Professional Documents

Culture Documents

Corrections: Volume II

Corrections: Volume II

Uploaded by

Sy Him0 ratings0% found this document useful (0 votes)

26 views1 pageThis document lists corrections that need to be made across multiple pages of an accounting textbook. The corrections include fixing incorrect dates, amounts, inventory labels, and other details. In total, there are over 40 individual corrections listed that span over 30 pages of the textbook.

Original Description:

Solman

Original Title

Corrections

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document lists corrections that need to be made across multiple pages of an accounting textbook. The corrections include fixing incorrect dates, amounts, inventory labels, and other details. In total, there are over 40 individual corrections listed that span over 30 pages of the textbook.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

26 views1 pageCorrections: Volume II

Corrections: Volume II

Uploaded by

Sy HimThis document lists corrections that need to be made across multiple pages of an accounting textbook. The corrections include fixing incorrect dates, amounts, inventory labels, and other details. In total, there are over 40 individual corrections listed that span over 30 pages of the textbook.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Corrections: Volume II

Page 8: Closing entries letter c: Branch Income Summary. 4,000

Income Summary

4,000

Page 19: II A balance sheet on December 31, 20x3 instead on 20x4.

Page 63: questions 9 and 10: the intercompany profit deferred of P6,000 should be in the Home office column

Page 69: No. 27 additional data Merchandise inventory, December 31, 20x4, P70,000.

Page 70: Branch expenses should be P12,000 instead of P7,200.

Page 123: A deferred payment of P20,000 instead of P25,000.

Page 124: Consideration payable should be P100,000 instead of P81,818

Page 125: December 31, 20x4

Consideration payable100,000

Interest expense (10% x P100,000).. 10,000

Cash.

110,000

Page 125: The deferred payment of P20,000 instead of P25,000.

Page 131: Illustration 14-16: on January 1, 20x4 instead of 2010.

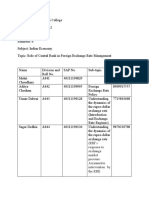

Page 237:

Figure 15-13: Ownership Structure of RR Company before and after Exchanges of Shares

Shares of

Shares of

RR Co.

TT Co,

(Legal Parent/

(Legal Subsidiary/

The Acquiree)

%

The Acquirer)

%

Stockholders of RR Co.

320

40%

128

40%

Stockholders of TT Co.

480

_60%

192

/ 60%*

800

100%

320

100%

Fair value of net assets

P 3,260

P

?

Book value of net assets

P 2,160

P 3,600

Fair value per share of stock

?

P 30

* The number of shares can be determined as follows:

1. Before the combination, the shareholders of TT hold 192 shares in that company.

2. TT would have to issue X additional shares such that the 192 currently owned shares will represent 60% of the total shares outstanding.

3. After the share issue, the total shares outstanding will be 192 shares + X additional shares to be issued by the legal subsidiary-the acquirer)

4. Therefore, the mathematical equation to determine additional shares are as follows:

192 = 60% (192 + X)

192 = 115.2 + .60X

192 115.2 = .60X

76.8/.60 = .60X/.60

X = 128

Or, simply (refer to No. 2 above): 192 shares/60% = 320 total shares x 40% = 128 shares of TT to be issued.

Page 239:

Are there Non-controlling Interests in a Reverse Acquisition?

Non-controlling interest is zero, if all of TTs stockholders accept the offer to exchange their shares in TT for shares in RR. If not all of TTs

stockholders agree to the exchange of shares, TT will have non-controlling interests that have interests in TTs legal entitys profits but not

consolidated net income. In the above example (refer to figure 15-13), there are no non-controlling interests as all of TTs stockholders accept

the exchange.

Page 418: Questions 88-93: Finch total assets should be P1,220,000; Capital should P790,000 instead of P800,000.

Page 436: Questions 19 to 22: On May 1, 20x4 instead of 20y0.

Page 474: (E9) and (E10) should be Beginning Inventory instead of Ending Inventory

Page 484: (E7) and (E8) should be Beginning Inventory instead of Ending Inventory

Page 494: (E7) and (E8) should be Beginning Inventory instead of Ending Inventory

Page 553: Unrealized gain (downstream instead of upstream), P12,500; Realized gain (downstream instead of upstream), P1,875

Page 565: Unrealized gain (downstream instead of upstream), P12,500; Realized gain (downstream instead of upstream), P1,875

Page 611: questions 21 to 23: On January 1, 20x3 instead of 20x4

Page 630: questions 22 to 26: 2nd par. - Company for P120,000 instead of P1,20x2.

Page 632: Questions 29 to 32: Should be 20x7 instead of 20x6 and 20y2

Page 728 and 729: fair value or premium of call option should be P100 instead of P400.

Page 738 and 739: fair value or premium of call option should be P120 instead of P480.

Page 740: No. 2: pound should be FCU.

Page 740: No. 3: euro should be FCU.

Page 756: to Australia should be foreign country; event that the US dollar should be peso; 06 should be x.6

You might also like

- Chapter 5 - ACTIVITIESDocument9 pagesChapter 5 - ACTIVITIESSophia De GuzmanNo ratings yet

- ReSA B44 AFAR First PB Exam Questions Answers SolutionsDocument22 pagesReSA B44 AFAR First PB Exam Questions Answers SolutionsWes100% (1)

- BusCom AssetAcquisitionDocument5 pagesBusCom AssetAcquisitionDanna Claire0% (1)

- 2 Land-Ownership-Under-Spain-Group-2Document21 pages2 Land-Ownership-Under-Spain-Group-2Random internet person100% (5)

- Mcdonalds Corporation Case StudyDocument19 pagesMcdonalds Corporation Case StudyAnas Mahmood100% (1)

- Chapter 17 Advacc2 PDFDocument58 pagesChapter 17 Advacc2 PDFJoyce Anne Garduque0% (1)

- Quiz 7: Use The Following Information For Questions 4 To 6Document9 pagesQuiz 7: Use The Following Information For Questions 4 To 6Tricia Mae Fernandez100% (2)

- Structure of The Examination PaperDocument12 pagesStructure of The Examination PaperRaffa MukoonNo ratings yet

- Template - Acctg. Major 3 Module 5 PDFDocument16 pagesTemplate - Acctg. Major 3 Module 5 PDFRia Mendez100% (2)

- Corrections volumeIIpart2Document2 pagesCorrections volumeIIpart2xxxxxxxxxNo ratings yet

- AFAR - Corp L, JA, HBODocument6 pagesAFAR - Corp L, JA, HBOJoanna Rose DeciarNo ratings yet

- Chapter-7 Installment Sales PDFDocument29 pagesChapter-7 Installment Sales PDFrgnrgy100% (2)

- Chapter 7 Advacc 1 DayagDocument31 pagesChapter 7 Advacc 1 Dayagchangevela83% (6)

- Solution Chapter 7Document39 pagesSolution Chapter 7Kriza Sevilla MatroNo ratings yet

- Buscom Quiz 2 MidtermDocument2 pagesBuscom Quiz 2 MidtermRafael Capunpon VallejosNo ratings yet

- Equity Method: Amortization of Allocated ExcessDocument4 pagesEquity Method: Amortization of Allocated ExcesseiaNo ratings yet

- Ac8dccd2 1613019594275Document7 pagesAc8dccd2 1613019594275Emey CalbayNo ratings yet

- Answers - Module 2Document4 pagesAnswers - Module 2bhettyna noayNo ratings yet

- Problems Revenues FR Contracts With CustomersDocument17 pagesProblems Revenues FR Contracts With CustomersJane DizonNo ratings yet

- Advanced-Accounting-Part 1-Dayag-2015-Chapter-7Document33 pagesAdvanced-Accounting-Part 1-Dayag-2015-Chapter-7trisha sacramentoNo ratings yet

- Problem: I - Comprehensive Problem: Goodwill Computation With Contingent ConsiderationDocument5 pagesProblem: I - Comprehensive Problem: Goodwill Computation With Contingent Considerationasdasda100% (4)

- Consolidation Workpaper - Year of AcquisitionDocument78 pagesConsolidation Workpaper - Year of AcquisitionJames Erick LermaNo ratings yet

- Depa 206Document7 pagesDepa 206MARISA SYLVIA CAALIMNo ratings yet

- ReSA B42 AFAR Final PB Exam - Questions, Answers - SolutionsDocument23 pagesReSA B42 AFAR Final PB Exam - Questions, Answers - SolutionsElaine Joyce GarciaNo ratings yet

- Resa Afar 2205 Quiz 2Document14 pagesResa Afar 2205 Quiz 2Rafael Bautista100% (1)

- Buscom 8Document11 pagesBuscom 8dmangiginNo ratings yet

- Mid-Term Exam - SolutionDocument8 pagesMid-Term Exam - Solutionhababammar660No ratings yet

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-18Document76 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-18allysa ampingNo ratings yet

- Advanced Accounting Solutions Chapter 7 ProblemsDocument1 pageAdvanced Accounting Solutions Chapter 7 Problemsjohn carlos doringoNo ratings yet

- 14207Document6 pages14207genenegetachew64No ratings yet

- Financial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreDocument16 pagesFinancial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreShane TorrieNo ratings yet

- Solution Chapter 7Document31 pagesSolution Chapter 7P.FabieNo ratings yet

- Advanced Accounting Chapter 7Document26 pagesAdvanced Accounting Chapter 7Shealalyn1No ratings yet

- Solution Chapter 7Document26 pagesSolution Chapter 7Roselle Manlapaz LorenzoNo ratings yet

- Acc 7 Second Mid TermDocument8 pagesAcc 7 Second Mid Termhailtonfernandes97No ratings yet

- Financial Accounting P3Document4 pagesFinancial Accounting P3amiNo ratings yet

- Quiz 2Document20 pagesQuiz 2randomlungs121223No ratings yet

- 5 Step Process Rev Rec Chapter Dayag SolmanDocument49 pages5 Step Process Rev Rec Chapter Dayag SolmanMichael Arevalo0% (1)

- Buscom 7Document9 pagesBuscom 7dmangiginNo ratings yet

- Acc 109 Practice ProblemsDocument17 pagesAcc 109 Practice Problemsasradaza11No ratings yet

- 1.3.1 Responsibility Acccounting Sample ProblemsDocument4 pages1.3.1 Responsibility Acccounting Sample Problemsdanilynbrmdz0602No ratings yet

- Quiz Installment Sales 2Document1 pageQuiz Installment Sales 2MARJORIE BAMBALANNo ratings yet

- Mock ExamDocument4 pagesMock ExamAna-Maria GhNo ratings yet

- Practical Accounting 2 SIR SALVADocument243 pagesPractical Accounting 2 SIR SALVAVirgo CruzNo ratings yet

- Review ch.6Document15 pagesReview ch.6LâmViên100% (9)

- Solutions For Midterm Exam Part 2 Selected RroblemsDocument10 pagesSolutions For Midterm Exam Part 2 Selected RroblemsJeane Mae BooNo ratings yet

- Problems: Trial Balances For The Companies For The Year Ended December 31, 20x4 Are As FollowsDocument10 pagesProblems: Trial Balances For The Companies For The Year Ended December 31, 20x4 Are As FollowsBetty SantiagoNo ratings yet

- Magbato, Ella Mae R. Problem 1Document11 pagesMagbato, Ella Mae R. Problem 1Ella Mae MagbatoNo ratings yet

- Important Questions For CBSE Class 12 Macro Economics Chapter 2 PDFDocument8 pagesImportant Questions For CBSE Class 12 Macro Economics Chapter 2 PDFAlans TechnicalNo ratings yet

- 03 AFAR (Consignment Drills & Preboards)Document8 pages03 AFAR (Consignment Drills & Preboards)Novemae CollamatNo ratings yet

- Topic 3 Computation of Taxable Profit or LossDocument25 pagesTopic 3 Computation of Taxable Profit or LossitulejamesNo ratings yet

- Capital Budgeting Decisions: Net Present Value (A) Investment Required (B) Project Profitability Index (A) ÷ (B)Document30 pagesCapital Budgeting Decisions: Net Present Value (A) Investment Required (B) Project Profitability Index (A) ÷ (B)mmh771984No ratings yet

- 8104 MbaexDocument3 pages8104 Mbaexgaurav jainNo ratings yet

- F 1040 SaDocument1 pageF 1040 Sahgfed4321No ratings yet

- What Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial MeasuresFrom EverandWhat Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial MeasuresRating: 4.5 out of 5 stars4.5/5 (9)

- Rethink Property Investing, Fully Updated and Revised Edition: Become Financially Free with Commercial Property InvestingFrom EverandRethink Property Investing, Fully Updated and Revised Edition: Become Financially Free with Commercial Property InvestingNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Special Events Advisor: A Business and Legal Guide for Event ProfessionalsFrom EverandThe Special Events Advisor: A Business and Legal Guide for Event ProfessionalsNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- Chapter 1Document8 pagesChapter 1Rafael GarciaNo ratings yet

- Revenue Regulations No. 7 - 2006: Quezon City May 18, 2006Document2 pagesRevenue Regulations No. 7 - 2006: Quezon City May 18, 2006Sy HimNo ratings yet

- Republika NG Pilipinas Kagawaran NG Pananalapi Kawanihan NG Rentas InternasDocument2 pagesRepublika NG Pilipinas Kagawaran NG Pananalapi Kawanihan NG Rentas InternasSy HimNo ratings yet

- Ask For ReceiptDocument2 pagesAsk For ReceiptSy HimNo ratings yet

- 15439rr04 12Document16 pages15439rr04 12Sy HimNo ratings yet

- 15711rr04 11Document16 pages15711rr04 11Sy HimNo ratings yet

- Bureau of Internal RevenueDocument1 pageBureau of Internal RevenueSy HimNo ratings yet

- Revenue Regulations No. 7-2002: Republic of The Philippines Department of FinanceDocument3 pagesRevenue Regulations No. 7-2002: Republic of The Philippines Department of FinanceSy HimNo ratings yet

- Revenue Regulations No. 12-2002Document5 pagesRevenue Regulations No. 12-2002Sy HimNo ratings yet

- Me Q-Bank FinalDocument52 pagesMe Q-Bank FinalHemant DeshmukhNo ratings yet

- Difference BTW Micro & Macro EconDocument5 pagesDifference BTW Micro & Macro EconshyasirNo ratings yet

- Flight Ticket - Bangalore To Patna: (Economy)Document3 pagesFlight Ticket - Bangalore To Patna: (Economy)nehaNo ratings yet

- CERC Project Cost For Solar PVDocument17 pagesCERC Project Cost For Solar PVNidhi GolaNo ratings yet

- Cordis UKDocument2 pagesCordis UKKirolos MinaNo ratings yet

- Business Organisations and Their StakeholdersDocument11 pagesBusiness Organisations and Their StakeholdersamirNo ratings yet

- Formula Sheet - Study Version. - Portfolio Management PDFDocument2 pagesFormula Sheet - Study Version. - Portfolio Management PDFAnhthu DangNo ratings yet

- Zahar EvaDocument23 pagesZahar EvaEngr Fizza AkbarNo ratings yet

- Exercise of Chapter 67Document3 pagesExercise of Chapter 67Jean TanNo ratings yet

- A Step-by-Step Guide For Parents: Parent PayDocument3 pagesA Step-by-Step Guide For Parents: Parent Payapi-237606250No ratings yet

- STC Growing: in Scale and ScopeDocument56 pagesSTC Growing: in Scale and Scopexnelson9No ratings yet

- Tybcom - A - Group No. - 5Document10 pagesTybcom - A - Group No. - 5Mnimi SalesNo ratings yet

- Eco Mains Strategy Riju BafnaDocument4 pagesEco Mains Strategy Riju BafnaJigisha SinghNo ratings yet

- BPM Main Brochure 13286 001 (Updated 12062008)Document16 pagesBPM Main Brochure 13286 001 (Updated 12062008)CharitynNo ratings yet

- Ibm 530Document6 pagesIbm 530Muhamad NasirNo ratings yet

- Mandvi Ibibo Tax InvoiceDocument2 pagesMandvi Ibibo Tax InvoiceSumit PatelNo ratings yet

- Accounts ReceivableDocument9 pagesAccounts ReceivableTrang LeNo ratings yet

- Executive SummaryDocument25 pagesExecutive SummaryAvijit GhoshNo ratings yet

- Broken Hill Prospecting IGR FINAL1Document49 pagesBroken Hill Prospecting IGR FINAL1Mauricio ASNo ratings yet

- CLSS Declaration - RevisedDocument3 pagesCLSS Declaration - RevisedIndudhar Jha100% (1)

- Nca LFP NMCDocument2 pagesNca LFP NMCDaniel Hilario PintoNo ratings yet

- Jeppiaar Engineering College: Question BankDocument25 pagesJeppiaar Engineering College: Question Bankpasrinivasan_19973520% (1)

- What Do We Mean by Neolithic Societies I PDFDocument22 pagesWhat Do We Mean by Neolithic Societies I PDFStella KatsarouNo ratings yet

- Directory List Directory ListDocument5 pagesDirectory List Directory ListBadhon RoyNo ratings yet

- 50 Petition Off Grid Solar Generation For RPO Case No. 33 of 2019Document7 pages50 Petition Off Grid Solar Generation For RPO Case No. 33 of 2019Abhishek SenguptaNo ratings yet

- TEST BANK: Daft, Richard L. Management, 11th Ed. 2014 Chapter 15Document39 pagesTEST BANK: Daft, Richard L. Management, 11th Ed. 2014 Chapter 15polkadots93980% (5)

- Environmental History and British ColonialismDocument19 pagesEnvironmental History and British ColonialismAnchit JassalNo ratings yet

- Scheme of Work Ads504 - October 2022 - February 2023 (All)Document16 pagesScheme of Work Ads504 - October 2022 - February 2023 (All)Leonard DavinsonNo ratings yet