Professional Documents

Culture Documents

Putnam Beat Inflation

Putnam Beat Inflation

Uploaded by

Putnam InvestmentsCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Independent Equity Research: How We Do It, and Why It Matters To InvestorsDocument12 pagesIndependent Equity Research: How We Do It, and Why It Matters To InvestorsPutnam InvestmentsNo ratings yet

- EU: Articles of Stationery - Market Report. Analysis and Forecast To 2020Document9 pagesEU: Articles of Stationery - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- Aug Pay SlipDocument1 pageAug Pay SlipDAYA SHANKARNo ratings yet

- Putnam White Paper: The Outlook For U.S. and European BanksDocument12 pagesPutnam White Paper: The Outlook For U.S. and European BanksPutnam InvestmentsNo ratings yet

- Affluent Investors Use of Social MediaDocument2 pagesAffluent Investors Use of Social MediaPutnam InvestmentsNo ratings yet

- Optimizing Your LinkedIn ProfileDocument2 pagesOptimizing Your LinkedIn ProfilePutnam Investments60% (5)

- Financial Advisors' Use of Social MediaDocument2 pagesFinancial Advisors' Use of Social MediaPutnam InvestmentsNo ratings yet

- Muni Rally May Continue, But Must Navigate Policy RisksDocument3 pagesMuni Rally May Continue, But Must Navigate Policy RisksPutnam InvestmentsNo ratings yet

- Putnam Research Fund Q&A Q3 2012Document4 pagesPutnam Research Fund Q&A Q3 2012Putnam InvestmentsNo ratings yet

- Putnam Gifting Opportunities in 2012Document4 pagesPutnam Gifting Opportunities in 2012Putnam InvestmentsNo ratings yet

- Asset ProtectionDocument4 pagesAsset ProtectionPutnam InvestmentsNo ratings yet

- Knowing The Contribution of Agriculture To The Nigerian GDPDocument52 pagesKnowing The Contribution of Agriculture To The Nigerian GDPmarkchima8No ratings yet

- 14Nov21-Brochure - Telemedicon-202Document2 pages14Nov21-Brochure - Telemedicon-202TULSI CHARAN DASNo ratings yet

- Final PPT of HUL Vs ITCDocument19 pagesFinal PPT of HUL Vs ITCJiten ShahNo ratings yet

- 1062 Shree Baba Ramdev TextilesDocument10 pages1062 Shree Baba Ramdev TextilesZain ShaikhNo ratings yet

- Havells Doubles Its Cable and Wire Manufacturing CapacityDocument3 pagesHavells Doubles Its Cable and Wire Manufacturing CapacityKaran SharmaNo ratings yet

- Prato Wool Textile IndustryDocument9 pagesPrato Wool Textile IndustryNaresh KumarNo ratings yet

- Four Weapons of The RBI-1Document14 pagesFour Weapons of The RBI-1yashjadhav08No ratings yet

- 4.5.1 Financial Aspect 4.5.2 Initial Investment and Sources of FundingDocument3 pages4.5.1 Financial Aspect 4.5.2 Initial Investment and Sources of FundingDemi OrocNo ratings yet

- Property Law ProjectDocument15 pagesProperty Law ProjectHarsh DixitNo ratings yet

- PRI11187 - Development Experience of Nepal 1.3Document43 pagesPRI11187 - Development Experience of Nepal 1.3Bishow KCNo ratings yet

- AesDocument48 pagesAesMinaz PatelNo ratings yet

- Summary of Bank Reconciliation StatementDocument3 pagesSummary of Bank Reconciliation StatementMary Roan CambaNo ratings yet

- 11th IFSB Summit Programme BookDocument43 pages11th IFSB Summit Programme BookAbdoulaye NdongNo ratings yet

- Investment CriteriaDocument27 pagesInvestment CriteriaCharu ModiNo ratings yet

- (Economics) OECD - OECD Economic Surveys. Romania - (Economic Assessment), 2001-2002.-Organisation For Economic Co-Operation and Development (2002)Document131 pages(Economics) OECD - OECD Economic Surveys. Romania - (Economic Assessment), 2001-2002.-Organisation For Economic Co-Operation and Development (2002)Iulian IstrateNo ratings yet

- Macro Essay PlansDocument9 pagesMacro Essay PlansLucas JonasNo ratings yet

- Installment Sales Method 1Document7 pagesInstallment Sales Method 1Roy Mitz Bautista29% (7)

- Straight-Line Depreciation: ExpenseDocument3 pagesStraight-Line Depreciation: ExpenseGhulam-ullah KhanNo ratings yet

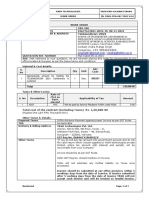

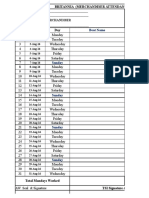

- Britannia (Merchandiser Attendance Sheet) : Beat NameDocument14 pagesBritannia (Merchandiser Attendance Sheet) : Beat NametechmindzNo ratings yet

- Laporan Fee Nov 2022 - SarnoDocument22 pagesLaporan Fee Nov 2022 - SarnoIklam AdsNo ratings yet

- Power Procurement (Competitive Bidding Principles)Document28 pagesPower Procurement (Competitive Bidding Principles)Ankur Pathak100% (1)

- HDFC Life Guaranteed Wealth Plus-Thu Jan 12 13 - 41 - 41 IST 2023Document3 pagesHDFC Life Guaranteed Wealth Plus-Thu Jan 12 13 - 41 - 41 IST 2023Azhar uddinNo ratings yet

- AeroflotDocument18 pagesAeroflotTomCatNo ratings yet

- Study of Commercial Property ValuationDocument5 pagesStudy of Commercial Property ValuationIJSTENo ratings yet

- Jadwal PenerbanganDocument5 pagesJadwal PenerbanganM Fajrur RahmanNo ratings yet

- Mid 2018 2019 512a 93eaafe3a2Document419 pagesMid 2018 2019 512a 93eaafe3a2J&A Partners JANNo ratings yet

- Recitation 1 Notes 14.01SC Principles of MicroeconomicsDocument3 pagesRecitation 1 Notes 14.01SC Principles of MicroeconomicsDivya ShahNo ratings yet

- Jazeera AirwaysDocument2 pagesJazeera Airwayso.adibi.alsakan.engNo ratings yet

Putnam Beat Inflation

Putnam Beat Inflation

Uploaded by

Putnam InvestmentsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Putnam Beat Inflation

Putnam Beat Inflation

Uploaded by

Putnam InvestmentsCopyright:

Available Formats

Beat inflation

After accounting for taxes, municipal bonds have outpaced inflation and CDs in 20 of the past 25 years.

20%

Investor Education

GROWTH OF $100,000 (19872011)

A $100,000 investment in 1987 would have had to grow to $204,645 in 2011 just to keep pace with inflation. Municipal bonds have grown over twice as fast.

AFTER-TAX RETURNS vs. INFLATION (19872011)

nInflation (2.91% on average) nCDs (after tax) (2.98% on average) nMunicipal bonds (6.46% on average)

15%

CDs (after tax)

$208,330

Municipal bonds

$478,170

10%

5%

0%

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

-5%

Data is historical. Past performance is not a guarantee of future results. Chart assumes a maximum federal tax rate of 35% on 6-month CDs, as measured by the Lipper 6-Month Total Return CD Index, an index composed of six-month certificates of deposit and derived from secondary market interest rates as published by the Federal Reserve. Municipal bonds and inflation are represented by the Barclays Capital Municipal Bond Index, an unmanaged index of long-term fixed-rate investment-grade tax-exempt bonds, and the Consumer Price Index, respectively. You -10% cannot invest directly in an index. Unlike bonds, which incur more risk, certificates of deposit (CDs) offer a fixed rate of return, and the interest and principal on CDs is generally insured by the FDIC up to $250,000. While all bonds have risks, municipal bonds may have a higher level of credit risk compared to CDs.

Why Putnam for municipal bond investing?

An experienced teamPutnams fixed-income team has managed tax-exempt bond funds since 1976. The team has deep expertise in all facets of municipal bond credit research, trading, and portfolio construction. A broad range of municipal bond fundsPutnam offers a choice of municipal bond funds, including nationally diversified funds and single-state funds. A prudent approachPutnams municipal bond fund team seeks to balance a durable level of income with capital preservation. Rather than pursue risky strategies in pursuit of higher yield, Putnams tax-exempt bond funds spread their assets among many different issuers and maturities, which may reduce risk and help to protect returns.

NATIONALLY DIVERSIFIED FUNDS

Putnam AMT-Free Municipal Fund Putnam Tax Exempt Income Fund Putnam Tax Exempt Money Market Fund Putnam Tax-Free High Yield Fund

SINGLE-STATE FUNDS

PPNAX PTAEX PTXXX PTHAX

Putnam AZ Tax Exempt Income Fund Putnam CA Tax Exempt Income Fund Putnam MA Tax Exempt Income Fund Putnam MI Tax Exempt Income Fund Putnam MN Tax Exempt Income Fund Putnam NJ Tax Exempt Income Fund Putnam NY Tax Exempt Income Fund Putnam OH Tax Exempt Income Fund Putnam PA Tax Exempt Income Fund

PTAZX PCTEX PXMAX PXMIX PXMNX PTNJX PTEIX PXOHX PTEPX

Consider these risks before investing: The funds invest in fewer issuers or concentrate their investments by region or sector, and involve more risk than a fund that invests more broadly. Lower-rated bonds may offer higher yields in return for more risk. Capital gains, if any, are taxable for federal and, in most cases, state purposes. For some investors, investment income may be subject to the federal alternative minimum tax. Income from federally exempt funds may be subject to state and local taxes. Tax-free funds may not be suitable for IRAs and other non-taxable accounts. The use of derivatives involves additional risks, such as the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. Mutual funds that invest in bonds are subject to certain risks including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Longterm bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses. Money market funds are not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other governmental agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in this fund.

Investors should carefully consider the investment objectives, risks, charges, and expenses of a fund before investing. For a prospectus , or a summary prospectus if available, containing this and other information for any Putnam fund or product, call your financial representative or contact Putnam at 1-800-225-1581. Please read the prospectus carefully before investing.

Putnam Investments | One Post Office Square | Boston, MA 02109 | putnam.com

Putnam Retail Management II8592720352/12

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Independent Equity Research: How We Do It, and Why It Matters To InvestorsDocument12 pagesIndependent Equity Research: How We Do It, and Why It Matters To InvestorsPutnam InvestmentsNo ratings yet

- EU: Articles of Stationery - Market Report. Analysis and Forecast To 2020Document9 pagesEU: Articles of Stationery - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- Aug Pay SlipDocument1 pageAug Pay SlipDAYA SHANKARNo ratings yet

- Putnam White Paper: The Outlook For U.S. and European BanksDocument12 pagesPutnam White Paper: The Outlook For U.S. and European BanksPutnam InvestmentsNo ratings yet

- Affluent Investors Use of Social MediaDocument2 pagesAffluent Investors Use of Social MediaPutnam InvestmentsNo ratings yet

- Optimizing Your LinkedIn ProfileDocument2 pagesOptimizing Your LinkedIn ProfilePutnam Investments60% (5)

- Financial Advisors' Use of Social MediaDocument2 pagesFinancial Advisors' Use of Social MediaPutnam InvestmentsNo ratings yet

- Muni Rally May Continue, But Must Navigate Policy RisksDocument3 pagesMuni Rally May Continue, But Must Navigate Policy RisksPutnam InvestmentsNo ratings yet

- Putnam Research Fund Q&A Q3 2012Document4 pagesPutnam Research Fund Q&A Q3 2012Putnam InvestmentsNo ratings yet

- Putnam Gifting Opportunities in 2012Document4 pagesPutnam Gifting Opportunities in 2012Putnam InvestmentsNo ratings yet

- Asset ProtectionDocument4 pagesAsset ProtectionPutnam InvestmentsNo ratings yet

- Knowing The Contribution of Agriculture To The Nigerian GDPDocument52 pagesKnowing The Contribution of Agriculture To The Nigerian GDPmarkchima8No ratings yet

- 14Nov21-Brochure - Telemedicon-202Document2 pages14Nov21-Brochure - Telemedicon-202TULSI CHARAN DASNo ratings yet

- Final PPT of HUL Vs ITCDocument19 pagesFinal PPT of HUL Vs ITCJiten ShahNo ratings yet

- 1062 Shree Baba Ramdev TextilesDocument10 pages1062 Shree Baba Ramdev TextilesZain ShaikhNo ratings yet

- Havells Doubles Its Cable and Wire Manufacturing CapacityDocument3 pagesHavells Doubles Its Cable and Wire Manufacturing CapacityKaran SharmaNo ratings yet

- Prato Wool Textile IndustryDocument9 pagesPrato Wool Textile IndustryNaresh KumarNo ratings yet

- Four Weapons of The RBI-1Document14 pagesFour Weapons of The RBI-1yashjadhav08No ratings yet

- 4.5.1 Financial Aspect 4.5.2 Initial Investment and Sources of FundingDocument3 pages4.5.1 Financial Aspect 4.5.2 Initial Investment and Sources of FundingDemi OrocNo ratings yet

- Property Law ProjectDocument15 pagesProperty Law ProjectHarsh DixitNo ratings yet

- PRI11187 - Development Experience of Nepal 1.3Document43 pagesPRI11187 - Development Experience of Nepal 1.3Bishow KCNo ratings yet

- AesDocument48 pagesAesMinaz PatelNo ratings yet

- Summary of Bank Reconciliation StatementDocument3 pagesSummary of Bank Reconciliation StatementMary Roan CambaNo ratings yet

- 11th IFSB Summit Programme BookDocument43 pages11th IFSB Summit Programme BookAbdoulaye NdongNo ratings yet

- Investment CriteriaDocument27 pagesInvestment CriteriaCharu ModiNo ratings yet

- (Economics) OECD - OECD Economic Surveys. Romania - (Economic Assessment), 2001-2002.-Organisation For Economic Co-Operation and Development (2002)Document131 pages(Economics) OECD - OECD Economic Surveys. Romania - (Economic Assessment), 2001-2002.-Organisation For Economic Co-Operation and Development (2002)Iulian IstrateNo ratings yet

- Macro Essay PlansDocument9 pagesMacro Essay PlansLucas JonasNo ratings yet

- Installment Sales Method 1Document7 pagesInstallment Sales Method 1Roy Mitz Bautista29% (7)

- Straight-Line Depreciation: ExpenseDocument3 pagesStraight-Line Depreciation: ExpenseGhulam-ullah KhanNo ratings yet

- Britannia (Merchandiser Attendance Sheet) : Beat NameDocument14 pagesBritannia (Merchandiser Attendance Sheet) : Beat NametechmindzNo ratings yet

- Laporan Fee Nov 2022 - SarnoDocument22 pagesLaporan Fee Nov 2022 - SarnoIklam AdsNo ratings yet

- Power Procurement (Competitive Bidding Principles)Document28 pagesPower Procurement (Competitive Bidding Principles)Ankur Pathak100% (1)

- HDFC Life Guaranteed Wealth Plus-Thu Jan 12 13 - 41 - 41 IST 2023Document3 pagesHDFC Life Guaranteed Wealth Plus-Thu Jan 12 13 - 41 - 41 IST 2023Azhar uddinNo ratings yet

- AeroflotDocument18 pagesAeroflotTomCatNo ratings yet

- Study of Commercial Property ValuationDocument5 pagesStudy of Commercial Property ValuationIJSTENo ratings yet

- Jadwal PenerbanganDocument5 pagesJadwal PenerbanganM Fajrur RahmanNo ratings yet

- Mid 2018 2019 512a 93eaafe3a2Document419 pagesMid 2018 2019 512a 93eaafe3a2J&A Partners JANNo ratings yet

- Recitation 1 Notes 14.01SC Principles of MicroeconomicsDocument3 pagesRecitation 1 Notes 14.01SC Principles of MicroeconomicsDivya ShahNo ratings yet

- Jazeera AirwaysDocument2 pagesJazeera Airwayso.adibi.alsakan.engNo ratings yet