Professional Documents

Culture Documents

12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EUR

12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EUR

Uploaded by

api-25889552Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EUR

12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EUR

Uploaded by

api-25889552Copyright:

Available Formats

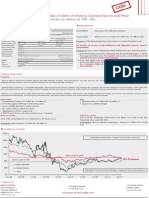

Worst Of Autocall Certificate with Memory Effect on BNP Paribas, Bouygues Deutsche Bank and Vivendi

12.6% p.a. Quarterly Conditional Coupon with Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EUR

Details Redemption

Issuer EFG Financial Products

Guarantor EFG International On 06.05.2010 Client pays EUR 1000 (Denomination)

Rating: Fitch A

Underlying BNP PARIBAS BOUYGUES SA DEUTSCHE BANK AG- VIVENDI Each Quarter, with N being the number of Quarters since the last Coupon (or since inception if

REGISTERED no Coupon has been paid so far)

Bbg Ticker BNP FP Equity EN FP Equity DBK GY Equity VIV FP Equity

Strike Level (100%) EUR 58.12 EUR 37.41 EUR 57.87 EUR 19.85 If all the Underlyings close above their Coupon Trigger Level:

Autocall Level (100%) EUR 58.12 EUR 37.41 EUR 57.87 EUR 19.85 The Investor will receive a ( N x 3.15%) Coupon

Barrier Level (60%) EUR 34.87 EUR 22.45 EUR 34.72 EUR 11.91

Coupon Trigger (60%) EUR 34.87 EUR 22.45 EUR 34.72 EUR 11.91 On top of the Coupon, if all the Underlyings close above their Autocall Trigger Level:

Conversion Ratio 17.2060 26.7310 17.2800 50.3078 The product is early redeemed and the Investor receives a Cash Settlement in EUR equal to:

Initial Fixing Date 22.04.2010 Denomination. The product expires.

Payment Date 06.05.2010

Valuation Date 22.07.2011

Maturity 05.08.2011 On 05.08.2011 Client receiv es (if the product has not been early redeemed):

Details Physical Settlement Quarterly Autocall and Coupon Observation

European Barrier a. If the Worst Performing Underlying closes above the Coupon Trigger Level on the Valuation date:

ISIN CH0111527708 The Investor will receive a Cash Settlement in EUR equal to:

Valoren 11152770 Denomination + (N x 3.15%) Coupon

SIX Symbol EFHFC

b. If the Worst Performing Underlying closes at or below the Barrier Level on the Valuation date:

The Investor will receive a predefined round number (i.e Convertion Ratio) of the worst

performing Underlying per Product

Characteristics

Underlying_____________________________________________________________________________________________________________________________________________________________________________________________

- BNP Paribas attracts deposits and offers commercial, retail, investment, private and corporate banking services. The Bank also provides asset management and investment advisory services to institutions and individuals in Europe,

the^United States, Asia and the Emerging Markets.

- Bouygues SA offers construction services, develops real estate, offers cellular communications services, produces television programming and movies, and manages utilities. The Company offers building, civil engineering, and oil and gas

contracting services, develops residential, commercial, and office projects, produces and distributes water and electricity, and collects waste.

- Deutsche Bank AG is a global financial service provider delivering commercial, investment, private and retail banking. The Bank offers debt, foreign exchange, derivatives, commodities, money markets, repo and securitization, cash

equities, research, equity prime services, loans, convertibles, advice on M&A and IPO's, trade finance, retail banking, asset management and corporate investments.

- Vivendi, through its subsidiaries, conducts operations ranging from music, games and television to film and telecommunications. The Company provides digital and pay television services, sells music compact discs (CDs), develops and

distributes interactive entertainment, and operates mobile and fixed-line telecommunications.

Opportunities______________________________________________________________________ Risks______________________________________________________________________________________________

1. Quarterly opportunity to receiv e a 3.15% Coupon (12.6% p.a.) and to be early redeemed. 1. If on the Valuation Date, at least one Underlying closes at or below its Barrier Level, the

2. Memory effect feature: if the Coupon is not paid on one observation date, it is not lost I nv estor will suffer a loss reflecting the performance of the Underlying

3. Your capital is protected against a decrease of 40% at maturity

4. Secondary market as liquid as equity markets

Best case scenario_________________________________________________________________ Worst case scenario_______________________________________________________________________________

The Worst Performing Underlying closes between the Coupon Trigger and the Autocall Level on each The Worst Performing Underlying has nev er closed abov e the Coupon Trigger Lev el and it closes

observation date, and closes at or abov e the Coupon Trigger Lev el on the Valuation Date below the Barrier Level on the Valuation Date.

Redemption: Denomination + 5 Coupons of 3.15% (Total return: 112.6%) Redemption: Shares of the worst performing Underlying

Historical Chart

160%

importer depuis la deuxieme feuille

Observation date scenario

140% N Quarters since last Coupon

120%

Early Redemption: Denomination

Autocall Level at 100%

100%

80% (N x 3.15%) Coupon is paid

Coupon Trigger and Barrier Level at 60%

60%

BNP Paribas

Deutsche Bank

40% Bouygues

Vivendi Redemption at Maturity: Shares of the

Worst Performing Underlying

20%

Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10

Contacts

Filippo Colombo Christophe Spanier Nathanael Gabay

Bruno Frateschi +41 58 800 10 45 Sofiane Zaiem

Stanislas Perromat +41 22 918 70 05

Alejandro Pou Cuturi Live prices at www.efgfp.com

+377 93 15 11 66

This publication serves only for info rmation purpo ses and is no t research; it co nstitutes neither a reco mmendatio n for the purchase of financial instruments no r an offer or an invitatio n fo r an o ffer. No respo nsibility is taken for the co rrectness of this info rmatio n. The financial instruments mentioned in this document are derivative instruments. They do no t qualify as units of a

co llective investment scheme pursuant to art. 7 et seqq. o f the Swiss Federal A ct on Co llective Investment Schemes (CISA) and are therefore neither registered no r supervised by the Swiss Financial M arket Superviso ry A uthority FINM A. Investors bear the credit risk o f the issuer/guarantor. Before investing in derivative instruments, Investors are highly recommended to ask their

financial advisor for advice specifically fo cused on the Investor´s financial situatio n; the info rmation co ntained in this do cument do es no t substitute such advice. This publication does not constitute a simplified pro spectus pursuant to art. 5 CISA, o r a listing pro spectus pursuant to art. 652a o r 1156 o f the Swiss Co de of Obligations. The relevant product documentatio n can be o btained

directly at EFG Financial P roducts AG: Tel. +41(0)58 800 1111, Fax +41(0)58 800 1010, or via e-mail: termsheet@efgfp.com. Selling restrictio ns apply fo r Europe, Hong Kong, Singapo re, the USA , US perso ns, and the United Kingdom (the issuance is subject to Swiss

law). The Underlyings´ perfo rmance in the past does no t constitute a guarantee fo r their future performance. The financial products' value is subject to market fluctuation, what can lead to a partial o r to tal loss o f the invested capital. The purchase o f the financial pro ducts triggers co sts and fees. EFG Financial P roducts A G and/or ano ther related company may o perate as market

maker for the financial products, may trade as principal, and may conclude hedging transactio ns. Such activity may influence the market price, the price mo vement, or the liquidity o f the financial pro ducts. © EFG Financial Pro ducts A G All rights reserved.

You might also like

- Worst of Autocall Certificate With Memory EffectDocument1 pageWorst of Autocall Certificate With Memory Effectapi-25889552No ratings yet

- 6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURDocument1 page6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURapi-25889552No ratings yet

- Coupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURDocument1 pageCoupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURapi-25889552No ratings yet

- 14% P.A. Semestrial Conditional Coupon With Memory Effect - European Barrier at 70% - 2 Years - USDDocument1 page14% P.A. Semestrial Conditional Coupon With Memory Effect - European Barrier at 70% - 2 Years - USDapi-25889552No ratings yet

- Worst of Autocall Certificate With Memory EffectDocument1 pageWorst of Autocall Certificate With Memory Effectapi-25889552No ratings yet

- 6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURDocument1 page6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURapi-25889552No ratings yet

- 7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDDocument1 page7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDapi-25889552No ratings yet

- Coupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURDocument1 pageCoupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURapi-25889552No ratings yet

- Coupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFDocument1 pageCoupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFapi-25889552No ratings yet

- Doubled-Up Worst of Barrier Reverse ConvertibleDocument1 pageDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552No ratings yet

- Coupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDDocument1 pageCoupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDapi-25890856No ratings yet

- Coupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFDocument1 pageCoupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFapi-25889552No ratings yet

- 1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURDocument1 page1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURapi-25889552No ratings yet

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- Coupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURDocument1 pageCoupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURapi-25889552No ratings yet

- 95% Capital Protected Autocallable Certificate With MemoryDocument1 page95% Capital Protected Autocallable Certificate With Memoryapi-25889552No ratings yet

- 1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%Document1 page1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%api-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552No ratings yet

- 15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDDocument1 page15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDapi-25889552No ratings yet

- Coupon 5.40% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On POWERSHARES QQQDocument1 pageCoupon 5.40% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On POWERSHARES QQQapi-25889552No ratings yet

- 6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDDocument1 page6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SAapi-25889552No ratings yet

- Coupon 10% P.A. - 6 Months - European Barrier at 70% - USDDocument1 pageCoupon 10% P.A. - 6 Months - European Barrier at 70% - USDapi-25889552No ratings yet

- 11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDDocument1 page11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDapi-25889552No ratings yet

- Coupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDDocument1 pageCoupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDapi-25890856No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVAapi-25889552No ratings yet

- Coupon 20% P.A. - 6 Months - American Barrier at 75% - GBPDocument1 pageCoupon 20% P.A. - 6 Months - American Barrier at 75% - GBPapi-25889552No ratings yet

- Doubled-Up Worst of Barrier Reverse ConvertibleDocument1 pageDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552No ratings yet

- Coupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKDocument1 pageCoupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKapi-25889552No ratings yet

- 7.6% P.A. Annual Conditional Coupon - Capital Guaranteed at 100% - 5 Years - EURDocument1 page7.6% P.A. Annual Conditional Coupon - Capital Guaranteed at 100% - 5 Years - EURapi-25889552No ratings yet

- Coupon 16% in Fine - 1 Year - American Barrier at 75% - CHFDocument1 pageCoupon 16% in Fine - 1 Year - American Barrier at 75% - CHFapi-25889552No ratings yet

- Express Certificate On CITIGROUP 8% P.A. QuarterlyDocument1 pageExpress Certificate On CITIGROUP 8% P.A. Quarterlyapi-25889552No ratings yet

- Coupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURDocument1 pageCoupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURapi-25889552No ratings yet

- Atk - 17.4% P.A. - (Googl, Tsla, GM) - 06 - 2024 - enDocument2 pagesAtk - 17.4% P.A. - (Googl, Tsla, GM) - 06 - 2024 - enVikas SrivastavaNo ratings yet

- Coupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECDocument1 pageCoupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius BaerDocument1 pageCoupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius Baerapi-25889552No ratings yet

- 262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onDocument1 page262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onapi-25889552No ratings yet

- 153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010Document1 page153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010api-25889552No ratings yet

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552No ratings yet

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- Coupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURDocument1 pageCoupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURapi-25889552No ratings yet

- 86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010Document1 page86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010api-25889552No ratings yet

- 4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDDocument1 page4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDapi-25889552No ratings yet

- 6% P.A. Semi-Annual Conditional Coupon - European Barrier at 68% - 2 Years - Quanto USDDocument1 page6% P.A. Semi-Annual Conditional Coupon - European Barrier at 68% - 2 Years - Quanto USDapi-25889552No ratings yet

- Coupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On ArcelormittalDocument1 pageCoupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On Arcelormittalapi-25889552No ratings yet

- Bonus Certificate On The EURO STOXX 50Document1 pageBonus Certificate On The EURO STOXX 50api-25889552No ratings yet

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocument1 pageCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552No ratings yet

- Coupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDDocument1 pageCoupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDapi-25889552No ratings yet

- xs2396246931 Phoenix Autocall Stepdown Memory On CCL NCLH RCLDocument6 pagesxs2396246931 Phoenix Autocall Stepdown Memory On CCL NCLH RCLvmakeienkoNo ratings yet

- Coupon 18% P.A. - American Barrier at 80% - 3 Months - PLNDocument1 pageCoupon 18% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552No ratings yet

- Capital Protection On EUR/CHF Foreign Exchange RateDocument1 pageCapital Protection On EUR/CHF Foreign Exchange Rateapi-25889552No ratings yet

- 2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDDocument1 page2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDapi-25889552No ratings yet

- Coupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%Document1 pageCoupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%api-25890856No ratings yet

- 98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010Document1 page98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010api-25889552No ratings yet

- Coupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTDocument1 pageCoupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTapi-25889552No ratings yet

- Coupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDDocument1 pageCoupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDapi-25889552No ratings yet

- Coupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDDocument1 pageCoupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDapi-25889552No ratings yet

- Coupon 13.4% P.A. - American Barrier at 80% - 6 Months - PLNDocument1 pageCoupon 13.4% P.A. - American Barrier at 80% - 6 Months - PLNapi-25889552No ratings yet

- CG European Income Fund: StrategyDocument2 pagesCG European Income Fund: Strategyapi-25889552No ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- CG European Capital Growth Fund: StrategyDocument2 pagesCG European Capital Growth Fund: Strategyapi-25889552No ratings yet

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552No ratings yet

- Morning News 1 June 2010Document3 pagesMorning News 1 June 2010api-25889552No ratings yet

- Global Financial Centres: March 2010Document41 pagesGlobal Financial Centres: March 2010api-25889552No ratings yet

- Morning News 28 May 2010Document3 pagesMorning News 28 May 2010api-25889552No ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Markets UpdateDocument33 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Markets UpdateDocument30 pagesDaily Markets Updateapi-25889552No ratings yet

- United Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, AustriaDocument65 pagesUnited Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, Austriaapi-25889552No ratings yet

- Daily Market Update: EquitiesDocument3 pagesDaily Market Update: Equitiesapi-25889552No ratings yet

- Worldwide Real Estates: Gibraltar LettingsDocument8 pagesWorldwide Real Estates: Gibraltar Lettingsapi-25889552No ratings yet

- Daily Markets UpdateDocument36 pagesDaily Markets Updateapi-25889552No ratings yet

- 1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40Document1 page1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40api-25889552No ratings yet

- Guy Butler Limited: AUD NZD CAD Denominated BondsDocument1 pageGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552No ratings yet

- 1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50Document1 page1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50api-25889552No ratings yet

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocument1 pageCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552No ratings yet

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- 97% Capital Protection 45% Participation 115% Cap 2 Year CHFDocument1 page97% Capital Protection 45% Participation 115% Cap 2 Year CHFapi-25889552No ratings yet

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552No ratings yet

- Morning News 12 May 2010Document3 pagesMorning News 12 May 2010api-25889552No ratings yet

- 62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEDocument1 page62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEapi-25889552No ratings yet

- CG European Income Fund: April 2010Document2 pagesCG European Income Fund: April 2010api-25889552No ratings yet

- La Ciencia Misteriosa de Los Faraones Del Abate T Moreux CompressDocument300 pagesLa Ciencia Misteriosa de Los Faraones Del Abate T Moreux CompresssalguerotiNo ratings yet

- At 01 - Introduction To Assurance and Related Services (Incl. Intro To Audit) - QuizzerDocument6 pagesAt 01 - Introduction To Assurance and Related Services (Incl. Intro To Audit) - QuizzerRei-Anne Rea100% (1)

- Fbidoj ComplaintDocument7 pagesFbidoj ComplaintPennLiveNo ratings yet

- Consolations of PhilosophyDocument28 pagesConsolations of Philosophyrkrish67100% (2)

- Paradise Mislaid: How We Lost Heaven and How We Can Regain ItDocument223 pagesParadise Mislaid: How We Lost Heaven and How We Can Regain Itlemonslover100% (2)

- Toshiba Satellite C660 Compal LA-7202P PWWHA Delphi 10R Rev1.0 SchematicDocument43 pagesToshiba Satellite C660 Compal LA-7202P PWWHA Delphi 10R Rev1.0 Schematicpcs prasannaNo ratings yet

- Case Study 6: Maternal and Child NursingDocument18 pagesCase Study 6: Maternal and Child NursingJayson Ray AbellarNo ratings yet

- Science Law-Q3-Week-5-6-7Document6 pagesScience Law-Q3-Week-5-6-7Prince Jallie Bien GuraNo ratings yet

- Week 3 & 4Document12 pagesWeek 3 & 4elbaNo ratings yet

- TAFJ-JMS MQ Install 8.0Document31 pagesTAFJ-JMS MQ Install 8.0MrCHANTHA100% (1)

- Ateneo de Zamboanga University: Application For Senior High School AdmissionDocument3 pagesAteneo de Zamboanga University: Application For Senior High School AdmissionAcel MonjardinNo ratings yet

- Equity EssayDocument8 pagesEquity EssayTeeruVarasuNo ratings yet

- Ethiopian Agriculture Sector - StrategyDocument2 pagesEthiopian Agriculture Sector - StrategyGeremewNo ratings yet

- English Rough Draft 1Document4 pagesEnglish Rough Draft 1api-463048454No ratings yet

- Modern Science and Vedic Science: by David Frawley (Vamadeva Shastri)Document8 pagesModern Science and Vedic Science: by David Frawley (Vamadeva Shastri)swami1423No ratings yet

- Hirsch, Edward - Poet's Choice (2007, Mariner Books) - Libgen - LiDocument227 pagesHirsch, Edward - Poet's Choice (2007, Mariner Books) - Libgen - Litrue dreamNo ratings yet

- Annuncicom 100Document2 pagesAnnuncicom 100RamtelNo ratings yet

- Canadian Business English Canadian 7th Edition Guffey Test Bank 1Document20 pagesCanadian Business English Canadian 7th Edition Guffey Test Bank 1tedNo ratings yet

- Customary Law Take Home TestDocument10 pagesCustomary Law Take Home TestGcina MaqoqaNo ratings yet

- Automation Testing 2 Years Exp 2Document3 pagesAutomation Testing 2 Years Exp 2Swapnil FulariNo ratings yet

- Thesis Statement Cafeteria FoodDocument7 pagesThesis Statement Cafeteria Foodafbwszvft100% (1)

- The Saddest Day of My Life 2. The Saddest Day of My LifeDocument1 pageThe Saddest Day of My Life 2. The Saddest Day of My LifeAnnjen MuliNo ratings yet

- Mathematical Induction (John A Bather)Document8 pagesMathematical Induction (John A Bather)NuranaNo ratings yet

- Christmas DollDocument20 pagesChristmas Dollcraftycow62No ratings yet

- Bharti Airtel in Africa: Case AnalysisDocument5 pagesBharti Airtel in Africa: Case Analysisyash sharmaNo ratings yet

- Compounding Self AssessmentDocument15 pagesCompounding Self AssessmentLara LaiNo ratings yet

- Loan Summary: Congratulations! Welcome To The Home Credit FamilyDocument1 pageLoan Summary: Congratulations! Welcome To The Home Credit FamilyRadha kushwahNo ratings yet

- GG October 2023 FinalDocument3 pagesGG October 2023 Finalapi-250691083No ratings yet

- Transforming An Urban Corridor: Bus Rapid Transit Along Lake StreetDocument40 pagesTransforming An Urban Corridor: Bus Rapid Transit Along Lake StreetRia NathNo ratings yet

- 1-5 Wages and SalarieDocument40 pages1-5 Wages and SalarieKvng LearNo ratings yet