Professional Documents

Culture Documents

The Small Business Management Flight Simulator in An Environment of Financial Indiscipline

The Small Business Management Flight Simulator in An Environment of Financial Indiscipline

Uploaded by

Mirjana Pejic BachOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Small Business Management Flight Simulator in An Environment of Financial Indiscipline

The Small Business Management Flight Simulator in An Environment of Financial Indiscipline

Uploaded by

Mirjana Pejic BachCopyright:

Available Formats

THE SMALL BUSINESS MANAGEMENT FLIGHT SIMULATOR IN AN

ENVIRONMENT OF FINANCIAL INDISCIPLINE

Mirjana Pejic Bach

Department for Business Computing

Faculty of Economics, University of Zagreb

Trg J.F.Kennedya 6, 10000 Zagreb, Croatia

E-mail: mpejic@efzg.hr

KEYWORDS

System dynamics modelling, simulation games, small

business finance, accounts receivable management,

financial indiscipline

ABSTRACT

The article describes the features of a system-dynamics

based game for financial strategies of small business in an

environment characterised by severe financial indiscipline

and with the restricted access to financial resources. The

problem of small firm striving to succeed in such

conditions is discussed in the framework of a system

dynamics model that is converted into a simulation game.

Player makes the decisions on bank credit, accounts

receivable policy, profit payout, and time to pay the

suppliers.

INTRODUCTION

One of the typical problems for the transition countries of

Central and Eastern Europe is financial indiscipline, when

firms delay payments to suppliers, banks, employees and

the government (Begg and Portes, 1993). It is very hard for

a small business to survive in such an environment. If its

buyers do not pay on time, the firm will initially face

liquidity crises and will eventually go bankrupt. Restricted

access to financial markets is the additional problem that

small businesses face (OECD, 1996).

System dynamics is a powerful tool that enhances learning

about company, market and competitors, portrays the

cognitive limitations on the information gathering and

processing power of human mind, facilitates the practice

of considering opinions, and supports building of "What

if" scenarios (Sterman, 2000).

Over the past twenty years, the growth of computer

technology has facilitated the wide application of system

dynamics modelling as sophisticated tools for simulating

business environments and situations. The basic goal of

management simulation games is to apply experiential

learning to the commercial world. They are designed in

order to allow the player to experiment with the model on

a compressed time basis while reducing costs and personal

risk. The participant is able to see the consequences of

his/her actions in few minutes or hours. In real world such

consequences are visible only after much longer time

(months or years).

The purpose of this article is to describe and demonstrate

applicability of system dynamics models as decision and

learning support tools for small businesses in an

environment of financial indiscipline that permit controlled

experimentation and enhance understanding of reality.

MODEL OVERVIEW

Several system dynamics studies have examined the

impact of financial policy on business success. Lyneis

(1980) proposes the use of system dynamics models in

deciding which action (e.g. capital rationing, increasing

prices, reducing the collection period) would be best in the

case where a firm faces a shortage of financial resources.

Indeed, this is a common problem for all growing

companies. Thompson (1986) examines the impact of cash

flow on the success of a small business, and suggests that

system dynamics can provide an overview of the complex

relationships between inventory, receivables, payables and

cash. Kolay (1991) recommends a system dynamics

approach in managing working capital crises, and

demonstrates the influence of debt collection efforts,

restricted credit policy, and deferred payment to creditors

on working capital. Bianchi and Mollona (1997) show how

the coupling of the dynamics of growth with that of net

working capital management creates recurring problems,

especially in the context of small entrepreneurial firms. An

interactive learning environment has also been created,

whose focus is on understanding the dynamics generated

by commercial and financial policies on sales revenue and

profitability on one hand, and net working capital and

liquidity on the other hand (Bianchi and Bivona, 1999).

The system dynamics model of a small firm in the

transitional Croatian economy striving to succeed in an

environment characterised by severe financial indiscipline

and with restricted access to financial resources. The goals

of the study were to help the owners of the firm to decide

which financial policy would be best in the situation of

financial indiscipline and to demonstrate an application of

system dynamics methodology in a small business

environment. The model is discussed at length by PejicBach (2003), and is converted into a simulation game that

consists on six major sectors: sales force, accounts

receivable policy, finance, demand, inventory, and

financial sources. Model sectors shall be described shortly.

Sales force sector

required number of workers and employs new staff in

order to reduce the difference. The number of workers

required depends on the expected demand.

Sales force sector describes sales force size and hiring

effort (Figure 1). The owner compares the current and

Sales force s ector

tim e to hire workers

average tim e as an expert

Workers

leaving workers

workers hired

hire fire decis ions

workers fired

tim e to fire workers

expected dem and

Figure 1: Stock and flow diagram of sales-force sector

Accounts receivable policy

Accounts receivable policy sector explains effect of

financial discipline on level of accounts receivable, and

how financial discipline could be controlled with accounts

receivable policy.

Increase in accounts receivable inflows into the level of

accounts receivable, and it depends on the number of

products sold and the selling price (Figure 2). Three

outflows reduce the level of accounts receivable: (1)

payment in advance, (2) the accounts receivable that are

collected, and (3) bad debts. Payment in advance depends

on the selling and payment in advance fraction that is

Financial discipline influences level of accounts receivable

by the following means: time to collect accounts

receivable, percentage of bad debt and percentage of early

payment. Normal financial discipline was defined as a

situation where customers pay on time, where 30% of sales

are collected in advance, and where 3% of accounts

receivable are bad debts that cannot be collected despite

influenced by financial discipline. The amount of accounts

receivable collected depends on the current level of

accounts receivable and the usual time to collect accounts

receivable, which is influenced by financial discipline. The

current level of the accounts receivable and bad debt

fraction determines the amount of bad debt. However, bad

debt does not reduce the accounts receivable immediately.

The owner of the firm will put pressure on bad customers

after the usual collection time has passed. For example,

bad debts reduce the level of accounts receivable after 9

months if the time to collect accounts receivable is 6

months and the owner puts pressure on bad customers for

an additional 3 months.

additional efforts. When financial discipline is lower than

normal, the time needed to collect accounts receivable is

longer than agreed, fewer than 30% of customers pay in

advance, and more than 3% of accounts receivable are

considered as bad debts.

Accounts receiv able

normal pay ment in adv ance f r

GOAL SELLING

products sold

pay ment in adv ance

selling price

~

ef f ect of f inancial discipline on

pay ment in adv ance

Accounts receiv able

selling

ratio of f inanc disc

acc rec collected

increase in acc rec

~

ef f ect of f inancial discipline

on bad debt f r

pay ment in adv ance f r

bad debt %

time to collect

~

accounts receiv ables

ef f ect of f inancial

discipline on time to collect

bad debt

ratio of f inanc disc

normal bad debt f r

time to press

bad customers

time to stop collecting

bad debt

normal time to collect

acc rec

Figure 2: Stock and flow diagram of accounts receivable

How can financial discipline be controlled? Is it possible at

all? What are the consequences of such actions? Accounts

receivable policy is one of the means to influence financial

discipline of firms customers. It comprises credit

standard, the collection policy, and cash discount. It would

be too complicated to model all the aspects of the

management of accounts policy. Therefore, we modelled

the accounts receivable policy as one variable that could

vary between two extremes a liberal and a restrictive

accounts receivable policy (Figure 3).

Accounts receivable policy

normal acc receiv policy

accounts receivable policy

ratio of financ disc

ratio of acc receiv

normal financ disc

Financial discipline

change in financ disc

effect of acc receiv policy

correction in financ disc

time to change financ disc

AVERAGE FINANC

DISC OF THE MARKET

Figure 3: Stock and flow diagram of accounts receivable policy

An accounts receivable policy is liberal if the credit period

is long, credit standards are low and if the collection policy

is loose. Easing the credit policy stimulates sales, but

carrying costs and bad debt and/or cash discount expenses

may also rise. An accounts receivable policy is restrictive

in the opposite case where the credit period is short, credit

standards are high and the collection policy is tightened.

Tightening accounts receivable policy increases financial

discipline of customers, but the firm risks to lose its

customers.

customers, and the credit period is long), its value is 0

pressure units. More than 50 pressure units represent a

restrictive accounts receivable policy.

Finance sector

Finance sector contains selling price calculation, cash flow,

income statement and ratio analysis. We shall explain only

the cash level, that is increased by the inflow and depleted

by the outflow (Figure 4). Inflows to the cash level are:

payment in advance, accounts receivable collected, and

pre-tax return. In addition, if the firm borrows money from

the bank, the cash level is increased by the amount

borrowed. Outflows from the cash level are: paying profit,

paying administrative and selling costs, paying suppliers,

and paying taxes. If the firm has borrowed money from the

bank, the cash level is decreased by the amount repaid and

by interest payments.

Players make the decisions on accounts receivable policy

that is expressed in pressure units. If financial discipline is

normal, than the player retains accounts receivable policy

also at the normal level (50 pressure units). The accounts

receivable policy is expressed in pressure units. If the

accounts receivable policy is completely liberal, (the firm

sells goods to everybody, does not put pressure on

Cash

amount repay ed

taxes

Cash

acc rec collected

interest pay ed

inf low

outf low

amoutn borrowed

pay ment in adv ance

prof it pay out

total pay ment to suppliers

pre tax return collected

import costs pay ed

currency ratio

pay ing

admin and sell costs

decrease in debt

to suppl

Figure 4: Stock and flow diagram of the cash level

Demand sector

Demand sector explains customer creation and retention,

and main factors that influence demand are: (1) word of

mouth, (2) accounts receivable policy, and (3) marketing

expenses (Figure 5). In the context of financial discipline

the accounts receivable policy and marketing expenses

influences the demand to the biggest extent. When

accounts receivable policies are liberal, sales increase, but

more customers with poor financial discipline are

attracted. If the accounts management policy is restrictive,

sales decrease, but customers of greater financial discipline

are more likely to be encouraged. The main way to

influence demand is through marketing expenses. If

marketing expenses are higher than the similar expenses of

competitors, demand increases very quickly. The goal of

the model is not unrestricted growth, but growth only to

the target level.

Inventory sector

takes the expected demand into account when she orders

new products. She compares the current and target

inventory and orders sufficient products to reduce the

difference.

Demand sector

The inventory level is increased by the products received

and is depleted by the products sold (Figure 6). The owner

time to average demand

expected demand

Demand

increase in demand

word of mouth

decrease in demand

increase fraction

normal attrition fraction

attrition fraction

ratio of acc receiv

~

effect of acc receiv on

decrease in demand

~

~

effect of mktg expenses

effect of acc receiv

on increase in demand

ratio of mktg expenses

demand ratio

firm's mktg expenses

GOAL DEMAND

Figure 6: Stock and flow diagram for inventory sector

competitor's mktg expenses

Financial sources sector

effect on mktg expenses

When

cash flow is lower than acceptable, the player can:

(1) increase time to pay suppliers, but never above the

highest limit that suppliers will tolerate, (2) retain profit to

finance day-to-day business, and (3) take credit from the

bank, but only the maximum amount approved by the

bank.

Three financial sources are available to the small

businesses: suppliers (Figure 7), bank credit (Figure 8) and

profit retained (Figure 9). Players make decisions on time

to pay suppliers, bank credit and profit payment policy.

Figure 5: Stock and flow diagram for demand sector

Debt to suppliers

buy ing price in

f oreign currency

increase in debt

to suppl

products receiv ed

decrease in debt

to suppl

time to pay suppliers

Figure 7: Stock and flow diagram for debt to suppliers

THE SMALL BUSINESS MANAGEMENT FLIGHT

SIMULATOR

Bank credit

two hours. Goal of the game is to make as large profit and

demand as possible, and in the same time remain the firm

in the liquid position in the conditions of financial

indiscipline. After the game the players are asked to

explain what they have observed.

Basic assumption of the model is that the financial

discipline is sensitive on accounts receivable policy. There

Bank credit

are four controllable variables in the model: (1) % profit

payout, (2) bank credit, (3) time to pay suppliers, and (4)

Ithink is the system dynamics software that is simple to

accounts receivable policy.

operate and has interface that encourages exploration. It

amoutn borrowed

amount repay ed

offers

user-friendly input and output devices that

The simulation game has been designed and played with

empowers the player to make decisions about controllable

credit needed

in 000

the objective to sensate

management

students and

variables.time

Control

for decision-making is presented

to repayPanel

the credit

practitioners to the problems of financial indiscipline.

(Figure 10.) Input devices are Slider Inputs, which allow

time to get credit

Team of players or one player makes

decisions about four

the player to make decisions. Every six months players

monthly

control variables. The players are encouraged to increase

make

the decisions on credit needed, percentage of profit

interest rate

turnover, maximise profit while maintaining positiveinterest

cashexpenses payout,

time to pay suppliers, and accounts receivable

flow. Every six months they make decisions.

policy. Output devices show the consequences of players

Interest pay able decisions on Numeric Display or graph. Players monitor

Game begins with discussion about the financial

time to collect accounts receivable, bad debt percentage,

indiscipline, and how it influences firms profitability and

cash, and profit or loss on Numeric Displays. Demand,

liquidity. Then, system dynamics model of small business

profit and cash are monitored on graphs.

increase in interest pay able

interest pay ed

is presented. Players gather around a machine for one or

time to pay interest

Figure 8: Stock and flow diagram for bank credit

Profit payout

Retained profit

profit made

profit

profit payout

percentage of profit payout

Figure 9: Stock and flow diagram for profit payout

Figure 10: Control panel of the game

LESSONS OF THE GAME

In an ideal situation every customer would pay on time,

there would be no bad debt, and the fraction of early

payments would be fairly high. It is pressumed that a

sudden and strong decay of financial discipline was

introduced.

Following strategies in case of financial discipline

problems are considered:

Strategy 1 - Retaining profit

Strategy 2- Retaining profit and borrowing money

from the bank

Strategy 3 - Retaining profit, borrowing money

from the bank and tightening the accounts

receivable policy (75 pressure units)

Strategy 4 - Retaining profit, tightening the

accounts receivable policy (65 pressure units) and

delaying payments to suppliers (5 months)

Game is played with employing above strategies, and the

results are following (Table 1). Equilibrium values at the

end of the simulation for demand, time to collect accounts

receivable, bad debt %, cash and profit are presented in the

table. As far as demand is concerned, Strategies 1 and 2

are better than Strategies 3 and 4. But, in terms of the time

to collect accounts receivable, bad debt, and profit

Strategies 3 and 4 are better. However, the firm faces

serious liquidity problems in Strategies 1 and 2.

Table 1. Business performance in different Strategies

Demand

(number of

products sold

per month)

Strategy 1

Strategy 2

Strategy 3

Strategy 4

4687

4687

3980

4149

Time to

collect

accounts

receivable

(months)

26.2

26.2

5.6

6.7

Bad debt %

The players would make the best results if they tighten the

accounts receivable policy and, at the same time, delay

payments to suppliers (Strategy 4). However, such a

strategy is good for the firm only in the short term, because

suppliers will not tolerate delayed payments indefinitely.

As a result of such actions, the firm would survive, but it

would lose its market share and would build up debts to its

suppliers. All of the profit would be retained and used to

finance the day-to-day running costs of the business. Most

of the firms in transition countries that suffer from

financial indiscipline operate in the same way. Firms delay

payments to suppliers and they themselves turn into bad

customers. Therefore, the circle is closed. In the end

everybody delays in making payments, and financial

indiscipline spreads even more widely. The conclusion of

the game is that in conditions of financial indiscipline,

there is no win-win solution for everybody.

Players are encouraged to think about available strategy

options in the conditions of financial indiscipline, instead

of sudden changes of the strategy. Main goal of the

simulation experiments is to demonstrate the following

conclusions for small business firms (Pejic-Bach, 2003):

Negative cash

position (local

currency in

millions)

22.5

22.5

5.2

5.7

Yes (-52.07)

Yes (-49.57)

No

No

Profit

(local currency)

698,986

658,176

1,078,253

1,110,523

When a firms customers start to delay with their

payments, the worst solution would be to do

nothing. In that case, every firm would very

quickly become illiquid and would not be able to

pay its taxes, suppliers, employees, and creditors.

Credit from the bank would not be sufficient to

cover the negative cash position because of the

restricted access felt by most transition countries

to the financial market.

A good solution would be to tighten the accounts

receivable policy, which would yield the

following results: an increase in the fraction of

early payments, a decrease in the fraction of bad

debt and time to collect payments. Still, because

of a restrictive accounts receivable policy the firm

would eventually lose its market share.

The other solution for the firm would be to use

informal sources of credit and to delay payments

to suppliers, which is the most likely reaction.

Because of the inefficiency of the legal system,

most firms decide to pay debts late simply

because the cost associated with late payment is

smaller than the cost of alternative sources of

finance. Underpaid suppliers usually do not

terminate further shipments for fear of losing their

clients, and, as a result, mutual arrears become a

universal practice.

CONCLUSIONS

Traditional methods of teaching tend to equip the students

with knowledge that could eventually help them in solving

their future business problems. On the other hand,

simulations are designed in order to initiate active, studentoriented learning. Students seek information that is useful

in achieving a goal of the game, and during that process

their understanding of the system increases.

Simulation games hold out the promise of new and

advantageous ways of learning, and could be useful in

education of credit managers. System dynamics model of

small business firm has been designed in order to allow

players to make decisions in conditions of financial

indiscipline in non-risk environment on a compressed time

basis. Players are encouraged to decide on credit needed,

percentage of profit payout, time to pay suppliers, and

accounts receivable policy in order to maximise profit and

demand while maintaining positive cash flow. Proposed

simulation game could be useful in developing decisionmaking skills, and could increase understanding of

possible strategy options available for small business firm

in the conditions of the financial indiscipline.

Finally, players are encouraged to reach the following

conclusions. In an environment of financial indiscipline

and restricted external sources of finance, most small firms

facing liquidity problems will probably restrict their

customer base and delay payments to suppliers, so

decreasing their market share. If the legal system is

inefficient, such a reaction will lead to an illiquid economy

in which the small business sector is weak. This would be

a severe problem because small business firms usually

play an important role in every economy. Furthermore,

everybody would eventually become a bad debtor.

REFERENCES

Begg, D. and R. Portes. 1993. Enterprise debt and financial

restructuring in Central and Eastern Europe. European

Economic Review 37, 396-407.

Bianchi, C. and E. Bivona. 2000. Commercial and financial

policies in family firms: The small business growth

management flight simulatior. Symulation & Gaming 31,

197-292.

Bianchi, C. and E. Mollona. 1997. A behavioural model of

growth and net working capital management in a small

enterprise. In Proceedings of the 1997 International

System Dynamics Conference. Istanbul, 269-272.

Kolay, M.K. 1991. Managing working capital crises: A system

dynamics approach. Management Decision 29, 46-52.

Lyneis, J.M. 1980. Corporate Planning and Policy Desing: A

System Dynamics Approach. Pugh-Roberts, Cambridge.

OECD. 1996. Micro-credit in transitional economies. OECD,

Paris.

Pejic-Bach, M. 2003. Surviving in an environment of financial

indiscipline: a case study from a transition country.

System Dynamics Review 19, 47-74.

Sterman, J.D. 2000. Business dynamics: System thinking and

modelling for a complex world. Irwin McGraw-Hill,

Boston.

Thompson, R. 1986. Understanding cash flow. Journal of

Small Business Management 24, 23-30.

BIOGRAPHY

Mirjana Pejic-Bach is a Research Assistant in Business

Informatics at the Faculty of EconomicsZagreb, Croatia.

She received a doctorate in Economics from the University

of Zagreb, Croatia, and completed the Guided Study

Program in System Dynamics organised by the MIT

System Dynamics in Education Project. Her present

research work focuses on business dynamics. She is

currently working on a research project devoted to

exploring the potentialities of system dynamics modelling

as a tool employed in management education.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- First Solar: CFRA's Accounting Quality ConcernsDocument2 pagesFirst Solar: CFRA's Accounting Quality ConcernsAnuj KhannaNo ratings yet

- MEW KuwaitDocument28 pagesMEW KuwaitbuddhikasatNo ratings yet

- Fin 550 Milestone 2Document6 pagesFin 550 Milestone 2writer topNo ratings yet

- Unlocking The Performance of The Chief Information Officer (CIO)Document24 pagesUnlocking The Performance of The Chief Information Officer (CIO)Mirjana Pejic BachNo ratings yet

- Pizza Bomb Feasib CompiledDocument235 pagesPizza Bomb Feasib CompiledSadAccountant100% (3)

- Eye On Money Idioms: (Exercises)Document2 pagesEye On Money Idioms: (Exercises)Paula Alcañiz López-Tello0% (1)

- Writing Scientific Papers About Data Science ProjectsDocument64 pagesWriting Scientific Papers About Data Science ProjectsMirjana Pejic BachNo ratings yet

- Usage of Social Neuroscience in E-Commerce ResearchDocument30 pagesUsage of Social Neuroscience in E-Commerce ResearchMirjana Pejic BachNo ratings yet

- Usage of Social Neuroscience in E-Commerce ResearchDocument30 pagesUsage of Social Neuroscience in E-Commerce ResearchMirjana Pejic BachNo ratings yet

- Hospital Websites: From The Information Repository To Interactive ChannelDocument14 pagesHospital Websites: From The Information Repository To Interactive ChannelMirjana Pejic BachNo ratings yet

- Personality Neuroscience of The Biology of Traits - Summary of The PaperDocument15 pagesPersonality Neuroscience of The Biology of Traits - Summary of The PaperMirjana Pejic BachNo ratings yet

- Fintech: European Union Perspective: Università Degli Studi Di MilanoDocument64 pagesFintech: European Union Perspective: Università Degli Studi Di MilanoMirjana Pejic BachNo ratings yet

- Simulation Games For ManagersDocument32 pagesSimulation Games For ManagersMirjana Pejic BachNo ratings yet

- Selection of Variables For Credit Risk Data Mining Models: Preliminary ResearchDocument28 pagesSelection of Variables For Credit Risk Data Mining Models: Preliminary ResearchMirjana Pejic BachNo ratings yet

- Egovernment Utilization in European Landscape: Hiearchical Cluster AnalysisDocument6 pagesEgovernment Utilization in European Landscape: Hiearchical Cluster AnalysisMirjana Pejic BachNo ratings yet

- Management Simulation Games For Entrepreneurship EducationDocument23 pagesManagement Simulation Games For Entrepreneurship EducationMirjana Pejic Bach0% (1)

- Banking Sector Profitability Analysis: Decision Tree ApproachDocument7 pagesBanking Sector Profitability Analysis: Decision Tree ApproachMirjana Pejic BachNo ratings yet

- Management Simulation Games For Entrepreneurship EducationDocument8 pagesManagement Simulation Games For Entrepreneurship EducationMirjana Pejic BachNo ratings yet

- Conceptual Framework DraftDocument3 pagesConceptual Framework DraftJp CombisNo ratings yet

- Factoring, Forfaiting & Bills DiscountingDocument3 pagesFactoring, Forfaiting & Bills DiscountingkrishnadaskotaNo ratings yet

- Transaciton ProcessDocument1 pageTransaciton ProcessRica de guzmanNo ratings yet

- Week 3 Statement of Financial PositionDocument22 pagesWeek 3 Statement of Financial PositionKushal KhatiwadaNo ratings yet

- Answer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 2Document16 pagesAnswer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 2ankitshah21No ratings yet

- Jnnurm: Improve Municipal Services Facilitate Local Economic Growth Improving Condition For PoorDocument10 pagesJnnurm: Improve Municipal Services Facilitate Local Economic Growth Improving Condition For PoorShivam ShanuNo ratings yet

- Ratio Analysis of Hindalco Industries LimitedDocument13 pagesRatio Analysis of Hindalco Industries LimitedSmall Town BandaNo ratings yet

- Lesson: 39: Give and Take: Collective BargainingDocument32 pagesLesson: 39: Give and Take: Collective Bargainingsarthak1826No ratings yet

- Market Dynamics.Document6 pagesMarket Dynamics.abidmehrajNo ratings yet

- Od 329808896732339100Document5 pagesOd 329808896732339100Rachna GuptaNo ratings yet

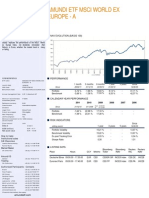

- Amundi Etf Msci World Ex Europe - A - Anglais - Eur - 3163!47!2!3!207 - MDocument2 pagesAmundi Etf Msci World Ex Europe - A - Anglais - Eur - 3163!47!2!3!207 - Mhp24714303No ratings yet

- Measurement: Impairment of LoanDocument3 pagesMeasurement: Impairment of LoanClar AgramonNo ratings yet

- Engineering Management Case Study 7Document7 pagesEngineering Management Case Study 7A ServallosNo ratings yet

- Dessler 10Document13 pagesDessler 10Anonymous 48eybn8No ratings yet

- The Independence Nature of LifeDocument1 pageThe Independence Nature of LifeWaleed KarmostajiNo ratings yet

- 6 Miscellaneous TransactionsDocument4 pages6 Miscellaneous TransactionsRichel ArmayanNo ratings yet

- Assignment - Banking & InsuranceDocument4 pagesAssignment - Banking & Insurancesandeep_kadam_7No ratings yet

- Purpose of Organisations Purpose of Organisations Defining Organisations Defining OrganisationsDocument10 pagesPurpose of Organisations Purpose of Organisations Defining Organisations Defining OrganisationsAkanksha AgarwalNo ratings yet

- Kinds of Taxpayers and Situs of IncomeDocument2 pagesKinds of Taxpayers and Situs of IncomeMelanie SamsonaNo ratings yet

- 14 Investor Value Added 2014 Venture Capital and Private Equity ContractinDocument6 pages14 Investor Value Added 2014 Venture Capital and Private Equity ContractinNovi AnriNo ratings yet

- Internal Control FrameworkDocument47 pagesInternal Control Frameworknico2176100% (2)

- Accounting For Intangible AssetsDocument47 pagesAccounting For Intangible AssetsMarriel Fate CullanoNo ratings yet

- DeutscheBank EquityIPO v1.1Document9 pagesDeutscheBank EquityIPO v1.1Abinash BeheraNo ratings yet

- Card SheetDocument21 pagesCard SheetJohn MillerNo ratings yet