Professional Documents

Culture Documents

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

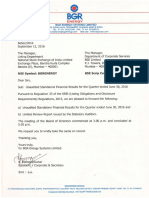

l0l, Siu Rrn Msrim.7l8Al. r6hi Rdd.

Krrol 84h. Nt* Dclhl. I l0 m5

r2lr498u / l3 Frr : 21621t29

emil : bf@bindb,in

ptinrhl@gndl.c{ryl

We have reviewed the accompanying statement of unaudited financial results of KOA

TOOLS INDIA LIMITED for the quarter ended 30tt September 2014 except for the

disclosures regarding 'Public Shareholding' and 'Promoter Group Shareholding' which

have been traced from disclosures made by the management and have not been audited

by us. This statement is the responsibility of the Company's Management and has been

approved by the Board of Directors/Committee of Board of Directors. Our responsibility

is to issue a report on these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE)

2400, engagcments to Review Financial Statements issued by the Institute of Chartered

Accountants of India. This standard requires that we plan and perform the review to

obtain moderate assurance as to whether the financial statements are free of material

misstatement. A review is limited primarily to inquiries of Company personnel and an

analytical procedure applied to financial data and thus provides less assurance than an

audii. We have not performed an audit and accordingly, we do not express an audit

opinion.

Based on our review conducted as above, nothing has come to our attention that causes us

to believe that the accompanying statement o[ unaudited results prepared in accordahce

with applicable accounting standafds and other recognized accounting practices

and

policiei has not disclosed the information required to be disclosed in terms of clause 4l

bf the Lirting Agreement including the manner in which it is to be disclosed, or that it

contains any material misstatement.

FoTP.C.BIIIDAL ie CO'

Ctrncrc*l

Acdnlrstl

MJ{o.tt6:tt

Place: New Delhi

Date:11.11.2014

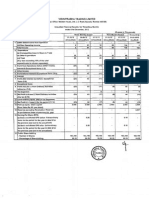

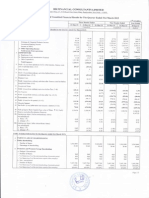

Statement of Standalone Unaudited Results for the Quarter and half year ended 30th September 2014

S. Particulars

Quarter

lncome from operations

(a) Gross Sales

Less: Excise Duty

Half Year

(Rs. in Lacs)

Year Ended

ended

16.75

32.45

34.72

49.20

80

79

133 61

Net Sales

(b) Other Operating lncomes

15.75

32.45

34.7 2

49.20

80.79

133.61

Total lncome from Ope6tions (Net)

16.75

32.45

34.72

49.20

16.15

19.21

Expenses

(a) Purchases ol stock-in-trade

(b) Changes in inventories of

stock-in-trade

(c) Employee benefits expense

(d) Depreciation and amortisation expense

(e) Other expenses

Total Expenses

Profit from operations before other

income, finance costs and exceptional items (l-2)

Other Income

Profit from ordinary activities before

finance costs and exceptional items (3 + 4)

Finance Costs

Profit from ordinary activities after finance

cost but before exceptional items(5-6)

Exceptional ltems

Profit from ordinary activities before tax(7+8)

(s.rs)

3.09

3.86

0.43

3.00

't33.61

97.03

35.96

(0.10)

2. i0)

686

30.55

0.65

4.05

34.55

(3.4s)

1.90

0.17

(3.1

710

0.43

s.25

20.24

3.96

80.79

(3.4

1 )

aa1

1.36

10 39

9.21

50.79

20.52

138.25

80.48

(r.5e)

1 )

21 8A

14.11

0.86

0.3'l

(4.64)

0.31

(4.59)

0.05

'10 Tax Expense

ll

Ended

30.09.2014 30.06.2014 30.09.2013 30.09.2014 30.09.2013 31.03.2014

(Unaudited) (Unaudlted) lUnaudited) lUnaudltedl lUnaudltedl lAudited)

No-

Net Profit / (Loss) for the period (9-10)

12 Paid-up Equity Share Capital

(Face Value in Rs)

(3 4e)

1.90

0.17

(1.5e)

(3.4e)

1.90

0.17

(1.se)

0.31

(4.59)

0.00

0.00

0.00

5.00

5.00

(3.4e)

1.90

0.17

(r.ss)

sl: r

0.41

(0 37)

o.37

0.06

(3.12)

1.53

0.t l

347 59

Rs.1

347.59

Rs.1

0.05

(1.5e)

347.59

5.25

347.59

347 59

Rs. 1

Rs. 1

Rs.1

0.41

!47.59

Rs.1

13 Reseryes excluding Revaluation Reseryes as per

59.59

balance sheet of previous accounting year

14 Earnings per share (before and after

extraordinary items (not annualised):

(a) Basic

(b) Diluted

(0.00)

S. ParticulaB

No.

A

I

Quarter

'

PARTICULARS OF SHAREHOLDING

Public Shareholding @

, Number of shares

Percentage of shareholding

Non - Encumbered

- Number of shares

- Percentage of shares (as a % of the total shareholding

of promoter and promoter group)

- Percentage of shares (as a % ot the total share capital

ol the company)

(0.00)

(o.oo)

0.00

0.00

Ended

Half Year

0.00

0.00

ended

0.00

0.00

Year Ended

30.09.2014 30.06.2014 30.09.2013 30.09.201/t 30.09.2013 31.03.2014

(Unaudited) (Unaudited) (Unauditod) (Unaudited) (Unaudited) (Audited)

34,325,150 34,325,150 34,325,150 34,325,150 34,325,150

98.75

Promoters and Promoter Group Shareholding

a) Pledged / Encumbered

- Number gf shares

- Percentage of shares (as a % of the total shareholding

of promoter and promoter group)

- Percentage of shares (as a o/o of the total share pital

of the company)

b)

0.00

0.00

{0.00)

98

75

98

75

98

38

34.325.150

75

98 75

Nrl

Nil

Nil

Nil

Nil

Nil

Nil

Nrl

Nil

Nil

Nit

Nil

Nrl

Nrl

Nil

Nil

Nit

o.,.iuo o..,iuo 433,;50

100

75

00

t00.00

100.00

.25

1.25

1.25

433,350

100.00

os.,iso

100.00

433,350

100.00

1.25

1.25

INVESTORCOMPLAINTS

Pending at the beginning of lhe quarter

Received during the quarter

Disposed of during the quarter

Remaining unresolved at the end of the quarter

Nil

1.25

Quarter Ended 30-09-2014

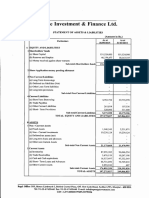

(Rs. in Lacs)

As

Particulars

at

As

at

As at

30.09.2014 30.09.2013

(unauditedl

31.03.2014

Iunauditedl

tor

?ootr

lAudiledl

lf

ttc.

upT;H

{ldl.

6lfl.

C,i,r"ror

EQUITY AND LIABILITIES

(1)

Shareholdr's Funds

{a) Share Capitat

(b) Reserves and Surplus

Sub-total-Shareholders' funds

(2) Non-CurrentLiabitities

(3) CurrentLiabilities

(a)

(b)

(c)

(d)

Short-Term Borrowings

Trade Payables

Other Current Lrabilities

Short-Term Provisions

12.85

14.21

0.06

4.69

Sub-totat_ Current liabitities

Totat_

25,64

Equity and Liabitities

18.1

5.13

23.24

441.33

t49.23

ASSETS

(1) Non-Currenl Assets

{a) Fixed Assets

2.31

266.50

(b) Non-Current lnvestments

(d) Long-Term Loans and Advances

(e) Other Non-Current Assets

Sub_total- Non -current assets

Q) Current Assets

(b) lnventories

(c) Trade Receivables

(d) Cash and Cash Equivatents

(e) Short-Term Loans and Advances

(f) Other Current Assets

Sub-total--current assets

Total-Asaetg

1

2

3

4

0.40

4.O4

3.18

286.50

0.40

266.50

0.40

269.21

6.78

437

4.68

58 09

65.27

57 02

4.44

10.08

2.50

102.19

0.22

172.12

74.40

0:17

158.29

106.02

0.22

170.44

441.33

449.23

440.52

NOTES:

The Company operates one segment only i e trading Accordingly, segment

Reporting as defined in Accountrng standard (As-l7) is not applicable

'n

Drsclosure ol assets and Liabilities

as per clause 41(l)(ea);f the tistin! igreement for ihe haif year ended 30

s;ptember 2014

Figures for previous yearl period have been regrouped wherever necJssiry

The above results have been reviewed by the Audit committee and iaken on record

by the Board of oirectors at their Meeting held on November 1 1 201 4

,

and subjected to a limited review by the statutory auditors

BY ORDER OF THE EOARO OF OIRECTORS

FOR XOA TOOI.S INDIA TIMITED

Place:Noida

oate: 11th November 2014

r (l),F"fiF"n,",

.Hq

You might also like

- Fundamentals of Accountancy, Business & Management I: 1St Generation Modules - Version 2.0Document34 pagesFundamentals of Accountancy, Business & Management I: 1St Generation Modules - Version 2.0Kim Flores79% (33)

- Purchase Mock 1 PDFDocument14 pagesPurchase Mock 1 PDFSayed Zain Shah0% (1)

- Toaz - Info Elec 1 Capital Budgeting Exercise Dec 6 2020 Bsa2 Answer Key PRDocument9 pagesToaz - Info Elec 1 Capital Budgeting Exercise Dec 6 2020 Bsa2 Answer Key PRJasper Gerald Q. OngNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Document4 pagesAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Document1 pageAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisNo ratings yet

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- DemonstraDocument74 pagesDemonstraFibriaRINo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- FY11 - Investor PresentationDocument11 pagesFY11 - Investor Presentationcooladi$No ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- KFA - Published Unaudited Results - Sep 30, 2011Document3 pagesKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNo ratings yet

- Pdfnews PDFDocument5 pagesPdfnews PDFMurthy KarumuriNo ratings yet

- Financial Results & Limited Review For December 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For December 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDocument3 pagesPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaNo ratings yet

- Regd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)Document1 pageRegd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)nitin2khNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Analyst Resume PDFDocument1 pageFinancial Analyst Resume PDFjayeshrane2107100% (1)

- Topic 2: Manufacturing Cost Concept and ComponentsDocument7 pagesTopic 2: Manufacturing Cost Concept and ComponentsAnice WongNo ratings yet

- Application Form Admission Advanced Level Exam 2021Document5 pagesApplication Form Admission Advanced Level Exam 2021Shakir Ul HaqueNo ratings yet

- BADNEWS!Document4 pagesBADNEWS!Janella CastroNo ratings yet

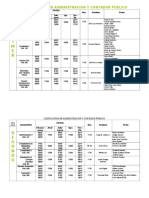

- P R I M E R: Licenciatura en Administración Y Contador PúblicoDocument7 pagesP R I M E R: Licenciatura en Administración Y Contador PúblicomatiasNo ratings yet

- Research On The Problems of Internal Control in Accounting ComputerizationDocument6 pagesResearch On The Problems of Internal Control in Accounting Computerizationhurmuzache ElenaNo ratings yet

- AP 500Q Pages 1 19 Quizzer Audit of Current AssetsDocument19 pagesAP 500Q Pages 1 19 Quizzer Audit of Current AssetsJessa Crystal QuinagonNo ratings yet

- Ysch Oolg Ist.c Om: Principles of Accounts General ObjectivesDocument6 pagesYsch Oolg Ist.c Om: Principles of Accounts General ObjectivesGabriel UdokangNo ratings yet

- Chapter 04Document39 pagesChapter 04LouiseNo ratings yet

- Assessment The Internal Control System of Banks: Tim SovaniskiDocument16 pagesAssessment The Internal Control System of Banks: Tim SovaniskitfdsgNo ratings yet

- Performance Measurement System Design - A Literature Review and Research AgendaDocument37 pagesPerformance Measurement System Design - A Literature Review and Research AgendaAlfa Riza GryffieNo ratings yet

- Auditing TheoryDocument12 pagesAuditing TheorymilleranNo ratings yet

- Ismiati Ulfah: Work Experience PersonalDocument2 pagesIsmiati Ulfah: Work Experience Personalinkasa jayaNo ratings yet

- Midlands State University: Department of AccountingDocument9 pagesMidlands State University: Department of AccountingusheNo ratings yet

- General Instructions: Read Carefully Each Questions. The Answers For The Questions Are To Be Submitted in Google ClassroomDocument3 pagesGeneral Instructions: Read Carefully Each Questions. The Answers For The Questions Are To Be Submitted in Google ClassroomRuby Amor DoligosaNo ratings yet

- SAP Financial Accounting Configuration Steps - SAP Training TutorialsDocument45 pagesSAP Financial Accounting Configuration Steps - SAP Training TutorialsNaveen KumarNo ratings yet

- Full Download Solution Manual For Core Concepts of Accounting Raiborn 2nd Edition PDF Full ChapterDocument34 pagesFull Download Solution Manual For Core Concepts of Accounting Raiborn 2nd Edition PDF Full Chapterhebraizelathyos6cae100% (24)

- Far 2 Vol1 by Sir Jawad - 2022-08-03 10-11-29Document298 pagesFar 2 Vol1 by Sir Jawad - 2022-08-03 10-11-29Ar Sal AnNo ratings yet

- FA - MCQ'sDocument8 pagesFA - MCQ'sAshika JayaweeraNo ratings yet

- MBA 687 Leaders Self EvaluationsDocument10 pagesMBA 687 Leaders Self EvaluationsAmit KumarNo ratings yet

- Accounting Rate of ReturnDocument7 pagesAccounting Rate of ReturnMahesh RaoNo ratings yet

- F7 Revision Test Section A and B 1Document15 pagesF7 Revision Test Section A and B 1Farman ShaikhNo ratings yet

- FARI Daisy 2021 Mock ExamDocument17 pagesFARI Daisy 2021 Mock ExamLauren McMahonNo ratings yet

- (BS Accountancy Program) : Department of Accounting Education Soc. Sci.6 - Course SyllabusDocument9 pages(BS Accountancy Program) : Department of Accounting Education Soc. Sci.6 - Course SyllabusChiote FaderaNo ratings yet

- 6e ch09Document35 pages6e ch09KM RobinNo ratings yet

- Acc 111Document10 pagesAcc 111adrian CharlesNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument79 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeAulia Eka Putri100% (1)