Professional Documents

Culture Documents

Stone

Stone

Uploaded by

hunky11Copyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Vastu Tips For Diagonal PlotDocument19 pagesVastu Tips For Diagonal Plothunky1175% (4)

- Load Declaration FormDocument2 pagesLoad Declaration Formhunky110% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Coconut OilDocument6 pagesCoconut Oilhunky11100% (1)

- Modes of EntryDocument10 pagesModes of EntryMirchi KothariNo ratings yet

- Of Permanent Value: The Story of Warren Buffett. Chapter 201Document2 pagesOf Permanent Value: The Story of Warren Buffett. Chapter 201Alex Bossert100% (1)

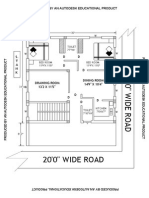

- Floor Is + 2'-6" Height From Road and Roof Height Is 11'-0" Clear From FloorDocument1 pageFloor Is + 2'-6" Height From Road and Roof Height Is 11'-0" Clear From Floorhunky11No ratings yet

- Vastu Tips For Diagonal Plot JAJPURDocument5 pagesVastu Tips For Diagonal Plot JAJPURhunky11No ratings yet

- DR Fixit Piditop 333 105 1Document3 pagesDR Fixit Piditop 333 105 1hunky11No ratings yet

- Exit Google Chrome CompletelyDocument1 pageExit Google Chrome Completelyhunky11No ratings yet

- SK Riaz GfloorDocument1 pageSK Riaz Gfloorhunky11No ratings yet

- SK Riaz F.floorDocument1 pageSK Riaz F.floorhunky11No ratings yet

- Bikash Ku - JenaDocument1 pageBikash Ku - Jenahunky11No ratings yet

- S.g.plan Ground FloorDocument1 pageS.g.plan Ground Floorhunky11No ratings yet

- Age of Empires II: The Conquerors Cheats & Codes: Cheat ListDocument4 pagesAge of Empires II: The Conquerors Cheats & Codes: Cheat Listhunky11No ratings yet

- Rashtrapati BhavanDocument7 pagesRashtrapati Bhavanhunky11100% (1)

- Barings Bank DisasterDocument13 pagesBarings Bank DisasterSatyaki RoyNo ratings yet

- Project Management UNIT-3Document43 pagesProject Management UNIT-3Nitish KumarNo ratings yet

- Bonds by Alan BrazilDocument86 pagesBonds by Alan BrazilAnuj SachdevNo ratings yet

- 1 Chapter 5 Internal Reconstruction PDFDocument22 pages1 Chapter 5 Internal Reconstruction PDFRabindranath Madhi Raju MadhiNo ratings yet

- Accenture CapMarkets CoreTrading CalypsoDocument4 pagesAccenture CapMarkets CoreTrading CalypsovimalgargNo ratings yet

- Dividend Policy: by Group 5: Aayush Kumar Lewis Francis Jasneet Sai Venkat Ritika BhallaDocument25 pagesDividend Policy: by Group 5: Aayush Kumar Lewis Francis Jasneet Sai Venkat Ritika BhallaChristo SebastinNo ratings yet

- Cta Eb CV 01590 D 2017dec18 AssDocument25 pagesCta Eb CV 01590 D 2017dec18 AssaudreydqlNo ratings yet

- BCG CII India Future of Jobs Mar 2017Document48 pagesBCG CII India Future of Jobs Mar 2017Learning EngineerNo ratings yet

- Portfolio Management 2Document30 pagesPortfolio Management 2arjunmba119624No ratings yet

- Herbalife Investor Presentation August 2016 PDFDocument38 pagesHerbalife Investor Presentation August 2016 PDFAla BasterNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument15 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- CARE IPO (Successful Issue) : AnalysisDocument4 pagesCARE IPO (Successful Issue) : AnalysisAshutosh PandeyNo ratings yet

- 3 1 Gavin HolmesDocument38 pages3 1 Gavin HolmesjokoNo ratings yet

- BAM WhitePaper Nov 2013 F PR PDFDocument23 pagesBAM WhitePaper Nov 2013 F PR PDFdmoo10No ratings yet

- MEFA - IV and V UnitsDocument30 pagesMEFA - IV and V UnitsMOHAMMAD AZEEMANo ratings yet

- VPP 3170 Prac02 Sem I 2015-2016Document14 pagesVPP 3170 Prac02 Sem I 2015-2016David AntonitoNo ratings yet

- Intermediate Goods Trade Between Vietnam - Ha Thi Hong VanDocument0 pagesIntermediate Goods Trade Between Vietnam - Ha Thi Hong Vanclazy8No ratings yet

- CIR V Traders Royal Bank, GR No. 167134, Mar 18, 2015Document3 pagesCIR V Traders Royal Bank, GR No. 167134, Mar 18, 2015SophiaFrancescaEspinosaNo ratings yet

- Project Finance SlidesDocument92 pagesProject Finance Slidespgp29177No ratings yet

- PR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Document15 pagesPR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Satrio Saja67% (3)

- AA11 FAB en July 2015 PDFDocument10 pagesAA11 FAB en July 2015 PDFNoel Cuthbert MushiNo ratings yet

- Answers To Questions For Chapter 14: (Questions Are in Bold Print Followed by Answers.)Document17 pagesAnswers To Questions For Chapter 14: (Questions Are in Bold Print Followed by Answers.)Yew KeanNo ratings yet

- Key Performance Indicators: Oil & Gas Industry: BY A.GokulakrishnaDocument36 pagesKey Performance Indicators: Oil & Gas Industry: BY A.GokulakrishnaMOON KINGNo ratings yet

- Valuation of BondsDocument4 pagesValuation of Bondsmayur_nakhwaNo ratings yet

- Interest Rates and Bond Valuation: All Rights ReservedDocument28 pagesInterest Rates and Bond Valuation: All Rights ReservedFahad ChowdhuryNo ratings yet

- Fraport v. The Philippines, Decision On The Merits, ICSID, August 16, 2007Document6 pagesFraport v. The Philippines, Decision On The Merits, ICSID, August 16, 2007JaneKarlaCansanaNo ratings yet

- Bharat Forge LTD Investor Update FY 2003Document12 pagesBharat Forge LTD Investor Update FY 2003Mayukh SinghNo ratings yet

- BBGreater JKT Landed Residential H22011Document10 pagesBBGreater JKT Landed Residential H22011JarjitUpinIpinJarjitNo ratings yet

Stone

Stone

Uploaded by

hunky11Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stone

Stone

Uploaded by

hunky11Copyright:

Available Formats

Activity: Stone Polishing

Banking Arrangement:

Brief Background (Company/ Group/ Promoters/ Management including shareholding pattern):

The unit is expected to purchase stone polishing machine, 10HP Motor machine, stone cutter with diamond cutter, 7.5 HP motor

for cutter for the stone polishing unit, the unit requires term loan for this purpose.

Assessment of Term Loan:

1. Project Details

Project cost

Cost

Margin (%)

Margin amount

Rs.in lakhs.

Required Bank Finance

Land &Buildings*

1.00

100

1.00

0.00

Plant& Machinery

0.94

25

0.24

0.70

WC margin

Contingencies

1.00

0.10

100

100

1.00

0.10

Total project cost

3.04

2.34

0.70

Means of finance

Own funds

Borrowings from friends

and relatives

1.89

Bank finance

0.70

others(Subsidy of the

project cost)

Total means of finance

0.45

3.04

Debt /Equity : 0.37

* Building can be hired by the borrower. However the borrowers can install the plant & machinery in his own land & building.

3. Details of capital expenditure i.e land and factory building as well as machinery proposed to purchase:

The unit will have to give in detail about the land & building (whether own or rented), details of plant and machinery to be

purchased (such as supplier of the machinery, invoice of the machinery, expected date of supply of the machinery after placing the

order, what will be the position of after sales service, credibility of the supplier etc.)

4. Remarks on cost of project & means of finance (in brief)

The unit will have to mention about the means of finance, particularly about the source of own fund.

5. Term Loan Assessment:

Years

Net Profit

1

(Act)

0.30

2

(E)

3

(E)

0.40

0.55

Rs.in lakhs

4

5

(E)

(E)

0.70

0.80

Depreciation

0.15

0.12

0.10

0.07

0.05

Cash Accruals

0.45

0.52

0.65

0.77

0.85

Repayment obligations

(including Interest)

Gross DSCR

0.22

0.20

0.18

0.16

0.13

2.04

2.60

3.60

4.80

6.50

Average Gross DSCR

3.64

The repayment of the term loan will be for a period of 60 months after a moratorium period of 6 months.

The average gross DSCR comes out to 3.64 and above the benchmark level of 1.75, so the unit is commercially viable.

6. Project implementation schedule:

The unit will have to mention about the probable date of completion.

Sl. No

PARTICULARS

PROBABLE DATE OF COMPLETION

1.

Civil Works

5 days

2.

Plant & Machinery

i) Placement of order

5 days

ii) Receipt of machines at site

10 days

iii) Assembling, fitting &

erection

5 days

iv) Electrical Installations

5 days

3.

Trial Run

5 days

4.

In regular operations

After 35 days

ASSESSMENT OF WORKING CAPITAL

Estimated Purchases in the current Year

Estimated Average Raw Material Holding at any time

(Calculated at cost of Purchases) (a)

Estimated Average holding of Stock in process and Finished goods at any one

time (b)

(calculated at cost of Production)*

Estimated Average Receivable outstanding at any one time (c)

Total Requirement (a+b+c)

Less estimated average credit enjoyed on purchases

Less Other Sources like unsecured loans, plough back of profits etc

Bank Finance Required

Working Capital Assessed/recommended

7.50

2.50

10.00

3.50

1.50

2.20

1.00

5.00

0.50

0.40

4.10

4.00

1.80

7.50

0.80

0.50

6.20

6.00

*Cost of production includes

i. Raw material Purchased

ii. Salary & wages (Supervisor/ Entrepreneur, Skilled Workers, Workers)

iii. Utilities (Power, Fuel, Water)

iv. Other Expenses (Rent paid, Postage & stationery expenses, transportation expenses, advertisement expenses, consumable

expenses, miscellaneous expenses)

v. Depreciation of the machinery purchased for the plant (calculated @15%)

vi. Interest paid for the Bank loan (calculated @ 13.50%)

Comments on Production aspects: (covering location advantages, availability of raw material and other utilities like water,

power, fuel, labour etc.

Brief Comments on Marketing Aspects:

As marketing which covers the finding the buyer, market, consumption pattern, patter of cash sale or credit sale, the unit is

expected to comment briefly of the marketing aspects.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Vastu Tips For Diagonal PlotDocument19 pagesVastu Tips For Diagonal Plothunky1175% (4)

- Load Declaration FormDocument2 pagesLoad Declaration Formhunky110% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Coconut OilDocument6 pagesCoconut Oilhunky11100% (1)

- Modes of EntryDocument10 pagesModes of EntryMirchi KothariNo ratings yet

- Of Permanent Value: The Story of Warren Buffett. Chapter 201Document2 pagesOf Permanent Value: The Story of Warren Buffett. Chapter 201Alex Bossert100% (1)

- Floor Is + 2'-6" Height From Road and Roof Height Is 11'-0" Clear From FloorDocument1 pageFloor Is + 2'-6" Height From Road and Roof Height Is 11'-0" Clear From Floorhunky11No ratings yet

- Vastu Tips For Diagonal Plot JAJPURDocument5 pagesVastu Tips For Diagonal Plot JAJPURhunky11No ratings yet

- DR Fixit Piditop 333 105 1Document3 pagesDR Fixit Piditop 333 105 1hunky11No ratings yet

- Exit Google Chrome CompletelyDocument1 pageExit Google Chrome Completelyhunky11No ratings yet

- SK Riaz GfloorDocument1 pageSK Riaz Gfloorhunky11No ratings yet

- SK Riaz F.floorDocument1 pageSK Riaz F.floorhunky11No ratings yet

- Bikash Ku - JenaDocument1 pageBikash Ku - Jenahunky11No ratings yet

- S.g.plan Ground FloorDocument1 pageS.g.plan Ground Floorhunky11No ratings yet

- Age of Empires II: The Conquerors Cheats & Codes: Cheat ListDocument4 pagesAge of Empires II: The Conquerors Cheats & Codes: Cheat Listhunky11No ratings yet

- Rashtrapati BhavanDocument7 pagesRashtrapati Bhavanhunky11100% (1)

- Barings Bank DisasterDocument13 pagesBarings Bank DisasterSatyaki RoyNo ratings yet

- Project Management UNIT-3Document43 pagesProject Management UNIT-3Nitish KumarNo ratings yet

- Bonds by Alan BrazilDocument86 pagesBonds by Alan BrazilAnuj SachdevNo ratings yet

- 1 Chapter 5 Internal Reconstruction PDFDocument22 pages1 Chapter 5 Internal Reconstruction PDFRabindranath Madhi Raju MadhiNo ratings yet

- Accenture CapMarkets CoreTrading CalypsoDocument4 pagesAccenture CapMarkets CoreTrading CalypsovimalgargNo ratings yet

- Dividend Policy: by Group 5: Aayush Kumar Lewis Francis Jasneet Sai Venkat Ritika BhallaDocument25 pagesDividend Policy: by Group 5: Aayush Kumar Lewis Francis Jasneet Sai Venkat Ritika BhallaChristo SebastinNo ratings yet

- Cta Eb CV 01590 D 2017dec18 AssDocument25 pagesCta Eb CV 01590 D 2017dec18 AssaudreydqlNo ratings yet

- BCG CII India Future of Jobs Mar 2017Document48 pagesBCG CII India Future of Jobs Mar 2017Learning EngineerNo ratings yet

- Portfolio Management 2Document30 pagesPortfolio Management 2arjunmba119624No ratings yet

- Herbalife Investor Presentation August 2016 PDFDocument38 pagesHerbalife Investor Presentation August 2016 PDFAla BasterNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument15 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- CARE IPO (Successful Issue) : AnalysisDocument4 pagesCARE IPO (Successful Issue) : AnalysisAshutosh PandeyNo ratings yet

- 3 1 Gavin HolmesDocument38 pages3 1 Gavin HolmesjokoNo ratings yet

- BAM WhitePaper Nov 2013 F PR PDFDocument23 pagesBAM WhitePaper Nov 2013 F PR PDFdmoo10No ratings yet

- MEFA - IV and V UnitsDocument30 pagesMEFA - IV and V UnitsMOHAMMAD AZEEMANo ratings yet

- VPP 3170 Prac02 Sem I 2015-2016Document14 pagesVPP 3170 Prac02 Sem I 2015-2016David AntonitoNo ratings yet

- Intermediate Goods Trade Between Vietnam - Ha Thi Hong VanDocument0 pagesIntermediate Goods Trade Between Vietnam - Ha Thi Hong Vanclazy8No ratings yet

- CIR V Traders Royal Bank, GR No. 167134, Mar 18, 2015Document3 pagesCIR V Traders Royal Bank, GR No. 167134, Mar 18, 2015SophiaFrancescaEspinosaNo ratings yet

- Project Finance SlidesDocument92 pagesProject Finance Slidespgp29177No ratings yet

- PR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Document15 pagesPR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Satrio Saja67% (3)

- AA11 FAB en July 2015 PDFDocument10 pagesAA11 FAB en July 2015 PDFNoel Cuthbert MushiNo ratings yet

- Answers To Questions For Chapter 14: (Questions Are in Bold Print Followed by Answers.)Document17 pagesAnswers To Questions For Chapter 14: (Questions Are in Bold Print Followed by Answers.)Yew KeanNo ratings yet

- Key Performance Indicators: Oil & Gas Industry: BY A.GokulakrishnaDocument36 pagesKey Performance Indicators: Oil & Gas Industry: BY A.GokulakrishnaMOON KINGNo ratings yet

- Valuation of BondsDocument4 pagesValuation of Bondsmayur_nakhwaNo ratings yet

- Interest Rates and Bond Valuation: All Rights ReservedDocument28 pagesInterest Rates and Bond Valuation: All Rights ReservedFahad ChowdhuryNo ratings yet

- Fraport v. The Philippines, Decision On The Merits, ICSID, August 16, 2007Document6 pagesFraport v. The Philippines, Decision On The Merits, ICSID, August 16, 2007JaneKarlaCansanaNo ratings yet

- Bharat Forge LTD Investor Update FY 2003Document12 pagesBharat Forge LTD Investor Update FY 2003Mayukh SinghNo ratings yet

- BBGreater JKT Landed Residential H22011Document10 pagesBBGreater JKT Landed Residential H22011JarjitUpinIpinJarjitNo ratings yet