Professional Documents

Culture Documents

Income

Income

Uploaded by

Karen Abella0 ratings0% found this document useful (0 votes)

14 views1 pageThis document discusses different aspects of income recognition for tax purposes. It defines income broadly to include gains from asset sales and factors beyond cash receipts like inventories. It describes constructive receipt of income occurring when money is made available without restrictions. It also outlines different accounting methods for recognizing income like cash vs accrual basis, and installment vs deferred vs percentage of completion for long-term contracts.

Original Description:

hhhuhyg

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses different aspects of income recognition for tax purposes. It defines income broadly to include gains from asset sales and factors beyond cash receipts like inventories. It describes constructive receipt of income occurring when money is made available without restrictions. It also outlines different accounting methods for recognizing income like cash vs accrual basis, and installment vs deferred vs percentage of completion for long-term contracts.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views1 pageIncome

Income

Uploaded by

Karen AbellaThis document discusses different aspects of income recognition for tax purposes. It defines income broadly to include gains from asset sales and factors beyond cash receipts like inventories. It describes constructive receipt of income occurring when money is made available without restrictions. It also outlines different accounting methods for recognizing income like cash vs accrual basis, and installment vs deferred vs percentage of completion for long-term contracts.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Income, in the broad sense, means all wealth which flows into the taxpayer other

than as a mere return of capital. It includes the forms of income specifically

described as gains and profits, including gains derived from the sale or other

disposition of capital assets. Income cannot be determined merely by reckoning

cash receipts, for the statute recognizes as income determining factor other items,

among which are inventories, accounts receivable, property exhaustion, and

accounts payable for expenses incurred. [Sec. 36, RR No. 0240 dated 10

February 1940]

CONSTRUCTIVE RECEIPT occurs when the money consideration or its equivalent is

placed at the control of the person who rendered the service without restrictions by

the payor. For example: i. Deposit in banks which are made available to the seller of

service without restrictions; ii. Issuance by the debtor of a notice to offset any debt

or obligation and acceptance thereof by the seller as payment for services

rendered; and iii. Transfer of amounts retained by the payor to the account of the

contractor. [Section 4.108-411 of RR No. 16-2005]

(3) Recognition of income

(4) Methods of accounting (a) Cash method v. Accrual method CASH METHOD

recognition of income and expense dependent on inflow or outflow of cash

(meaning, you recognize the income when you actually receive the cash payment

for the sale, and you recognize the expense when you actually pay cash for the

expense).

ACCRUAL METHOD method under which income, gains and profits are included

in gross income when earned whether received or not, and expenses are allowed as

deductions when incurred, although not yet paid. It is the right to receive and not

the actual receipt that determines the inclusion of the amount in gross income.

(b) Installment payment v. Deferred payment v. Percentage of completion

INSTALLMENT METHOD the taxpayer may report income over the several taxable

years in which collections are made based on the terms of payment.

Generally, the income derived on installment sale is the proportion of installment

collection actually received during the year in relation to the gross profit and

contract price.

DEFERRED PAYMENT METHOD where the initial payments on installment sale

exceed 25% of the selling price but they may only be realized in the subsequent

year, the taxpayer is allowed to defer reporting income for accounting purposes but

such sale is to be considered as the equivalent of "cash" which will be considered as

taxable in the month of sale. [Sec. 177, RR No. 2 as cited in BIR Ruling No. 263-92

dated September 16, 1992]

PERCENTAGE OF COMPLETION METHOD a method of recognizing the earnings

derived from long-term construction contracts. This method requires recognition of

income based on the progress of work.

You might also like

- BIR Audit ManualDocument89 pagesBIR Audit ManualRivera RwlrNo ratings yet

- Chapter 3 Concept of IncomeDocument6 pagesChapter 3 Concept of IncomeChesca Marie Arenal Peñaranda100% (1)

- BIR Form 1702-RTDocument8 pagesBIR Form 1702-RTDianne SantiagoNo ratings yet

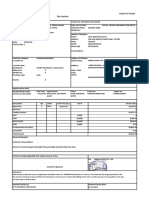

- PreSalarySlip JanDocument1 pagePreSalarySlip JanAnonymous fNNhXzTTyNo ratings yet

- Income Tax in GeneralDocument6 pagesIncome Tax in GeneralMatt Marqueses PanganibanNo ratings yet

- International Accounting Standard (IAS-18) : RevenueDocument13 pagesInternational Accounting Standard (IAS-18) : RevenueTanvirNo ratings yet

- Methods of AccountingDocument1 pageMethods of AccountingKateBarrionEspinosaNo ratings yet

- NIRC - Notes On Accounting Periods and Methods of AccountingDocument5 pagesNIRC - Notes On Accounting Periods and Methods of AccountingJeff SarabusingNo ratings yet

- International Accounting Standard (IAS-18) : RevenueDocument14 pagesInternational Accounting Standard (IAS-18) : RevenueRavi BhaisareNo ratings yet

- VAT RefundDocument2 pagesVAT RefundERICK MLINGWANo ratings yet

- Taxation 1 Transcript (Part 5 Syllabus)Document8 pagesTaxation 1 Transcript (Part 5 Syllabus)cristiepearlNo ratings yet

- Revenue Recognition - Installment SalesDocument3 pagesRevenue Recognition - Installment SalesMariah Janey VicenteNo ratings yet

- Tax ReviewerDocument13 pagesTax ReviewerRabelais MedinaNo ratings yet

- Tax RemediesDocument6 pagesTax RemediesJollibee Bida BidaNo ratings yet

- Inome Tax April 15Document2 pagesInome Tax April 15brainNo ratings yet

- Accounting Methods and Periods Methods of AccountingDocument2 pagesAccounting Methods and Periods Methods of AccountingVedia Genon IINo ratings yet

- Revenue and Other Receipts: Revenue From Exchange TransactionsDocument6 pagesRevenue and Other Receipts: Revenue From Exchange TransactionsMaria Cecilia ReyesNo ratings yet

- Chapter 15Document88 pagesChapter 15YukiNo ratings yet

- Ias 18 Revenue Recognition FinalsDocument8 pagesIas 18 Revenue Recognition FinalssadikiNo ratings yet

- IAS18Document2 pagesIAS18Farah DibaNo ratings yet

- Income Tax ReviewerDocument5 pagesIncome Tax ReviewerClarissa de VeraNo ratings yet

- IFRS Chapter 15 The Legal Versus The Commercial View of AccountingDocument23 pagesIFRS Chapter 15 The Legal Versus The Commercial View of AccountingSamuel Kpakpo Grippman33% (3)

- RemediesDocument53 pagesRemediesJohn Noldan AugustinNo ratings yet

- PP On Sales Tax Refund and RecoveriesDocument11 pagesPP On Sales Tax Refund and RecoveriesMA AttariNo ratings yet

- (This Page Is Intentionally Left Blank.) : The Tax ReviewerDocument35 pages(This Page Is Intentionally Left Blank.) : The Tax ReviewerBSA 1-CChelsee Rosemae MoraldeNo ratings yet

- IAS 18 Revenue: Technical SummaryDocument2 pagesIAS 18 Revenue: Technical SummaryKyleRodSimpsonNo ratings yet

- Presentation On Taxation To The Construction Industry Federation of Zimbabwe (Cifoz)Document44 pagesPresentation On Taxation To The Construction Industry Federation of Zimbabwe (Cifoz)Franco DurantNo ratings yet

- IAS 18 Revenue PDFDocument2 pagesIAS 18 Revenue PDFAK0% (1)

- Receivables (Handouts)Document6 pagesReceivables (Handouts)Crystal Padilla100% (1)

- 01 - Tax - Acctng Methods PeriodsDocument22 pages01 - Tax - Acctng Methods PeriodsShiela MeiNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Methods of Accounting: AX Ccounting Eriods AND EthodsDocument11 pagesMethods of Accounting: AX Ccounting Eriods AND EthodsAiron BendañaNo ratings yet

- PWC Newsletter - Value Added Tax Regulations, 2015 - Updated VersionDocument5 pagesPWC Newsletter - Value Added Tax Regulations, 2015 - Updated VersionAnonymous FnM14a0No ratings yet

- Income Tax ComplianceDocument4 pagesIncome Tax ComplianceJusefNo ratings yet

- IAS 18 - Revenue RecognitionDocument26 pagesIAS 18 - Revenue Recognitionwakemeup143No ratings yet

- Corp - ITRDocument40 pagesCorp - ITRMiguel CasimNo ratings yet

- Basics of Accounts11Document40 pagesBasics of Accounts11Vinay BehraniNo ratings yet

- Chapter 4 - Reveneus and Other ReceiptsDocument57 pagesChapter 4 - Reveneus and Other ReceiptsBENITEZ, DIANNE ASHLEY G.100% (1)

- Accounting 4 Revenue N ExpensesDocument23 pagesAccounting 4 Revenue N Expenseseizah_osman3408No ratings yet

- AS9 Revenue RecognitionDocument2 pagesAS9 Revenue RecognitionrajNo ratings yet

- Tanzania Revenue Authority - VAT RefundDocument1 pageTanzania Revenue Authority - VAT RefundMICHAEL MBILINYINo ratings yet

- Bsa2 - TaxDocument40 pagesBsa2 - TaxLyca Nichol IbanNo ratings yet

- IAS18Document12 pagesIAS18Ali AmirAliNo ratings yet

- Ipsas - 9 - Revenue From Exchange TransactionDocument24 pagesIpsas - 9 - Revenue From Exchange TransactionduncanNo ratings yet

- Revenue Recognition: Accounting Standard (AS) 9Document13 pagesRevenue Recognition: Accounting Standard (AS) 9Abhishek SinghNo ratings yet

- Receivables HandoutDocument3 pagesReceivables HandoutTeyNo ratings yet

- Lecture Outline/Notes and Guide Questions Minimum Corporate Income Tax (Mcit) InstructionsDocument8 pagesLecture Outline/Notes and Guide Questions Minimum Corporate Income Tax (Mcit) InstructionsPaul S.D.No ratings yet

- Business Requirement: Accrual Accounting Matching Principle Accounting Period Revenues ExpensesDocument8 pagesBusiness Requirement: Accrual Accounting Matching Principle Accounting Period Revenues ExpensesshekarNo ratings yet

- CHAPTER 4 - IncomeTaxDocument7 pagesCHAPTER 4 - IncomeTaxVicente, Liza Mae C.No ratings yet

- Sample Earnout ProvisionDocument4 pagesSample Earnout ProvisionAfiq KhidhirNo ratings yet

- Procedure To Be Followed For Delhi Value Added TaxDocument6 pagesProcedure To Be Followed For Delhi Value Added TaxChirag MalhotraNo ratings yet

- Chamber of Real Estate and Builders Associations, Inc., v. The Hon. Executive Secretary Alberto Romulo, Et AlDocument6 pagesChamber of Real Estate and Builders Associations, Inc., v. The Hon. Executive Secretary Alberto Romulo, Et AlMathew Beniga GacoNo ratings yet

- Final Tax Audit-JigarDocument20 pagesFinal Tax Audit-JigarJigar MehtaNo ratings yet

- Financial Accounting and Reporting - PAS No. 18 Accounting For RevenueDocument15 pagesFinancial Accounting and Reporting - PAS No. 18 Accounting For RevenueLuisitoNo ratings yet

- Income Tax Schemes, Accounting Periods, Accounting Methods and ReportingDocument32 pagesIncome Tax Schemes, Accounting Periods, Accounting Methods and ReportingSassy GirlNo ratings yet

- Ind-AS 115-Revenue From Contract With Customers: C.A. Hemant WaniDocument42 pagesInd-AS 115-Revenue From Contract With Customers: C.A. Hemant WaniBijay ShresthaNo ratings yet

- Recenue Recognition PDFDocument33 pagesRecenue Recognition PDFVinay GoyalNo ratings yet

- Chapter 4Document31 pagesChapter 4yebegashetNo ratings yet

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet

- Civpro MTDDocument18 pagesCivpro MTDKaren AbellaNo ratings yet

- Illegal Recruitment and The Labor Dimensions of Trafficking in Persons: Intersection, Similarities and DistinctionDocument1 pageIllegal Recruitment and The Labor Dimensions of Trafficking in Persons: Intersection, Similarities and DistinctionKaren AbellaNo ratings yet

- G.R. No. 109266Document20 pagesG.R. No. 109266Karen AbellaNo ratings yet

- Sales FullDocument84 pagesSales FullKaren AbellaNo ratings yet

- Assignment No.10Document32 pagesAssignment No.10Karen AbellaNo ratings yet

- Title: EadingDocument1 pageTitle: EadingKaren AbellaNo ratings yet

- Assignment 12Document34 pagesAssignment 12Karen AbellaNo ratings yet

- Pantranco V PSCDocument2 pagesPantranco V PSCKaren AbellaNo ratings yet

- PETRONDocument5 pagesPETRONKaren AbellaNo ratings yet

- Form 1Document1 pageForm 1Ganesh DasaraNo ratings yet

- Fresh: Commission/Incentive Approval ReportDocument2 pagesFresh: Commission/Incentive Approval ReportRohit ChhabraNo ratings yet

- Mushak-9.1 VAT Return On 17.DEC.2023Document6 pagesMushak-9.1 VAT Return On 17.DEC.2023Md. Abu NaserNo ratings yet

- Capital Gains TaxDocument25 pagesCapital Gains TaxZander100% (1)

- Deduction Under Section 80 CCD of Income TaxDocument2 pagesDeduction Under Section 80 CCD of Income Taxnahar_sv1366No ratings yet

- GP 22002166Document1 pageGP 22002166ashishmehta736No ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceAnish SonyNo ratings yet

- Ranchi Po Box - State Post Code Fax - Telephone - CityDocument1 pageRanchi Po Box - State Post Code Fax - Telephone - CityImranNo ratings yet

- Bill HondaDocument1 pageBill Hondanaveenkgarg72No ratings yet

- Handout On Losses - Part 1aDocument6 pagesHandout On Losses - Part 1aGlyds D. UrbanoNo ratings yet

- Amazon Order FormatDocument4 pagesAmazon Order FormatAlok S YadavNo ratings yet

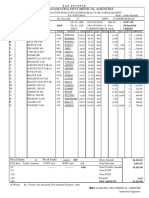

- Apr PayslipDocument1 pageApr PayslipSidvik InfotechNo ratings yet

- 2122 CompDocument2 pages2122 CompAjay PratapNo ratings yet

- FazaDocument5 pagesFazaZacarias and Ana De JesusNo ratings yet

- GST Reg. RamcoDocument3 pagesGST Reg. RamcoSuraj SNo ratings yet

- Form 16Document6 pagesForm 16jawedaman123No ratings yet

- Verification of Non Filer International 0Document1 pageVerification of Non Filer International 0parth shuklaNo ratings yet

- TRAIN Law Abstract PDFDocument2 pagesTRAIN Law Abstract PDFRizaRCNo ratings yet

- Neena Advertiser: Order Form / QuotationDocument1 pageNeena Advertiser: Order Form / QuotationJoginder ChhikaraNo ratings yet

- Customs, Excise Service Tax Appellate Tribunal West Block No.2, R.K. Puram, New Delhi-110066Document3 pagesCustoms, Excise Service Tax Appellate Tribunal West Block No.2, R.K. Puram, New Delhi-110066AnonymousNo ratings yet

- Payslip February 2022Document2 pagesPayslip February 2022Priyanka KambleNo ratings yet

- Chapter 2 Multiple ChoiceDocument4 pagesChapter 2 Multiple ChoiceLess Balesoro100% (1)

- Public Notice 20 of 2021 First Quarter Provisional Income TaxDocument3 pagesPublic Notice 20 of 2021 First Quarter Provisional Income TaxTim StockwellNo ratings yet

- Intax Quiz 2: B. Winterfell Could Deduct Its P6 Million Loss From Its P5 Million GainDocument2 pagesIntax Quiz 2: B. Winterfell Could Deduct Its P6 Million Loss From Its P5 Million GainBLACKPINKLisaRoseJisooJennieNo ratings yet

- Sri Rajamatha Devi Medical Agencies: Tax InvoiceDocument1 pageSri Rajamatha Devi Medical Agencies: Tax Invoicevenkatesh sNo ratings yet

- Fine and Penalties: Under Income Tax Act & Value Added TaxDocument7 pagesFine and Penalties: Under Income Tax Act & Value Added Taxbhaskar rijalNo ratings yet

- 06 Estate Tax PayableDocument12 pages06 Estate Tax PayableJabonJohnKennethNo ratings yet

- 1 Using The Andersons Information Determine The Total Amount ofDocument2 pages1 Using The Andersons Information Determine The Total Amount oftrilocksp SinghNo ratings yet