Professional Documents

Culture Documents

El Punto Final by David Arthur Walters

El Punto Final by David Arthur Walters

Uploaded by

David Arthur Walters0 ratings0% found this document useful (0 votes)

65 views16 pages1) The document discusses Treasury Secretary Henry Paulson's $700 billion bailout plan and the criticism it has received.

2) While some claim it was a rip-off that benefited Wall Street, others argue Paulson was simply doing the bidding of President Bush and had broad discretion under the bailout act to promote financial stability.

3) Instead of purchasing troubled assets as originally intended, Paulson decided to directly invest in banks by purchasing stock, though this also faced criticism for merely propping up Wall Street without doing enough to curb foreclosures or stimulate the broader economy.

Original Description:

Will the banks and their political cabinet in Washington finally get the point?

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The document discusses Treasury Secretary Henry Paulson's $700 billion bailout plan and the criticism it has received.

2) While some claim it was a rip-off that benefited Wall Street, others argue Paulson was simply doing the bidding of President Bush and had broad discretion under the bailout act to promote financial stability.

3) Instead of purchasing troubled assets as originally intended, Paulson decided to directly invest in banks by purchasing stock, though this also faced criticism for merely propping up Wall Street without doing enough to curb foreclosures or stimulate the broader economy.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

65 views16 pagesEl Punto Final by David Arthur Walters

El Punto Final by David Arthur Walters

Uploaded by

David Arthur Walters1) The document discusses Treasury Secretary Henry Paulson's $700 billion bailout plan and the criticism it has received.

2) While some claim it was a rip-off that benefited Wall Street, others argue Paulson was simply doing the bidding of President Bush and had broad discretion under the bailout act to promote financial stability.

3) Instead of purchasing troubled assets as originally intended, Paulson decided to directly invest in banks by purchasing stock, though this also faced criticism for merely propping up Wall Street without doing enough to curb foreclosures or stimulate the broader economy.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 16

El Punto Final

By David Arthur Walters

Last edited: Wednesday, February 18, 2009

Posted: Thursday, November 20, 2008

Bailout Economics: Are we facing a dead end?

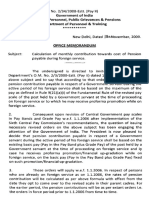

Treasury Secretary Henry Paulson is being

castigated for the purported failure of his discretionary

financial bailout plan. Some critics claim that he is the

figurehead for one of the greatest rip-offs in world history. We do not

subscribe to that conspiracy theory; a man who loves birds and wants to

close the income inequality gap cannot be all that bad. Of course he

may with all good intentions be simply doing the bidding of the

President, as if the President, who himself failed dismally as a

businessman, knew from experience exactly what not to do or to do if

anything to fix the seriously damaged financial and economic system.

Loyalty is the President’s chief virtue; loyalty in his tribe is

virtually synonymous with its integrity. And one thing the President is

very fond of doing is staying the course. Wherefore Mr. Paulson’s

supporters claim that he is obviously not the President’s loyal stooge,

for the Secretary has changed course along with the changing facts, as

if there were no certain course except to avoid further collisions and to

keep the Titanic afloat.

Au contraire, say the cynics: they claim the secretarial deeds

dovetail nicely with the presidential will. Where the markets are

concerned, the President, a Master of Business Administration, has the

market fundamentalist’s faith in the deity who built and wound up the

clock to fix itself with a bare minimum of human intervention, guided,

ever so lightly, by the deity’s invisible right hand.

“In God We Trust,” reads the Federal Reserve Note. God’s plan

for America no doubt accords with His judgment or Doom, and that

happens to be inscrutable at this time. As Secretary Paulson averred on

November 18, 2008 at an House Financial Services Committee TARP

oversight hearing, the Bush administration had "no playbook" to follow

hence the official strategy was being adjusted on an ad hoc basis. He

said the financial markets would be worse off if Congress had not

approved the package, but we know that only God knows if that is a

fact.

Naturally human intervention must be discretionary if man is

made in the image of his deity and thus has a portion of divine free will.

Discretion is a sine qua non of the deity’s omnipotence, and the

President and the People have duly delegated considerable discretion to

the Secretary Treasurer so that he might accomplish the Purpose

charged in the Bill and made Law after the political church was duly

convened in the name of God; to wit:

“The purposes of this Act are to immediately provide authority

and facilities that the Secretary of the Treasury can use to restore

liquidity and stability to the financial system of the United States; and

to ensure that such authority and such facilities are used in a manner

that protects home values, college funds, retirement accounts, and life

savings; preserves homeownership and promotes jobs and economic

growth; maximizes overall returns to the taxpayers of the United States;

and provides public accountability for the exercise of such authority.”

To that end the Secretary Treasurer may take Necessary Actions:

“The Secretary is authorized to take such actions as the Secretary

deems necessary to carry out the authorities in this Act….”

Section 8 of the original, 900-word plan submitted to Congress in

September for its approval provided virtually unlimited power to the

Secretary to do whatever he deemed necessary: “Sec. 8. Review.

Decisions by the Secretary pursuant to the authority of this Act are non-

reviewable and committed to agency discretion, and may not be

reviewed by any court of law or any administrative agency.” However,

in the final plan actually approved, the Secretary’s power does not seem

to be as unlimited as God’s, for his actions are subjected to statutory

judicial review: “Actions by the Secretary pursuant to the authority of

this Act shall be subject to chapter 7 of title 5, United States Code,

including that such final actions shall be held unlawful and set aside if

found to be arbitrary, capricious, an abuse of discretion, or not in

accordance with law….”

Well, the law has authorized a distribution of $700 billion, and the

distributions will be announced after they are made, so that leaves the

fallible reason of judges to determine whether or not a distribution was

arbitrary or capricious. May we then assume that the recipients of $700

billion might finally have to give it back? Hardly: “No injunction or

other form of equitable relief shall be issued against the Secretary for

actions pursuant to section 101 [purchase of troubled assets], 102

[insurance of troubled assets], 106 [sale of troubled assets], and 109

[foreclosure mitigation efforts], other than to remedy a violation of the

Constitution….”

The Supreme Court has already given Congress implied powers to

delegate constitutional discretion. The Bailout Bill states that there is no

other governing law to fall back on: “With the exception of section 131

[i.e. Exchange Stabilization Fund], nothing in this Act may be

construed to limit the authority of the Secretary or the Board under any

other provision of law.”

Wherever discretion is afforded during emergencies so severe that

atheists pray to God and appoint temporary dictators, there shall be

some bitter complaints about its exercise. Mr. Paulson and his team

have definitely not pleased all the people all the time. The discretionary

content of the bailout act has been abided by, but the initially stated

intent of the desperate legislators, which was for the Secretary to buy

the distressed assets financial institutions could not afford to hold, and

to provide some relief against foreclosure for the delinquent

homeowners in respect to those mortgages held by the property

manager for Federal government entities, was not complied with.

“The Secretary is authorized to establish the Troubled Asset

Relief Program (or ‘‘TARP’’) to purchase, and to make and fund

commitments to purchase, troubled assets from any financial

institution, on such terms and conditions as are determined by the

Secretary, and in accordance with this Act and the policies and

procedures developed and published by the Secretary.”

Alas, the panicky legislature, notwithstanding their regrettable

experience with the Bush administration, was afraid to tie the hands of

the Secretary Treasurer, and left him and the Chairman of the Federal

Reserve a broad alternative, which we emphasized below for good

reason:

“The term ‘’troubled assets’ means residential or commercial

mortgages and any securities, obligations, or other instruments that are

based on or related to such mortgages, that in each case was originated

or issued on or before March 14, 2008, the purchase of which the

Secretary determines promotes financial market stability; and any other

financial instrument that the Secretary, after consultation with the

Chairman of the Board of Governors of the Federal Reserve System,

determines the purchase of which is necessary to promote financial

market stability, but only upon transmittal of such determination, in

writing, to the appropriate committees of Congress.”

“To the extent that the Federal property manager holds, owns, or

controls mortgages, mortgage backed securities, and other assets

secured by residential real estate, including multi-family housing, the

Federal property manager shall implement a plan that seeks to

maximize assistance for homeowners and use its authority to encourage

the servicers of the underlying mortgages, and considering net present

value to the taxpayer, to take advantage of the HOPE for Homeowners

Program under section 257 of the National Housing Act or other

available programs to minimize foreclosures. (2) MODIFICATIONS.

—In the case of a residential mortgage loan, modifications made under

paragraph (1) may include (A) reduction in interest rates; (B) reduction

of loan principal; and (C) other similar modifications.”

Instead of taking the junk off the investment bankers’ hand, Mr.

Paulson decided not to fool around: he took George Soros’ suggestion

to heart, and proceeded to buy stock in the banks, which amounted to a

direct transfusion of taxpayer dollars into the patients’ circulatory

systems. The banks in turn were expected to turn around and lend out

up to ten times the increase in capital. Instead, given their bad

experience with loans and their mounting gambling liabilities for

derivatives, the funds were either sat upon or used to buy other banks to

further expand the capital base of the purchasers.

In other words, the bankers, unwilling to throw good money after

bad, were behaving prudently for a change. The hue-and-cry initially

raised against the emergency recovery bill by Main Street, that it was a

Wall Street bailout, was raised once again. The initial outcry had been

suppressed by rapidly declining stock prices; on second thought, it was

decided that it might be a good idea to save Wall Street along with

one’s own 401-k portfolio. Somehow, something also must be done to

curb the mounting foreclosures. And the economy should of course be

stimulated too. Maybe the taxpayers should buy the automotive

industry and other ailing sectors of the economy; eventually all the

directors of the stakeholders in big corporations and big governments

and big unions could sit on a pyramidal hierarchy of subsidiary

corporate boards that would put Italian corporativismo to shame and

prove once and for all that fascism is the perfection of capitalism in one

body with no more than four castes.

So what’s not to like about Mr. Paulson’s discretionary behavior

thus far? The financial plumbing seems to be working again albeit

sluggishly – Federal Reserve Chairman Bernanke testified on

November 18 that the flow is “far from normal.” The overnight interest

rate on loans between banks so breathlessly watched nowadays by

Americans who might be paying twenty times that rate on their credit

cards has come down somewhat from the height it reached because

banks go bankrupt in the middle of the night so their debts to one

another may be worthless in the morning. Okay, then, but the economy

is worsening and the number of foreclosures has increased and is

expected to get larger. Mind you that the vast majority of homeowners,

the Forgotten Homeowners, are simply making their payments and may

continue to do so until the government comes up with a program that

awards them with a loan modification to default on their loans. Not

much has been done in the way of foreclosure relief. A mere few

thousand mortgage loans have been modified, and a quarter of them are

in default again. The chief bureaucrats are bickering over what

approach to take, and how to persuade private holders of mortgages to

voluntarily cooperate with any such approach. Thus far no government

official that we know of is championing the one loan modification that

has been crucial to the resolution of similar problems in the past; in

fact, authority for that modification is provided in the Paulson Bailout

Bill: “reduction of loan principal.”

Across-the-board reduction of loan principal, when the amounts

owed are much larger than the collateral is presently worth, is naturally

anathema to lenders, especially when the value of the collateral is

expected to recover any time soon. But the borrower may not expect

such a recovery; and in any event he might not want to pay for lost

equity he can no longer borrow on: he might prefer to just walk away

and rent a place to live, and perhaps re-enter the market when he stands

to gain some equity instead of lose his shirt.

Analysts were rightly worried all along about the effect

speculators were having on condominium construction and prices in

Miami and other markets. Speculators, who never intended to live in

the units they purchased, were flipping their condos for substantial

gains even before they took title. “Buy now, pay later,” is the old

standard refrain. Credit standards were incredibly low, and now the bill

has come due with a vengeance for those people who do not have the

cash or further credit to pay it. Many working stiffs feel cheated out of

the homes they never would have been able to obtain without lowered

credit standards; they blame the realtors and lenders for their

predicament, and might vandalize their homes before moving out. But a

speculating immigrant, a practical nurse in New York, bought three

luxury condos in Florida on speculation, she blames the collapse on the

vagaries of the market and the alignment of the planets; she would take

another chance at good fortune if she had the credit to make another

wager if the tide were rising again. Let us not forget that there is a

speculative factor at play even when people purchase residences to live

in, and also think of the purchase as an “investment.” Ordinary people

are actually “speculating” on a rise in prices because, despite recent

experience, real estate prices may stagnate for decades. It is not, as our

generation has said, always better to own than to rent.

Naturally, there are more speculators and investors in higher

income brackets than in the lower brackets. Lower income homeowners

find compensation enough in simply having their own home to live in,

and may take pride in it to such an extent that they are often,

paradoxically, less likely to default than those who think of their

residences as more of an investment than as a home-sweet-home.

One Charles W. Calomiris not only believes in “reduction of loan

principal” but he also believes taxpayers should pick up the tab for part

of the write-down. His views are well worth noting, as he is the Henry

Kaufman Professor of Financial Institutions at the Columbia University

Graduate School of Business, and has enjoyed such positions as

Professor at Columbia's School of International and Public Affairs,

Research Associate of the National Bureau of Economic Research, and

was a Senior Fellow at the Council on Foreign Relations, Co-Director

of Project on Financial Deregulation and Arthur Burns Scholar in

International Economics at the American Enterprise Institute, and

Member of the Shadow Financial Regulatory Committee. His has some

hands-on banking experience – he was Chairman of the Board of a

troubled bank, the Greater Atlantic Financial Corporation, a position his

esteemed father, William Calomiris, a Washington, D.C. real estate

magnate, left him – and has written erudite tracts on banking crises. His

papers, "Consequences of Bank Distress During the Great Depression"

(with Joseph Mason), in the American Economic Review (June 2003),

"Fundamentals, Panics, and Bank Distress During the Depression"

(with Joseph Mason), in the American Economic Review (December

2003), are well worth reading. We first encountered him in his October

14, 2008 Forbes Commentary, “How To Prevent Foreclosures.”

“A more modest proposal than that of Sen. McCain…would

follow the example of the successful Mexico ‘Punto Final’ plan of

1999, which resulted in substantial debt write-downs very quickly and

the resolution of much financial gridlock in that country. The

government would share losses borne by lenders from mortgage

principal write-downs on a proportional basis. For example, taxpayers

could absorb 20% of the write-down cost borne by lenders on any

mortgage so long as it is agreed through a voluntary renegotiation

between lenders and borrowers, and so long as doing so creates a

sufficient write-down for borrowers to be able to qualify for

refinancing….” He explains that lenders would be far more apt to

modify the principal amount if the cost of doing so is shared by

taxpayers in such a way that the total cost to the bank is less than what

it would be if the bank foreclosed.

We note well Professor Calomiris’ interest in deregulation and his

association with the American Enterprise Institute, a neoconservative

think tank with which the Bush administration has so many ties, and we

wonder why he would therefore propose such a monumental

intervention by means of government funding of mortgage principal

write-downs. The cynical leftist might fall back on the great right-wing

conspiracy theory, that the neoconservative agenda made wildly

popular by Ronald Reagan, who in 1988 said that "The American

Enterprise Institute stands at the center of a revolution in ideas of which

I, too, have been a part,” was to unleash Greed and eventually bankrupt

the government, leaving it with just enough funding to wage war and

protect the property of baron robbers from peasants and proletariat. On

the other hand, perhaps the professor, who is, after all, a professor at

Columbia, is simply being objective, and is just as sincerely concerned

as Henry Paulson is with closing the gap between rich and poor by

broadening the home-owning middle class, voluntarily.

However that may be, the evidence seems to support the notion

that “reduction of principle” might go a long ways towards alleviating

the foreclosure crisis. For example, take the 2000 study, “The Mexico

Mortgage Market Boom, Bust and Bail Out: Determinants of Borrower

Default and Loan Restructure After the 1995 Currency Crisis”

published by the Joint Center for Housing Studies at Harvard

University. Secretary Paulson might find work authored by Natalie

Pickering, an Associate at Goldman Sachs at the time, pleasing, for it

seems that "the best and brightest" in finance are associated with that

illustrious firm. He has been severely criticized for stacking his

recovery team with Goldman Sachs associates because that investment

banking firm, lead by his good self, were instrumental in bringing on

the financial ills we presently face. But the causes may better effect a

cure, if the homeopathic approach has merit, so let the wizards have at

it. We take brief excerpts from Dr. Pickering’s paper for good health:

“This paper examines borrower choice to default or restructure

mortgage loans under the initial phase of the [Mexican] government

relief program called ‘The Accord for the Assistance of the Banking

System’ or ADE. It uses microdata from a commercial bank to test

whether it was borrowers net equity or ability-to-pay that primarily

drove them to default or restructure. Under the assumption that it was

primarily an ability-to-pay problem that drove default, the ADE

provided borrowers with an interest rate subsidy, and later a monthly

payment subsidy, if they restructured their loans. However, the results

here show that it was borrowers’ net home equity that primarily

influenced the decision to default or restructure and that lower income

borrower’s were both less likely to default or restructure, choosing

instead to continue paying under their original loan contracts. The ADE

program was an inappropriate policy response to borrower default.”

“Higher relative wealth and income were actually associated with

higher default rates as well as higher restructure rates. Low income

borrowers were more apt to continue paying on their original loans. The

results provide new evidence in the long-standing debate on the causes

of mortgage default. Over the years this debate has centered on the

question of whether the borrower’s net equity position in the house or

ability to pay drives default. Cunningham and Capone (1990) were

among the first to synthesize the evidence in the United States, and they

concluded that for both fixed and adjustable rate mortgages, equity was

of greater importance than ability to pay in predicting default.

Subsequent research has conceptualized default as a financial put

option and focused on the so-called “ruthlessness” with which

borrowers exercise this option.”

“The results presented here reveal that discounts directly off the

loan balance—not payment discounts--were needed from the onset of

the crisis to encourage restructure and stem default. In fact, such

balance discounts were ultimately granted in a much later borrower

relief program called El Punto Final (January 1999). This study points

out that it was possible to predict, based on data available as early as

May 1996, that balance rather than payment discounts would be a more

effective policy measure. It also shows that payment discounts had a

regressive distributional effect.”

This sort of discussion would normally put the average reader to

sleep, but given the severity of the present crisis and the impact it might

have on his well being, the patient is advised to stay with us for another

dose:

“Nearly two decades of research on mortgage pricing have shown

that default should be viewed as a contingent claim attached to the

mortgage contract. Lenders sell a put option when they originate a

mortgage that explicitly allows the borrower to relinquish the home at

the price of the mortgage. When the value of the outstanding loan

exceeds the value of the house, the put is in the money and a rational,

wealth-maximizing borrower will default. Mexican mortgage holders

have largely responded, as financial theory would predict, by exercising

the put option to default on their loans. The ADE program, by giving

payment discounts, did not affect borrowers’ negative equity and did

not address the root cause of default. In fact, the results presented here

show that this policy decision was also regressive in that lower income

borrowers were less likely to participate in the program choosing

instead to continue paying on their current mortgages. High and

medium income borrowers were more likely to default or to restructure

and thus receive the benefits of these discounts. Many loans fell into

delinquency subsequent to restructuring. Some claim that because

payments rose with inflation under the restructured contracts, borrowers

became delinquent again when they were unable to keep up with

payment increases. Others point out that the ADE program only

provided borrowers with an opportunity to defer foreclosure, but

borrowers’ participation in the program did not represent a greater

willingness to pay. Later evidence suggests that many borrowers did

restructure only to fall into delinquency again. Foreclosure deferral was

a plausible motivation for this behavior, but payment increases were

not. A more likely reason is that since many borrowers were still in a

negative equity position following restructure, they were rationally

exercising the option to default even subsequent to the ADE.This is not

to say that default was only brought on by negative equity. Borrowers

have suffered payment problems due to a decline in income under the

old and new contracts alike. In addition, the systemic rise in default has

made foreclosure even more difficult for banks. Moral hazard has

plagued the mortgage market, creating excessive administrative burdens

for banks and courts alike. Many borrowers, recognizing that banks are

unable to possess their properties without an extended and costly court

case, have chosen non-payment as a means to obtain a discounted

settlement with the bank. The results of this study would suggest that

higher income borrowers, who here show a propensity to default even

when holding positive equity in their homes, are more adept at

receiving these discounts. Again this leads to a regressive outcome for

resolving the delinquency problem. The results of this study point out

that basic research on the causes of borrower behavior in the mortgage

market would have aided the government in designing a relief program

that better addressed the causes of default and benefited lower-income

borrowers. Direct discounts off the balance of the loan would have been

a more effective policy for stemming default and encouraging

restructure. Eventually, nearly three years later, the government did

decide to support banks in granting such discounts through a program

called Punto Final. By this time, however, borrowers had grown to

expect a new relief program each time delinquency rose. Strategic

default was well cultivated in the market making it ever harder to attain

positive results even from a well-designed program. Successive policy

failures, such as that of the ADE program, helped nurture a culture of

non-payment. Only better-designed policy initiatives t hat take into

consideration the causes of borrower choice can reverse this trend.”

“El punto final” is the final point, the final reckoning, meaning in

our context, “the last chance.” Professor Calomiris puts the Punto Final

plan’s best foot forward in Forbes, but elsewhere, in a paper on

financial debt restructuring, “A Taxonomy of Financial Crisis

Resolution Mechanisms: Cross-Country Experience”, World Bank

Policy Research Working Paper 3379, August 2004, with scholars

Daniela Klingebiel and Luc Laeven, serious doubts were expressed.

Both financial doctor and patients should find the following brief

excerpts edifying if they are not to big to swallow:

"As an example of government sharing of loan losses, we

consider the Punto Final Program in Mexico. The Punto Final Program

in Mexico For three years, the FOBAPROA program initiated in 1995

had failed to reduce the amount of past due loans and to provide debtor

relief. In a final attempt to offer debt relief, the government initiated in

December 1998 the Punto Final program, which was a government-led

debt-relief program targeted to mortgage holders, agribusinesses, and

small and medium-sized enterprises (SMEs). The program offered large

subsidies (up to 60% of the book value of the loan) to bank debtors to

pay back their loan..."

"Although both the Punto Final program and the FOBAPROA

program combined an element of loss sharing between the government

and the financial institutions, there were four key improvements of the

Punto Final program vis-à-vis its predecessor. First, loss sharing was

geared toward small loans, as the discount offered was higher for

smaller loans. Small borrowers are a desirable group to target, since

assisting them improves competition in the economy, and since

assistance channeled to these borrowers is less likely to result from

their political or economic power over governments or financial

institutions. Second, the loss sharing arrangement offered an incentive

for banks to restart lending to SMEs and individuals because it linked

the size of government assistance to the amount of new lending by the

participating bank. Third, the program may have made more effective

use of taxpayers' resources, because it relied on borrowers' willingness

to participate, and it required borrowers to pay part of their outstanding

loans. Borrower self-selection, in principle, can reduce the number of

participating borrowers, and reduce taxpayers' cost of resolution per

borrower by requiring borrowers to repay part of their loans. Just as

important, self-selection may ensure that participants are more likely to

be those that were "worth helping." The borrowers willing to repay part

of their loans should be those that value access to credit in the future,

which also tend to be more value-creating borrowers. The FOBAPROA

program, in contrast, had not been selective, and had greatly benefited

large borrowers at high cost to taxpayers, irrespective of the desirability

of assisting them, and even if those borrowers were not in default.

Fourth, unlike its predecessor, the Punto Final program offered to

quickly resolve ongoing disputes between creditors and debtors, and

thus made it easier to analyze the balance sheets of participating

borrowers and banks going forward. Resolving the uncertainty about

how much of their preexisting debts would be repaid is a key

requirement for analyzing the balance sheets of borrowers when

making new loans. Debt resolution, in theory, should help to make

credit available to creditworthy firms. Despite these potentially

attractive features, it would be premature to declare the Punto Final

program a model of successful restructuring."

"The selectivity that comes from conditional programs like Punto

Final can result in better targeting of taxpayer resources toward

borrowers that were worth saving, because of the type of borrowers that

will self-select into the program. In the case of Punto Final, resource

savings and effectiveness probably were enhanced by the fact that the

program focused primarily on SMEs and other small borrowers, which

are less likely to be entwined in the too often corrupt iron triangle of

banks, conglomerates, and government officials. Furthermore, by

linking assistance to new credit supplied by banks, the Punto Final

program helped to further its goal of restarting the credit supply process

more than an across-the-board subsidization of write 21 downs would.

Finally, because conditional subsidization requires borrowers to share

somewhat in the costs of financial sector subsidies, the adverse

incentive effects of these subsidies for future borrowing and lending

behavior will be less than for unconditional subsidies of write downs.

For all of these reasons, conditional subsidization of loan losses through

a program like Punto Final seems superior to across the board

subsidization of loan write downs by bank"

"If the goal is a large-scale restructuring of the financial system,

the microeconomic advantages of selectivity must be traded off against

the macroeconomic advantages of large-scale improvements in

corporate debt capacity and bank net worth. For that reason, to be

effective, the Punto Final model would have to be applied to a

significant share of the population of borrowers (not just SMEs). The

strengths of Punto Final, however, are mainly confined to assistance to

SMEs, where concerns about corruption in the implementation of

selectivity, and concerns about inefficient use of resources to prop up

powerful conglomerates may not be as great. Finally, we note that

conditional subsidies and across-the-board write down subsidies share

some of the same limitations. Neither approach distinguishes among

banks with respect to the allocation of assistance. Indeed, banks that

made the worst lending decisions prior to the crisis will receive the

most assistance after the crisis. Thus neither approach does much to

address the adverse-selection and moral-hazard problems of providing

assistance to insolvent banks."

"It is difficult to assess the effectiveness of the Punto Final

program, not least because it was preceded by, and coincided with,

numerous other financial support and debtor relief programs. After all,

the Punto Final program, as its name indicates, was intended to finalize

the bailout of the banking sector and the debtor relief program in

Mexico. There were also other positive developments: growth,

increased banking sector income, and foreign entry into banking, which

improved the condition of banks and the supply of credit during this

period. Nevertheless, despite the difficulties of attribution, we note that

the banking system did show some improvements in indicators of asset

quality, profitability, and capital adequacy during the years 1997-2000,

and that Punto Final may have played a role in those improvements....

Past due loans to total loans excluding FOBAPROA decreased from

17.6 percent in 1997 to 8.5 percent in 2000. The improvements in asset

quality largely reflect the conclusion of debtor relief programs through

the Punto Final program (IMF 2001a). 20 However, even with

additional debt relief offered under the Punto Final program, bank

lending did not restart as expected. Bank credit to the private sector has

contracted from about 19 percent of GDP at end-1998 to 10 percent of

GDP at end-2000."

"We were unable to undertake a microeconomic analysis of the

Punto Final program to determine the extent to which the allocation of

assistance was executed fairly and efficiently owing to a lack of

available data. That lack of data, in part, seems to reflect the political

climate of Mexico and the political controversies that surround debt

relief programs."

Must something be immediately done to ameliorate foreclosure

pain in the current crisis? Federal Deposit Insurance Corporation

Chairwoman Sheila Bair thinks so: "The root cause of the current

economic crisis is the failure to deal effectively with unaffordable loans

and unnecessary foreclosures," she testified at the TARP oversight

hearing. Conservatives might think that the root cause of the crisis was

in making the unaffordable loans in the first place, and that the best way

to deal effectively with the unnecessary crisis is to foreclose on the

collateral, sell it, and write off the balance. The ulterior aim of writing

and selling mortgage-backed securities and other collateralized debt

obligations, and then the so-called insurance derivatives called credit

default swaps, was to offload the risk onto someone else willing to take

the gamble. Mission accomplished; let the gamblers fall under the load,

not the taxpayer. Why not take a page out of the neoconservatives’

playbook, before the neocons cowered and ran to Congress for a

handout, and let them fail? If we heed the ambiguities proffered by

Steve Forbes and the like, government is damned whether it intervenes

or not, and it probably only prolongs the pain when it does.

Maybe the foreclosure issue should be put on the back burner for

now: When questioned, Secretary Paulson said he had to save first

things first. First of all, the financial system had to be saved, and, for

the time being at least, that mission had been temporarily accomplished.

"Congress passed legislation to deal with financial instability, and that

is what we are doing," he said in response to complaints at the

November 18 TARP oversight hearing.

Well, we must admit that, if the worst case scenario for

foreclosures came true, and all those debtors foreclosed upon were

thrown out of their homes and had to rent some place to live or live

under viaducts, more people in the United States would still own their

own homes than in any other country in the world. Eventually the

foreclosed homes, given falling real estate prices, would be purchased

by someone else. But if the banking system went down, that would be

the end of the world as we know it.

Policy architects must consider the greatest happiness of the

greatest number; undoubtedly pain will be keenly felt by some in order

to achieve that end, so let the sacrifices be voluntary.

We should not worry so much about the administrative

inconsistencies, or bother to call leaders like Secretary Paulson

hypocrites instead of pragmatists for changing course in midstream

because the facts have changed: we certainly would not call a man a

hypocrite for changing his clothes! Facts that seemingly fly in the face

of policy should be conveniently written off as political misconceptions

of divine providence or justified as God’s unfathomable mysteries.

After all, " A foolish consistency is the hobgoblin of little

minds."(Emerson). Mr. Paulson’s actions do not really vary from the

overarching policy: "Congress passed legislation to deal with financial

instability, and that is what we are doing," he rightly declared, as we

can see if we reread the Purpose of the Act above.

The Secretary Treasurer acted as he thought best, and acted

according to the discretion delegated. The overseers and inspectors

general may complain as they like but they may not undo what has been

done. His behavior was bound at the outset to be consistently

inconsistent in a sense, because history never precisely repeats itself.

History, after all is said and done, is always a mistake, for only Nothing

is perfect; the Ideal can never be truly realized in this absurd dimension

given the limitations of our fundamental categories. Whatever we have

done, we might be sorry for it, but it could have been much worse. We

are moving on, looking forward to our El Punto Final with high hopes

for the afterlife.

You might also like

- How To Make 10K A Month With Dropshipping Ebook PDFDocument21 pagesHow To Make 10K A Month With Dropshipping Ebook PDFhappy100% (1)

- FullfaithandcreditDocument4 pagesFullfaithandcreditJavis Blalock100% (4)

- Azazel PDFDocument175 pagesAzazel PDFDevon MonstratorNo ratings yet

- 2022.12.20 Final Report House Ways and MeansDocument29 pages2022.12.20 Final Report House Ways and MeansBrandon Conradis25% (4)

- Case Study - Your Star Salesperson LiedDocument15 pagesCase Study - Your Star Salesperson Liedchandrasekar guruNo ratings yet

- Parlimentarian LetterDocument13 pagesParlimentarian LetterColin MeynNo ratings yet

- Def of Legal Tender MatterDocument13 pagesDef of Legal Tender Matterjoerocketman100% (4)

- The Real Crash: America's Coming Bankruptcy - How to Save Yourself and Your CountryFrom EverandThe Real Crash: America's Coming Bankruptcy - How to Save Yourself and Your CountryRating: 4 out of 5 stars4/5 (5)

- There Is No Us TreasuryDocument5 pagesThere Is No Us TreasuryGary Krimson100% (2)

- Report On State Budget Process (Final - 2020)Document21 pagesReport On State Budget Process (Final - 2020)Boris Santos100% (1)

- Learning Agreement Traineeships Form Nou 2016-2017-1Document5 pagesLearning Agreement Traineeships Form Nou 2016-2017-1florin31No ratings yet

- Leaders Make A Real Differents in An Organization's PerformanceDocument12 pagesLeaders Make A Real Differents in An Organization's Performancesantha clauseNo ratings yet

- The Dirty Dozen: How Twelve Supreme Court Cases Radically Expanded Government and Eroded FreedomFrom EverandThe Dirty Dozen: How Twelve Supreme Court Cases Radically Expanded Government and Eroded FreedomNo ratings yet

- Emergency Economic Stabilization ActDocument4 pagesEmergency Economic Stabilization Actmusic2hisearsNo ratings yet

- Puerto Rico and The Bond MarketDocument3 pagesPuerto Rico and The Bond MarketJohn E. MuddNo ratings yet

- Araullo vs. Aquino - LeonenDocument23 pagesAraullo vs. Aquino - Leonenbloome9ceeNo ratings yet

- Economist Insights 2013 10 072Document2 pagesEconomist Insights 2013 10 072buyanalystlondonNo ratings yet

- CBO Letter To Congressional LeadersDocument7 pagesCBO Letter To Congressional LeadersSpeakerBoehnerNo ratings yet

- Financial Regulatory Reform: Protecting Taxpayers and The EconomyDocument61 pagesFinancial Regulatory Reform: Protecting Taxpayers and The EconomyScribd Government DocsNo ratings yet

- Grem - The Liberty Amendment Money Trap (Analysis of Central Banking) (1979) PDFDocument74 pagesGrem - The Liberty Amendment Money Trap (Analysis of Central Banking) (1979) PDFwroueaweNo ratings yet

- Senate Hearing, 111TH Congress - Nomination of Herbert M. Allison, Jr.Document49 pagesSenate Hearing, 111TH Congress - Nomination of Herbert M. Allison, Jr.Scribd Government DocsNo ratings yet

- Hearing Committee On Agriculture House of RepresentativesDocument48 pagesHearing Committee On Agriculture House of RepresentativesScribd Government DocsNo ratings yet

- 2016-06-23 GSEs - Former White House Officials Involved in GSE ScandalDocument11 pages2016-06-23 GSEs - Former White House Officials Involved in GSE ScandalJoshua Rosner100% (1)

- New Rules, New ToolsDocument8 pagesNew Rules, New Toolstbone999No ratings yet

- The Origination Clause of The US Constitution: Interpretation and EnforcementDocument20 pagesThe Origination Clause of The US Constitution: Interpretation and EnforcementJohn MalcolmNo ratings yet

- A Primer On MoneyDocument74 pagesA Primer On MoneyaspharagusNo ratings yet

- Primary Source - Hamilton vs. Jefferson - National BankDocument4 pagesPrimary Source - Hamilton vs. Jefferson - National BankJess ReynoldsNo ratings yet

- 2015-12-15 GSE PAPER Something Old, Somethng New, Something BorrowedDocument78 pages2015-12-15 GSE PAPER Something Old, Somethng New, Something BorrowedJoshua RosnerNo ratings yet

- Financial Crisis PrimerDocument13 pagesFinancial Crisis PrimerMilton RechtNo ratings yet

- Obamacare & GSEs - Key Players Trading HatsDocument51 pagesObamacare & GSEs - Key Players Trading HatsJoshua Rosner100% (4)

- The Disbursement Acceleration ProgramDocument3 pagesThe Disbursement Acceleration ProgramRon VillanuevaNo ratings yet

- Senate Hearing, 111TH Congress - Federal Reserve's Second Monetary Policy Report For 2010Document135 pagesSenate Hearing, 111TH Congress - Federal Reserve's Second Monetary Policy Report For 2010Scribd Government DocsNo ratings yet

- Constantino V CuisiaDocument2 pagesConstantino V Cuisiaatoydequit100% (1)

- American International Group: Examining What Went Wrong, Government Inter-Vention, and Implications For Future RegulationDocument72 pagesAmerican International Group: Examining What Went Wrong, Government Inter-Vention, and Implications For Future RegulationScribd Government DocsNo ratings yet

- A+Promissory+Note+07 2022Document2 pagesA+Promissory+Note+07 2022landmarkchurchofhouston100% (3)

- Oversight of The Troubled Assets Relief ProgramDocument76 pagesOversight of The Troubled Assets Relief ProgramScribd Government DocsNo ratings yet

- In Addition To Mandatory Private Health Insurance Premiums, Your Paycheck May Soon Be Hit With A "Mandatory Savings"taxDocument4 pagesIn Addition To Mandatory Private Health Insurance Premiums, Your Paycheck May Soon Be Hit With A "Mandatory Savings"taxLterzi5599No ratings yet

- Deceptive CDocument4 pagesDeceptive CA. CampbellNo ratings yet

- 60 Guingona vs. Carague 196 Scra 221Document19 pages60 Guingona vs. Carague 196 Scra 221Bennet Balberia100% (1)

- Unregulated Markets: How Regulatory Reform Will Shine A Light in The Financial SectorDocument83 pagesUnregulated Markets: How Regulatory Reform Will Shine A Light in The Financial SectorScribd Government Docs100% (1)

- Pham Letter Final GrassleyDocument5 pagesPham Letter Final GrassleyMartin AndelmanNo ratings yet

- How Did We Get Here?Document28 pagesHow Did We Get Here?Tony StaufferNo ratings yet

- The Legality of The Federal Reserve SystemDocument18 pagesThe Legality of The Federal Reserve SystemParvaneh100% (2)

- The Economic Exposure of Federal Credit ProgramsDocument105 pagesThe Economic Exposure of Federal Credit ProgramsScribd Government DocsNo ratings yet

- U.S. Bailout Plan Calms Markets, But Struggle Looms Over DetailsDocument5 pagesU.S. Bailout Plan Calms Markets, But Struggle Looms Over Detailsdavid rockNo ratings yet

- Oped 250908 Sceptical US Politicians Slow To Buy Paulson S 700bn Bailout Plan Independent AADocument3 pagesOped 250908 Sceptical US Politicians Slow To Buy Paulson S 700bn Bailout Plan Independent AABruegelNo ratings yet

- Update 8 1 98Document7 pagesUpdate 8 1 98Committee For a Responsible Federal BudgetNo ratings yet

- Thesis of Federalist 70Document7 pagesThesis of Federalist 70WritingPaperServicesToledo100% (1)

- Slaters 29Document2 pagesSlaters 29tmurseNo ratings yet

- Debt Limit BoehnerDocument2 pagesDebt Limit BoehnerBrett LoGiuratoNo ratings yet

- PG 79 Deposits March 9 1933 Act HR 1491Document1 pagePG 79 Deposits March 9 1933 Act HR 1491jjNo ratings yet

- Bob Chapman The Fed S Purchase of US Sovereign Debt 16 6 10Document3 pagesBob Chapman The Fed S Purchase of US Sovereign Debt 16 6 10sankaratNo ratings yet

- Dwnload Full Income Tax Fundamentals 2012 30th Edition Whittenburg Test Bank PDFDocument31 pagesDwnload Full Income Tax Fundamentals 2012 30th Edition Whittenburg Test Bank PDFseritahanger121us100% (7)

- House Ways and Means Committee Report On IRS Mandatory Presidential Audit ProgramDocument29 pagesHouse Ways and Means Committee Report On IRS Mandatory Presidential Audit ProgramCNBC.com100% (1)

- HkuuhDocument410 pagesHkuuhMichaella Claire LayugNo ratings yet

- Why Constitutions MatterDocument6 pagesWhy Constitutions MatterZerohedge100% (1)

- Save America WebDocument10 pagesSave America WebTerri ThomasNo ratings yet

- Senate Hearing, 113TH Congress - Flirting With Disaster: Solving The Federal Debt CrisisDocument88 pagesSenate Hearing, 113TH Congress - Flirting With Disaster: Solving The Federal Debt CrisisScribd Government DocsNo ratings yet

- The Bailout's New Financial OligarchyDocument17 pagesThe Bailout's New Financial OligarchyvanathelNo ratings yet

- Senate Hearing, 111TH Congress - Nomination of Daniel I. WerfelDocument77 pagesSenate Hearing, 111TH Congress - Nomination of Daniel I. WerfelScribd Government DocsNo ratings yet

- McCulloch Vs Maryland Case BriefDocument5 pagesMcCulloch Vs Maryland Case BriefIkra MalikNo ratings yet

- Regulating Hedge Funds and Other Private Investment Pools: HearingDocument108 pagesRegulating Hedge Funds and Other Private Investment Pools: HearingScribd Government DocsNo ratings yet

- Short Term Rental Ruling 7 Oct 2019 in Re Natalie Nichols V City of Miami BeachDocument26 pagesShort Term Rental Ruling 7 Oct 2019 in Re Natalie Nichols V City of Miami BeachDavid Arthur WaltersNo ratings yet

- DOJ Bicyle Theft Mitigation ReportDocument87 pagesDOJ Bicyle Theft Mitigation ReportDavid Arthur WaltersNo ratings yet

- Inquisition Into Florida Bar Conduct in Eisenberg V City of Miami BeachDocument21 pagesInquisition Into Florida Bar Conduct in Eisenberg V City of Miami BeachDavid Arthur WaltersNo ratings yet

- Signs of Miami Beach Corruption To Alleged ReformerDocument16 pagesSigns of Miami Beach Corruption To Alleged ReformerDavid Arthur WaltersNo ratings yet

- Rod Eisenberg V City of Miami Beach 18-cv-22540-FAMDocument21 pagesRod Eisenberg V City of Miami Beach 18-cv-22540-FAMDavid Arthur WaltersNo ratings yet

- Solstice Healthcare Benefits in DoubtDocument25 pagesSolstice Healthcare Benefits in DoubtDavid Arthur WaltersNo ratings yet

- Florida Interior Design License OrdealDocument44 pagesFlorida Interior Design License OrdealDavid Arthur WaltersNo ratings yet

- Miami Beach Tennis Management LLC ReportDocument24 pagesMiami Beach Tennis Management LLC ReportDavid Arthur WaltersNo ratings yet

- Hechicera Del FuegoDocument4 pagesHechicera Del FuegoDavid Arthur WaltersNo ratings yet

- He Is An Honest ManDocument4 pagesHe Is An Honest ManDavid Arthur WaltersNo ratings yet

- Florida Lawyers Shalt Not Blackmail LitigantsDocument14 pagesFlorida Lawyers Shalt Not Blackmail LitigantsDavid Arthur WaltersNo ratings yet

- The City of Miami Beach Can Do No WrongDocument9 pagesThe City of Miami Beach Can Do No WrongDavid Arthur WaltersNo ratings yet

- An Exemplary Florida LawyerDocument23 pagesAn Exemplary Florida LawyerDavid Arthur Walters100% (1)

- Miami Beach Building Department Internal SOP ManualDocument274 pagesMiami Beach Building Department Internal SOP ManualDavid Arthur WaltersNo ratings yet

- Vocal Forms of African MusicDocument29 pagesVocal Forms of African MusicShendelista BaysedNo ratings yet

- IntonationDocument8 pagesIntonationWendell EspinalNo ratings yet

- D - City of Sydney Capacity StudyDocument46 pagesD - City of Sydney Capacity StudyDorjeNo ratings yet

- Temporary Card 8 - GarnetDocument29 pagesTemporary Card 8 - GarnetJemebel NosaresNo ratings yet

- Film AnalysisDocument6 pagesFilm Analysishumanupgrade100% (1)

- Akib Ticket 1Document2 pagesAkib Ticket 1khanNo ratings yet

- When Your Spouse Wants A Divorce and You Don't: Kim BowenDocument16 pagesWhen Your Spouse Wants A Divorce and You Don't: Kim Boweninneed1100% (1)

- BBA (FIA) Revised Syllabus 2019Document15 pagesBBA (FIA) Revised Syllabus 2019SD HAWKNo ratings yet

- CLE 7 Week 3 - Prophets Speak To Us About HolinessDocument5 pagesCLE 7 Week 3 - Prophets Speak To Us About HolinessSrRose Ann ReballosNo ratings yet

- Dopt OM No. 19.11.2009Document2 pagesDopt OM No. 19.11.2009Veda PrakashNo ratings yet

- Borrowing Cost & Gov Grants-QUIZDocument3 pagesBorrowing Cost & Gov Grants-QUIZDanah EstilloreNo ratings yet

- Case Study On Godavari Water DisputeDocument2 pagesCase Study On Godavari Water DisputeInsider PC GamingNo ratings yet

- Pamantayan Sa Interpretatibong PagbasaDocument7 pagesPamantayan Sa Interpretatibong Pagbasamargie l. carbajosaNo ratings yet

- The Canterville Ghost and Other Stories: Book KeyDocument4 pagesThe Canterville Ghost and Other Stories: Book KeyDesweet12No ratings yet

- Beginners Guide To Voip WP 2016Document13 pagesBeginners Guide To Voip WP 2016sharnobyNo ratings yet

- Re-Imagining Crotonville:: Epicentre of Ge'S LeadershipDocument7 pagesRe-Imagining Crotonville:: Epicentre of Ge'S LeadershipShalini SarkarNo ratings yet

- Cricket Calender INDIADocument3 pagesCricket Calender INDIAjigbizzNo ratings yet

- Unit - Ii Indian Partnership Act, 1932Document17 pagesUnit - Ii Indian Partnership Act, 1932shobhanaNo ratings yet

- English QuestionnaireDocument5 pagesEnglish QuestionnairePamelaCindyTumuyu80% (15)

- Revista Paradores Otoño 2011Document85 pagesRevista Paradores Otoño 2011filustroNo ratings yet

- HRM in Private & Public Sector BanksDocument76 pagesHRM in Private & Public Sector BanksAnonymous hHrsiJnY100% (1)

- DH 2011 1008 Part A DCHB KishanganjDocument594 pagesDH 2011 1008 Part A DCHB Kishanganjaditi kaviwalaNo ratings yet

- Jungheinrich Update Files Jeti SH 4 36 Cz14Document22 pagesJungheinrich Update Files Jeti SH 4 36 Cz14rebeccathompsondds120800pkq100% (123)

- The Internet and Social Media Provide Young People With A Range of BenefitsDocument2 pagesThe Internet and Social Media Provide Young People With A Range of BenefitstabilinNo ratings yet

- mg2CURRICULUM VITAEDocument4 pagesmg2CURRICULUM VITAELovely Rose Dungan TiongsonNo ratings yet