Professional Documents

Culture Documents

Wakefield Reutlinger Realtors March 2010 Newsletter

Wakefield Reutlinger Realtors March 2010 Newsletter

Uploaded by

Wakefield Reutlinger RealtorsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wakefield Reutlinger Realtors March 2010 Newsletter

Wakefield Reutlinger Realtors March 2010 Newsletter

Uploaded by

Wakefield Reutlinger RealtorsCopyright:

Available Formats

Wakefield,Reutlinger AND COMPANY/REALTORS

o r s .c o m

Rr e al t

W

Insider

REAL ESTATE

A Publication of Wakefield, Reutlinger and Company/Realtors Vol. 1 No. 23 March 2010

Why You Should Get Off The Fence

In case you missed the news, the federal government lead to higher mortgage rates. Producer prices

will give you, if you buy a house, up to $8,000 for first for finished goods were up 1.4 percent in January.

time buyers and up to $6,500 for current homeowners This represents the third consecutive monthly advance

with price, income and time limitations. The benefit in prices.

covers buyers who enter into contracts before April 30 Another reason to get off the fence is that the surge in

home sales over the last year was driven by buyers

and close by June 30. responding strongly to the tax credits combined with

In addition, mortgage rates are at historically low levels low mortgage rates. With inventory levels trending

with the Federal Reserve’s ongoing mortgage purchase down, housing market conditions will become more

program. However, this program is scheduled to end balanced by late spring increasing the possibility of

March 31. Some economists fear that will drive higher prices.

mortgage rates up. So, if you’re sitting on the fence If that’s not enough to convince you, Forbes.com just

Come to historic Locust Grove about whether or not to take advantage of the tax credits came out with a list of the top 10 best housing markets,

at 561 Blankenbaker Lane on right now…don’t wait. Senate Finance Committee Chair- and Louisville’s number 2 on the list. In order to make

man Max Baucus (D. Mont.) was credited with this the list, the housing market should have appreciating

March 28th for the Emilie Strong comment, “It is important that this tax credit does not

Smith Chamber Music Series. A become a permanent fixture in the tax code.” It is prices that show homeowners are making wise invest-

ments, an affordability rating that gives middle-class

rare opportunity to enjoy music widely anticipated that the tax credits will not be renewed. families with good credit entry into the market, and a

of the early 1800’s. Light refresh- Also, with the economy slowly pulling out of its deep relatively low number of foreclosures, which keeps

ments are served at 5pm, the concert recession, producer prices are rising which could also prices stable and indicates there isn’t an excess of

begins at 5:30pm. impact mortgage rates. Higher prices can eventually inventory.

lghh@locustgrove.org.

Hogan’s Fountain

Metro Parks is devel-

Louisville Real Estate UPDATE

Units Sold YTD

oping a new master

plan for the Hogan’s

Fountain area of

Cherokee Park, a 409

acre Olmsted Park

created in 1891.

Louisvilleky.gov

You know you’re in Louisville

when: You’ve shoveled 10+

inches of snow and worn shorts

in the same week. Year to Date at a Glance Month at a Glance

You’ve lived here for years, yet Sales by Price Range-Single Family Residential & Condo Residential Sales Stats Single Family Residential & Condo

get hopelessly lost when Price Range Statistics 1/1-1/31 09 1/1-1/31 10 % Change Jan. - 08 Jan. - 09 Jan. - 10

attempting a short cut through Up to $99,999 194 221 +13.9%

Cherokee Park. Houses Sold 802 529 702

$100,000-$199,999 216 301 +39.4%

$200,000-$299,999 68 112 +64.7%

Average Selling Price $172,725 $160,018 $155,995

$300,000-$399,999 26 44 +69.2%

$400,000-$499,999 8 9 +12.5% Median Selling Price $133,800 $123,000 $130,000

$500,000+ 17 15 -11.8%

ALL THE WAY HOME...425-0225

Source: Greater Louisville MLS.

There's never been a better time to

buy with the extended and expanded

home buyer tax credits and low interest

rates. Call me and let me help you

take advantage of this once in a

lifetime opportunity!

Mortgage Rates

30 Year Fixed 4.8650%

15 Year Fixed 4.25%

30 Year FHA 5%

This is not intended to solicit a currently listed property. Information

is deemed reliable, but not guaranteed.

Your Guide to Outdoor Maintenance by Dave Toht FEATURED PROPERTY

Substantial snowmelt and heavy spring rains block foundation; $10,000 or more to

signal the onset of summer’s heat and humidity straighten it.

in the Midwest—extreme conditions that put 2. Clean the Gutters

stress on the exterior of a house and other 3. Repair the Gutters

features, such as driveways and fences. Rou‐ 4. Correct the Grade

tine outdoor maintenance helps ensure that The grade should slope away from the house

your property withstands nature’s challenges at least 6 inches for every 10 feet. If possible,

while preserving the value of your investment. use soil with some clay content to divert the

1. Maintain Proper Drainage water. Or, lay down plastic sheeting, making

Controlling water around the perimeter of the sure it slopes away from the house. Adhere

house is always very important. In the Midwest, the edge of the plastic to the foundation

there is a lot of expansive clay soil. Bad drainage with silicone caulk. Cover the plastic with soil,

around the house can cause foundation sand, or mulch. Keep the final grade at least

problems and basement wetness issues, as 6 inches away from any siding or trim.

well as mold. That means you’ll need proper Cost ‐ $40 for 10x100 ft. roll of 4ml plastic,

grading and gutters that are in good repair $3.50 for 50lb sand, $2.50 pine bark mulch,

and cleared of debris, and adequate down‐ $6.75 silicone caulk.

spout extensions. None of these is an For more on carpenter ants, sprinkler and spigot

expensive fix, but the price of neglect is maintenance, fences and gates, sidewalks, drive‐

high: $3,000 or more to stabilize bowing in a ways and decks go to houselogic.com.

Replace Old Windows with $8,200 to $10,600. Plus, if you choose windows

that qualify for the new federal tax credit (U-

or equal to 0.3 regardless of climate zone. Not

all Energy Star windows qualify.

Energy-Efficient Models factor and solar heat gain coefficient ratings Know the Language of Windows

If your windows are more than 15 years old, must be 0.3 or less), you can effectively lop It’s also helpful to familiarize yourself with

you may be putting up with draftiness, windows $1,500 off the purchase price. You’re also terms that appear on many window labels:

that stick in their frames, and skyrocketing energy likely to see modest savings on your energy Glazing is simply the glass used in the window.

bills. Energy-efficient windows would be a bill. In general, you’ll save $126 to $465 a year Low-E stands for low emissivity, the window’s

great improvement, but replacement can be if single-pane windows in a 2,000-square foot ability to reflect rather than absorb heat when

very expensive. house are replaced with tax-credit-eligible coated with a thin metallic substance. Low-E

Windows Recoup Much of Their Cost windows, according to the Efficient Windows coatings add up to 10% to the price of a window.

The range for energy-efficient window pricing Collaborative*. Keep in mind, though, that the If your windows are in relatively good shape

is wide, but Energy Star-qualified windows savings can vary widely by climate, local energy but you’d like better insulation, you can buy

start around $120 for a 36” x 72” single-hung costs, and the energy efficiency of both the and apply Low-E films to your windows.

window and can go up 10 times that. With windows purchased and the windows being Gas Fills typically consist of argon or krypton

labor, you’re looking at about $270 to $800+ replaced. Finally, you may qualify for low- gas sandwiched between glazing layers to

per window. But that doesn’t mean the numbers interest loans or other incentives offered by improve insulation and slow heat transfer.

can’t make sense for you. For starters, window your local utility that can sweeten the deal. Spacers separate sheets of glass in a window

replacement is one of the best home remodeling Evaluate Price vs. Energy Efficiency to improve insulating quality.

projects in terms of investment return. For Energy Star labels will tell you whether a window Frame Materials include vinyl, wood, aluminum,

vinyl windows, you can recoup about 75% of performs well in your climate based on ratings fiberglass, and combinations of. They each

the project cost in added home value, according from the National Fenestration Rating Council. have different strengths in.

to Remodeling Magazine’s annual Cost vs. However, if you’re looking for windows that For this complete article: houselogic.com

Value Report. Based on the projects outlined qualify for the $1,500 federal tax credit, make *A coalition of government agencies, research organizations,

in Cost vs. Value, that’s a value add of about sure the U-factor and SHGC are both less than and Manufacturers that promotes efficient window technology.

You might also like

- WestJet Airlines - Ivey Publishing - Case Study SolutionsDocument7 pagesWestJet Airlines - Ivey Publishing - Case Study SolutionsNest Imperial100% (1)

- IB Economics 1Document3 pagesIB Economics 1Igor NechaevNo ratings yet

- (Referred To in Paragraphs 10.2.20 and 10.2.22) : Indenture For Secured AdvancesDocument3 pages(Referred To in Paragraphs 10.2.20 and 10.2.22) : Indenture For Secured AdvanceschanderpawaNo ratings yet

- Gov - Uk: Register For and File Your Self Assessment Tax ReturnDocument4 pagesGov - Uk: Register For and File Your Self Assessment Tax ReturnJane Yonzon-RepolNo ratings yet

- Wakefield Reutlinger Realtors Nov 2009 NewsletterDocument2 pagesWakefield Reutlinger Realtors Nov 2009 NewsletterWakefield Reutlinger RealtorsNo ratings yet

- WR May News 2010Document2 pagesWR May News 2010Wakefield Reutlinger RealtorsNo ratings yet

- Wakefield Reutlinger Realtors Jan 2010 NewsletterDocument2 pagesWakefield Reutlinger Realtors Jan 2010 NewsletterWakefield Reutlinger RealtorsNo ratings yet

- 7 Reasons Why Now Is A Great Time To Buy e BookDocument10 pages7 Reasons Why Now Is A Great Time To Buy e Bookapi-199906911No ratings yet

- Q3 10 Alameda 1.1Document1 pageQ3 10 Alameda 1.1pamoettelNo ratings yet

- C02 Burbuja Casas USADocument25 pagesC02 Burbuja Casas USAavallebNo ratings yet

- Real Estate Report For March, 2009Document2 pagesReal Estate Report For March, 2009longley-martins100% (2)

- Ocal Appenings: Lorem Ipsum MAY 1, 2017Document8 pagesOcal Appenings: Lorem Ipsum MAY 1, 2017Dallas WoodNo ratings yet

- Yuli Lyman San Mateo County Real Estate Market ReportDocument4 pagesYuli Lyman San Mateo County Real Estate Market ReportylymanNo ratings yet

- San Meteo County Update June 2009Document4 pagesSan Meteo County Update June 2009gwenchiaNo ratings yet

- The Dream of Home Ownership ReflectionDocument6 pagesThe Dream of Home Ownership Reflectionapi-659085933No ratings yet

- UK's Housing Boom - Is The Party Over?: by Jay Lakhani, President, Bindal FXDocument4 pagesUK's Housing Boom - Is The Party Over?: by Jay Lakhani, President, Bindal FXPawan SharmaNo ratings yet

- Orange County: The State of The MarketDocument4 pagesOrange County: The State of The Marketapi-25886701No ratings yet

- Ventura County: The State of The MarketDocument4 pagesVentura County: The State of The Marketapi-26714676No ratings yet

- Real Estate: InsiderDocument4 pagesReal Estate: InsiderWakefield Reutlinger RealtorsNo ratings yet

- February NewsletterDocument1 pageFebruary NewsletterremaxbaysideNo ratings yet

- View From The MountainDocument31 pagesView From The Mountainsakhalinsk100% (3)

- Greenlight Q2 LetterDocument8 pagesGreenlight Q2 LetterZerohedge100% (1)

- Builders Outlook 2016 Issue 7Document16 pagesBuilders Outlook 2016 Issue 7TedEscobedoNo ratings yet

- San Diego County: The State of The MarketDocument4 pagesSan Diego County: The State of The Marketapi-26157345No ratings yet

- Orange County: Favorable News For The Economy and HousingDocument4 pagesOrange County: Favorable News For The Economy and Housingapi-25886701No ratings yet

- HOUSINGDocument45 pagesHOUSINGK JagannathNo ratings yet

- Beverly Hills Market Watch: Home Prices Up 9.7% in January From Year Earlier, Corelogic ReportsDocument2 pagesBeverly Hills Market Watch: Home Prices Up 9.7% in January From Year Earlier, Corelogic ReportsNanette MarchandNo ratings yet

- Ventura County: Favorable News For The Economy and HousingDocument4 pagesVentura County: Favorable News For The Economy and Housingapi-26714676No ratings yet

- Santa Clara County Market Update - October 2011Document4 pagesSanta Clara County Market Update - October 2011Gwen WangNo ratings yet

- House Poor: How to Buy and Sell Your Home Come Bubble or BustFrom EverandHouse Poor: How to Buy and Sell Your Home Come Bubble or BustNo ratings yet

- Quarterly Review: Are You A Gambler?Document4 pagesQuarterly Review: Are You A Gambler?Nicholas FrenchNo ratings yet

- Armstrong 2016 Commentary Uk Housing Market Problems and PoliciesDocument5 pagesArmstrong 2016 Commentary Uk Housing Market Problems and PoliciesCandelaNo ratings yet

- The Retreat at Storm Branch: Lot Sizes Up To 3.56 Acres!Document16 pagesThe Retreat at Storm Branch: Lot Sizes Up To 3.56 Acres!Aiken StandardNo ratings yet

- FAM Sample From Last SemsterDocument12 pagesFAM Sample From Last SemsterCharles Mwangi WaweruNo ratings yet

- The Real Estate Bubble, MS2003Document14 pagesThe Real Estate Bubble, MS2003Argyn ToktamyssovNo ratings yet

- Wakefield Reutlinger Realtors September 2010 NewsletterDocument2 pagesWakefield Reutlinger Realtors September 2010 NewsletterWakefield Reutlinger RealtorsNo ratings yet

- Cause and Effect EssayDocument4 pagesCause and Effect EssayGloriaNo ratings yet

- Housing Fact 2005 07Document5 pagesHousing Fact 2005 07feliciafarmNo ratings yet

- Escrow Examiner: Southern California Home Sales Dip, Median Price Rises From '09Document2 pagesEscrow Examiner: Southern California Home Sales Dip, Median Price Rises From '09api-25884946No ratings yet

- Our Non-Existent Housing Bubble - John Wilson, PIMCO - Commentary - Business SpectatorDocument6 pagesOur Non-Existent Housing Bubble - John Wilson, PIMCO - Commentary - Business SpectatorPeter MaverNo ratings yet

- Screenshot 2023-03-12 at 10.59.00 AMDocument1 pageScreenshot 2023-03-12 at 10.59.00 AMpaendabakhtNo ratings yet

- A Land Backed Currency Issued by A Local Authority1Document14 pagesA Land Backed Currency Issued by A Local Authority1DanNo ratings yet

- TD Economics: Special ReportDocument21 pagesTD Economics: Special ReportInternational Business TimesNo ratings yet

- San Diego CountyDocument4 pagesSan Diego Countyapi-26216409No ratings yet

- Ministry of Finance - Potential Implications of Reducing Foreign Ownership of BC's Housing MarketDocument10 pagesMinistry of Finance - Potential Implications of Reducing Foreign Ownership of BC's Housing MarketCKNW980No ratings yet

- San Diego CountyDocument4 pagesSan Diego Countyapi-26216409No ratings yet

- Orange County: Home Buyer Tax Credit Extended and ExpandedDocument4 pagesOrange County: Home Buyer Tax Credit Extended and Expandedapi-26807834No ratings yet

- Economic Focus Feb. 20, 2012Document1 pageEconomic Focus Feb. 20, 2012Jessica Kister-LombardoNo ratings yet

- Is A House A Good InvestmentDocument21 pagesIs A House A Good InvestmentskahkajhdksaNo ratings yet

- Housing Affordability Study: How Even The Cheapest Metros Are More Unaffordable Than Big CitiesDocument6 pagesHousing Affordability Study: How Even The Cheapest Metros Are More Unaffordable Than Big CitiesJust Rent to OwnNo ratings yet

- Aust House Prices OI 21 2012Document2 pagesAust House Prices OI 21 2012TihoNo ratings yet

- Bienville Macro Review (U.S. Housing Update)Document22 pagesBienville Macro Review (U.S. Housing Update)bienvillecapNo ratings yet

- San Diego County: Favorable News For The Economy and HousingDocument4 pagesSan Diego County: Favorable News For The Economy and Housingapi-27643796No ratings yet

- Home Without Equity RentalDocument31 pagesHome Without Equity RentalJoshua RosnerNo ratings yet

- Keeping Current Matters in Today's Market": Positioning Agents As Experts in The MarketplaceDocument32 pagesKeeping Current Matters in Today's Market": Positioning Agents As Experts in The MarketplacerealmiamibeachNo ratings yet

- Aftershock Moodys Real Estate AnalysisDocument2 pagesAftershock Moodys Real Estate AnalysisRobert IronsNo ratings yet

- Market OverviewDocument4 pagesMarket OverviewmiguelnunezNo ratings yet

- Value Investing Congress October 13, 2010 T2 Accredited Fund, LP Tilson Offshore Fund, Ltd. T2 Qualified Fund, LPDocument46 pagesValue Investing Congress October 13, 2010 T2 Accredited Fund, LP Tilson Offshore Fund, Ltd. T2 Qualified Fund, LPuxfarooqNo ratings yet

- Wakefield Reutlinger and Company/Realtors October 2011 NewsletterDocument2 pagesWakefield Reutlinger and Company/Realtors October 2011 NewsletterWakefield Reutlinger RealtorsNo ratings yet

- The Pros & Cons of Homeownership #3: Inflation Protection: Financial Freedom, #209From EverandThe Pros & Cons of Homeownership #3: Inflation Protection: Financial Freedom, #209No ratings yet

- A Broom Cupboard of One's Own: The housing crisis and how to solve it by boosting home-ownershipFrom EverandA Broom Cupboard of One's Own: The housing crisis and how to solve it by boosting home-ownershipNo ratings yet

- Real Estate: InsiderDocument4 pagesReal Estate: InsiderWakefield Reutlinger RealtorsNo ratings yet

- Wakefield Reutlinger Realtors Newsletter 1st Quarter 2013Document4 pagesWakefield Reutlinger Realtors Newsletter 1st Quarter 2013Wakefield Reutlinger RealtorsNo ratings yet

- Wakefield Reutlinger Realtors Newsletter 3rd Quarter 2013Document4 pagesWakefield Reutlinger Realtors Newsletter 3rd Quarter 2013Wakefield Reutlinger RealtorsNo ratings yet

- Wakefield Reutlinger Realtors Newsletter 4th Quarter 2012Document4 pagesWakefield Reutlinger Realtors Newsletter 4th Quarter 2012Wakefield Reutlinger RealtorsNo ratings yet

- Wakefield Reutlinger and Company/Realtors April 2011 NewsletterDocument2 pagesWakefield Reutlinger and Company/Realtors April 2011 NewsletterWakefield Reutlinger RealtorsNo ratings yet

- Wakefield Reutlinger and Company/Realtors October 2011 NewsletterDocument2 pagesWakefield Reutlinger and Company/Realtors October 2011 NewsletterWakefield Reutlinger RealtorsNo ratings yet

- WR May News 2010Document2 pagesWR May News 2010Wakefield Reutlinger RealtorsNo ratings yet

- Wakefield Reutlinger and Company/Realtors Newsletter November 2010Document2 pagesWakefield Reutlinger and Company/Realtors Newsletter November 2010Wakefield Reutlinger RealtorsNo ratings yet

- Wakefield Reutlinger Realtors September 2010 NewsletterDocument2 pagesWakefield Reutlinger Realtors September 2010 NewsletterWakefield Reutlinger RealtorsNo ratings yet

- Wakefield Reutlinger Realtors Jan 2010 NewsletterDocument2 pagesWakefield Reutlinger Realtors Jan 2010 NewsletterWakefield Reutlinger RealtorsNo ratings yet

- Wakefield Reutlinger Realtors Nov 2009 NewsletterDocument2 pagesWakefield Reutlinger Realtors Nov 2009 NewsletterWakefield Reutlinger RealtorsNo ratings yet

- Wakefield Reutlinger Realtors July 2009 NewsletterDocument2 pagesWakefield Reutlinger Realtors July 2009 NewsletterWakefield Reutlinger RealtorsNo ratings yet

- Wakefield Reutlinger Realtors Sept 09 NewsletterDocument2 pagesWakefield Reutlinger Realtors Sept 09 NewsletterWakefield Reutlinger RealtorsNo ratings yet

- Linkedin Connects HR HeadsDocument2 pagesLinkedin Connects HR HeadsVinu ThomasNo ratings yet

- Autolock Box Concepts in r12Document21 pagesAutolock Box Concepts in r12devender_bharatha3284No ratings yet

- Base24 Argentina Response CodesDocument3 pagesBase24 Argentina Response CodesPichon JuarezNo ratings yet

- Scgplastics SettlementDocument5 pagesScgplastics SettlementTCIJNo ratings yet

- Certified Expert in ESG and Impact Investing 2022Document4 pagesCertified Expert in ESG and Impact Investing 2022Amit PNo ratings yet

- Presentation ON Analysis of Financial Trends of S.J.V.N.Ltd. (SHIMLA)Document15 pagesPresentation ON Analysis of Financial Trends of S.J.V.N.Ltd. (SHIMLA)Pushp Raj ThakurNo ratings yet

- Search Results For "Certification" - Wikimedia Foundation Governance Wiki PDFDocument2 pagesSearch Results For "Certification" - Wikimedia Foundation Governance Wiki PDFAdriza LagramadaNo ratings yet

- University of Kelaniya: Viva Voice Presentation On Business InternshipDocument14 pagesUniversity of Kelaniya: Viva Voice Presentation On Business InternshipAsiri KasunjithNo ratings yet

- Obligations and ContractsDocument7 pagesObligations and ContractsJosemari JuanicoNo ratings yet

- Assignment 2Document4 pagesAssignment 2Sultan LimitNo ratings yet

- Eoif Working Capital FinanceDocument16 pagesEoif Working Capital Financeengr_asad364No ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource WasReznakNo ratings yet

- B01032 - Chapter 07 - The Stock Market, The Theory of Rational Expectations and The Efficient Market HypothesisDocument14 pagesB01032 - Chapter 07 - The Stock Market, The Theory of Rational Expectations and The Efficient Market HypothesisDương Thị Kim HiềnNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument3 pagesSworn Statement of Assets, Liabilities and Net WorthJosa Carpio-JunioNo ratings yet

- S.No Code Bank Name Netbanking Debit Card Sponsor Bank: Bank Status in API E-MandateDocument2 pagesS.No Code Bank Name Netbanking Debit Card Sponsor Bank: Bank Status in API E-MandateRajuNo ratings yet

- Option Trading Tactics With Oliver Velez PDFDocument62 pagesOption Trading Tactics With Oliver Velez PDFhansondrew100% (1)

- Invoice 43904700Document1 pageInvoice 43904700Sandra IvanovićNo ratings yet

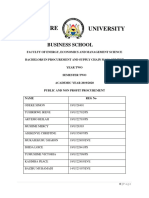

- Public and Non Profit Procurement WorkDocument13 pagesPublic and Non Profit Procurement Workkitderoger_391648570No ratings yet

- Intramuros Adminstration - Exec Summary 06Document9 pagesIntramuros Adminstration - Exec Summary 06Anonymous p47liBNo ratings yet

- Certificate of Business Name Registration: MGTV Sari Sari StoreDocument2 pagesCertificate of Business Name Registration: MGTV Sari Sari StoreMaria MalangNo ratings yet

- Statement of Cash Flow PT ManunggalDocument1 pageStatement of Cash Flow PT ManunggalDelia OktaNo ratings yet

- The Amount of Funds Necessary To Cover The Cost of Operating The EnterpriseDocument5 pagesThe Amount of Funds Necessary To Cover The Cost of Operating The EnterpriseVauntedNo ratings yet

- Desktop Rates July 2023 1Document3 pagesDesktop Rates July 2023 1Ahsan RiazNo ratings yet

- The Rise and Fall of Ramalinga RajuDocument2 pagesThe Rise and Fall of Ramalinga RajuPayal MaskaraNo ratings yet

- Multi Fire ProtectionDocument2 pagesMulti Fire Protectionpmcmbharat264No ratings yet

- Deed of Consent - PlatformDocument43 pagesDeed of Consent - PlatformYonca YalçınNo ratings yet

- Elleine Maling - E-TIVITY 1 IA2Document8 pagesElleine Maling - E-TIVITY 1 IA2Rose MalingNo ratings yet