Professional Documents

Culture Documents

PDF Processed With Cutepdf Evaluation Edition

PDF Processed With Cutepdf Evaluation Edition

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDF Processed With Cutepdf Evaluation Edition

PDF Processed With Cutepdf Evaluation Edition

Uploaded by

Shyam SunderCopyright:

Available Formats

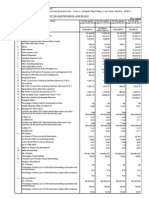

YUKEN INDIA LIMITED

Regd. Office: P B No. 16, Whitefield Road, Whitefield,

Bangalore 560 066, India.

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER & NINE MONTHS ENDED

31ST DECEMBER 2014

CIN : L29150KA1976PLC003017

PART-I

Sl

no

Rs. in lakhs

Description

1 Income from operations

Net sales / Income from operations (Net of Excise duty)

2 Expenditure:

a) Cost of materials consumed

b) Purchase of stock-in-trade

c) Changes in inventories of finished goods, work - in-progress and stock-in-trade

d) Employee benefits expense

e) Depreciation and amortisation expense

f) Other expenses

Total expenses

3 months ended

31/12/2014

Preceding

3 months ended

30/09/2014

(Unaudited)

(Unaudited)

8

9

10

11

12

13

14

1

2

9 months ended

31/12/2014

(Unaudited)

Corresponding

9 months ended

31/12/2013 in the

previous year

(Unaudited)

Previous year

ended 31.03.2014

(Audited)

4,524.91

4,713.83

4,210.34

13,012.67

11,191.26

16,448.62

2,270.16

9.25

2,431.90

2.97

2,249.55

2.49

6,744.21

14.98

5,726.32

17.02

8,476.64

22.66

(32.92)

(107.79)

(226.39)

(305.56)

795.11

110.98

1,214.47

4,399.91

(0.06)

836.08

112.34

1,283.13

4,595.05

673.18

108.02

1,122.35

4,122.67

2,401.36

333.22

3,640.75

13,026.73

1,948.19

323.91

3,197.28

10,986.32

2,836.31

431.34

4,560.98

16,022.37

125.00

118.78

87.67

(14.06)

204.94

426.25

3 Profit/(Loss) from Operations before Other Income& finance costs (1-2)

4

5

6

7

Corresponding

3 months ended

31/12/2013 in the

previous year

(Unaudited)

(71.37)

10.38

21.21

14.74

49.07

44.23

63.67

Other Income

Profit from ordinary activities before finance costs ( 3+4)

135.38

139.99

102.41

35.01

249.17

489.92

107.20

108.02

90.42

312.40

279.05

375.79

Finance costs

Profit/(Loss) from ordinary activities after finance costs but before

28.18

31.97

11.99

(277.39)

(29.88)

114.13

exceptional item and tax expense (5-6)

Exceptional Item

200.59

200.59

200.59

Profit/(Loss) before tax expense (7+8)

28.18

31.97

212.58

(277.39)

170.71

314.72

3.77

6.95

25.41

(95.50)

12.95

60.98

Tax expense (Net)

Net Profit/(Loss) for the period (9-10)

24.41

25.02

187.17

(181.89)

157.76

253.74

300.00

Paid up equity share capital (Rs. 10/- per share)

Reserves excluding revaluation reserves as per balance sheet of previous

5,178.52

accounting year

Earnings/(Loss) Per Share (Rs.) before extraordinary items (of Rs.10 /- each)

not annualised

0.81

0.83

6.24

(6.06)

5.26

8.46

a) Basic

0.81

0.83

6.24

(6.06)

5.26

8.46

b)Diluted

Earnings/(Loss) Per Share (Rs.) after extraordinary items (of Rs.10 /- each) not

annualised

0.81

0.83

6.24

(6.06)

5.26

8.46

a) Basic

0.81

0.83

6.24

(6.06)

5.26

8.46

b) Diluted

See accompanying notes to the financial results

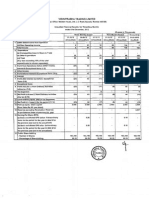

PART - II

Particulars Of Shareholding

Public share holding

a)Number of shares

1,423,718

1,423,718

1,423,718

1,423,718

1,423,718

1,423,718

47.46

47.46

47.46

47.46

47.46

47.46

b)Percentage of share holding

Promoters and Promoter group Shareholding

a) Pledged/Encumbered

- No. of Shares

- Percentage of shares (as a % of the total shareholding of promoter and

promoter group)

- Percentage of shares (as a % of the total share capital of the Company)

b) Non-Encumbered

- No. of Shares

1,576,282

1,576,282

1,576,282

1,576,282

1,576,282

1,576,282

- Percentage of shares (as a % of the total shareholding of promoter and

100.00

100.00

100.00

100.00

100.00

100.00

promoter group)

52.54

52.54

52.54

52.54

52.54

52.54

- Percentage of shares (as a % of the total share capital of the Company)

Notes :

The above unaudited results for the quarter and nine months ended 31 December, 2014 have been reviewed by the Audit Committee and approved by the Board of Directors at its meeting held on 07th

February,2015

Information on investor complaints pursuant to Clause 41 of the Listing Agreement for the quarter ended 31st December 2014

Nature of complaints received

1. Non receipt of Share Certificates

2. Non receipt of Dividend Warrants

3. Non receipt of Annual Report

4. Complaint from Stock Exchange / SEBI

TOTAL

3 Previous period figures have been re-grouped/reclassified wherever necessary.

Opening Balance

as on 01.10.2014

Received

Disposal

Closing Balance as

on 31.12.2014

0

0

0

0

0

0

2

0

0

2

0

2

0

0

2

0

0

0

0

0

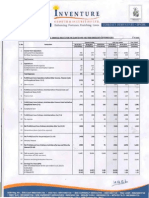

Unaudited Segment-wise Revenue, Results and Capital Employed for the Nine monhts ended 31st December, 2014

(Rs. in lakhs)

Particulars

3 months ended

31/12/2014

1 Segment Revenue (Sales and Other operating income)

(a) Hydraulic Business

(b) Other Business

(c) Unallocated Income

Total Segment Revenue

Less: Inter Segment Revenue

Net Segment Revenue

2 Segment Results (Profit before tax and interest from ordinary activities)

(a) Hydraulic Business

(b) Other Business

Total Segment Results

Less: Finance Costs

Add/(Less): Other unallocable income net of unallocable expenditure

Total Profit/(Loss) before tax expense

3 Total Capital Employed (Segment assets less Segment liabilities)

4,002.94

645.73

3.44

4,652.11

116.82

4,535.29

665.91

(141.23)

524.68

107.20

(389.30)

28.18

5,296.63

Preceding

3 months ended

30/09/2014

9 months ended

31/12/2014

4,167.02

817.36

16.73

5,001.11

266.07

4,735.04

602.28

(202.99)

399.29

108.02

(259.30)

31.97

5,272.22

Notes on Segment Information

1. Segment Revenue, Results represent amounts identifiable to each of the segments. Other unallocable income net of unallocable expenditure mainly includes interest,

dividend, gain on sale of investments (net), expenses on common services not directly identifiable to individual segments and corporate expenses.

2. There is no segmentwise bifurcation of Assets & Liabilities for Hydraulic Business and Other Business. Assets & Liabilities of the Company are jointly used by all segments.

3.The segment information is being presented in the manner above, for the first year by the Company, accordingly comparable information relating to the corresponding to

quarter of the previous year and for the year ended 31st March 2014 were not available and hence not presented.

By Order of the Board of Directors

Place : Bangalore

Date: 07th February,2015

PDF processed with CutePDF evaluation edition www.CutePDF.com

C P Rangachar

Managing Director

11,545.39

2,114.20

24.44

13,684.03

622.29

13,061.74

1,586.75

(516.76)

1,069.99

312.40

(1,034.98)

(277.39)

5,296.63

You might also like

- Netscape Case SolutionDocument6 pagesNetscape Case SolutionMaksym Malovichko60% (5)

- Accounting: Making Sound Decisions: Non-Current AssetsDocument2 pagesAccounting: Making Sound Decisions: Non-Current AssetsAniruddha Rantu40% (5)

- Product Pricing Recommendation: Acme Pickle Company Capella UniversityDocument9 pagesProduct Pricing Recommendation: Acme Pickle Company Capella UniversitydanielNo ratings yet

- Chapter 2 and SolutionsDocument6 pagesChapter 2 and Solutionsgeo_biNo ratings yet

- RJR Nabisco Harshavardhan 2015PGP254Document18 pagesRJR Nabisco Harshavardhan 2015PGP254Harsha Vardhan100% (1)

- Financial Accounting Problems: Problem I (Current Assets)Document21 pagesFinancial Accounting Problems: Problem I (Current Assets)Fery AnnNo ratings yet

- Chapter 11. Solution of Problems PDFDocument26 pagesChapter 11. Solution of Problems PDFMicha Maalouly100% (1)

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- Avt Naturals (Qtly 2012 12 31)Document1 pageAvt Naturals (Qtly 2012 12 31)Karl_23No ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Fin Resu Dec 12Document1 pageFin Resu Dec 12Adil SiddiquiNo ratings yet

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Document1 pageIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- $&C +$C CCCCCCCCCDocument4 pages$&C +$C CCCCCCCCCAlok SinghalNo ratings yet

- SEBI Results Mar13Document2 pagesSEBI Results Mar13Mansukh Investment & Trading SolutionsNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- HUL MQ 12 Results Statement - tcm114-286728Document3 pagesHUL MQ 12 Results Statement - tcm114-286728Karunakaran JambunathanNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Result)Document5 pagesFinancial Results & Limited Review For Dec 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Analysis of Apollo TiresDocument12 pagesAnalysis of Apollo TiresTathagat ChatterjeeNo ratings yet

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- Bil Quarter 2 ResultsDocument2 pagesBil Quarter 2 Resultspvenkatesh19779434No ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For December 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For December 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- MSSL Results Quarter Ended 31st December 2011Document4 pagesMSSL Results Quarter Ended 31st December 2011kpatil.kp3750No ratings yet

- Avt Naturals (Qtly 2010 03 31) PDFDocument1 pageAvt Naturals (Qtly 2010 03 31) PDFKarl_23No ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Audited Results 31.3.2012 TVSMDocument2 pagesAudited Results 31.3.2012 TVSMKrishna KrishnaNo ratings yet

- Unaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Document1 pageUnaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Amar Mourya MouryaNo ratings yet

- Sebi Million Q3 1213 PDFDocument2 pagesSebi Million Q3 1213 PDFGino SunnyNo ratings yet

- Result Q-1-11 For PrintDocument1 pageResult Q-1-11 For PrintSagar KadamNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Results Q1FY11 12Document1 pageResults Q1FY11 12rao_gsv7598No ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document11 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Userfiles Financial 6fDocument2 pagesUserfiles Financial 6fTejaswini SkumarNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- MRF PNL BalanaceDocument2 pagesMRF PNL BalanaceRupesh DhindeNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Reliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003Document3 pagesReliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003ak47ichiNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Afm PDFDocument5 pagesAfm PDFBhavani Singh RathoreNo ratings yet

- Ajooni BiotechDocument21 pagesAjooni BiotechSunny RaoNo ratings yet

- Unaudited Financial Results For The Quarter Ended 30Th June, 2011Document1 pageUnaudited Financial Results For The Quarter Ended 30Th June, 2011Ayush JainNo ratings yet

- Alok - Performance Report - q4 2010-11Document24 pagesAlok - Performance Report - q4 2010-11Krishna VaniaNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Statement of Assets & Liabilties As On September 30, 2016 (Result)Document2 pagesStatement of Assets & Liabilties As On September 30, 2016 (Result)Shyam SunderNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 2-Harga Pokok ProduksiDocument32 pages2-Harga Pokok ProduksiMuhammad Fadhil C100% (2)

- Session 5 NewDocument79 pagesSession 5 NewFasih RehmanNo ratings yet

- Comparable Company Analysis - 1Document8 pagesComparable Company Analysis - 1mohd shariqNo ratings yet

- Smes - Assets Inventories Basic Financial Instruments Investment in Associate Investment PropertyDocument21 pagesSmes - Assets Inventories Basic Financial Instruments Investment in Associate Investment PropertyToni Rose Hernandez LualhatiNo ratings yet

- Rethinking Revenue Recognition Fakultt FR Betriebswirtschaft - CompressDocument37 pagesRethinking Revenue Recognition Fakultt FR Betriebswirtschaft - CompressMafaza NadaNo ratings yet

- Screenshot 2023-10-15 at 6.04.05 PMDocument7 pagesScreenshot 2023-10-15 at 6.04.05 PMshughandeepsingh100% (1)

- Accounting For Investment SecuritiesDocument9 pagesAccounting For Investment Securitiesxpac_53No ratings yet

- Parcor 001Document16 pagesParcor 001Vincent Larrie Moldez0% (2)

- 2017 2016 2015 2014 2013 2012 Gross Carrying AmountDocument3 pages2017 2016 2015 2014 2013 2012 Gross Carrying AmountAli OptimisticNo ratings yet

- Exam - SHE, RE & Share Based CompensationDocument4 pagesExam - SHE, RE & Share Based CompensationJohnAllenMarilla100% (2)

- FUN ACC Elements of The FInancial StatementsDocument4 pagesFUN ACC Elements of The FInancial StatementsFranchesca CalmaNo ratings yet

- Dividend Policy in 2010Document6 pagesDividend Policy in 2010Manoj0% (2)

- Intercorporate Acquisitions and Investments in Other EntitiesDocument56 pagesIntercorporate Acquisitions and Investments in Other EntitiesErawati KhusnulNo ratings yet

- IA 1 - Chapter 6 Notes Receivable Problems Part 2Document11 pagesIA 1 - Chapter 6 Notes Receivable Problems Part 2John CentinoNo ratings yet

- Audit Ppe 1Document2 pagesAudit Ppe 1ellaNo ratings yet

- Mcs 35 SyllabusDocument3 pagesMcs 35 SyllabusSebastianNo ratings yet

- Property BRRR Model v1Document9 pagesProperty BRRR Model v1Trịnh Minh TâmNo ratings yet

- Accounting Is The Process of Keeping Track of A Business' FinancesDocument52 pagesAccounting Is The Process of Keeping Track of A Business' FinancesJowjie TV100% (1)

- BBPW3203 930312085578002Document15 pagesBBPW3203 930312085578002KomaljitNo ratings yet

- Example To Accompany Tutorial 6 Walker Sweets Inc. (WSI) (Statement of Income and Statement of Financial Position)Document2 pagesExample To Accompany Tutorial 6 Walker Sweets Inc. (WSI) (Statement of Income and Statement of Financial Position)richelyn velardeNo ratings yet

- Chap 2Document10 pagesChap 2Houn Pisey100% (1)

- Acc Q4Document9 pagesAcc Q4risvana rahimNo ratings yet

- Accounting Principles and Procedures m001 PDFDocument2 pagesAccounting Principles and Procedures m001 PDFUmer BhuttaNo ratings yet