finished qoods,

0.00

0.00

0.00

0.00

0.00

0.00

727.06

102 ro

841.95

1-21 lo

102 /O

1300.4s

7.46

IJ 19

110.01

155.12

/.ot

7.50

2.40

0.78

4.65

A AA

5.61

tlb.bv

t46.22

4.37

7.27

0.00

4.37

z3.t

aal

aa

7.46

{a

10

E? OE

110.01

155.12

1148.61

5.92

t/.ot

7.50

18.52

6.24

2.92

7.29

2.40

0.78

3.65

4.65

0.15

19.96

5.61

19.46

827 31

74.64

116.69

4.37

786.22

1262.71

7.27

37.74

0.00

o.24

0.00

0.00

0.24

7.27

14.88

4.37

7.27

37.98

work-in-oroBress and stock-in-trade

ld) Emolovee benefits exDense

le) Depreciation and amortisation expehse

n Other exoenses (Anv item exceedinq

1 0% of the total expenses relatinq to

:ontinuino ooerations to be shown

;eparatelv)

fotal expenses

3 Profit I lLoss) from ooerations before other

income, finance costs and exceptional

items {'l-21

4 )ther income

5 ?rofit I {Loss} from ordinary activities

0.1 5

3.21

refore finance costs and exceDtional items

'3+41

6

:inance costs

3.10

5.56

5.85

3.10

5.56

23.11

)rofit / {Lossl from ordinarv activities after

t.z7

1-.71

9.03

7.27

r.7t

14.87

0.00

0.00

0.00

0.00

7.77

9.03

0.00

t.27

0.00

1.27

7.77

74.87

0,38

0.50

L.2I

2.88

0.38

0.50

4.63

0.89

6.15

0.89

7.21

70.24

0.00

0.00

0.00

0.00

0.00

0.00

'inance costs but before exceptional items

5+61

-xceptional items

9 Profit / (Loss) from ordinarv activities

before tax

t7+8t

10

Tax exoense - Provision for taxation

Net Profit / {Loss) from ordinary activities

after tax {9 + 1 0}

12 Exraordinary items

11

for the oeriod {1 1 + 1 2}

't4 Share of profit / (loss) of associates*

15 N/inoritv interest "

15 Net Profit I {Loss) after taxes, minoritv

interest and share of profit / (loss) of

associates {13 + 14 +'l5l *

17 Paid-up eouitv share capital

:Face Value of the Share shall be indicated)

18 Reserve excludino Revaluation Reserves as

13 Net Profit / JLossl

0.89

L.27

6.15

0.89

0.00

0.00

000

0.00

0.00

0.00

0.00

t.21

0.00

0.00

r0.24

0.00

0.00

6.15

0.89

1.27

1O.24

0.89

0.00

t.27

418.34

418.34

418.34

418.34

418.34

10

10

10

10

10

33.46

33.46

33.46

33.46

Z47fi1ar}.

q7Tt46

\ A

Mffi

33.46

,'F

l7

IU,

)ffi# f

?t

Kohinoor Techno Engineers Limited

(Previously Known as Asian independent Network Limited)

Reg.

All lS0 9001-2008 Certilied

Office:'KOHINOOR HOUSE", Plot No.1, Gajera lndustrial Estate,

Opp. l.C.GandhiMill, A. K. Road, SURAT-GUJARAT-INDIA.

Tel.: (+91 -92611 2542786, Fax : 0261 -2563650

Web : www.kohinoormachineries.com

Email : sale@kohinoormachineries.com

ainl*surat@yahoo.in

Date:

Ref No..

ler balance sheet of Drevious accountino vear

19.i Earninqs per share (before extraordinary

tems)

(of Rs.10/- each) (not annualised):

a)

Basic

b) Diluted

0.02

0.02

U.

UJ

0.15

0.1 5

0.02

0.02

0.03

0.03

0.24

0.03

0.02

0.02

0.03

0.03

0.15

o_02

0.1 5

0.02

0.03

0.03

4.24

0.24

024

19.i Earninqs per share (after extraordinary

items)

lof Rs l0/- eachl {not annualised}:

a) Basic

lb) Diluted

See ccompanvinq note to the financial results

" Applicable in the case of consolidated results.

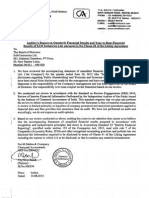

Notes: 1. The above results were reviewed by Audit Committee and taken on record by the Board

Directors at its meeting held on 1310812015

of

2. The Company has two Reportable Business Segment i.e. Manufacturing of machineries &

related services and trading of diamonds in terms of requirements of Accounting Standard 1 7.

3. During the quarter ended3010612015. No complaints u,ere received and attended.

4. Previous quafter's figures have been re-grouped / re-an'anged u'herever necessary.

5. The figures of last quarter a:-e the balancing fi-eures betr.veen audited figures in respect of the

full financial

thepublishedyeaItodatefigqI:suptothethirdquarterof1hecurr:entfinancialyear.

By Order of the Board of Directors

Place

SURAT

Date

13t48t2015

year and

Kohinoor Techno Engineers Limited

(Previously Known as Asian independent Network Limited)

Reg.

All lS0 9001-2008 Certitied

Ref No..

2.

Offce:"KOHINOOR HOUSE", Plot No.1, Gajera lndustrial Estate,

Opp. l.C.Gandhi Mill, A. K. Road, SURAT-GUJARAT-INDIA.

Tel.: (+91 -9261) 2542786, Fax : 0261-2563650

Web : wwwkohinoormachineries.com

Email : sale@kohinoormachineries.com

ainl_surat@yahoo.in

Annexure-lX of Clause 41

Eatb lacs

Standalone Statement of Assets and

Lia

bilities

Particulars

As at

(current Year Ended

As at

end

30/06/201 5

3UA6t2014

EQUITYAND LIABILITIES

1

Shareholders'funds

(a) Share capital

(b) Reserves and surplus

418.34

(e8.s0)

418.34

(108.41)

319.84

0.00

0.00

?no o"

0.00

0.00

8.74

28.02

0.00

(c) Money received against share warrants

Sub-total - Shareholders' funds

2 Share application money pending allotment

Minority interest "

4 Non-current liabilities

3

(a) Long-term borrowings

(b) Deferred tax iiabilities (net)

(c) Other long{erm liabilities

0.00

0.00

9.81

17.58

(d) Long{erm provisions

Sub-tc;tal - Non-current liabilities

27.39

JO./O

161 .50

Sub-total - Curent liabilities

81.18

1,027.93

2.37

3.48

1,114.86

1 ,'1

TOTAL - EQUITY AND LIABILITIES

1,462.09

1,448.62

17.17

3.47

(e) Long{erm loans and advanees

42.11

48.33

(f) Other non-current assets

6.25

5 Current liabilities

(a) Shofi{erm borrowings

(b) Trade payables

(c) Other current liabilities

(d) Short-term provisions

931.87

2.11

6.45

01 .93

ASSETS

B

1

Non-current assets

(a) Fixed assets

*

ib) Goodwill on consolidation

(C ) Non-current investments

Sub-total - Non-current assets

65.53

51.80

69.73

1,263.83

34.07

28.93

88.61

2 Current assets

(a) Current investments

(b) lnyentories

(c) Trade receivables

(d) Cash and cash equivalents

(e) Short-term loans and advances

1,164 91

69.26

74 04

(0 Other current assets

Sub-total - Current assets

TOTAL - ASSETS

rZ*ro EIUi\'"

1,396.56

1,462.09

1,396.8?

'1,448.6

er{(N

\.'

I

ry

lrt

Wde

Kohinoor Techno Engineers Limited

(Previously Known as Asian independent Network Limited)

Reg,

All lS0 9001-2008 Certitied

ffice: "KOHINOOR HOUSE", Plot No.1, Gajera lndustrial Estate,

Opp. l.C.Gandhi Mill, A. K. Road, SURAT-GUJARAT-INDIA.

Tel.: (+91 -0261, 2542786, Fax : 0261-2563650

Web : www.kohinoormachineries.com

Email : sale@kohinoormachineries.com

ainl_surat@yahoo.in

Date:

Ref No..

Quarterly Report of Segment wise revenue, results and capital employed under clause 41 of listing agreement

Rs in Lacs

SN

Pa

flalf Year Ended

Quarter Ended

rticu lars

30/slZAL5'

30/A612a14

n/a3/2or sOl06lz}ts ta/a6lzaLt

Year Ended

3L/A3/ZCILs

Segment Revenue

(Net sales/ lncome from

each segment should be

disclosed under this head

Segment A- Mfg of Machineries

Segment B - Trading of Diamond:

Less

33.48

36.83

6.04

33.48

110.25

115.42

160.01

805.12

115.02

160.01

1190.20

121.A6

193.49

1300.45

lnter Segment Revenue

Net Sales

6.04

lncome From Operation

Segment Results

121.06

10?

^o

841.95

'

(Profit +/ Loss- before Tax and

lnterest from each segment

a

b

Segment A- Mfg of Machineries

3.45

8.58

(1.s8)

3.45

8.58

18.63

Segment B - Trading of Diamond

3.96

3.11

22"34

3.96

3.11

34.76

lnterest

3.10

5.56

5.85

3.10

s.s6

23.1,1

ii

Other unallocable Expenditure

3.42

4.92

8.76

3.42

4.92

20.44

0.89

1".27

6.15

Less

net off un-cllocable income

Total profit After tax

0.89

1.21

r0.24

Capital Employed

(Segment Assets - Segment Liabilities)

a

b

Segment A- Mfg of Machineries

129.35

132.43

129.3s

1s5.05

1.32.43

Segment B - Trading of Oiamondsl

t90.49

185.s3

190.49

154.88

186.53

---'-'-l

319.84

318.96

319.84

309.93

318.96

Total

Place : Surat

Date '.

l,llll

By Order of the Board of Directors

1310812015

,m

o\

t Network Limited)

-rc

'A

le

Kohinoor Techno Engineers Limited

(Previously Known asAsian independent Network Limited)

"KOHINOOR HOUSE", Plot No.1, Gajera lndustrial Estate,

Opp. l.C.GandhiMill, A. K. Road, SURAT-GUJARAI-INDIA.

Tel.: (+91.9261) 2542786, Fax : 0261-2563650

Web : www.kohinoormachineries.com

Email : sale@kohinoormachineries.oom

ainl_surat@yahoo.in

Reg. Office:

All lS0 9001-2008 Certilied

Date:

Ref No..

ART II

Audited Results for the Quarter Ended 30106/2015

Pa

4

1

rticulars

30/6t70rs

30/06lzoL4

37/03/20r.5

3 Months Ended

3 Months Ender

3 Months Ended

{Unaudited)

(Unaudited)

(Unaudited)

30106/2075

Yearlv

Current

Period ended

(Audited)

2873360

2873360

Zd / JJbU

zd / 55bu

2873360

87.52o/a

87.52%

87.52%

87.520/"

0.00

0.00

0.00%

0.00

0.0f

0.00

0.00%

0.00o/o

0.00%

A.00Yo

0.00

0.00%

0.ajyo

0 000/.

0.00olo

0.00o/o

0.00%

0.o00/.

1310042

00.00%

1310042

1310042

100.00%

100.000/"

1310042

00.00%

100.000/"

12.48%

72.44%

L2.48%

12.48%

L7.48%

30toa2a14

(Audited)

r ended

(Audited)

26 I 336U

31t03t2015

Yearly

Yearlv

Preyious

Previous

Year ended

>ARTICULARS OF SHAREHOLDING

)ublic shareholdino

Number of shares

' Percentaoe of shareholdino

2 Promoters and Promoter Grouo Shareholdino

) Pledqed/Encumbered

- Number of shares

Percentaqe of shares (as a % of the toial

shareholdino of oromoter and Dromoier

rrouo)

- Percentaqe of shares (as a % of the total

;hare capital of the companv)

:) Non-encumbered

Number of shares

Percentaae of shares (as a 7o of the total

ihareholdino of the Promoter and

rromoter qroup)

1310042

100.000/"

Perceniaoe of shares (as a o/o of the total

rhare caDital of the comoanv)

Particulars

2.48%

months ended

'30i 06/201 5t

INVESTOR COMPLAINTS

Pendinq at the beoinninq of the auarter

0

Received durinq thd.quarter

0

Disoosed of durino the ouarter

0

Remainino unresolved at the end of the ouart

,0r K0hm00t

1310042

You might also like

- Heating and Ventilating Contractors' AssociationDocument4 pagesHeating and Ventilating Contractors' Associationsshoeburrahman0% (2)

- CHALK 2017-09-29 Complaint PDFDocument39 pagesCHALK 2017-09-29 Complaint PDFal_crespoNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document8 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Document3 pagesAnnounces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document6 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam Sunder0% (1)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2014 (Audited) (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2014 (Audited) (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document6 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- SIDBI Financial Result DEC 2010 EnglishDocument2 pagesSIDBI Financial Result DEC 2010 EnglishSunil GuptaNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Impacts of The Downtown Environment On The Tourism Industry and Vistor PerceptionsDocument13 pagesImpacts of The Downtown Environment On The Tourism Industry and Vistor PerceptionsMichael_Lee_RobertsNo ratings yet

- Marquise 902A Price SheetDocument1 pageMarquise 902A Price SheetBungalowwalaNo ratings yet

- Delhi Inter-State Migrant Workmen (Regulation of Employee and Conditions of Service) Rules, 1982Document26 pagesDelhi Inter-State Migrant Workmen (Regulation of Employee and Conditions of Service) Rules, 1982Ayesha AlwareNo ratings yet

- A Critique On Accounting For Murabaha Contract A Comparative Analysis of IFRS and AAOIFI Accounting Standards PDFDocument13 pagesA Critique On Accounting For Murabaha Contract A Comparative Analysis of IFRS and AAOIFI Accounting Standards PDFAhmad BaehaqiNo ratings yet

- TSCM52 - 66 SAP Certified Application Associate - MMDocument3 pagesTSCM52 - 66 SAP Certified Application Associate - MMAmar Singh0% (1)

- Hse TasksDocument9 pagesHse TasksAnonymous xEZHQfNo ratings yet

- Model Management StrategicDocument15 pagesModel Management StrategicMarian Butacu100% (1)

- Country-Of-Origin Marketing: A List of Typical Strategies With ExamplesDocument13 pagesCountry-Of-Origin Marketing: A List of Typical Strategies With Examplesnoneedforausername2No ratings yet

- Concepts/approaches of Strategic ManagementDocument1 pageConcepts/approaches of Strategic ManagementVidushi KhajuriaNo ratings yet

- Tendeing IntroductionDocument7 pagesTendeing IntroductionAmulieNo ratings yet

- Industry Analysis Is A Tool That Facilitates A CompanyDocument3 pagesIndustry Analysis Is A Tool That Facilitates A CompanyAri NugrahaNo ratings yet

- ACCT2121 Ch8Document52 pagesACCT2121 Ch8Derek DerekNo ratings yet

- Multiple Choice - AuditDocument22 pagesMultiple Choice - AuditArem CapuliNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsDhruv NarangNo ratings yet

- Government of Andhra Pradesh Municipal Administration DepartmentDocument6 pagesGovernment of Andhra Pradesh Municipal Administration Departmentuttamreddy8244266No ratings yet

- Method For Grid ConnectivityDocument5 pagesMethod For Grid ConnectivitydevashreechandeNo ratings yet

- 1.1 Pros and Cons of Entrepreneurship VsDocument14 pages1.1 Pros and Cons of Entrepreneurship VsJef GalinganNo ratings yet

- Audit of ReceivablesDocument9 pagesAudit of Receivablesmissy100% (2)

- F&F ATS - SellerDocument1 pageF&F ATS - SellerAdarsh PandeyNo ratings yet

- Huawei ODN Products Series BrochureDocument38 pagesHuawei ODN Products Series BrochureDitu Daniel0% (1)

- SDSD SDDDocument10 pagesSDSD SDDshambhu ChoudharyNo ratings yet

- Currency DerivativesDocument28 pagesCurrency DerivativesChetan Patel100% (1)

- Batch Derivation With BADI Derivation - SAP BlogsDocument9 pagesBatch Derivation With BADI Derivation - SAP BlogsSudeep JainNo ratings yet

- Strikes and LockoutDocument11 pagesStrikes and LockoutbaboabNo ratings yet

- SAS AddIn MS OfficeDocument92 pagesSAS AddIn MS Officeaminiotis100% (1)

- Sew What Inc - Case StudyDocument12 pagesSew What Inc - Case Studytaniya17No ratings yet

- Economictimes IndiatimeDocument5 pagesEconomictimes IndiatimeSrinivas BhupathiNo ratings yet

- MoaDocument25 pagesMoahermae valenzonaNo ratings yet