Professional Documents

Culture Documents

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

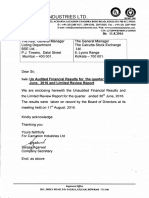

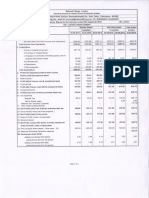

ffi;;; il;;t Exchanse Limited,

MUMBAI

SIMRAN FARMS tTD.:- 519566

(cr N r0l 222MPl 9UPLC@2627)

UNAUDITED FINANCIAL RESULTS (Reviewed) FOR THE QUARTER ENDED oN 30.09.2014

Rs, ln Lacs

Porliculors

Review

l. lo)Nel Soles/lncome from Operolions

0231.3(

l.lt

lb)Other Operoling Income

f.l Tdldl

2.

10232.45

Quorler Ended

30-lun-14

3O-Seo-13

Review

Review

9828. 7C

031

8961.9

0.6

4962

?42?

tear Ended

Holf Yeor Ended

30-Seo-14

Review

Review

20060.0(

16412.Ot

Audited

35970.7r

l?

15(

0.6(

20061 -5(

16412.7i

35972,11

Expenses

8983.7r

82s2.91

7320.3(

L7 z5b.bc

13456.52

29624.62

240.11

28.80

1111.25

240.14

183.0(

802.55

34.24

1209.2(

t293.2!

440.24

73.7e

2620,57

377.rt

41.91

2344.51

5205.O7

10663.87

9747,32

8830.85

2o4tt,ts

16243.s8

35764.O5

(4:'r.381

81.6r

131.7;

(349.691

I 69.r

208.0(

(431-34'

81.6t

l3l.7i

(34?.6

40

90.8;

I 69.1;

59

(508.29'

69.7!

I 1.9

(4?6.34

1r0.01

208.0(

123

84.6

(196.35

I10.01

44.6i

22.01

22.1

(496.35

88.0(

62.5t

(o)Consumption of row moieriols

(blChonges in invenlories of finished goods

(c) Employees benefif expenses

{d)Depreciofion

(e)Olher expenses

(e)Totol

of,.Ji

l3l

.81

(Any ifem exceeding l0% of fhe totol expendiiure io be

cha*,n <aXnrnlahn

3. Profit from Operolions before Other Income.

finonce cost

ond Exceolionol llems ll-21

4. Other Income

). rrolrl oelore ltnonce cosr ono Excepllonol lrems lJ+41

6 Finonce cosl

7. Profilofter finonce cosf buf before Exceplionol llems (5-6)

I Exceolionol ilems

. Proltl l+l/ Loss l-l lrom ordtnory AcTrvrlres Delore lox l/+ul

0. Tox exoense lCunenl)/Deffred

I l. Nel Protil l+l/ Loss l-l lrom

Ordinory Aclivilies ofler tox l9-10)

12. Exlroordinorv llems

3. Nel Proltll+l/ Lossl-l lor fne penoo | | r- rzl

4. Mtnonly Inreresl

5. Nel l'rotti{+l/ Lossl-l oner Mtnonty Inleresl I lJ- l4

16. Poid-up equily shore copilol

lFoce Volue of lhe Shore sholl be indicoted)

17. Reserves excluding Revoluofion Reserves os per

bolonce sheet of previous occounlino yeor

18. Eornings Pershore (Et',s) | ol Rs. l0eochl

Bosic ond diluled EPS before Exceptionol ilems

Bosic ond diluted EPS ofter Exceplionol items

I

9. Public shoreholding

- Number of Shores

- Perceniooe of Shoreholdino

10. Promolers ond promoler group

Shoreholding

lo) Pledged/Encumbered

- Number of shores

- Percenfoge of shores (os o % of fhe

promoter ond promoter group)

- Percenfoge of shores (os o% of the

the componyl

(bl Non-encumbered

- Number of Shores

- Percentoge of shores los o% of ihe

promoier ond promoler groupl

- Percenloge of shores {os o % of fhe

00(

(508.29'

l't.9r

90.8:

12.24

18.36

(506.0r

2.2t

9.6{

(506.01

9.66

72.51

(496_35

88.00

62.54

(506.01

9.66

72.51

(496.3s'

88.00

62 54

72.51

0.00

379.|t

379.17

379.t7

379.L7

5t9.L/

1147.61

3.35

3.35

0.2!

0.2!

t.9l

t.9l

(r3.0el

23t

23t

l .61

{r 3.0el

2385650

238s6s0

23847oC

238s6s0

2384700

62,92o/c

62.92o/a

62-89o/t

62.92o/o

62.89o/o

238565C

62-92o/t

(r

(r

NI

NI

*1

t.6:

lotol shoreholding of

tolol shore copilol of

4060s(

1@2

1406050

l/t0700C

't40605(

1007<

100%

1406050

1@%

140700(

lolol shoreholding of

1@%

1007,

lotol shore copiiol of

37.O8?,

37.@7,

37.117<

37.@%

37.11V

lhe comoonvl

Received during the quarter

Disposed of during the quartel

unresolved at the end of the

4

4

o

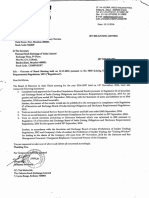

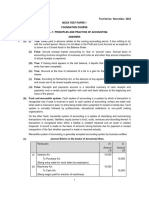

1. Above Unaudited Financial Results were reviewed by Audit Committee and approved by Board of Directors

in their meeting held on 14th November 2014

2, The Company has been primarily engaged in Poultry Breeding & Farming activities only. As such there is

no separate segment under Accounting Standard -AS 17 on segment reporting

3. During the period the company incurred losses due to lower realization from sale of grown up birds due to

market fluctuation.

4. Depreciation fo. the quarter has been charged on the basis ofthe useful life and the lates being followed upto

31st March 2014. since estimation of the remaining useful life of all assets as required in the companies act 2013

is in process difference if any will be recognised in due course

5, These figures are stand alone figures as they do not includes the figures of subsidiary Company

M/s, Pulegene Biotech Limited.

5. The deffred tax will be calculated at the end of year.

7, The statuary auditors have carried out a limited review of the lesult for quarter ended 3oth Sep. 2014

PDF Place:

processed

with CutePDF evaluation edition www.CutePDF.com

INDORE

Date : 14th November 2014

379,17

37.O8?,

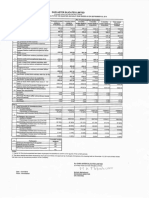

SIMRAN FARMS LIMITED:- 519566

(cr N L01 222MPl 984PLC0026271

Reg. Office 1-B, Vikash Rekha Complex Tower Square Indore- 452001

Unaudited (Review) Statement of Assets Liabilities as on September 30, 2014

(Rs. In Lacs except per share data)

Standalone

Particulars

30. September 2014

31, March 2014

Unaudited

Audited

EQUITY AND LIABILITIES

Shareholders' funds

(a) Share capital

(b) Reserves and surplus

(c) Minority interest

379.17

379.17

667.43

1147.64

046.60

1526.81

648.94

169.15

Non-current I iabilities

(a) Long term borrowings

(b) Deferred tax liabilities (net)

(d) Long-term provisions

10.88

10.88

73.43

73.43

833.25

353.46

Current liabilities

(a) Short term borrowing

(b) Trade payables

(c) Other current liabilities

(d) Shortterm provisions

1979.70

490.55

7182.81

5607.33

155.42

651.01

185.07

171.56

9503.00

6920.45

11382.85

8800.70

1505.91

1395.00

65.03

22.57

131.54

131.54

62.21

62.34

1764.69

1611.45

(a) Inventories

7243.10

5561.95

(b) Trade receivables

1474.47

1236.39

rOTAL EQUITY AND LIABILITIES

qSSETS

\|on-current assets

(a) Fixed assets

(i) Tangible assets

(ii) Capital work-in-progress

(b) Non current investment

(c) Long term loans and advances

Surrent assets

(c) Cash and bank balances

(d) Shortterm loans and advances

rOTAL ASSETS

448.72

150.99

451.87

239.92

961 8.1 6

7189.25

1382.85

8800.70

Simran Farms limited

lr

ll

fl+.atrv(r-,t-

Place: INDORE

Date : 14th November 2014

(H.S. Bhatia)

Managing Director

KAKANI & COM

D ACCOUNTANTS

8, Johari Palace, First Floor, 51 M. G. Road,

INDORE _ 452 001

Phone : 07 91 - 2S,t A269, 2529539 f ax : Ot gl _

+0420 1 9

E-mail : kkc@cakhanderwarkakani.coL o kkc_inoore@

rediffmair.com

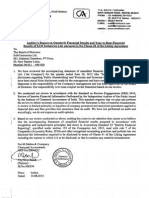

LIMITED REVIEW REPORT

we have reviewed the accompanying statement

of unaudited financial result of M/s simran

Farms Ltd' For the Quarter ended

30th septem ber, 2o!4 except for

the discrosure regarding

'Public shareholding' and Promoter

group of shareholding, which has

been traced from the

disclosure made by the management

and have not been audited by us. This

statement is

responsibility of the company's Management

and has been approved by the Board

of the

Directors' our responsibility is to issue

a report on

revtew.

these financial statements based on

our

we conducted our review in accordance

with the standard in Review Engagement

(sRE) 2410,

"Review of tnterim Financial

lnformotion Performed by the lndependent

Auditors of the Entity,,

issued by The Institute of chartered

Accountant. A Review of Interim Financiar

Information

consist of making enquiries, primarily

of persons responsible for financial and accounting

matters' and applying analytical and

other review procedures. A review is

substantiary ress in

the scope than an audit conducted

e with standards on auditing and

consequently

does not enable us to obtain assur

would become aware of all significant

matters

that might be id'entified in an audit.

we do not express an audit opinion.

Based on our Review conducted

as above, nothing has come to our

notice that caused us to

believe that the accompanying

statement of unaudited financial result prepared

in accordance

with Accounting standard and other recognized

accounting practices and policies,

has not

disclosed the information required

to be disclosed in terms of clause 41. of Listing

Agreement

including the manner in which it is

to be disclosed, orthat it contains materiar

misstatement.

Place: Indore

For Khandelwal Kakani& Co.

Date: 14.11.2OL4

(Chartered Accountants)

F.R.No. 001311C

CA V,K Khandelwal

(Partner)

M.No.070546

You might also like

- Pittman Company Is A Small But Growing Manufacturer of Telecommunications Equipment.Document12 pagesPittman Company Is A Small But Growing Manufacturer of Telecommunications Equipment.Kailash KumarNo ratings yet

- AKPK Power - Chapter 2 - Borrowing BasicsDocument20 pagesAKPK Power - Chapter 2 - Borrowing BasicsEncik Anif100% (1)

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2014 (Result)Document4 pagesFinancial Results & Limited Review For March 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Consolidated Financial StatementsDocument78 pagesConsolidated Financial StatementsAbid HussainNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results & Limited Review Report For The Quarter Ended December 31, 2015 (Result)Document5 pagesAnnounces Q3 Results & Limited Review Report For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q1 (Standalone) Results, Limited Review Report (Standalone) & Results Press Release For The Quarter Ended June 30, 2016 (Result)Document4 pagesAnnounces Q1 (Standalone) Results, Limited Review Report (Standalone) & Results Press Release For The Quarter Ended June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document4 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Dhompur: 'I.), (LL (RiDocument7 pagesDhompur: 'I.), (LL (RiShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- KFA - Published Unaudited Results - Sep 30, 2011Document3 pagesKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2015 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document1 pageFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Escort FinalDocument77 pagesEscort FinalHaridas GoyalNo ratings yet

- Corporate-Entity-Piercing-Corporate-Veil New YorkDocument29 pagesCorporate-Entity-Piercing-Corporate-Veil New YorkDavid AlejandroNo ratings yet

- Retirement BenefitsDocument8 pagesRetirement Benefitsramineedi6No ratings yet

- Audit CommitteeDocument4 pagesAudit CommitteeAnkit SharmaNo ratings yet

- Summer Project: Presented By: Priyancy Goyal A3906411222 BBA (G) 2011-2014Document11 pagesSummer Project: Presented By: Priyancy Goyal A3906411222 BBA (G) 2011-2014Vartika BaranwalNo ratings yet

- Hungarian Insolvency Act Act Xlix of 1991 2019Document136 pagesHungarian Insolvency Act Act Xlix of 1991 2019Bálint FodorNo ratings yet

- CFAS - Chapter 6: IdentificationDocument1 pageCFAS - Chapter 6: Identificationagm25100% (1)

- 14 DFA and BSP Vs Falcon PDFDocument47 pages14 DFA and BSP Vs Falcon PDFYen YenNo ratings yet

- Model Exit Exam - Cost and Management Accounting IIDocument12 pagesModel Exit Exam - Cost and Management Accounting IIfageenyakaraaNo ratings yet

- MTP 14 28 Answers 1701406110Document11 pagesMTP 14 28 Answers 1701406110aim.cristiano1210No ratings yet

- Brazilian Sugar OfferDocument2 pagesBrazilian Sugar OfferRajnikant ChauhanNo ratings yet

- FINAL 421-A Hearing PowerpointDocument22 pagesFINAL 421-A Hearing PowerpointJanet BabinNo ratings yet

- MFDocument49 pagesMFDeep SekhonNo ratings yet

- Capital Structure and LeverageDocument49 pagesCapital Structure and LeverageSENO PANDU AHMADNo ratings yet

- Introduction To Auditing: D. An Audit Has A Benefit Only To The OwnersDocument4 pagesIntroduction To Auditing: D. An Audit Has A Benefit Only To The OwnersChristine Mae ManliguezNo ratings yet

- Funa V Manila Economic and Cultural OfficeDocument5 pagesFuna V Manila Economic and Cultural OfficeNina CuerpoNo ratings yet

- Muthoot Finace Annual Report 2013Document68 pagesMuthoot Finace Annual Report 2013aayush13No ratings yet

- De Grauwe Keynes' Saving ParadoxDocument20 pagesDe Grauwe Keynes' Saving ParadoxecrcauNo ratings yet

- Xu Et Al (2018) IC in Korean Manufacturing IndustryDocument17 pagesXu Et Al (2018) IC in Korean Manufacturing Industrymarsa amruNo ratings yet

- Tentatif ZawedDocument7 pagesTentatif ZawedrmazmanNo ratings yet

- Sonal Project (Transfer of Property Act)Document15 pagesSonal Project (Transfer of Property Act)Handcrafting BeautiesNo ratings yet

- Small Country and Large CountryDocument3 pagesSmall Country and Large Countryhims08No ratings yet

- Harp Du Refi Plus FaqsDocument32 pagesHarp Du Refi Plus FaqscrennydaneNo ratings yet

- (b3) Koide HaruyaDocument12 pages(b3) Koide HaruyaAsian Development Bank ConferencesNo ratings yet

- Financial Planner ThesisDocument8 pagesFinancial Planner Thesisgj6sr6d7100% (2)

- US Internal Revenue Service: F8453ol - 2003Document2 pagesUS Internal Revenue Service: F8453ol - 2003IRSNo ratings yet

- Newton CaseDocument1 pageNewton CaseSaran SeeranganNo ratings yet

- Maryam Nawaz Sharifi vs. Chairman NABDocument33 pagesMaryam Nawaz Sharifi vs. Chairman NABmohsin ali razaNo ratings yet