Professional Documents

Culture Documents

DCB Bank Features

DCB Bank Features

Uploaded by

dileepreddy220Copyright:

Available Formats

You might also like

- Du Bill 09305426 Aug 2011Document8 pagesDu Bill 09305426 Aug 2011Syira Lola0% (1)

- Panama Deposit Slip 2 BGDocument1 pagePanama Deposit Slip 2 BGWilliam Dillon100% (1)

- Final Project Reports SBI POSDocument83 pagesFinal Project Reports SBI POSTarun Kathiriya80% (5)

- Walta Act 2002Document15 pagesWalta Act 2002dileepreddy220No ratings yet

- Questionnaire On SmeDocument6 pagesQuestionnaire On SmeDaisy Arora67% (3)

- Tapaswini Book For Accounting Process PDFDocument2 pagesTapaswini Book For Accounting Process PDFSudeep DharNo ratings yet

- RB Chapter 2 - Current DepositsDocument3 pagesRB Chapter 2 - Current DepositsRohit KumarNo ratings yet

- Casa PresentationDocument25 pagesCasa PresentationGupta Bhawna GuptaNo ratings yet

- Payment Gateway DetailsDocument9 pagesPayment Gateway DetailsArvind SrivastavaNo ratings yet

- Most Important Terms & ConditionsDocument93 pagesMost Important Terms & Conditionslancy_dsuzaNo ratings yet

- Product Disclosure Sheet: What Is This Product About?Document6 pagesProduct Disclosure Sheet: What Is This Product About?faisal_ahsan7919No ratings yet

- Credit CardDocument6 pagesCredit Cardredwanur_rahman2002No ratings yet

- PDS Revision Eng & BM Online (Final)Document6 pagesPDS Revision Eng & BM Online (Final)Faiziya BanuNo ratings yet

- HSBC Savings AccountDocument3 pagesHSBC Savings AccountLavanya VitNo ratings yet

- Brochure Offer Professionals Engineers Graduates StudentsDocument8 pagesBrochure Offer Professionals Engineers Graduates StudentsYash ThumarNo ratings yet

- CD PremiumDocument1 pageCD PremiumnelzonpouloseNo ratings yet

- RatesDocument4 pagesRatesashukundanNo ratings yet

- HCBC CC InfoDocument5 pagesHCBC CC Infooninx26No ratings yet

- Priority Product Brochure - 26!04!12Document2 pagesPriority Product Brochure - 26!04!12K Kunal RajNo ratings yet

- HDFC - Saving AccountsDocument11 pagesHDFC - Saving Accountsপ্রিয়াঙ্কুর ধরNo ratings yet

- National Saving BankDocument3 pagesNational Saving BankjackseenNo ratings yet

- Banking Products & Operations: Session3Document63 pagesBanking Products & Operations: Session3Vaidyanathan RavichandranNo ratings yet

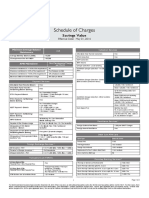

- Schedule of Charges: Savings ValueDocument2 pagesSchedule of Charges: Savings ValueNavjot SinghNo ratings yet

- Airtel Payments Bank - Nanded PDFDocument19 pagesAirtel Payments Bank - Nanded PDFMuzakkir SiddiquiNo ratings yet

- Yes Bank - Schedule of Charges - Savings Select AccountDocument2 pagesYes Bank - Schedule of Charges - Savings Select AccountBOOMTIMENo ratings yet

- Bac Core Checking EnusDocument2 pagesBac Core Checking Enusapi-285070305No ratings yet

- Most Important Terms & ConditionsDocument75 pagesMost Important Terms & Conditionsjamin2020No ratings yet

- Internet Banking FeaturesDocument7 pagesInternet Banking FeaturesDhrumi PatelNo ratings yet

- RatesDocument4 pagesRatesashukundanNo ratings yet

- Savings AccountDocument27 pagesSavings AccountkjlgururajNo ratings yet

- RB Chapter 3 - Savings BankDocument10 pagesRB Chapter 3 - Savings BankHarish YadavNo ratings yet

- HDFC ServicesDocument16 pagesHDFC ServicesVenkateshwar Dasari NethaNo ratings yet

- Banking: Presented by Mukundan SDocument31 pagesBanking: Presented by Mukundan SRajalingam100% (1)

- Stanbic - Wealth and Investment PAYG Account FactsheetDocument2 pagesStanbic - Wealth and Investment PAYG Account FactsheetAnthony kiplangatNo ratings yet

- PDS Eng June2013Document2 pagesPDS Eng June2013NickHansenNo ratings yet

- Topic 7: Traditional Banking ProductsDocument26 pagesTopic 7: Traditional Banking ProductsPremah BalasundramNo ratings yet

- PARAGRAPHDocument8 pagesPARAGRAPHAjajur RoshidNo ratings yet

- Allied Bank Different AccountsDocument8 pagesAllied Bank Different AccountsShahzaib KhanNo ratings yet

- CBO Module 1 Retail Banking Deposit ProductsDocument17 pagesCBO Module 1 Retail Banking Deposit ProductsRajabNo ratings yet

- Elite Savings Account: You Are Our PriorityDocument2 pagesElite Savings Account: You Are Our Prioritykamlesh bohraNo ratings yet

- Annex 3 Prime Salary AccountDocument1 pageAnnex 3 Prime Salary Accountfr123No ratings yet

- CitibankDocument9 pagesCitibankSiva BalajiNo ratings yet

- Emergence of Doorstep Banking - Merits and DemeritsDocument11 pagesEmergence of Doorstep Banking - Merits and Demeritsmani100% (1)

- Retail InfoDocument6 pagesRetail InfoRajeshNo ratings yet

- What Is Core Banking SolutionDocument7 pagesWhat Is Core Banking Solutionmickey4482No ratings yet

- Central Bank of IndiaDocument1 pageCentral Bank of IndiaSoutik ChakrabortyNo ratings yet

- Annexure 3 Salary Accounts Under State Government Salary Package (SGSP)Document2 pagesAnnexure 3 Salary Accounts Under State Government Salary Package (SGSP)harpal_abhNo ratings yet

- BankingDocument18 pagesBankingpiyush_ckNo ratings yet

- Axix Bank AccountsDocument18 pagesAxix Bank AccountsSindhu PriyaNo ratings yet

- Current AccountsDocument21 pagesCurrent AccountsSupriyo SenNo ratings yet

- Transaction Banking Slides-FinalDocument25 pagesTransaction Banking Slides-FinalManjil ShresthaNo ratings yet

- ProjectDocument28 pagesProjectKapil BhavnaniNo ratings yet

- Bank Card & Epayment 2005: E-Payment Products Based On Centralised Rbi PlatformsDocument23 pagesBank Card & Epayment 2005: E-Payment Products Based On Centralised Rbi PlatformsKunal PuriNo ratings yet

- Bank AsiaDocument5 pagesBank AsiaMonjurul Islam RonyNo ratings yet

- Select ChargesDocument1 pageSelect ChargesMd Imran ImuNo ratings yet

- Dear Sir/Madam,: Features of Angel BrokingDocument6 pagesDear Sir/Madam,: Features of Angel BrokingharishkumarsharmaNo ratings yet

- Deposit Schemes: Savings Plus AccountDocument17 pagesDeposit Schemes: Savings Plus AccountMAnmit SIngh DadraNo ratings yet

- MidDocument1 pageMidSdspl DelhiNo ratings yet

- Self Study TopicDocument13 pagesSelf Study TopicRohit SoniNo ratings yet

- Real Time Gross Settlement (RTGS)Document5 pagesReal Time Gross Settlement (RTGS)Vinit MathurNo ratings yet

- Introduction To The StudyDocument97 pagesIntroduction To The StudysaifasainudeenNo ratings yet

- Final Project Reports SBI POSDocument83 pagesFinal Project Reports SBI POSManishNo ratings yet

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- GE LED Light Book PDFDocument27 pagesGE LED Light Book PDFdileepreddy220No ratings yet

- Quartz Exports in 2018-19 N 2019-20 (F)Document1 pageQuartz Exports in 2018-19 N 2019-20 (F)dileepreddy220No ratings yet

- Factors Affecting Hammermill Performance PDFDocument62 pagesFactors Affecting Hammermill Performance PDFdileepreddy220No ratings yet

- ASTM E11 15 Standards Table PDFDocument1 pageASTM E11 15 Standards Table PDFdileepreddy220No ratings yet

- CITES NDF Report - Pterocarpus Santalinus - IndiaDocument30 pagesCITES NDF Report - Pterocarpus Santalinus - Indiadileepreddy220No ratings yet

- Kiya FelekeDocument69 pagesKiya Felekekiya felelkeNo ratings yet

- Somali Banking Goes InternationalDocument4 pagesSomali Banking Goes InternationalAMISOM Public Information ServicesNo ratings yet

- Translated File CC Bill April 1Document2 pagesTranslated File CC Bill April 1sanchaliNo ratings yet

- FOREXDocument24 pagesFOREXPrasenjit Chakraborty0% (1)

- 0001 Irs Remics List 938 - Dec 2005Document185 pages0001 Irs Remics List 938 - Dec 2005Tara IsmineNo ratings yet

- Block (Ed.) - The Organized Criminal Activities of The Bank of Credit and Commerce International.. (2001)Document176 pagesBlock (Ed.) - The Organized Criminal Activities of The Bank of Credit and Commerce International.. (2001)Anonymous OOeTGKMAdDNo ratings yet

- Case Digest - General Banking ActDocument15 pagesCase Digest - General Banking ActAiko DalaganNo ratings yet

- Summer Training ReportDocument45 pagesSummer Training ReportAb Suryansh YadavNo ratings yet

- Schedule of Audit Findings and RecommendationsDocument2 pagesSchedule of Audit Findings and RecommendationsElibom DnegelNo ratings yet

- Professor Nitzan Weiss 12/19/2017 Team Members: Pooja Kohli Priyesha Sanjeev Dani Ruchi Pankaj PrajapatiDocument6 pagesProfessor Nitzan Weiss 12/19/2017 Team Members: Pooja Kohli Priyesha Sanjeev Dani Ruchi Pankaj PrajapatiShubham PalNo ratings yet

- Vehicle Insurance PopDocument2 pagesVehicle Insurance PopTadiwanashe ChikoworeNo ratings yet

- GXMFFL 4 B 4 Q 7 Uu 0 RhzeabDocument1 pageGXMFFL 4 B 4 Q 7 Uu 0 RhzeabRAMAKRISHNA MADALANo ratings yet

- Forex ProblemsDocument17 pagesForex ProblemsFoo Chuan Mao100% (1)

- Investing Tips: Lesson 18: Student Activity Sheet 1Document3 pagesInvesting Tips: Lesson 18: Student Activity Sheet 1GONZALO JIMENEZ MORALESNo ratings yet

- Visanet - Treyas - PGLDocument5 pagesVisanet - Treyas - PGLreyben454No ratings yet

- Canara Bank: General OverviewDocument6 pagesCanara Bank: General Overviewshraddha anandNo ratings yet

- Central Banking EcoDocument11 pagesCentral Banking EcoRohit YadavNo ratings yet

- TraveleenDocument5 pagesTraveleenshahrukhNo ratings yet

- What Type of Proof of Funds Are Available?Document1 pageWhat Type of Proof of Funds Are Available?nurdinyusofNo ratings yet

- Internship Report On General Banking Activities of Dutch Bangla Bank LimitedDocument36 pagesInternship Report On General Banking Activities of Dutch Bangla Bank LimitedJames BlackNo ratings yet

- Daily TransactionDocument46 pagesDaily TransactionSukuje JeNo ratings yet

- UnlockedDocument5 pagesUnlockedmonsomnath704No ratings yet

- Economics Art IntegrationDocument19 pagesEconomics Art IntegrationAditi AKNo ratings yet

- MXP 3 M9 F ITSh BNVK7911Document52 pagesMXP 3 M9 F ITSh BNVK7911Noshaba MaqsoodNo ratings yet

- Detailed StatementDocument19 pagesDetailed StatementPushpendra ChauhanNo ratings yet

- Jagruti Rajesh Gurav FINAL PROJECTDocument83 pagesJagruti Rajesh Gurav FINAL PROJECTArtisan VenturesNo ratings yet

- Module 2 Time Value of MoneyDocument62 pagesModule 2 Time Value of MoneyNEERAJ N RCBSNo ratings yet

DCB Bank Features

DCB Bank Features

Uploaded by

dileepreddy220Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DCB Bank Features

DCB Bank Features

Uploaded by

dileepreddy220Copyright:

Available Formats

UNIQUE FEATURES OF DCB CURRENT BANK:

Zero Balance Account*(initial cheque required)

Non-maintenance charges of AQG / MAB are Zero

Earn Savings Account Interest on Current Account Balances

(Balances more than threshold amount will be transferred to

savings account)

Option to choose your Acccount Number

All Branches in India are home branches

Any branch cash deposit as home branch

Flexible Cash Deposits (AQB * 30 times)

Ex: If your Average Quarterly Balance is Rs.1,00,000/-, then you can deposit the

cash upto Rs.30,00,000/- without any charges. (No other Bank provides this

facility)

Door Step Banking (Cash & Cheque Pick up*)

Free DDs*

FREE Any Bank ATM withdrawal

FREE NEFT & RTGS transactions

FREE SMS Alerts, Statements and Internet Banking

FREE Payable at par Cheque Book

FREE online Utility Bill Payments and Tax Payments

Cash Back facility on Platinum Debit Card*

*Conditions Apply

P.SRINIVASULU, RM, Assets and Liabilities Group - Ph: 9949158351

Indias fastest growing Bank

Wide Network of Branches

Cash & Cheque pickup:- ( Get Cash

deposited or delivered at doorstep)

Overdraft facility for business

accounts

Personal Accident Insurance, Lost

card Liability Protection on your

International Debit Card.

All over India Home Banking

facilities

Base

Location

Concept

(Allows customer to utilize

free limits across all branches

in India)

Unlimited access to any bank

ATM usage

Wide Product Suite

Customised Products

Tax Payment

Grouping & Pooling Facility

Door Step Banking

Trade & Forex Related Services:

Processing of Export & Import Bills

Letter of Credit

Bank Guarantee

PRIVILIGE BANKING:

Privilege Banking customers enjoy relationship privileges across DCB Bank Products

and services including deposits, loans, cards, forex and locker facilities. In addition to these, our

tie-ups with carefully chosen alliance partners help provide exclusive offers that complement

your tastes and lifestyle.

Relationship Privileges

1. Qualification for your loan eligibility.

2. Preferential interest rates and/or processing fees on Loan products.

3. Preferential pricing on purchase of gold, sale/purchase of forex.

Priority Service

Preferential Access - Reduction in your waiting time. Enjoy priority service at our branches

and at Customer Care

Over the Counter Servicing (OTC) - Prompt resolutions. A range of service requests are

processed over the counter.

Priority Processing - Fast-tracked through dedicated teams. All account opening requests and

loan/credit card applications processed on priority.

Priority Updates - Be updated even while on the move Updates through SMS on the status of

your service requests

DIFFERENT TYPES OF CURRENT ACCOUNTS AVAILABLE AT DCB BANK

Elite Account

Business Saver Account

Smart Gain Account

Classic Account

P.SRINIVASULU, RM, Assets and Liabilities Group - Ph: 9949158351

You might also like

- Du Bill 09305426 Aug 2011Document8 pagesDu Bill 09305426 Aug 2011Syira Lola0% (1)

- Panama Deposit Slip 2 BGDocument1 pagePanama Deposit Slip 2 BGWilliam Dillon100% (1)

- Final Project Reports SBI POSDocument83 pagesFinal Project Reports SBI POSTarun Kathiriya80% (5)

- Walta Act 2002Document15 pagesWalta Act 2002dileepreddy220No ratings yet

- Questionnaire On SmeDocument6 pagesQuestionnaire On SmeDaisy Arora67% (3)

- Tapaswini Book For Accounting Process PDFDocument2 pagesTapaswini Book For Accounting Process PDFSudeep DharNo ratings yet

- RB Chapter 2 - Current DepositsDocument3 pagesRB Chapter 2 - Current DepositsRohit KumarNo ratings yet

- Casa PresentationDocument25 pagesCasa PresentationGupta Bhawna GuptaNo ratings yet

- Payment Gateway DetailsDocument9 pagesPayment Gateway DetailsArvind SrivastavaNo ratings yet

- Most Important Terms & ConditionsDocument93 pagesMost Important Terms & Conditionslancy_dsuzaNo ratings yet

- Product Disclosure Sheet: What Is This Product About?Document6 pagesProduct Disclosure Sheet: What Is This Product About?faisal_ahsan7919No ratings yet

- Credit CardDocument6 pagesCredit Cardredwanur_rahman2002No ratings yet

- PDS Revision Eng & BM Online (Final)Document6 pagesPDS Revision Eng & BM Online (Final)Faiziya BanuNo ratings yet

- HSBC Savings AccountDocument3 pagesHSBC Savings AccountLavanya VitNo ratings yet

- Brochure Offer Professionals Engineers Graduates StudentsDocument8 pagesBrochure Offer Professionals Engineers Graduates StudentsYash ThumarNo ratings yet

- CD PremiumDocument1 pageCD PremiumnelzonpouloseNo ratings yet

- RatesDocument4 pagesRatesashukundanNo ratings yet

- HCBC CC InfoDocument5 pagesHCBC CC Infooninx26No ratings yet

- Priority Product Brochure - 26!04!12Document2 pagesPriority Product Brochure - 26!04!12K Kunal RajNo ratings yet

- HDFC - Saving AccountsDocument11 pagesHDFC - Saving Accountsপ্রিয়াঙ্কুর ধরNo ratings yet

- National Saving BankDocument3 pagesNational Saving BankjackseenNo ratings yet

- Banking Products & Operations: Session3Document63 pagesBanking Products & Operations: Session3Vaidyanathan RavichandranNo ratings yet

- Schedule of Charges: Savings ValueDocument2 pagesSchedule of Charges: Savings ValueNavjot SinghNo ratings yet

- Airtel Payments Bank - Nanded PDFDocument19 pagesAirtel Payments Bank - Nanded PDFMuzakkir SiddiquiNo ratings yet

- Yes Bank - Schedule of Charges - Savings Select AccountDocument2 pagesYes Bank - Schedule of Charges - Savings Select AccountBOOMTIMENo ratings yet

- Bac Core Checking EnusDocument2 pagesBac Core Checking Enusapi-285070305No ratings yet

- Most Important Terms & ConditionsDocument75 pagesMost Important Terms & Conditionsjamin2020No ratings yet

- Internet Banking FeaturesDocument7 pagesInternet Banking FeaturesDhrumi PatelNo ratings yet

- RatesDocument4 pagesRatesashukundanNo ratings yet

- Savings AccountDocument27 pagesSavings AccountkjlgururajNo ratings yet

- RB Chapter 3 - Savings BankDocument10 pagesRB Chapter 3 - Savings BankHarish YadavNo ratings yet

- HDFC ServicesDocument16 pagesHDFC ServicesVenkateshwar Dasari NethaNo ratings yet

- Banking: Presented by Mukundan SDocument31 pagesBanking: Presented by Mukundan SRajalingam100% (1)

- Stanbic - Wealth and Investment PAYG Account FactsheetDocument2 pagesStanbic - Wealth and Investment PAYG Account FactsheetAnthony kiplangatNo ratings yet

- PDS Eng June2013Document2 pagesPDS Eng June2013NickHansenNo ratings yet

- Topic 7: Traditional Banking ProductsDocument26 pagesTopic 7: Traditional Banking ProductsPremah BalasundramNo ratings yet

- PARAGRAPHDocument8 pagesPARAGRAPHAjajur RoshidNo ratings yet

- Allied Bank Different AccountsDocument8 pagesAllied Bank Different AccountsShahzaib KhanNo ratings yet

- CBO Module 1 Retail Banking Deposit ProductsDocument17 pagesCBO Module 1 Retail Banking Deposit ProductsRajabNo ratings yet

- Elite Savings Account: You Are Our PriorityDocument2 pagesElite Savings Account: You Are Our Prioritykamlesh bohraNo ratings yet

- Annex 3 Prime Salary AccountDocument1 pageAnnex 3 Prime Salary Accountfr123No ratings yet

- CitibankDocument9 pagesCitibankSiva BalajiNo ratings yet

- Emergence of Doorstep Banking - Merits and DemeritsDocument11 pagesEmergence of Doorstep Banking - Merits and Demeritsmani100% (1)

- Retail InfoDocument6 pagesRetail InfoRajeshNo ratings yet

- What Is Core Banking SolutionDocument7 pagesWhat Is Core Banking Solutionmickey4482No ratings yet

- Central Bank of IndiaDocument1 pageCentral Bank of IndiaSoutik ChakrabortyNo ratings yet

- Annexure 3 Salary Accounts Under State Government Salary Package (SGSP)Document2 pagesAnnexure 3 Salary Accounts Under State Government Salary Package (SGSP)harpal_abhNo ratings yet

- BankingDocument18 pagesBankingpiyush_ckNo ratings yet

- Axix Bank AccountsDocument18 pagesAxix Bank AccountsSindhu PriyaNo ratings yet

- Current AccountsDocument21 pagesCurrent AccountsSupriyo SenNo ratings yet

- Transaction Banking Slides-FinalDocument25 pagesTransaction Banking Slides-FinalManjil ShresthaNo ratings yet

- ProjectDocument28 pagesProjectKapil BhavnaniNo ratings yet

- Bank Card & Epayment 2005: E-Payment Products Based On Centralised Rbi PlatformsDocument23 pagesBank Card & Epayment 2005: E-Payment Products Based On Centralised Rbi PlatformsKunal PuriNo ratings yet

- Bank AsiaDocument5 pagesBank AsiaMonjurul Islam RonyNo ratings yet

- Select ChargesDocument1 pageSelect ChargesMd Imran ImuNo ratings yet

- Dear Sir/Madam,: Features of Angel BrokingDocument6 pagesDear Sir/Madam,: Features of Angel BrokingharishkumarsharmaNo ratings yet

- Deposit Schemes: Savings Plus AccountDocument17 pagesDeposit Schemes: Savings Plus AccountMAnmit SIngh DadraNo ratings yet

- MidDocument1 pageMidSdspl DelhiNo ratings yet

- Self Study TopicDocument13 pagesSelf Study TopicRohit SoniNo ratings yet

- Real Time Gross Settlement (RTGS)Document5 pagesReal Time Gross Settlement (RTGS)Vinit MathurNo ratings yet

- Introduction To The StudyDocument97 pagesIntroduction To The StudysaifasainudeenNo ratings yet

- Final Project Reports SBI POSDocument83 pagesFinal Project Reports SBI POSManishNo ratings yet

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- GE LED Light Book PDFDocument27 pagesGE LED Light Book PDFdileepreddy220No ratings yet

- Quartz Exports in 2018-19 N 2019-20 (F)Document1 pageQuartz Exports in 2018-19 N 2019-20 (F)dileepreddy220No ratings yet

- Factors Affecting Hammermill Performance PDFDocument62 pagesFactors Affecting Hammermill Performance PDFdileepreddy220No ratings yet

- ASTM E11 15 Standards Table PDFDocument1 pageASTM E11 15 Standards Table PDFdileepreddy220No ratings yet

- CITES NDF Report - Pterocarpus Santalinus - IndiaDocument30 pagesCITES NDF Report - Pterocarpus Santalinus - Indiadileepreddy220No ratings yet

- Kiya FelekeDocument69 pagesKiya Felekekiya felelkeNo ratings yet

- Somali Banking Goes InternationalDocument4 pagesSomali Banking Goes InternationalAMISOM Public Information ServicesNo ratings yet

- Translated File CC Bill April 1Document2 pagesTranslated File CC Bill April 1sanchaliNo ratings yet

- FOREXDocument24 pagesFOREXPrasenjit Chakraborty0% (1)

- 0001 Irs Remics List 938 - Dec 2005Document185 pages0001 Irs Remics List 938 - Dec 2005Tara IsmineNo ratings yet

- Block (Ed.) - The Organized Criminal Activities of The Bank of Credit and Commerce International.. (2001)Document176 pagesBlock (Ed.) - The Organized Criminal Activities of The Bank of Credit and Commerce International.. (2001)Anonymous OOeTGKMAdDNo ratings yet

- Case Digest - General Banking ActDocument15 pagesCase Digest - General Banking ActAiko DalaganNo ratings yet

- Summer Training ReportDocument45 pagesSummer Training ReportAb Suryansh YadavNo ratings yet

- Schedule of Audit Findings and RecommendationsDocument2 pagesSchedule of Audit Findings and RecommendationsElibom DnegelNo ratings yet

- Professor Nitzan Weiss 12/19/2017 Team Members: Pooja Kohli Priyesha Sanjeev Dani Ruchi Pankaj PrajapatiDocument6 pagesProfessor Nitzan Weiss 12/19/2017 Team Members: Pooja Kohli Priyesha Sanjeev Dani Ruchi Pankaj PrajapatiShubham PalNo ratings yet

- Vehicle Insurance PopDocument2 pagesVehicle Insurance PopTadiwanashe ChikoworeNo ratings yet

- GXMFFL 4 B 4 Q 7 Uu 0 RhzeabDocument1 pageGXMFFL 4 B 4 Q 7 Uu 0 RhzeabRAMAKRISHNA MADALANo ratings yet

- Forex ProblemsDocument17 pagesForex ProblemsFoo Chuan Mao100% (1)

- Investing Tips: Lesson 18: Student Activity Sheet 1Document3 pagesInvesting Tips: Lesson 18: Student Activity Sheet 1GONZALO JIMENEZ MORALESNo ratings yet

- Visanet - Treyas - PGLDocument5 pagesVisanet - Treyas - PGLreyben454No ratings yet

- Canara Bank: General OverviewDocument6 pagesCanara Bank: General Overviewshraddha anandNo ratings yet

- Central Banking EcoDocument11 pagesCentral Banking EcoRohit YadavNo ratings yet

- TraveleenDocument5 pagesTraveleenshahrukhNo ratings yet

- What Type of Proof of Funds Are Available?Document1 pageWhat Type of Proof of Funds Are Available?nurdinyusofNo ratings yet

- Internship Report On General Banking Activities of Dutch Bangla Bank LimitedDocument36 pagesInternship Report On General Banking Activities of Dutch Bangla Bank LimitedJames BlackNo ratings yet

- Daily TransactionDocument46 pagesDaily TransactionSukuje JeNo ratings yet

- UnlockedDocument5 pagesUnlockedmonsomnath704No ratings yet

- Economics Art IntegrationDocument19 pagesEconomics Art IntegrationAditi AKNo ratings yet

- MXP 3 M9 F ITSh BNVK7911Document52 pagesMXP 3 M9 F ITSh BNVK7911Noshaba MaqsoodNo ratings yet

- Detailed StatementDocument19 pagesDetailed StatementPushpendra ChauhanNo ratings yet

- Jagruti Rajesh Gurav FINAL PROJECTDocument83 pagesJagruti Rajesh Gurav FINAL PROJECTArtisan VenturesNo ratings yet

- Module 2 Time Value of MoneyDocument62 pagesModule 2 Time Value of MoneyNEERAJ N RCBSNo ratings yet