Professional Documents

Culture Documents

FINS 2624 Quiz 2 Answers

FINS 2624 Quiz 2 Answers

Uploaded by

sagarox7Copyright:

Available Formats

You might also like

- Huawei HCIA-IoT v. 2.5 Evaluation QuestionsDocument77 pagesHuawei HCIA-IoT v. 2.5 Evaluation Questionstest oneNo ratings yet

- Magic Arms and Armor Price GuideDocument55 pagesMagic Arms and Armor Price GuideFrank JamisonNo ratings yet

- Biology ATAR Y12 Sample Assessment Tasks WACE 2015 - 16 - PDFDocument31 pagesBiology ATAR Y12 Sample Assessment Tasks WACE 2015 - 16 - PDFpartyNo ratings yet

- TOK Essay - Application of KnowkedgeDocument6 pagesTOK Essay - Application of KnowkedgeAdin Becker0% (1)

- Chapter 12 Case Clues Case 12.1 Peaceful Valley: Trouble in Suburbia Case ObjectiveDocument3 pagesChapter 12 Case Clues Case 12.1 Peaceful Valley: Trouble in Suburbia Case ObjectiveSheikh Hasan0% (1)

- 3.2.2 Answer Key To Data Response Questions On Exchange RatesDocument5 pages3.2.2 Answer Key To Data Response Questions On Exchange RatesI-Zac LeeNo ratings yet

- UCAT Practice Test Results 637354262214053584 PDFDocument1 pageUCAT Practice Test Results 637354262214053584 PDFAyanHabaneNo ratings yet

- Example Question #1: Necessary Assumption: LSAT Logical Reasoning AssumptionDocument98 pagesExample Question #1: Necessary Assumption: LSAT Logical Reasoning AssumptionSumera KaziNo ratings yet

- Topic Test - Graps of Physical PhenomenaDocument5 pagesTopic Test - Graps of Physical PhenomenaTony TranNo ratings yet

- l4 Dichotomous Key Marking SchemeDocument1 pagel4 Dichotomous Key Marking SchemeJesse J.ENo ratings yet

- 7.2 Structured 1Document75 pages7.2 Structured 1Anonymous Fspcb0No ratings yet

- TM355: Communications Technology: Take Home Exam For Final Assignment 2020-2021/ FallDocument7 pagesTM355: Communications Technology: Take Home Exam For Final Assignment 2020-2021/ FallHusseinJdeedNo ratings yet

- Fins 2624 Quiz 2 Answers 1Document2 pagesFins 2624 Quiz 2 Answers 1sagarox70% (1)

- JPJC JC1 H2 Math Revision For WA2 Questions 2023Document6 pagesJPJC JC1 H2 Math Revision For WA2 Questions 2023vincesee85No ratings yet

- 2021 Standard 2 TrialDocument33 pages2021 Standard 2 TrialSia GuptaNo ratings yet

- Physics Problems: Workbook 1Document18 pagesPhysics Problems: Workbook 1Jessica NakumaNo ratings yet

- 2017 Newington Economics Trial (W Solutions)Document36 pages2017 Newington Economics Trial (W Solutions)lg019 workNo ratings yet

- 2021 James Ruse HSC Economics Trial (W Solutions)Document42 pages2021 James Ruse HSC Economics Trial (W Solutions)lg019 workNo ratings yet

- Sydney Boys 2014 Business Studies Trials & SolutionsDocument25 pagesSydney Boys 2014 Business Studies Trials & SolutionsThomas SomyNo ratings yet

- 2021 Abbotsleigh Economics Trial (Marking Guide)Document22 pages2021 Abbotsleigh Economics Trial (Marking Guide)lg019 workNo ratings yet

- 2019 Advanced Trial Paper 1 Question BookletDocument9 pages2019 Advanced Trial Paper 1 Question BookletRoger YaoNo ratings yet

- Economics HSC Notes 2006Document27 pagesEconomics HSC Notes 2006Billy BobNo ratings yet

- Artificial LanguageDocument3 pagesArtificial Languagevinothan vinothanNo ratings yet

- Knox 2012 Business Studies TrialsDocument16 pagesKnox 2012 Business Studies TrialsArpit KumarNo ratings yet

- VCE BIOLOGY UnitDocument24 pagesVCE BIOLOGY Unitjess_heathNo ratings yet

- Penrith 2021 Biology Trials & SolutionsDocument50 pagesPenrith 2021 Biology Trials & SolutionsHewadNo ratings yet

- Food Tech Full Summary HSCDocument46 pagesFood Tech Full Summary HSCAxqen kmorjNo ratings yet

- Y10 Science Semester 2 Exam Paper 2014Document28 pagesY10 Science Semester 2 Exam Paper 2014Joshua JohnNo ratings yet

- PEM 2021 Mathematics Standard Preliminary Examination PaperDocument33 pagesPEM 2021 Mathematics Standard Preliminary Examination PaperBurnt llamaNo ratings yet

- Economics HeadstartDocument81 pagesEconomics HeadstarthadiahNo ratings yet

- Atomic Structure For Grade 10Document4 pagesAtomic Structure For Grade 10Aja AndersonNo ratings yet

- Series and Parallel Circuits Questions - KS3 EditDocument4 pagesSeries and Parallel Circuits Questions - KS3 EditDominic Wynes-DevlinNo ratings yet

- Bonding SL+HL p2Document73 pagesBonding SL+HL p2Murat KAYANo ratings yet

- CIE IGCSE SUMMER 2007 MATHEMATICS PAPERS - 0580 s07 QP 3Document12 pagesCIE IGCSE SUMMER 2007 MATHEMATICS PAPERS - 0580 s07 QP 3zincfalls100% (13)

- Hi-Tech ISTDocument360 pagesHi-Tech ISTDharineeshNo ratings yet

- Letter To Cancel or Withdraw A Customer's Credit AccountDocument1 pageLetter To Cancel or Withdraw A Customer's Credit AccountVita Nur AryatiNo ratings yet

- Bebras Solution Guide 2023 R1 SecondaryDocument102 pagesBebras Solution Guide 2023 R1 SecondaryKarlota GorrotxateguiNo ratings yet

- Topic 9 Voltaic CellsDocument3 pagesTopic 9 Voltaic CellsMRMFARAHNo ratings yet

- Kunci Jawaban MergedDocument350 pagesKunci Jawaban MergedDananjaya PranandityaNo ratings yet

- Year 10 TrigonometryDocument2 pagesYear 10 TrigonometryDavid StoneNo ratings yet

- 2021 HSC EconomicsDocument24 pages2021 HSC EconomicspotpalNo ratings yet

- Paper 1 Nov 2000 PhysicsDocument16 pagesPaper 1 Nov 2000 Physicssolarixe100% (1)

- Bebras Solution Guide 2022 R1 PrimaryDocument60 pagesBebras Solution Guide 2022 R1 PrimaryFatima DionísioNo ratings yet

- June 2021 Crash Course - JC2 H2 Math With Solutions.4JunDocument103 pagesJune 2021 Crash Course - JC2 H2 Math With Solutions.4JunPatrick ChanNo ratings yet

- "Discovery Shapes Identity." DiscussDocument6 pages"Discovery Shapes Identity." Discusssuitup123No ratings yet

- 9 - Greg Reid - Assessing HOT Skills in ICASDocument52 pages9 - Greg Reid - Assessing HOT Skills in ICASLaiyee ChanNo ratings yet

- ESS Paper 2Document20 pagesESS Paper 2ziverNo ratings yet

- Application For HNDEDocument2 pagesApplication For HNDEdharul khair67% (9)

- 2011 Trial Physics AnswersDocument27 pages2011 Trial Physics AnswersGeorgeNo ratings yet

- Sunday Times Good University Guide 2021Document57 pagesSunday Times Good University Guide 2021So Ho HanNo ratings yet

- IB Final Exam NotesDocument22 pagesIB Final Exam NotesJian Zhi TehNo ratings yet

- Fort ST 2021 3U Trials & SolutionsDocument20 pagesFort ST 2021 3U Trials & SolutionspotpalNo ratings yet

- How Is Personal Experience Distinguished From Shared Knowledge? PersonalDocument4 pagesHow Is Personal Experience Distinguished From Shared Knowledge? PersonalHarun ĆehovićNo ratings yet

- Complex PDFDocument60 pagesComplex PDFRickyChanNo ratings yet

- Unit Plan - Year 7 Science States of MatterDocument23 pagesUnit Plan - Year 7 Science States of Matterapi-708755416No ratings yet

- Grade 9 SCIENCE QUESTIONSDocument3 pagesGrade 9 SCIENCE QUESTIONSSharreah LimNo ratings yet

- Applications and Interpretation Standard May 2022 Paper 2 TZ2Document8 pagesApplications and Interpretation Standard May 2022 Paper 2 TZ2liberttacaoNo ratings yet

- Year 10 Worksheet 2 PDFDocument19 pagesYear 10 Worksheet 2 PDFTavishi PragyaNo ratings yet

- Year 10 Physics Workbook AnswersDocument2 pagesYear 10 Physics Workbook AnswersύπατίαNo ratings yet

- Market Structure Worksheets and AnswersDocument16 pagesMarket Structure Worksheets and AnswersNate ChenNo ratings yet

- Biology HSC Questions ARC 2006Document28 pagesBiology HSC Questions ARC 2006timeflies23No ratings yet

- Take Test: Online Quiz 2: Questi On 1Document3 pagesTake Test: Online Quiz 2: Questi On 1jonNo ratings yet

- Take Test: Online Quiz 2: Questi On 1Document3 pagesTake Test: Online Quiz 2: Questi On 1jonNo ratings yet

- FINS 2624 Quiz 2 Attempt 2 PDFDocument3 pagesFINS 2624 Quiz 2 Attempt 2 PDFsagarox7No ratings yet

- Fins 2624 Quiz 2 Answers 1Document2 pagesFins 2624 Quiz 2 Answers 1sagarox70% (1)

- Mockterm FINS2624 S1 2013Document12 pagesMockterm FINS2624 S1 2013sagarox7No ratings yet

- Fins 2624 Quiz 1Document3 pagesFins 2624 Quiz 1sagarox7No ratings yet

- Formula SheetDocument1 pageFormula Sheetsagarox7No ratings yet

- School of Mathematics and Statistics: Topic and Contents MatricesDocument5 pagesSchool of Mathematics and Statistics: Topic and Contents Matricessagarox7No ratings yet

- Stability of Floating BodiesDocument6 pagesStability of Floating Bodieskharry8davidNo ratings yet

- A Teacher's Guide To CosmosDocument45 pagesA Teacher's Guide To CosmosMSU UrbanSTEM100% (2)

- Harrison Bergeron - With AnnotationsDocument8 pagesHarrison Bergeron - With Annotationserica.hugoNo ratings yet

- 12h Identification Des Pieces Service BrakeDocument3 pages12h Identification Des Pieces Service BrakeaniriNo ratings yet

- Expansion Joints hoses-KLINGER AUDocument7 pagesExpansion Joints hoses-KLINGER AUMichael PhamNo ratings yet

- Self-Awareness To Being Watched and Socially-Desirable Behavior: A Field Experiment On The Effect of Body-Worn Cameras On Police Use-Of-ForceDocument14 pagesSelf-Awareness To Being Watched and Socially-Desirable Behavior: A Field Experiment On The Effect of Body-Worn Cameras On Police Use-Of-ForcePoliceFoundationNo ratings yet

- District CalendarDocument1 pageDistrict Calendarapi-271737972No ratings yet

- ExamenesDocument4 pagesExamenesZareli Lazo AriasNo ratings yet

- Lesson Plan Ces422 PDFDocument2 pagesLesson Plan Ces422 PDFdzikrydsNo ratings yet

- Lesson 1: The Making of The Rizal Law: 1.1. Debate in The Senate 1.2. Conflict in The Catholic ChurchDocument21 pagesLesson 1: The Making of The Rizal Law: 1.1. Debate in The Senate 1.2. Conflict in The Catholic ChurchJii JisavellNo ratings yet

- Year 2018 Best Ongoing Practices Bijhari Block by Vijay Kumar Heer, BRCC PrimaryDocument24 pagesYear 2018 Best Ongoing Practices Bijhari Block by Vijay Kumar Heer, BRCC PrimaryVIJAY KUMAR HEERNo ratings yet

- 7480H - Catalog - Mobile - Fuel - Filtration - Filtors Racor PDFDocument98 pages7480H - Catalog - Mobile - Fuel - Filtration - Filtors Racor PDFFrank Felipe Cruz ChavezNo ratings yet

- Box Culvert / U-Drain Section Design: File:///conversion/tmp/scratch/488560866Document9 pagesBox Culvert / U-Drain Section Design: File:///conversion/tmp/scratch/488560866azwanNo ratings yet

- 151-Enablon Orm - Permit To WorkDocument2 pages151-Enablon Orm - Permit To WorkRishikesh GunjalNo ratings yet

- Liebert - CRV Series Air Conditioner User Manual: V1.4 Revision Date May 28, 2012 BOM 31011886Document79 pagesLiebert - CRV Series Air Conditioner User Manual: V1.4 Revision Date May 28, 2012 BOM 31011886Dam Ngoc KienNo ratings yet

- Dance: Choreographic Forms inDocument29 pagesDance: Choreographic Forms inROCELYN IMPERIALNo ratings yet

- CT Secondary InjectionDocument2 pagesCT Secondary InjectionHumayun AhsanNo ratings yet

- Book Review of I Love You Since 1892Document2 pagesBook Review of I Love You Since 1892hannah100% (1)

- Sample 70 - 2Document7 pagesSample 70 - 2Mikhael MangopoNo ratings yet

- Seminar-Quality Assurance (13-11-2013) - Copy (Repaired)Document200 pagesSeminar-Quality Assurance (13-11-2013) - Copy (Repaired)ASIR DHAYANINo ratings yet

- Payton Tackett Resume 7 13 22Document2 pagesPayton Tackett Resume 7 13 22api-624729128No ratings yet

- Tourism Management: Emily Ma, Huijun Yang, Yao-Chin Wang, Hanqun SongDocument13 pagesTourism Management: Emily Ma, Huijun Yang, Yao-Chin Wang, Hanqun Song韩意颜No ratings yet

- Sap fb08 Amp f80 Tutorial Document ReversalDocument16 pagesSap fb08 Amp f80 Tutorial Document Reversalsaeedawais47No ratings yet

- A6 Standard Lift Assembly m3 CAN Plasma System: Instruction ManualDocument79 pagesA6 Standard Lift Assembly m3 CAN Plasma System: Instruction ManualJulio De la RosaNo ratings yet

- Proverbs 18-24 Ronnie LoudermilkDocument1 pageProverbs 18-24 Ronnie LoudermilkKeneth Chris NamocNo ratings yet

- Family EngagementDocument8 pagesFamily Engagementapi-559316869No ratings yet

- Course Outline: Raazi@pafkiet - Edu.pkDocument2 pagesCourse Outline: Raazi@pafkiet - Edu.pkMohammedNo ratings yet

FINS 2624 Quiz 2 Answers

FINS 2624 Quiz 2 Answers

Uploaded by

sagarox7Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FINS 2624 Quiz 2 Answers

FINS 2624 Quiz 2 Answers

Uploaded by

sagarox7Copyright:

Available Formats

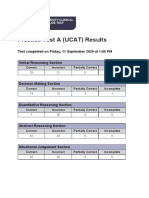

Review Test Submission: Online quiz 2

1 of 2

FINS2624-Portfolio Mgmt - s1/2013

https://lms-blackboard.telt.unsw.edu.au/webapps/assessment/review/re...

Online quizzes

Online Quiz 2

Review Test Submission: Online quiz 2

Review Test Submission: Online quiz 2

User

David WANG

Submitted

27/03/13 20:46

Status

Completed

Score

100 out of 100 points

Instructions

Question 1

10 out of 10 points

Suppose you observe the following two bonds in the market:

A one-year zero-coupon bond with a face value of $1000 trading at $900.

A two-year bond paying an annual coupon of $120 and a face value of $1000 trading at par.

What can you conclude about the arbitrage-free forward rate between times 1 and 2, f ?

12

Selected Answer:

It is 13%

Question 2

10 out of 10 points

Which of the following are important differences between the theoretical concept of the term structure

of interest as we've discussed it in class, and the zero-coupon interest rates of government bonds we

use to approximate it, e.g. in slide two of lecture two?

Selected Answer:

D. A and B

Question 3

10 out of 10 points

Suppose the current term structure of interest rates is as follows:

y

1 = 4%

y2 = 5%

y3 = 9%

y4 = 10%

y5 = 11%

What is the arbitrage-free forward rate between times 2 and 4, f ? Give your answer in percentage

24

units with two decimal points, e.g. answer 6.34 if you think the forward rate is 0.06342.

Selected Answer:

15.24

Question 4

10 out of 10 points

The expectations theory of the term structure of interest rates states

that

Selected

Answer:

forward rates are market expectations of future

interest rates.

Question 5

10 out of 10 points

Suppose you observe the three following bonds in the market:

OK

27/03/2013 10:10 PM

Review Test Submission: Online quiz 2

2 of 2

https://lms-blackboard.telt.unsw.edu.au/webapps/assessment/review/re...

A two-year zero-coupon bond with a face value of $100 trading for $89.00

A two-year bond with a face value of $100 and a $10 coupon trading for $107.51

A two-year bond with a face value of $100 and a $20 coupon trading for $127.53

Which of the following statements is true?

Selected Answer:

B. There is a possible arbitrage trade involving a short position in bond C

Question 6

10 out of 10 points

Which of the following are valid reasons why the yield on bonds with

long times to maturity may include a liquidity premium?

Selected Answer:

All of the above

Question 7

10 out of 10 points

Suppose you have an investment horizon of 3 years and hold a 5 year zero-coupon bond. You would

be facing:

Selected Answer:

B. Liquidity risk

Question 8

10 out of 10 points

Suppose you want to find the arbitrage-free forward rate between time 1 and 2, f . What information

12

would be sufficient?

A - The price of a two-year bond with an annual coupon payment of $10 and a face value of $100.

B - The price of a two-year bond with an annual coupon payment of $20 and a face value of $100.

C - The price of a one-year zero-coupon bond with a face value of $100.

Selected Answer:

4. Any of the above combinations.

Question 9

10 out of 10 points

Suppose you observe the following interest rates in the market:

y = 6%

3

f = 6%

12

f = 5%

13

What is the arbitrage-free two-year spot rate, y ?

2

Selected Answer:

7%

Question 10

10 out of 10 points

One way of interpreting the term structure of interest rates is that it

shows the relationship between:

Selected

Answer:

the yield on zero-coupon bonds and the time to maturity

of those bonds.

Wednesday, 27 March 2013 20:46:20 o'clock EST

27/03/2013 10:10 PM

You might also like

- Huawei HCIA-IoT v. 2.5 Evaluation QuestionsDocument77 pagesHuawei HCIA-IoT v. 2.5 Evaluation Questionstest oneNo ratings yet

- Magic Arms and Armor Price GuideDocument55 pagesMagic Arms and Armor Price GuideFrank JamisonNo ratings yet

- Biology ATAR Y12 Sample Assessment Tasks WACE 2015 - 16 - PDFDocument31 pagesBiology ATAR Y12 Sample Assessment Tasks WACE 2015 - 16 - PDFpartyNo ratings yet

- TOK Essay - Application of KnowkedgeDocument6 pagesTOK Essay - Application of KnowkedgeAdin Becker0% (1)

- Chapter 12 Case Clues Case 12.1 Peaceful Valley: Trouble in Suburbia Case ObjectiveDocument3 pagesChapter 12 Case Clues Case 12.1 Peaceful Valley: Trouble in Suburbia Case ObjectiveSheikh Hasan0% (1)

- 3.2.2 Answer Key To Data Response Questions On Exchange RatesDocument5 pages3.2.2 Answer Key To Data Response Questions On Exchange RatesI-Zac LeeNo ratings yet

- UCAT Practice Test Results 637354262214053584 PDFDocument1 pageUCAT Practice Test Results 637354262214053584 PDFAyanHabaneNo ratings yet

- Example Question #1: Necessary Assumption: LSAT Logical Reasoning AssumptionDocument98 pagesExample Question #1: Necessary Assumption: LSAT Logical Reasoning AssumptionSumera KaziNo ratings yet

- Topic Test - Graps of Physical PhenomenaDocument5 pagesTopic Test - Graps of Physical PhenomenaTony TranNo ratings yet

- l4 Dichotomous Key Marking SchemeDocument1 pagel4 Dichotomous Key Marking SchemeJesse J.ENo ratings yet

- 7.2 Structured 1Document75 pages7.2 Structured 1Anonymous Fspcb0No ratings yet

- TM355: Communications Technology: Take Home Exam For Final Assignment 2020-2021/ FallDocument7 pagesTM355: Communications Technology: Take Home Exam For Final Assignment 2020-2021/ FallHusseinJdeedNo ratings yet

- Fins 2624 Quiz 2 Answers 1Document2 pagesFins 2624 Quiz 2 Answers 1sagarox70% (1)

- JPJC JC1 H2 Math Revision For WA2 Questions 2023Document6 pagesJPJC JC1 H2 Math Revision For WA2 Questions 2023vincesee85No ratings yet

- 2021 Standard 2 TrialDocument33 pages2021 Standard 2 TrialSia GuptaNo ratings yet

- Physics Problems: Workbook 1Document18 pagesPhysics Problems: Workbook 1Jessica NakumaNo ratings yet

- 2017 Newington Economics Trial (W Solutions)Document36 pages2017 Newington Economics Trial (W Solutions)lg019 workNo ratings yet

- 2021 James Ruse HSC Economics Trial (W Solutions)Document42 pages2021 James Ruse HSC Economics Trial (W Solutions)lg019 workNo ratings yet

- Sydney Boys 2014 Business Studies Trials & SolutionsDocument25 pagesSydney Boys 2014 Business Studies Trials & SolutionsThomas SomyNo ratings yet

- 2021 Abbotsleigh Economics Trial (Marking Guide)Document22 pages2021 Abbotsleigh Economics Trial (Marking Guide)lg019 workNo ratings yet

- 2019 Advanced Trial Paper 1 Question BookletDocument9 pages2019 Advanced Trial Paper 1 Question BookletRoger YaoNo ratings yet

- Economics HSC Notes 2006Document27 pagesEconomics HSC Notes 2006Billy BobNo ratings yet

- Artificial LanguageDocument3 pagesArtificial Languagevinothan vinothanNo ratings yet

- Knox 2012 Business Studies TrialsDocument16 pagesKnox 2012 Business Studies TrialsArpit KumarNo ratings yet

- VCE BIOLOGY UnitDocument24 pagesVCE BIOLOGY Unitjess_heathNo ratings yet

- Penrith 2021 Biology Trials & SolutionsDocument50 pagesPenrith 2021 Biology Trials & SolutionsHewadNo ratings yet

- Food Tech Full Summary HSCDocument46 pagesFood Tech Full Summary HSCAxqen kmorjNo ratings yet

- Y10 Science Semester 2 Exam Paper 2014Document28 pagesY10 Science Semester 2 Exam Paper 2014Joshua JohnNo ratings yet

- PEM 2021 Mathematics Standard Preliminary Examination PaperDocument33 pagesPEM 2021 Mathematics Standard Preliminary Examination PaperBurnt llamaNo ratings yet

- Economics HeadstartDocument81 pagesEconomics HeadstarthadiahNo ratings yet

- Atomic Structure For Grade 10Document4 pagesAtomic Structure For Grade 10Aja AndersonNo ratings yet

- Series and Parallel Circuits Questions - KS3 EditDocument4 pagesSeries and Parallel Circuits Questions - KS3 EditDominic Wynes-DevlinNo ratings yet

- Bonding SL+HL p2Document73 pagesBonding SL+HL p2Murat KAYANo ratings yet

- CIE IGCSE SUMMER 2007 MATHEMATICS PAPERS - 0580 s07 QP 3Document12 pagesCIE IGCSE SUMMER 2007 MATHEMATICS PAPERS - 0580 s07 QP 3zincfalls100% (13)

- Hi-Tech ISTDocument360 pagesHi-Tech ISTDharineeshNo ratings yet

- Letter To Cancel or Withdraw A Customer's Credit AccountDocument1 pageLetter To Cancel or Withdraw A Customer's Credit AccountVita Nur AryatiNo ratings yet

- Bebras Solution Guide 2023 R1 SecondaryDocument102 pagesBebras Solution Guide 2023 R1 SecondaryKarlota GorrotxateguiNo ratings yet

- Topic 9 Voltaic CellsDocument3 pagesTopic 9 Voltaic CellsMRMFARAHNo ratings yet

- Kunci Jawaban MergedDocument350 pagesKunci Jawaban MergedDananjaya PranandityaNo ratings yet

- Year 10 TrigonometryDocument2 pagesYear 10 TrigonometryDavid StoneNo ratings yet

- 2021 HSC EconomicsDocument24 pages2021 HSC EconomicspotpalNo ratings yet

- Paper 1 Nov 2000 PhysicsDocument16 pagesPaper 1 Nov 2000 Physicssolarixe100% (1)

- Bebras Solution Guide 2022 R1 PrimaryDocument60 pagesBebras Solution Guide 2022 R1 PrimaryFatima DionísioNo ratings yet

- June 2021 Crash Course - JC2 H2 Math With Solutions.4JunDocument103 pagesJune 2021 Crash Course - JC2 H2 Math With Solutions.4JunPatrick ChanNo ratings yet

- "Discovery Shapes Identity." DiscussDocument6 pages"Discovery Shapes Identity." Discusssuitup123No ratings yet

- 9 - Greg Reid - Assessing HOT Skills in ICASDocument52 pages9 - Greg Reid - Assessing HOT Skills in ICASLaiyee ChanNo ratings yet

- ESS Paper 2Document20 pagesESS Paper 2ziverNo ratings yet

- Application For HNDEDocument2 pagesApplication For HNDEdharul khair67% (9)

- 2011 Trial Physics AnswersDocument27 pages2011 Trial Physics AnswersGeorgeNo ratings yet

- Sunday Times Good University Guide 2021Document57 pagesSunday Times Good University Guide 2021So Ho HanNo ratings yet

- IB Final Exam NotesDocument22 pagesIB Final Exam NotesJian Zhi TehNo ratings yet

- Fort ST 2021 3U Trials & SolutionsDocument20 pagesFort ST 2021 3U Trials & SolutionspotpalNo ratings yet

- How Is Personal Experience Distinguished From Shared Knowledge? PersonalDocument4 pagesHow Is Personal Experience Distinguished From Shared Knowledge? PersonalHarun ĆehovićNo ratings yet

- Complex PDFDocument60 pagesComplex PDFRickyChanNo ratings yet

- Unit Plan - Year 7 Science States of MatterDocument23 pagesUnit Plan - Year 7 Science States of Matterapi-708755416No ratings yet

- Grade 9 SCIENCE QUESTIONSDocument3 pagesGrade 9 SCIENCE QUESTIONSSharreah LimNo ratings yet

- Applications and Interpretation Standard May 2022 Paper 2 TZ2Document8 pagesApplications and Interpretation Standard May 2022 Paper 2 TZ2liberttacaoNo ratings yet

- Year 10 Worksheet 2 PDFDocument19 pagesYear 10 Worksheet 2 PDFTavishi PragyaNo ratings yet

- Year 10 Physics Workbook AnswersDocument2 pagesYear 10 Physics Workbook AnswersύπατίαNo ratings yet

- Market Structure Worksheets and AnswersDocument16 pagesMarket Structure Worksheets and AnswersNate ChenNo ratings yet

- Biology HSC Questions ARC 2006Document28 pagesBiology HSC Questions ARC 2006timeflies23No ratings yet

- Take Test: Online Quiz 2: Questi On 1Document3 pagesTake Test: Online Quiz 2: Questi On 1jonNo ratings yet

- Take Test: Online Quiz 2: Questi On 1Document3 pagesTake Test: Online Quiz 2: Questi On 1jonNo ratings yet

- FINS 2624 Quiz 2 Attempt 2 PDFDocument3 pagesFINS 2624 Quiz 2 Attempt 2 PDFsagarox7No ratings yet

- Fins 2624 Quiz 2 Answers 1Document2 pagesFins 2624 Quiz 2 Answers 1sagarox70% (1)

- Mockterm FINS2624 S1 2013Document12 pagesMockterm FINS2624 S1 2013sagarox7No ratings yet

- Fins 2624 Quiz 1Document3 pagesFins 2624 Quiz 1sagarox7No ratings yet

- Formula SheetDocument1 pageFormula Sheetsagarox7No ratings yet

- School of Mathematics and Statistics: Topic and Contents MatricesDocument5 pagesSchool of Mathematics and Statistics: Topic and Contents Matricessagarox7No ratings yet

- Stability of Floating BodiesDocument6 pagesStability of Floating Bodieskharry8davidNo ratings yet

- A Teacher's Guide To CosmosDocument45 pagesA Teacher's Guide To CosmosMSU UrbanSTEM100% (2)

- Harrison Bergeron - With AnnotationsDocument8 pagesHarrison Bergeron - With Annotationserica.hugoNo ratings yet

- 12h Identification Des Pieces Service BrakeDocument3 pages12h Identification Des Pieces Service BrakeaniriNo ratings yet

- Expansion Joints hoses-KLINGER AUDocument7 pagesExpansion Joints hoses-KLINGER AUMichael PhamNo ratings yet

- Self-Awareness To Being Watched and Socially-Desirable Behavior: A Field Experiment On The Effect of Body-Worn Cameras On Police Use-Of-ForceDocument14 pagesSelf-Awareness To Being Watched and Socially-Desirable Behavior: A Field Experiment On The Effect of Body-Worn Cameras On Police Use-Of-ForcePoliceFoundationNo ratings yet

- District CalendarDocument1 pageDistrict Calendarapi-271737972No ratings yet

- ExamenesDocument4 pagesExamenesZareli Lazo AriasNo ratings yet

- Lesson Plan Ces422 PDFDocument2 pagesLesson Plan Ces422 PDFdzikrydsNo ratings yet

- Lesson 1: The Making of The Rizal Law: 1.1. Debate in The Senate 1.2. Conflict in The Catholic ChurchDocument21 pagesLesson 1: The Making of The Rizal Law: 1.1. Debate in The Senate 1.2. Conflict in The Catholic ChurchJii JisavellNo ratings yet

- Year 2018 Best Ongoing Practices Bijhari Block by Vijay Kumar Heer, BRCC PrimaryDocument24 pagesYear 2018 Best Ongoing Practices Bijhari Block by Vijay Kumar Heer, BRCC PrimaryVIJAY KUMAR HEERNo ratings yet

- 7480H - Catalog - Mobile - Fuel - Filtration - Filtors Racor PDFDocument98 pages7480H - Catalog - Mobile - Fuel - Filtration - Filtors Racor PDFFrank Felipe Cruz ChavezNo ratings yet

- Box Culvert / U-Drain Section Design: File:///conversion/tmp/scratch/488560866Document9 pagesBox Culvert / U-Drain Section Design: File:///conversion/tmp/scratch/488560866azwanNo ratings yet

- 151-Enablon Orm - Permit To WorkDocument2 pages151-Enablon Orm - Permit To WorkRishikesh GunjalNo ratings yet

- Liebert - CRV Series Air Conditioner User Manual: V1.4 Revision Date May 28, 2012 BOM 31011886Document79 pagesLiebert - CRV Series Air Conditioner User Manual: V1.4 Revision Date May 28, 2012 BOM 31011886Dam Ngoc KienNo ratings yet

- Dance: Choreographic Forms inDocument29 pagesDance: Choreographic Forms inROCELYN IMPERIALNo ratings yet

- CT Secondary InjectionDocument2 pagesCT Secondary InjectionHumayun AhsanNo ratings yet

- Book Review of I Love You Since 1892Document2 pagesBook Review of I Love You Since 1892hannah100% (1)

- Sample 70 - 2Document7 pagesSample 70 - 2Mikhael MangopoNo ratings yet

- Seminar-Quality Assurance (13-11-2013) - Copy (Repaired)Document200 pagesSeminar-Quality Assurance (13-11-2013) - Copy (Repaired)ASIR DHAYANINo ratings yet

- Payton Tackett Resume 7 13 22Document2 pagesPayton Tackett Resume 7 13 22api-624729128No ratings yet

- Tourism Management: Emily Ma, Huijun Yang, Yao-Chin Wang, Hanqun SongDocument13 pagesTourism Management: Emily Ma, Huijun Yang, Yao-Chin Wang, Hanqun Song韩意颜No ratings yet

- Sap fb08 Amp f80 Tutorial Document ReversalDocument16 pagesSap fb08 Amp f80 Tutorial Document Reversalsaeedawais47No ratings yet

- A6 Standard Lift Assembly m3 CAN Plasma System: Instruction ManualDocument79 pagesA6 Standard Lift Assembly m3 CAN Plasma System: Instruction ManualJulio De la RosaNo ratings yet

- Proverbs 18-24 Ronnie LoudermilkDocument1 pageProverbs 18-24 Ronnie LoudermilkKeneth Chris NamocNo ratings yet

- Family EngagementDocument8 pagesFamily Engagementapi-559316869No ratings yet

- Course Outline: Raazi@pafkiet - Edu.pkDocument2 pagesCourse Outline: Raazi@pafkiet - Edu.pkMohammedNo ratings yet