Professional Documents

Culture Documents

Cairn India Financial Info

Cairn India Financial Info

Uploaded by

hirenchavla93Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cairn India Financial Info

Cairn India Financial Info

Uploaded by

hirenchavla93Copyright:

Available Formats

CAIRN INDIA

Submitted to :

Prof Hetal Jhaveri

Submitted By

Hiren Chavla B-08

Date :Friday, February 13, 2015

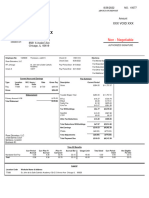

1. What are the changes in the capital structure?

Year

Total Equity

Paid up equity capital

Borrowings

Debentures and bonds

2010-11

19,019.2

0

19,019.2

0

13,500.0

0

13,500.0

0

2011-12

19,074.0

0

19,074.0

0

12,500.0

0

12,500.0

0

2012-13

19,102.4

0

19,102.4

0

2013-14

19,076.3

0

19,076.3

0

Answering the question from 2010-11 to 2011-12 the Debt is reducing by

1000 million and

And the in the next year company is repaying all its debt. While equities have

been more or less the same. Buy back and Release of equity has been

evident from the report

2. What are the reasons for these changes?

The Company was founded in 2007 and deals in OIL drilling and exploration.

Until the year 2011-12 it did do any sales as they were setting up production

plant. The day they made sales they had excess money so the company decided

to repay its debt. Company started making its sales from main product in 2012 it

self, before this minimal revenue came from financial activities. The company

changes its capital structure to provide higher rate of returns to the

shareholders. The company increases the balance of its reserve and surpluses to

meet the contingencies

As the company have enough of working capital and no shortage of liquidity.

So there is no requirement to issue more debt. Even the reserves of the

company have been increasing after the sales increased

From Shareholders Point of view, if there were any changes in the Capital

Structure, an increase in debt could make them highly leveraged company

this would result in paying high interest from Earnings and less part would

remain for Equity Share Holders.

3. What is the debt-equity ratio?

Year

2010-11

2011-12

201213

Total Equity

19,019.20

19,074.00

19,102.40

19,076.30

19,019.20

19,074.00

19,102.40

19,076.30

13,500.00

12,500.00

13,500.00

12,500.00

0.7098

09

0.6553

42

Paid up equity capital

Borrowings

Debentures and bonds

Debt Equity Ratio

201314

It seems that company has a huge capital investment and has huge turnover

thats why from the day it started making profits out of sales, it repaid all its

debt. While talking about debt to equity Ratio in 2 years the debt has been

around 0.7 to 0.65 that shows the stability of company and acquiring a huge

debt and paying interest on time is what shows the stability of company.

Company has a strong hold and the incomes and expenditure are well

planned.

The ideal ratio considered is 1:1 that would help them give a tax shelter but

as such there is Dividend Distribution Tax (DDT) it wouldnt matter much.

4. What is the cost of the debt?

Year

Interest paid

Borrowings

Debentures

bonds

2011-12

201213

201314

1,367.20

1,095.50

0.2

0.005

13,500.00

12,500.00

13,500.00

12,500.00

10.13

8.764

and

Cost of Debt

2010-11

As shown in the table the cost of debt is around 9-11% this of course is a

good rate at which the debt is acquired.

5. What is the impact on interest cost to the company?

Company in the 2010-11 and 2011-12 had debt rest of the year it managed

to repay all its debt so it had to pay interest but even got the tax shelter.

Then repaying all its debt the cost of debt becomes 0. No interest to pay.

The equity shareholder will probably get lesser amounts of returns as the

return amount is shared by paying interest as such after a point of time the

debt becomes 0 so the amount to pay becomes 0 and all earnings are for

equity holders. And when all debt is paid that is the First time when company

pays dividend (interim Dividend as well as final dividend) to equity

shareholders

6. What is the impact on shareholders returns?

Announcement

date

Dividend

rate

(%)

Dividend per

share

(Rs.)

23-Apr-14

65

6.5

22-Oct-13

60

22-Apr-13

65

6.5

31-Oct-12

50

Dividend type

Final

Interim

Final

Interim

When there is debt the company isnt paying any returns to equity share

holders as such it has not been making sales in regards to production being

setup so as soon as it starts sales the company pays off all its debts and even

gives return to equity share holders. P-E ratio (From -1.1 in 2011-12 to 32.5 in

2012-13) and EPS increased drastically

7. Your analysis based on the classroom discussion and the above

questions.

The company is in stong position. And as there is no debt it is good for the

company

Capital structure is the composition of debt and equity which are considered

as sources of capital. We can understand how the company efficiently uses

the funds provided. The working capital structure measures the market

capitalization as well as the return on assets.

Therefore it can be concluded that the primary factors that affects the capital

structure decisions are business risk, companys tax exposure, growth rate,

financial flexibility, market conditions

Thank You

You might also like

- Usaa Receipt ShareDocument10 pagesUsaa Receipt ShareRohan DuncanNo ratings yet

- 90 Day Workbook-Digital 14JUNv1 - Fill v2Document111 pages90 Day Workbook-Digital 14JUNv1 - Fill v2SAM100% (25)

- Assignment 4Document4 pagesAssignment 4Fitri Choerunisa0% (1)

- Solutions Manual: Introducing Corporate Finance 2eDocument9 pagesSolutions Manual: Introducing Corporate Finance 2eMane Scal JayNo ratings yet

- Financial Report Dutch LadyDocument55 pagesFinancial Report Dutch Ladymed11dz87% (23)

- Case Study - Track SoftwareDocument6 pagesCase Study - Track SoftwareRey-Anne Paynter100% (14)

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionMichelle Rodríguez100% (1)

- A Case Study of D'Leon IncDocument13 pagesA Case Study of D'Leon IncTimNo ratings yet

- Executive Order 11490Document44 pagesExecutive Order 11490nacfuzzy0% (1)

- Project Report On Credit Risk ManagementDocument56 pagesProject Report On Credit Risk ManagementGayatriThotakura80% (30)

- Total Assets Total Equity Equity Ratio 2013 2012 2011Document3 pagesTotal Assets Total Equity Equity Ratio 2013 2012 2011Salman EjazNo ratings yet

- Financial Statement and Comparative Analysis at Idbi Federal Insurance Co LTDDocument17 pagesFinancial Statement and Comparative Analysis at Idbi Federal Insurance Co LTDManikanthBhavirisettyNo ratings yet

- Adobe Trading CompanyDocument6 pagesAdobe Trading CompanyTeodoro QuijanoNo ratings yet

- ACI Limited Submitted To:: ULAB School of Business Bachelor of Business Administration (B.B.A.) Term Paper OnDocument13 pagesACI Limited Submitted To:: ULAB School of Business Bachelor of Business Administration (B.B.A.) Term Paper OnashikNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisBharatsinh SarvaiyaNo ratings yet

- Financial Analysis of NestleDocument5 pagesFinancial Analysis of NestleArun AhlawatNo ratings yet

- Capital Structure Analysis of IOCLDocument31 pagesCapital Structure Analysis of IOCLAmit SardanaNo ratings yet

- How A Company Goes PublicDocument2 pagesHow A Company Goes PublicNarasinha BidarhalliNo ratings yet

- Financial Analysis Assignment No.2 Submitted By: Ahsan Nazar Usama Jalil Ali Arshad Submitted To: Prof. T.Eesha Section: ADocument12 pagesFinancial Analysis Assignment No.2 Submitted By: Ahsan Nazar Usama Jalil Ali Arshad Submitted To: Prof. T.Eesha Section: AAhsan NazarNo ratings yet

- Financial Analysis of Tesco PLCDocument7 pagesFinancial Analysis of Tesco PLCSyed Toseef Ali100% (1)

- Practice Technicals 3Document6 pagesPractice Technicals 3tigerNo ratings yet

- 15 - Nishikant Dhawale - EAI-17-112Document4 pages15 - Nishikant Dhawale - EAI-17-112NISHIKANT DHAWALENo ratings yet

- Fin 517 - Take Home ExamDocument3 pagesFin 517 - Take Home ExamJennifer PearsallNo ratings yet

- Cash Flow and Ratio AnalysisDocument7 pagesCash Flow and Ratio AnalysisShalal Bin YousufNo ratings yet

- Financial Ratios NestleDocument23 pagesFinancial Ratios NestleSehrash SashaNo ratings yet

- Strategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Document40 pagesStrategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Rupesh KadamNo ratings yet

- Long Term Debt: Times Interest Earned RatioDocument4 pagesLong Term Debt: Times Interest Earned RatioDiv KabraNo ratings yet

- Banna Leisure 111Document2 pagesBanna Leisure 111ravinyseNo ratings yet

- CasesDocument18 pagesCasesparmendra_singh25No ratings yet

- Jatin Johar Jitendra Kumar Tiwari Mahesh Singh Leena Bhatia Amit Kumar SinghDocument18 pagesJatin Johar Jitendra Kumar Tiwari Mahesh Singh Leena Bhatia Amit Kumar SinghJatin JoharNo ratings yet

- Case Study 1 Fin745Document11 pagesCase Study 1 Fin745nieyoot0% (1)

- FINANCIAL STATEMENT ANALYSIS OF Nokia Inc LTDDocument4 pagesFINANCIAL STATEMENT ANALYSIS OF Nokia Inc LTDROHIT SETHI100% (2)

- Financial Analysis P&GDocument10 pagesFinancial Analysis P&Gsayko88No ratings yet

- Problems-Finance Fall, 2014Document22 pagesProblems-Finance Fall, 2014jyoon2140% (1)

- Home Depot Financial QuestionDocument3 pagesHome Depot Financial Questionmktg1990No ratings yet

- FinMan - Case #1Document3 pagesFinMan - Case #1Shaula Tan SombilonNo ratings yet

- Why Are Ratios UsefulDocument5 pagesWhy Are Ratios UsefulLosing SleepNo ratings yet

- Abbott Laboratories (ABT)Document8 pagesAbbott Laboratories (ABT)Riffat Al ImamNo ratings yet

- Foundation AccountingDocument11 pagesFoundation AccountingNaijalegendNo ratings yet

- Microsoft Corporation: Net Cash From OperationsDocument4 pagesMicrosoft Corporation: Net Cash From OperationsrmsNo ratings yet

- Audit Prob InvestmentDocument5 pagesAudit Prob InvestmentANGIE BERNAL100% (1)

- Videocon Financial AnalysisDocument9 pagesVideocon Financial AnalysisDiv KabraNo ratings yet

- Final Project On Engro FinalDocument27 pagesFinal Project On Engro FinalKamran GulNo ratings yet

- BWBB 3083 Corporate Banking (Terms Loan)Document11 pagesBWBB 3083 Corporate Banking (Terms Loan)neemNo ratings yet

- Financial Analysis of SSGDocument12 pagesFinancial Analysis of SSGAdnan GulfamNo ratings yet

- Mm0057 Financial Management Midterm Exam: No. 1 - Track Software, IncDocument15 pagesMm0057 Financial Management Midterm Exam: No. 1 - Track Software, Incnavier funtabulousNo ratings yet

- Financial Analysis Ratio Analysis of The Shifa International HospitalDocument4 pagesFinancial Analysis Ratio Analysis of The Shifa International HospitalNaheed AdeelNo ratings yet

- Patrick Oliphant ACCT 211 Dr. Rickling Individual ReportDocument5 pagesPatrick Oliphant ACCT 211 Dr. Rickling Individual ReportPatrickOliphantNo ratings yet

- Conclusion and RecommendationsDocument3 pagesConclusion and RecommendationschayncikoNo ratings yet

- Bhel Ratio AnalysisDocument9 pagesBhel Ratio Analysissumit mittalNo ratings yet

- Du PontDocument8 pagesDu PontTên Hay ThếNo ratings yet

- Cases in Finance - FIN 200Document3 pagesCases in Finance - FIN 200avegaNo ratings yet

- Return On Equity: Investing ConceptsDocument9 pagesReturn On Equity: Investing Conceptsapi-555390406No ratings yet

- Case: Riyadh SportsDocument4 pagesCase: Riyadh SportslackylukNo ratings yet

- Assignment 2 Zain MalikDocument6 pagesAssignment 2 Zain Malikhamna wahabNo ratings yet

- Lucky Cement AnalysisDocument6 pagesLucky Cement AnalysisKhadija JawedNo ratings yet

- Sample Business Plan 1 2021 2022Document23 pagesSample Business Plan 1 2021 2022Claudio MatarazzoNo ratings yet

- Cash Flow Interpretation of Hero Moto Corp ForDocument15 pagesCash Flow Interpretation of Hero Moto Corp ForNikita KhandujaNo ratings yet

- Finamn 1Document11 pagesFinamn 1michean mabaoNo ratings yet

- Profitability RatioDocument3 pagesProfitability Ratiobhawna.licdu318No ratings yet

- Fin 254 - Project: Company Name: Meghna Cement Mills LimitedDocument18 pagesFin 254 - Project: Company Name: Meghna Cement Mills LimitedAniruddha RantuNo ratings yet

- Analysis of Xyz Limited' Company: Liquidity RatiosDocument7 pagesAnalysis of Xyz Limited' Company: Liquidity RatiosdharmapuriarunNo ratings yet

- Fake PDFDocument15 pagesFake PDFAkshay AggarwalNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- GR 9 Teachers GuideDocument107 pagesGR 9 Teachers GuideAmogelang Katlego MakhalemeleNo ratings yet

- Macro EconomicsDocument63 pagesMacro EconomicsShimpi BeraNo ratings yet

- Equity Research Module AdvanceDocument14 pagesEquity Research Module AdvanceVIRAL VAULTNo ratings yet

- MM PropositionDocument61 pagesMM PropositionVikku AgarwalNo ratings yet

- Excel Skills - Exercises - Income Statement: Step TaskDocument7 pagesExcel Skills - Exercises - Income Statement: Step Taskdang lamliNo ratings yet

- Business Environment: ApprovedDocument1 pageBusiness Environment: ApprovedRitaSethiNo ratings yet

- Credit ManagementDocument22 pagesCredit ManagementAlmira EntrenaNo ratings yet

- Personalizing Your Own Compliance Manual Template 3Document20 pagesPersonalizing Your Own Compliance Manual Template 3williamhancharekNo ratings yet

- Transfer Information DocumentDocument2 pagesTransfer Information Documentshahzeel khanNo ratings yet

- Impact of FII On Indian Stock MarketDocument62 pagesImpact of FII On Indian Stock MarketNikhil Jadhav100% (5)

- FAR Assignment 3 - CalculationsDocument5 pagesFAR Assignment 3 - CalculationsRumani ChakrabortyNo ratings yet

- Presentation For Partners ENGDocument20 pagesPresentation For Partners ENGinvestorsclinicleadsNo ratings yet

- Project On HDFCDocument36 pagesProject On HDFCjhansidummyNo ratings yet

- Financial Accounting An Introduction To Concepts Methods and Uses Weil 14th Edition Test BankDocument11 pagesFinancial Accounting An Introduction To Concepts Methods and Uses Weil 14th Edition Test Bankfroggedgoout.3ez83100% (55)

- 1.2. Types of Bank: Dhruba Koirala National Law CollegeDocument38 pages1.2. Types of Bank: Dhruba Koirala National Law CollegeMadan ShresthaNo ratings yet

- Report 1Document2 pagesReport 1Raashid Qyidar Aqiel ElNo ratings yet

- Advance Financial AccountingDocument37 pagesAdvance Financial AccountingDr. Kaustubh JianNo ratings yet

- DOCUMENT: Bank Statement Reflecting All FIRS Transfers To President Buhari's FriendDocument1 pageDOCUMENT: Bank Statement Reflecting All FIRS Transfers To President Buhari's FriendSahara ReportersNo ratings yet

- Unit 3.1 3.7 Multiple ChoiceDocument4 pagesUnit 3.1 3.7 Multiple ChoiceNieL TianNo ratings yet

- The Traditional Approach To Capital Structure Implies That An Optimum DebtDocument3 pagesThe Traditional Approach To Capital Structure Implies That An Optimum DebtYougal MalikNo ratings yet

- Ratio Analysis of Rafhan FoodsDocument6 pagesRatio Analysis of Rafhan FoodsusmanazizbhattiNo ratings yet

- Quiz 1Document2 pagesQuiz 1Nathalie GetinoNo ratings yet

- Reviewer MPCBDocument7 pagesReviewer MPCBMJ NuarinNo ratings yet

- Cost of CapitalDocument66 pagesCost of CapitalPriya SinghNo ratings yet

- Module 3 Individual Taxpayers 1Document8 pagesModule 3 Individual Taxpayers 1Chryshelle Anne Marie LontokNo ratings yet