Professional Documents

Culture Documents

Estácio: Material Fact - Third Issue of Debentures

Estácio: Material Fact - Third Issue of Debentures

Uploaded by

Estacio Investor RelationsCopyright:

Available Formats

You might also like

- GIRO - FAST WITH INV - V1.5 (With PayNow)Document7 pagesGIRO - FAST WITH INV - V1.5 (With PayNow)chriskhohkNo ratings yet

- Activity Based CostingDocument65 pagesActivity Based CostingOrko AbirNo ratings yet

- Shree CementDocument53 pagesShree CementRoma Pareek100% (3)

- HW2 Solution Key: Ricardian Model Problem 1Document9 pagesHW2 Solution Key: Ricardian Model Problem 1Mia KulalNo ratings yet

- Estácio: Material Fact - Issue of Simple, Unsecured, Non-Convertible DebenturesDocument2 pagesEstácio: Material Fact - Issue of Simple, Unsecured, Non-Convertible DebenturesEstacio Investor RelationsNo ratings yet

- Debntures 2011 INGLSDocument2 pagesDebntures 2011 INGLSMultiplan RINo ratings yet

- Estacio Comunicado Encerramento Oferta Publica 20141023 Eng PDFDocument1 pageEstacio Comunicado Encerramento Oferta Publica 20141023 Eng PDFEstacio Investor RelationsNo ratings yet

- Estácio: Notice To The Market - Early Debenture RedemptionDocument2 pagesEstácio: Notice To The Market - Early Debenture RedemptionEstacio Investor RelationsNo ratings yet

- M e S e S.ADocument149 pagesM e S e S.AMillsRINo ratings yet

- Ills Struturas E Erviços de NgenhariaDocument5 pagesIlls Struturas E Erviços de NgenhariaMillsRINo ratings yet

- Material FactDocument2 pagesMaterial FactEstacio Investor RelationsNo ratings yet

- Estacio Comunicado Esclarecimento Bovespa 20140521 EngDocument2 pagesEstacio Comunicado Esclarecimento Bovespa 20140521 EngEstacio Investor RelationsNo ratings yet

- Management Proposal Management and Audit Committee RemunerationDocument6 pagesManagement Proposal Management and Audit Committee RemunerationKlabin_RINo ratings yet

- Notice To Shareholders - Results of The Exercise of Preemptive Rights and First Additional Period For The Subscription of Unsubscribed SharesDocument5 pagesNotice To Shareholders - Results of The Exercise of Preemptive Rights and First Additional Period For The Subscription of Unsubscribed SharesMPXE_RINo ratings yet

- Notice To Shareholders - Payment of DividendsDocument2 pagesNotice To Shareholders - Payment of DividendsFibriaRINo ratings yet

- Notice To Shareholders: Private Capital Increase Decided by The Board of DirectorsDocument13 pagesNotice To Shareholders: Private Capital Increase Decided by The Board of DirectorsMultiplan RINo ratings yet

- Direct Taxes CircularDocument34 pagesDirect Taxes CircularratiNo ratings yet

- Dividend DistributionDocument2 pagesDividend DistributionFibriaRINo ratings yet

- IT Deductions Allowed Under Chapter VI-A Sec 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB Etc - APTEACHERS WebsiteDocument13 pagesIT Deductions Allowed Under Chapter VI-A Sec 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB Etc - APTEACHERS WebsiteKIMS IECNo ratings yet

- NCCPL Regulations Petaining To CGT PDFDocument10 pagesNCCPL Regulations Petaining To CGT PDFabby bendarasNo ratings yet

- Minutes of The Ordinary and Extraordinary Shareholders MeetingDocument15 pagesMinutes of The Ordinary and Extraordinary Shareholders MeetingFibriaRINo ratings yet

- Management's ProposalDocument266 pagesManagement's ProposalFibriaRINo ratings yet

- To The Members of The Board of Directors. From Mills Estruturas e Serviços de Engenharia S/ADocument2 pagesTo The Members of The Board of Directors. From Mills Estruturas e Serviços de Engenharia S/AMillsRINo ratings yet

- Republic Act NoDocument28 pagesRepublic Act NoAyen GarciaNo ratings yet

- CREATE Bill - Draft Enrolled Copy 02.16.21Document77 pagesCREATE Bill - Draft Enrolled Copy 02.16.21Joshua CustodioNo ratings yet

- Annex 30-XXXII of Instruction No. 480/09 of CVMDocument9 pagesAnnex 30-XXXII of Instruction No. 480/09 of CVMMillsRINo ratings yet

- Public Held Company Corporate Registry (NIRE) 33.3.0028974-7 Corporate Taxpayer's ID (CNPJ/MF) N.º 27.093.558/0001-15Document8 pagesPublic Held Company Corporate Registry (NIRE) 33.3.0028974-7 Corporate Taxpayer's ID (CNPJ/MF) N.º 27.093.558/0001-15MillsRINo ratings yet

- G.R. No. 108067, January 20, 2000Document8 pagesG.R. No. 108067, January 20, 2000AlexisNo ratings yet

- Termos SapDocument9 pagesTermos SapAnonymous 49Dl1oyzDr0% (1)

- Taxation: Far Eastern University - ManilaDocument4 pagesTaxation: Far Eastern University - ManilacamilleNo ratings yet

- SEC Manual On Registration of SecuritiesDocument10 pagesSEC Manual On Registration of SecuritiesGeoanne Battad Beringuela100% (1)

- Annual Shareholders' Meeting 04.18.2016 - Summary Statement Sent by The Central DepositoryDocument2 pagesAnnual Shareholders' Meeting 04.18.2016 - Summary Statement Sent by The Central DepositoryBVMF_RINo ratings yet

- Create LawDocument42 pagesCreate LawMark Efren RamasNo ratings yet

- Orporate Axpayers Orporate EgistryDocument10 pagesOrporate Axpayers Orporate EgistryMillsRINo ratings yet

- Estácio: Material Fact - Order Issued by CADEDocument1 pageEstácio: Material Fact - Order Issued by CADEEstacio Investor RelationsNo ratings yet

- Section 80P - Deduction For Co-Operative SocietiesDocument15 pagesSection 80P - Deduction For Co-Operative SocietiesSURESHNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 40-2004 Issued On July 1, 2004Document2 pagesREVENUE MEMORANDUM CIRCULAR NO. 40-2004 Issued On July 1, 2004Kyrzen NovillaNo ratings yet

- Tax Incentives 10708Document5 pagesTax Incentives 10708Hib Atty TalaNo ratings yet

- BVMF Presentation - March 2009Document67 pagesBVMF Presentation - March 2009BVMF_RINo ratings yet

- Estácio: Notice To The Market - Policy For Related Party TransactionsDocument1 pageEstácio: Notice To The Market - Policy For Related Party TransactionsEstacio Investor RelationsNo ratings yet

- Ezion Holdings LimitedDocument5 pagesEzion Holdings Limitedopenid_b9jhTbHKNo ratings yet

- Section 80CCD (1B) Deduction - About NPS Scheme & Tax BenefitsDocument7 pagesSection 80CCD (1B) Deduction - About NPS Scheme & Tax BenefitsP B ChaudharyNo ratings yet

- Zain KSA ProspectusDocument249 pagesZain KSA ProspectusMohd RashdanNo ratings yet

- PFRF MildsDocument31 pagesPFRF Mildsgerald lloyd sudarioNo ratings yet

- Sicaf-Operational-Manual (Sem Marca)Document33 pagesSicaf-Operational-Manual (Sem Marca)ElderSantosNo ratings yet

- Estácio: Material Fact - Developments in The Approval Process by CADE - Business Combination Between Estácio and KrotonDocument2 pagesEstácio: Material Fact - Developments in The Approval Process by CADE - Business Combination Between Estácio and KrotonEstacio Investor RelationsNo ratings yet

- Notification On Financial Reporting and Disclosure-20-6-2018Document7 pagesNotification On Financial Reporting and Disclosure-20-6-2018noor ahmadNo ratings yet

- Estácio: Material Fact - Aquisition of FATERNDocument1 pageEstácio: Material Fact - Aquisition of FATERNEstacio Investor RelationsNo ratings yet

- Non-Members With Accumulated Reserves and Undivided Net Savings of Not More Than Ten Million Pesos (P10,000,000.00)Document2 pagesNon-Members With Accumulated Reserves and Undivided Net Savings of Not More Than Ten Million Pesos (P10,000,000.00)Fairy Ann PeñanoNo ratings yet

- An Act Reforming The Corporate Income Tax and Incentives SystemDocument25 pagesAn Act Reforming The Corporate Income Tax and Incentives SystemMhaniell TorrejasNo ratings yet

- Swift Bylaws 202106 v2Document12 pagesSwift Bylaws 202106 v2Centro turistico Los rosalesNo ratings yet

- OGM - Management?s Proposal For The Allocation of Net Income 2014Document2 pagesOGM - Management?s Proposal For The Allocation of Net Income 2014MillsRINo ratings yet

- Call NoticeDocument2 pagesCall NoticeJBS RINo ratings yet

- Blog Details Declaration and Payment of Dividend 20Document9 pagesBlog Details Declaration and Payment of Dividend 20Abhinay KumarNo ratings yet

- UntitledDocument2 pagesUntitledMillsRINo ratings yet

- R.A. No. 11534 Create LawDocument42 pagesR.A. No. 11534 Create LawJessa PuerinNo ratings yet

- Minutes of Board of Directors Meeting 07 13 2012Document10 pagesMinutes of Board of Directors Meeting 07 13 2012LightRINo ratings yet

- Citizens Manual No. 4Document4 pagesCitizens Manual No. 4anon_236743361No ratings yet

- Tax Reviewer General Principles by Rene CallantaDocument8 pagesTax Reviewer General Principles by Rene CallantarehnegibbNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Reinsurance Carrier Revenues World Summary: Market Values & Financials by CountryFrom EverandReinsurance Carrier Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Mercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryFrom EverandMercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Material FactDocument2 pagesMaterial FactEstacio Investor RelationsNo ratings yet

- Estacio - Material Fact 24/08/2017Document1 pageEstacio - Material Fact 24/08/2017Estacio Investor RelationsNo ratings yet

- Estacio - Notice To The Market 14.08Document1 pageEstacio - Notice To The Market 14.08Estacio Investor RelationsNo ratings yet

- Estácio: Notice To The Market - Early Debenture RedemptionDocument2 pagesEstácio: Notice To The Market - Early Debenture RedemptionEstacio Investor RelationsNo ratings yet

- Kroton Educacional S.A. Estácio Participações S.ADocument1 pageKroton Educacional S.A. Estácio Participações S.AEstacio Investor RelationsNo ratings yet

- Notice To The MarketDocument1 pageNotice To The MarketEstacio Investor RelationsNo ratings yet

- Estácio - 2Q17 InviteDocument1 pageEstácio - 2Q17 InviteEstacio Investor RelationsNo ratings yet

- Material Fact E P S.A. ("E: Stácio Articipações Stácio OmpanyDocument2 pagesMaterial Fact E P S.A. ("E: Stácio Articipações Stácio OmpanyEstacio Investor RelationsNo ratings yet

- Estácio: Material Fact - Developments in The Approval Process by CADE - Business Combination Between Estácio and KrotonDocument2 pagesEstácio: Material Fact - Developments in The Approval Process by CADE - Business Combination Between Estácio and KrotonEstacio Investor RelationsNo ratings yet

- Estácio: Notice To The Market - CADE (Antitrust Agency)Document1 pageEstácio: Notice To The Market - CADE (Antitrust Agency)Estacio Investor RelationsNo ratings yet

- Estácio: Notice To The Market - Sale of Material Shareholding Interest BrandesDocument3 pagesEstácio: Notice To The Market - Sale of Material Shareholding Interest BrandesEstacio Investor RelationsNo ratings yet

- Estácio: Notice To The Market - Sale of Material Shareholding Interest CoronationDocument3 pagesEstácio: Notice To The Market - Sale of Material Shareholding Interest CoronationEstacio Investor RelationsNo ratings yet

- Fundamentos de La Contabilidad de Coberturas: (Hedge Accounting)Document78 pagesFundamentos de La Contabilidad de Coberturas: (Hedge Accounting)doiNo ratings yet

- LC Draft Raw Cashew NutDocument5 pagesLC Draft Raw Cashew NutUDAYNo ratings yet

- Chapter-9 Ihrm Trends and Future ChallengesDocument2 pagesChapter-9 Ihrm Trends and Future ChallengesPreeti BhaskarNo ratings yet

- Calculate Project ROI Using NPV, IRR and Packback PeriodDocument5 pagesCalculate Project ROI Using NPV, IRR and Packback PeriodsapsrikaanthNo ratings yet

- Public RelationsDocument25 pagesPublic Relationssamy7541No ratings yet

- Overview of Indian Retail IndustryDocument7 pagesOverview of Indian Retail IndustryPurva AgrawalNo ratings yet

- Defining Entrepreneurship: by J. Barton Cunningham and Joe LischeronDocument18 pagesDefining Entrepreneurship: by J. Barton Cunningham and Joe LischeronDimas sandiNo ratings yet

- Bottleneck The GoalDocument15 pagesBottleneck The GoalSaumitr ChaturvediNo ratings yet

- INSE 6260 Software Quality Assurance: Prof. Rachida DssouliDocument27 pagesINSE 6260 Software Quality Assurance: Prof. Rachida Dssoulivivian12345No ratings yet

- Adopting Consultative Selling Best Practices GuideDocument15 pagesAdopting Consultative Selling Best Practices GuideDemand MetricNo ratings yet

- InfosysDocument2 pagesInfosystejumola250% (1)

- Field Assignment On Sales and Distribution Management of Pharma CompaniesDocument9 pagesField Assignment On Sales and Distribution Management of Pharma CompaniesAyyappa ReddyNo ratings yet

- Ch7 9 SolutionDocument16 pagesCh7 9 SolutionNikhil KaushikNo ratings yet

- GST Invoice Format in ExcelDocument57 pagesGST Invoice Format in ExcelJugaadi BahmanNo ratings yet

- Principles of Marketing Chapter1 NoteDocument5 pagesPrinciples of Marketing Chapter1 NoteQuazi Mahbub Hassan100% (3)

- Excel Trading Journal TemplateDocument23 pagesExcel Trading Journal TemplateramojiraNo ratings yet

- Greater Essex County District School Board Public Salary Disclosure 2016Document8 pagesGreater Essex County District School Board Public Salary Disclosure 2016windsorstarNo ratings yet

- Importance and Relevance of Documentation in AdvancesDocument13 pagesImportance and Relevance of Documentation in AdvancesShephard JackNo ratings yet

- Internal Control Questionnaire (ICQ) IndexDocument62 pagesInternal Control Questionnaire (ICQ) IndexrajsalgyanNo ratings yet

- Anmol Setia Project On New Scheme Launch by Present Govement Like Jhan Dhan and Bima Yojana - Undertaken in Oriental Bank of Commerce .Document87 pagesAnmol Setia Project On New Scheme Launch by Present Govement Like Jhan Dhan and Bima Yojana - Undertaken in Oriental Bank of Commerce .ANMOLNo ratings yet

- Go NegosyoDocument5 pagesGo NegosyoRonaldNo ratings yet

- LAW 123 Negotiable Instruments Finals ReviewerDocument7 pagesLAW 123 Negotiable Instruments Finals ReviewerTrinca Diploma100% (1)

- UriDocument40 pagesUrigauravNo ratings yet

- L1 Accounting LWB 2017 Answer Book PDFDocument88 pagesL1 Accounting LWB 2017 Answer Book PDFL PG0% (1)

- 1300 Verbos IrregularesDocument16 pages1300 Verbos IrregularesKaterinCoy0% (1)

Estácio: Material Fact - Third Issue of Debentures

Estácio: Material Fact - Third Issue of Debentures

Uploaded by

Estacio Investor RelationsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estácio: Material Fact - Third Issue of Debentures

Estácio: Material Fact - Third Issue of Debentures

Uploaded by

Estacio Investor RelationsCopyright:

Available Formats

ESTCIO PARTICIPAES S.A.

Publicly-held Company

Corporate Taxpayers ID (CNPJ) 08.807.432/0001-10

Company Registry (NIRE) 33.3.0028205-0

MATERIAL FACT

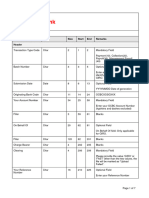

Estcio Participaes S.A. (Estcio or Company - Bovespa: ESTC3), in compliance with paragraph 4 of

Article 157 of Law 6,404/76 and CVM Instruction 358/02, as amended, hereby informs the market and public

in general that, on meeting held on August 20, 2015, the Companys Board of Directors approved the third

issue of simple, unsecured, non-convertible debentures, in a single series up to twenty-five thousand (25,000)

debentures, with a unit par value of ten thousand reais (R$10,000.00) (Unit Par Value), totaling, on the date

of issue, two hundred and fifty million reais (R$250,000,000.00) (Issue and Debentures, respectively), for

public distribution with restricted placement efforts, in accordance with CVM Instruction 476 of January 16,

2009, as amended (CVM Instruction 476 and Restricted Offering). The maturity date of the Issue is two

(2) years as of the issue date, except for the cases of: (i) cancellation of the Debentures; (ii) the offer of

anticipated redemption; and (iii) early maturity, under the terms of the Private Indenture of the Third (3rd)

Public Issue of Unsecured, Non-convertible Debentures, in a Single Series, for Distribution with Restricted

Placement Efforts, of Estcio Participaes S.A. (Indenture). The Issue is directed exclusively to qualified

investors, as defined in CVM Instruction 476.

The Unit Par Value of the Debentures will not be restated by any index. The Debentures will receive

remunerative interest corresponding to a certain percentage of the accrued variation in the average daily

rate of the DI one-day over extra-group rate, expressed as an annual percentage, based on a year of two

hundred and fifty-two (252) business days, calculated and published in the daily bulletin of CETIP S.A. Assets

and Derivatives OTC on its website (http://www.cetip.com.br) (DI Rates), plus a percentual surcharge, to

be defined according to the collection of investment intentions to be held before Qualified Investors, in any

case limited to one hundred and eight percent (108.00%) of the DI Rates (Compensatory Interest),

calculated exponentially and cumulatively, pro rata temporis, per business day, of the Unit Par Value since

the date of issue of the Debentures or the preceding date of payment of Compensatory Interest, whichever

is the latest, and paid at the end of each capitalization period until the due date, as defined in the Indenture.

The proceeds of the Issue will be used to strengthen the Companys cash position in order to fund its

expansion and investment policies. The Issue does not have any guarantee.

The minutes of the Board of Directors Meeting, which approved the Issue and the Restricted Offering, are

available on the Companys website and on the website of the Brazilian Securities and Exchange Commission.

This material fact is of an exclusively informative nature, pursuant to the prevailing legislation, and should

not be considered as an attempt to sell and/or disclosure the Debentures.

Rio de Janeiro, August 20, 2015.

Virglio Deloy Capobianco Gibbon

Chief Financial and Investor Relations Officer

You might also like

- GIRO - FAST WITH INV - V1.5 (With PayNow)Document7 pagesGIRO - FAST WITH INV - V1.5 (With PayNow)chriskhohkNo ratings yet

- Activity Based CostingDocument65 pagesActivity Based CostingOrko AbirNo ratings yet

- Shree CementDocument53 pagesShree CementRoma Pareek100% (3)

- HW2 Solution Key: Ricardian Model Problem 1Document9 pagesHW2 Solution Key: Ricardian Model Problem 1Mia KulalNo ratings yet

- Estácio: Material Fact - Issue of Simple, Unsecured, Non-Convertible DebenturesDocument2 pagesEstácio: Material Fact - Issue of Simple, Unsecured, Non-Convertible DebenturesEstacio Investor RelationsNo ratings yet

- Debntures 2011 INGLSDocument2 pagesDebntures 2011 INGLSMultiplan RINo ratings yet

- Estacio Comunicado Encerramento Oferta Publica 20141023 Eng PDFDocument1 pageEstacio Comunicado Encerramento Oferta Publica 20141023 Eng PDFEstacio Investor RelationsNo ratings yet

- Estácio: Notice To The Market - Early Debenture RedemptionDocument2 pagesEstácio: Notice To The Market - Early Debenture RedemptionEstacio Investor RelationsNo ratings yet

- M e S e S.ADocument149 pagesM e S e S.AMillsRINo ratings yet

- Ills Struturas E Erviços de NgenhariaDocument5 pagesIlls Struturas E Erviços de NgenhariaMillsRINo ratings yet

- Material FactDocument2 pagesMaterial FactEstacio Investor RelationsNo ratings yet

- Estacio Comunicado Esclarecimento Bovespa 20140521 EngDocument2 pagesEstacio Comunicado Esclarecimento Bovespa 20140521 EngEstacio Investor RelationsNo ratings yet

- Management Proposal Management and Audit Committee RemunerationDocument6 pagesManagement Proposal Management and Audit Committee RemunerationKlabin_RINo ratings yet

- Notice To Shareholders - Results of The Exercise of Preemptive Rights and First Additional Period For The Subscription of Unsubscribed SharesDocument5 pagesNotice To Shareholders - Results of The Exercise of Preemptive Rights and First Additional Period For The Subscription of Unsubscribed SharesMPXE_RINo ratings yet

- Notice To Shareholders - Payment of DividendsDocument2 pagesNotice To Shareholders - Payment of DividendsFibriaRINo ratings yet

- Notice To Shareholders: Private Capital Increase Decided by The Board of DirectorsDocument13 pagesNotice To Shareholders: Private Capital Increase Decided by The Board of DirectorsMultiplan RINo ratings yet

- Direct Taxes CircularDocument34 pagesDirect Taxes CircularratiNo ratings yet

- Dividend DistributionDocument2 pagesDividend DistributionFibriaRINo ratings yet

- IT Deductions Allowed Under Chapter VI-A Sec 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB Etc - APTEACHERS WebsiteDocument13 pagesIT Deductions Allowed Under Chapter VI-A Sec 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB Etc - APTEACHERS WebsiteKIMS IECNo ratings yet

- NCCPL Regulations Petaining To CGT PDFDocument10 pagesNCCPL Regulations Petaining To CGT PDFabby bendarasNo ratings yet

- Minutes of The Ordinary and Extraordinary Shareholders MeetingDocument15 pagesMinutes of The Ordinary and Extraordinary Shareholders MeetingFibriaRINo ratings yet

- Management's ProposalDocument266 pagesManagement's ProposalFibriaRINo ratings yet

- To The Members of The Board of Directors. From Mills Estruturas e Serviços de Engenharia S/ADocument2 pagesTo The Members of The Board of Directors. From Mills Estruturas e Serviços de Engenharia S/AMillsRINo ratings yet

- Republic Act NoDocument28 pagesRepublic Act NoAyen GarciaNo ratings yet

- CREATE Bill - Draft Enrolled Copy 02.16.21Document77 pagesCREATE Bill - Draft Enrolled Copy 02.16.21Joshua CustodioNo ratings yet

- Annex 30-XXXII of Instruction No. 480/09 of CVMDocument9 pagesAnnex 30-XXXII of Instruction No. 480/09 of CVMMillsRINo ratings yet

- Public Held Company Corporate Registry (NIRE) 33.3.0028974-7 Corporate Taxpayer's ID (CNPJ/MF) N.º 27.093.558/0001-15Document8 pagesPublic Held Company Corporate Registry (NIRE) 33.3.0028974-7 Corporate Taxpayer's ID (CNPJ/MF) N.º 27.093.558/0001-15MillsRINo ratings yet

- G.R. No. 108067, January 20, 2000Document8 pagesG.R. No. 108067, January 20, 2000AlexisNo ratings yet

- Termos SapDocument9 pagesTermos SapAnonymous 49Dl1oyzDr0% (1)

- Taxation: Far Eastern University - ManilaDocument4 pagesTaxation: Far Eastern University - ManilacamilleNo ratings yet

- SEC Manual On Registration of SecuritiesDocument10 pagesSEC Manual On Registration of SecuritiesGeoanne Battad Beringuela100% (1)

- Annual Shareholders' Meeting 04.18.2016 - Summary Statement Sent by The Central DepositoryDocument2 pagesAnnual Shareholders' Meeting 04.18.2016 - Summary Statement Sent by The Central DepositoryBVMF_RINo ratings yet

- Create LawDocument42 pagesCreate LawMark Efren RamasNo ratings yet

- Orporate Axpayers Orporate EgistryDocument10 pagesOrporate Axpayers Orporate EgistryMillsRINo ratings yet

- Estácio: Material Fact - Order Issued by CADEDocument1 pageEstácio: Material Fact - Order Issued by CADEEstacio Investor RelationsNo ratings yet

- Section 80P - Deduction For Co-Operative SocietiesDocument15 pagesSection 80P - Deduction For Co-Operative SocietiesSURESHNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 40-2004 Issued On July 1, 2004Document2 pagesREVENUE MEMORANDUM CIRCULAR NO. 40-2004 Issued On July 1, 2004Kyrzen NovillaNo ratings yet

- Tax Incentives 10708Document5 pagesTax Incentives 10708Hib Atty TalaNo ratings yet

- BVMF Presentation - March 2009Document67 pagesBVMF Presentation - March 2009BVMF_RINo ratings yet

- Estácio: Notice To The Market - Policy For Related Party TransactionsDocument1 pageEstácio: Notice To The Market - Policy For Related Party TransactionsEstacio Investor RelationsNo ratings yet

- Ezion Holdings LimitedDocument5 pagesEzion Holdings Limitedopenid_b9jhTbHKNo ratings yet

- Section 80CCD (1B) Deduction - About NPS Scheme & Tax BenefitsDocument7 pagesSection 80CCD (1B) Deduction - About NPS Scheme & Tax BenefitsP B ChaudharyNo ratings yet

- Zain KSA ProspectusDocument249 pagesZain KSA ProspectusMohd RashdanNo ratings yet

- PFRF MildsDocument31 pagesPFRF Mildsgerald lloyd sudarioNo ratings yet

- Sicaf-Operational-Manual (Sem Marca)Document33 pagesSicaf-Operational-Manual (Sem Marca)ElderSantosNo ratings yet

- Estácio: Material Fact - Developments in The Approval Process by CADE - Business Combination Between Estácio and KrotonDocument2 pagesEstácio: Material Fact - Developments in The Approval Process by CADE - Business Combination Between Estácio and KrotonEstacio Investor RelationsNo ratings yet

- Notification On Financial Reporting and Disclosure-20-6-2018Document7 pagesNotification On Financial Reporting and Disclosure-20-6-2018noor ahmadNo ratings yet

- Estácio: Material Fact - Aquisition of FATERNDocument1 pageEstácio: Material Fact - Aquisition of FATERNEstacio Investor RelationsNo ratings yet

- Non-Members With Accumulated Reserves and Undivided Net Savings of Not More Than Ten Million Pesos (P10,000,000.00)Document2 pagesNon-Members With Accumulated Reserves and Undivided Net Savings of Not More Than Ten Million Pesos (P10,000,000.00)Fairy Ann PeñanoNo ratings yet

- An Act Reforming The Corporate Income Tax and Incentives SystemDocument25 pagesAn Act Reforming The Corporate Income Tax and Incentives SystemMhaniell TorrejasNo ratings yet

- Swift Bylaws 202106 v2Document12 pagesSwift Bylaws 202106 v2Centro turistico Los rosalesNo ratings yet

- OGM - Management?s Proposal For The Allocation of Net Income 2014Document2 pagesOGM - Management?s Proposal For The Allocation of Net Income 2014MillsRINo ratings yet

- Call NoticeDocument2 pagesCall NoticeJBS RINo ratings yet

- Blog Details Declaration and Payment of Dividend 20Document9 pagesBlog Details Declaration and Payment of Dividend 20Abhinay KumarNo ratings yet

- UntitledDocument2 pagesUntitledMillsRINo ratings yet

- R.A. No. 11534 Create LawDocument42 pagesR.A. No. 11534 Create LawJessa PuerinNo ratings yet

- Minutes of Board of Directors Meeting 07 13 2012Document10 pagesMinutes of Board of Directors Meeting 07 13 2012LightRINo ratings yet

- Citizens Manual No. 4Document4 pagesCitizens Manual No. 4anon_236743361No ratings yet

- Tax Reviewer General Principles by Rene CallantaDocument8 pagesTax Reviewer General Principles by Rene CallantarehnegibbNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Reinsurance Carrier Revenues World Summary: Market Values & Financials by CountryFrom EverandReinsurance Carrier Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Mercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryFrom EverandMercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Material FactDocument2 pagesMaterial FactEstacio Investor RelationsNo ratings yet

- Estacio - Material Fact 24/08/2017Document1 pageEstacio - Material Fact 24/08/2017Estacio Investor RelationsNo ratings yet

- Estacio - Notice To The Market 14.08Document1 pageEstacio - Notice To The Market 14.08Estacio Investor RelationsNo ratings yet

- Estácio: Notice To The Market - Early Debenture RedemptionDocument2 pagesEstácio: Notice To The Market - Early Debenture RedemptionEstacio Investor RelationsNo ratings yet

- Kroton Educacional S.A. Estácio Participações S.ADocument1 pageKroton Educacional S.A. Estácio Participações S.AEstacio Investor RelationsNo ratings yet

- Notice To The MarketDocument1 pageNotice To The MarketEstacio Investor RelationsNo ratings yet

- Estácio - 2Q17 InviteDocument1 pageEstácio - 2Q17 InviteEstacio Investor RelationsNo ratings yet

- Material Fact E P S.A. ("E: Stácio Articipações Stácio OmpanyDocument2 pagesMaterial Fact E P S.A. ("E: Stácio Articipações Stácio OmpanyEstacio Investor RelationsNo ratings yet

- Estácio: Material Fact - Developments in The Approval Process by CADE - Business Combination Between Estácio and KrotonDocument2 pagesEstácio: Material Fact - Developments in The Approval Process by CADE - Business Combination Between Estácio and KrotonEstacio Investor RelationsNo ratings yet

- Estácio: Notice To The Market - CADE (Antitrust Agency)Document1 pageEstácio: Notice To The Market - CADE (Antitrust Agency)Estacio Investor RelationsNo ratings yet

- Estácio: Notice To The Market - Sale of Material Shareholding Interest BrandesDocument3 pagesEstácio: Notice To The Market - Sale of Material Shareholding Interest BrandesEstacio Investor RelationsNo ratings yet

- Estácio: Notice To The Market - Sale of Material Shareholding Interest CoronationDocument3 pagesEstácio: Notice To The Market - Sale of Material Shareholding Interest CoronationEstacio Investor RelationsNo ratings yet

- Fundamentos de La Contabilidad de Coberturas: (Hedge Accounting)Document78 pagesFundamentos de La Contabilidad de Coberturas: (Hedge Accounting)doiNo ratings yet

- LC Draft Raw Cashew NutDocument5 pagesLC Draft Raw Cashew NutUDAYNo ratings yet

- Chapter-9 Ihrm Trends and Future ChallengesDocument2 pagesChapter-9 Ihrm Trends and Future ChallengesPreeti BhaskarNo ratings yet

- Calculate Project ROI Using NPV, IRR and Packback PeriodDocument5 pagesCalculate Project ROI Using NPV, IRR and Packback PeriodsapsrikaanthNo ratings yet

- Public RelationsDocument25 pagesPublic Relationssamy7541No ratings yet

- Overview of Indian Retail IndustryDocument7 pagesOverview of Indian Retail IndustryPurva AgrawalNo ratings yet

- Defining Entrepreneurship: by J. Barton Cunningham and Joe LischeronDocument18 pagesDefining Entrepreneurship: by J. Barton Cunningham and Joe LischeronDimas sandiNo ratings yet

- Bottleneck The GoalDocument15 pagesBottleneck The GoalSaumitr ChaturvediNo ratings yet

- INSE 6260 Software Quality Assurance: Prof. Rachida DssouliDocument27 pagesINSE 6260 Software Quality Assurance: Prof. Rachida Dssoulivivian12345No ratings yet

- Adopting Consultative Selling Best Practices GuideDocument15 pagesAdopting Consultative Selling Best Practices GuideDemand MetricNo ratings yet

- InfosysDocument2 pagesInfosystejumola250% (1)

- Field Assignment On Sales and Distribution Management of Pharma CompaniesDocument9 pagesField Assignment On Sales and Distribution Management of Pharma CompaniesAyyappa ReddyNo ratings yet

- Ch7 9 SolutionDocument16 pagesCh7 9 SolutionNikhil KaushikNo ratings yet

- GST Invoice Format in ExcelDocument57 pagesGST Invoice Format in ExcelJugaadi BahmanNo ratings yet

- Principles of Marketing Chapter1 NoteDocument5 pagesPrinciples of Marketing Chapter1 NoteQuazi Mahbub Hassan100% (3)

- Excel Trading Journal TemplateDocument23 pagesExcel Trading Journal TemplateramojiraNo ratings yet

- Greater Essex County District School Board Public Salary Disclosure 2016Document8 pagesGreater Essex County District School Board Public Salary Disclosure 2016windsorstarNo ratings yet

- Importance and Relevance of Documentation in AdvancesDocument13 pagesImportance and Relevance of Documentation in AdvancesShephard JackNo ratings yet

- Internal Control Questionnaire (ICQ) IndexDocument62 pagesInternal Control Questionnaire (ICQ) IndexrajsalgyanNo ratings yet

- Anmol Setia Project On New Scheme Launch by Present Govement Like Jhan Dhan and Bima Yojana - Undertaken in Oriental Bank of Commerce .Document87 pagesAnmol Setia Project On New Scheme Launch by Present Govement Like Jhan Dhan and Bima Yojana - Undertaken in Oriental Bank of Commerce .ANMOLNo ratings yet

- Go NegosyoDocument5 pagesGo NegosyoRonaldNo ratings yet

- LAW 123 Negotiable Instruments Finals ReviewerDocument7 pagesLAW 123 Negotiable Instruments Finals ReviewerTrinca Diploma100% (1)

- UriDocument40 pagesUrigauravNo ratings yet

- L1 Accounting LWB 2017 Answer Book PDFDocument88 pagesL1 Accounting LWB 2017 Answer Book PDFL PG0% (1)

- 1300 Verbos IrregularesDocument16 pages1300 Verbos IrregularesKaterinCoy0% (1)