Professional Documents

Culture Documents

8843 Instructions: You Did Not Earn Any Money in The U.S. (See The OISS Website To Determine If You Are A Resident or

8843 Instructions: You Did Not Earn Any Money in The U.S. (See The OISS Website To Determine If You Are A Resident or

Uploaded by

anaga1982Copyright:

Available Formats

You might also like

- Sia Application Form NotesDocument40 pagesSia Application Form NotesRobin HardyNo ratings yet

- Statement For Exempt Individuals and Individuals With A Medical ConditionDocument4 pagesStatement For Exempt Individuals and Individuals With A Medical ConditionMathew BobanNo ratings yet

- Example - 8843 F-1 - F-2 or J-1 - J-2 Student - 2023 2Document4 pagesExample - 8843 F-1 - F-2 or J-1 - J-2 Student - 2023 2Anh LêNo ratings yet

- Statement For Exempt Individuals and Individuals With A Medical ConditionDocument4 pagesStatement For Exempt Individuals and Individuals With A Medical Conditionjosue gomezNo ratings yet

- Statement For Exempt Individuals and Individuals With A Medical ConditionDocument4 pagesStatement For Exempt Individuals and Individuals With A Medical Conditionluke903702420No ratings yet

- Allie Do Tax FormDocument4 pagesAllie Do Tax FormAnh LêNo ratings yet

- Imm 008Document26 pagesImm 008Rizwan HameedNo ratings yet

- Guidelines On Filling Up The Application FormDocument4 pagesGuidelines On Filling Up The Application FormSai SreenadhNo ratings yet

- Gao 202 FormDocument1 pageGao 202 FormTyrel McleodNo ratings yet

- Background InvestigationDocument43 pagesBackground InvestigationcasseyraizaNo ratings yet

- AlaAL ZAALIG2011Document5 pagesAlaAL ZAALIG2011Ala AlzaaligNo ratings yet

- Form 8862Document2 pagesForm 8862Francis Wolfgang UrbanNo ratings yet

- Application Form For Admission As A Recognised Student 2013-14Document14 pagesApplication Form For Admission As A Recognised Student 2013-14Celia MillerNo ratings yet

- IOM Personal History FormDocument5 pagesIOM Personal History FormEdward Ebb Bonno100% (4)

- 2019 IRS 8843 InstructionsDocument9 pages2019 IRS 8843 InstructionsBoopity SnootNo ratings yet

- 2011 1040NR-EZ Form - SampleDocument2 pages2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- CIT0002EDocument0 pagesCIT0002EBujar NuhiuNo ratings yet

- Glacier Tax User GuideDocument5 pagesGlacier Tax User Guideinter4ever77No ratings yet

- W-7 FormDocument1 pageW-7 FormRaviLifewideNo ratings yet

- Perdon de Pago I-912Document11 pagesPerdon de Pago I-912ChrisNo ratings yet

- Student Visa: ApplicationDocument16 pagesStudent Visa: ApplicationYunilo Camral Jr.No ratings yet

- Bed For ShireDocument4 pagesBed For ShireNishant Sethi100% (1)

- Step 4 - I-765 and I-765WS Completion GuideDocument6 pagesStep 4 - I-765 and I-765WS Completion GuideElrandomheroNo ratings yet

- Application Form: Use This Form If: Registration HelplineDocument28 pagesApplication Form: Use This Form If: Registration HelplineSala Petru-LaurenţiuNo ratings yet

- Application Form International MIT Melb 2013-01-21Document4 pagesApplication Form International MIT Melb 2013-01-21Ranjit SinghNo ratings yet

- Education Program FormDocument12 pagesEducation Program FormROCKNo ratings yet

- Application Form (F1) : Instructions: NotesDocument4 pagesApplication Form (F1) : Instructions: Notesapi-136633166No ratings yet

- Personal Particulars For Assessment Including Character Assessment - Form 80Document18 pagesPersonal Particulars For Assessment Including Character Assessment - Form 80Milos Fra Ljubanic0% (1)

- About You: Read This FirstDocument8 pagesAbout You: Read This FirstScientificBoysClubNo ratings yet

- Submitting Your U.S. Tax Documents: Print, Sign, MailDocument5 pagesSubmitting Your U.S. Tax Documents: Print, Sign, MailGia Han100% (1)

- Itin Aa-Caa Online Pre-ApplicationtrainingDocument88 pagesItin Aa-Caa Online Pre-ApplicationtrainingshahsaagarNo ratings yet

- IRS f13614nrDocument2 pagesIRS f13614nrMartin PetroskyNo ratings yet

- Rose Hudson Workbook Case StudyDocument6 pagesRose Hudson Workbook Case StudyMary O'KeeffeNo ratings yet

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDocument2 pages1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No Dependentspixel986No ratings yet

- 2014 Undergraduate Application FormDocument4 pages2014 Undergraduate Application Formleomille2No ratings yet

- 2011-2012 Dependent Verification Worksheet: About The Verification ProcessDocument2 pages2011-2012 Dependent Verification Worksheet: About The Verification ProcessJerry WilkNo ratings yet

- Start-Up Entrepreneur Programme Application Form: Step1Document19 pagesStart-Up Entrepreneur Programme Application Form: Step1ankur.aroraNo ratings yet

- 2012-13 Transfer Aid ApplicationDocument4 pages2012-13 Transfer Aid ApplicationLufinancial AidNo ratings yet

- Frequently Asked Tax Questions 2015sdaDocument8 pagesFrequently Asked Tax Questions 2015sdaVikram VickyNo ratings yet

- Application Form 2017: Intellectual Exchange and Innovation ProgramDocument7 pagesApplication Form 2017: Intellectual Exchange and Innovation ProgramKustomoNo ratings yet

- Form 1040nrez 2010Document2 pagesForm 1040nrez 2010David A. VestNo ratings yet

- Vaf9-App81 NOV2012Document8 pagesVaf9-App81 NOV2012lucasm4st3rNo ratings yet

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDocument2 pages1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsRajesh Kumar ReddyNo ratings yet

- TimeDocument3 pagesTimeVan TalawecNo ratings yet

- Cleveland State University Residency Petition For Tuition PurposesDocument7 pagesCleveland State University Residency Petition For Tuition PurposesjerrytouilleNo ratings yet

- FW 7Document1 pageFW 7klumer_xNo ratings yet

- WWW - Irs.gov Pub Irs-PDF Fw7Document1 pageWWW - Irs.gov Pub Irs-PDF Fw7desikudi9000No ratings yet

- Planet E Tutors: Form NoDocument3 pagesPlanet E Tutors: Form NoPlanete TutorsNo ratings yet

- PPTC 190Document8 pagesPPTC 190test0% (1)

- Maternity Benefit FormDocument12 pagesMaternity Benefit Formapi-259279833No ratings yet

- WWW Financialaid Ou EduDocument3 pagesWWW Financialaid Ou EduJoel VandiverNo ratings yet

- Tier 4 Applicationform 1Document37 pagesTier 4 Applicationform 1Anjum SattarNo ratings yet

- Instructions: Incomplete Applications Will Be IneligibleDocument8 pagesInstructions: Incomplete Applications Will Be IneligiblecollegeofficeNo ratings yet

- Canada Study Permit Success Guide: The Ultimate Guide to Student Visa and Study Permit ApplicationFrom EverandCanada Study Permit Success Guide: The Ultimate Guide to Student Visa and Study Permit ApplicationNo ratings yet

- US Immigration Exam Study Guide in English and Spanish: Study Guides for the US Immigration Test, #12From EverandUS Immigration Exam Study Guide in English and Spanish: Study Guides for the US Immigration Test, #12No ratings yet

- US Immigration Exam Study Guide in English and SpanishFrom EverandUS Immigration Exam Study Guide in English and SpanishRating: 1 out of 5 stars1/5 (3)

- Application For Admission For The 2009-2010 Academic Year 2013-2014Document2 pagesApplication For Admission For The 2009-2010 Academic Year 2013-2014anaga1982No ratings yet

- (See Rule 12 (2) ) : (At The Time ofDocument2 pages(See Rule 12 (2) ) : (At The Time ofanaga1982No ratings yet

- SNAP 2010 Question Paper and Ans KeyDocument19 pagesSNAP 2010 Question Paper and Ans Keyanaga1982No ratings yet

- Re Advertisement 5-13Document27 pagesRe Advertisement 5-13anaga1982No ratings yet

- APC311 CompletedDocument7 pagesAPC311 CompletedShahrukh Abdul GhaffarNo ratings yet

- 16-16911 - In-Lease Individual Tabs 2014-2015Document173 pages16-16911 - In-Lease Individual Tabs 2014-2015RecordTrac - City of OaklandNo ratings yet

- F&A Best - SAPOSTDocument23 pagesF&A Best - SAPOSTsheikh arif khan100% (2)

- Direct Tax MCQSDocument90 pagesDirect Tax MCQSTaruni JashnaniNo ratings yet

- 001 VOL 1B Pasvi 19 03 19Document89 pages001 VOL 1B Pasvi 19 03 19Dhaval ParmarNo ratings yet

- Fundamentals of Computer Problem Solving: Assignment 3Document7 pagesFundamentals of Computer Problem Solving: Assignment 3Nor Syahirah Mohd NorNo ratings yet

- Myanmar Tax Booklet - 2021 2022 2022 2023Document61 pagesMyanmar Tax Booklet - 2021 2022 2022 2023Ya Min KyawNo ratings yet

- Sterling Parfums Internship RepotDocument42 pagesSterling Parfums Internship RepotSopan O&M CO. PVT. LTD.No ratings yet

- Decision Making and Relevant InformationDocument48 pagesDecision Making and Relevant InformationDwidarNo ratings yet

- Investment Decision: Unit IiiDocument50 pagesInvestment Decision: Unit IiiFara HameedNo ratings yet

- Gov. Salceda's Vision For AlbayDocument151 pagesGov. Salceda's Vision For Albaymareinert100% (1)

- F3ltd-Payroll With Payslip FormatDocument6 pagesF3ltd-Payroll With Payslip FormatSonu PathakNo ratings yet

- Residential Status Problems 2021-2022-1Document5 pagesResidential Status Problems 2021-2022-120-UCO-517 AJAY KELVIN ANo ratings yet

- Calculate Your Federal TaxesDocument6 pagesCalculate Your Federal Taxesapi-719544021No ratings yet

- BMAC5203Document177 pagesBMAC5203PrabhuNo ratings yet

- Money, Its MeaningDocument19 pagesMoney, Its MeaningJayson GambaNo ratings yet

- HR Metrics Absence Rate: EMA/Cost Per Hire Staffing Metrics SurveyDocument4 pagesHR Metrics Absence Rate: EMA/Cost Per Hire Staffing Metrics SurveyVaibhav Jain100% (1)

- A Research Presented To: Feasibility of Operating National Bookstore in Boac, MarinduqueDocument4 pagesA Research Presented To: Feasibility of Operating National Bookstore in Boac, MarinduqueArrianne UmaliNo ratings yet

- Quarterly Report Q3 2010 MJNADocument20 pagesQuarterly Report Q3 2010 MJNAcb0bNo ratings yet

- PagibigDocument4 pagesPagibigElma B. CaquilalaNo ratings yet

- Quiz 3. Adjusting Entries Attempt ReviewDocument11 pagesQuiz 3. Adjusting Entries Attempt ReviewTrisha Monique VillaNo ratings yet

- Astra Account December 2020Document163 pagesAstra Account December 2020Kalpin SaragihNo ratings yet

- Sales 24344504 q3Document3 pagesSales 24344504 q3Vedantam GuptaNo ratings yet

- Summary Chapter 6: Entrepreneurship and Starting Small BusinessDocument19 pagesSummary Chapter 6: Entrepreneurship and Starting Small BusinessriskaNo ratings yet

- Future of Handloom Industry in Kerala During The Post Global Is at Ion PeriodDocument8 pagesFuture of Handloom Industry in Kerala During The Post Global Is at Ion PeriodHarikrishnan Menoth100% (1)

- SriLankan Airlines Annual Report 2015-16 EnglishDocument92 pagesSriLankan Airlines Annual Report 2015-16 EnglishChandu De Silva100% (2)

- Dipifr 2018 Jun QDocument8 pagesDipifr 2018 Jun QMyo NaingNo ratings yet

- ch12 PDFDocument9 pagesch12 PDFEmma Mariz GarciaNo ratings yet

- What Is Goodwill?: Key TakeawaysDocument4 pagesWhat Is Goodwill?: Key TakeawaysTin PangilinanNo ratings yet

- What Is Unearned Revenue?Document3 pagesWhat Is Unearned Revenue?JNo ratings yet

8843 Instructions: You Did Not Earn Any Money in The U.S. (See The OISS Website To Determine If You Are A Resident or

8843 Instructions: You Did Not Earn Any Money in The U.S. (See The OISS Website To Determine If You Are A Resident or

Uploaded by

anaga1982Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

8843 Instructions: You Did Not Earn Any Money in The U.S. (See The OISS Website To Determine If You Are A Resident or

8843 Instructions: You Did Not Earn Any Money in The U.S. (See The OISS Website To Determine If You Are A Resident or

Uploaded by

anaga1982Copyright:

Available Formats

8843 Instructions

Scroll down to find the form 8843 (can be filled in by hand or online:

http://www.irs.gov/pub/irs-pdf/f8843.pdf). If you have a pre-printed 8843 from Human Resources (usually

sent at the end of February), you can use the preprinted form.

All students and dependents considered non-residents for Federal Tax purposes must file the 8843 even if

you did not earn any money in the U.S. (See the OISS website to determine if you are a resident or

non-resident for Federal tax purposes). Those who earned income and have to file a 1040NR or

1040NR-EZ should attach the 8843 with their tax return which can be completed using the Windstar

System. See the OISS tax website for details.

Name and Address:

Fill in "First name", "Last name", and "Social Security number". If you do not have a Social

Security Number leave this blank.

Fill in the "Address in county of residence" box with your home country address

Fill in the "Address in the United States" box with your local address

Part I: All students and scholars including dependents:

1a. Enter visa status and date when you last entered the U.S. This information can be found on your I-94

card, the white card that was given to you when you entered the U.S.

1b. Enter your current immigration status. It will be the same as above unless you changed your status in

the U.S. since your last entry.

2. 3. and 3a. Enter citizenship and relevant information.

4a and 4b. 4b will be the number of days you were in the U.S in 2012.

Part II: J Visiting Professor, Scholar or Researcher

5. Enter: Boston College, 140 Commonwealth Ave. Chestnut Hill MA. If you were a researcher or

professor at more than one university, enter the most recent university in 2012.

6. Enter the name, address (use the BC address above) and the phone number for the department chair or

your faculty sponsor.

7. Complete if you held a J or Q status in the listed years.

8. Only list the years that you were that you were considered a non-resident in A, G, F, J, M, or Q status.

Part III: Students

9. Enter the most recent academic institution you attended in 2012. For Boston College enter: Boston

College, 140 Commonwealth Ave. Chestnut Hill, MA 02467

10. Enter: Adrienne Nussbaum, Office of International Students and Scholars, 140 Commonwealth Ave.,

Maloney Hall Suite 249, 02467. 617 552 8005.

Part IV and Part V: Skip

Sign and Mail:

Sign and date the form at the bottom

Make a photocopy of your completed Form 8843 to keep for your records.

Mail to:

Internal Revenue Service Austin, TX 73301-0215 (Note: There is no street address)

Filing deadlines:

If you had no U.S. earned income and are filing only Form 8843, the deadline for filing this form is

June 15.

If you must file Form 1040NR-EZ or 1040NR, then you must complete Form 8843 and mail with

your tax return before the filing deadline, which is April 15.

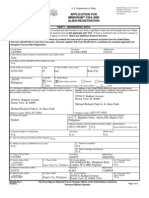

Form

8843

Statement for Exempt Individuals and Individuals

With a Medical Condition

OMB No. 1545-0074

2012

For use by alien individuals only.

Department of the Treasury

Internal Revenue Service

Information about Form 8843 and its instructions is at www.irs.gov/form8843.

beginning

Your first name and initial

Fill in your

addresses only if

you are filing this

form by itself and

not with your tax

return

Part I

Attachment

Sequence No. 102

For the year January 1December 31, 2012, or other tax year

, 2012, and ending

Last name

Address in country of residence

, 20

Your U.S. taxpayer identification number, if any

Address in the United States

General Information

1a Type of U.S. visa (for example, F, J, M, Q, etc.) and date you entered the United States

b Current nonimmigrant status and date of change (see instructions) a

Of what country were you a citizen during the tax year?

What country issued you a passport?

Enter your passport number a

Enter the actual number of days you were present in the United States during:

2012

2011

2010

b Enter the number of days in 2012 you claim you can exclude for purposes of the substantial presence test

2

3a

b

4a

Part II

Teachers and Trainees

For teachers, enter the name, address, and telephone number of the academic institution where you taught in 2012 a

For trainees, enter the name, address, and telephone number of the director of the academic or other specialized program

you participated in during 2012 a

Enter the type of U.S. visa (J or Q) you held during: a

2006

2007

. If the type of visa you held during any

2008

2009

2010

2011

of these years changed, attach a statement showing the new visa type and the date it was acquired.

Were you present in the United States as a teacher, trainee, or student for any part of 2 of the 6 prior

calendar years (2006 through 2011)? . . . . . . . . . . . . . . . . . . . . . . . .

Yes

If you checked the Yes box on line 8, you cannot exclude days of presence as a teacher or trainee unless

you meet the Exception explained in the instructions.

Part III

9

No

Students

Enter the name, address, and telephone number of the academic institution you attended during 2012

10

Enter the name, address, and telephone number of the director of the academic or other specialized program you participated

in during 2012 a

11

Enter the type of U.S. visa (F, J, M, or Q) you held during: a

2006

2007

. If the type of visa you held during any

2008

2009

2010

2011

of these years changed, attach a statement showing the new visa type and the date it was acquired.

Were you present in the United States as a teacher, trainee, or student for any part of more than 5 calendar

years? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

If you checked the Yes box on line 12, you must provide sufficient facts on an attached statement to

establish that you do not intend to reside permanently in the United States.

12

13

14

During 2012, did you apply for, or take other affirmative steps to apply for, lawful permanent resident status

in the United States or have an application pending to change your status to that of a lawful permanent

resident of the United States? . . . . . . . . . . . . . . . . . . . . . . . . . .

If you checked the Yes box on line 13, explain a

For Paperwork Reduction Act Notice, see page 4.

Cat. No. 17227H

Yes

No

No

Form 8843 (2012)

Page 2

Form 8843 (2012)

Part IV

Professional Athletes

15

Enter the name of the charitable sports event(s) in the United States in which you competed during 2012 and the dates of

competition a

16

Enter the name(s) and employer identification number(s) of the charitable organization(s) that benefited from the sports

event(s) a

Note. You must attach a statement to verify that all of the net proceeds of the sports event(s) were contributed to the charitable

organization(s) listed on line 16.

Part V

17a

Individuals With a Medical Condition or Medical Problem

Describe the medical condition or medical problem that prevented you from leaving the United States a

b Enter the date you intended to leave the United States prior to the onset of the medical condition or medical problem described

on line 17a a

c

18

Enter the date you actually left the United States a

Physicians Statement:

I certify that

Name of taxpayer

was unable to leave the United States on the date shown on line 17b because of the medical condition or medical problem

described on line 17a and there was no indication that his or her condition or problem was preexisting.

Name of physician or other medical official

Physicians or other medical officials address and telephone number

Date

Physicians or other medical officials signature

Under penalties of perjury, I declare that I have examined this form and the accompanying attachments, and, to the best of my knowledge and belief,

they are true, correct, and complete.

Your signature

Sign here

only if you

are filing

this form by

itself and

not with

your tax

return

Date

Form 8843 (2012)

You might also like

- Sia Application Form NotesDocument40 pagesSia Application Form NotesRobin HardyNo ratings yet

- Statement For Exempt Individuals and Individuals With A Medical ConditionDocument4 pagesStatement For Exempt Individuals and Individuals With A Medical ConditionMathew BobanNo ratings yet

- Example - 8843 F-1 - F-2 or J-1 - J-2 Student - 2023 2Document4 pagesExample - 8843 F-1 - F-2 or J-1 - J-2 Student - 2023 2Anh LêNo ratings yet

- Statement For Exempt Individuals and Individuals With A Medical ConditionDocument4 pagesStatement For Exempt Individuals and Individuals With A Medical Conditionjosue gomezNo ratings yet

- Statement For Exempt Individuals and Individuals With A Medical ConditionDocument4 pagesStatement For Exempt Individuals and Individuals With A Medical Conditionluke903702420No ratings yet

- Allie Do Tax FormDocument4 pagesAllie Do Tax FormAnh LêNo ratings yet

- Imm 008Document26 pagesImm 008Rizwan HameedNo ratings yet

- Guidelines On Filling Up The Application FormDocument4 pagesGuidelines On Filling Up The Application FormSai SreenadhNo ratings yet

- Gao 202 FormDocument1 pageGao 202 FormTyrel McleodNo ratings yet

- Background InvestigationDocument43 pagesBackground InvestigationcasseyraizaNo ratings yet

- AlaAL ZAALIG2011Document5 pagesAlaAL ZAALIG2011Ala AlzaaligNo ratings yet

- Form 8862Document2 pagesForm 8862Francis Wolfgang UrbanNo ratings yet

- Application Form For Admission As A Recognised Student 2013-14Document14 pagesApplication Form For Admission As A Recognised Student 2013-14Celia MillerNo ratings yet

- IOM Personal History FormDocument5 pagesIOM Personal History FormEdward Ebb Bonno100% (4)

- 2019 IRS 8843 InstructionsDocument9 pages2019 IRS 8843 InstructionsBoopity SnootNo ratings yet

- 2011 1040NR-EZ Form - SampleDocument2 pages2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- CIT0002EDocument0 pagesCIT0002EBujar NuhiuNo ratings yet

- Glacier Tax User GuideDocument5 pagesGlacier Tax User Guideinter4ever77No ratings yet

- W-7 FormDocument1 pageW-7 FormRaviLifewideNo ratings yet

- Perdon de Pago I-912Document11 pagesPerdon de Pago I-912ChrisNo ratings yet

- Student Visa: ApplicationDocument16 pagesStudent Visa: ApplicationYunilo Camral Jr.No ratings yet

- Bed For ShireDocument4 pagesBed For ShireNishant Sethi100% (1)

- Step 4 - I-765 and I-765WS Completion GuideDocument6 pagesStep 4 - I-765 and I-765WS Completion GuideElrandomheroNo ratings yet

- Application Form: Use This Form If: Registration HelplineDocument28 pagesApplication Form: Use This Form If: Registration HelplineSala Petru-LaurenţiuNo ratings yet

- Application Form International MIT Melb 2013-01-21Document4 pagesApplication Form International MIT Melb 2013-01-21Ranjit SinghNo ratings yet

- Education Program FormDocument12 pagesEducation Program FormROCKNo ratings yet

- Application Form (F1) : Instructions: NotesDocument4 pagesApplication Form (F1) : Instructions: Notesapi-136633166No ratings yet

- Personal Particulars For Assessment Including Character Assessment - Form 80Document18 pagesPersonal Particulars For Assessment Including Character Assessment - Form 80Milos Fra Ljubanic0% (1)

- About You: Read This FirstDocument8 pagesAbout You: Read This FirstScientificBoysClubNo ratings yet

- Submitting Your U.S. Tax Documents: Print, Sign, MailDocument5 pagesSubmitting Your U.S. Tax Documents: Print, Sign, MailGia Han100% (1)

- Itin Aa-Caa Online Pre-ApplicationtrainingDocument88 pagesItin Aa-Caa Online Pre-ApplicationtrainingshahsaagarNo ratings yet

- IRS f13614nrDocument2 pagesIRS f13614nrMartin PetroskyNo ratings yet

- Rose Hudson Workbook Case StudyDocument6 pagesRose Hudson Workbook Case StudyMary O'KeeffeNo ratings yet

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDocument2 pages1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No Dependentspixel986No ratings yet

- 2014 Undergraduate Application FormDocument4 pages2014 Undergraduate Application Formleomille2No ratings yet

- 2011-2012 Dependent Verification Worksheet: About The Verification ProcessDocument2 pages2011-2012 Dependent Verification Worksheet: About The Verification ProcessJerry WilkNo ratings yet

- Start-Up Entrepreneur Programme Application Form: Step1Document19 pagesStart-Up Entrepreneur Programme Application Form: Step1ankur.aroraNo ratings yet

- 2012-13 Transfer Aid ApplicationDocument4 pages2012-13 Transfer Aid ApplicationLufinancial AidNo ratings yet

- Frequently Asked Tax Questions 2015sdaDocument8 pagesFrequently Asked Tax Questions 2015sdaVikram VickyNo ratings yet

- Application Form 2017: Intellectual Exchange and Innovation ProgramDocument7 pagesApplication Form 2017: Intellectual Exchange and Innovation ProgramKustomoNo ratings yet

- Form 1040nrez 2010Document2 pagesForm 1040nrez 2010David A. VestNo ratings yet

- Vaf9-App81 NOV2012Document8 pagesVaf9-App81 NOV2012lucasm4st3rNo ratings yet

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDocument2 pages1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsRajesh Kumar ReddyNo ratings yet

- TimeDocument3 pagesTimeVan TalawecNo ratings yet

- Cleveland State University Residency Petition For Tuition PurposesDocument7 pagesCleveland State University Residency Petition For Tuition PurposesjerrytouilleNo ratings yet

- FW 7Document1 pageFW 7klumer_xNo ratings yet

- WWW - Irs.gov Pub Irs-PDF Fw7Document1 pageWWW - Irs.gov Pub Irs-PDF Fw7desikudi9000No ratings yet

- Planet E Tutors: Form NoDocument3 pagesPlanet E Tutors: Form NoPlanete TutorsNo ratings yet

- PPTC 190Document8 pagesPPTC 190test0% (1)

- Maternity Benefit FormDocument12 pagesMaternity Benefit Formapi-259279833No ratings yet

- WWW Financialaid Ou EduDocument3 pagesWWW Financialaid Ou EduJoel VandiverNo ratings yet

- Tier 4 Applicationform 1Document37 pagesTier 4 Applicationform 1Anjum SattarNo ratings yet

- Instructions: Incomplete Applications Will Be IneligibleDocument8 pagesInstructions: Incomplete Applications Will Be IneligiblecollegeofficeNo ratings yet

- Canada Study Permit Success Guide: The Ultimate Guide to Student Visa and Study Permit ApplicationFrom EverandCanada Study Permit Success Guide: The Ultimate Guide to Student Visa and Study Permit ApplicationNo ratings yet

- US Immigration Exam Study Guide in English and Spanish: Study Guides for the US Immigration Test, #12From EverandUS Immigration Exam Study Guide in English and Spanish: Study Guides for the US Immigration Test, #12No ratings yet

- US Immigration Exam Study Guide in English and SpanishFrom EverandUS Immigration Exam Study Guide in English and SpanishRating: 1 out of 5 stars1/5 (3)

- Application For Admission For The 2009-2010 Academic Year 2013-2014Document2 pagesApplication For Admission For The 2009-2010 Academic Year 2013-2014anaga1982No ratings yet

- (See Rule 12 (2) ) : (At The Time ofDocument2 pages(See Rule 12 (2) ) : (At The Time ofanaga1982No ratings yet

- SNAP 2010 Question Paper and Ans KeyDocument19 pagesSNAP 2010 Question Paper and Ans Keyanaga1982No ratings yet

- Re Advertisement 5-13Document27 pagesRe Advertisement 5-13anaga1982No ratings yet

- APC311 CompletedDocument7 pagesAPC311 CompletedShahrukh Abdul GhaffarNo ratings yet

- 16-16911 - In-Lease Individual Tabs 2014-2015Document173 pages16-16911 - In-Lease Individual Tabs 2014-2015RecordTrac - City of OaklandNo ratings yet

- F&A Best - SAPOSTDocument23 pagesF&A Best - SAPOSTsheikh arif khan100% (2)

- Direct Tax MCQSDocument90 pagesDirect Tax MCQSTaruni JashnaniNo ratings yet

- 001 VOL 1B Pasvi 19 03 19Document89 pages001 VOL 1B Pasvi 19 03 19Dhaval ParmarNo ratings yet

- Fundamentals of Computer Problem Solving: Assignment 3Document7 pagesFundamentals of Computer Problem Solving: Assignment 3Nor Syahirah Mohd NorNo ratings yet

- Myanmar Tax Booklet - 2021 2022 2022 2023Document61 pagesMyanmar Tax Booklet - 2021 2022 2022 2023Ya Min KyawNo ratings yet

- Sterling Parfums Internship RepotDocument42 pagesSterling Parfums Internship RepotSopan O&M CO. PVT. LTD.No ratings yet

- Decision Making and Relevant InformationDocument48 pagesDecision Making and Relevant InformationDwidarNo ratings yet

- Investment Decision: Unit IiiDocument50 pagesInvestment Decision: Unit IiiFara HameedNo ratings yet

- Gov. Salceda's Vision For AlbayDocument151 pagesGov. Salceda's Vision For Albaymareinert100% (1)

- F3ltd-Payroll With Payslip FormatDocument6 pagesF3ltd-Payroll With Payslip FormatSonu PathakNo ratings yet

- Residential Status Problems 2021-2022-1Document5 pagesResidential Status Problems 2021-2022-120-UCO-517 AJAY KELVIN ANo ratings yet

- Calculate Your Federal TaxesDocument6 pagesCalculate Your Federal Taxesapi-719544021No ratings yet

- BMAC5203Document177 pagesBMAC5203PrabhuNo ratings yet

- Money, Its MeaningDocument19 pagesMoney, Its MeaningJayson GambaNo ratings yet

- HR Metrics Absence Rate: EMA/Cost Per Hire Staffing Metrics SurveyDocument4 pagesHR Metrics Absence Rate: EMA/Cost Per Hire Staffing Metrics SurveyVaibhav Jain100% (1)

- A Research Presented To: Feasibility of Operating National Bookstore in Boac, MarinduqueDocument4 pagesA Research Presented To: Feasibility of Operating National Bookstore in Boac, MarinduqueArrianne UmaliNo ratings yet

- Quarterly Report Q3 2010 MJNADocument20 pagesQuarterly Report Q3 2010 MJNAcb0bNo ratings yet

- PagibigDocument4 pagesPagibigElma B. CaquilalaNo ratings yet

- Quiz 3. Adjusting Entries Attempt ReviewDocument11 pagesQuiz 3. Adjusting Entries Attempt ReviewTrisha Monique VillaNo ratings yet

- Astra Account December 2020Document163 pagesAstra Account December 2020Kalpin SaragihNo ratings yet

- Sales 24344504 q3Document3 pagesSales 24344504 q3Vedantam GuptaNo ratings yet

- Summary Chapter 6: Entrepreneurship and Starting Small BusinessDocument19 pagesSummary Chapter 6: Entrepreneurship and Starting Small BusinessriskaNo ratings yet

- Future of Handloom Industry in Kerala During The Post Global Is at Ion PeriodDocument8 pagesFuture of Handloom Industry in Kerala During The Post Global Is at Ion PeriodHarikrishnan Menoth100% (1)

- SriLankan Airlines Annual Report 2015-16 EnglishDocument92 pagesSriLankan Airlines Annual Report 2015-16 EnglishChandu De Silva100% (2)

- Dipifr 2018 Jun QDocument8 pagesDipifr 2018 Jun QMyo NaingNo ratings yet

- ch12 PDFDocument9 pagesch12 PDFEmma Mariz GarciaNo ratings yet

- What Is Goodwill?: Key TakeawaysDocument4 pagesWhat Is Goodwill?: Key TakeawaysTin PangilinanNo ratings yet

- What Is Unearned Revenue?Document3 pagesWhat Is Unearned Revenue?JNo ratings yet