Professional Documents

Culture Documents

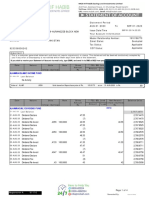

GCA Consultants: Introduction of The Euro

GCA Consultants: Introduction of The Euro

Uploaded by

Naeem MalikCopyright:

Available Formats

You might also like

- F7 - C3B, C4 FullDocument83 pagesF7 - C3B, C4 FullK59 Vo Doan Hoang AnhNo ratings yet

- Uber Financial StatementDocument6 pagesUber Financial StatementAdrean GonzalesNo ratings yet

- Praktikum Kerta Kerja Sesi 1 Shared After ClassDocument13 pagesPraktikum Kerta Kerja Sesi 1 Shared After ClassDian Permata SariNo ratings yet

- Ifrs 2021 - SicsDocument24 pagesIfrs 2021 - SicsAamir IkramNo ratings yet

- CombinepdfDocument14 pagesCombinepdfKen ZafraNo ratings yet

- CombinepdfDocument20 pagesCombinepdfKen ZafraNo ratings yet

- Sic 15Document4 pagesSic 15Cryptic LollNo ratings yet

- SIC 07 - Introduction of The EuroDocument4 pagesSIC 07 - Introduction of The EuroJimmyChaoNo ratings yet

- Sic 7Document4 pagesSic 7Evelina Del RosarioNo ratings yet

- CombinepdfDocument8 pagesCombinepdfKen ZafraNo ratings yet

- Introduction of The Euro: SIC Interpretation 7Document4 pagesIntroduction of The Euro: SIC Interpretation 7Rolando G. Cua Jr.No ratings yet

- Introduction of The Euro: SIC Interpretation 7Document4 pagesIntroduction of The Euro: SIC Interpretation 7Cryptic LollNo ratings yet

- IAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFDocument20 pagesIAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFMichelle TanNo ratings yet

- Interim Financial Reporting and Impairment: IFRIC Interpretation 10Document6 pagesInterim Financial Reporting and Impairment: IFRIC Interpretation 10Matt PuaNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument20 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsJorreyGarciaOplasNo ratings yet

- Ifrs Updates August 2019Document9 pagesIfrs Updates August 2019obedNo ratings yet

- IAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument7 pagesIAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsLeen LurNo ratings yet

- IAS 21 - Effects of Changes in Foreign Exchange PDFDocument22 pagesIAS 21 - Effects of Changes in Foreign Exchange PDFJanelle SentinaNo ratings yet

- Introduction of The Euro: SIC Interpretation 7Document4 pagesIntroduction of The Euro: SIC Interpretation 7Jerwin DaveNo ratings yet

- MFRS 108Document22 pagesMFRS 108Yeo Chioujin0% (1)

- Chapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document24 pagesChapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- ICAP TRsDocument45 pagesICAP TRsSyed Azhar Abbas0% (1)

- Ias 10Document17 pagesIas 10NvioNo ratings yet

- Chapter 9 IAS-8 Accounting Policies, Change in Estimates and ErrorsDocument30 pagesChapter 9 IAS-8 Accounting Policies, Change in Estimates and Errorszarnab azeemNo ratings yet

- Consolidated and Separate Financial Statements: International Accounting Standard 27Document41 pagesConsolidated and Separate Financial Statements: International Accounting Standard 27davidwijaya1986No ratings yet

- 298 Announ 1222 LRAS11Document4 pages298 Announ 1222 LRAS11teamhackerNo ratings yet

- Ias 1Document3 pagesIas 1ash_muhammedNo ratings yet

- International Financial Reporting StandardsDocument5 pagesInternational Financial Reporting StandardsRohan BhagatNo ratings yet

- Operating Leases-Incentives: SIC Interpretation 15Document4 pagesOperating Leases-Incentives: SIC Interpretation 15Asis KoiralaNo ratings yet

- IAS 34: Interim Financial ReportingDocument8 pagesIAS 34: Interim Financial ReportingcolleenyuNo ratings yet

- Interim Financial Reporting: International Accounting Standard 34Document16 pagesInterim Financial Reporting: International Accounting Standard 34Cryptic LollNo ratings yet

- The Effects of Changes in Foreign Exchange Rates: Limited Revision To Accounting Standard (AS) 11 (Revised 2003)Document4 pagesThe Effects of Changes in Foreign Exchange Rates: Limited Revision To Accounting Standard (AS) 11 (Revised 2003)sks0865No ratings yet

- Interim Financial Reporting: IAS Standard 34Document18 pagesInterim Financial Reporting: IAS Standard 34JorreyGarciaOplasNo ratings yet

- Edu Bound Volume 2012 - Ifrs 8 - Part A - 121Document20 pagesEdu Bound Volume 2012 - Ifrs 8 - Part A - 121AKNo ratings yet

- Separate Financial Statements: International Accounting Standard 27Document10 pagesSeparate Financial Statements: International Accounting Standard 27babylovelylovelyNo ratings yet

- MFRS 121 042015 PDFDocument26 pagesMFRS 121 042015 PDFChessking Siew HeeNo ratings yet

- SIC 10 - Government Assistance - No Specific Relation To Operating ActivitiesDocument4 pagesSIC 10 - Government Assistance - No Specific Relation To Operating ActivitiesJimmyChaoNo ratings yet

- Government Assistance-No Specific Relation To Operating ActivitiesDocument3 pagesGovernment Assistance-No Specific Relation To Operating ActivitiesCryptic LollNo ratings yet

- Format of Financial Statements Under The Revised Schedule VIDocument97 pagesFormat of Financial Statements Under The Revised Schedule VIDebadarshi RoyNo ratings yet

- Revised Schedule VI in Excel FormatDocument97 pagesRevised Schedule VI in Excel FormatRaghavendran ThiyagarajanNo ratings yet

- Accounting StandardDocument13 pagesAccounting StandardJohanna Pauline SequeiraNo ratings yet

- Measurement of Profit & Reporting Comprehensive Income: Week 11 LectureDocument6 pagesMeasurement of Profit & Reporting Comprehensive Income: Week 11 LecturelegolasckkNo ratings yet

- Ias 1 Presentation of Financial StatementsDocument13 pagesIas 1 Presentation of Financial StatementsShahbaz MalikNo ratings yet

- 48 - Ifrs 03 bv2008Document203 pages48 - Ifrs 03 bv2008MK RKNo ratings yet

- Ias34 en PDFDocument9 pagesIas34 en PDFAgnieszka KsnNo ratings yet

- 2 Presentation of Financial Statements - Lecture Notes PDFDocument14 pages2 Presentation of Financial Statements - Lecture Notes PDFCatherine RiveraNo ratings yet

- Ifric 7Document6 pagesIfric 7Cryptic LollNo ratings yet

- IAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument5 pagesIAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsTope JohnNo ratings yet

- CDI:HIDI :8DC9:CH:98DCHDA 96I:9 C6C8 6AHI6I:B:CIH: LVMH GroupDocument38 pagesCDI:HIDI :8DC9:CH:98DCHDA 96I:9 C6C8 6AHI6I:B:CIH: LVMH GroupArun PrakashNo ratings yet

- Date Development Comments: Reporting PublishedDocument4 pagesDate Development Comments: Reporting PublishedJuan TañamorNo ratings yet

- Summary of Significant Accounting PoliciesDocument6 pagesSummary of Significant Accounting PoliciesCaptain ObviousNo ratings yet

- Petron PDFDocument71 pagesPetron PDFEliza MapaNo ratings yet

- Events After The Reporting Period: IAS Standard 10Document12 pagesEvents After The Reporting Period: IAS Standard 10JorreyGarciaOplasNo ratings yet

- International Financial Reporting Standards: Revised Readiness ToolkitDocument40 pagesInternational Financial Reporting Standards: Revised Readiness ToolkitBikaZeeNo ratings yet

- G4+1 1999Document37 pagesG4+1 1999David KohNo ratings yet

- IFRS03 BV2009 - Business CombinationsDocument144 pagesIFRS03 BV2009 - Business CombinationsShaik Abdul Cader DawoodNo ratings yet

- Ias 8Document35 pagesIas 8saif700No ratings yet

- RTP Ipcc-P5Document52 pagesRTP Ipcc-P5aliabbas966No ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Wiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Naeem Ullah: Registration #: 91116Document4 pagesNaeem Ullah: Registration #: 91116Naeem MalikNo ratings yet

- 0022-AHL000056 (Mehran)Document1 page0022-AHL000056 (Mehran)Naeem MalikNo ratings yet

- KH - Imran Hafeez S/O KH - Hafeez Akhtar 365-B-I M.A.Johar Town LHRDocument1 pageKH - Imran Hafeez S/O KH - Hafeez Akhtar 365-B-I M.A.Johar Town LHRNaeem MalikNo ratings yet

- Employee Retirement BenefitsDocument8 pagesEmployee Retirement BenefitsNaeem MalikNo ratings yet

- Awaz Foundation-CDS Management LetterDocument5 pagesAwaz Foundation-CDS Management LetterNaeem MalikNo ratings yet

- Khawab Aur Tabeer Jadeed Edition PDFDocument962 pagesKhawab Aur Tabeer Jadeed Edition PDFNaeem MalikNo ratings yet

- Ghubar e KhatirDocument436 pagesGhubar e KhatirNaeem Malik100% (1)

- PAS 38 Intangible Assets: Lecture AidDocument18 pagesPAS 38 Intangible Assets: Lecture Aidwendy alcosebaNo ratings yet

- Consolidation Subsequent To Acquisition Date: Solutions Manual, Chapter 5Document86 pagesConsolidation Subsequent To Acquisition Date: Solutions Manual, Chapter 5olivia caoNo ratings yet

- Chapter 8 Intangible AssetsDocument12 pagesChapter 8 Intangible AssetsKrissa Mae Longos100% (3)

- IntangiblesworksheetDocument2 pagesIntangiblesworksheetammad uddinNo ratings yet

- Ia1 5a Investments 15 FVDocument55 pagesIa1 5a Investments 15 FVJm SevallaNo ratings yet

- Module 14 PAS 38Document5 pagesModule 14 PAS 38Jan JanNo ratings yet

- Ufrs FinalsDocument2 pagesUfrs FinalsChristine Joyce MagoteNo ratings yet

- IAS 38 - Intangible Assets PDFDocument7 pagesIAS 38 - Intangible Assets PDFADNo ratings yet

- J17 DipIFR - AnswersDocument8 pagesJ17 DipIFR - Answers刘宝英No ratings yet

- Chapter 6 Notes To Financial StatementsDocument109 pagesChapter 6 Notes To Financial StatementsLede Ann Calipus Yap100% (2)

- Intermediate Accounting I Intangible AssetsDocument7 pagesIntermediate Accounting I Intangible AssetsKyla Flaviano GallegoNo ratings yet

- Consolidated Cash Flow StatementDocument5 pagesConsolidated Cash Flow Statementlal kapdaNo ratings yet

- Portfolio123 Switching From Thomson Reuters Fundamental Data To CompustatDocument22 pagesPortfolio123 Switching From Thomson Reuters Fundamental Data To CompustatGeorgeNo ratings yet

- Standard Operating Procedure Asset Management at Perform PC Sop Ga 004 v01Document42 pagesStandard Operating Procedure Asset Management at Perform PC Sop Ga 004 v01Akintunde SulaimanNo ratings yet

- 05 01 Interview Question ModelDocument3 pages05 01 Interview Question ModelXintongHuangNo ratings yet

- Asset Management 101Document19 pagesAsset Management 101mehrbloor@gmail.comNo ratings yet

- Chapter 3 (Revised As PerAS 26)Document74 pagesChapter 3 (Revised As PerAS 26)Deepak Kumar DNo ratings yet

- Pas 37 38 40 41 PFRS 1Document5 pagesPas 37 38 40 41 PFRS 1LALALA LULULUNo ratings yet

- Past Paper Questions Up To Winter 2015 PDFDocument99 pagesPast Paper Questions Up To Winter 2015 PDFsamit shresthaNo ratings yet

- Financial Accounting and Reporting-IIDocument5 pagesFinancial Accounting and Reporting-IIMuhammad Hassan TariqNo ratings yet

- Intermediate Financial Accounting I: Intangible AssetsDocument46 pagesIntermediate Financial Accounting I: Intangible Assetsmukesh00888No ratings yet

- IAS 38 - Intangible AssetsDocument27 pagesIAS 38 - Intangible AssetsArshad BhuttaNo ratings yet

- Click The Blue Buttons Below To Navigate Part 1 More EfficientlyDocument89 pagesClick The Blue Buttons Below To Navigate Part 1 More Efficientlyelite writerNo ratings yet

- Final Dissertation For Bothwell L Shoko MBADocument110 pagesFinal Dissertation For Bothwell L Shoko MBABothwell Lucent ShokoNo ratings yet

- 4Document3 pages4Carlo ParasNo ratings yet

- IAS 36-Impairment: Nguyễn Đình Hoàng UyênDocument31 pagesIAS 36-Impairment: Nguyễn Đình Hoàng UyênHồ Đan ThụcNo ratings yet

- Pure Gold Financial StatementsDocument90 pagesPure Gold Financial StatementsHanz SoNo ratings yet

GCA Consultants: Introduction of The Euro

GCA Consultants: Introduction of The Euro

Uploaded by

Naeem MalikOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GCA Consultants: Introduction of The Euro

GCA Consultants: Introduction of The Euro

Uploaded by

Naeem MalikCopyright:

Available Formats

SIC Interpretation 7

ult

an

Introduction of the Euro

ts

SIC-7

In April 2001 the International Accounting Standards Board adopted SIC-7 Introduction of the

Euro, which had originally been issued by the Standing Interpretations Committee of the

International Accounting Standards Committee in May 1998.

Other Standards have made minor consequential amendments to SIC-7, including IFRS 9

Financial Instruments (Hedge Accounting and amendments to IFRS 9, IFRS 7 and IAS 39)

GC

Co

ns

(issued November 2013).

IFRS Foundation

A1479

ts

SIC-7

ult

an

SIC Interpretation 7 Introduction of the Euro (SIC-7) is set out in paragraphs 3 and 4. SIC-7 is

accompanied by a Basis for Conclusions. The scope and authority of Interpretations are

set out in paragraphs 2 and 716 of the Preface to International Financial Reporting Standards.

GC

Co

ns

FOR THE BASIS FOR CONCLUSIONS ON SIC-7 SEE PART B OF THIS EDITION

A1480

IFRS Foundation

ts

SIC-7

References

ult

an

SIC Interpretation 7

Introduction of the Euro

IAS 1 Presentation of Financial Statements (as revised in 2007)

IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors

IAS 10 Events after the Reporting Period

IAS 21 The Effects of Changes in Foreign Exchange Rates (as revised in 2003)

IAS 27 Consolidated and Separate Financial Statements (as amended in 2008)

Issue

From 1 January 1999, the effective start of Economic and Monetary Union (EMU),

the euro will become a currency in its own right and the conversion rates

between the euro and the participating national currencies will be irrevocably

fixed, ie the risk of subsequent exchange differences related to these currencies

is eliminated from this date on.

The issue is the application of IAS 21 to the changeover from the national

currencies of participating Member States of the European Union to the euro

(the changeover).

ns

Co

Consensus

The requirements of IAS 21 regarding the translation of foreign currency

transactions and financial statements of foreign operations should be strictly

applied to the changeover. The same rationale applies to the fixing of exchange

rates when countries join EMU at later stages.

This means that, in particular:

foreign currency monetary assets and liabilities resulting from

transactions shall continue to be translated into the functional currency

at the closing rate. Any resultant exchange differences shall be

recognised as income or expense immediately, except that an entity shall

continue to apply its existing accounting policy for exchange gains and

losses related to hedges of the currency risk of a forecast transaction;

GC

(a)

(b)

cumulative exchange differences relating to the translation of financial

statements of foreign operations, recognised in other comprehensive

income, shall be accumulated in equity and shall be reclassified from

equity to profit or loss only on the disposal or partial disposal of the net

investment in the foreign operation; and

(c)

exchange differences resulting from the translation of liabilities

denominated in participating currencies shall not be included in the

carrying amount of related assets.

IFRS Foundation

A1481

ts

SIC-7

Date of consensus

Effective date

ult

an

October 1997

This Interpretation becomes effective on 1 June 1998. Changes in accounting policies shall

be accounted for according to the requirements of IAS 8.

IAS 1 (as revised in 2007) amended the terminology used throughout IFRSs. In addition it

amended paragraph 4. An entity shall apply those amendments for annual periods

beginning on or after 1 January 2009. If an entity applies IAS 1 (revised 2007) for an earlier

period, the amendments shall be applied for that earlier period.

GC

Co

ns

IAS 27 (as amended in 2008) amended paragraph 4(b). An entity shall apply that

amendment for annual periods beginning on or after 1 July 2009. If an entity applies IAS 27

(amended 2008) for an earlier period, the amendment shall be applied for that earlier

period.

A1482

IFRS Foundation

SIC Interpretation 10

ult

an

Government AssistanceNo Specific

Relation to Operating Activities

ts

SIC-10

In April 2001 the International Accounting Standards Board adopted SIC-10 Government

AssistanceNo Specific Relation to Operating Activities, which had originally been issued by the

GC

Co

ns

Standing Interpretations Committee of the International Accounting Standards Committee

in July 1998.

IFRS Foundation

A1483

ts

SIC-10

ult

an

SIC Interpretation 10 Government AssistanceNo Specific Relation to Operating Activities (SIC-10)

is set out in paragraph 3. SIC-10 is accompanied by a Basis for Conclusions. The scope

and authority of Interpretations are set out in paragraphs 2 and 716 of the Preface to

International Financial Reporting Standards.

GC

Co

ns

FOR THE BASIS FOR CONCLUSIONS ON SIC-10 SEE PART B OF THIS EDITION

A1484

IFRS Foundation

ts

SIC-10

ult

an

SIC Interpretation 10

Government AssistanceNo Specific Relation to Operating

Activities

References

IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors

IAS 20 Accounting for Government Grants and Disclosure of Government Assistance

Issue

In some countries government assistance to entities may be aimed at

encouragement or long-term support of business activities either in certain

regions or industry sectors. Conditions to receive such assistance may not be

specifically related to the operating activities of the entity. Examples of such

assistance are transfers of resources by governments to entities which:

(a)

operate in a particular industry;

(b)

continue operating in recently privatised industries; or

(c)

start or continue to run their business in underdeveloped areas.

The issue is whether such government assistance is a government grant within

the scope of IAS 20 and, therefore, should be accounted for in accordance with

this Standard.

Co

Consensus

3

ns

Government assistance to entities meets the definition of government grants in

IAS 20, even if there are no conditions specifically relating to the operating

activities of the entity other than the requirement to operate in certain regions

or industry sectors. Such grants shall therefore not be credited directly to

shareholders interests.

Date of consensus

January 1998

Effective date

GC

This Interpretation becomes effective on 1 August 1998. Changes in accounting policies

shall be accounted for in accordance with IAS 8.

IFRS Foundation

A1485

GC

ts

ult

an

ns

Co

SIC Interpretation 15

ult

an

Operating LeasesIncentives

ts

SIC-15

In April 2001 the International Accounting Standards Board adopted SIC-15 Operating

LeasesIncentives, which had originally been issued by the Standing Interpretations

GC

Co

ns

Committee of the International Accounting Standards Committee in December 1998.

IFRS Foundation

A1487

ts

SIC-15

ult

an

SIC Interpretation 15 Operating LeasesIncentives (SIC-15) is set out in paragraphs 36.

SIC-15 is accompanied by a Basis for Conclusions and illustrative examples. The scope

and authority of Interpretations are set out in paragraphs 2 and 716 of the Preface to

International Financial Reporting Standards.

FOR THE FOLLOWING MATERIAL ACCOMPANYING SIC-15:

BASIS FOR CONCLUSIONS

ILLUSTRATIVE EXAMPLE

GC

Co

ns

SEE PART B OF THIS EDITION

A1488

IFRS Foundation

ts

SIC-15

References

ult

an

SIC Interpretation 15

Operating LeasesIncentives

IAS 1 Presentation of Financial Statements (as revised in 2007)

IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors

IAS 17 Leases (as revised in 2003)

Issue

In negotiating a new or renewed operating lease, the lessor may provide

incentives for the lessee to enter into the agreement. Examples of such

incentives are an up-front cash payment to the lessee or the reimbursement or

assumption by the lessor of costs of the lessee (such as relocation costs, leasehold

improvements and costs associated with a pre-existing lease commitment of the

lessee). Alternatively, initial periods of the lease term may be agreed to be

rent-free or at a reduced rent.

The issue is how incentives in an operating lease should be recognised in the

financial statements of both the lessee and the lessor.

Consensus

The lessor shall recognise the aggregate cost of incentives as a reduction of

rental income over the lease term, on a straight-line basis unless another

systematic basis is representative of the time pattern over which the benefit of

the leased asset is diminished.

The lessee shall recognise the aggregate benefit of incentives as a reduction of

rental expense over the lease term, on a straight-line basis unless another

systematic basis is representative of the time pattern of the lessees benefit from

the use of the leased asset.

All incentives for the agreement of a new or renewed operating lease shall be

recognised as an integral part of the net consideration agreed for the use of the

leased asset, irrespective of the incentives nature or form or the timing of

payments.

Co

ns

GC

Costs incurred by the lessee, including costs in connection with a pre-existing

lease (for example costs for termination, relocation or leasehold improvements),

shall be accounted for by the lessee in accordance with the Standards applicable

to those costs, including costs which are effectively reimbursed through an

incentive arrangement.

Date of consensus

June 1998

IFRS Foundation

A1489

ts

SIC-15

Effective date

GC

Co

ns

ult

an

This Interpretation becomes effective for lease terms beginning on or after 1 January 1999.

A1490

IFRS Foundation

ts

SIC-25

SIC Interpretation 25

ult

an

Income TaxesChanges in the Tax Status

of an Entity or its Shareholders

In April 2001 the International Accounting Standards Board adopted SIC-25 Income

TaxesChanges in the Tax Status of an Entity or its Shareholders, which had originally been issued

GC

Co

ns

by the Standing Interpretations Committee of the International Accounting Standards

Committee in July 2000.

IFRS Foundation

A1491

ts

SIC-25

ult

an

SIC Interpretation 25 Income TaxesChanges in the Tax Status of an Entity or its Shareholders

(SIC-25) is set out in paragraph 4. SIC-25 is accompanied by a Basis for Conclusions. The

scope and authority of Interpretations are set out in paragraphs 2 and 716 of the Preface

to International Financial Reporting Standards.

GC

Co

ns

FOR THE BASIS FOR CONCLUSIONS ON SIC-25 SEE PART B OF THIS EDITION

A1492

IFRS Foundation

ts

SIC-25

References

ult

an

SIC Interpretation 25

Income TaxesChanges in the Tax Status of an Entity or its

Shareholders

IAS 1 Presentation of Financial Statements (as revised in 2007)

IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors

IAS 12 Income Taxes

Issue

A change in the tax status of an entity or of its shareholders may have

consequences for an entity by increasing or decreasing its tax liabilities or assets.

This may, for example, occur upon the public listing of an entitys equity

instruments or upon the restructuring of an entitys equity. It may also occur

upon a controlling shareholders move to a foreign country. As a result of such

an event, an entity may be taxed differently; it may for example gain or lose tax

incentives or become subject to a different rate of tax in the future.

A change in the tax status of an entity or its shareholders may have an

immediate effect on the entitys current tax liabilities or assets. The change may

also increase or decrease the deferred tax liabilities and assets recognised by the

entity, depending on the effect the change in tax status has on the tax

consequences that will arise from recovering or settling the carrying amount of

the entitys assets and liabilities.

Co

ns

The issue is how an entity should account for the tax consequences of a change

in its tax status or that of its shareholders.

Consensus

A change in the tax status of an entity or its shareholders does not give rise to

increases or decreases in amounts recognised outside profit or loss. The current

and deferred tax consequences of a change in tax status shall be included in

profit or loss for the period, unless those consequences relate to transactions and

events that result, in the same or a different period, in a direct credit or charge

to the recognised amount of equity or in amounts recognised in other

comprehensive income. Those tax consequences that relate to changes in the

recognised amount of equity, in the same or a different period (not included in

profit or loss), shall be charged or credited directly to equity. Those tax

consequences that relate to amounts recognised in other comprehensive income

shall be recognised in other comprehensive income.

GC

Date of consensus

August 1999

IFRS Foundation

A1493

ts

SIC-25

Effective date

ult

an

This consensus becomes effective on 15 July 2000. Changes in accounting policies shall be

accounted for in accordance with IAS 8.

GC

Co

ns

IAS 1 (as revised in 2007) amended the terminology used throughout IFRSs. In addition it

amended paragraph 4. An entity shall apply those amendments for annual periods

beginning on or after 1 January 2009. If an entity applies IAS 1 (revised 2007) for an earlier

period, the amendments shall be applied for that earlier period.

A1494

IFRS Foundation

ts

SIC-27

SIC Interpretation 27

ult

an

Evaluating the Substance of Transactions

Involving the Legal Form of a Lease

In December 2001 the International Accounting Standards Board issued SIC-27 Evaluating the

Substance of Transactions Involving the Legal Form of a Lease, which had originally been developed

by the Standing Interpretations Committee of the International Accounting Standards

Committee.

GC

Co

ns

Other Standards have made minor consequential amendments to SIC-27. They include

IFRS 9 Financial Instruments (Hedge Accounting and amendments to IFRS 9, IFRS 7 and IAS 39)

(issued November 2013), IFRS 15 Revenue from Contracts with Customers (issued May 2014) and

IFRS 9 Financial Instruments (issued July 2014).

IFRS Foundation

A1495

ts

SIC-27

ult

an

SIC Interpretation 27 Evaluating the Substance of Transactions Involving the Legal Form of a Lease

(SIC-27) is set out in paragraphs 311. SIC-27 is accompanied by a Basis for Conclusions

and implementation guidance. The scope and authority of Interpretations are set out in

paragraphs 2 and 716 of the Preface to International Financial Reporting Standards.

FOR THE FOLLOWING MATERIAL ACCOMPANYING SIC-27:

BASIS FOR CONCLUSIONS

IMPLEMENTATION GUIDANCE

A Linked transactions

B The substance of an agreement

GC

Co

ns

SEE PART B OF THIS EDITION

A1496

IFRS Foundation

ts

SIC-27

References

ult

an

SIC Interpretation 27

Evaluating the Substance of Transactions Involving the

Legal Form of a Lease

IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors

IAS 17 Leases (as revised in 2003)

IAS 37 Provisions, Contingent Liabilities and Contingent Assets

IFRS 4 Insurance Contracts

IFRS 9 Financial Instruments

IFRS 15 Revenue from Contracts with Customers

Issue

An Entity may enter into a transaction or a series of structured transactions (an

arrangement) with an unrelated party or parties (an Investor) that involves the

legal form of a lease. For example, an Entity may lease assets to an Investor and

lease the same assets back, or alternatively, legally sell assets and lease the same

assets back. The form of each arrangement and its terms and conditions can

vary significantly. In the lease and leaseback example, it may be that the

arrangement is designed to achieve a tax advantage for the Investor that is

shared with the Entity in the form of a fee, and not to convey the right to use an

asset.

Co

ns

When an arrangement with an Investor involves the legal form of a lease, the

issues are:

(a)

how to determine whether a series of transactions is linked and should

be accounted for as one transaction;

(b)

whether the arrangement meets the definition of a lease under IAS 17;

and, if not,

GC

(i)

whether a separate investment account and lease payment

obligations that might exist represent assets and liabilities of the

Entity (eg consider the example described in paragraph A2(a) of

the guidance accompanying the Interpretation);

(ii)

how the Entity should account for other obligations resulting

from the arrangement; and

(iii)

how the Entity should account for a fee it might receive from an

Investor.

Consensus

3

A series of transactions that involve the legal form of a lease is linked and shall

be accounted for as one transaction when the overall economic effect cannot be

IFRS Foundation

A1497

ts

SIC-27

ult

an

understood without reference to the series of transactions as a whole. This is the

case, for example, when the series of transactions are closely interrelated,

negotiated as a single transaction, and takes place concurrently or in a

continuous sequence.

(Part A of the accompanying guidance provides

illustrations of application of this Interpretation.)

4

The accounting shall reflect the substance of the arrangement. All aspects and

implications of an arrangement shall be evaluated to determine its substance,

with weight given to those aspects and implications that have an economic

effect.

IAS 17 applies when the substance of an arrangement includes the conveyance

of the right to use an asset for an agreed period of time. Indicators that

individually demonstrate that an arrangement may not, in substance, involve a

lease under IAS 17 include (Part B of the accompanying guidance provides

illustrations of application of this Interpretation):

an Entity retains all the risks and rewards incident to ownership of an

underlying asset and enjoys substantially the same rights to its use as

before the arrangement;

(b)

the primary reason for the arrangement is to achieve a particular tax

result, and not to convey the right to use an asset; and

(c)

an option is included on terms that make its exercise almost certain (eg a

put option that is exercisable at a price sufficiently higher than the

expected fair value when it becomes exercisable).

ns

(a)

the Entity is not able to control the investment account in pursuit of its

own objectives and is not obligated to pay the lease payments. This

occurs when, for example, a prepaid amount is placed in a separate

investment account to protect the Investor and may only be used to pay

the Investor, the Investor agrees that the lease payment obligations are

to be paid from funds in the investment account, and the Entity has no

ability to withhold payments to the Investor from the investment

account;

(a)

Co

The definitions and guidance in paragraphs 4964 of the Framework1 shall be

applied in determining whether, in substance, a separate investment account

and lease payment obligations represent assets and liabilities of the Entity.

Indicators that collectively demonstrate that, in substance, a separate

investment account and lease payment obligations do not meet the definitions

of an asset and a liability and shall not be recognised by the Entity include:

GC

(b)

the Entity has only a remote risk of reimbursing the entire amount of

any fee received from an Investor and possibly paying some additional

amount, or, when a fee has not been received, only a remote risk of

paying an amount under other obligations (eg a guarantee). Only a

remote risk of payment exists when, for example, the terms of the

The reference to the Framework is to IASCs Framework for the Preparation and Presentation of Financial

Statements, adopted by the IASB in 2001. In September 2010 the IASB replaced the Framework with

the Conceptual Framework for Financial Reporting. Paragraphs 4964 are now paragraphs 4.44.19 of the

Conceptual Framework.

A1498

IFRS Foundation

ts

SIC-27

arrangement require that a prepaid amount is invested in risk-free assets

that are expected to generate sufficient cash flows to satisfy the lease

payment obligations; and

other than the initial cash flows at inception of the arrangement, the

only cash flows expected under the arrangement are the lease payments

that are satisfied solely from funds withdrawn from the separate

investment account established with the initial cash flows.

ult

an

(c)

Other obligations of an arrangement, including any guarantees provided and

obligations incurred upon early termination, shall be accounted for under

IAS 37, IFRS 4 or IFRS 9, depending on the terms.

The requirements in IFRS 15 shall be applied to the facts and circumstances of

each arrangement in determining when to recognise a fee as income that an

Entity might receive. Factors such as whether there is continuing involvement

in the form of significant future performance obligations necessary to earn the

fee, whether there are retained risks, the terms of any guarantee arrangements,

and the risk of repayment of the fee, shall be considered. Indicators that

individually demonstrate that recognition of the entire fee as income when

received, if received at the beginning of the arrangement, is inappropriate

include:

ns

obligations either to perform or to refrain from certain significant

activities are conditions of earning the fee received, and therefore

execution of a legally binding arrangement is not the most significant

act required by the arrangement;

(b)

limitations are put on the use of the underlying asset that have the

practical effect of restricting and significantly changing the Entitys

ability to use (eg deplete, sell or pledge as collateral) the asset;

Co

(a)

the possibility of reimbursing any amount of the fee and possibly paying

some additional amount is not remote. This occurs when, for example,

(i)

the underlying asset is not a specialised asset that is required by

the Entity to conduct its business, and therefore there is a

possibility that the Entity may pay an amount to terminate the

arrangement early; or

(ii)

the Entity is required by the terms of the arrangement, or has

some or total discretion, to invest a prepaid amount in assets

carrying more than an insignificant amount of risk (eg currency,

interest rate or credit risk). In this circumstance, the risk of the

investments value being insufficient to satisfy the lease payment

obligations is not remote, and therefore there is a possibility that

the Entity may be required to pay some amount.

(c)

GC

The fee shall be presented in the statement of comprehensive income based on

its economic substance and nature.

IFRS Foundation

A1499

ts

SIC-27

Disclosure

(a)

(b)

11

ult

an

All aspects of an arrangement that does not, in substance, involve a lease under

IAS 17 shall be considered in determining the appropriate disclosures that are

necessary to understand the arrangement and the accounting treatment

adopted. An Entity shall disclose the following in each period that an

arrangement exists:

a description of the arrangement including:

(i)

the underlying asset and any restrictions on its use;

(ii)

the life and other significant terms of the arrangement;

(iii)

the transactions that are linked together, including any options;

and

the accounting treatment applied to any fee received, the amount

recognised as income in the period, and the line item of the statement of

comprehensive income in which it is included.

The disclosures required in accordance with paragraph 10 of this Interpretation

shall be provided individually for each arrangement or in aggregate for each

class of arrangement. A class is a grouping of arrangements with underlying

assets of a similar nature (eg power plants).

Date of consensus

February 2000

Co

Effective date

ns

10

This Interpretation becomes effective on 31 December 2001. Changes in accounting policies

shall be accounted for in accordance with IAS 8.

IFRS 9 amended paragraph 7. An entity shall apply that amendment when it applies IFRS 9.

GC

IFRS 15 Revenue from Contracts with Customers, issued in May 2014, amended the References

section and paragraph 8. An entity shall apply those amendments when it applies IFRS 15.

A1500

IFRS Foundation

SIC Interpretation 29

ult

an

Service Concession Arrangements:

Disclosures

ts

SIC-29

In December 2001 the International Accounting Standards Board (IASB) issued SIC-29

DisclosureService Concession Arrangements, which had originally been developed by the

Standing Interpretations Committee of the International Accounting Standards Committee.

GC

Co

ns

In November 2006, when the IASB issued IFRIC 12 Service Concession Arrangements, SIC-29s

title was changed to Service Concession Arrangements: Disclosures.

IFRS Foundation

A1501

ts

SIC-29

ult

an

SIC Interpretation 29 Service Concession Arrangements: Disclosures (SIC-29) is set out in

paragraphs 67. SIC-29 is accompanied by a Basis for Conclusions. The scope and

authority of Interpretations are set out in paragraphs 2 and 716 of the Preface to

International Financial Reporting Standards.

GC

Co

ns

FOR THE BASIS FOR CONCLUSIONS ON SIC-29 SEE PART B OF THIS EDITION

A1502

IFRS Foundation

References

ult

an

SIC Interpretation 29

Service Concession Arrangements: Disclosures

IAS 1 Presentation of Financial Statements (as revised in 2007)

IAS 16 Property, Plant and Equipment (as revised in 2003)

IAS 17 Leases (as revised in 2003)

IAS 37 Provisions, Contingent Liabilities and Contingent Assets

IAS 38 Intangible Assets (as revised in 2004)

IFRIC 12 Service Concession Arrangements

Issue

An entity (the operator) may enter into an arrangement with another entity (the

grantor) to provide services that give the public access to major economic and

social facilities. The grantor may be a public or private sector entity, including a

governmental body. Examples of service concession arrangements involve water

treatment and supply facilities, motorways, car parks, tunnels, bridges, airports

and telecommunication networks. Examples of arrangements that are not

service concession arrangements include an entity outsourcing the operation of

its internal services (eg employee cafeteria, building maintenance, and

accounting or information technology functions).

Co

ns

ts

SIC-29

A service concession arrangement generally involves the grantor conveying for

the period of the concession to the operator:

(a)

the right to provide services that give the public access to major

economic and social facilities, and

(b)

in some cases, the right to use specified tangible assets, intangible assets,

or financial assets,

in exchange for the operator:

committing to provide the services according to certain terms and

conditions during the concession period, and

(c)

(d)

GC

when applicable, committing to return at the end of the concession

period the rights received at the beginning of the concession period

and/or acquired during the concession period.

The common characteristic of all service concession arrangements is that the

operator both receives a right and incurs an obligation to provide public

services.

The issue is what information should be disclosed in the notes in the financial

statements of an operator and a grantor.

Certain aspects and disclosures relating to some service concession

arrangements are already addressed by existing International Financial

IFRS Foundation

A1503

ts

SIC-29

ult

an

Reporting Standards (eg IAS 16 applies to acquisitions of items of property, plant

and equipment, IAS 17 applies to leases of assets, and IAS 38 applies to

acquisitions of intangible assets). However, a service concession arrangement

may involve executory contracts that are not addressed in International

Financial Reporting Standards, unless the contracts are onerous, in which case

IAS 37 applies. Therefore, this Interpretation addresses additional disclosures of

service concession arrangements.

Consensus

All aspects of a service concession arrangement shall be considered in

determining the appropriate disclosures in the notes. An operator and a grantor

shall disclose the following in each period:

a description of the arrangement;

(b)

significant terms of the arrangement that may affect the amount, timing

and certainty of future cash flows (eg the period of the concession,

re-pricing dates and the basis upon which re-pricing or re-negotiation is

determined);

(c)

the nature and extent (eg quantity, time period or amount as

appropriate) of:

(d)

(e)

(i)

rights to use specified assets;

(ii)

obligations to provide or rights to expect provision of services;

(iii)

obligations to acquire or build items of property, plant and

equipment;

(iv)

obligations to deliver or rights to receive specified assets at the

end of the concession period;

(v)

renewal and termination options; and

(vi)

other rights and obligations (eg major overhauls);

changes in the arrangement occurring during the period; and

how the service arrangement has been classified.

An operator shall disclose the amount of revenue and profits or losses

recognised in the period on exchanging construction services for a financial

asset or an intangible asset.

6A

ns

(a)

Co

The disclosures required in accordance with paragraph 6 of this Interpretation

shall be provided individually for each service concession arrangement or in

aggregate for each class of service concession arrangements. A class is a

grouping of service concession arrangements involving services of a similar

nature (eg toll collections, telecommunications and water treatment services).

GC

Date of consensus

May 2001

A1504

IFRS Foundation

Effective date

ult

an

This Interpretation becomes effective on 31 December 2001.

ts

SIC-29

GC

Co

ns

An entity shall apply the amendment in paragraphs 6(e) and 6A for annual periods

beginning on or after 1 January 2008. If an entity applies IFRIC 12 for an earlier period, the

amendment shall be applied for that earlier period.

IFRS Foundation

A1505

GC

ts

ult

an

ns

Co

SIC Interpretation 32

ult

an

Intangible AssetsWeb Site Costs

ts

SIC-32

In March 2002 the International Accounting Standards Board issued SIC-32 Intangible

AssetsWeb Site Costs, which had originally been developed by the Standing Interpretations

Committee of the International Accounting Standards Committee.

GC

Co

ns

Other Standards have made minor consequential amendments to SIC-32, including IFRS 15

Revenue from Contracts with Customers (issued May 2014).

IFRS Foundation

A1507

ts

SIC-32

ult

an

SIC Interpretation 32 Intangible AssetsWeb Site Costs (SIC-32) is set out in paragraphs 710.

SIC-32 is accompanied by a Basis for Conclusions and an example illustrating the

application of the Interpretation. The scope and authority of Interpretations are set out

in paragraphs 2 and 716 of the Preface to International Financial Reporting Standards.

FOR THE FOLLOWING MATERIAL ACCOMPANYING SIC-32:

BASIS FOR CONCLUSIONS

ILLUSTRATIVE EXAMPLE

GC

Co

ns

SEE PART B OF THIS EDITION

A1508

IFRS Foundation

References

ult

an

SIC Interpretation 32

Intangible AssetsWeb Site Costs

IFRS 3 Business Combinations

IFRS 15 Revenue from Contracts with Customers

IAS 1 Presentation of Financial Statements (as revised in 2007)

IAS 2 Inventories (as revised in 2003)

IAS 16 Property, Plant and Equipment (as revised in 2003)

IAS 17 Leases (as revised in 2003)

IAS 36 Impairment of Assets (as revised in 2004)

IAS 38 Intangible Assets (as revised in 2004)

The stages of a web sites development can be described as follows:

(a)

Planningincludes undertaking feasibility studies, defining objectives

and specifications, evaluating alternatives and selecting preferences.

(b)

Application and Infrastructure Developmentincludes obtaining a

domain name, purchasing and developing hardware and operating

software, installing developed applications and stress testing.

(c)

Graphical Design Developmentincludes designing the appearance of

web pages.

(d)

Content Developmentincludes creating, purchasing, preparing and

uploading information, either textual or graphical in nature, on the web

site before the completion of the web sites development. This

information may either be stored in separate databases that are

integrated into (or accessed from) the web site or coded directly into the

web pages.

An entity may incur internal expenditure on the development and operation of

its own web site for internal or external access. A web site designed for external

access may be used for various purposes such as to promote and advertise an

entitys own products and services, provide electronic services, and sell products

and services. A web site designed for internal access may be used to store

company policies and customer details, and search relevant information.

Co

ns

Issue

ts

SIC-32

Once development of a web site has been completed, the Operating stage begins.

During this stage, an entity maintains and enhances the applications,

infrastructure, graphical design and content of the web site.

When accounting for internal expenditure on the development and operation of

an entitys own web site for internal or external access, the issues are:

GC

IFRS Foundation

A1509

ts

SIC-32

whether the web site is an internally generated intangible asset that is

subject to the requirements of IAS 38; and

(b)

the appropriate accounting treatment of such expenditure.

ult

an

(a)

This Interpretation does not apply to expenditure on purchasing, developing,

and operating hardware (eg web servers, staging servers, production servers and

Internet connections) of a web site. Such expenditure is accounted for under

IAS 16. Additionally, when an entity incurs expenditure on an Internet service

provider hosting the entitys web site, the expenditure is recognised as an

expense under IAS 1.88 and the Framework1 when the services are received.

IAS 38 does not apply to intangible assets held by an entity for sale in the

ordinary course of business (see IAS 2 and IFRS 15) or leases that fall within the

scope of IAS 17. Accordingly, this Interpretation does not apply to expenditure

on the development or operation of a web site (or web site software) for sale to

another entity. When a web site is leased under an operating lease, the lessor

applies this Interpretation. When a web site is leased under a finance lease, the

lessee applies this Interpretation after initial recognition of the leased asset.

ns

Consensus

An entitys own web site that arises from development and is for internal or

external access is an internally generated intangible asset that is subject to the

requirements of IAS 38.

A web site arising from development shall be recognised as an intangible asset if,

and only if, in addition to complying with the general requirements described in

IAS 38.21 for recognition and initial measurement, an entity can satisfy the

requirements in IAS 38.57. In particular, an entity may be able to satisfy the

requirement to demonstrate how its web site will generate probable future

economic benefits in accordance with IAS 38.57(d) when, for example, the web

site is capable of generating revenues, including direct revenues from enabling

orders to be placed. An entity is not able to demonstrate how a web site

developed solely or primarily for promoting and advertising its own products

and services will generate probable future economic benefits, and consequently

all expenditure on developing such a web site shall be recognised as an expense

when incurred.

Any internal expenditure on the development and operation of an entitys own

web site shall be accounted for in accordance with IAS 38. The nature of each

activity for which expenditure is incurred (eg training employees and

maintaining the web site) and the web sites stage of development or

post-development shall be evaluated to determine the appropriate accounting

treatment (additional guidance is provided in the illustrative example

accompanying this Interpretation). For example:

GC

Co

The reference to the Framework is to IASCs Framework for the Preparation and Presentation of Financial

Statements, adopted by the IASB in 2001. In September 2010 the IASB replaced the Framework with

the Conceptual Framework for Financial Reporting.

A1510

IFRS Foundation

ts

SIC-32

the Planning stage is similar in nature to the research phase in

IAS 38.54.56. Expenditure incurred in this stage shall be recognised as

an expense when it is incurred.

(b)

the Application and Infrastructure Development stage, the Graphical

Design stage and the Content Development stage, to the extent that

content is developed for purposes other than to advertise and promote

an entitys own products and services, are similar in nature to the

development phase in IAS 38.57.64. Expenditure incurred in these

stages shall be included in the cost of a web site recognised as an

intangible asset in accordance with paragraph 8 of this Interpretation

when the expenditure can be directly attributed and is necessary to

creating, producing or preparing the web site for it to be capable of

operating in the manner intended by management. For example,

expenditure on purchasing or creating content (other than content that

advertises and promotes an entitys own products and services)

specifically for a web site, or expenditure to enable use of the content

(eg a fee for acquiring a licence to reproduce) on the web site, shall be

included in the cost of development when this condition is met.

However, in accordance with IAS 38.71, expenditure on an intangible

item that was initially recognised as an expense in previous financial

statements shall not be recognised as part of the cost of an intangible

asset at a later date (eg if the costs of a copyright have been fully

amortised, and the content is subsequently provided on a web site).

(c)

expenditure incurred in the Content Development stage, to the extent

that content is developed to advertise and promote an entitys own

products and services (eg digital photographs of products), shall be

recognised as an expense when incurred in accordance with IAS 38.69(c).

For example, when accounting for expenditure on professional services

for taking digital photographs of an entitys own products and for

enhancing their display, expenditure shall be recognised as an expense

as the professional services are received during the process, not when the

digital photographs are displayed on the web site.

Co

ns

ult

an

(a)

(d)

A web site that is recognised as an intangible asset under paragraph 8 of this

Interpretation shall be measured after initial recognition by applying the

requirements of IAS 38.72.87. The best estimate of a web sites useful life

should be short.

10

the Operating stage begins once development of a web site is complete.

Expenditure incurred in this stage shall be recognised as an expense

when it is incurred unless it meets the recognition criteria in IAS 38.18.

GC

Date of consensus

May 2001

IFRS Foundation

A1511

ts

SIC-32

Effective date

ult

an

This Interpretation becomes effective on 25 March 2002. The effects of adopting this

Interpretation shall be accounted for using the transition requirements in the version of

IAS 38 that was issued in 1998. Therefore, when a web site does not meet the criteria for

recognition as an intangible asset, but was previously recognised as an asset, the item shall

be derecognised at the date when this Interpretation becomes effective. When a web site

exists and the expenditure to develop it meets the criteria for recognition as an intangible

asset, but was not previously recognised as an asset, the intangible asset shall not be

recognised at the date when this Interpretation becomes effective. When a web site exists

and the expenditure to develop it meets the criteria for recognition as an intangible asset,

was previously recognised as an asset and initially measured at cost, the amount initially

recognised is deemed to have been properly determined.

IAS 1 (as revised in 2007) amended the terminology used throughout IFRSs. In addition it

amended paragraph 5. An entity shall apply those amendments for annual periods

beginning on or after 1 January 2009. If an entity applies IAS 1 (revised 2007) for an earlier

period, the amendments shall be applied for that earlier period.

GC

Co

ns

IFRS 15 Revenue from Contracts with Customers, issued in May 2014, amended the References

section and paragraph 6. An entity shall apply that amendment when it applies IFRS 15.

A1512

IFRS Foundation

You might also like

- F7 - C3B, C4 FullDocument83 pagesF7 - C3B, C4 FullK59 Vo Doan Hoang AnhNo ratings yet

- Uber Financial StatementDocument6 pagesUber Financial StatementAdrean GonzalesNo ratings yet

- Praktikum Kerta Kerja Sesi 1 Shared After ClassDocument13 pagesPraktikum Kerta Kerja Sesi 1 Shared After ClassDian Permata SariNo ratings yet

- Ifrs 2021 - SicsDocument24 pagesIfrs 2021 - SicsAamir IkramNo ratings yet

- CombinepdfDocument14 pagesCombinepdfKen ZafraNo ratings yet

- CombinepdfDocument20 pagesCombinepdfKen ZafraNo ratings yet

- Sic 15Document4 pagesSic 15Cryptic LollNo ratings yet

- SIC 07 - Introduction of The EuroDocument4 pagesSIC 07 - Introduction of The EuroJimmyChaoNo ratings yet

- Sic 7Document4 pagesSic 7Evelina Del RosarioNo ratings yet

- CombinepdfDocument8 pagesCombinepdfKen ZafraNo ratings yet

- Introduction of The Euro: SIC Interpretation 7Document4 pagesIntroduction of The Euro: SIC Interpretation 7Rolando G. Cua Jr.No ratings yet

- Introduction of The Euro: SIC Interpretation 7Document4 pagesIntroduction of The Euro: SIC Interpretation 7Cryptic LollNo ratings yet

- IAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFDocument20 pagesIAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFMichelle TanNo ratings yet

- Interim Financial Reporting and Impairment: IFRIC Interpretation 10Document6 pagesInterim Financial Reporting and Impairment: IFRIC Interpretation 10Matt PuaNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument20 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsJorreyGarciaOplasNo ratings yet

- Ifrs Updates August 2019Document9 pagesIfrs Updates August 2019obedNo ratings yet

- IAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument7 pagesIAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsLeen LurNo ratings yet

- IAS 21 - Effects of Changes in Foreign Exchange PDFDocument22 pagesIAS 21 - Effects of Changes in Foreign Exchange PDFJanelle SentinaNo ratings yet

- Introduction of The Euro: SIC Interpretation 7Document4 pagesIntroduction of The Euro: SIC Interpretation 7Jerwin DaveNo ratings yet

- MFRS 108Document22 pagesMFRS 108Yeo Chioujin0% (1)

- Chapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document24 pagesChapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- ICAP TRsDocument45 pagesICAP TRsSyed Azhar Abbas0% (1)

- Ias 10Document17 pagesIas 10NvioNo ratings yet

- Chapter 9 IAS-8 Accounting Policies, Change in Estimates and ErrorsDocument30 pagesChapter 9 IAS-8 Accounting Policies, Change in Estimates and Errorszarnab azeemNo ratings yet

- Consolidated and Separate Financial Statements: International Accounting Standard 27Document41 pagesConsolidated and Separate Financial Statements: International Accounting Standard 27davidwijaya1986No ratings yet

- 298 Announ 1222 LRAS11Document4 pages298 Announ 1222 LRAS11teamhackerNo ratings yet

- Ias 1Document3 pagesIas 1ash_muhammedNo ratings yet

- International Financial Reporting StandardsDocument5 pagesInternational Financial Reporting StandardsRohan BhagatNo ratings yet

- Operating Leases-Incentives: SIC Interpretation 15Document4 pagesOperating Leases-Incentives: SIC Interpretation 15Asis KoiralaNo ratings yet

- IAS 34: Interim Financial ReportingDocument8 pagesIAS 34: Interim Financial ReportingcolleenyuNo ratings yet

- Interim Financial Reporting: International Accounting Standard 34Document16 pagesInterim Financial Reporting: International Accounting Standard 34Cryptic LollNo ratings yet

- The Effects of Changes in Foreign Exchange Rates: Limited Revision To Accounting Standard (AS) 11 (Revised 2003)Document4 pagesThe Effects of Changes in Foreign Exchange Rates: Limited Revision To Accounting Standard (AS) 11 (Revised 2003)sks0865No ratings yet

- Interim Financial Reporting: IAS Standard 34Document18 pagesInterim Financial Reporting: IAS Standard 34JorreyGarciaOplasNo ratings yet

- Edu Bound Volume 2012 - Ifrs 8 - Part A - 121Document20 pagesEdu Bound Volume 2012 - Ifrs 8 - Part A - 121AKNo ratings yet

- Separate Financial Statements: International Accounting Standard 27Document10 pagesSeparate Financial Statements: International Accounting Standard 27babylovelylovelyNo ratings yet

- MFRS 121 042015 PDFDocument26 pagesMFRS 121 042015 PDFChessking Siew HeeNo ratings yet

- SIC 10 - Government Assistance - No Specific Relation To Operating ActivitiesDocument4 pagesSIC 10 - Government Assistance - No Specific Relation To Operating ActivitiesJimmyChaoNo ratings yet

- Government Assistance-No Specific Relation To Operating ActivitiesDocument3 pagesGovernment Assistance-No Specific Relation To Operating ActivitiesCryptic LollNo ratings yet

- Format of Financial Statements Under The Revised Schedule VIDocument97 pagesFormat of Financial Statements Under The Revised Schedule VIDebadarshi RoyNo ratings yet

- Revised Schedule VI in Excel FormatDocument97 pagesRevised Schedule VI in Excel FormatRaghavendran ThiyagarajanNo ratings yet

- Accounting StandardDocument13 pagesAccounting StandardJohanna Pauline SequeiraNo ratings yet

- Measurement of Profit & Reporting Comprehensive Income: Week 11 LectureDocument6 pagesMeasurement of Profit & Reporting Comprehensive Income: Week 11 LecturelegolasckkNo ratings yet

- Ias 1 Presentation of Financial StatementsDocument13 pagesIas 1 Presentation of Financial StatementsShahbaz MalikNo ratings yet

- 48 - Ifrs 03 bv2008Document203 pages48 - Ifrs 03 bv2008MK RKNo ratings yet

- Ias34 en PDFDocument9 pagesIas34 en PDFAgnieszka KsnNo ratings yet

- 2 Presentation of Financial Statements - Lecture Notes PDFDocument14 pages2 Presentation of Financial Statements - Lecture Notes PDFCatherine RiveraNo ratings yet

- Ifric 7Document6 pagesIfric 7Cryptic LollNo ratings yet

- IAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument5 pagesIAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsTope JohnNo ratings yet

- CDI:HIDI :8DC9:CH:98DCHDA 96I:9 C6C8 6AHI6I:B:CIH: LVMH GroupDocument38 pagesCDI:HIDI :8DC9:CH:98DCHDA 96I:9 C6C8 6AHI6I:B:CIH: LVMH GroupArun PrakashNo ratings yet

- Date Development Comments: Reporting PublishedDocument4 pagesDate Development Comments: Reporting PublishedJuan TañamorNo ratings yet

- Summary of Significant Accounting PoliciesDocument6 pagesSummary of Significant Accounting PoliciesCaptain ObviousNo ratings yet

- Petron PDFDocument71 pagesPetron PDFEliza MapaNo ratings yet

- Events After The Reporting Period: IAS Standard 10Document12 pagesEvents After The Reporting Period: IAS Standard 10JorreyGarciaOplasNo ratings yet

- International Financial Reporting Standards: Revised Readiness ToolkitDocument40 pagesInternational Financial Reporting Standards: Revised Readiness ToolkitBikaZeeNo ratings yet

- G4+1 1999Document37 pagesG4+1 1999David KohNo ratings yet

- IFRS03 BV2009 - Business CombinationsDocument144 pagesIFRS03 BV2009 - Business CombinationsShaik Abdul Cader DawoodNo ratings yet

- Ias 8Document35 pagesIas 8saif700No ratings yet

- RTP Ipcc-P5Document52 pagesRTP Ipcc-P5aliabbas966No ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Wiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Naeem Ullah: Registration #: 91116Document4 pagesNaeem Ullah: Registration #: 91116Naeem MalikNo ratings yet

- 0022-AHL000056 (Mehran)Document1 page0022-AHL000056 (Mehran)Naeem MalikNo ratings yet

- KH - Imran Hafeez S/O KH - Hafeez Akhtar 365-B-I M.A.Johar Town LHRDocument1 pageKH - Imran Hafeez S/O KH - Hafeez Akhtar 365-B-I M.A.Johar Town LHRNaeem MalikNo ratings yet

- Employee Retirement BenefitsDocument8 pagesEmployee Retirement BenefitsNaeem MalikNo ratings yet

- Awaz Foundation-CDS Management LetterDocument5 pagesAwaz Foundation-CDS Management LetterNaeem MalikNo ratings yet

- Khawab Aur Tabeer Jadeed Edition PDFDocument962 pagesKhawab Aur Tabeer Jadeed Edition PDFNaeem MalikNo ratings yet

- Ghubar e KhatirDocument436 pagesGhubar e KhatirNaeem Malik100% (1)

- PAS 38 Intangible Assets: Lecture AidDocument18 pagesPAS 38 Intangible Assets: Lecture Aidwendy alcosebaNo ratings yet

- Consolidation Subsequent To Acquisition Date: Solutions Manual, Chapter 5Document86 pagesConsolidation Subsequent To Acquisition Date: Solutions Manual, Chapter 5olivia caoNo ratings yet

- Chapter 8 Intangible AssetsDocument12 pagesChapter 8 Intangible AssetsKrissa Mae Longos100% (3)

- IntangiblesworksheetDocument2 pagesIntangiblesworksheetammad uddinNo ratings yet

- Ia1 5a Investments 15 FVDocument55 pagesIa1 5a Investments 15 FVJm SevallaNo ratings yet

- Module 14 PAS 38Document5 pagesModule 14 PAS 38Jan JanNo ratings yet

- Ufrs FinalsDocument2 pagesUfrs FinalsChristine Joyce MagoteNo ratings yet

- IAS 38 - Intangible Assets PDFDocument7 pagesIAS 38 - Intangible Assets PDFADNo ratings yet

- J17 DipIFR - AnswersDocument8 pagesJ17 DipIFR - Answers刘宝英No ratings yet

- Chapter 6 Notes To Financial StatementsDocument109 pagesChapter 6 Notes To Financial StatementsLede Ann Calipus Yap100% (2)

- Intermediate Accounting I Intangible AssetsDocument7 pagesIntermediate Accounting I Intangible AssetsKyla Flaviano GallegoNo ratings yet

- Consolidated Cash Flow StatementDocument5 pagesConsolidated Cash Flow Statementlal kapdaNo ratings yet

- Portfolio123 Switching From Thomson Reuters Fundamental Data To CompustatDocument22 pagesPortfolio123 Switching From Thomson Reuters Fundamental Data To CompustatGeorgeNo ratings yet

- Standard Operating Procedure Asset Management at Perform PC Sop Ga 004 v01Document42 pagesStandard Operating Procedure Asset Management at Perform PC Sop Ga 004 v01Akintunde SulaimanNo ratings yet

- 05 01 Interview Question ModelDocument3 pages05 01 Interview Question ModelXintongHuangNo ratings yet

- Asset Management 101Document19 pagesAsset Management 101mehrbloor@gmail.comNo ratings yet

- Chapter 3 (Revised As PerAS 26)Document74 pagesChapter 3 (Revised As PerAS 26)Deepak Kumar DNo ratings yet

- Pas 37 38 40 41 PFRS 1Document5 pagesPas 37 38 40 41 PFRS 1LALALA LULULUNo ratings yet

- Past Paper Questions Up To Winter 2015 PDFDocument99 pagesPast Paper Questions Up To Winter 2015 PDFsamit shresthaNo ratings yet

- Financial Accounting and Reporting-IIDocument5 pagesFinancial Accounting and Reporting-IIMuhammad Hassan TariqNo ratings yet

- Intermediate Financial Accounting I: Intangible AssetsDocument46 pagesIntermediate Financial Accounting I: Intangible Assetsmukesh00888No ratings yet

- IAS 38 - Intangible AssetsDocument27 pagesIAS 38 - Intangible AssetsArshad BhuttaNo ratings yet

- Click The Blue Buttons Below To Navigate Part 1 More EfficientlyDocument89 pagesClick The Blue Buttons Below To Navigate Part 1 More Efficientlyelite writerNo ratings yet

- Final Dissertation For Bothwell L Shoko MBADocument110 pagesFinal Dissertation For Bothwell L Shoko MBABothwell Lucent ShokoNo ratings yet

- 4Document3 pages4Carlo ParasNo ratings yet

- IAS 36-Impairment: Nguyễn Đình Hoàng UyênDocument31 pagesIAS 36-Impairment: Nguyễn Đình Hoàng UyênHồ Đan ThụcNo ratings yet

- Pure Gold Financial StatementsDocument90 pagesPure Gold Financial StatementsHanz SoNo ratings yet