Professional Documents

Culture Documents

Chapter 5

Chapter 5

Uploaded by

Falih Fzm Custom0 ratings0% found this document useful (0 votes)

60 views2 pages1. Contingent liabilities are disclosed in the notes to the financial statements under IAS 37 when there is more than a remote possibility of an outflow of resources.

2. Under IAS 19, employee benefits covered include post-employment benefits, compensated absences, bonuses, deferred compensation, and disability benefits.

3. One difference between IAS 37 and US GAAP is that IAS 37 allows recognition of a restructuring provision before a liability has been incurred, whereas US GAAP does not allow recognition until a liability has been incurred.

Original Description:

Audit

Original Title

chapter 5

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Contingent liabilities are disclosed in the notes to the financial statements under IAS 37 when there is more than a remote possibility of an outflow of resources.

2. Under IAS 19, employee benefits covered include post-employment benefits, compensated absences, bonuses, deferred compensation, and disability benefits.

3. One difference between IAS 37 and US GAAP is that IAS 37 allows recognition of a restructuring provision before a liability has been incurred, whereas US GAAP does not allow recognition until a liability has been incurred.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

60 views2 pagesChapter 5

Chapter 5

Uploaded by

Falih Fzm Custom1. Contingent liabilities are disclosed in the notes to the financial statements under IAS 37 when there is more than a remote possibility of an outflow of resources.

2. Under IAS 19, employee benefits covered include post-employment benefits, compensated absences, bonuses, deferred compensation, and disability benefits.

3. One difference between IAS 37 and US GAAP is that IAS 37 allows recognition of a restructuring provision before a liability has been incurred, whereas US GAAP does not allow recognition until a liability has been incurred.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

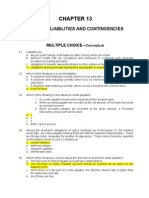

1.

Under IAS 37, how are contigent liabilities treated in the

financial statements?

a. IAS 37 does not address contigent liabilities

b. They are recorded as current liabilities if the amount is

reasonablu measured

c. They are disclosed in the notes to the financial statements

when there is more than a remote possibility of an outflows

of resources

d. They are not disclosed

2. How does U.S GAAP require prior service costs related to

retirees to be recognized?

a. Amortize over the average remaining working lives of

active employees

b. Recognize immediately

c. Dont recognize at all

d. Amortize over remaining expected life of the retirees

3. Under IAS 19, employee benefits, which of the following

benefits are covered?

a. Compensated absences and bonuses

b. Post-employement benefits

c. Deferred compensation and disability benefits

d. All of the above

4. Which of the following is a difference between IAS 37 and U.S

GAAP with respect to restructuring provisions?

a. U.S GAAP does not allow recognition of a restructuring

provision until a liability has been incurred.

b. There is no difference between IAS 37 and U.S GAAP with

respect to restructuring provisions

c. IAS 37 does not allow recognition of a restructuring

provision untill a liability has been incurred

d. A restructuring provision and related loss is more likely to

occur later under IAS 37 than under U.S GAAP

5. Under U.S GAAP, with respect to equity-settled share-based

payments, if the fair value of the equity instrument is used,

the value is determined

a. At the earlier of the date a commitment for performance is

reached or the date the services are actually completed

b. At the date the services are actually completed

c. At the date a commitment for performance is reached

d. None of the above

6. Under IAS 36, Income Taxes, which of the following issues are

covered?

a. Temporary differences

b. Operating Loss Carry-forwards

c. Tax credit carry-forwards

d. All of the above

7. What kinds of temporary differences related to income taxes

can arise under IFRS that dont occur under U.S GAAP?

a. Book and tax differences related to the revaluation of

property, plant, and equipment for book purposes and cost

method for tax purposes.

b. Book and tax differences related to the calculation of

impairments for book purposes with no like adjustment for

tax purposes

c. Both (A) and (B)

d. Use of the LIFO inventory method for book purposes and

the FIFO inventory method for tax purposes

8. Under IAS 18, which of the following is an employee of

retention of significant risks and rewards by the seller?

a. The buyer has no right to rescind the purchase

b. The seller is under no obligation for satisfactory

performance not covered by normal warranties

c. Goods are sold subject to installation, but installation is not

a significant part of the contract and has not yet been

completed

d. Receipt of revenue by the seller is contigent on the buyer

generating revenue through its sale of the goods.

9. IAS 32 defines a financial instruments as

a. the currency of the foreign country in which the enterprise

does business

b. a certified check

c. any contract that gives rise to a financial asset of one

entity and a financial liability or equity instrument of

another entity

d. a recognized stock exchange

10.

Under IAS 39, financial instruments: recognition and

measurement, which of the following is not a category into

which a financial asset must be classified?

a. property, plant and equipment

b. held-to-maturity investments

c. loans and receivables

d. available-for-sale financial assets

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- ch13 Testbank Intermediate AccountingDocument43 pagesch13 Testbank Intermediate Accountingalaa96% (53)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- FAR Theory Quiz 1Document7 pagesFAR Theory Quiz 1Ednalyn CruzNo ratings yet

- A Complete List of Market Makers For OTC ListingsDocument26 pagesA Complete List of Market Makers For OTC ListingsLankershim TaftNo ratings yet

- No Broad Level Report Options Available For Report Execution Tcode in SAPDocument48 pagesNo Broad Level Report Options Available For Report Execution Tcode in SAPpankajsri68100% (1)

- Chapter 05 - IFRS Part IIDocument11 pagesChapter 05 - IFRS Part IIDianaNo ratings yet

- International Accounting 4th Edition Doupnik Test Bank DownloadDocument30 pagesInternational Accounting 4th Edition Doupnik Test Bank DownloadGloria Kroesing100% (27)

- Questions BSA2111Document6 pagesQuestions BSA2111glaize.zoeNo ratings yet

- Test Bank Reviewer Part 2Document4 pagesTest Bank Reviewer Part 2tres gian de guzmanNo ratings yet

- IA Reviewer 2Document25 pagesIA Reviewer 2Krishele G. GotejerNo ratings yet

- Financial AccountingDocument5 pagesFinancial Accountingimsana minatozakiNo ratings yet

- FINALS - Theory of AccountsDocument8 pagesFINALS - Theory of AccountsAngela ViernesNo ratings yet

- CFAS Testbank Answer KeyDocument14 pagesCFAS Testbank Answer KeyPrince Jeffrey FernandoNo ratings yet

- Consolidated FAR UCDocument28 pagesConsolidated FAR UCNathalie GetinoNo ratings yet

- ToaDocument5 pagesToaGelyn CruzNo ratings yet

- CFAS Testbank Answer KeyDocument15 pagesCFAS Testbank Answer KeyPrince Jeffrey FernandoNo ratings yet

- SM08 4thExamReview-TheoryDocument7 pagesSM08 4thExamReview-TheoryHilarie JeanNo ratings yet

- CFASDocument7 pagesCFASchoigyu031301No ratings yet

- Toa - Preboard - May 2016Document11 pagesToa - Preboard - May 2016Kenneth Bryan Tegerero Tegio100% (1)

- Acctexam - Current Liabilities and ContingenciesDocument7 pagesAcctexam - Current Liabilities and ContingenciesAsheNo ratings yet

- Accounting CoreDocument10 pagesAccounting CoreGioNo ratings yet

- Toa PreboardDocument9 pagesToa PreboardLeisleiRagoNo ratings yet

- CFASDocument15 pagesCFASCamille Anne GalvezNo ratings yet

- GEN 010 P1 ExamDocument20 pagesGEN 010 P1 ExamJulian Adam PagalNo ratings yet

- 6950 - FAR Theory Preweek LectureDocument7 pages6950 - FAR Theory Preweek LectureVanessa Anne Acuña DavisNo ratings yet

- 1234449Document19 pages1234449Jade MarkNo ratings yet

- Intermediate Accouting Testbank ch13Document23 pagesIntermediate Accouting Testbank ch13cthunder_192% (12)

- Financial Accountinng 3Document10 pagesFinancial Accountinng 3Nami2mititNo ratings yet

- Finacc5 LQ1Document6 pagesFinacc5 LQ1by ScribdNo ratings yet

- Current Liabilities Provisions and Contingencies TheoriesDocument12 pagesCurrent Liabilities Provisions and Contingencies TheoriesKristine Trisha Anne SabornidoNo ratings yet

- Practice Final PB Far AfarDocument20 pagesPractice Final PB Far AfarBenedict Boac100% (2)

- Theory of AccountsDocument7 pagesTheory of AccountsChristopher PriceNo ratings yet

- Pre BoardDocument7 pagesPre BoardJose Dula II50% (2)

- Cash and Cash Equivalents, Accounts Receivable, Bad DebtsDocument5 pagesCash and Cash Equivalents, Accounts Receivable, Bad DebtsDennis VelasquezNo ratings yet

- University of San Jose-Recoletos Theory of AccountsDocument9 pagesUniversity of San Jose-Recoletos Theory of AccountsChelseyNo ratings yet

- MCQ Cfas - 2Document12 pagesMCQ Cfas - 2Koko LaineNo ratings yet

- DocxDocument7 pagesDocxPearl Jade YecyecNo ratings yet

- IntAcc 1 Reviewer - Module 2 (Theories)Document8 pagesIntAcc 1 Reviewer - Module 2 (Theories)Lizette Janiya SumantingNo ratings yet

- IfrsDocument12 pagesIfrspapagayo_cNo ratings yet

- Midterm - Exam PDFDocument16 pagesMidterm - Exam PDFLouisse Marie Catipay100% (1)

- Liability FinalDocument26 pagesLiability FinalJomarie UyNo ratings yet

- ch13 PDFDocument43 pagesch13 PDFerylpaez100% (3)

- Quiz #1: Intacc ReviewerDocument39 pagesQuiz #1: Intacc ReviewerUNKNOWNN0% (1)

- Far TheoriesDocument4 pagesFar Theoriesfrancis dungcaNo ratings yet

- Comprehensive Accounting Review 2333Document3 pagesComprehensive Accounting Review 2333linkin soyNo ratings yet

- Final Exam ConceptualDocument8 pagesFinal Exam ConceptualJun GilloNo ratings yet

- Reviewer - ReceivablesDocument5 pagesReviewer - ReceivablesMaria Kathreena Andrea AdevaNo ratings yet

- NFJPIA - Mockboard 2011 - TOA PDFDocument7 pagesNFJPIA - Mockboard 2011 - TOA PDFSteven Mark MananguNo ratings yet

- DocDocument20 pagesDochis dimples appear, the great lee seo jinNo ratings yet

- INSTRUCTIONS: Write Your Final Answer in The Answer Sheet. NO ERASURES ALLOWEDDocument18 pagesINSTRUCTIONS: Write Your Final Answer in The Answer Sheet. NO ERASURES ALLOWEDSandra Mae CabuenasNo ratings yet

- Seeds of The Nations Review-MidtermsDocument9 pagesSeeds of The Nations Review-MidtermsMikaela JeanNo ratings yet

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryクロードNo ratings yet

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryROMAR A. PIGANo ratings yet

- Chapter 13 Intermediate AccoutingDocument8 pagesChapter 13 Intermediate AccoutingMarlind3No ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Build Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthFrom EverandBuild Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthNo ratings yet

- Quiz Finance 1Document3 pagesQuiz Finance 1studentNo ratings yet

- Financial AnalysisDocument691 pagesFinancial Analysissanu sayed100% (1)

- Optimising Value Creation From IT Investments - Res - Eng - 0105 PDFDocument27 pagesOptimising Value Creation From IT Investments - Res - Eng - 0105 PDFMuhammadChaerulTammimiNo ratings yet

- Financial Accounting Chapter 2Document19 pagesFinancial Accounting Chapter 2abhinav2018No ratings yet

- SsssDocument14 pagesSsssSakthisivaNo ratings yet

- Daouk, Lee, NG - 2006 - Capital Market Governance How Do Security Laws Affect Market PerformanceDocument34 pagesDaouk, Lee, NG - 2006 - Capital Market Governance How Do Security Laws Affect Market PerformanceujgilaniNo ratings yet

- Econ 442 - Problem Set 3Document6 pagesEcon 442 - Problem Set 3Nguyễn Hải GiangNo ratings yet

- Investing With Simplicity 1-30-99Document18 pagesInvesting With Simplicity 1-30-99Uros PetrovicNo ratings yet

- Mirae Asset Multicap Fund NFO PPT - 28 July 2023 To 11 Aug 2023Document37 pagesMirae Asset Multicap Fund NFO PPT - 28 July 2023 To 11 Aug 2023Sajid NavyNo ratings yet

- Banking Law Reviewer Hot JuristDocument27 pagesBanking Law Reviewer Hot Juristgrego centillas100% (1)

- Proiect RwandaDocument3 pagesProiect RwandaBianca ConstantinNo ratings yet

- High Performance Notes PDFDocument5 pagesHigh Performance Notes PDFDummy Indian SupportNo ratings yet

- Major Transaction Used in TRMDocument9 pagesMajor Transaction Used in TRMAbhishek SarawagiNo ratings yet

- Initiating Coverage - Den Networks LTDDocument19 pagesInitiating Coverage - Den Networks LTDVinit Bolinjkar100% (1)

- March 2012 Part III InsightDocument100 pagesMarch 2012 Part III InsightLegogie Moses Anoghena100% (1)

- Answers To Questions Chapter 06.part IIDocument19 pagesAnswers To Questions Chapter 06.part IIDaniel TadejaNo ratings yet

- Sample-Report-DCF As Per RBI Guidelines PDFDocument26 pagesSample-Report-DCF As Per RBI Guidelines PDFRujan BajracharyaNo ratings yet

- All Rev Pem Sem IDocument201 pagesAll Rev Pem Sem ISahil AhujaNo ratings yet

- Module 3 Functions of Financial ManagementDocument3 pagesModule 3 Functions of Financial ManagementSofia YuNo ratings yet

- Employee EngagementDocument157 pagesEmployee EngagementYamini Priya88% (8)

- Capital Structure: Questions and ExercisesDocument4 pagesCapital Structure: Questions and ExercisesLinh HoangNo ratings yet

- Section 1 The Balance of PaymentsDocument26 pagesSection 1 The Balance of PaymentskwtneoNo ratings yet

- The Home DepotDocument30 pagesThe Home DepotParveen BariNo ratings yet

- Mena Full Deck 20161109Document106 pagesMena Full Deck 20161109rezaNo ratings yet

- Reflection#4 - Asset ManagementDocument2 pagesReflection#4 - Asset ManagementnerieroseNo ratings yet

- Multi Period Financial PlanningDocument12 pagesMulti Period Financial PlanningRaam BharathwaajNo ratings yet

- Nutresa Nov 3Document13 pagesNutresa Nov 3SemanaNo ratings yet

- Decision Trees Background NoteDocument14 pagesDecision Trees Background NoteibrahimNo ratings yet