Professional Documents

Culture Documents

Executive Summary: State Bank of India

Executive Summary: State Bank of India

Uploaded by

vinu_ckdOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Executive Summary: State Bank of India

Executive Summary: State Bank of India

Uploaded by

vinu_ckdCopyright:

Available Formats

STATE BANK OF INDIA

EXECUTIVE SUMMARY

This project report has been undertaken in “State Bank Of India,” which highlights

the details study of “Non Performing Assets Management and Banking study of SBI”.

The objective of this project is to get the good knowledge banking and NPA

management.

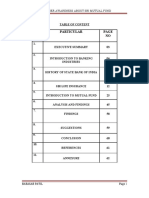

This project report is divided into 4 parts

Part A ….origin, history

Part B…. Introduction about NPA, RBI guidelines, etc

Part C….case on SARFESI ACT

Part D…. SWOT analysis, conclusion.

Part A gives brief information regarding banks history, objectives, which help to

know the about the bank in detail.

Part B gives knowledge about NPA, which help to know about NPA , what and how

NPA is ascertained.

Part C gives information regarding case and how it dealt under SARFESI ACT.

Part D gives ideas about SWOT Analysis of the bank.

KLS’s Institute Of Management Education And Research, Belgaum 1

STATE BANK OF INDIA

ORIGIN AND HISTORY OF STATE BANK OF INDIA

State Bank of India started its Origin on June 2nd 1806 as bank of Calcutta. In 1809 it

came out with the new name as bank of Bengal. With the changes in social and economic

conditions of the country in 1840 there was evolution of bank of Bombay and in 1843 bank

of Madras. Earlier these 3 banks of were called as presidency bank of India.

With the advent of independence and the nationalist fervor sweeping the country, the

demand for the nationalization of the imperial bank of India intensified. After 1955, the bank

in its avatar as he state bank of India has been able to reach out trough the wild network of its

branches to a majority of our rural masses.

Today, as we look forward into new century and witness the transformation of the

bank trough BPR and technological initiatives we find that the bank is drawing together the

various threads of its past to weave a new tapestry encompassing all aspects of banking with

its operations spanning not just our country but entire globe.

Now by the year 2009 it is celebrating its bicentennial year i.e. 204 years of

celebration. SBI is having nearly 11000 branches all over India and some of the branches are

also operating in countries

KLS’s Institute Of Management Education And Research, Belgaum 2

STATE BANK OF INDIA

OBJECTIVE OF STUDY

1. To know the working of the State Bank Of India.

2. To know about the non-performing assets management of SBI.

3. To analyze the different NPA ratios

4. To study the NPA amount under different categories over the years

KLS’s Institute Of Management Education And Research, Belgaum 3

STATE BANK OF INDIA

Board Members List

Central Board of Directors

Chairman Shri. O.P. Bhatt

Managing directors Shri. S.K. Bhattacharyya

Shri. R. Sridharan

Directors elected under

section 19 (c) of SBI Act Dr. Ashok Jhunijhunwala

Shri. Dileep C. Choksi

Shri. S. Venkatachalam

Shri. D. Sundaram

Director nominated under

section19(d)of SBI Act Dr. Deva Nand Balodhi

Prof. Md. Salahuddin Ansari

Dr. (Mrs.) Vasantha Bharucha

Dr. Rajiv Kumar

Director under

section 19(f) of SBI Act Smt. Shyamala Gopinath

KLS’s Institute Of Management Education And Research, Belgaum 4

STATE BANK OF INDIA

Members of Local Boards in Bangalore

Smt. Mahapara Ali

Chief General Manager (Ex-Officio)

Smt. N.S. Rathna Prabha

Shri L. Chandrashekar

Shri R. Ashok Kumar

Shri Srinivas Tiwari

Members of Central Management Committee

Shri O.P. Bhatt

Chairman

Shri S.K. Bhattacharyya

Managing Director & Chief Credit & Risk Officer

Shri R. Sridharan

Managing Director & Group Executive

(Associates & Subsidiaries)

Shri C. Narasimhan

Deputy Managing Director & Group Executive

(Global Markets)

Shri Abhijit Datta

Deputy Managing Director & Group Executive

(Mid Corporate)

Shri Anup Banerji

Deputy Managing Director & Group Executive

(Rural Business)

Shri Ashok Mukand

Deputy Managing Director &

Chief Financial Officer

Shri H.G. Contractor

Deputy Managing Director & Group Executive

(Corporate Banking)

Shri R.P. Sinha

Deputy Managing Director

(Information Technology)

Shri Pratip C. Chaudhuri

Deputy Managing Director & Group Executive

(International Banking)

KLS’s Institute Of Management Education And Research, Belgaum 5

STATE BANK OF INDIA

The Structure of Indian Banking:

The Indian banking industry has Reserve Bank of India as its Regulatory Authority.

This is a mix of the Public sector, Private sector, Co-operative banks and foreign banks. The

private sector banks are again split into old banks and new banks.

Reserve Bank of India

[Central Bank]

Scheduled Banks

Scheduled Commercial

Banks Scheduled Co-operative Banks

Public Private

Sector Sector Foreign Regional

Banks Rural Banks

Banks Banks

Scheduled Urban Scheduled State

Nationalized SBI & its

Co-Operative

Banks Associates Co-Operative Banks

Banks

Old Private New Private

Sector Banks Sector Banks

KLS’s Institute Of Management Education And Research, Belgaum 6

STATE BANK OF INDIA

RESPONSIBILITY STATEMENT

The board of director hereby states:

i. That in the preparation of the annual accounts, the applicable accounting

standards have been followed along with proper explanation relating to material

departures;

ii. That they have selected such accounting policies and applied them consistently

and made judgment and estimates that are reasonable and prudent so as to give a

true and fair view of the state of affairs of the bank as on 31 st march 2009,and of

the profit or loss of the bank for the year ended on that date;

iii. That they have taken proper and sufficient care for maintenance of adequate

accounting records in accordance with the provisions of the banking regulation

act, 1949 and state bank of India act, 1955 for safeguarding the assets of the bank

and preventing and detecting frauds and other irregularities; and

iv. That they have prepared the annual accounts on a going concern basis.

KLS’s Institute Of Management Education And Research, Belgaum 7

STATE BANK OF INDIA

EVOLUTION OF INFORMATION TECHNOLOGY IN SBI

Several IT projects, encompassing various facets of modern day banking have been

launched.

I. ATMs Projects:

The Bank, along with its Associate banks have a common ATM network which is the

largest in the country. It crossed the milestone of 10,000 ATMs in December 2008 and with

an addition of 2911 ATMs during the year, the Bank has now a network of more than 11300

ATMs. The Bank also has 33 Multi Currency Module enabled ATMs at 19 foreign centres in

6 countries. Functionalities available at our ATMs include Card to Card Transfer, Fee

Payments, Utility Bill Payments, and Donations to Temples/Trusts etc. The Bank is also in

the process of installing Biometric and low cost rural ATMs

II. Core Banking:

The Bank achieved full Core Banking status on 23.07.2008 when all the branches of

the Bank were made functional on CBS. This is one of the most important achievements of

the Bank as our network along with Associate Banks is one of the largest banking networks

in the world to have gone on centralized data base (Core Banking) system. Core Banking has

not only enhanced our transaction processing capabilities but has also empowered our

customers to transact their banking business from any of the 11448 branches of the Bank.

Our 506 branches have been enabled for Core Integrated Trade Finance also

III. Internet Banking:

With enabling of over 2100 branches for internet banking, all the branches of the

Bank are now internet banking enabled. Apart from enabling Anywhere Anytime banking,

our Internet Banking offers a host of value added services like funds transfer through

RTGS/NEFT, Payment of Taxes, SMS Alerts, Bills Payments, Fee Payments, Mutual Fund

Investments, Subscription to IPO’s, Temple/Trust Donations etc. For Corporate customers,

additional facilities like CBEC Payment, Customs Payment, Fee collections for DGFT,

Freight collection for Railways etc. have been provided. A number of e-Governance

initiatives have also been enabled through Internet Banking..

KLS’s Institute Of Management Education And Research, Belgaum 8

STATE BANK OF INDIA

IV. Data Warehouse Project:

Implementation of Enterprise Data Warehouse is under progress. Its implementation

will provide critical tools necessary to help the Bank strengthen itself as an “intelligent

organization”, to improve processes, delivery of information for Decision Support System

(DSS) consisting of analytics on product performance, channel management, customer

relationship management, concurrent audit, Inspection and Audit, budgeting and monitoring

and self service for internal users..

V. Mobile Banking:

The Bank has launched its mobile banking facility which offers various features like

Funds Transfer using NEFT, Enquiry Services (balance enquiry / mini statement), Request

Services (cheque book request), m-commerce (Mobile Top Up, merchant payments, SBI Life

Insurance premium) and bill payment (utility bills, credit cards).

IT POLICY AND IS SECURITY POLICY

The bank has framed a comprehensive IT policy and is security policy

with the assistance of professional of IT security consultants. The policy

standards and procedures have been disseminated to application owners for

implementations. Security awareness training is being conducted for end users

on ongoing basis.

KLS’s Institute Of Management Education And Research, Belgaum 9

STATE BANK OF INDIA

PART-B

KLS’s Institute Of Management Education And Research, Belgaum 10

STATE BANK OF INDIA

INTRODUCTION TO NON-PERFORMING ASSETS

With a view to move towards internationally accepted norms for asset classification

and income recognition, RBI has been “tightening” the definition of NPAs in a phased

manner. Thus, from the norm of classifying only those assets as non-performing which are

four quarters past due, which was applicable until 1993, RBI moved to the norm of three

quarters past due in 1994 and then to two quarters (90 days) past due in 1995. In 2001, RBI

tightened this further by removing the “past due” concept. As a result, NPAs are to be

recognized 30 days earlier than they were to be before 2001.

RBI has now advised banks to move to the 90 days norm for recognizing loans as non-

performing, with effect from March 31, 2004.

This tightening of norms, coupled with the year of economic recession, resulted in an

increase in the recognized stock of NPAs in the Indian financial system. The same time, the

ratio of gross NPAs in to gross advances has shown a declining trend.

The definition of NPAs is prescribed in the prudential norms on asset classification

and advances laid down by RBI. An advance is classified as n NA where in the case of:

i) Terms Loan the interest and/or installment of principal remain overdue for a

period of more than 90 days.

ii) Overdraft/case credit (OD/CC) the account remains out of order.

iii) Bills purchased and discounted the bill remains overdue for a period of more than

90 days.

iv) Advance granted for agricultural purposes interest and/or installment of principal

remain overdue for two harvest seasons but for a period not exceeding two half

year, and

v) Other accounts any amount to be received remains overdue for a period of more

then 90 days.

With a view to moving towards international best practices and to ensure greater

transparency, it has been decided to adopt the ’90 days’ overdue norm for identification of

KLS’s Institute Of Management Education And Research, Belgaum 11

STATE BANK OF INDIA

NPAs, from the year ending March 31,2004. Accordingly, with the effects from March

31,2004,an advance will be classified as an NPA where in he case of:

i) Term Loan the interest and/or installment of principal remains overdue for a

period of more than 90 days.

ii) Overdraft/cash credit (OD/CC) the account remains out of order.

iii) Bills purchased and discounted the bill remains overdue for a period of more then

90 days.

iv) Advance granted for agricultural purposes interest and/or installment of principal

remain overdue for two harvest seasons but for a period not exceeding two half

years, and

v) Other accounts any amount to be received remains overdue for a period of more

than 90 days

Indian bank have, for a long time, treated all the sticky loan assets as Non-performing

Assets (NPAs). The accrual concept of accounting convention has also been followed

without reckoning the amount actually realized. The word “realized” is noteworthy, which is

distinct from the word “reliability”. It means that if a loan given by a bank fails to fetch a

return in the form of interest realized from the borrower, it (the

Bank) has no right debit the borrowal account with the interest chargeable following

the accrual principal. In that event, it then truly signifies that the asset is not performing i.e.,

not yielding any income to the bank. This is the essence of income recognition norms, based

on the recommendation of the Committee on Financial sector reforms (popularly known as

Narasimhan Committee), adopted by Indian banks.

An asset, which ceases to yield income for the bank, should be treated as NPA, and

any income from loan assets should not be booked as income until it is actually recovered.

So, banks, which charge interests to loan Accounts Park it in “Interest Not Collected

Account” (INCA) until recovery, and on recovery, reverse it from INCA and credit interest

account.

KLS’s Institute Of Management Education And Research, Belgaum 12

STATE BANK OF INDIA

NPA ratio: - The net non-performing assets to loan (advances) ratios are used as a

measure of the overall quality of the banks. Net NPAs are calculated by reducing cumulative

balance of provisions outstanding at a period end from gross NPAs. Higher ratio reflects

rising bad quality of loans.

NPA ratio = Net non-performing assets

-----------------------------------

Loans given

RBI GUIDELINES ON CLASSIFICATION OF BANK ASSETS

Reserve Bank of India (RBI) has issued guidelines on provisioning requirement with

respect to bank advances. In terms of these guidelines, bank advances are mainly. Classified

into: -

1. Standard Assets: Such an asset is not a non-performing asset. In other words, it carries

not more then normal risk attached to the business.

2. Sub-Standard Assets: It is classified as no-performing assets for a period not exceeding

18 months.

3. Doubtful Assets: Assets that has remained NPA for a period exceeding 18 months is a

doubtful asset.

4. Loss Assets: Here loss is identified by the bank concerned or by internal auditors or by

external auditor or by Reserve Bank India (RBI) inspection. In terms of RBI guidelines, as

and when an asset become a NPA, such advance would be first classified as a sub-standard

one for a period that should not exceed 18 months and subsequently as doubtful assets. It

should be not that the above classification is only for the purpose of computing the amount of

provision that should be made with respect to banks advance and certainly not for the

purpose of presentation of advance in the bank balance sheet.

KLS’s Institute Of Management Education And Research, Belgaum 13

STATE BANK OF INDIA

Types of Loans Provided by SBI

1) Cash Credits/ Overdraft:

When an account is not of order for any 2 quarters out of 4 quarters of the years ending 31 st

March, the account will be treated as an NPA. Out of Order:-

Out standings exceeding the limit/drawing power for any two quarters (continuous or

otherwise)

Out standings are well within the Limit/drawing power, BUT

a) No credit in the account for the last 6 months.

b) Credits in the accounts are not sufficient to meet interest debits for any 2

quarters.

2) Term Loans:

If interest/installments of principal remain unpaid for any 2 quarters of the year

ending 31st March the account will be NPA ‘Past Due’ – Grace period of 30 days is NOT to

be reckoned in your bank. Its means that quarter’s interest/Installments up to 31 st December

should be recovered before 31st March, as otherwise account will be treated as NPA.

3) Agricultural Term Loans/Cash Credits.

If interest/installments of principal (after it has become due) has not been paid during the

last two seasons of harvest (covering two half years), the account will be NPA.

‘Past Due’- Grace period of 30 days is not applicable in our bank to Agricultural Loans.

Date for reckoning interest/installment due is the date as stipulated in the sanction.

4) Advanced secured by Term Deposits, National Savings Certificates Indira Vikas

Patras Surrender Values of LIC Policies:

Advance accounts against this securities need not be treated as NPAs and no

provisions made need be made even though interest there on as not been paid for 2 quarters

or more on a balance sheet date. Interest on such accounts may be taken to income account

on due date provided adequate margins is available in the accounts (i.e. the out standings,

KLS’s Institute Of Management Education And Research, Belgaum 14

STATE BANK OF INDIA

after interest application, must be less than advance value of security).However, advance

against gold ornaments and government securities do not qualify for this relaxation.

5) Bills purchased and discounted

The bills purchased will become NPA if they remain overdue and unpaid for 2

quarters as on 31st march.

OVERDUE INTEREST

Overdue interest should not be charged and taken to income account in respect f

overdue bills unless it is realized.

6) Other Accounts:

The account becomes NPA if the account remains unpaid for any 2 quarters or more

as on 31st march.

7) Consortium advance

Each member bank will classify the account in accordance with the conduct in its

books

8) Government Guaranteed Advances:

Though, credit facilities backed by the government guarantee may became past due

with income not being booked, they need not be treated s NPAs. In some case it is observed

that banks have to file suits against the borrower after invoking the government guarantees

with a view to overcome the limitation period. In such circumstances, the branches may treat

the advances guaranteed by the government as NPAs only when the government concerned

when invoked.

KLS’s Institute Of Management Education And Research, Belgaum 15

STATE BANK OF INDIA

Procedures for Identification of NPA and Resolution

1) Internal checks and control: -

Since high level of NPAs dampens the performance of the bank identification of potential

problem accounts and there close monitoring assumes importance.

The EWS enable a bank to identify the borrower accounts, which show signs of credit

deterioration and initiate remedial action. Many banks have evolved and adopted an elaborate

EWS, which allows them to identify potential distress signals and plan their options before

hand, accordingly. The major components/process of an EWS followed by banks in India as

brought out by study conducted by Reserve Bank of India at the instance of the Board of

financial supervision are as follows.

i) Designing Relationship Manager/credit Officer for Monitoring account

ii) Preparation of ‘Know your Client’ profile

iii) Credit rating system

iv) Identification of watch-list/ special mention category accounts

v) Monitoring of early warning signals.

2) Management / resolution of NPAs: -

Reeducation in the total gross and net NPAs in the India financial system indicates a

significant improvement in management of NPAs. This is also on account of various

resolution mechanisms introduced in the recent past, which include the SARFESI act.

One-time settlement schemes, setting u of the CDR mechanism, strengthening of DRTs

3) Credit Information Bureau: -

State Bank of India, HDFC Limited M/s Dun incorporated credit Information Bureau

(India) Limited (CIBIL) in Jan 2001 and Bradstreet Information services (India) Pvt.

Information between banks and FIs for curbing the growth of NPAs. The CIBIL is in the

process of getting operationalised.

4) Willful Defaulters: -

KLS’s Institute Of Management Education And Research, Belgaum 16

STATE BANK OF INDIA

RBI has revised guidelines in respect of detection of willful default and diversion and

siphoning of funds. As per these guidelines a willful default occurs when a borrower

defaults in meeting its obligations to the leader when it has capacity to honor the

obligations or when funds have been utilized for the purposes other than those for which

finance was granted. RBI has advised the lenders to initiate legal measures including

criminal actions, wherever required, and undertake a proactive approach in change in

management, where appropriate.

5) Legal and Regulatory Regime: -

a) Debt Recovery Tribunals

b) Lokadalats

c) Enactments of SRFAESI Act

d) Assets reconstruction companies

e) Institution of CDR Mechanism

f) Compromise settlement schemes

Underlying Reasons for NPAs

An internal study conducted by RBI shows that in order of prominence, the following

factor contribute to NPAs,

Internal Factors:-

1) Diversion of funds for expansion/diversification/modernization taking up new

projects, helping/promoting associate concerns.

2) Time/cost overrun during the project implementation stage.

3) Business (product, marketing, etc) failure

4) Inefficiency in management.

5) Slackness in credit management and monitoring.

6) Inappropriate technology/ technical problems.

7) Lack of co-ordination among leaders.

KLS’s Institute Of Management Education And Research, Belgaum 17

STATE BANK OF INDIA

External Factor: -

1) Recession

2) Input / power shortage

3) Prince escalation

4) Exchange rate fluctuation

5) Accidents and natural calamities, etc

6) Changes in government polices in excise/import duties, pollution control

orders.

The above mentioned cause were reaffirmed, some other were also mentioned.

A brief discussion is provided below.

a) Liberalization of economy/removal of restrictions/reduction of tariffs:

A large number of NPA borrowers were unable to compete in a competitive market in

which lower prices and greater choice were available to consumers. Further borrower

operating in specific industries has suffered due to political, fiscal and social

compulsions, compounding pressures from liberalization.

b) Lax monitoring of credit and failure to recognize early warning signal:

It has been stated the approval of loan proposals is generally thorough many levels

before approval is granted. However, the monitoring of some time complex credit

files has not received the attention it needed, which meant that early warning signals

were not recognized and standard assets slipped to NPA category without banks being

able to take proactive measure to prevent this. Partly due to this reason, adverse

trends in borrowers performance were not noted and the position further deteriorated

before action was taken.

c) Over optimistic promoters: -

KLS’s Institute Of Management Education And Research, Belgaum 18

STATE BANK OF INDIA

Promoters were often optimistic in Setting up large projects and in some cases were

not fully above board in their intentions. Screening procedures did not always

highlight these issues. Often projects where set up with the expectation that part of

funding would be arrange from that capital Market, which were booming at the time

of project appraisal. When the capital market subsequently

crashed, the requisite funds could never be raised, promoters often lost interest and

lenders were left stranded with incomplete/unviable projects.

d) Directs Lending: -

Government’s police rather than commercial imperatives dictated loans to some

segments.

e) Highly leveraged borrowers: -

Some borrowers were under capitalized and over burdened with debt to absorb the

changing economic situation in the country. Operating within a protected market

resulted in low appreciation of commercial/market risk.

f) Funding mismatch: -

There are said to be many cases where loans granted for short term were used to fund

long term transaction.

g) High cost of funds: -

Interest rates as high as 20% were not uncommon. Coupled with high leveraging and

falling demand, borrowers could not continue to service high cost debt.

h) Willful Defaulters: -

There are a number of borrowers who have strategically defaulted on their debt

service obligations realizing that the legal recourse available to creditors is slow

in achieving results.

KLS’s Institute Of Management Education And Research, Belgaum 19

STATE BANK OF INDIA

An Analysis of Factor Contributing to NPA’s

An analysis of the contributory factor resulting in the emergence of NPAs on a

stupendous scale amongst Commercial Banks and Financial Institutions in the preceding

decade and particularly in the early Nineties would lead to the following conceptualization: -

PSBs performed creditably all through in respect of all parameters set for them. But in the

early Nineties the truth emerged that PSBs were suffering from acute capital inadequacy

and many of them were depicting negative profitability. This is because the parameters

set for they’re functioning were deficient and they did not project the paramount needs

for these corporate goals. Incorrect goals perception and identification led them to wrong

destination.

Pre-reform era witnessed PSBs functioning under the overall control and direction of the

Finance Ministry. Along with Reserve Bank of India (RBI) it decided/directed all aspects

of the working of the bank. Banks were not free to price their products in competition

with each other. They could not freely cater their funds in the best interest as they

considered. It was thus a directed banking and the role of bank management was

“executory”.

Since the 70s, the SCBs of India function totally as captive capsule units cut off from

international banking and unable to participate in the structural transformations, the

sweeping changes, and the new type of leading products training and knowledge

resources required to compete with international industry had resulted in the

accumulation of assets, which are termed as non-unprecedented level 8.

Major policy decision was take externally by the Finance Ministry/RBI. Though directors

were to be appointed based on their possession of specialized knowledge in banking and

related discipline, the environment of receiving decisions from a political background as

distinguished from a professional outfit, prevented the best talents coming to occupy the

KLS’s Institute Of Management Education And Research, Belgaum 20

STATE BANK OF INDIA

position as Directors of PSBs and taking part an active role in the deliberations of the

boards of these banks.

“Audit and Inspections” remained as functions under the control of the executive officers.

Which were not independent and were thus unable to correct the effects of serious flaws

in policies and directions of the higher us.

The quantum of credit extended by the PSBs increased by about 160times in the three

decades after nationalization (from around 3000 crore in 1970 to 475113 crore on

31.03.2000). The bank was not developed in terms of skills and expertise to regulate such

stupendous growth in the volume and manage the diverse risk that emerged in the

process. The need for organizing an effectives mechanism to gather and disseminate

credit information amongst the commercial banks was never felt or implemented. The

archaic laws of secrecy of customers-information that was binding banking India, disable

bank to publish names of defaulters for common knowledge of the other bank in the

system.

Effective recovery of defaulters and overdue of borrowers was “hampered”. But in India

Legal remedies were beset willful defaulters and the banks were left helpless. Effective

corporate management was a concept alien to the corporate houses then. In respect of

PSBs the board were ineffective and the only/main shareholder was the government of

India. Government exercised multiple role and concerns, and the instinct to act as a

watchful shareholder and increase the shareholders value of these corporate bodies

(banks & financial. Institution) was never felt/experienced by the government.

Credit management on the part of the leader to the borrower to secure their genuine and

bonfire interests was not based on pragmatically calculated anticipated cash flows of the

borrower concern, while recovery of installments of term Loan was not out of profit and

surplus generated but through recourses to the corpus of working capital of the borrower

concerns. This eventually led to the failure of the project financed leaving idle assets.

Functional inefficiency was also caused due to over-staffing, manual processing of over-

expanded operations and failure to computerize banks in India, when elsewhere

throughout the world the system was to switch over to computerization of operations.

KLS’s Institute Of Management Education And Research, Belgaum 21

STATE BANK OF INDIA

Action Plan For The Operating Functionaries: -

a) Analyze the NPAs and delineate them in sub-groups.

b) Do age-wise sub grouping

c) ABC analyses of advances.

d) Targets for recovery of various categories

e) Monthly reporting and monitoring in preview meetings.

PREVENTIVE MEASURES: -

a) Regular/timely contact with the borrowers should be maintained on one-to-one basic

in order that the loans/advances are monitored effectively.

b) The recovery work should be specifically entrusted to the identified loan officers/

clerks who will have regular contacts with the borrowers particularly at the time,

which is more suitable for recovery, like pre and post-harvest period in case of

agricultural advance.

c) The high value advance should be specifically monitored and in case of advance,

which displays signals of slipping to sub-standard category, intensive follow-up is

necessary.

d) The repayment programmes should be fixed up realistically keeping in view the

probability of cash accruals taking place as per the projections.

e) In case where units are facing genuine difficulty in adhering to the repayment

schedule fixed while sanctioning the loan, the loan can be rescheduled so that the

advance does not turn out of order or past due.

KLS’s Institute Of Management Education And Research, Belgaum 22

STATE BANK OF INDIA

f) Borrower should be counseled to route the sales proceeds through the account, which

will ensure that the account does not turn out of order merely on account of interest

application.

g) A written communication be sent to all borrowers advising them about the need to

ensure that there advance remain standard assets to enable the bank to consider

favorably their future request for financial assistance, if needs.

h) Pre-disbursement and post disbursement inspection, beside the periodical inspections

are very important to ensure proper utilization of bank funds as also the assets

acquired the from.

i) A system for settlement of goals for recovery of periodical loan installments and

quarterly interest and monitoring performance there against should be set up.

j) Timely renewal/review of advance will be very effective in monitoring the position of

advance and taking safeguarding steps before an advance turns sub-standard.

k) The unit displaying disquieting features may be studies by experts/consultants for

suggesting steps to prevent deterioration of their condition and to revitalize their

operations.

Conclusion: -

The situation calls for an urgent action by all concerned for improvement. Based on

our experience we consider that the branches will have to constantly work to prevent

the NPA virus from contaminating the new credit portfolio. Also concurrently they

will have to reinforce effective strategies to remove the virus from the existing NPA

portfolio. The task although difficult is achievable. Monitoring and follow-up are the

key watchwords in the task of managing and reducing NPAs.

KLS’s Institute Of Management Education And Research, Belgaum 23

STATE BANK OF INDIA

REMEDIAL MEASURES:

1. Regular meetings with the borrowers and interaction with them on their business

prospects and their position of their accounts should take place.

2. Periodical meetings with group of borrowers particularly those financed under

government-sponsored schemes and in rural areas should be held in which the need

for prompt payments of dues should be explained. It needs to be made clear to these

borrowers that there will not be any further debt relief scheme in future and that they

will benefit in the long run by paying the banks dues.

3. Recovery camps/recovery workshops can be organized in co-ordination with the

government authorities in rural areas or in respect of SBI advance under

government sponsored schemes.

4. In case of suck units, viability studies need to be conducted promptly and quick

dispensation of rehabilitation packages is essential so that the advance to them can

be upgraded.

5. Close monitoring of sick units, which are under nursing is important to ensure that

they abide by the stipulation made under the nursing program and thereby there

borrowal account are upgraded.

6. Target for recovery should be fixed for individual functionaries and their performance

should be closely is closely monitored.

7. Periodical inspection of the units financed and follow-up for recovery of the overdue

amount should be closely monitored.

8. Village level workers be instructed to maintain register for details of various

borrowers under the government sponsored schemes to ensure regular fallow-up.

9. For smaller advance, Lok Adalat is an effective avenue for on the spot settlement of

bank loan case and this mechanism should be used effectively.

10. As regards cases involving debt for over Rs.10 lakhs, the forum of Debt Recovery

Tribunal should be effectively used.

11. Periodical meetings should be held with the lawyers handling Bank’s cases to discuss

various issue connected with the ending loans case with a view to reducing the delays

in settlement of the cases.

KLS’s Institute Of Management Education And Research, Belgaum 24

STATE BANK OF INDIA

12. Settling the cases out of court and entering into compromises, wherever considered

appropriate, may rove to be quicker and more e effective than legal action.

However, any tendency to get undue advantage from the bank should be guarded

against.

13. Realization of securities in cases of advances under litigation needs greater attention.

It should be our endeavor to obtain permission of the court for attachments and

disposal of securities charged to the bank before judgment. Where such permission is

granted or where suit is decreed in bank’s favors, the securities covered by the suit

should promptly realize.

14. The portfolio of the loss assets has to be critically examined to weed out all such

assets where there is no hope of any recovery. In such cases, the ultimate step of

writing off the advance needs to be taken and any delay in the matter is of no benefit.

15. The services of Non-Government Organizations (NGOs) may also be utilized in area

where these are active, for counseling the small borrowers. These borrowers may be

organized in-group and financed, if considered appropriate and prudent, through the

NGOs concerned.

TACKLING NPA’s

The major tools for tackling assets, which have already turned into non-performing assets,

are the following: -

1. Recovery through legal action including the forum of debt recovery

tribunals and lok adalats.

2. Utilizing the machinery of state government for recovery of rural death.

3. Entering into comprises through negotiations.

4. Rehabilitation packages for potentially viable sick units.

5. Rescheduling/ rephrasing of dues in case of irregular advances of viable

units.

6. Recovery of over due amount through persistent follow up and by

counseling / educating the borrowers.

KLS’s Institute Of Management Education And Research, Belgaum 25

STATE BANK OF INDIA

FOCUSED STRATERGIES

1. Constant follow up and periodically dialogue with the borrower to know the prospects

of his business and difficulties, if any, faced. Case to case review of NPAs and

replacement of loan to suit the revised income generation pattern so that he is able to

repay dues of the bank has per his cash generation capacity.

2. Branch recovery team consisting of 2/3 resourceful staff members/ Officials, should

be formed (if not so) at each critical branch. The team member should be exhorted to

set up recovery endeavors and produce quick tangible results

3. Establishment of “district Recovery Team” at each District Headquarter with the help

of District headquarter with the help of district co-ordinate’s / lead bank

officers/Nodal officers of the concerned district to liaise with the local Government

functionaries/Lok Adalats/certificate Officers, etc. this team may co-ordinate the

activities of the “Branch Recovery Team” within the district.

4. “Lawyer Meet” may be organized at all district headquarters by the concerned Asst.

general Manager and AGM (Law) where other officials from local head office may

also participate. Suit field case of high value loan amount should be reviewed

individually to expedite the recovery process. Involvement of law officers in follow

up recovery efforts through debt recovery tribunals is necessary.

5. To ensure that “Target of Recovery” has been allotted to all the critical branches for

reducing NPAs/INC/AUC by their respective controlling authorities and the

controllers concerned monitor their performance. The Dy. General manager should

oversee the position on monthly basis.

6. One time settlement (OTS) has been found to be another method whereby the bank

would finally recover its due depending upon the repayment capacity of the borrower

from all sources.

7. To consider, in consultation with controllers, on selective basis in decreed cases, the

need for biding in bank’s name for sale of mortgaged properties (secured for our

loans) in auction with the permission of court for expediting the recovery process.

KLS’s Institute Of Management Education And Research, Belgaum 26

STATE BANK OF INDIA

PART-C

KLS’s Institute Of Management Education And Research, Belgaum 27

STATE BANK OF INDIA

ASSET CLASSIFICATION AS TOOL KIT TO BRING DOWN THE

BRANCH NPAs TO THE BEAREST MINIMUM.

Credit Appraisal and Advance Monitoring: -

i) End use of funds should be monitored by effectively following up QIS statements,

analyzing them.

ii) Verify the financials submitted by the borrower and compare with that of

assumption made at the time of previous sanction.

iii) Pre-sanction visit to the sites of collateral security should invariable be done by

the appraising officers before accepting them as collateral. The field staff branch

manager, division managers, should inspect this at yearly or half yearly intervals.

iv) Borrowers are willing to furnish any detail on their assets and liabilities and

execute any document before disbursement of loan. Obtain all relevant details and

documents prior to disbursing the loan/advance.

v) Book fresh quality advances and market for such advance. At present we are

financing to those who have approached us. Approach good borrower and bring to

our books. Marketing is the need of hour.

vi) Follow-up all account with one quarter interest dues and ensure that borrower

meets interest commitments.

vii) Cost escalation or delay in project implementation should be taken care of while

sanctioning loan itself. If there are any significant developments during

implementation that has affected the project please review sanction well before

the commencement of production and installment falls due.

viii) Strengthen pre-sanction and post-sanction inspection at all levels.

ix) Seasonal activities-monitor the recovery in the account and ensure recovery effort

coincides with the time of revenue inflow.

x) Be aware of the danger signals received from the borrowers about the problem

loans. Preventive and curative action should be taken immediately.

xi) Do not be just satisfied and let lose the good borrowers. Complacency towards

existing good borrowers may lead to account turning NPAs later.

KLS’s Institute Of Management Education And Research, Belgaum 28

STATE BANK OF INDIA

SUBSTANDARD ASSETS:-

i) A Sizable portion of NPA is in substandard category. It should be possible to

upgrade account in this segment.

ii) Ensure that substandard account does not slip down to doubtful and loss category.

iii) Efforts should be made to upgrade the account to standard categories NPAs affect

our balance sheet four ways:

1) We cannot book income

2) Capital adequacy ratio gets affected

3) NPAs require provisioning from post tax profits.

4) Affects image in international level.

iv) Once the amount becomes NPA verify weather documentation is in order. If not

rectify it first.

v) Rectify all irregularities in documentation as pointed out by branch Inspectors.

vi) Regular counsel and educate defaulting borrower. Maintain regular contact with the

borrowers and monitor the asset. Keep the branch manager informed of the

developments at regular intervals.

vii) Do not permit excess drawing unless otherwise necessary for three unit to run. If

the situations warrants, renew/review the account record excess drawings, if any,

permitted in the account and insists for letters and document it.

viii) In case of sick units if satisfied about the problems of sickness strengthen the assets

with collaterals. This will help in making small provision against such advances.

Chalk out a rehabilitation programme in consultation with the controllers immediately

failing which we may not have any assets to fall back upon later. A quick action is

needed. If give a chance, grab the earliest to palm off the account from our books to

any other financial agency.

KLS’s Institute Of Management Education And Research, Belgaum 29

STATE BANK OF INDIA

DOUBTFUL ASSETS

i) Experience in the previous years indicate that there has been steady slippage in the

quality of assets in the NPA categories from sub standard to doubtful assets and then

to loss assets. One reason could be that appropriate action as mentioned above is not

taken in case of sub standard assets. Secondly suit field accounts in various civil

courts\ debts recovery tribunal is not followed up in the manner required ad or are

getting very little attention. These accounts particularly suit field /decreed account

required constant review at the operating level so that appropriate steps like enforcing

decree, facilitating compromises or write off if need be initiated instead of holding

such un-remunerative accounts on long term basis in your books as NPAs.

ii) Issues raised by advocates should be tackled to get the suits disposed of and executive

the decreased so obtained to reduced the NPAs.

iii) Where branches have got backlog in settlement to DICGC claims such claims should

followed up rigorously. For this purpose dealing official at the branch should explore

the possibilities of getting the claim settled at an earliest in consideration with the

DICGC Chennai / Mumbai.

iv) Compromise as a strategy for reducing NPAs is receiving attention of branch

functionaries. Encourage compromise proposal selectively without giving wrong

signals to the other good borrowers. Branches should view such compromise

proposals based on the net present value, nature and value of value of assets presently

available to us.

KLS’s Institute Of Management Education And Research, Belgaum 30

STATE BANK OF INDIA

LOSS ASSETS

i) Write off Doubtful and loss assets was initiated by branches from the first quarter of

the year itself.

ii) High value doubtful and loss assets where DICGC has settled the claims and / or

rejected the such case should be first dealt with write-off proposals with additional

information should be submitted immediately where ever assets are not available.

iii) Identify all loss assets where full provision is available to write off. Where ever suits

are pending and prospect of recovery exists such account can be parked in advance

under collections accounts.

iv) Recommendation to write up file value loss asset should be sent on priority basis.

v) Write off out standings where provision is short up to Rs 25000 may be sent

immediately without further loss of time

vi) Where ever compromises are / where entertained earlier and write-off the balance

still exist arrange to sent such write-off proposals and ensure that the account does not

appear in balance sheet of the bank.

KLS’s Institute Of Management Education And Research, Belgaum 31

STATE BANK OF INDIA

INTEREST NOT COLLECTED ACCOUNT :-

i) Few branch operating functionaries are still not aware of the IRAC norms. Even

though account is classified as NPA interest is being applied blindly with out

thinking of consequence of such application of interest. It inflates the INCA

figures.

ii) Serious efforts in upgrading the assets from NPA category will results in

reduction of INCA. Pressurize induce the borrowers to bring down their

outstanding levels compared to the previous year. This will enable the bank to

book income on partial recovery basis.

iii) Where fundamentals of the industry/unit/borrowers are sound rehabilitation of the

unit may be taken up on priority.

KLS’s Institute Of Management Education And Research, Belgaum 32

STATE BANK OF INDIA

ADVANCE UNDER COLLECTION ACCOUNT

i) The number of advance under collection account and out standings there in is the rise.

ii) Due to the policy decision taken to write-off loss assets irrespective of suit position

may add a few more account to advance under collection account.

iii) There will be very marginal recovery during the years.

iv) Review all accounts parked in advance under collection account on priority basis and

efforts should be made to recover full dues and remove such accounts from advance

under collection account.

v) Encourage compromise proposals.

vi) Regular view of the recovery prospects and removal of such accounts from advance

under collection account does not appear to be receiving level of attention.

vii) This area needs a special attention of the operating staff.

KLS’s Institute Of Management Education And Research, Belgaum 33

STATE BANK OF INDIA

Provisioning Norms of SBI:

In conformity with the prudential norms, provisions should be made on the NPA on

the basis of classification of assets into prescribed categories as mentioned above .Taking

into account the time lag between doubtful of recovery, it’s recognition as such, the

realization of security and the erosion over time in the value of securities charged to the

bank, the provisions against sub-standard assets, doubtful assets and loss assets are provided

as below:

Particulars Secured Unsecured

Sub-standard(secured)(21) 10%

Sub-standard (unsecured)(22) 20%

Doubtful

Up to 1 year (D-I) (31) 20% 100%

Up to 1 to 3 year(D-II) (32) 30% 100%

More than 3 year(D-III) (33) 100% 100%

Loss assets(4) 100% 100%

RISK MANAGEMENT IN SBI

KLS’s Institute Of Management Education And Research, Belgaum 34

STATE BANK OF INDIA

L.1 Risk Management Structure

• An independent Risk Governance structure is in place for Integrated Risk Management

covering Credit, Market, Operational and Group Risks. This framework visualizes

empowerment of Business Units at the operating level, with technology being the key driver,

enabling identification and management of risk at the place of origination.

• Being alive to this imperative, efforts are on hand to enhance the degree of awareness at the

operating level in alignment with better risk management practices, Basel II requirements

and the overarching aim of the conservation and optimum use of capital.

• Keeping in view the changes which the Bank’s portfolios may undergo in stressed

situations, the Bank has in place a policy which provides a framework for conducting Stress

Tests at periodic intervals and initiating remedial measures wherever warranted. The scope of

the tests is constantly reviewed to include more stringent scenarios.

• Risk Management is perceived as an enabler for business growth and in strategic business

planning, by aligning business strategy to the underlying risks. This is achieved by constantly

reassessing the interdependencies / interfaces amongst each silo of Risk and business

functions.

ENFORCEMENT OF SECURITY INTEREST ACT 2002

KLS’s Institute Of Management Education And Research, Belgaum 35

STATE BANK OF INDIA

(SARFESI). SARFESI – the Security Interest Legislation

SARESI provides for the enforcement of security interests in movable (tangible or

intervention of court, by way of a simplistic, expeditious and a cost effective process.

Where any borrower makes any default in repayment of secured debt or nay

installment there of, and his account in respect of such debt has been classified by the

secured creditor as non-performing asset, then, the secured creditor may call upon the

borrower by way of a written legal; notice to discharge in full, his liabilities within sixty days

from the date of the notice failing which the secured creditor would be entitled to exercise all

or any of the rights set out under SARFESI. The notice must contain details of debt and

secured assets.

Any bank or public financial institution or any other institution or non-banking

financial company as specified by central government or international finance corporation or

a consortium there of, and his account in resects of such debt has been classified by the

secured creditor as non-performing assets, then the secured creditor may call upon the

borrow by the way of a written legal notice to discharge in full, his liabilities within 60 days

from the date of the notice failing which the secured creditor would be entitled to exercise all

or any of the rights set out under SARFSI.

The provision of SARFESI relating to security of interest can be invoked by any bank

or public financial institution under section 4A of the Companies Act, 1956 or any institution

specified by central government under sub clause (ii) of clause (h) of section 2 of recovery of

debt due to banks and financial institutions Act, 1993 or any other institution or non banking

financial company as specified by central government or international finance corporation or

a consortium thereof.

KLS’s Institute Of Management Education And Research, Belgaum 36

STATE BANK OF INDIA

ANALYSIS

KLS’s Institute Of Management Education And Research, Belgaum 37

STATE BANK OF INDIA

SUMMARY OF NPA A/C ON 31-3-2009

Assets No. Total Net o/s Value OF Balance o/s Gross Net Net

of O/s Balance of

Category Provision Provision NPA

Balance

a/c’s security Secured Unsecured

Sub-Std. 15 17950 17950 26389 17900 50 1795 1795 16155

secured

Assets

Sub-Std. 11 445 445 Nil Nil 445 89 89 356

Unsecured

Assets

Doubtful I 4 478 478 818 478 Nil 96 96 382

Doubtful 9 3500 3500 3848 3848 Nil 1050 1050 2450

II

Doubtful 5 1517 1517 2190 1517 Nil 1517 1517 Nil

III

Loss 16 1488 1488 Nil Nil 1488 1488 1488 Nil

Assets

NPA A/c 60 25378 25378 23743 1983 6035 6035 19343

33245

TOTAL

SUMMARY OF NPA A/C ON 31-3-2008

KLS’s Institute Of Management Education And Research, Belgaum 38

STATE BANK OF INDIA

Assets No. Total O/s Net o/s Value OF Balance o/s Gross Net Net

Category of Balance Balance of Provisions

Secured Unsecured Provisions NPA

a/c’s security

Sub-Std. 25 20614 20614 30549 20608 6 2061 2061

18552

Secured

Assets

Sub-Std. 5 245 245 Nil Nil 245 49 49

196

Unsecured

Assets

Doubtful I 9 965 965 1159 965 Nil 193 193 772

Doubtful II 10 4283 4283 4526 4283 Nil 1285 1285 2998

Doubtful III 0 0 0 0 0 0 0 0 0

Loss Assets 18 1274 1274 Nil Nil 1274 1274 1274 Nil

NPA A/c 63 27381 27381 36234 25856 1525 4862 4862 22518

TOTAL

SUMMARY OF NPA A/C ON 31-3-2007

KLS’s Institute Of Management Education And Research, Belgaum 39

STATE BANK OF INDIA

Assets No. Total Net o/s Value Of Balance o/s Gross Net Net

of O/s Balance of

Category Secured Unsecured Provision Provision NPA

a/cs Balance security

17281

Sub-Std. 26 19201 19201 28845 19201 0 1920 1920

Secured

Assets

Sub-Std. 11 1441 1441 Nil 39 1402 288 288 1153

Unsecured

Assets

Doubtful I 17 3170 3170 3845 3170 Nil 951 951 2219

Doubtful 18 7600 7600 9068 7590 10 2288 2288 5312

II

Doubtful 0 0 0 0 0 0 0 0 0

III

Loss 5 403 403 Nil Nil 403 403 403 Nil

Assets

NPA A/c 78 31815 31815 41758 30000 1815 5850 5850 25965

TOTAL

Net NPA as % of Net Advances

Net NPA Ratio = Gross NPA – Provision * 100

Total Advances – Provision

Years Net NPA Net Advances %

2007 25965000 7,13,29,440 36.41%

KLS’s Institute Of Management Education And Research, Belgaum 40

STATE BANK OF INDIA

2008 22518000 10,50,92,553 21.43%

2009 19343000 10,44,28,599 18.52%

N e t NP A a s % o f N e t A d v a n c e s

3 6 .4 1 %

4 0 .0 0 %

3 0 .0 0 % 2 1 .4 3 % 1 8 .5 2 %

Ratios

2 0 .0 0 % Ra tio

1 0 .0 0 %

0 .0 0 %

2007 2008 2009

Ye ar

Interpretation:

From the above chart we come to know that even though the NPA ratio is in decreasing trend

but it is not according to the standard NPA norms (i.e.10%). When we compared 3 years data

i.e. 2007, 2008, & 2009 it has been decreased by 36.41% to 18.52%.

Net NPA as % of Net Assets

Years Net NPA Net Assets %

2006 25965000 150301444 17.27%

2007 22518000 150203062 14.99%

KLS’s Institute Of Management Education And Research, Belgaum 41

STATE BANK OF INDIA

2008 19343000 156292234 12.37%

Net NPA as % of Net Assets

20.00% 17.27%

14.99%

15.00% 12.37%

Ratios

10.00% Ratio

5.00%

0.00%

2007 2008 2009

Year

Interpretation:

By seeing the above chart we can conclude that the % of NPA to the Net Assets is

decreased in 2009 as compared to 2007 & 2008. Which shows Branch is getting more return

on their assets.

Gross NPA as % of Total Advances

Gross NPA Ratio = Gross NPA * 100

Total Advances

Years Gross NPA Gross %

Advances

2007 3,18,15,000 7,13,36,325.60 44.60

KLS’s Institute Of Management Education And Research, Belgaum 42

STATE BANK OF INDIA

2008 2,73,81,000 11,42,99,553.64 23.95

2009 2,53,78,000 11,32,34,599.25 22.41

Gross NPA as % of Total Advances

50 44.6

40

30 23.95

Ratio

22.41

Ratio

20

10

0

2007 2008 2009

Year

Interpretation:

In the above chart the gross NPA is decreasing, it shows, the branch is providing

better quality of loans.

KLS’s Institute Of Management Education And Research, Belgaum 43

STATE BANK OF INDIA

Gross NPA as % of Total Assets

Years Gross NPA Total Assets %

2007 3,18,15,000 150301444 21.17%

2008 2,73,81,000 150202062 18.23%

2009 2,53,78,000 156292234 16.24%

Gross NPA as % of Total Assets

25.00%

21.17%

20.00% 18.23%

16.24%

15.00%

Ratio

Ratio

10.00%

5.00%

0.00%

1 2 3

Year

Interpretation:

By seeing the above chart we can conclude that the % of NPA to the Total Assets is

decreased in 2009 as compared to 2007 & 2008. Which shows Branch is getting more return

on their assets.

KLS’s Institute Of Management Education And Research, Belgaum 44

STATE BANK OF INDIA

Sub-Standard Assets Ratio (Secured)

Rs. in ‘000’s\

Years Sub-Standard Net NPA %

Secured

17281

2007 25,965 66.56%

18552

2008 22518 82.39%

2009 16155 19343 83.51%

Sub-Standard Assets Ratio (Secured)

100.00%

82.39% 83.51%

80.00% 66.56%

60.00%

Ratio

Ratio

40.00%

20.00%

0.00%

2007 2008 2009

Year

Interpretation:

From the above chart we can find that the contribution of sub- standard assets (Secured) to

Net NPA has been increased in 2009 as compare to 2007 & 2008. This may be because of the

recession.

KLS’s Institute Of Management Education And Research, Belgaum 45

STATE BANK OF INDIA

Sub-Standard Assets Ratio (Un-secured)

Rs. in ‘000’s

Years Sub-Standard Net NPA %

Un-secured

2007 1153 25,965 4.44%

2008 22518 0.87%

196

2009 356 19343 1.84%

Sub-Standard Assets Ratio(Un-secured)

5.00% 4.44%

4.00%

3.00%

Ratio

1.84% Ratio

2.00%

0.87%

1.00%

0.00%

2007 2008 2009

Year

Interpretation:

From the above chart we can find that the contribution of sub- standard assets (Unsecured) to

Net NPA is high in 2007 & 2009 it may be due to reckless advances and poor recovery

management. Here there is high scope for the advance up-gradation or improvement because

it will be very easy to recover the loan as minimum duration of default.

KLS’s Institute Of Management Education And Research, Belgaum 46

STATE BANK OF INDIA

Doubtful Assets Ratio

Rs. in ‘000’s

Years Doubtful Net NPA %

Assets

2007 7531 25,965 29.00%

2008 3770 22518 16.74%

2009 2832 19343 14.64%

Doubtful Assets Ratio

35.00%

29.00%

30.00%

25.00%

20.00% 16.74%

Ratio

14.64% Ratio

15.00%

10.00%

5.00%

0.00%

2007 2008 2009

Year

Interpretation:

In the above chart there has been reduction in doubtful assets in 2009 it is because of increase

in Sub-standard Asset Ratio. But also the contribution of Doubtful Assets to NPA is low,

because of compromising measures from the Branch.

KLS’s Institute Of Management Education And Research, Belgaum 47

STATE BANK OF INDIA

NPA Amount under different categories Rs. in ‘000’s

Year 2007 2008 2009

Sub-Standard assets 20642 20859 18395

Doubtful Assets 10770 5248 5495

Loss Assets 403 1274 1488

Total 31815 27381 25378

Interpretation:

The above chart depicts the following: -

When we compare 3 years data we can interpreted that, the Sub-Standard Assets are

contributing more to the Total NPA.

NPA Accounts in different years

KLS’s Institute Of Management Education And Research, Belgaum 48

STATE BANK OF INDIA

Year 2007 2008 2009

Sub-Standard assets 37 30 26

Doubtful Assets 35 19 18

Loss Assets 5 18 16

Interpretation:

In the above chart we can see that the numbers of Accounts in the Sub-standard Asset

category are more in all 3 years as compare to other category of assets.

KLS’s Institute Of Management Education And Research, Belgaum 49

STATE BANK OF INDIA

FINDINGS

1. The net NPA ratio is decreasing continuously over the three years, but it is not in the

standard norm. It shows the poor NPA management.

2. The reason for reduction in Net NPA ratio is due to recovery in NPA accounts and the

provisions made by the Branch.

3. The branch’s gross NPA ratio is decreasing it shows, the branch is providing better

quality of loans.

4. The contribution of sub- standard assets (Secured) to Net NPA has been increased in

2009 as compare to 2007 & 2008. This may be because of the recession.

5. The contribution of sub- standard assets (Unsecured) to Net NPA is high in 2007 &

2008 it may be due to reckless advances and poor recovery management

6. The contribution of Doubtful Assets to NPA is low, because of better compromising

measures from the Branch

7. The numbers of Accounts in the Sub-Standard Asset category are more in all 3 years as

compare to other category of assets.

8. The amount in loss asset category is low in all the 3 years as compared to other category

of assets.

KLS’s Institute Of Management Education And Research, Belgaum 50

STATE BANK OF INDIA

SUGGESTIONS

1. The Branch has to increase in the quality of assets which adds value to its profitability.

The quality of assets can be increased by scouting the best Borrowers and by increasing

the quality of advances. The percentage of NPAs to Net Advances can be brought down

by increasing the standard assets. .

2. Operating staffs’ credit skills should be upgraded.

3. The Credit section should carefully watch the warning signals viz. non-payment of

quarterly interest, dishonor of check etc.

4. Loans should not be given beyond the borrower’s repayment capacity.

5. Effective inspection system should be implemented.

6. The branch should take compromising measures for settlement of NPA accounts

7. The branch should try to reduce number of NPA accounts

8. Even though there is 100% provision for loss assets there should be proper control and

better recovery management in order to bring down the loss assets

KLS’s Institute Of Management Education And Research, Belgaum 51

STATE BANK OF INDIA

CONCLUSION

The provisions are to be made on the NPA accounts which will reduce the profits of the

Bank. The bank must adopt structured NPAs management policy for elimination or reducing

the NPAs in the Bank

KLS’s Institute Of Management Education And Research, Belgaum 52

STATE BANK OF INDIA

PART-D

KLS’s Institute Of Management Education And Research, Belgaum 53

STATE BANK OF INDIA

SWOT ANALYSIS

STRENGTHS: -

i) SBI has an experience of more that 204 years of service in the banking sector.

ii) It is working with the new project of CORE BANKING SOUTIONS (CBS).

iii) It is a public sector undertaking with the GOV and RBI share of 53%

iv) Wider network more than 10,000 with other associated banks.

v) Skilled staff is considered best in financial sector.

WEAKNESS:-

i) Delay in decision making and implementation approved decisions because of

large hierarchy.

ii) Delay in settlement of NPAs.

iii) Compromise settlements are time consuming process.

OPPORTUNITIES:-

1. SBI should advertise more about their products and services.

2. It has the more opportunity to have more customers in rural areas as of the

agriculturists.

3. By the introduction of CBS, SBI has the opportunity to compete with other foreign

banks.

THREATS:-

i) SBI has already been the largest bank in INDIA with the control of RBI but also it

should face competition from the private banks such as ICICI, HDFC, IDBI,

CENTURIAN, INDUSIND and many other banks because of opening up of

Indian economy of globalization and Liberalization.

KLS’s Institute Of Management Education And Research, Belgaum 54

STATE BANK OF INDIA

Conclusion form SWOT Analysis: -

By the vision of SWOT analysis we can come to the conclusion that SBI is strong in

financial sector with more experience in banking sector. Application of latest

technology is a key to success in the competitive global economy. Positively the new

era beckons the SBI as “Customer Delight” and builds up a new banking world in the

future days to come.

KLS’s Institute Of Management Education And Research, Belgaum 55

STATE BANK OF INDIA

BIBLIOGRAPHY

PRIMARY DATA Personal interview

SECONDARY DATA Banks manuals, Texts

WEB SITES www.sbi.com

KLS’s Institute Of Management Education And Research, Belgaum 56

You might also like

- Working Capital Management and FinanceFrom EverandWorking Capital Management and FinanceRating: 3.5 out of 5 stars3.5/5 (8)

- Blackbook ProjectDocument78 pagesBlackbook ProjectKriti Somani71% (28)

- An Assessment of The Emirates NBD BankDocument25 pagesAn Assessment of The Emirates NBD BankHND Assignment Help100% (1)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Customer Awareness at SBI Mutual Fund PROJECT REPORT MBA MARKETINGDocument63 pagesCustomer Awareness at SBI Mutual Fund PROJECT REPORT MBA MARKETINGBabasab Patil (Karrisatte)100% (3)

- A Summer Internship Project On A Study On Sale of Pos Machine of SbiDocument64 pagesA Summer Internship Project On A Study On Sale of Pos Machine of Sbiakshparmar25100% (1)

- Notice For DiscoveryDocument2 pagesNotice For Discoverybob doleNo ratings yet

- Profile of SBIDocument15 pagesProfile of SBIkarthikrishnaNo ratings yet

- S.No Particular NO: Customer Awareness About Sbi Mutual FundDocument63 pagesS.No Particular NO: Customer Awareness About Sbi Mutual FundRishabh MitraNo ratings yet

- Chapter 1 Profile of Sbi and Its Customer SatisfactionDocument13 pagesChapter 1 Profile of Sbi and Its Customer SatisfactionNirav PatelNo ratings yet

- G H Raisoni Institute of Engineering & Technology, NagpurDocument34 pagesG H Raisoni Institute of Engineering & Technology, NagpurPratik JainNo ratings yet

- Financial Analysis OF State Bank of IndiaDocument59 pagesFinancial Analysis OF State Bank of IndiaPratik KansaraNo ratings yet

- State Bank of IndiaDocument14 pagesState Bank of IndiaMahadevan KrishnamurthyNo ratings yet

- SBI SHRM Project - MihirDocument26 pagesSBI SHRM Project - MihirAmul KapoorNo ratings yet

- Mobile BankingDocument61 pagesMobile BankingtirupathiNo ratings yet

- To Study The Net Banking and Technology: A Project Report OnDocument59 pagesTo Study The Net Banking and Technology: A Project Report OnChhaya LimjeNo ratings yet

- PROJECT On Bank InternshipDocument26 pagesPROJECT On Bank Internshipshubham roteNo ratings yet

- A Study of Bank Audit ProcessDocument61 pagesA Study of Bank Audit ProcessSunil PawarNo ratings yet

- Project ReportDocument61 pagesProject ReportMayur MankarNo ratings yet

- Customer's Perception Towards The Loan Product of State Bank of IndiaDocument60 pagesCustomer's Perception Towards The Loan Product of State Bank of IndiaSubodh Sonawane33% (3)

- Project Report ON Management Functions in Sbi: Submitted To Submitted byDocument19 pagesProject Report ON Management Functions in Sbi: Submitted To Submitted bykeyursuhagiyaNo ratings yet

- Job Satisfaction at SBI Project Report Mba HRDocument78 pagesJob Satisfaction at SBI Project Report Mba HRBabasab Patil (Karrisatte)0% (1)

- Ms Archana. Wali MBA II Semester Exam No. MBA0702009Document78 pagesMs Archana. Wali MBA II Semester Exam No. MBA0702009vijayakooliNo ratings yet

- Seminar On Central Bank of IndiaDocument23 pagesSeminar On Central Bank of IndiaHarshkinder SainiNo ratings yet

- YesbbnkDocument50 pagesYesbbnklatest updateNo ratings yet

- NPA TariqDocument77 pagesNPA TariqkalpanaNo ratings yet

- Introduction To BanksDocument26 pagesIntroduction To BanksNirmal Mangalji SolankiNo ratings yet

- Bank of IndiaDocument22 pagesBank of IndiaLeeladhar Nagar100% (1)

- Loan and AdvancesDocument72 pagesLoan and AdvancesAbdulqayum SattigeriNo ratings yet

- Project SBIDocument66 pagesProject SBIsourabh tyagiNo ratings yet

- Executive Summary: NPA Management in State Bank of IndiaDocument62 pagesExecutive Summary: NPA Management in State Bank of IndiaFurkhan Ahmed SamNo ratings yet

- A Project Report On Non-Performing Assets of Bank of MaharashtraDocument80 pagesA Project Report On Non-Performing Assets of Bank of MaharashtraBabasab Patil (Karrisatte)No ratings yet

- A) Brief Relevance of The Topic and The Organization.: GrowthDocument38 pagesA) Brief Relevance of The Topic and The Organization.: GrowthShree CyberiaNo ratings yet

- State Bank of IndiaDocument14 pagesState Bank of IndiaParmeet Karan NagiNo ratings yet

- Financial Statement Analysis of Apex BankDocument61 pagesFinancial Statement Analysis of Apex BankMohd Shahid75% (4)

- Structure of IBS Proj. by Mayur BankarDocument40 pagesStructure of IBS Proj. by Mayur BankarmayurNo ratings yet

- SBI SoubikaDocument70 pagesSBI SoubikaSidharth Gupta0% (1)

- Atm MaintenanceDocument59 pagesAtm MaintenanceRanjeet RajputNo ratings yet

- Corporation Bank Report FinalDocument61 pagesCorporation Bank Report FinalJasmandeep brarNo ratings yet

- Manasi Banking Law AshishDocument22 pagesManasi Banking Law AshishAshish SinghNo ratings yet

- Functions of Reserve Bank of IndiaDocument5 pagesFunctions of Reserve Bank of IndiapraveenNo ratings yet

- Bank of India 9Document60 pagesBank of India 9Yashraj UchilNo ratings yet

- Summer Training Report FOR Union Bank of IndiaDocument29 pagesSummer Training Report FOR Union Bank of IndiaRavina MehtaNo ratings yet

- Industry Profile Banking Industry in India:: Study On Agricultural Credit Facility of Canara BankDocument66 pagesIndustry Profile Banking Industry in India:: Study On Agricultural Credit Facility of Canara BankGoutham BindigaNo ratings yet

- Finis HeDocument119 pagesFinis HeMohan JainNo ratings yet

- Introduction To Banking SectorDocument6 pagesIntroduction To Banking Sectorshweta khamarNo ratings yet

- Awareness Level of Personal Banking Products of SBI BankDocument88 pagesAwareness Level of Personal Banking Products of SBI BankshaliniNo ratings yet

- "Credit Risk Management in State Bank of India": Title of The ProjectDocument43 pages"Credit Risk Management in State Bank of India": Title of The Projectswarali deshmukhNo ratings yet

- 7 P S of Marketing Mix PDFDocument78 pages7 P S of Marketing Mix PDFanil gondNo ratings yet

- Internship Report On NBP, Civil Line Branch, Sargodha, (2010)Document69 pagesInternship Report On NBP, Civil Line Branch, Sargodha, (2010)Malik AyaanNo ratings yet

- Final Central Bak of IndiaDocument40 pagesFinal Central Bak of IndiaNitinAgnihotriNo ratings yet

- A Research Report ON Service Quality AND Customer Satisfaction of Kotak Mahindra BankDocument88 pagesA Research Report ON Service Quality AND Customer Satisfaction of Kotak Mahindra BankchaudharinitinNo ratings yet

- 7 Sbi, ProjectDocument54 pages7 Sbi, ProjecturjanagarNo ratings yet

- Study On Loans and AdvancesDocument58 pagesStudy On Loans and AdvancesUday Gowda100% (1)

- Ittrat JehanDocument69 pagesIttrat JehanRana Muhammad YaseenNo ratings yet

- Mobile Banking Full Project OrgDocument35 pagesMobile Banking Full Project Orggouravwadhwa0001100% (3)

- Deepak 1Document65 pagesDeepak 1PRO FilmmakerNo ratings yet

- SBI Non Performing AssetsDocument43 pagesSBI Non Performing AssetsVikram RokadeNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Weathering the Global Crisis: Can the Traits of Islamic Banking System Make a Difference?From EverandWeathering the Global Crisis: Can the Traits of Islamic Banking System Make a Difference?No ratings yet

- Corporate Governance, Firm Profitability, and Share Valuation in the PhilippinesFrom EverandCorporate Governance, Firm Profitability, and Share Valuation in the PhilippinesNo ratings yet

- Ecommerce Report 2Document14 pagesEcommerce Report 2Riya SthaNo ratings yet

- Leap of Faith: Using The Internet Despite The DangersDocument42 pagesLeap of Faith: Using The Internet Despite The DangersDr-Mirza Abdur RazzaqNo ratings yet

- ch18 PDFDocument34 pagesch18 PDFLê Chấn PhongNo ratings yet

- Table of Content: Chapter Number 1Document46 pagesTable of Content: Chapter Number 1Hssan Ali0% (1)

- Parkin Public Announcement of Offering - EnglishDocument1 pageParkin Public Announcement of Offering - Englishbasitrasheed18No ratings yet

- Busnetticket 20220313145552Document1 pageBusnetticket 20220313145552Hasbi AshShidiqNo ratings yet

- Fu RVFi 7 Sob C3 Ty X0Document8 pagesFu RVFi 7 Sob C3 Ty X0Hari Om MishraNo ratings yet

- Dell Quotation INDDocument5 pagesDell Quotation INDManisha AgrawalNo ratings yet

- Contoh Bill 3Document12 pagesContoh Bill 3ustat888100% (1)

- Using Broadband To Enhance Financial Inclusion PP 7-8 and 18-36Document62 pagesUsing Broadband To Enhance Financial Inclusion PP 7-8 and 18-36Davy OUATTARANo ratings yet

- ASHNR 2008: American Society of Head and Neck RadiologyDocument8 pagesASHNR 2008: American Society of Head and Neck RadiologyradRounds Radiology NetworkNo ratings yet

- CAT Universal HODocument4 pagesCAT Universal HOMarienella PaduaNo ratings yet

- Advanced Preventive and Predictive Maintenance PH GO PDFDocument10 pagesAdvanced Preventive and Predictive Maintenance PH GO PDFangelNo ratings yet

- Karate1boletin 2023 Karate 1 Premier League Fukuoka 001Document31 pagesKarate1boletin 2023 Karate 1 Premier League Fukuoka 001ACHMAD IRVANNo ratings yet

- PDFDocument 1Document2 pagesPDFDocument 1supermacaNo ratings yet

- Payment Processing KPI Library - BlueSnap PDFDocument14 pagesPayment Processing KPI Library - BlueSnap PDFplastikliebeNo ratings yet

- ? Thanks! Your Booking Is Confirmed at Flora Inn Hotel Dubai AirportDocument6 pages? Thanks! Your Booking Is Confirmed at Flora Inn Hotel Dubai AirportMuzhgan NaseeriNo ratings yet

- E-Commerce Law in The Philippines - Sales PaperDocument17 pagesE-Commerce Law in The Philippines - Sales PaperNaomi Corpuz75% (4)

- WHMCS Gateway Module DocsDocument11 pagesWHMCS Gateway Module DocstimwangyanNo ratings yet

- 02-Client Agreement Contract - 112021Document4 pages02-Client Agreement Contract - 112021FandENo ratings yet

- Mortgage DeclarationDocument3 pagesMortgage DeclarationMark JacksonNo ratings yet

- Upstart's UpshotDocument16 pagesUpstart's UpshotAbhay Italiya100% (1)

- Day 1 T1 Content V3 September 2022Document41 pagesDay 1 T1 Content V3 September 2022vishal ranaNo ratings yet