Professional Documents

Culture Documents

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

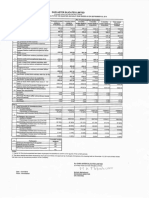

VISHVPRABHA TRADING LIMITED

elN : L51900MH1985PLC034865

Reg-d, Office: Wardsn HousiI'J 340, J,J. Road, Byculla, Mumbal401) 008,

Unaudited Flnanc.!aJ Results for the Quarter

$nded 30th September, 2014

(I'{upees In Th Qusan ds I

S,.

Part!cufars

No.

3

Montfls-

3

Months

Corresp~

'{ear to'

Year to

Accounting

cndlng: 3

Date figures

Yeerended

ended

aJldad

month$:

Date figures

for Curront

ended In

Period

Period

Previous

ended

ended

Y"ar

30,(16,2014

30,09,2013

(Ul'lil.udJtgd,

iUnaudltod}

(UnDudlt~d\i

..

300

(b)Other Op&ratlng Income

Tota! Inoome

ExpendllUls

{al (lncraase)IDecrease In

I

i

30.D9.2014

1 (a)Net SalesJlncome from Operation

28

tell Total

28

30.09.2014

30.09,2013

31.03.2{)14

J~naudlt.d)

{UnaudlWUI

{Audited)

3.0

4

73

145 :

145

18

18

173 '

113

(145)

.5

127

(1'5

55

121

12

25

127,

12

28

179

78 :

.]

8.

,~

119

15.

154

(Any Item exceeding 10% ofttle total

expendltutelO be shown separateM

3 Pront from Operations before Other Income,

Interest & Exceptlonalltems (1.2.

4 Other Income

212

5 Prom I./tIforo InwTws.t & Exc8ptlonalltems (3+4~

5 Interest

212

7 Profit after Intol'<fst but beforo Exceptional

Items (S,.,&)

272

(14')

272

(145)

8 ExcepUonall1ems

Profit (+)/loss H from Ordinal)' Activities

b&fore tax (7+8)

,.

Sg:

Sfock:~lnTrade

(b) Other Expenditure

for Previous

Tax Expensss

11 Nat Profit {+iJLoS$ H from OrdInary ActIVIties

after tax (S10)

212

25,

12

55

55

121

55 ;

121

25

12

1145)

15

12

10,

,

12 Extra Ordinary !tams (Net of Tax Expenses)

Net Profit [+) I LossH for Ule perIod i11~12}

1. Paldup equity share capital

212

"

2,450

(145

2,450

lIS

121

2.450

2,450

12

2,450

1.

2,450

{Face Va!uo Rs.10{ per Sbam}

2,817

15 Reserve'S exclud!ng Revaluation Reserves

,.

as per Balance Sheet of previous Ale year

Earn!ng Per Shart (EPSj

(al 8asJc and diluted EPS before Extraordinary

1.11

0.22 :

' 59)

0.62

.Jl5

0.04

0.(15

0.0'1

items for th& panod for the year to date 8. for

the previous year {not to be- annuallmd)

1,11

fb) Basic and diluted EPS after Extraordinary

Items for the period for the year to date & for

0.22

(0.5')

0.52

the prevlous~rinot to be annualized}

11 PUblic Share Holding

Number of Shares

PefC&ntage of Shareholding

1,63,150

66.59

18 Promoters and promoter group Sharehofdlng

al P!edged/EnclJmbltred

Number of shares

Percentage of shares (as a % of the total

shareholdlng of promoter and promoter

group)

Percentage: of shares (as a % of thlt total

1,63,161)

66.59

1,63,150

66.59

1,63,150 .

66.59 ;

:

i

1,63,160

66.59

1,63,150

56.59

share capital of (hit company;

b) Non-EIncumbereci

~ Number of t.Mre$

Poroontagc of sbQrclJ. (UG Q % of the total

sbareholdlng of promotl!r ~nd promowr

81,800

$1,850

100.00

100.00

81,850

81,650

81,850

81,8IID

100.00

100,00

100.00

100.00

33.41

33,41

33.41

33.41

group)

- P~rcgntage Qf shares (as a % of the total

33.41

share capital of the company)

lJ.:~bii?)

Ie~~:> \. ~ $'"

\t"'Pi~ ",.

~/

33.41

STATEMENT OF ASSETS AND LIABILITIES AS AT 30TH SEPTEMBER, 2014

(Rupees in Thousands,

S~I

PARTICULARS

NO,

A

AS AT

AS AT

3010912014

3110312014

(Unaudited)

(Audited)

EQUITY AND LIABILITIES

1 Share Holders' Fund

(a) Share Capital

2,450

2,944

5,394

(b) Reserves & Surplus

Sub Total Share Holders' Fund

2,450

2,817

5,267

2 CUmin! Liabilities

(a) Trade Payable

Itb) Other Curren! LlabilHie.

Sub Total Current Liabilities

TOTAL EQUITY AND LIABILITIES

s

_.

20

fi

200

.~

205

5,599

20

5,287

1,537

37

1,574

1,537

3,001

4,544

3,075

426

524

4,025

5,599

426

317

743

5,287

ASSETS

1 Non-Current Assets

i

:

(a) NonCurrent Investment

(b) long Term Loans & Advances

Sub Total Non Current Assets

2 Current Assets

(a) Current Investments

(b) Inventorl

(e) Cash and sank Balance

Sub Total Curre"t Assets

TOTAL ASSETS

Notes:

1 The above results were taken on record by the Board of Directors of the Company

at its meellng held on 30.10.2014

2 Previous period's figures have been regrouped/rearranged wherever necessary.

3 The company is a single segment company in accordance with

AS~17

(Segment Reporting)

Issued by the ICAI.

4 There is no material tax effect of timing difference based on the estimated computation

for a reasonable period, hence there is no provision for deferred tax in lenns of AS

~22.

5 No Investor complaints were received during the quarter ended 30.09.2014

6 Provision lor tax If any will be considered al the end of the year,

For VISHVPRABHA TRADING LIMITED

Place: Mumbai

Dated: 3Q.1Q.2014

I. G. Naik & Co.

Chartered Accountants

M,COM" LLB" FeA,

Independent Auditor's Report on Limited Review of the Uuaudited Financial Resnlts of the

company for the Quarter elided 30" September. %014.

To

The Board of Directors

Vishvprabha Trading Limited

Warden House, 340, J.J. Road,

Bycullll, Mumbai -400 008

We have reviewed the accompanying statement of unaudited financial results of Visbvprabba Trading

Limited for the three-months period ended 30th September, 2014, except for the disclosures regarding

"Public Shareholding" and "Promoter and Promoter Group shareholding" which have been traced from

disclosures made by the management and have not been audited by us. This Statement is the

responsibility of the Company's Management and has been approved by the Board of

Directors/Committee of the Board of Directors. Our responsibility is to issue a report on these financial

statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

engagements to Review Financial Statements issued by the Institute of Chartered Accountants of India.

This Standard requires that we plan and perform the review to obtain moderate assurance as to whether

the financial statements are free of material misstatement. A review is limited primarily to inquiries of

Company personnel and analytical procedures applied to financial data and thus provide less assurance

than an audit. We have not performed an audit and accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to believe that

the accompanying Statement of unaudited financial results prepared in accordauce with the applicable

accounting standards and other recognized accounting practiccs and policies has not disclosed the

information required to be disclosed in terms of Clause 41 of the Listing Agreements including the

manner in which it is to be disclosed, or that it contains any material misstatement.

Place: Mumbal

Date:30'h October, 2014

For LG. Naik & Co.

Chartered Aecountants

~N.''''lOW

I:G. Naik

Proprietor

Membership No. 034504

Chandrama. 2nd Floor. 21, Kalanagar. Bandra (E),. Mumbai - 400 051,

Tel.: +912226591851 Fax: +91 2226408898 Mobile: +919820149972

Email: ign1953@gmail.com

You might also like

- Business Mathematics Exercises Break Even AnalysisDocument14 pagesBusiness Mathematics Exercises Break Even AnalysisEida Hidayah83% (6)

- Sample Internal Audit ReportDocument3 pagesSample Internal Audit ReportRaashid Saigol100% (1)

- CVP Analysis Review Problem SolutionDocument3 pagesCVP Analysis Review Problem SolutionSUNNY BHUSHANNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- WD 0000072Document2 pagesWD 0000072ilove_greenNo ratings yet

- Multiple Choice QuestionsDocument33 pagesMultiple Choice QuestionsJananiNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Apl 2013Document45 pagesApl 2013Wasif Pervaiz DarNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document2 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- CAT: Annual ReportDocument131 pagesCAT: Annual ReportBusinessWorldNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Annual Report 2013 - Olympic IndustriesDocument26 pagesAnnual Report 2013 - Olympic IndustriesAlif RussellNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet

- Wiley Practitioner's Guide to GAAS 2023: Covering All SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2023: Covering All SASs, SSAEs, SSARSs, and InterpretationsNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Contract Management: Procurement GuidanceDocument32 pagesContract Management: Procurement Guidancejonasete77No ratings yet

- CHP 12Document26 pagesCHP 12Thenappan GanesenNo ratings yet

- Logistics Quick Study NotesDocument1 pageLogistics Quick Study NotesPuro MkNo ratings yet

- Competency Management - Class Notes HRM 2018-20Document18 pagesCompetency Management - Class Notes HRM 2018-20Rahul Raj0% (1)

- SGS IE Brochure Life Cycle Assessment enDocument7 pagesSGS IE Brochure Life Cycle Assessment enPRASHANT DASHNo ratings yet

- Tutorial 1-Cost Assignment-AnswersDocument3 pagesTutorial 1-Cost Assignment-AnswersJunaid Ali IslamianNo ratings yet

- The Six Core Elements of Business Process Management - InTDocument13 pagesThe Six Core Elements of Business Process Management - InTZahra ArdanaNo ratings yet

- Team 9Document39 pagesTeam 9tisakia1226No ratings yet

- POM - Notes PDFDocument70 pagesPOM - Notes PDFTeju Kiran85% (26)

- Scope of MBA in Rural Management in Banking & FinanceDocument1 pageScope of MBA in Rural Management in Banking & FinanceThe IIHMR UniversityNo ratings yet

- Cartilla de Ingles FinalDocument10 pagesCartilla de Ingles Finalapi-383779957No ratings yet

- 7.1.4 Environment For The Operation of ProcessesDocument2 pages7.1.4 Environment For The Operation of ProcessesGVS RaoNo ratings yet

- Certified Internal AuditorDocument2 pagesCertified Internal AuditorKiby AliceNo ratings yet

- Sales Strategy - A Strategic Decision Area: 1. Classification of AccountsDocument7 pagesSales Strategy - A Strategic Decision Area: 1. Classification of AccountsALYZA ANGELA ORNEDONo ratings yet

- Pmwj103 Mar2021 Guida Monassi The New Iso 21502Document15 pagesPmwj103 Mar2021 Guida Monassi The New Iso 21502RaedNo ratings yet

- Quiz 6A SolDocument2 pagesQuiz 6A SolimagineimfNo ratings yet

- Huzong ProfesHuzongsors ListDocument9 pagesHuzong ProfesHuzongsors ListdigitalfaniNo ratings yet

- Bsbcmm511 - Task 2Document7 pagesBsbcmm511 - Task 2miraNo ratings yet

- Spare Part Inventory Analysis Report: Normal Distribution-Curve EOQ ModelDocument1 pageSpare Part Inventory Analysis Report: Normal Distribution-Curve EOQ ModelRanjan ShankarNo ratings yet

- E4 E5 MGMNT CompleteDocument621 pagesE4 E5 MGMNT Completesanjay109No ratings yet

- Tutorial Week 4: Short Answer QuestionsDocument6 pagesTutorial Week 4: Short Answer QuestionssimranNo ratings yet

- IA 1 - 5 InventoriesDocument8 pagesIA 1 - 5 InventoriesVJ MacaspacNo ratings yet

- AQA-03-QA Engineer (Manual)Document2 pagesAQA-03-QA Engineer (Manual)Duy Tran MinhNo ratings yet

- MAS Advisors, LLC Acquires Insurance Agency, Synergy Life Brokerage GroupDocument2 pagesMAS Advisors, LLC Acquires Insurance Agency, Synergy Life Brokerage GroupPR.comNo ratings yet

- Second Draft of Babcock Ranch Preserve Management PlanDocument92 pagesSecond Draft of Babcock Ranch Preserve Management PlanNews-PressNo ratings yet